The inspection has requested documents: how to correctly submit “paper” copies

In relations with the inspectorate, the accountant often has to provide the tax authorities with copies of certain documents. Before submitting to the inspection, copies must be certified, which is expressly provided for by the Tax Code. However, the certification procedure is not described in the Code, which often causes conflict situations. However, such rules are still established by law. In this article we have collected situations that most often cause controversy. The result was a selection in the format of questions and answers, or, as they say on the Internet, in the format FAQ - Frequently asked questions.

Q. What rule obliges the taxpayer to submit certified copies to the inspectorate? A. This is stated in paragraph 2 of Art. 93 Tax Code of the Russian Federation. According to this rule, if a taxpayer submits the requested documents on paper to the inspectorate, then he is obliged to submit copies certified by the person being inspected.

Q. Does this mean that copies must be notarized? A. No, inspectors may require copies to be notarized only if expressly required by law. This rule is also fixed in paragraph 2 of Art. 93 Tax Code of the Russian Federation. Accordingly, when presenting a requirement for notarization of a copy of a document, inspectors must justify it by reference to the rule of law introducing such an obligation. In all other cases, the requirement to notarize documents is illegal.

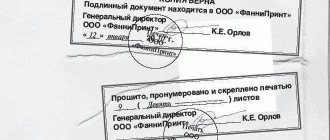

Q. What inscriptions need to be made on a copy of a document when it is certified? A. According to GOST, a mark on certification of the copy is placed under the “signature” attribute. The certification mark includes the word “True”, the title of the position of the person who certified the copy, his handwritten signature and its transcript (initials, surname) and the date of certification. The certification mark can be made using a stamp.

In addition, one more inscription must be made on the copy - about the storage location of the document from which the copy was made. This inscription should be certified with the seal of the organization. For example, “The original document is located in Altair LLC in file No. 23/19 for 2020.”

Q. How to certify multi-page documents? A. When certifying copies of multi-page documents, options are possible. Firstly, you can certify each page separately according to the general rules (stamp, position, signature, transcript, date, record of the document’s storage location).

Secondly, you can organize the firmware of a multi-page document, that is, stitch copies of all sheets into one document and certify it as a whole. This is done by putting a certification inscription on a paper sticker placed on the back of the last sheet at the place where the sheets are fastened with thread. The certification inscription must contain the position of the person who certified the authenticity of the documents (or an indication that the inscription was made by an individual entrepreneur), his personal signature, full name, indication of the number of sheets (in Arabic numerals and in words), the date of signing (Order of the Federal Tax Service of Russia dated 07.11.18 No. ММВ-7-2/ [email protected] ).

Q. Are there any special requirements for firmware documents? A. Yes, they are set out in the order of the Federal Tax Service of Russia dated November 7, 2018 No. ММВ-7-2/ [email protected] According to this document, when creating bound documents (copies) on paper, the following rules must be observed. All sheets must be divided into volumes (parts). In this case, the volume of each volume should not exceed 150 sheets. Each volume is stitched separately. Numbering is done in Arabic numerals in a continuous manner, starting from one. The volume limitation requirement does not apply to multi-page documents over 150 sheets - they are formed in one volume. At the same time, the firmware should not interfere with the free reading of the text, all details, dates, visas, resolutions, other inscriptions, stamps, seals and marks, as well as copying each individual sheet of the firmware.

All sheets must be stitched with a strong thread, the ends of which are brought to the back of the last sheet and tied. On the reverse side of the last sheet, at the place of fastening, you need to stick a paper sticker and put a certification inscription on it.

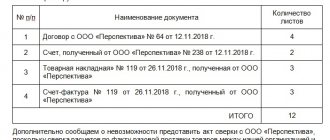

Q. Is an inventory of the documents being submitted necessary? A. Yes, according to the order of the Federal Tax Service of Russia dated November 7, 2018 No. ММВ-7-2/ [email protected], a list of the submitted documents is attached to the covering letter or is its component part.

Q. Is a cover letter required? A. Yes, the order of the Federal Tax Service of Russia dated November 7, 2018 No. ММВ-7-2/ [email protected] states that documents must be submitted to the tax office with a covering letter indicating the basis for their submission (details of the requirement to submit documents ( information) - date and number of the requirement) and the total number of sheets of documents.

A sample of such a document is given below.

Cover letter sample

On the letterhead of the organization "LLC Rassvet" To the Inspectorate of the Federal Tax Service of Russia No. 1 for the city of Ryazan 03/07/2019 No. 28/n

On No. 1258/7 dated 03/04/2019

Based on the Requirement for the submission of documents and information dated March 4, 2019 No. 1258/7, we are sending the following documents to your address: 1. A copy of the agreement between Rassvet LLC and Blagovest LLC dated May 22, 2018 without a number on 1 page. in 1 copy. 2. A copy of the work acceptance certificates under the agreement between Rassvet LLC and Blagovest LLC dated May 22, 2018 without a number for the period May-September 2020 on 8 pages. in 1 copy. 3. Copy of the payment order dated 08/08/2018 on 1 page. in 1 copy.

The total number of sheets is 10 (ten).

Head Nagiev V.P. Nagiyev

Electronic documents

If the requested documents are compiled in electronic form in established formats, then the taxpayer has the right to send them to the inspectorate in electronic form via telecommunication channels (TCS) (paragraph 3, paragraph 2, article 93 of the Tax Code of the Russian Federation).

The procedure for sending a request for the submission of documents (information) and the procedure for submitting documents (information) at the request of the tax authority in electronic form via telecommunication channels was approved by Order of the Federal Tax Service of the Russian Federation dated February 17, 2011 No. ММВ-7-2/ [email protected] (hereinafter referred to as the Procedure) .

The taxpayer receives within the next business day after sending the requested document in electronic form (clause 21 of the Procedure): 1) confirmation of the date of sending; 2) receipt of admission or notice of refusal of admission.

When you receive a receipt from the inspection for accepting a document in electronic form, there is no need to submit this document to the inspection on paper (clause 5 of the Procedure). If you have not received a receipt, then the requested document must be sent to the inspection on paper within the prescribed period (clause 24 of the Procedure).

- using postal services by registered mail;

- submit to the tax office in person or through an authorized representative;

- via telecommunication channels in electronic form;

The taxpayer has the right to choose the method of transferring the necessary documents at his own discretion (letter of the Federal Tax Service dated November 25, 2014 No. ED-4-2/24315).

The copies of documents required by the tax inspectorate must be certified, that is, their complete similarity to the originals must be confirmed. Documents in the form of certified copies determine their legal significance.

In 2020, new requirements appeared for the preparation of documents submitted to the tax office in paper form (Appendix No. 18, Order of the Federal Tax Service dated November 7, 2018 No. MMV-7-2 / [email protected] ).

Over time, the rules according to which it is necessary to certify numerous copies of original documents sent to the tax office have become somewhat simplified. Previously, it was necessary to certify a copy of each document in a single binder.

In accordance with the letter of the Ministry of Finance of the Russian Federation, it has become permissible, when transferring to the tax inspectorate a stack of copies of documents formed and bound in 150 sheets, to certify the entire bound volume of documents once, and not each copy separately, as was previously the case (Letter of the Ministry of Finance of the Russian Federation dated October 29 .2015 No. 03-02-RZ/62336).

The requirements for the preparation of documents submitted to the tax office in 2019 do not conflict with the content of the letter from the Ministry of Finance of the Russian Federation given above. According to the new requirements in 2020, all requested copies of documents should be grouped into volumes containing no more than 150 pages in each of them (Appendix No. 18 Order of the Federal Tax Service dated November 7, 2018 No. ММВ-7-2 / [email protected] ).

| ★ Best-selling book “Accounting from Scratch” for dummies (understand how to do accounting in 72 hours) purchased by {amp}gt; 8000 books |

What further actions need to be taken to correctly format the requested documents after grouping their copies into volumes and/or books

1) All pages must be numbered, starting with one, using Arabic numerals.

2) Sew copies of documents, leave the ends of a strong thread on the back of the last numbered sheet and tie them.

3) In the place where the ends of the thread are fastened on the back side of the last document, stick paper and seal the entire stitched volume on this paper.

- Copies of documents submitted to receive a tax deduction can be certified by a notary.

- Copies of documents submitted to receive a tax deduction can be certified by the citizen himself in the following order:

- each copy page must be signed separately;

- confirmation of the authenticity of the copy is made out with the words “the copy is correct”, which are located at the bottom of the page. The signature, its decoding and date are also placed here.

Documents sent to the Federal Tax Service from a private individual to obtain a tax deduction are accompanied by an inventory, which indicates all copies of documents submitted.

To send copies of documents to the tax office, tax office employees developed a special format, which was approved by order (Order of the Federal Tax Service dated January 18, 2017 No. ММВ-7-6 / [email protected] ).

It is also possible to provide documents in scanned form, in accordance with the requirements of the Federal Tax Service, approved by order (Order of the Federal Tax Service dated February 17, 2011 No. ММВ-7-2 / [email protected] ).

After sending the requested documents electronically to the tax office, the taxpayer receives on the next business day:

- an electronic document confirming receipt or information about refusal of admission;

- confirmation of sending documents electronically.

The right of tax authorities to request copies of certain documents from taxpayers is secured by Articles 88, 93, 93.1 of the Tax Code of the Russian Federation.

At the same time, almost every business entity, be it an organization or an individual entrepreneur, at some point is faced with the practical effect of these norms, which translates into the obligation to submit documents to the tax authority.

The most common situation in this matter is the preparation of copies of documents for the regulatory authority. Tax officials also have the right to familiarize themselves with the original documentation, but in strictly specified cases.

The presentation of copies is accompanied by the requirement to transfer them to the tax service certified “in the prescribed manner,” “properly,” “appropriately,” “in accordance with the requirements of current legislation,” and so on.

So what are the requirements of the current legislation regulating the certification of copies in the proper manner in the prescribed manner?

Most often, cases of notarization are directly specified in the law and have no alternative.

Another thing is independent certification, which concerns the organization’s or individual entrepreneur’s own documents, or documents of other persons, the originals of which are kept by the witness for any reason.

We invite you to read: Complaint to the tax office (FTS) in 2019

For example, a person has the right to certify the accuracy of a copy of his copy of the supplier’s invoice, but not his Unified State Register of Legal Entities certificate, a copy of which was received from the supplier along with the invoice.

A copy of a document should be considered a document that fully reproduces the information contained in the original and all its external features. The copy has no legal force.

But a certified copy of the document, that is, the one on which all the necessary details are applied, already has legal force and can be accepted for consideration of its contents.

In this case, the details are a mandatory element of document design.

The Federal Tax Service has developed a new procedure for certifying paper documents. The draft departmental order was published on the unified portal of regulatory legal acts. The new procedure differs from the old one in the requirements for the sticker and certification signature.

According to the new rules, copies of documents must be submitted in a package of no more than 150 sheets. The exception is multi-page documents that themselves contain more than 150 sheets.

Each sheet in the binder must be numbered in Arabic numerals. Including the first sheet - 1, 2, 3, etc.

All sheets in the binder must be stitched with a strong thread using two to four punctures. Bring the ends of the thread to the back of the last sheet and tie. You need to stick a paper rectangle - a sticker - on the thread knot. In this case, the sticker and the length of the threads can be any.

Now the Ministry of Finance stipulates that the sticker should be 6x4 cm in size (±1-2 cm). The sticker should completely cover the place where the firmware is attached. Only the ends of the threads can extend beyond the boundaries of the sticker. Maximum 2-2.5 cm.

- the word "True";

- the total number of sheets in the binder - in Arabic numerals and in words;

- position of the person who certified the file. It has the right to be certified by the general director of the organization or another representative. For example, deputy general director, chief or ordinary accountant;

- the surname and initials of this employee;

- his personal signature;

- date of certification of documents.

In this case, the certifying personal signature must partially cover the sticker.

The submitted documents should be accompanied by a covering letter, which indicates the basis for their submission (details of the tax requirement) and the total number of sheets of documents.

If a company or individual entrepreneur does not comply with the new requirements for certification of paper documents, tax authorities may force them to redo the documents or issue a fine in the amount of 200 rubles. for each rejected copy.

Home → Accounting articles

The article from the magazine “MAIN BOOK” is current as of November 20, 2015.

Contents of the magazine No. 23 for 2020 October 29 Letter of the Ministry of Finance dated October 29, 2015 No. 03-02-RZ/62336

The financial department has issued recommendations on how to prepare a paper package of copies of documents that tax authorities require them to submit during any audit. 1, 2 tbsp. 93 Tax Code of the Russian Federation.

So, when you file the requested documents, consider the following:

- the volume of each stitched bundle should not exceed 150 sheets;

- each sheet in the bundle must be numbered in Arabic numerals starting with one;

- the pack is stitched through two or four punctures with a strong thread, the ends of which are brought out to the back side of the last sheet, tied and sealed with a paper sticker covering the place where the stitching is fastened;

- on the sticker you need to indicate the number of sheets in numbers and words, certify this inscription with the signature of the manager or other authorized person, write his last name, initials, position, as well as the date;

- documents must be bound so that inspectors can easily read them and, if necessary, copy individual sheets.

Here's an illustration of what the final sheet of the binder might look like with a sticker on it.

The sticker size recommended by the Ministry of Finance is approximately 40-60 by 40-50 mm. It should cover the place where the pack is fastened completely. Only the ends of the stitching threads can extend beyond the sticker, but not more than 2-2.5 cm.

- There is no need to print on the binding (volume), even if there is one. A personal handwritten signature of the person who certified the documents is sufficient, so that it partially covers the paper sticker.

- It is not required to indicate the storage location of the originals (unlike GOST R 7.0.97-2016)

- A multi-page document can be compiled into a separate bound volume (volume) of more than 150 sheets. The 150 sheet limit does not apply.

Rules on how to certify paper copies of documents for submission to the inspection

From January 4, 2020, certify documents in a new way.

We will tell you in our review how the new rules differ from how it is now customary to prepare paper copies. In addition, tax authorities have approved the forms of documents that companies will receive from the inspectorate.

How to make copies on paper in a new way from January 4

Now there are only recommendations on how to create document stitching. Explanations can be found in the Letter from the Ministry of Finance (the Federal Tax Service sent it to its subordinates so that they could use it in their work). In practice, these recommendations are used when certifying both copies of multi-page documents and stitching of various documents.

There are few significant differences from established practice in the new rules (Appendix No. 18 to the Order):

- Bindings of multi-page documents (in a new way, stapling is called “volume” or “part”) can be more than 150 sheets in volume. They will need to be compiled in one volume or part. Currently, there is no such clarification in the recommendations for multi-page documents;

The firmware of the documents will not need to be certified with a seal, even if there is one. It is enough to put a signature that partially covers the paper sticker. Now they put a stamp, if there is one.

The remaining changes are technical.

Please note: before the appearance of the mentioned recommendations, the Ministry of Finance issued a letter from which it followed that a copy of each document should be certified, and not a binder. Therefore, if you need to submit documents to the inspectorate before January 4, check to see if the tax authorities object to certifying the entire file.

From January 4, tax authorities will send you updated document forms

The order also approved many forms of demands, decisions, decrees and other documents that tax authorities use. Here are some of the ones you may encounter:

- requirement to submit documents (information);

- addition to the tax audit report;

- decision to bring to justice for committing a tax offense;

- notification of a summons to the tax authority of a taxpayer (fee payer, insurance premium payer, tax agent);

- requirement to provide explanations;

- protocol of interrogation of a witness;

- tax audit report;

- notification of the time and place of consideration of tax audit materials;

- notification of failure to submit calculations for insurance premiums.

Irina Morozova invites you to her own seminar on wages

SALARY IN 2020. ACCOUNTING, LEGAL AND TAX ISSUES

At the seminar, along with other issues, the speaker will definitely consider one of the most pressing issues of 2020 - changes in federal state control in the field of migration.

AUTHOR AND EVENT HOST:

expert consultant on labor and wage accounting for enterprises of various forms of ownership, author of numerous books and publications, current member of the Institute of Professional Accountants of Russia.

How to certify copies of documents according to the new GOST from July 1, 2020

06/28/2019, 12:53 Copying documents is a common procedure for any person. But a copy acquires legally significant status only after it has been properly certified. What is the procedure for requesting and processing copies, and what changes in this process from July 1, we will tell you in our material. Any citizen may need certain copies of documents from their place of work. For example, banks may request a copy of the work record when issuing a loan or new employers when registering employees on an external part-time basis. What to do if you were asked for a copy of the work record or you needed a certified duplicate of another personnel document?

The algorithm of actions is simple, but certain rules established by law still exist: This will be the starting mechanism for the procedure for obtaining a copy.

Desk audit - what is it?

A desk audit is a type of tax audit carried out at the location of the tax inspectorate on the basis of tax returns (calculations) and documents submitted by the organization, as well as other documents about its activities available to the tax inspectorate (clause 1 of Article 88 of the Tax Code of the Russian Federation).

A desk tax audit begins after the organization submits a declaration (calculation) to the inspectorate. It is carried out by tax inspectors authorized to do so by their official duties. They do not require special permission from the head of the tax inspectorate to conduct a desk audit. This is stated in paragraph 2 of Article 88 of the Tax Code of the Russian Federation.

The Tax Inspectorate conducts a desk audit based on:

- tax returns (calculations) and additional documents submitted by the organization along with the reporting;

- other documents about the activities of the audited organization that are available to the tax inspectorate.

How to sign photocopies of documents

If documents are submitted in paper form, then a number of rules should be followed.

Photocopies of documents must be certified by the manager or other authorized person. You can also seal them if the organization has one. But this is optional. Tax officials allow not to certify the submitted copies with a seal, even if the company or individual entrepreneur has not abandoned the seal in its activities (letter of the Federal Tax Service of Russia dated 08/05/2015 No. BS-4-17 / [email protected] ).

We suggest you read: Why don’t banks give loans with a good credit history?

The authorized person acts on the basis of a power of attorney issued by the manager. The power of attorney must be drawn up in accordance with the requirements of the law (Articles 185-189 of the Civil Code of the Russian Federation and subparagraph 1, paragraph 3, Article 29 of the Tax Code of the Russian Federation).

Position of the certifier Personal signature Initials, surname

It is necessary to take into account that the established procedure is advisory in nature, therefore it is considered optional (subclause 4, clause 1 of GOST R 6.30-2003). Thus, inscriptions can be located anywhere in the document.

Copy is right.

November 20, 2020

Smirnov

General Director of Orion LLC ———— Smirnov A.P.

M.P.

There is no need to notarize copies of documents (Clause 2, Article 93 of the Tax Code of the Russian Federation). But a situation may arise when you cannot do without a notary. Find out about this in the next section.

How not to miss a requirement (notification) under TKS

Requests or notifications from the tax office must be responded to in a timely manner. Otherwise, inspectors will block the organization’s current account.

How long does it take to respond to a request? Look at the date on the request. Within six business days after this date, you must send a receipt to the tax office indicating receipt of this request. Or refuse to receive it within the same period if the request was sent to the wrong address.

Let's say you received a request on June 25. This means that you need to respond to it no later than July 3. If the receipt is not sent within the prescribed period, the inspection has the right to block the organization’s account.

Important! The inspector has the right to send a request for a desk audit only within three months from the day you submitted the declaration. If the request was sent later, you do not have to respond to it. There is an exception to this rule: the inspector may send a request within the framework of additional tax control measures outside the three-month period.

Why are documents stapled?

Before we figure out how to staple documents correctly, let's discuss why this is actually needed. Not every person knows why this is done. But there are a lot of organizations that accept documents only in correct, properly executed form. For example, when submitting to the archives, to participate in tenders, when submitting papers to the tax office, etc.

We would like to note that there is no clear instruction on this matter. However, there are regulations governing the procedure for preparing documentation. It is believed that absolutely all papers must be stitched if their volume is more than one sheet. This also applies to copies, for example, documents of the charter of legal entities (the company’s seal is not placed on the copies). In addition, the stitched sheets are numbered with Arabic numerals. They are placed in the upper right corner. To stitch documents you will need special twine, an awl, and a needle. A certification note containing information about the number of pages must be affixed to the back side of the last sheet. It bears the signature of the manager and the seal of the enterprise.

Deadline for fulfilling requirements for submitting documents to the tax office

The organization is obliged to fulfill the requirement to submit documents within 10 working days from the date of its receipt (paragraph 1, paragraph 3, article 93, paragraph 6, article 6.1 of the Tax Code of the Russian Federation). The countdown of the period begins the next day after the day of actual receipt of the demand (clause 2 of article 6.1 of the Tax Code of the Russian Federation).

The inspectorate may send a request electronically via telecommunications channels. In this case, the determination of the 10-day period allotted for the preparation and submission of documents has some features.

Organizations that are required to submit tax reports under the TKS count the 10-day period from the next day after receiving the electronic request from the inspectorate. In this case, no later than the sixth working day after sending the request by the inspectorate, the organization must confirm receipt of the request with an electronic receipt (clause 5.1 of Article 23 of the Tax Code of the Russian Federation).

Missing the six-day deadline for sending your receipt can have serious consequences. Within 10 working days after the six-day period expires, if the receipt is not sent, the inspection has the right to block the organization’s bank account (subclause 2, clause 3, article 76 of the Tax Code of the Russian Federation).

Organizations that are not required to submit tax reports under the TKS may not respond to requests received in electronic format. Having not received an electronic receipt from the organization regarding acceptance of the request, the inspection will send the request on paper. This follows from the provisions of paragraphs 15, 16 and 19 of the Procedure, approved by order of the Federal Tax Service of Russia dated February 17, 2011 No. ММВ-7-2/168. In this case, the 10-day period allotted for the submission of documents must be counted from the next day after receipt of the paper request. Moreover, if the inspection sent a paper demand by mail, the date of its receipt by the organization is considered to be the sixth day from the date of sending the registered letter (Clause 4 of Article 31 of the Tax Code of the Russian Federation).

How to certify a copy of a document “properly”

The article from the magazine “MAIN BOOK” is relevant as of December 23, 2011 M.G.

The considered court decisions can be found: Perhaps there is no accountant who would not have to prepare copies of documents: for submission to tax authorities, to extra-budgetary funds, for issuance to employees, participants (hereinafter referred to as the JSC Law); (hereinafter referred to as the LLC Law), for the organization’s participation in a competition (auction), etc. At the same time, the accountant is often faced with the requirement to certify copies “in the prescribed manner,” “properly,” or simply “properly.”

What does it mean? There is no definition of these terms in the legislation.

In essence, they all mean one thing: certification in order to confirm the compliance of the copy with the original, as required by law or other regulatory document. If we talk about making copies for

How to certify copies of documents for the tax office

In what case are paper documents submitted to the Federal Tax Service not stamped?

The Federal Tax Service has approved rules on how to certify copies on paper from 2020

From January 4, 2020, submit copies of paper documents to the tax office according to the new rules. The Federal Tax Service first approved the requirements for how to certify copies in Appendix 18 to Order No. ММВ-7-2/628 dated November 7, 2018.

Copies should be combined into volumes of a maximum of 150 sheets each. If the document is more than 150 sheets, there is no need to divide it into different volumes. After you group copies of documents into volumes, you need to:

- number the sheets continuously using Arabic numerals, starting with one;

- sew the sheets with a strong thread, the ends of which are brought to the back of the last sheet and tied;

- stick a paper sticker and make a certification inscription on it - job title, signature, full name, number of sheets in Arabic numerals and words, date. The signature must partially cover the paper sticker; no stamp is required.

Bound and certified copies must be securely fastened so that the binder does not fall apart during study and copying. All sheets in the binder must be free to read and copy. Volumes with copies must be submitted to the inspection with a covering letter. The letter or annex to it must contain an inventory of the documents submitted.

Requirements for documents submitted to the tax authority on paper

In the event that the tax inspectorate requires the submission of photocopied documentation (for example, during a counter audit), it is better to prepare the transferred package of documents according to the rules recommended by the Ministry of Finance.

1. All sheets of documents submitted on paper must be divided into volumes (parts). In this case, the volume of each volume (part) cannot exceed 150 sheets. Each volume (part) is stitched separately, its sheets are numbered in a continuous manner using Arabic numerals, starting from one. The requirement to limit the volume of one volume (part) does not apply to multi-page documents of more than 150 sheets, which are formed by one volume (part).

3. Documents must be flashed in such a way that:

- ensure the ability to freely read the text of documents, all details, dates, visas, resolutions, other inscriptions, seals, stamps and marks;

- ensure the possibility of free copying of each individual sheet of documents using copiers;

- exclude the possibility of mechanical destruction of sheets of documents and the threads with which they are stitched when studying and copying them.

4. All sheets of documents must be stitched with a strong thread, the ends of which are brought to the back of the last sheet and tied. On the reverse side of the last sheet of the volume (part), a paper sticker is pasted at the place of binding, on which the certification inscription is located.

5. The certification signature must contain the name of the position of the person who certified the authenticity of the documents (or an indication that the certification statement was made by an individual entrepreneur (lawyer, notary engaged in private practice, arbitration manager, appraiser, mediator, patent attorney and other person engaged in private practice ), his personal signature, surname, initials, indication of the number of sheets (in Arabic numerals and words) and date.The certifying personal signature must partially cover the paper sticker.

6. Documents must be submitted to the tax authority with a covering letter indicating the basis for their submission (details of the request for the submission of documents (information) - date and number of the request), the total number of sheets of documents. The covering letter must contain or be accompanied by an inventory of the documents submitted.

How to correctly prepare documents at the request of the tax service in accordance with the new requirements

Over time, the rules according to which it is necessary to certify numerous copies of original documents sent to the tax office have become somewhat simplified. Previously, it was necessary to certify a copy of each document in a single binder. In accordance with the letter of the Ministry of Finance of the Russian Federation, it has become permissible, when transferring to the tax inspectorate a stack of copies of documents formed and bound in 150 sheets, to certify the entire bound volume of documents once, and not each copy separately, as was previously the case (Letter of the Ministry of Finance of the Russian Federation dated October 29 .2015 No. 03-02-RZ/62336).

The requirements for the preparation of documents submitted to the tax office in 2020 do not conflict with the content of the letter from the Ministry of Finance of the Russian Federation given above. According to the new requirements in 2020, all requested copies of documents should be grouped into volumes containing no more than 150 pages in each of them (Appendix No. 18 Order of the Federal Tax Service dated November 7, 2020 No. ММВ-7-2 / [email protected] ).

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

The procedure for submitting documents to the inspection

The Federal Tax Service issued letter No. ED-16-2/304 dated December 4, 2015, in which it clarified some issues related to the submission of documents as part of tax audits and other tax control activities. In particular, officials said that inspectors have the right to request from the taxpayer being inspected documents that he had previously submitted for specific transactions outside the scope of the tax audit. The authors of the letter also answered whether the inspection should justify its decision to refuse to extend the deadline for submitting documents, and whether scans of documents on disks or flash drives could be transferred to the inspection.

According to paragraph 5 of Article 93 of the Tax Code of the Russian Federation, during a tax audit or other tax control activities, inspectors do not have the right to request from the person being inspected documents previously submitted during desk or field tax audits. According to Federal Tax Service specialists, the provision of this norm does not apply to cases where a taxpayer submits documents outside the framework of a tax audit. This means that inspectors have the right to re-request from the person being inspected documents that were previously submitted to the inspection upon a request for a specific transaction outside the scope of the inspection in accordance with Article 93.1 of the Tax Code of the Russian Federation, which allows the tax authorities to request documents regarding a specific transaction from the participants in this transaction or from others persons who have documents (information) about this transaction.

Tax officials do not have the right to ask for the same documents twice

If copies of documents have already been submitted by the taxpayer to the inspectorate, then employees of the Federal Tax Service should not request the same documents a second time.

For example, when conducting a counter audit, tax authorities do not have the right to request from a company or individual entrepreneur documentation that was previously submitted to the Federal Tax Service during a desk or field audit or as part of tax monitoring. However, there are two exceptions to this rule. Thus, re-requesting documentation is completely legal if:

- the documents were submitted to the Federal Tax Service in the form of originals and have already been returned to the person being inspected;

- documents previously submitted to the inspection were lost due to force majeure (for example, burned in a fire).

Certification of copies of documents for the tax authorities

→ → Current as of: October 19, 2020 When conducting an audit - desk, field or counter - tax authorities have the right to require the organization/individual entrepreneur to submit additional documents (,).

The Tax Code of the Russian Federation provides several ways to do this ():

- documents are transmitted to the Federal Tax Service in electronic form via TKS or through the taxpayer’s personal account.

- the head of the organization (IP) personally or through a representative submits documents to the inspection;

- documents are sent by registered mail (usually with a list of attachments);

Naturally, it is not the original documents that are submitted to the tax authorities, but their copies, which must be properly certified.

On a reasoned refusal to extend the deadline for submitting documents

If the taxpayer cannot submit the requested documents within the prescribed period, he must notify the inspectorate in writing. Within two days from the date of receipt of such notification, the head (deputy head) of the Federal Tax Service has the right to extend the deadline for submitting documents or to refuse this, for which a separate decision is made (clause 3 of Article 93 of the Tax Code of the Russian Federation). When making a decision to refuse to extend the deadline for submitting documents, the reasons why documents cannot be submitted within the established time frame are taken into account; the volume of documents required, as well as other relevant circumstances. At the same time, the head of the inspection is not required to justify his decision to refuse, since this is not provided for by tax legislation, the Federal Tax Service noted.

Rules for certification of documents

In general, the requirements have become simpler and no longer contain detailed technical requirements directly for the firmware method[*].

1. Form documents into volumes, no more than 150 sheets (except for large multi-page documents)

2. Sew: with strong thread, and tie the ends on the back of the last sheet.

3. Sticker: stick a paper sticker with a certification inscription at the place of fastening.

If the law simply refers to a copy, then theoretically you have the right to issue a photocopy without certification (for example, when confirming the zero rate of VAT Article 165 of the Tax Code of the Russian Federation). But judicial practice sometimes produces other decisions.

Thus, the Supreme Arbitration Court of the Russian Federation recently clarified that a joint-stock company is obliged to issue certified copies of documents if its shareholder has made such a demand. 9 Information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated January 18, 2011 No. 144. Although this does not follow from the text of the law. 91 of the Law on JSC.

Certifying copies does not require much effort. But if you have to do this often, then order yourself a stamp with a full set of details - then you definitely won’t forget anything.

– the full title of the position of the employee who confirms the authenticity of copies of the documents provided (there may also be a record of what is certified by the individual entrepreneur or any responsible person);

We suggest you familiarize yourself with: Which is correct: agreement or contract? - Education

– signature of the person certifying the documents, with a transcript (indication of last name and initials);

– an indication of the number of sheets stitched (in words and numbers);

– the date when copies of documents were certified,

Seal is not a mandatory attribute when binding documents, since there are many enterprises that do without it, i.e. if the company has a seal, it is affixed, but if it is absent, it is not, and this will not be a violation of the requirements for preparing copies of documents for tax office employees.

The requirements of the Ministry of Finance are much stricter with regard to registration, in particular, they prescribe the length of the ends of the threads that remain after stitching copies of documents, the size of the paper sticker on the last page, mandatory confirmation with a seal (Letter of the Ministry of Finance of the Russian Federation No. 03-02-РЗ/6233) .

The new requirements of the Federal Tax Service for the preparation of documents provided at their request do not contain such nuances.

If it is necessary to provide copies of documents of a personal nature to the tax office, the procedure for certifying them is slightly different. So, in order for an individual to receive the deductions due to him, social or property, copies of documents must be attached to the application. Let's consider the procedure for their certification.

Something to remember! To receive a tax deduction, you must provide the tax office with not only copies of documents, but also originals, such as:

- certificate in form 2-NDFL;

- declaration 3-NDFL;

- confirmation of training;

- tax refund application;

- other.

Copies of which documents are included in the package of documents for obtaining a tax deduction?

- passports;

- payment orders;

- extracts;

- evidence;

- others.

The seal, if used in the organization, is placed on the certification in such a way that it partially covers the sticker, personal signature, surname and initials of the person, as well as the date of certification.

A certified copy of a document is a copy of the document, on which, in accordance with the established procedure, the necessary details are affixed to ensure its legal significance.

As the Ministry of Finance of the Russian Federation indicated, when certifying copies of documents, it is necessary to be guided by GOST R 6.30-2003 Unified documentation systems “Unified system of organizational and administrative documentation. Documentation requirements."

According to this GOST, when certifying the conformity of a copy of a document with the original, below the “Signature” requisite the following is indicated:

certification: “Correct”

position of the person who certified the copy;

personal signature; decryption of signature (initials, surname);

date of certification.

It is necessary to take into account the purposes of submitting copies of taxpayer documents to the tax authorities, namely their further use in control work, including as an evidence base.

Currently, in business practice, there are two ways to certify multi-page documents: certifying each individual sheet of a copy of a document or binding a multi-page document and certifying it as a whole. Everyone chooses the method that is convenient for them.

ensure the ability to freely read the text of each document in the document, all dates, visas, resolutions, etc. and so on.;

exclude the possibility of mechanical destruction (embroidery) of the binder (pack) when studying a copy of the document;

ensure the possibility of free copying of each individual sheet of a document in a stack using modern copying equipment (if it is necessary to submit a copy of the document to the court);

carry out sequential numbering of all sheets in the binder (bundle) and, when certified, indicate the total number of sheets in the binder (bundle) (except for a separate sheet containing the certification inscription).

On the reverse side of the last sheet (or on a separate sheet) the following details must be affixed: “Signature”, “Correct”, position of the person who certified the copy, personal signature; transcript of the signature (initials, surname), date of certification.

The Ministry of Finance draws attention to the fact that copies of documents must be submitted to the tax authorities with a covering letter and a list of the documents being submitted. This must be done in order to avoid repeated submission of documents contrary to paragraph 5 of Article 93 of the Tax Code of the Russian Federation.

The relationship between accounting employees of any organization and fiscal authorities often involves documentary confirmation of certain stages of the company’s activities and its status. To do this, the Tax Inspectorate may request copies of the necessary documents.

The Tax Code directly states that all copies must be notarized before delivery. True, the procedure for registering them and giving them legal significance is not prescribed in any way in the Tax Code. It is because of this that controversial and even outright conflict situations often arise.

The Ministry of Finance has clarified the rules for certifying copies required by tax authorities from organizations.

21.03.2018

The Tax Service has updated the regulations for organizing work with payers of taxes, fees, insurance contributions for compulsory pension insurance, as well as tax agents. The amendments concern activities that are mandatory when a taxpayer transfers from one Federal Tax Service Inspectorate to another.

Certification of copies of documents is done as follows:

- the word “True” is a certification;

- job title of the person who certifies the copy;

- signature of the person certifying the copy;

- deciphering the signature of an official;

- date of authentication of the copy.

It is allowed to certify a copy of a document with a seal determined at the discretion of the organization (clause 3.26 of GOST R 6.30–2003).

Deputy Head of the Office Management Service_________A. I. Malikov

02/17/2016 Print

Which documents are stamped and which{amp}gt;{amp}gt;

The position of the tax authority on this issue is as follows: based on the provisions of Art. 93 of the Tax Code of the Russian Federation, each copy of the document must be certified, and not the filing of these documents (Letters of the Ministry of Finance of Russia dated May 11, 2012 No. 03-02-07/1–122, dated October 24, 2011 No. 03-02-07/1–374, Federal Tax Service Russia from 02.10.

2012 No. AS-4-2/16459). Only if the document is multi-page, the Federal Tax Service of Russia agrees with the certification of the bound document (Letter of the Federal Tax Service of Russia dated September 13, 2012 No. AS-4-2 / [email protected] ).

Consequently, a copy of each document submitted to the tax authority is certified separately, and not a binder.

Clause 1 of Article 129.1 of the Tax Code of the Russian Federation provides for liability for unlawful failure (untimely communication) by a person of information at the request of the tax authority. Liability includes a fine of 5,000 rubles.

Courts, when considering such disputes, come to the conclusion that the timely submission of documents in the form of a binder does not constitute a refusal to submit them. Consequently, no offense is formed. Examples may be the Resolutions of the Federal Antimonopoly Service of the West Siberian District dated November 29.

We suggest you read: Is it necessary to change the TIN when changing your registration in 2020?

2012 No. A75-10186/2011, dated 08/30/2012 No. A75-10187/2011, dated 08/24/2012 No. A75-10184/2011.

Conclusion: certification of copies of documents by filing can lead to the collection of a fine. At the same time, the courts support the taxpayer’s position and overturn the decisions of the tax authorities. So it is better to certify each document separately if their number does not exceed reasonable limits.

Find out how to properly draw up a power of attorney{amp}gt;{amp}gt;

Documents transferred to CenterInform JSC upon conclusion of the contract cannot be returned

Certification of copies of documents provided by a client - a legal entity - can be carried out by the following employees of the client - a legal entity (at the client’s choice):

- Head of a legal entity The powers of the head of a legal entity are confirmed by an extract from the Unified State Register of Legal Entities for this legal entity, where in the section “Information on individuals who have the right to act on behalf of the legal entity without a power of attorney” the position, surname, first name and patronymic of the person who certified the copies are indicated.

- Chief accountant The client, a legal entity, provides a copy of the order for the appointment of the chief accountant indicating the name of the legal entity, position and full name. chief accountant. A copy of the order can be certified by the head of the legal entity or the chief accountant himself.

- An employee of the HR department (personnel department, personnel service, etc.) The client - a legal entity provides a copy of the order for the appointment of an employee of the HR department, indicating the name of the legal entity, position and full name. of this employee. A copy of the order can be certified by the head of the legal entity or the HR department employee himself.

- Another employee of a legal entity. The client, a legal entity, provides: A copy of the order can be certified by the head of the legal entity or the employee himself.

- Any individual (including those NOT in an employment relationship with a legal entity). This person provides the original power of attorney on behalf of the legal entity (with the signature of the head of the legal entity and the seal of this legal entity), in which: The original power of attorney is presented to CenterInform JSC, a copy certified by the authorized person remains at CenterInform JSC.

- The phrases “the copy is correct”, “matches the original” or “true” (affixed to certify the validity of the paper provided).

- Signature of the person (official) who certified the copies.

- Explanation of the signature indicating the surname and initials of the person who signed the documents.

- Date of certification of copies of documents in the established format, example: 01/01/2018.

- Stamp of the seal of the enterprise (organization) or private entrepreneur.

As a rule, at large enterprises the inscription is affixed in the form of a stamp rather than written by hand

Important! If an individual entrepreneur does not have his own seal, submitting copies without affixing it is permitted and will not lead to the recognition of the certification as “inappropriate.”

Electronic document flow with the Federal Tax Service via Internet TKS and on a flash drive

How to submit documents electronically

Documents required by the Federal Tax Service can be sent electronically:

- in xml file format;

- in the form of scan images.

When sending documents, make an electronic inventory of them (format approved by order of the Federal Tax Service dated January 18, 2017 No. ММВ-7-6/16). This Order of the Federal Tax Service allows you to include in the inventory any documents in xml file format or as scanned copies.

The Xml format can only be used for documents that are included in the Tax Documentation Classifier (KND) and have the appropriate code. Even those documents that do not have a KND code can be scanned and included in the inventory. The main thing is that the file has a tif, jpg, pdf or png extension.

Scan images must be in black and white with a resolution of no less than 150 and no more than 300 dpi using 256 shades of gray. This procedure follows from tables 4.9 and 4.10 of the appendix to the order of the Federal Tax Service dated January 18, 2017 No. ММВ-7-6/16.

Electronic documents must be certified by an enhanced qualified electronic signature of the organization or its representative (Clause 2 of Article 93 of the Tax Code).

Attention: if documents cannot be sent in xml format or as a scanned copy, submit them on paper.

You can send electronic files for inspection to inspectors:

- via telecommunication channels;

- through the taxpayer’s personal account.

The procedure for submitting documents electronically using the TCS was approved by Federal Tax Service order No. MMV-7-2/168 dated February 17, 2011, and the procedure for submitting documents through the taxpayer’s personal account was approved by Federal Tax Service order No. MMV-7-17/617 dated August 22, 2017.

Documents are considered received by the tax office at the moment when the organization receives an electronic receipt from it (clauses 12–13 of the Procedure, approved by order of the Federal Tax Service dated February 17, 2011 No. ММВ-7-2/168).

About submitting electronic documents on a flash drive

Order of the Federal Tax Service of Russia dated June 29, 2012 No. ММВ-7-6/ [email protected] approved the format of the inventory of documents sent to the tax authority in electronic form via TKS. It follows from this that you can submit to the TCS inspection:

- documents that are compiled electronically in an established format (in the form of an xml file) and transferred to counterparties through an electronic document management system (for example, Diadoc). Among such documents are an invoice, an acceptance certificate for work (services), TORG-12.

- documents that were originally compiled on paper or in electronic form, but in a free format (in the form of scanned images). These include GTD, TORG-12, TTN, work (services) acceptance certificate, contract, specification, etc.

This means that via the Internet you can send to the inspectorate those documents that were originally drawn up on paper. It is important to understand that to send the documents requested by the inspection (both electronic and paper scans), a reporting system is used (for example, “Kontur.Extern”), and not an electronic document management system with counterparties (“Diadoc”).

Tax audits and electronic document flow with the Federal Tax Service since 2016

From 07/01/2016, stricter rules will come into force for companies required to submit tax returns (calculations) under the TKS. A period has been set for them during which they are obliged to establish electronic document flow with the inspection.

No more than 10 days are given for this from the date the obligation to submit reports electronically arises. During this time, you need to have time to conclude an agreement with the operator and obtain a qualified certificate for the electronic signature verification key. And in a situation where an authorized representative of the organization is responsible for online interaction between the company and the Federal Tax Service, you must also submit a document confirming his authority to the inspectorate. Otherwise, tax authorities may block the account of a sluggish taxpayer.

Tax audit will require less paperwork from the person being audited

From July 1, 2016, during inspections carried out, incl. inspections and funds, companies and individual entrepreneurs will no longer need to submit documents that are already at the disposal of other government agencies, incl. electronic.

Instead, inspectors will request the necessary information themselves from the relevant department. The Government of the Russian Federation has approved a list of documents and information that regulatory authorities will exchange among themselves, and not require them from businessmen. Among other things, this list included:

- information from accounting (financial) statements;

- extracts from the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs;

- data on the presence (absence) of debts for taxes, fees, penalties and fines;

- information on the average number of employees;

- information about debts on insurance premiums, etc.

In addition, from 01/01/2017 (clause 5.1 of Article 23 of the Tax Code of the Russian Federation), when conducting a desk audit of a VAT return submitted electronically using the TKS, explanations will also need to be submitted electronically. Explanations on paper will be considered not provided.

Accordingly, if paper explanations are sent instead of electronic ones, the person being inspected will face a fine for failure to report (late reporting) of the requested information: 5 thousand rubles for the first violation, and 20 thousand rubles for a repeated offense committed during the calendar year.

In addition, it is now legally stipulated that in the event that the tax office requires the submission of photocopied documentation, the documents must be submitted in the form of a numbered staple. Requirements for document firmware will be separately developed by the Federal Tax Service. Let us remind you that at the moment, copies of documents sent to the inspection should be prepared in accordance with the recommendations of the Ministry of Finance.

Who has the right to certify copies of documents sent to the Federal Tax Service to receive a tax deduction?

- Copies of documents submitted to receive a tax deduction can be certified by a notary.

- Copies of documents submitted to receive a tax deduction can be certified by the citizen himself in the following order:

- each copy page must be signed separately;

- confirmation of the authenticity of the copy is made out with the words “the copy is correct”, which are located at the bottom of the page. The signature, its decoding and date are also placed here.

Documents sent to the Federal Tax Service from a private individual to obtain a tax deduction are accompanied by an inventory, which indicates all copies of documents submitted.

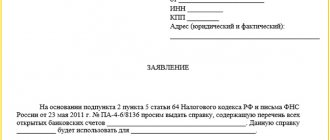

Form of notification of impossibility to provide requested documents

The Federal Tax Service has developed a form and electronic format for a notification that a taxpayer must send to the Federal Tax Service in response to a request for the submission of documents (information) in the event that he cannot fulfill this requirement within the prescribed period.

If during the audit the tax authorities sent a request for the presentation of documentation, then, as a general rule, the audited person has 10 working days from the date of receipt of such a request to submit the requested documents to the Federal Tax Service Inspectorate (clause 3 of Article 93 of the Tax Code).

If for some reason it is impossible to do this on time, the taxpayer, within the day following the day of receipt of the request, must notify the inspectorate in writing in accordance with the developed form about the impossibility of fulfilling the request on time, indicating the reasons and deadlines when documents (information) can be presented.

The notification can be submitted to the tax authority in person, through a representative, transmitted electronically via telecommunication channels or through the “Taxpayer’s Personal Account”. Persons who, in accordance with paragraph 3 of Art. 80 of the Tax Code of the Russian Federation does not impose the obligation to submit a tax return in electronic form; they can send a notification by registered mail.

Certified copies of documents for tax deductions

Other actions are necessary when certifying copies of documents confirming personal actions. For example, when an individual submits an application to receive the required property or social tax deduction.

Let us remind you that the package of documents for deduction must consist not only of copies, but also originals of some documents, which include 2-NDFL certificates, 3-NDFL tax returns, an application for a tax refund, certificates confirming training, etc.

Copied documents (passport, various certificates, extracts, payment orders, etc.) can be certified by the applicant independently. And this should be done as follows:

every page is signed;

the certification record is located at the bottom of the copied page and is drawn up, signed, the signature is deciphered and the date is affixed.

The package of documents prepared for submission to the Federal Tax Service, in the same way as when submitted by an enterprise, is accompanied by an inventory in which each of them is recorded.

Is it possible to submit a scan of the “primary” to the inspection instead of a paper original?

If the tax authorities requested the original of the primary document, which was originally drawn up on paper, then it is this “paper” original that must be submitted to the inspectorate. Replacing the original with an electronic scanned image, the file with which is signed with an enhanced qualified signature, is not allowed. This position is expressed in the letter of the Federal Tax Service of Russia dated May 17, 2016 No. AS-4-15/ [email protected]

During control activities, the tax inspectorate has the right to request from the taxpayer originals (originals) of primary documents. The original of a document is its first or single copy. This is stated in paragraph 3.1 of the National Standard of the Russian Federation “Office work and archiving. Terms and definitions" (GOST R 7.0.8-2013, approved by order of Rosstandart dated October 17, 2013 No. 1185-st).

Based on this, the authors of the letter conclude: if the primary document is drawn up on paper, then such a copy with the handwritten signatures of the persons responsible for processing the transaction is the original. It is impossible to submit an electronic scan image instead, even if the corresponding file is signed with an enhanced qualified signature.

Replacing the original with its electronic scanned image, even certified by the parties to the transaction using enhanced qualified electronic signatures, is not allowed in this situation, and accordingly, is equated to failure to provide the requested documentation, which threatens with a fine of 200 rubles for each unsubmitted document.

How to certify documents for the tax office from January 4, 2020: new requirements of the Federal Tax Service

On January 4, 2019, new requirements for documents submitted to the tax authority on paper came into force. Order of the Federal Tax Service dated November 7, 2020 N ММВ-7-2/ [email protected] , Appendix N 18. In July 2018, the new GOST R 7.0.97-2016, some of its requirements contradicted the rules for certification of documents for the Federal Tax Service in force at that time .

How to certify documents for the tax authorities under the new rules? Let's look at the key changes.

From January 4, 2020, new rules for certifying document bindings for the Federal Tax Service are in effect.

What is a certification inscription and how to affix it correctly yourself?

The certification, which is affixed to the copies requested by the Federal Tax Service, consists of:

- The phrases “the copy is correct”, “matches the original” or “true” (affixed to certify the validity of the paper provided).

- Signature of the person (official) who certified the copies.

- Explanation of the signature indicating the surname and initials of the person who signed the documents.

- Date of certification of copies of documents in the established format, example: 01/01/2018.

- Stamp of the seal of the enterprise (organization) or private entrepreneur.

As a rule, at large enterprises the inscription is affixed in the form of a stamp rather than written by hand

Important! If an individual entrepreneur does not have his own seal, submitting copies without affixing it is permitted and will not lead to the recognition of the certification as “inappropriate.”

When one document is submitted to the tax office, the entire certification is written directly on the copy itself. If the document is on several sheets, it is stitched. It is necessary to sew the package with a large needle, make holes with an awl or a hole punch, the holes should not touch the text, and after fastening there should be free access to completely turn the sheets and make copies from them; for this, two or three holes are made on the left side on a vertically located A4 sheet . You need to sew with strong threads (silk threads or ribbons). The ends of the threads are brought to the back of the folder, and a strong knot is tied.

You need to make a rectangle measuring 6 by 4 centimeters from white paper and glue it to the stitched folder so that the knot of threads is in the center of the glued rectangle. The ends of the rope should be a little more than two centimeters.

The certification inscription is affixed directly to the glued rectangle, which also indicates the number of stitched and numbered sheets (as a rule, organizations have forms of such certification sheets).

Important! All documents in the bound folder are numbered. It is necessary to number sheets, not pages, since a double-sided copy is not allowed when presented to the tax office.

Improper certification of copies of documents submitted to the tax authorities may result in a fine.

If several documents are stitched, then an inventory is also included in the folder indicating the number of copies, names of documents and pages in the folder on which they are located.

The location of the indicated inscriptions on the certification sheet is also important. So, the seal should cover the signature, the transcript of the signature and part of the phrase about the authenticity of the copy.

Paper copies

Submission of documents on paper is made in the form of copies certified by the person being verified (paragraph 2, paragraph 1, article 93 of the Tax Code of the Russian Federation).

A copy of a document is a copy of a document that completely reproduces the information of the original document (clause 23 of GOST R 7.0.8-20131).

An extract from a document is a copy of part of the document, certified in the prescribed manner (clause 26 of GOST R 7.0.8-2013).

Keep in mind that, if necessary, the tax authority has the right to familiarize itself with the original documents (paragraph 5, paragraph 2, article 93 of the Tax Code of the Russian Federation). Such a need may arise, in particular, in the event of a discrepancy between the information provided and the information contained by the tax office, as well as in the case of verification of copies of documents with their originals (letter of the Ministry of Finance of the Russian Federation dated January 11, 2009 No. 03-02-07/1-1) .

We certify copies

A certified copy of a document is a copy on which, in accordance with the established procedure, details are affixed that ensure its legal significance (clause 25 of GOST R 7.0.8-2013).

We invite you to read: My tax contributions - advice from lawyers and lawyers

When certifying compliance, copies of the document are affixed below the “Signature” detail (clause 3.26 of GOST R 6.30-20032):

- certification “Correct”;

- position of the person who certified the copy;

- personal signature;

- decryption of the signature (initials, surname);

- certification date.

For a sample certification, see Example 1.

Please note: tax authorities cannot require notarization of copies of documents (paragraph 2, paragraph 2, article 93 of the Tax Code of the Russian Federation).

Officials in letters of the Federal Tax Service of Russia dated September 13, 2012 No. AS-4-2/ [email protected] and the Ministry of Finance of Russia dated August 7, 2014 No. 03-02-RZ/39142 (sent by letter of the Federal Tax Service of Russia dated August 29, 2014 No. AS-4-2 /17341) explained the procedure for certification of multi-page documents.

When flashing a multi-page document, you must:

- ensure the ability to freely read the text of each document;

- eliminate the possibility of mechanical embroidering of the hem;

- provide the ability to freely copy each individual sheet of a document;

- carry out sequential numbering of all sheets in the binder and, when certified, indicate the total number of sheets in the binder (except for a separate sheet containing the certification inscription).

On the reverse side of the last sheet (or on a separate sheet) the following details must be indicated:

- certification inscription “True”;

- position of the person who certified the copy;

- personal signature;

- decryption of signature (initials, surname);

- date of certification;

- the inscription “Total numbered, laced, sealed _____ sheets” (the number of sheets is indicated in words).

For a sample certification, see Example 2.

Document filing

The Tax Code of the Russian Federation does not provide for the submission to the inspection of a binder of documents certified on the back of the last sheet of the last document. Officials believe that every copy of a document should be certified, and not the filing of these documents.

Arbitration practice on this issue is contradictory. Some judges believe that the certified filing of documents is legal.

The arbitrators came to the conclusion that the timely submission by the company of copies of documents requested by the inspection, drawn up in the form of a binder containing the certification signature of an authorized person, does not constitute a refusal to submit them and cannot be regarded as a failure to provide documents at all. This conclusion was made in the decisions of the Federal Antimonopoly Service of the Central District dated November 1, 2013 in case No. A54-8663/2012 and the West Siberian District dated August 30, 2012 in case No. A75-10187/2011.

At the same time, we found judicial acts that say that every copy of a document must be certified, and not the filing of these documents.

The court found that the applicant submitted to the Federal Tax Service a file of documents containing the following entry on the reverse side of one of the documents: “In total, 270 (two hundred and seventy) sheets are numbered, laced, and sealed. Copy. Right. Representative of Trivium-XX1 LLC, economist Lazutkina E.G. 08/05/2008.” The arbitrators decided that this fact indicates that the company submitted copies of documents that were not properly certified (resolution of the Federal Antimonopoly Service of the Moscow District dated November 5, 2009 No. KA-A41/11390-09 (determination of the Supreme Arbitration Court of the Russian Federation dated February 17, 2010 No. VAS-946/10)) .

List of documents

Tax officials do not have the right to demand from the person being inspected documents that were previously submitted to the inspectorate during desk or field audits. True, this restriction does not apply to cases where documents were previously submitted to the inspection in the form of originals, which were subsequently returned, as well as to situations where documents were lost due to force majeure (clause 5 of Article 93 of the Tax Code of the Russian Federation).

In order to comply with the restriction on re-requesting documents, officials recommend that taxpayers submit documents with a covering letter and inventory (letter of the Ministry of Finance of Russia dated 08/07/2014 No. 03-02-РЗ/39142).

If they are sent in paper form, then the inventory is drawn up in free form (Example 3).

For valuable postal items, you can choose the service - inventory of attachments. In this case, a legally significant description of the contents is attached to the letter. The letter with the inventory is submitted to the post office in open form and with the inventory form filled out in two copies according to Form 1074. You can fill out the form on the official website of the Russian Post5.

If documents are sent in electronic form via TKS, then the inventory is compiled in electronic format. Order of the Federal Tax Service of Russia dated June 29, 2012 No. ММВ-7-6/ [email protected] approved the format of the inventory of documents sent to the inspection in electronic form via TKS, which includes the formats of the documents specified in the inventory and presented in the form of scanned images.