An internal part-time worker is sent on a business trip. How to register his absence and what will happen to earnings from his main job, read about it in the article.

Internal part-time work - performing other regular paid work for the same employer in free time from the main job (Part 1 of Article 60.1 of the Labor Code of the Russian Federation).

Two employment contracts are concluded with the employee: one for the main job, the second for part-time work, which states that this job is part-time (Part 4 of Article 282 of the Labor Code of the Russian Federation).

Two personal cards are issued in form N T-2 or T-13, the forms are approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 N 1 (hereinafter referred to as Resolution N 1).

For each position (main job and part-time job), the employee is assigned a personnel number.

Salary, vacation pay, benefits and other payments are calculated separately for each position.

Thus, internal part-time work presupposes for each position an autonomous labor relationship with the same employer.

Is it possible to send an internal part-time worker on a business trip?

The Labor Code contains a closed list of conditions and circumstances under which the employer does not have the right to send employees on business trips. They are given:

- in Article 203 of the Labor Code of the Russian Federation - during the period of validity of the apprenticeship contract, employees cannot be sent on business trips not related to the apprenticeship;

- Article 259 of the Labor Code of the Russian Federation - it is prohibited to send pregnant women on business trips;

- Article 268 of the Labor Code of the Russian Federation - it is prohibited to send workers under the age of 18 on business trips.

Thus, internal part-time work is not an obstacle to sending an employee on a business trip.

Note. General guarantees for posted workers

When sending an employee on a business trip, he must be provided with guarantees and compensation provided for in Articles 168 and 167 of the Labor Code of the Russian Federation, namely:

— maintaining a place of work (position);

— maintaining average earnings;

— reimbursement of expenses related to business travel.

https://youtu.be/inzI4-P5jUo

The procedure for registering a part-time business trip

The procedure for sending an employee on a business trip from one of the organizations has a number of features. On the one hand, a boss who dispatches his subordinate must adhere to the standard algorithm of actions prescribed by the legislator. On the other hand, the second employer is also required to document the legal absence of the person at the place of work.

So, the official who sends the employee on a business trip must:

- Issue the appropriate Order. The document is developed in the form T-9 or T-9a, depending on the number of persons sent on business. This form is unified, however, the employer is allowed to use its own order template, developed for use exclusively within the organization;

- Based on the Order, accounting staff calculate the amount of money due to the person to cover business expenses during the trip. At the same time, the accountant must pay attention to the country where the employee is sent, since the currency in which the finances should be provided will depend on this fact. The advance is issued to a person in any way convenient for him, either in cash or by bank transfer to a card;

- Currently, issuing a business trip certificate is no longer necessary, however, in the internal documentation of some organizations such a need still exists. If the employer practices issuing this document to subordinates, then it is subject to mandatory registration in the relevant Enterprise Register;

- It is necessary to make an appropriate note on the working time sheet indicating that the employee is absent from his actual place. To indicate the departure of a person on a business trip, it is customary to use the code: “K”;

- Upon returning from a trip, the employee is required to fill out advance reporting in Form AO-1. The document is accompanied by all checks/receipts and other supporting documents confirming that all funds received were spent by the person for their intended purpose.

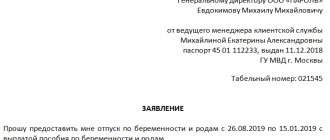

The second employer is obliged to issue unpaid leave to the employee. To do this, the worker will be required to fill out an appropriate application indicating the period of absence and the reason contributing to the absence from work. On behalf of the manager, a corresponding Order is issued, on the basis of which a citizen may not appear in the organization within a specified time frame.

No rating yet

Performing a business trip during the rest period

When working part-time, the duration of working hours should not exceed half of the monthly working hours. That is, the employee will not be able to perform job duties at a part-time job for a time exceeding 20 hours a week, four hours a day. This is stated in Part 1 of Article 284 of the Labor Code of the Russian Federation.

An internal part-time worker can work full-time (shift) only on days when he is free from performing work duties at his main place of work (Part 1 of Article 284 of the Labor Code of the Russian Federation).

During the period of a business trip, a part-time employee is exempt from performing labor duties at the main place of work, which means that he can perform a business trip assignment during a full working day.

Obviously, in this case, the part-time employee will perform a business trip outside of 4 working hours - during the time designated by the part-time work schedule for rest.

Part-time business trip

If an employee is sent on a business trip, he cannot refuse to perform a work assignment. But for this, he is obliged to notify his second employer, if, of course, he is an external part-time worker.

So, a part-time business trip is possible in the following cases:

- if appropriate permission has been received from the main employer;

- if the part-time worker has provided the main employer with a document confirming the need for the trip;

- when a copy of the travel order was provided.

Who should take care of solving problems with a part-time worker’s business trip?

When an external part-time employee is sent on a business trip, the solution to all problems that arise due to discrepancies in schedules and working hours in different organizations is assigned to him. As a rule, during the period of absence from his main job, he takes leave without pay (Article 128 of the Labor Code of the Russian Federation).

If an internal part-time employee is sent on a business trip, the employer is obliged to compensate him for all losses arising in this case.

Let's look at what it can do.

Sending an internal part-time worker on a business trip

If the combination of positions is carried out with the same employer, then the procedure for sending on a business trip will not have any difficulties, since everything is approved by the same person. As a rule, it is advisable to send an internal part-time worker whose positions are similar, since in this case there will be no additional questions from the inspection authorities. When on a business trip, an internal part-time worker has certain guarantees that the employer must provide him with:

- Firstly, upon returning from the trip, the amount of his monthly earnings should remain the same;

- Secondly, the manager is obliged to reimburse the subordinate from the organization’s budget for all expenses incurred by the person while traveling for official needs. At the same time, compensation is carried out for the main position, and not for the additional one.

As a rule, sending a citizen who combines two positions in one organization on a business trip is carried out for the purpose of:

- Performing several assigned labor tasks in another organization for both positions held;

- The need to send a qualified employee of the relevant professional field on a business trip.

How to maintain income from two positions

If an employee is sent on a business trip only for part-time work, the employer is obliged to maintain his average earnings only for this position, because the law does not provide for the calculation of wages for the period when the employee does not perform job duties. However, in all cases when an employee is deprived of the opportunity to be at the workplace and (or) perform his labor (official) duties due to the fault (in our case, on the initiative) of the employer, his average earnings are also retained as a guarantee. This conclusion follows from Part 1 of Article 165 of the Labor Code of the Russian Federation.

Features of an external part-time worker’s business trip

According to Decree of the Government of the Russian Federation dated October 13, 2008 No. 749, an employee has the following guarantees:

- maintaining a job;

- compensation of the average monthly salary during absence from work;

- payment of travel expenses.

Also, questions about the secondment of an external part-time worker are reflected in Articles 165, 166, 167, 168 and 169 of the Labor Code of the Russian Federation. When applying for unpaid leave, an employee temporarily loses earnings at their main place of work. The blame for the duties that the part-time worker did not have time to perform at the additional place of work due to his being sent on a business trip falls on the head of the additional work in accordance with Article 155 of the Labor Code of Russia.

In the employee’s report card at the main place of work, the letter code “DO” or the numeric “16” is entered. At the place of part-time work, the code “K” or “06” is entered. There is also an option in which an employee at his main place of work can be sent on a business trip to the same area as at another place of work. In this case, the employee retains his job and average salary from both employers, and also receives funding from both for business travel, accommodation and other expenses of the part-time worker. This is the most suitable option for the employee.

Failure to fulfill labor duties due to the fault of the employer

In accordance with Part 1 of Article 155 of the Labor Code of the Russian Federation, in case of failure to comply with labor standards or failure to fulfill labor (official) duties, the employee is paid in an amount not lower than his average salary, calculated in proportion to the time actually not worked due to the fault of the employer.

By making a decision to send an employee on a business trip for one (combined) position, the employer simultaneously deprives the employee of the opportunity to fulfill the work standard (job responsibilities) for his main job. In other words, failure to comply with labor standards (failure to fulfill official duties) for the main job in the situation under consideration was due to the fault of the employer. Thus, during the period that an internal part-time worker is on a business trip, the employer must maintain his average earnings at his main place of work.

Calculation of average earnings saved for the period of a business trip at a combined place of work and for the period of non-fulfillment of official duties due to the fault of the employer at the main place of work is made according to uniform rules: based on the wages actually accrued to the employee and the time actually worked by him for the 12 calendar months preceding the period , in which the business trip began. This procedure is established in part 3 of article 139 of the Labor Code of the Russian Federation and paragraph 4 of the Regulations on the specifics of the procedure for calculating average wages, approved by Decree of the Government of the Russian Federation of December 24, 2007 N 922.

conclusions

Based on this article, we will draw several main conclusions:

- The law does not prohibit business trips for part-time workers who work in several places at the same time.

- If the part-time job is external, it is recommended to write an application for leave at your own expense at your main place.

- When the part-time job is internal, the employee does not need to write anything, he simply goes and receives payment based on the average salary for both positions.

- If a person goes on a business trip as a part-time worker, overtime hours are entered on his timesheet, since he is there for more than 4 hours a day. Overtime hours are paid at an increased rate.

An employee sent on a business trip only to his main place of work is not required to take leave without pay for an internal part-time job for this period. In this case, in our opinion, in part-time work on the basis of Art. 155 of the Labor Code of the Russian Federation, the employee retains his average earnings for the entire period of his business trip.

Performing other work, in addition to that provided for in the employment contract, for the same employer, in accordance with the Labor Code of the Russian Federation, is allowed on the terms of internal part-time work. Internal part-time work means that an employee, in his free time from his main job, performs another regular paid job for the same employer under a separate employment contract (Article 60.1, 282 of the Labor Code of the Russian Federation).

A business trip is a trip by an employee by order of the employer for a certain period of time to carry out an official assignment outside the place of permanent work (Article 166 of the Labor Code of the Russian Federation). In this case, the employee can be sent on a business trip at the same time both at the main place of work and part-time (paragraph 2, clause 9 of the Regulations on the specifics of sending employees on business trips, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749).

At the same time, the regulatory legal acts do not regulate the issue of registering the period of time when an employee is sent on a business trip to only one place of work (either at the main place of work or part-time).

As a rule, in practice, such an employee is granted unpaid leave during a business trip. For example, Deputy Head of the Federal Service for Labor and Employment (Rostrud) I.I. Shklovets, in an informal explanation, noted that in the case when an employee is sent on a business trip for his main position, during the period of absence for a combined position, he (the internal part-time worker) can take leave without pay.

However, it should be noted that the employee is not required to agree to take unpaid leave in such a situation. We emphasize that the law does not provide for such an obligation; therefore, this issue must be resolved by agreement of the parties, and it is important to take into account that the initiative to use such leave can only come from the employee (Part 1 of Article 128 of the Labor Code of the Russian Federation).

Accordingly, being sent on a business trip to the main place of work, the employee is not obliged to take leave for this period without pay on an internal part-time basis.

In turn, the employer, by sending the employee on a business trip for his main position, simultaneously deprives the employee of the opportunity to fulfill the work standard (job responsibilities) for an internal part-time job. On this basis, the courts come to the conclusion that in this case Art. 155 of the Labor Code of the Russian Federation, accordingly, the employer for a combined position must pay the employee the average salary (decision of the Khanty-Mansiysk District Court of the Khanty-Mansiysk Autonomous Okrug - Ugra dated 06/09/2015 in case No. 2-2773/2015).

Thus, in our opinion, when sent on a business trip only to the main place of work at a part-time job on the basis of Art. 155 of the Labor Code of the Russian Federation, the employee retains his average earnings for the entire period of his business trip.

In conclusion, we note that the employer has the right to send an employee on a business trip at the same time both at the main place of work and part-time, and in this case it will be necessary to maintain the average earnings for the two positions.

Carrying out part-time work is taken into account by the norms of the Labor Code of the Russian Federation. One type of such combination is internal part-time work. This means that the employee performs job responsibilities in two directions. At the same time, he performs work in one organization. Under any circumstances, one of the jobs will be the main one, and the other will be performed part-time. One of the most difficult issues with internal part-time work is the business trip of such an employee. And the complexity of this issue lies in the fact that this situation is not directly regulated by law.

Business trip to both places of work

If an employee is sent on a business trip simultaneously for his main job and part-time work, the average salary is maintained for both positions on the basis of Article 167 of the Labor Code of the Russian Federation and paragraph 2 of clause 9 of the Regulations on the specifics of sending employees on business trips, approved by Decree of the Government of the Russian Federation dated 13.10. .2008 N 749 (hereinafter referred to as the Regulations on Business Travel).

The employer has the right to arrange two business trips for one employee at the same time and to the same place with tasks for both positions. In this case, the job assignment must be drawn up for each position separately. The employee will be required to submit separate reports on the performance of each task. And travel expenses - travel, renting accommodation, daily allowance, etc. - will be reimbursed by the employer to the employee in a single amount.

What does the law say on this topic?

In Art. 282 of the Labor Code of the Russian Federation states that part-time work is the labor activity of a citizen, carried out in his free time from his main job. Thus, any circumstances on the spot should not interfere with work in the main position, including business trips.

Also, the specifics of business trips are regulated by Decree of the Government of the Russian Federation of October 13, 2008 No. 749, which states the following:

- If an employer sends his employee on a business trip, he retains his average earnings. Travel expenses must also be paid in advance, and upon return he must provide an advance report to determine the amount of all expenses and, if necessary, demand compensation for his own funds if they were reasonably spent.

- If, by coincidence, both employers send their employee on a business trip, then the average salary remains with him in all places, and the payment of travel expenses is distributed between them.

- Before going on a business trip, an external part-time worker must notify the employer at the main place about this in order to agree on a work schedule. If this is not done, then the latter may count the days of absence as absenteeism, which will adversely affect labor relations and activities in general, because this constitutes valid grounds for dismissal.

Below we will consider an example of a situation in which a manager sends an employee who is on maternity leave for a child under 3 years old on a business trip:

Sazonova V.Yu. She is employed at Elf LLC as a part-time PR manager and is on maternity leave. The director asked her to go to a neighboring city to conduct promotions, and she agreed, providing him with written consent. In this case, it is not necessary to notify the employer at the main place, because the employee is still on maternity leave - accordingly, she does not return to work at her main position and the business trip cannot interfere with the work process.

During a business trip

The choice of code for the report card depends on the method in which it was decided to register the absence of an employee for his main position.

Two business trips. The period of simultaneous presence of a part-time worker on two business trips is noted in the time sheet separately for each position with the letter code K or digital code 06. However, the number of hours worked is not recorded.

Business trip - only to one place of work, to another place of work - failure to fulfill official duties through the fault of the employer. The code for time not worked through the fault of the employer is not established by Resolution No. 1. It will have to be introduced by a separate order. This can be a combination of letters - BP, numbers - 38 or any other options. The main thing is to establish a correspondence between this code and the procedure for paying for the time indicated by it.

To perform a business trip - 8 hours a day. To solve the problem of the discrepancy between the usual 4-hour work schedule and the 8-hour work schedule of a part-time worker on a business trip, you can change the internal part-time work schedule for the period of the business trip - set its duration to within 8 hours a day.

In general, establishing a special work schedule for the period of a business trip, including additional hours, would mean that the employee would work during the time that is intended for rest. This involves paying for overtime hours at an increased rate in accordance with Article 152 or 153 of the Labor Code of the Russian Federation (clause 5 of the Business Travel Regulations).

In our case, additional payment can be avoided. On what basis? Let's figure it out.

So, the new work schedule for a part-time employee during a business trip is 8 hours a day. But these 8 hours do not apply to just one position. The first 4 hours are the time of work provided in exchange for deprivation of the opportunity to perform basic work. The next 4 hours correspond to the regular part-time work schedule (they do not require additional payment). The components of the travel task execution time are presented in the diagram.

Thus, by changing the employee’s work schedule for the business trip period, we arrive at the following payment breakdown at the main place of work:

- for the time during which the employee was completely deprived of the opportunity to perform his job duties at the main job (the first 4 hours a day), in accordance with Part 1 of Article 155 of the Labor Code of the Russian Federation, the average earnings are maintained;

— during the time during which the employee performs duties in another (lower paid) position for 4 hours a day, he retains the average earnings at his main place of work on the basis of Part 4 of Article 72.2 of the Labor Code of the Russian Federation.

Example. At LLC Isabella, A. R. Vinogradov works as a financial director with a salary of 40,000 rubles. in a five-day work week, 8 hours a day. On July 16, 2012, the organization entered into an employment contract with him to work as a translator from Chinese on an internal part-time basis in a five-day work week, 4 hours a day. The translator's salary is 20,000 rubles. It is paid if the employee performs the full work standard - 40 hours a week. In our case, accrual is made in proportion to the actual time worked (20 hours per week).

From January 21 to January 31, 2013, A. R. Vinogradov was on a business trip to participate in negotiations with Chinese partners. The secondee had no assignments for his main position. The business trip order states that A.R. Vinogradov must complete the task within 8 hours on working days corresponding to his time schedule. In this case, it is considered that 4 hours a day are worked towards the time spent on the main position. It is necessary to determine the amount of accruals to the employee for January 2013 for both positions if the following data is known.

Table

Payment order

According to the Labor Code of the Russian Federation, the working hours of a part-time worker cannot exceed 4 hours a day.

But, a business trip most often involves more work time.

If a part-time worker is sent on a trip to the part-time place, the employer must enter overtime hours and pay them at an increased rate.

A business trip is paid not according to hours or salary, but according to average earnings for the last year. Additionally, the person will receive a full daily allowance.

That is, if the company has approved a daily allowance of 500 rubles, he will receive exactly that much per day.

You cannot go on a business trip:

- pregnant employee;

- employees under eighteen years of age;

- employees during student leave.

It is mandatory to request consent from:

- women with a child under 3 years old;

- an employee with disabled children;

- workers caring for sick family members.

An employer can be held liable for violating the law.

Important! When an employee is not classified as a category of persons prohibited from traveling and, under an employment contract, he may be invited to travel, he has no right to refuse.

If work is carried out on weekends, then payment is made at a double rate.

If an external or internal part-time employee is sent on a trip

Usually, when working part-time (externally), business trips are not practiced.

After all, part-time work is work in your free time from your main job. However, such situations are not excluded.

Then it is recommended to take vacation at your own expense at the employee’s main place of work.

The approximate content of a statement to an employer would look like this:

I ask you to grant me leave without pay in the period from January 9 to January 15, 2020, since I am sent on a business trip to my place of part-time work.

Attached is a certificate of the upcoming business trip.

But the manager has the right not to give such leave.

Important! You must remember that absenteeism is absence from work without a good reason.

Therefore, you can risk appealing the dismissal through the court. Judges usually side with workers.

It is only recommended to notify the employer about a business trip with another employer in writing, so that in court it can be proven that the manager was notified of the departure.

The best option is to write an application for leave at your own expense, attach to it a business trip order from another employer and register it with the secretary.

Under such circumstances, it will no longer be possible to fire a person for absenteeism, as well as for failure to perform official duties.

Even if this happens, the court will reinstate him.

Another way out of the situation is to take days of paid rest from one of the companies.

And here the manager also has the right to refuse a person.

An employee cannot be refused to accept an application for leave if he belongs to a preferential category of citizens according to the law.

Important! If a part-time employee wishes to refuse a trip, he must have good reasons for this.

The situation is simpler if the employee works part-time at the place of his main work (internal).

Then the employer will simply arrange a business trip for both positions, and the average payment will be made in the total amount.

Then you won't have to pay any overtime. Typically, an employee for both positions is sent on a business trip if:

- you need to complete tasks both at your main place and at an internal part-time job;

- when it is necessary to send a person in one of the positions on a trip.

If an employee on a business trip performed work at his main place, but not part-time, then the average salary is paid only at the main place.

Upon return, the employee is required to provide two reports: an advance report and a report on the work done.

The second report allows you to estimate the percentage of completion of the task.

If the main job and part-time job are with different employers, then the organizations divide travel expenses in half.

Important! If an employee (external part-time worker) is sent on a business trip and at the same time writes a leave application at his main place at his own expense, he will, of course, lose in salary.

If the employee travels to his main place of work

When an employee goes on a business trip to his main place of work, it is recommended that he retain the average salary that he received before leaving. However, in practice it makes more sense to do this:

- if an employee works in different places, then take leave without pay at one of them, and go to another place;

- if a person works part-time in the same place as his main job, the total average salary is simply paid, and he is listed as leaving. Indeed, in fact, despite different positions, one person goes on a business trip.

It is allowed for two employers to jointly send an employee to solve the problems of each company.

Under such circumstances, enterprises have the right to divide travel expenses in half, which will lead to savings.

This situation could be, for example, if an employee is a sales manager in one organization at his main location and a part-time sales manager in another company.

Moreover, both organizations set the task in the same city.

Main difficulties during registration and payment

In Art. 167 of the Labor Code of the Russian Federation states that an employee sent on a business trip must maintain the average salary and place of work, as well as reimburse all expenses: travel, accommodation, daily allowance and additional expenses agreed upon in advance with the manager.

The procedure for calculating average earnings is regulated by Decree of the Government of the Russian Federation No. 922, and the following payments must be taken into account:

- Salaries for hours worked.

- Salary at piece rates.

- Salary accrued for commissions or percentages of completed transactions.

- Salary paid to municipal employees for periods worked.

- Salaries transferred to civil servants in replaced positions.

- Salary accrued for the previous calendar year.

- Allowances for professional qualifications, length of service, part-time work, increase in the volume of work, etc.

- All remunerations and bonuses provided for in the employment contract.

It often happens that an employee goes on a business trip to perform tasks for two positions at once, in which case he must retain the average salary for both places of work if he is an internal part-time worker. For example:

Yaglov S.N. works at Tezis LLC in the main position as a system administrator, and is also a part-time translator. The manager sends her on a business trip to another city to coordinate a project on an IT system with foreign partners. Thus, he is employed in two positions at once, and his average earnings from both places are retained, but travel expenses are paid once.