How to properly pay an advance in 2019-2020 according to the Labor Code

The concept of “advance” is not enshrined in labor legislation. Since the employer is obliged to pay his employees wages every half month, payment for the first half of the month is called an advance.

How are advances paid under the Labor Code of the Russian Federation? Specific terms for payment of wages and advances are not established in the Labor Code of the Russian Federation. The rules for advance payment currently applied (since October 3, 2016) limit the period for issuing money to 15 calendar days from the end of the period for which the salary was accrued (Article 136 of the Labor Code of the Russian Federation). At the same time, the Labor Code does not prohibit making advance payments more often than every half month, for example, 3 times a month (every decade) or 1 time a week. The employer independently establishes the exact dates for payment of income calculated to employees in internal local regulations:

- in the regulations on remuneration;

- collective agreement;

- employment contract.

Thus, according to the current rules for advance payment, the deadline for payment of wages for the first half of the month can be set on one of the days from the 16th to the 30th (31st) day, and for the final payment - from the 1st to the 15th e day of the month (letters of the Ministry of Labor dated 03/12/2019 No. 14-2/ОOG-1663, dated 09/21/2016 No. 14-1/В-911). At the same time, establishing a variable period for transferring income calculated to an employee, for example with the wording “salaries are paid from the 1st to the 10th” or “... no later than the 10th”, is considered a violation of the requirements of the Labor Code, since the employer is obliged to set a specific date of issue (Clause 3 of the letter of the Ministry of Labor dated November 28, 2013 No. 14-2-242).

IMPORTANT! Setting deadlines for paying salaries on the 15th day and advance payments on the 30th is considered inappropriate due to the need to calculate and withhold personal income tax from the advance payment if there are 30 days in a month (i.e. if its payment falls on the last day of the month) .

Let's look at how an advance is paid and when it is necessary to withhold personal income tax from it.

How much is salary advance paid?

From the interpretation in the Labor Code it follows that in reality labor legislation is not endowed with such a concept as an advance. This is just a certain part of the salary, paid directly for the first fifteen days of the month.

In what ratio is the advance and salary paid? It is important to note that, in accordance with Article 423 of the Labor Code, the standards of the Soviet Union are used today when they do not contradict modern labor legislation. Thus, there is a very interesting resolution of the Council of Ministers, the name of which is “The procedure for paying wages to workers for the first fifteen days of the month.” The surprising thing is that it does not contradict the Code at all. It states that the amount of the advance payment towards the employee’s wages for the first fifteen days of the month is formed directly by agreement between the employer and the trade union. In addition, this fact is mandatory in the collective liability agreement.

How much is the salary advance paid? The minimum amount of the advance payment must exceed the employee’s tariff rate for the time actually worked. Thus, when calculating wages for the first fifteen days of the month, the employer must pay attention to the above resolution and be sure to take into account the time that the employee actually worked. By the way, the relevance of the USSR-era resolution was confirmed by Rostrud in a letter dated September 8, 2006 “Calculation of advance payments for wages.”

Personal income tax when issuing an advance to employees

In general, there is no need to withhold personal income tax from the advance payment. This has been pointed out more than once by government departments (letters from the Ministry of Finance dated 02/13/2019 No. 03-04-06/8932, dated 07/13/2017 No. 03-04-05/44802, Federal Tax Service dated 04/29/2016 No. BS-4-11/7893, dated 03/24/2016 No. BS-4-11/4999). Officials justify their point of view as follows:

- the date of actual receipt by the employee of income in the form of wages is the last day of the working month (clause 2 of Article 223 of the Tax Code of the Russian Federation);

- At the time the advance is issued, income has not yet been generated, which means there is nothing to tax.

Therefore, personal income tax must be withheld only upon final payment to the employee for the month worked.

But if the advance payment date is set on the 30th day and it is the last day of the month, problems cannot be ruled out, since tax authorities may recognize the last day of the month as the date of actual receipt of income, and judges may support them (see the Supreme Court ruling dated May 11. 2016 No. 309-KG16-1804).

Also inconvenient will be the date of payment of the advance for the 1st half of the month, set on the 15th day of the month, since the employer will be obliged to pay the 2nd part of the salary on the 30th day of the current month. But the time sheets for the time worked by employees will reach the accounting department no earlier than the 1st day of the next month. Consequently, the accountant simply physically will not be able to calculate wages and pay them to employees on the 30th.

In what cases personal income tax is withheld from the advance, find out here.

Read about how to correctly reflect the advance in form 6-NDFL (nuances).

Methods for assigning an advance

The algorithm for assigning an advance payment is also not established by law and is determined by the employer himself. Various departments in their letters recommend determining the amount of the advance in proportion to the time worked by the employee (letters from the Ministry of Labor dated August 10, 2017 No. 14-1/B-725 and Rostrud dated September 26, 2016 No. T3/5802-6-1).

At the same time, according to officials, the advance amount should include a number of compensation and incentive bonuses, for example, for length of service or for night work. But bonuses, which depend on the achievement of planned indicators, as well as compensation payments calculated after fulfilling the monthly working hours, are not included in the calculation of the advance payment. An example of such compensation is payments for overtime work or work on non-working days.

Thus, officials propose to calculate the amount of wages twice a month, taking into account the actual amount of work performed or the time worked by each employee. The formula for calculating the advance in this case is as follows:

A = Zp ÷ Knd × Kfd,

Where:

Salary - salary;

Knd - standard number of working days;

Kfd - actual number of days worked.

Example 1

Alternativa LLC sets the advance payment deadline for the 16th day of each month, based on the time actually worked by each employee. According to the timesheet, sales department employees worked the following amount of time:

| FULL NAME. employee | Job title | Number of days worked in the 1st half of the month | Salary, rub. | Advance amount, rub. | Calculation of the advance amount |

| Stepanov A. M. | Sales Director | 10 | 40 000 | 18 181,82 | 40 000 ÷ 22 × 10 |

| Artemov L. E. | Sales Manager | 7 (I was on vacation for 3 days without pay) | 25 000 | 7 954,55 | 25 000 ÷ 22 × 7 |

| Bushmin A.V. | Sales Manager | 10 | 25 000 | 11 363,64 | 25 000 ÷ 22 × 10 |

| Bushmin A.V. | Logistician (internal combination) | 5 | 10 000 | 2 272,73 | 10 000 ÷ 22 × 5 |

| Gordienko T. E. | Sales Manager | vacation | 25 000 | — | — |

Employee Bushmin A.V. combined the position of sales manager and logistics manager for 5 days, and therefore will receive an advance payment for 2 positions.

Artemov L. E. was on vacation at his own expense for 3 days. Consequently, he is not entitled to an advance for these days.

Manager Gordienko T.E. will not receive an advance payment, because he was on regular vacation.

This approach to calculating an advance payment is quite time-consuming and labor-intensive; only small businesses with a small staff can choose it. As a rule, large companies set a fixed advance. Let's consider the calculation algorithm and the rules for paying an advance in a fixed amount.

How to calculate the amount of a fixed advance

The fixed amount for the advance can be set:

- in total terms;

- in the amount of a certain percentage of the salary.

By paying an advance in a fixed amount, for example 10,000 rubles, the employer is at great risk. The risk is due to the fact that the employer is obliged to pay an advance in a constant amount, regardless of whether the employee was working or was, for example, on sick leave. Also, at the end of the month, the amount of the entire salary may be less than the advance paid. Therefore, employers rarely choose the first option for paying an advance.

The most common option is to determine the amount of the advance as a percentage of the salary. Since the Ministry of Health and Social Development indicates that the amount of the advance and salary should be approximately equal (letter dated February 25, 2009 No. 22-2-709), employers, as a rule, set the advance at 40–50% of the salary. But if the amount of the advance is set at ½ of the amount of earnings, then salaries for the first and second halves of the month will be very different. Let's look at an example.

Example 2

The employee's salary is set at 40,000 rubles. The personal income tax amount will be 5,200 rubles. (40,000 × 13%)

| Advance amount | Prepaid expense | Salary |

| 40% | 16 000 (40 000 × 40%) | 18 800 (40 000 – 5 200 – 16 000) |

| 50% | 20 000 (40 000 × 50%) | 14 800 (40 000 – 5 200 – 20 000) |

As can be seen from the example, the amount of monthly salary when paying an advance of 50% is significantly less than the amount of the advance itself.

The employer decides independently how to pay the advance in 2019-2020. We recommend setting the advance at 40-45% of the amount of earnings with a correlation to the time actually worked: by the date of payment of the advance, the accountant is provided with time sheets of the time worked by employees, and the salary amount for the 1st half of the month is adjusted to the number of days worked.

Let's consider the procedure for calculating such an advance using the example of manager L. E. Artemov.

Example 3

The employee's salary is 25,000 rubles. We will calculate the advance based on 40% of the salary and the correlation for the actual time worked.

The planned amount of the advance is 10,000 rubles. (25,000 × 40%).

But since the employee worked 7 days instead of 10, the amount of advance payment to be issued will be 7,000 rubles. (10,000 ÷ 10 × 7).

How much is the advance?

What percentage of the salary is the advance? Legislative documents do not provide a specific answer. When calculating it, the time actually worked by the employee is taken into account. The amount cannot be less than the minimum tariff rate for this time. Legislative acts do not prohibit the calculation of payments as a percentage of the salary, so the employer can do this in the following ways:

- by the number of time units actually worked (days, hours);

- set a percentage of the salary, also taking into account the time worked. This is usually around 40-50 percent, which is equivalent to half a month's labor costs.

The amount and calculation method are fixed in the company’s regulatory documents. In any of the considered cases, the calculation takes into account the work time sheet.

The second part of the salary will always be greater than the first, because when calculating it is impossible to take into account all the allowances, bonuses, and additional payments that are calculated based on the results of the month already worked. It follows from this that the advance payment is not always half the monthly salary.

We invite you to familiarize yourself with Certificates and documents from the place of work: to whom, when, what

How is an advance paid for the first half of the month?

The Labor Code does not regulate the nuances of advance payment.

The procedure for issuing an advance on wages is no different from paying wages for the month:

- a statement is drawn up in form T-53;

- the employee signs in a specially designated cell of the statement and receives funds;

- after payment of the advance, this statement with signatures is attached to the cash receipt in form KO-2;

- the accounting records the posting Dt 70 Kt 50.

The advance can also be paid to the employee’s bank card. Before this, the employer must obtain written consent from the employee to receive the salary into a bank account.

How to fill out such an application, read the article “Application for transferring salary to a card - sample”.

The posting when paying an advance to an employee on a card looks like this: Dt 70 Kt 51.

If you have access to K+, see step-by-step instructions for paying salaries. If you don't have access, get a free trial and go to the Salary Guide.

How to keep track of salaries in accounting, see here.

ATTENTION! The employee has the right to change the credit institution by notifying the employer. From 08/06/2019, the notice period is no later than fifteen calendar days before the day of payment of wages. (clause 4 of article 136 of the Tax Code of the Russian Federation).

Why 40 percent?

If the calculation of salary advance in accordance with the law is exactly as described above, why is it so popular today to pay forty percent as an advance? In the Labor Code, none of the articles indicates the exact amount of the advance payment. Thus, the question about the percentage of advance payment from wages can be considered inappropriate. However, the employer will not be able to pay less than forty percent. Why?

The fact is that labor legislation substantiates the rules only regarding the payment of wages. This means that the amount of payment for the first fifteen days of the month, one way or another, must correspond to the employee’s energy costs. If you subtract thirteen percent of the personal income tax from one hundred percent of the salary, you get eighty-seven percent of the salary. The rounded half of this value is the notorious forty percent. If the employer establishes a smaller advance payment, employees have the right to file a complaint with the relevant government authorities, because this is a direct violation of labor legislation (Article 136 of the Labor Code). To avoid risk, it is advisable to determine the advance payment directly based on the results of calculations, rather than establishing a fixed percentage. In addition, when an employee is hired in the second part of the month, for example, on the eighteenth, and the advance is paid, as a rule, on the twentieth, then the payment is not accrued to the new employee, since he did not carry out work in the first half of the month.

Is it possible to issue an advance before the due date?

Payment of an advance within the time limits strictly specified by local regulations of the employer is not always possible, since sometimes the dates for issuing an advance or salary fall on weekends or non-working days. And then the employer is obliged to pay wages the day before. For example, an organization has a salary payment date set for the 7th day of each month, and 09/07/2019 falls on a Saturday. How is the advance paid in this case? The employer is obliged to pay employees on Friday, 09/06/2019.

A situation is possible when the employer, of his own free will, decides to pay the advance in advance on a date not established for this event. The Labor Code does not contain restrictions on early payment of an advance or salary. But when checking, the labor inspectorate may consider this method a violation, since formally the period until the next salary payment will be more than half a month. Therefore, when issuing an advance, it is better to adhere to the established deadlines. Or, then issue the next part earlier in order to meet the 15 days (letter of the Ministry of Labor dated January 25, 2019 No. 14-1/OOG-461).

We wrote more about the position of officials on this issue here.

Is it possible to pay an advance ahead of schedule at the request of an employee? As noted above, the Labor Code does not contain a direct prohibition. But the answer to this question depends on the amount of the advance requested by the employee.

If an employee with a salary of 30,000 rubles. asks to give him 100,000 rubles. against future salaries, then, firstly, the employer bears high risks, because the employee may quit without paying the full amount. Secondly, the labor inspectorate can fine you for violating the requirement to pay wages every six months. And a dispute will most likely arise with the tax authorities about the timing and procedure for paying personal income tax.

When issuing an advance, as we have already found out, personal income tax is not withheld. And if at the end of the month there is no salary to be paid, then there will be nothing to withhold personal income tax from. Also, tax authorities may regard the advance payment as an interest-free loan and charge the employee personal income tax at a rate of 35% of the savings on interest. And organizations will be fined for failure to fulfill the duty of a tax agent.

How to correctly reflect early salary in 6-NDFL, read here.

Responsibility for non-issuance or late payment of advance payment

Payment of an advance after the deadline established by local regulations (or failure to pay an advance at all) is subject to Art. 142 of the Labor Code of the Russian Federation, according to which the employer and officials bear administrative responsibility under clause 6 of Art. 5.27 Code of Administrative Offences:

- from 1000 to 5000 rub. for individual entrepreneurs;

- from 10,000 to 20,000 rub. for officials of the employer;

- from 30,000 to 50,000 rub. for legal entities.

IMPORTANT! The employer will be fined for failure to pay the advance even if he has a written application from the employee to pay wages once a month, since this approach contradicts Art. 136 Labor Code of the Russian Federation.

In addition, for late payment of wages, including advance payments, the employer will bear financial liability in the form of compensation for each day of delay in the amount of 1/150 of the Central Bank key rate (Article 236 of the Labor Code of the Russian Federation).

Is it possible to change salary payment dates?

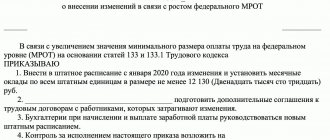

The employer has the right to change the terms of payment of wages; the law does not prohibit this, provided that all rules and regulations are observed. At the same time, it is not necessary to issue a separate order to change the dates of receipt of wages; you only need to make amendments to the collective agreement, as well as internal regulations and contracts with employees.

It should be taken into account that changes are made to each of the documents in its own order and in accordance with its own standards:

- the collective agreement is adjusted according to Article 44 of the Labor Code of the Russian Federation;

- internal regulations - under Articles 190 and 372 of the Labor Code of the Russian Federation;

- employment contracts - under Article 72 of the Labor Code of the Russian Federation.

It is very important to comply with the legal dates for the release of earned funds. Failure to comply with established deadlines, especially increasing them, can lead not only to administrative, but also to criminal liability of the organization.

It is important to observe not only the deadlines, but also the procedure for paying wages. When calculating and subsequently issuing wages, the employer must use unified forms of primary documentation for accounting and payment, approved by Resolution of the State Statistics Committee No. 1 of 01/05/2004.

The set of documents includes the following statements:

- settlement and payment;

- payment;

- statement log book.

When receiving a payment, the employee must receive not only the funds earned, but also a pay slip.

The payslips include the following information:

- all components of the salary accrued to the employee for the reporting period;

- other amounts, including compensation, vacation pay and other payments due to the employee by law or local regulations in force at a particular enterprise;

- amounts that are designated for deduction from wages, with justification for the deductions made, as well as the total amount of money that is due for payment.

The organization has the right to use payslips in its own form. But at the same time, it is necessary to take into account the opinion of the representative bodies of the enterprise’s employees. In most cases, the manner in which employees receive their salaries is specified when signing employment contracts. On the established day of payment of earned funds, the employee can receive the funds due to him in specially equipped cash register rooms or transferred to the desired bank account, for example, a plastic card.

As a rule, for this purpose, the organization organizes a salary project with the bank, opening current accounts in banks with which agreements have been concluded. At the same time, if desired, an employee of the organization can choose another credit organization to which his salary will be transferred. To do this, he must submit an application to the accounting department, indicating the necessary bank details.

An employee must receive earned and accrued funds independently, except in cases provided for by federal legislation or an employment contract.

Penalties provided for failure to comply with payment deadlines The legislation establishes fines for accountants and companies in accordance with Article 236 of the Labor Code of the Russian Federation and 5.25 of the Administrative Code. So, if the date of payment of wages in an organization is set later than the 15th, as well as in the case of failure to issue pay slips and vacation pay before the due date, the accountant and entrepreneur will be fined in the amount of 1,000 to 5,000 rubles, and the organization - from 30 to 50 thousand rubles. In case of repeated violation, the amount of the fine will be higher: for an accountant from 20 to 30 thousand or deprivation of the right to hold a position for a period of 1 to 3 years.

An entrepreneur may be fined in the amount of 10 to 30 thousand rubles, and an enterprise - from 50 to 100 thousand.

Also, new adjustments to legislative documents require officials and enterprises to pay compensation to employees for failure to meet payment deadlines in the amount of 1/150 of the key rate of the Central Bank of the Russian Federation for each overdue day. Moreover, the employer cannot include these amounts in expenses that reduce income tax, since there is no way to economically justify expenses associated with delays in payments.

This is important to know: the minimum wage is 12130 from what

And from the accrued interest you will have to pay contributions to the Pension Fund and social tax, as well as withhold personal income tax. And these are not the only expenses that the employer will incur in the event of late payment of wages.

According to Law No. 434-FZ of December 30, 2015, starting from January 10, 2016, the employer is obliged to retain their average earnings for employees who do not go to work due to late payment of wages. An employee receives the right not to go to work 15 days after the employer violates the deadline for paying wages. This is stated in Article 142 of the Labor Code of the Russian Federation.

In this case, the employee is required to notify the employer in writing about the reason that prompted him not to perform his job duties. In addition, the employee has the right to go to court regarding late payment of wages within a year from the date of payment established by the organization. An employee has the right to file such a claim not at the location of the organization, but at his place of residence. This is convenient for workers in cases where employers change their legal address or are registered in other regions or localities.

The employee’s right to go to court is based on Article 136 of the Labor Code of the Russian Federation, according to which, after the date of payment of wages, it becomes the property of the employee and he has the right to dispose of it at his own discretion. Failure to pay wages on time is interpreted as a violation of property rights.

Results

Wages must be paid to employees 2 times a month: from the 16th to the 30th - the advance part, from the 1st to the 15th - the final part of the salary. The timing of the advance payment, as well as the algorithm for calculating it, are set by the employer independently. When paying an advance, there is no need to withhold and transfer personal income tax to the budget.

Sources:

- Labor Code of the Russian Federation

- Tax Code of the Russian Federation

- Code of Administrative Offenses of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Changes in the Law

The terms for payment of advance payments and salaries in 2020 have undergone changes. In accordance with the innovations, payment must be made no later than the 15th day of the month following the reporting period.

It is worth noting that liability for failure to comply with payment deadlines is becoming stricter. Based on the new regulations, penalties for violations have been increased. All changes will take effect on October 3, 2019. They are regulated by Federal Law No. 272, which was issued on June 3, 2019.

The law provides for changes to Article 136 of the Labor Code of the Russian Federation. It reflects the new deadlines for transferring salaries to employees. Specific dates are not specified in it. The law provides for payments at least for each half of the month worked.

The new version of the article will be valid on October 3, 2019. In addition to the fact that payment will be made every half month, legislators have added to the norms an indication that funds will be transferred no later than the 15th of the next month.

Specific deadlines are prescribed in local documents in force in the institution.

These include:

- inner order rules;

- collective agreement;

- contract of employment.