What it is

Each manager must calculate and transfer contributions for employees to the Pension Fund once a month. In addition to the Pension Fund, you still need to make transfers to the Social Insurance Fund and the Federal Compulsory Medical Insurance Fund.

The meaning of such transfers is that the manager makes certain payments and if insurance situations arise in the fund to which the payments are transferred, the opposite conclusion is made in favor of the employee.

For example, when an employee takes sick leave, the Social Insurance Fund organization issues a benefit, which must be transferred in case of temporary disability. The Russian Pension Fund does the same thing when it is necessary to pay a pension upon reaching a certain age.

ATTENTION! It must be remembered that pensions and other types of contributions depend on the manager, and he does not have the right to deduct these amounts from the worker’s salary. As for pension accruals, they are divided into 2 types: insurance pension and funded pension.

It should be noted that since 2014, transfers have not been made in favor of creating a funded part, since all funds are spent on replenishing the insurance.

What to choose: NPF or Pension Fund?

Unpredictable pension policy forces many citizens to make a drastic decision and transfer funds to a non-state storage facility. In addition, the return on savings in a non-state pension fund is significantly higher - the difference can reach 3-7% of the amount of savings per year.

Additional advantages of switching to a non-state pension fund:

- the employee has the right to independently choose a fund and switch to another one once a year;

- representatives of a non-state fund do not hide their investment policy and will willingly notify the client about this;

- The status of your pension account can be tracked online;

- savings can be bequeathed or transferred to heirs;

- in case of bankruptcy of a non-state pension fund, the savings will be returned to the state pension fund - the citizen will not lose anything.

In order not to make a mistake in choosing a non-state fund for storing pension money, we recommend that you familiarize yourself with

Millions of able-bodied Russians have transferred personal pension savings to non-state pension funds (NPFs), which offer higher interest rates and the opportunity to inherit savings. Citizens received the right to choose how to manage their future pension funds. Non-state pension funds send out an annual report to citizens, which indicates the profitability and directions of investment. In some companies, the client can track the status of an individual account online.

In fact, choosing a non-state pension fund does not pose any risks - pension savings are protected by the state. If the fund’s license is revoked, the funds will be returned to the Pension Fund’s accounts.

Who makes the payments and when?

Contributions to the Pension Fund are a guarantee of a person’s right to a pension. These are measures taken by the government to ensure people get paid in the future. Labor pension by age, by disability group, by loss of a breadwinner, and so on.

https://youtu.be/OWu_omaK8Ng

At the same time, the payment of various social benefits is also formed from insurance transfers. benefits, fixed payments towards pensions and so on. The following must transfer funds to the pension fund:

- institutions that make payments under labor and paid civil contracts for individuals. persons;

- all individual entrepreneurs: for themselves and those persons to whom they paid money or otherwise paid for labor activities, works, services under any agreements;

- physical persons if they have made payments under agreements and in the case where they are not considered individual entrepreneurs;

- lawyers, notaries and other groups of self-employed citizens.

It turns out that even in ordinary life, if we use the services of another person, we must make contributions to the Pension Fund.

Who pays extra

In Art. 428 of the Tax Code of the Russian Federation indicates payers who are obliged to pay increased SV for their employees in addition to those already paid at the rates presented in Art. 426.

The tariff depends on the type of work activity:

| What job | How much additional does the employer send to the Pension Fund? |

| Underground, hazardous or in “hot” workshops | 9% |

| The rest, in which the person has the right to early retirement (difficult working conditions, locomotive drivers, tram or trolleybus drivers, fish and seafood production, test pilots, rescuers, etc.) | 6% |

If the enterprise has made a special assessment of the parameters of labor activity, then instead of the indicated rates (9 or 6%), others are applied, depending on the assigned class:

| Category of working conditions | Tariff, % |

| 4 | 8 |

| 3,4 | 7 |

| 3,3 | 6 |

| 3,2 | 4 |

| 3,1 | 2 |

| 2 | 0 |

| 1 | 0 |

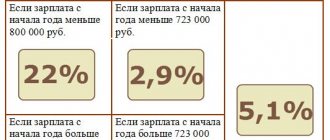

How much should be transferred

By law, the employer must transfer a tax of twenty-two percent to the Pension Fund for each of its employees. Also, some companies operate under a simplified taxation scheme and pay for their workers instead of 22% - 20% deductions.

ATTENTION! At the same time, if company employees work in poor and hazardous conditions, their manager, in addition to the required transfers, also pays an additional four percent tax.

Amount of accruals to the Pension Fund

It is immediately worth highlighting that, unlike personal income tax, which is determined based on salary, bonuses, employee coefficient, insurance type, contributions are not included in the salary. That is, the worker receives a salary minus personal income tax.

But in the Pension Fund, the employer also pays money based on the employee’s income. This amount is not included in the employee’s salary. This means that it is not deducted from earnings. Important points:

- Since 2020, institutions that are on a simple tax system, individual entrepreneurs on patents, will switch to standard tariffs. In 2017-2018 they transferred 20%. At the moment – 22%. And plus 10% if they exceed the established base.

- Add. tariffs for insurance transfers to the Pension Fund of the Russian Federation have been introduced for employers who have jobs with serious and dangerous production , i.e. in favor of citizens entitled to a preferential pension. The tariff is set based on the assessment of working conditions and the assigned class.

- It turns out that the amount of charges to the Pension Fund will depend on the category of the payer.

For companies that are at the general tax level, i.e. for most, in 2020 this amount will be 22%. And plus ten percent if the size of the base (the main amount of profitability) for each employee is more than 1,150,000 rubles. This limit will also change in 2020.

Every year the Russian Government adopts a resolution setting this size . The base is determined separately for each employee for each month from the beginning of enrollment for him and on a cumulative basis.

How are deductions made?

For employees registered under a contract or work book, the accounting department calculates wages and withholds a certain percentage in order to make transfers to savings funds, including pension funds. The funds are transferred as income tax, but in fact they are deductions for several expense items.

Income tax is reflected in all accounting entries. This is what the credit institution sees in the 2-NDFL certificate, which the borrower provides when receiving a loan. It is generally accepted that an employee of an organization pays taxes on his own, but in fact, payments are made by his employer on the basis of current legislation without the consent of a specialist. Let us recall that not all income is taxed. Payments are not made from the following types of cash receipts:

- if a citizen receives unemployment payments from the Employment Service;

- when maternity benefits are paid;

- for transfers due upon retirement, staff reduction or dismissal;

- compensation payments from the employer (unused vacation, workplace injuries, etc.).

Important! The taxpayer has the right to return part of the funds paid to the budget. If you paid for your studies, doctors’ services, or purchased a new home, the funds will be returned by the tax authorities after submitting a package of documents.

The higher the employee's salary level, the higher the amount of tax deductions and the more money he can return when buying a home. The remaining funds will become the basis of the funded part of the future pension. Therefore, every citizen who wants to receive a decent pension should be primarily interested in the official salary.

For employees registered under a contract or work book, the organization makes payments to the budget from each salary in the form of income tax. This amount can be seen in the 2NDFL certificate, which the accounting department issues at the request of the employee or upon dismissal.

The employee makes deductions from his income, and the company is the tax agent that makes the transfer. Although in fact no one is interested in the specialist’s opinion, and funds are collected without his notification.

Tax is not levied on all income. No need to pay to the state:

- Unemployment benefit;

- Payments in connection with pregnancy and childbirth;

- Severance pay in connection with dismissal, retirement;

- Compensation payments for unused vacation.

Important information

Self-employed people (lawyers, KHL managers, etc.) pay a fixed contribution to the Pension Fund for themselves. In 2020 in the amount of 29,354 rubles. And if the income crosses the line of 300,000 rubles, then 1% will be added.

It is from the amount of profitability exceeding these 300,000 rubles. In 2020, the fixed payment will be 32,448 rubles. Such transfer is made before December thirty-first by each individual entrepreneur for himself, as well as by persons with the status of a lawyer.

IMPORTANT! Self-employed people who pay individual tax - 4 or 6% (for now an experiment in some places) payment of contributions to the Pension Fund depends on their personal choice.

Percentage of contributions to the Pension Fund for individual entrepreneurs and other self-employed persons

Minimum wage * 26% * 12 months. (minimum wage is the minimum wage)

https://www.youtube.com/watch?v=FFU5tJ4EtDY

Transfers from the Federal Compulsory Medical Insurance Fund according to the same principle are equal to 5,840 rubles. FSS payments are deducted if a self-employed person has employees. The deadline for all payments is until the end of the current year, regardless of whether the payer is engaged in activities that generate income for him or not.

Such fixed payments are made if the annual profit of an individual entrepreneur or self-employed person does not exceed 300 thousand rubles. If the income is higher, then another 1% of the amount that exceeded 300 thousand rubles is added to the budget. This money is deducted until July 1, 2020.

How to check your balance

All contributions to the Pension Fund are displayed on the personal account of the insured. Don’t forget that if a citizen wants to take advantage of a funded pension, you can find out your pension savings using SNILS.

Pension type deductions can be checked through the government services portal. You can easily obtain a certificate on the Pension Fund portal, in your personal account. You can also contact the Pension Fund in person at your place of residence. You need to take your SNILS and passport with you. Another person can find out information about enrollment in the Pension Fund only if they have an official power of attorney.

Rates

The pension sector is constantly undergoing changes, but the general tariff for transfers to the Pension Fund does not change. For 2020, it is also 22% of the salary, provided that transfers cannot exceed the annual limit.

If it is exceeded, then transfers amount to 10% of wages.

Those persons who pay contributions independently will also transfer fixed-type contributions to the Pension Fund, which amount to 26% of the minimum wage. This amount must also be multiplied by twelve months.

It turns out that based on the official minimum wage, which is 7,500 rubles, the total amount of the established contribution for the year is 23,400 rubles.

What percentage of salary goes towards pension payments?

Monthly contributions from employees are an income tax of 22% in the Pension Fund. It is paid by the employer's accounting department, and the average employee has no idea about this money. This contribution consists of 2 parts: 6% goes to the savings part, and 16% to the insurance part. In a smaller part, i.e. The employee has the right to dispose of 6% of the funded portion at his individual discretion, for example, transfer it to a non-state pension fund of one of the banks or insurance companies.

Representatives of selected industries, including the IT sector, pay minimum interest. Conversely, the organization pays higher taxes for workers in certain specialties. Enterprises where personnel are forced to work in harmful or difficult conditions pay more than ordinary companies.

Taxation of individuals differs by category:

- Individual entrepreneurs, from 2020 – self-employed, i.e. citizens who work for themselves, starting from 2020, transfer a fixed payment at the end of the year. Until 2020, income tax was calculated based on the minimum wage.

- Persons without Russian citizenship living in the country. Highly qualified employees transfer 13%, patent holders - a fixed amount, TOP managers from the EEC, refugees - 13%.

In 2020, employees of organizations are subject to a withholding of 22% in the Pension Fund of the Russian Federation. The employer pays the funds, but the payer does not see this amount in his payroll. Information about pension contributions is only available in the company’s financial statements.

Pension Fund contributions consist of two payments:

- Cumulative part in the amount of 6%;

- The insurance portion is 16% of wages.

Several years ago, 6% could be disposed of independently - transfer the money to non-state funds or leave it in the Pension Fund of the Russian Federation. Recently, these payments have been frozen. In fact, the state simply confiscates them.

Categories of citizens for whom taxation differs from the standard:

- Individual entrepreneurs and self-employed people who do not have employees have been paying a fixed contribution since 2018, which is calculated at the end of the year. Previously, the amount was calculated based on the minimum wage;

- Non-residents and foreign employees living in the regions of the Russian Federation permanently or temporarily also pay taxes to the budget. Contributions for highly qualified personnel amount to 13%, payments for patents are fixed amounts, residents of the EurAsEC, refugees from other states - 13%.

What to do if the money doesn't come

If, from the received certificate about the company’s transfers to the Pension Fund of the Russian Federation, a citizen understands that his employer treats this issue in bad faith and does not make transfers in order to defend his rights, the citizen can appeal to the court.

In this situation, the official claim should definitely include a work book and a copy of it, an employment contract with copies, and payment invoices. If there is enough evidence, the judicial authority will oblige the unscrupulous manager to compensate for the due payments, and will also force him to pay a huge fine for violating the laws of the Russian Federation.

You should not delay solving the problem, because many employers use fraudulent schemes for their own benefit. You can always achieve justice in court if you prepare well and consult with a specialist.