Which LLC transaction will be large?

The law has two signs of a major transaction:

- the transaction amount is more than 25% of the book value of assets. We'll talk about assets a little later;

- the transaction is outside the normal course of business of the company. Typical activities are those that are typical for other companies in the industry. If a construction company builds houses, there are no questions. But if a construction company suddenly makes a deal to sell a ton of pies, that deal is out of scope.

A transaction is considered a major transaction if both signs coincide. Now let's take a closer look at an example:

A construction company is selling a residential building. The house is worth more than 25% of the company's assets. But building and selling houses is common for construction companies, so it's not a big deal.

An example from another area. Clients have stopped coming to the chain of hair salons, but the chain owns 12 premises. The network decides to rent out half of them, which results in more than 25% of the assets. And renting out premises is an atypical transaction; hair salons usually do not do this. If both signs coincide, it means the deal is big.

It happens that the transaction itself is for a small amount, but there are many such transactions, they are similar and ultimately give more than 25% of assets. This is called a series of transactions, which the tax authorities may also consider large.

A chain of hair salons is selling six premises to different people, the price of each is 5% of the chain's assets. These transactions meet the criterion of atypicality and give a total of 30%. A series of such transactions will be considered large.

Now let's look at the book value of assets.

JSC Law on Major Transactions

The Law “On Amendments...” dated 07/03/2016 No. 343-FZ, from 01/01/2017, significant changes were made to the Law “On Joint-Stock Companies” dated 12/26/1995 No. 208-FZ, according to which the procedure for joint-stock companies to commit large transactions.

This article is based on the new version of Law No. 208, taking into account all the latest changes. The concept of a major transaction is contained in paragraph 1 of Art. 78 of Law No. 208, according to which an agreement is recognized as an agreement that goes beyond the normal activities of the company and is aimed at the following purposes:

- Acquisition or alienation of property, the value of which exceeds the value of 25% of all assets of the joint-stock company. The value of assets is determined based on financial statements.

- Transfer to other persons of property, an intellectual property product, or a means of individualization under a license if the price of such transactions exceeds 25% of the book value of the JSC’s property. The book value of the property is also determined based on the financial statements.

Thus, Law No. 208 defines a major transaction on the basis of the value of the property being sold and the inconsistency of the agreement with the usual activities characteristic of the company.

Let’s figure out which transactions are considered outside the scope of the normal activities of a joint-stock company.

Signs of transactions that go beyond the normal activities of the joint-stock company

Although Law No. 208 does not establish the signs by which it is determined whether a particular transaction is outside the scope of ordinary business activities, they can be identified by reading paragraph 4 of Art. 78 of Law No. 208.

To be recognized as such, major transactions in a joint stock company must have the following characteristics:

Read us on Yandex.Zen Yandex.Zen

- Not characteristic of the activities carried out by a specific JSC.

- They can lead to the termination of the organization’s activities (for example, they lead to its bankruptcy if it is impossible to fulfill its obligations).

- May lead to a change in the type of activity of the JSC.

- Result in a significant downward change in the scale of the company’s activities.

To recognize a transaction as a major one, the first criterion must be present in combination with one of the subsequent ones. Read about what criteria a transaction must have in order to be recognized as a major one for an LLC.

How to calculate a large deal

To understand which transaction will be large, you need to understand the balance sheet of the LLC. The balance sheet is the company's assets and liabilities. Assets are the property of a company that can generate income. For example:

- money;

- debts that must be repaid to her;

- real estate;

- securities;

- investments;

- reserves.

And liabilities are what assets consist of, for example, authorized and additional capital, loans.

Every year, an accountant calculates how many assets a company has and how many liabilities it has. This calculation is called the “balance sheet.” His company submits it to the tax authorities and Rosstat.

This is what the balance sheet looks like at the end of the year:

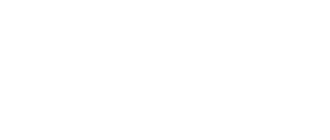

Whether a major transaction is or not can be determined by the amount in the “total assets” line.

Let's calculate which transaction will be considered major for the company from the example. For convenience, let’s round 12,597,519 rubles to 12 million:

12,000,000 rubles - company assets;

25% of assets - the amount with which the transaction will be large;

x - major transaction in rubles.

We count. To quickly get 25% of any amount, divide by four:

x = 12,000,000 / 4 = 3,000,000 rubles - for the company in the example, transactions from this amount are considered large.

Companies present their balance sheet reports in different ways. Standard - until March 31 of the next year, but for 2020 it must be submitted before April 1, 2019, because March 31 is a day off. If the transaction takes place in February 2020, when the report for last year has not yet been submitted, the amount of assets is taken from the report for 2020.

There are companies that submit reports more often than once a year. This is called interim reporting. For example, construction companies and those with loans submit reports once a quarter. They count transactions based on the amount of assets from the last report.

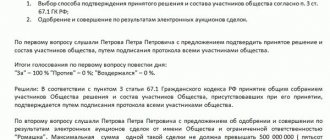

Prepare a decision on approval of the transaction

Approval of a transaction is the consent of the company's participants to its implementation. Without consent, the tax authority and any of the company participants can cancel it.

The transaction is approved at a meeting of company participants. During the meeting, the secretary takes minutes and writes: who voted against and who voted for. There should be at least one more votes in favor.

The company's charter may stipulate other conditions. For example: to approve a major transaction, only the consent of the general director, management company or other LLC is required. The condition is prescribed in the charter at the time of creation of the company.

What is the significance of the fact that a transaction is classified as a major transaction?

The presence of legislative grounds for recognizing a major transaction makes it possible for owners to actually protect their business from unwanted and uncoordinated actions of the general director. If a transaction that meets the criteria of a major one is carried out without the approval of the owners, they will have a legal opportunity to challenge it.

Concluding a major transaction for an LLC or JSC, as a rule, imposes a number of large-scale obligations on the business entity. Most often financial (for example, related to payment for purchased goods). Acceptance of such obligations without the knowledge of the owners of the company or their authorized representatives is in many cases an extremely undesirable scenario for business.

There may be a corruption component here (when the director negotiates a large purchase from “his” supplier), and insufficient competence of the manager (when the supplier is not “his”, but not the most profitable, which only the owners know about, and the director, due to inexperience, is not suspects this).

Let us now take a closer look at the specifics of conducting large transactions by limited liability companies.

What does the company risk?

The main risk with large transactions is the cancellation of the deal. The tax office or company members can cancel it if the transaction went through without approval.

sold the building. By all indications, the transaction was large, but the selling company did not receive the approval of the company participants. Six months later, the tax authorities canceled the deal. The building returned to "Bourgeois", and "Elite" got their money back.

But during these six months, Elite invested a million rubles in repairs and advertising. The “Elite” will demand this million from the “Bourgeois” in court.

The buyer can play it safe: ask the selling company for a balance sheet to calculate whether the transaction is large. And, if yes, make sure that it is approved according to the rules: ask for a copy of the protocol or decision.

What awaits an LLC that has entered into a major transaction without approval (consequences)

If the transaction has not been approved, but it is mandatory, then the company’s participants, counterparties, interested parties, and members of the board of directors have the right to file an application with the court to declare the concluded agreement invalid. By virtue of the provisions of Art. 173.1 of the Civil Code of the Russian Federation, an agreement for which approval has not been received is considered invalid, if such is required in cases provided for by law.

When considering the case, the applicant will need to prove that the transaction is really large, and it was not approved before or after it was completed.

***

Thus, if the transaction is large, its approval is mandatory, since otherwise it may be declared invalid with all the ensuing consequences.

What are the risks for society members?

The law has a concept - subsidiary liability. This is when members of a company are liable for debts with personal property if a major transaction has led the company to bankruptcy.

The usual scenario: the company has an authorized capital of at least 10,000 rubles. With this capital she is responsible for her debts. Money, apartments and iPhones of LLC participants are not taken away for debts.

Bad scenario: if the bankruptcy manager admits that a large transaction is to blame for bankruptcy, everyone who approved this transaction will be liable with property.

There are risks even if the company has one founder, and he does not need to obtain approval. He is also liable for debts with his property.

Director's responsibility to the company

A transaction is not considered major until proven otherwise. The plaintiff is the one who goes to court to cancel the deal. The plaintiff has a year to do this.

The year is counted from the day when the plaintiff learned or should have learned about the violation of the requirements for approval of the transaction. I should have found out - the wording is from the law, in practice, everything is ambiguous with the definition of this moment. For example, for a company participant, the countdown begins on the day he is given a summons to a meeting to discuss a major transaction.

One of the important documents that the supplier, a Limited Liability Company, will need to participate in tenders is a decision to approve a major transaction. It is compiled by the founders of the company. However, before this, it is important to understand which contracts will be considered large and how their conclusion will affect the well-being of the company.

What is a big deal?

The concept of a major transaction is regulated by Article 46 of the 14-FZ of 02/08/1998. It implies the conclusion of a contract, during the execution of which there is an alienation or acquisition of property in an amount exceeding 25% of the value of the assets of the LLC itself. The organization's charter may establish a higher percentage. In this case, the subject of the agreement can be not only goods or equipment, but also securities, intellectual property, and funds.

The following contracts are most often classified as large:

- Gift, exchange or transfer of debt.

- Sale or purchase of real estate.

- Transactions with securities.

- Loan agreements.

- Contracts of pledge of property or surety.

Several interrelated transactions in some cases may qualify as one large one. The signs of such transactions are: proximity in time, participation of the same persons in concluding an agreement, homogeneity, and a single economic purpose.

Whether a transaction is major should be determined on the basis of data from accounting reports for the period preceding the time of execution of the contract. The assessment procedure is discussed in Part 2 of Article 46 of 14-FZ. The analysis takes into account two main criteria:

- The ratio of the amount of the transaction to the book value of the company’s assets.

- Does the agreement go beyond the usual business activities of the organization?

The book value of the company's property is indicated in line 1100 of the balance sheet. It must be compared with the amount of the contract that is planned to be concluded. If the result of dividing the contract amount by the book value exceeds 0.25, then the transaction can be considered large.

Example:

Romashka LLC acquires real estate worth 15 million rubles. The book value of the company's assets for the previous period was 50 million rubles. The acquisition of property falls under the characteristics of a major transaction. We carry out the calculation: 15 million / 50 million = 0.3. Therefore, the contract price is 30% of the book value of the assets. The transaction is considered major.

Decision Rules

To participate in government procurement, a company must provide its consent to enter into major transactions. The procedure for making such a decision is prescribed in Part 3 of Article 46 of 14-FZ. Drawing up the document is within the competence of the general meeting of LLC participants, however, the company’s charter may assign this function to the board of directors.

Book value of assets in a budget institution in 2020

The legal topic is very complex, but in this article we will try to answer the question “Book value of assets in a budget institution in 2020.” Of course, if you still have questions, you can consult with lawyers online for free directly on the website.

In relation to the approved form of the balance sheet (Order of the Ministry of Finance dated July 2, 2010 No. 66n), the book value of assets is balance sheet line 1600 “Balance”. This is the answer to the question of how to calculate the book value of assets on the balance sheet.

Book value of assets

The total balance sheet assets is an indicator that reflects the total book value of all types of assets of the organization.

The procedure for determining the book value of assets is disclosed in the relevant regulatory documents governing accounting.

At the same time, it is important to take into account the main requirement for reflecting assets on the balance sheet: they are reflected in a net valuation, that is, minus regulatory values (clause 35 of PBU 4/99).

Book value of assets: where to look on the balance sheet

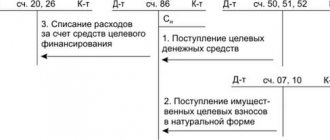

Thus, fixed assets are reflected in the balance sheet at their residual value. The residual value of fixed assets is their original (replacement) cost reduced by accrued depreciation. In accordance with the Chart of Accounts (Order of the Ministry of Finance dated October 31, 2000 No. 94n), the residual value of fixed assets (COST) as of any reporting date is determined as follows:

Romashka LLC acquires real estate worth 15 million rubles. The book value of the company's assets for the previous period was 50 million rubles. The acquisition of property falls under the characteristics of a major transaction. We carry out the calculation: 15 million / 50 million = 0.3. Therefore, the contract price is 30% of the book value of the assets. The transaction is considered major.

Contracts executed in violation of the procedure for approving their conclusion are declared invalid in accordance with Article 173.1 of the Civil Code of Russia. An appeal to the court on such an issue can be initiated by any member of the board of directors or a participant in the LLC. If the limitation period for such a case is missed, it cannot be restored.

Decision Rules

The concept of a major transaction is regulated by Article 46 14-FZ of 02/08/1998.

It implies the conclusion of a contract, during the execution of which there is an alienation or acquisition of property in an amount exceeding 25% of the value of the assets of the LLC itself. The organization's charter may establish a higher percentage.

In this case, the subject of the agreement can be not only goods or equipment, but also securities, intellectual property, and funds.

An enterprise can, upon request, provide information about the state of its assets to credit and insurance organizations and some counterparties when making transactions. To do this, the company draws up a certificate of the book value of assets, which includes the calculation given above.

: Calculate the pension of a man born in 1959

Fixed assets and intangible assets are classified as non-current and are indicated in the BB at their residual value, that is, at the purchase price minus accumulated depreciation and taking into account revaluation, if it was carried out at the enterprise.

Why is the book value of assets calculated?

Thus, some transactions of an organization for the sale of assets are recognized as large ones in accordance with paragraph 1 of Art. 46 Federal Law No. 14-FZ dated 02/08/1998 (for LLC) and clause 1 of Art. 78 Federal Law No. 208-FZ dated December 26, 1995 (for joint-stock companies). To determine the size of the transaction, it is necessary to calculate the book value of assets and the value of the property being sold.

If the cost of the property being sold is more than 25% of the book value of the organization’s assets, the transaction is considered a major transaction. In this case, a decision of the meeting of shareholders or founders is required to carry out the transaction.

If the book value of assets is determined incorrectly or not calculated at all, the transaction may be considered invalid.

https://youtu.be/iFfawzJQUpM

The certificate is generated on the basis of indicators for accounting for property and liabilities reflected in off-balance sheet accounts. Indicators are reflected in the certificate in the context of activities with targeted funds (columns 4, 8), activities under state assignment (columns 5, 9) and income-generating activities (columns 6, 10).

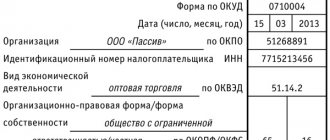

The following information is automatically indicated in the header part of the balance sheet from the client’s registration card in the SBIS system:

- the date on which it is compiled;

- adjustment number (if the balance is primary, then “0” is indicated);

- code and name of the tax authority;

- name of the institution (separate unit) and TIN;

- founder and name of the body exercising the powers of the founder;

- code according to the classifier of enterprises and organizations (OKPO);

- OKTMO code;

- chapter on the budget code;

- the unit of measurement in which the balance sheet is compiled and its code (OKEI).

Certificate of availability of property and liabilities on off-balance sheet accounts

Attention! All indicators of the opening balance sheet must coincide with the indicators that are reflected in the final balance sheet for the previous year, with the exception of cases of changes in indicators during the inter-reporting period (for example, during reorganization, correction of errors of previous years, etc.).

Working capital includes assets, the use of which in the activities of an enterprise to achieve financial success is quite frequent. They are involved for 12 months or another established cycle. These include:

Any balance sheet is designed in such a way that it allows you to calculate not only the book value of assets , but also its average. It gives a clearer understanding of the value and size of assets. It seems to neutralize the circumstances that distort the real amount.

Calculation

If we speak in the language of accountants about what the book value of an enterprise's assets is , then this is the amount of all the company's assets in cash, which is clearly shown in the accounting. balance.

No company can do without calculating the book value of assets. There are at least two reasons why this should be done. First, if you do not know the value of assets, it will be impossible to find out their profitability.

That is, whether the property in which the company has invested is profitable. Secondly, without knowledge of cost, it will not be possible to assess the effectiveness of assets. A more complex term for this indicator is turnover ratio.

: Amount of funeral benefit in 2020 in Chelyabinsk

Asset value - how to calculate in 2020

Everything is very simple - the sum of all assets will be the figure we need. That is, all the company’s investments, its fixed assets must be added together. To put it even more simply, we need the sum of lines 1100 and 1200. The resulting indicator is recorded in line 1600 of the balance sheet.

Articles on the topic

For a company, the book value of assets is one of the most important indicators. Using it, a company can assess its financial position. There are two possible situations: assets are less than the authorized capital or more than it.

According to the general rule established by law, a major transaction is a transaction provided that its price or the value of the alienated or transferred property exceeds 10 percent of the book value of the institution’s assets, determined according to its financial statements as of the last reporting date.

At the same time, as follows from the above provisions of Law No. 14-FZ, criteria for determining large transactions are established based on the ratio of the transaction amount and the book value of the assets of the company as a whole, and not the value of net assets.

The procedure provides for the preparation and submission to the Bank of Russia of a report for the first quarter, first half of the year, nine months of the reporting year for credit institutions (with the exception of non-bank credit institutions).

Thus, non-bank credit organizations compile and submit to the Bank of Russia only a balance sheet for the reporting year.

Major transaction for LLC: concept, calculation, approval procedure in 2020

Ultimately, the transaction is considered major. Major transaction for an LLC with one founder Conducted by a single participant of the company, who simultaneously acts as a manager, transactions do not belong to the list of large ones.

Hello, in this article we will try to answer the question “Determination of the Book Value of Assets for a Major Transaction in 2020.” You can also consult with lawyers online for free directly on the website.

Determining the Book Value of Assets for a Major Transaction in 2020

According to the provisions of Instruction No. 33n, the mandatory report in the annual accounting (financial) statements for budgetary institutions is the Balance Sheet of a state (municipal) institution (f. 0503730) (hereinafter referred to as the Balance Sheet (f. 0503730)).

Book value of enterprise assets

Not all businessmen who have established an LLC understand when a major transaction is being made. Let's define what such a transaction is, what its main criteria are and find out the calculation rules. What standards should be taken into account in 2020?

Having assessed the evidence presented by the parties together, taking into account the requirements of Art. 71 of the Arbitration Procedural Code of the Russian Federation, the courts rightfully established that the real estate purchase and sale transaction disputed by the plaintiff is not a major one.

How to determine the size of a large transaction in a budget institution

As follows from the case materials and was lawfully established by the courts on May 18, 2007.

Between JSC RNII Agropribor (Seller) and LLC FavoritProekt (Buyer) a contract for the purchase and sale of real estate was concluded, under the terms of which the Seller sells and the Buyer buys real estate - part of the building owned by the Seller by right of ownership, with a total area of 7 794.2 sq. m, located at the address: Moscow, st. Skakovaya, 36...

The task of an accountant is to accurately and timely reflect the facts of economic activity. But in reality, to run a business, an accountant is also required to analyze the net assets indicator, which gives a clear picture of the functioning of the organization as a whole.

Balance sheet asset 2020

The organization's net assets (NA) are the amount of funds of an economic entity, determined by calculation, which will remain at the disposal of the company after full repayment of debt obligations. In other words, the value of net assets is calculated as the arithmetic difference between the total indicators of the company’s property, material and financial assets and assumed liabilities.

Calculation of net assets in 2020 according to the balance sheet

In valuation activities, the net asset method is used as one of the methods for assessing the value of a business. With this method, the appraiser uses data on the organization's net assets according to the financial statements, previously adjusted based on its own estimated values of the market value of property and liabilities.

Economic services calculate the value of assets for various purposes. In particular, find out the absolute value of the property as a whole or by its constituent elements, for example, exclusively fixed assets, intangible assets or liabilities.

Informing partners and users - investors, founders, insurers - is the responsibility of the enterprise, and they have the right to request various information, and first of all, about the condition of assets.

For them, a “Certificate on the book value of assets” is provided, which is based on the specified calculation formula and, although not a mandatory form, is compiled quite often. We will learn how to calculate the book value of an enterprise's assets, and for what purposes such calculations are carried out.

Company assets are resources expressed in value that support the production process. These include non-current assets (buildings, structures, work equipment, machines, vehicles, as well as business reputation, software products that are intangible assets) and current assets, i.e.

e. money in cash and in bank accounts, inventories, accounts receivable, short-term investments and others. Our publication is devoted to such a concept as the book value of assets. Where to look in the balance sheet, as well as find out how the book value and average annual value of assets are calculated is the topic of this article.

Related publications

According to the laws of the balance sheet, both of its first sections, combined together, make up the full value of the company's property. Their sum is the book value of the assets. Where can I see this indicator on the balance sheet? Line 1600 is the final value showing the balance of assets in value equivalent as of the reporting date.

Source: https://baiksp.ru/registratsiya-avtomobilya/balansovaya-stoimost-aktivov-v-byudzhetnom-uchrezhdenii-v-2019-godu

What transaction is considered major for an LLC?

In the current law on LLCs, a major transaction is designated as an agreement that can be considered major for the following forms of ownership: LLC and JSC. This term is applicable to a concluded transaction if it meets certain criteria and takes into account the legal form of the legal entity. This can also include a group of united interrelated transactions. The following parameters act as signs of the relationship of these agreements: homogeneity, sufficient proximity in terms of the date of their execution, the same list of parties involved and one acquirer, a common economic goal.

The very concept of a major transaction for an LLC is defined in the relevant Federal Law No. 14, in Article 46. The designated term is described here and detailed explanations are given regarding all aspects of the issue posed. According to this legislative act, two key criteria for a major transaction for an LLC are established:

- Comparative value of a specific object with the total book value of the existing assets of the enterprise

- Establishing the fact of going beyond the boundaries of the organization’s normal business activities

The concept of property that is the object of a transaction includes equipment, real estate, other tangible objects, shares in uncertificated form, cash, and intellectual property.

A major transaction for an LLC can also be recorded in the main charter document of a particular company. The qualitative criterion according to which the concluded contract is assessed includes two elements:

- An object that defines a legal connection with property

- Action performed on specified property

The quantitative criterion during the evaluation of the contract becomes paramount.

The definition of a major transaction for an LLC involves the alienation of either property acquired by it with a value of 25% of all property owned by the company, or has a value above this threshold. The organization's charter may contain a higher limit, according to which a transaction will be recognized as a major one. According to the company’s charter, the following types of transactions may be included in the group of large transactions that require approval:

- Purchase and sale of securities, real estate, etc.

- Transactions of exchange, donation, transfer of debt

- Loan agreements

- Surety contracts and property pledge agreements

- Other types of contracts

The main internal law of an LLC may also classify as large any transactions whose value exceeds the established threshold.

A comparison of the book value of the company's assets is carried out with:

- Book value or contract value established for the alienated property - the maximum of two indicators is used

- The purchase price of this object

- The price of shares available for purchase due to the emergence of an obligation to make a mandatory offer

These indicators serve as a basis for comparison.

You can understand what constitutes a major transaction for LLCs and JSCs based on the following rules.

The LLC compares the object of the transaction being signed with the value of its property, recorded in accordance with the information in the accounting report for the latest reporting period. In the situation with a joint-stock company, the basis of comparison is the book value of the assets of this organization as of the last reporting date, which is recorded in Article 78 of Federal Law No. 208. The explanation of the term major transaction for organizations of the specified organizational and legal forms is similar, but there are also nuances. The key difference between the concept of a major transaction for a joint-stock company and an LLC is precisely that organizations with the first form of ownership take into account the total value of assets as a basis for comparison, and in the case of an LLC, the value of its existing property is taken as a basis. Calculation of the value of LLC property and JSC assets is carried out in accordance with current accounting data.

Two-step solution

The decision on a major transaction can be divided into two stages.

At the first level, voting is carried out by the board of directors, which is also called the supervisory board. It sometimes includes some members of the joint-stock company, which means they have the right to take part in decision-making. If in the end the elections do not end unanimously, then the deal is considered not accepted and the second stage begins. This is a meeting of shareholders.

Elections in the second stage count the majority of votes to approve a major deal. If the number of shareholders who accept the terms of the transaction is minimal, then it is considered unprofitable.

For large transactions that exceed the value of 50% of the enterprise’s cash balance, the second stage is immediately applied with the participation of the general meeting of shareholders. A majority vote allows or denies a financial transaction. Consent to the contract is only valid if three quarters of the shareholders choose this option (supermajority).

A decision to approve a major JSC transaction is required only if the company is managed by several owners. There are cases when one person owns 100% of the shares. In such situations, it is not possible to hold elections or assemble a board of directors, and all transactions are reviewed by the sole owner of the company. There is one caveat.

Permission from the sole shareholder must be obtained only by the general director, who manages all the affairs of the company, but only partially manages the financial capabilities.

Calculation of a major transaction for an LLC

The calculation of a major transaction for an LLC is carried out as follows. Initially, the total amount of the transaction is calculated. Then the obtained result is compared with the value of the company’s property according to the financial statements for the last reporting period. The value of the property of an LLC is the total amount of all its assets.

The size of a major transaction in 2020 is determined by calculating 25% of the indicator indicated in line 700 “Balance” of the current accounting report. The obtained result serves as a control value that allows you to determine the size of the transaction.

Before concluding a specific contract, it should be carefully analyzed to ensure it meets the size criteria. The procedure is as follows:

- Calculation of the value of assets as of the last reporting date that precedes the signing of the contract.

- Calculation of the ratio of the value of the contract being concluded and the assets of the company - if the final indicator exceeds the threshold of 25%, a more thorough analysis of the operation should be carried out.

- Determination of the cause-and-effect relationship with the organization's property.

- Establishing relationships with other contracts that have a similar meaning.

- Identification of the fact that the operation is classified as ordinary business activity.

As a result of the analysis performed, the size of the operation is determined.

An example of calculating a large transaction:

is planning to purchase office space. It allocates funds in the amount of 12 million rubles for the acquisition. At the same time, the balance sheet of its assets is 40.0 million rubles. Analysis of intentions to conclude a contract allows us to identify qualitative indicators of size (purchase of property). The quantitative criterion indicates the size of the transaction. The calculation is made according to the following scheme: comparison of the transaction amount of 12 million rubles. with a balance indicator of 40 million rubles is 30%. (12.0: 40.0 X100 = 30). Ultimately, the transaction is considered major.

Major deal for an LLC with one founder

Transactions carried out by a single participant in the company, who simultaneously acts as a manager, do not belong to the list of large ones. This nuance is regulated by the legislative act Federal Law No. 14 - this point is described in paragraph 7 of Article 46. To confirm the fact that the organization has a single participant and at the same time a manager, an extract from the Unified State Register of Legal Entities is used. The issue of the need to approve a transaction that is carried out on the basis of a preliminary agreement, subject to a change in the composition of participants or managers of the company by the date of its implementation, becomes relevant. There is no formal requirement to obtain consent, but there is a potential to violate the interests of new LLC participants. In this regard, it is advisable to properly formalize the receipt of consent.