All about trade in Russia

To conduct trade as such, licensing is not required.

According to the current Presidential Decree No. 65 of January 29, 1992, freedom of this activity has been introduced on the territory of Russia. Article navigation

- Trade license

- Trade permit for individual entrepreneurs

- Pyrotechnics

- Food

- Medical products

- fuels and lubricants

- Veterinary preparations

- Jewelry

- Cloth

- Flowers

- How to obtain a trade permit

- How much does a sales license cost?

- What documents are needed

- Outbound trade: permit, documents

- Street vending permit

- Wholesale license

- Wholesale trade of medicines

- Do I need a permit for retail trade and wholesale sales of dietary supplements?

- Temporary trade permit

- What is the fine for illegal trade?

- Fines and punishment for trading without registering an individual entrepreneur

Any legal entity or individual (individual entrepreneur) who intends to engage in trading activities in the Russian Federation is required to obtain the appropriate documents giving such a right, as well as register in the general Trade Register. The process of obtaining this certificate sometimes causes difficulties, mainly due to poor awareness of current legislation. This article will help fill in the gaps.

Sales of food products

Do I need to obtain a permit to sell food? The Licensing Law establishes that a license to trade such goods is not required. But the Government Decree “On the notification procedure for starting certain types of business activities” obliges the entrepreneur to send a notification and a package of documents to the Rospotrebnadzor unit before starting work.

The conclusion of the sanitary and epidemiological service on compliance of activities with sanitary standards is mandatory. Trade in specific types of products also requires certificates and declarations of conformity, which must be provided by the product supplier.

Trade license

To conduct trade as such, licensing is not required. According to the current Presidential Decree No. 65 of January 29, 1992, freedom of this activity has been introduced on the territory of Russia, and local authorities are obliged to facilitate it, allocate areas for markets, maintain order, and comply with sanitary standards. However, there are a number of requirements that entrepreneurs must adhere to.

A license is a document issued by a special authorized executive body, which indicates the right of an individual entrepreneur or legal entity to engage in a certain type of business, subject to mandatory compliance with legislative restrictions.

The list of goods whose circulation is limited is listed by Federal Law No. 128-FZ of 08.08.01 “On licensing of certain types of activities.” Article 17 of this document defines the areas requiring a trade license:

- Manufacturing, development, sale of special means of covert surveillance and wiretapping;

- Production and sale of counterfeit-proof printed products (forms);

- Sales of weapons, military equipment, small arms, their main components;

- Sale of ammunition, hunting cartridges;

- Distribution of industrial explosives;

- Sale of pyrotechnics that meet state standards of class IV and V;

- Ensuring the circulation of narcotic and psychotropic drugs, including their development, production, purchase, use and even destruction. The circulation of these substances is regulated by Federal Law No. 3-FZ of 01/08/98 (“On Narcotic Drugs and Psychotropic Substances”);

- Sale of electricity to citizens;

- Sales of travel tickets;

- Sales of alcohol and tobacco products.

To this list it is necessary to add some other types of business that can harm the health, rights, and other vital interests of citizens, the country’s defense capability, and the safety of the cultural heritage of the peoples inhabiting the Russian Federation (128-FZ, Art. 4).

A license to sell products whose turnover is legally limited is valid for five years. Its early cancellation is carried out if the subject has repeatedly (more than twice) grossly violated the established conditions and requirements, which is confirmed by inspection reports or by a court, on the initiative of the authority that issued the permit.

Trade permit for individual entrepreneurs

As of 2020, the procedure for obtaining a permit is as follows: an individual entrepreneur notifies the authorities of his intention to engage in trading activities, and accompanies his application with a package of certificates:

- An extract from the Unified State Register of Legal Entities or a certificate of registration of individual entrepreneurs;

- Certificate of registration of individual entrepreneurs with the Federal Tax Service;

- A certified copy of the title document for the ownership of the premises where the sales or lease agreement will be carried out;

- Sanitary passport of the premises of the retail outlet;

- Conclusions of the State Fire Supervision, Sanitary and Epidemiological Service;

- A copy of the waste removal agreement;

- List of goods to be sold;

- If the product is subject to licensing - a license.

It should be noted that it is easier for an individual entrepreneur to obtain a trade permit than for a legal entity.

It is necessary to dwell in more detail on the licensed types of business activities.

Pyrotechnics

The most important thing that an individual entrepreneur who decides to sell firecrackers, firecrackers and firecrackers should know is that the sale of household pyrotechnic products of hazard class I-III is not subject to licensing.

At the same time, he must comply with the rules of trade in fireworks, as well as standards for their storage. They are set out by Decree of the Government of the Russian Federation N 1052 of December 22, 2009, as well as by the Customs Regulations of the Customs Union.

The sale of products of higher hazard classes (IV, V), capable of creating a shock wave with a danger zone radius of over 30 meters, requires licensing.

Food

A license to trade food products, according to the already mentioned Law No. 128-FZ, is not required, however, the entrepreneur should pay attention to the obligation to notify the administration about the start of this type of activity. The permission of Rospotrebnadzor is also not formally needed - this organization simply needs to be notified, but the conclusion of the SES on the compliance of the point with the established sanitary standards is necessary.

Regardless of the nature of the food products, the seller must have documents confirming their good quality (certificate, declaration of conformity for each item), which must be received along with the goods from the supplier. Representatives of such types of business as the sale of sweets in a shopping center on the “island”, fast food, and other public catering must be prepared to check the sanitary conditions of food preparation.

SES inspectors also check the expiration date (in cases of canned food, concentrates, baby food or other shelf-stable products) and compliance with organoleptic standards.

As with other food products, no special permit is required to sell fresh meat, but if it turns out that there are violations (lack of sanitary books, certificates, veterinary form No. 4, refrigerators, stamps), then troubles for the seller are guaranteed.

Selling on the street, including fruits and vegetables from a car, requires the consent of the local administration. This is dictated by quite reasonable considerations: firstly, the authorities are obliged to ensure the safety of citizens, therefore it will be mandatory to check SES products. And secondly, selling is not appropriate everywhere. In other words, the retail outlet should not interfere with transport and people.

Food products also include tobacco products and alcohol. The entrepreneur will find out where to buy a license for the right to sell them (it is needed for this case) from the executive authority in charge of this issue.

Trade scales CAS PR-15В

Reliable, functional and inexpensive scales for retail. Steel coating, keyboard for cost calculation, mains or battery operation. Possibility of connecting a USB port. Price 7907 rub.

Go to product

Medical products

This concept includes not only medicines, but also medical equipment, as well as various equipment and auxiliary items. Based on this division, it is determined whether a license is needed to sell a particular product. All pharmacological products are subject to mandatory licensing. But there are features due to changes in current legislation. For example, the sale of medicines outside of stationary retail outlets or by peddling is prohibited. A license for the sale of medical equipment is not required (Law N 128-FZ dated 08.08.01), but licensing is required for its maintenance (except for those intended for the own needs of a legal entity or individual entrepreneur). In any doubtful case, it is best for the owner of a retail outlet to consult a lawyer.

fuels and lubricants

The procedure for selling fuels and lubricants is difficult to determine. Law No. 99 of 05/04/11 states that it is possible to sell fuel and lubricants without a license, but, as Rostechnadzor explains, if gasoline or diesel fuel is stored or transported, then it is needed. In addition, this is an excisable product, including for individual entrepreneurs, but only when carrying out export operations.

Veterinary preparations

Medicines intended for animals are classified as pharmacological products; their sale is subject to licensing (Government Decree No. 1081 of December 22, 2011). You should contact the local representative office of the State Agricultural Surveillance or, if the medicinal products will be used by the veterinary service, then the Federal Service for Veterinary and Phytosanitary Control.

Trade in veterinary drugs without a license entails liability provided for in part two of Article 14.1 of the Administrative Code. One of the conditions for obtaining a permit is the presence of special education.

Jewelry

The sale of jewelry does not require licensing, but this does not mean that the state does not control it. The role of the permitting document is played by the Assay Card with a notification of special registration with the State Property Inspectorate under the Ministry of Finance of the Russian Federation. To obtain these papers, a minimum of formalities is required; in addition to the standard package of papers, you need to write an application with the appropriate content, provide an opinion from the Private Security Department, confirm the presence of a safe, and register on the Rosfinmonitoring website.

Useful links for entrepreneurs selling jewelry:

Aurora Necklace

Silver chain with a stone made of artificial material. Unusual colorful appearance. Chain length 55 cm. Price 750 rub.

Detailed description

Pearls with pendant

Gift set – natural pearls in a shell + pendant. One of the most unusual and beautiful gifts on Aliexpress. Price 300 rub.

Detailed description

Bright rings

Women's silver rings with topaz stone. There are 10 colors and 8 sizes to choose from. Weight – 2.3 grams. Discounts for wholesale buyers. Price 160 rub.

Detailed description

Cloth

This type of business activity does not stand out with almost any special features. You can find out what documents are needed to sell clothes when registering a retail outlet at the tax office. The specificity is expressed in three points :

- The need for a conclusion from Rospotrebnadzor on the safety of products due to direct daily contact with the consumer’s skin (such a certificate is also needed for the sale of shoes);

- Sellers must have medical records;

- Quality certificates are required only for children's clothing.

Useful links for clothing sellers:

Women's pullover

Knitted pullover with long sleeves. There are 10 colors to choose from. Season: autumn-winter. Material – cotton. High-quality tailoring and material. Price 665 rub.

Detailed description

Man's T-shirt

Men's V-neck short sleeve T-shirt. Material – polyester and cotton. Available in 10 colors. Brand MRMT. Price 315 rub.

Detailed description

Child dress

Festive dress for girls. Decorated with lace. Length – ankle length. There are 6 colors to choose from. Material – chiffon, polyester, spandex. Price 725 rub.

Detailed description

Flowers

No special permit is required to sell flowers. A regular package of documents is required that meets the requirements of Federal Law N 381-FZ, a general permit to conduct business activities, and a conclusion from the sanitary and epidemiological station.

○ Non-stationary retail facility.

“Non-stationary retail facility is a retail facility that is a temporary structure or temporary structure that is not firmly connected to the land plot, regardless of the presence or absence of a connection (technological connection) to engineering support networks, including mobile structures.” (Clause 6, Article 2 of Law No. 381-FZ).

In order to install a non-stationary object, the self-government body submits to the owner of the land where the installation of the non-stationary object is planned an application for its inclusion in the site layout scheme. The owner of the site makes his decision within a month (Rules approved by Decree of the Government of the Russian Federation No. 772).

If the land owner agrees to locate the facility, the corresponding scheme is approved. It is made available to the public via the Internet. Citizens who want to open their own sales point there must win a competition to place their non-stationary facility on the site. The authority enters into an agreement with the winner.

✔ Obtaining a license.

Obtaining a license is necessary only if the non-stationary facility intends to trade in the goods listed above. In other cases, licensing is not carried out.

How to obtain a trade permit

To obtain the right to trade, an entrepreneur must complete the following procedure:

- Submit a notification application to the local office of Rospotrebnadzor;

- Coordinate the territorial location with the administration of the locality;

- At the sanitary and epidemiological station, obtain a conclusion on compliance with sanitary and hygienic requirements;

- Obtain a safety report from the fire inspectorate;

- If the product is subject to licensing, get it.

How much does a sales license cost?

Since there are quite a lot of licensed types of goods, and the sales process is most often accompanied by other actions that also require licensing (storage, transportation), it is not possible to list all state duties in a short article.

As an example, some of them can be cited:

- Retail sales of alcoholic beverages will cost 65 thousand rubles annually or 325 thousand rubles. immediately for five years (clause 94, clause 1, article 333.33 of the Tax Code);

- The price for a license giving the right to carry out activities in the pharmaceutical field is from 45 thousand rubles. It is considered indefinite.

In this case, you should take into account the strict rules for providing permits, which are indicated separately in each case.

What documents are needed

The issuance of a permit indicating registration in the Trade Register is possible after submitting the following set of documents:

- Foundation agreement legal persons, individual entrepreneur registration certificate or extract from the Unified State Register of Legal Entities;

- Certificate of registration with the Federal Tax Service;

- Personal data of the manager, chief accountant, bank details (for legal entities only);

- A document of title on the ownership of the premises or a lease agreement;

- Sanitary passport of the premises;

- Conclusions of the fire service, SES;

- Garbage removal agreement;

- Expected assortment.

Outbound trade: permit, documents

Outbound trading refers to the sale of goods from a car (automatic shop) or from a tent installed temporarily, as a rule, in settlements remote from the supplier. Wherein:

- The place of sale must be equipped with a sign indicating the enterprise and its address;

- For food products, a permit from the SES and a certificate of conformity are required;

- The forwarder must have shipping documentation;

- The place of sale of the goods is agreed with the local administration, as indicated on the page of the issued permit, upon receipt of which a fee is paid. How to get it has already been described above;

- Sellers must have health certificates (if the nature of the goods requires them);

- It is necessary to comply with sanitary standards provided for by well-known rules (garbage cans, hygienic surfaces);

- In the case of selling licensed products, sellers are required to present a license to representatives of regulatory authorities.

Street vending permit

Part of the question of whether it is possible to sell on the street has already been discussed, as well as the limitations of this type of sales. Stalls, tents, counters installed on the sidewalk can create significant obstacles to the population and transport, so their installation locations must be agreed upon with the administration, which is documented in the appropriate document. Street trading in an unspecified place is prohibited, and fines are applied to violators, as well as for failure to comply with sanitary standards.

Without permission, an individual entrepreneur or a registered taxpayer can sell goods on the territory of specially designated areas. We mentioned earlier what documents are needed to trade on the market - these are TIN and OGRN certificates. Of course, you will have to pay for the right to use the trading place and scales (if they are needed).

Rules for selling consignment goods

The rules for commission trade in non-food products appeared due to the spread of “Second Hand” type outlets. The legislation of the Russian Federation strictly regulates the rules of trade in relation to used goods. In connection with this, the following requirements are imposed:

- Preparatory stage. All goods must undergo a mandatory pre-sale preparation procedure, which includes product inspection, sorting for wear and tear, and quality control.

- Sanitary standards. For retail sale, the product must undergo cleaning, washing and disinfection procedures. However, the Russian legislative framework does not provide for documents that could confirm these actions. In this case, the seller is obliged to carry out these procedures independently.

- Informing. The seller is obliged to inform the consumer about the quality of the product, the presence of defects, what procedures were performed (see clause 2), technical characteristics, and purpose of the product.

It is mandatory to provide all the data on the label or price tags; if the organization does not do this, then the consumer has the right to act in accordance with clause 27 of the General Rules of Trade in Russia, which contain a legal requirement to provide a discount, repair, etc.

For the sale of product groups - electronics, household appliances, computer equipment, etc. Information about the possible service life should be provided. The store is also required to provide a warranty period of 14 days.

By the way, there are changes in the acquisition of this group of goods abroad, by Russian citizens. In the Republic of Belarus (RB), the rules for the sale of consignment goods are similar. In this regard, a citizen of the Russian Federation has the right to purchase products in Second Hand stores in the territory of the Republic of Belarus under the same conditions as citizens of the Republic of Belarus. If you have any complaints about quality, you can use the rules of commission trading in the Republic of Belarus.

Wholesale license

In addition to retail sales, there is also wholesale. Wholesale sales of goods subject to licensing must be carried out only with its availability. This applies to the sale of products such as alcoholic beverages, tobacco products, fuels and lubricants, weapons, and other special items. When issuing a license for wholesale distribution, the seller’s storage, security and other important factors are taken into account. The duty, of course, is more expensive than for retail sales.

Wholesale trade of medicines

This type of sales, according to Federal Law No. 323-FZ dated November 21, 2011, requires a license for pharmaceutical activities. This procedure applies to retail and wholesale. A pharmaceutical license is issued by the Federal Service for Surveillance in Healthcare and Social Development, for which a standard set of papers is provided. In this case, the enterprise must ensure the fulfillment of a number of strict conditions:

- Availability of retail (warehouse) premises of sufficient space, owned or leased;

- Medical organizations need a license to provide medical services;

- The manager must have a specialized medical education, more than 3 years of experience, and a certificate of advanced training. If this is not the case, then the requirement for experience in performing similar duties is increased to five years.

In the case of trade in pharmaceutical products for veterinary purposes, the requirements are the same. The difference between how a license for retail trade and wholesale is issued is only in the physical volume of warehouse space that allows storing medicines and medical products.

Do I need a permit for retail trade and wholesale sales of dietary supplements?

As stated earlier, licensing is required only for goods listed by Federal Law No. 128-FZ of 08.08.01. It should be remembered that trading in dietary supplements does not require separate certificates. Biologically active substances are essentially food products, so their sale is not subject to licensing for pharmaceutical activities. Retail trade, like wholesale, can be carried out according to general principles.

What is a non-food product

In fact, non-food products include all products that are not food products. They are implemented to satisfy a wide variety of customer needs and requests. As of today, there is a whole system in accordance with which all non-food products are classified and systematized. It is customary to distinguish the following categories:

- household products;

- haberdashery products (these include goods that were made from leather, textiles of any type or metal);

- household chemicals . The basic principle for identifying such products is the presence of chemically active substances (washing powders, adhesives, polishes, detergents);

- glass products (this can be any tableware, as well as lamps and window sheets);

- ceramics (this includes products made of porcelain, earthenware, clay. As a rule, these are dishes or objects of applied art);

- materials used in construction . We are talking about all types of mixtures, liquids, suspensions and emulsions, as well as metal frames, ceramic structures and so on;

- furniture . It can be made of any material, but in any case it will belong to this category due to its purpose;

- products that were made from alloys of various metals . These can be construction tools, kitchen utensils, household items and much more;

- household appliances and electrical devices of all types . This category also includes cords, adapters, and measuring instruments;

- textile products (piece products only);

- sewing products (ready-made clothing and household items);

- knitwear;

- shoes;

- products that were made from fur (this includes all types of fur products and semi-finished products);

- the result of the jewelers’ activities (regardless of the name of the metals and stones used);

- stationery of all types and areas of use;

- all equipment used for photography;

- all the equipment needed to create music , mix sound, and perform all related tasks;

- radio-electronic equipment;

- all sports equipment (regardless of materials and affiliation with a specific sport);

- toys and board games for children;

- books , as well as any other result of the printing industry.

Let us note the fact that the above classification is used not only by lawyers, but also by employees of retail outlets.

You will notice that products in stores and supermarkets are distributed precisely according to the above categories.

Temporary trade permit

It often happens that the sale of a product is seasonal and does not require a stationary outlet or store (for example, Christmas trees, fruits, vegetables). The sale of such products from tents and car bodies must be carried out at designated places, and the seller only needs to have a temporary permit issued by the administration of the locality.

Most often the police have to present it - other inspectors usually do not even have time to pay attention to such a retail outlet. In its essence, temporary entrepreneurial activity is similar to traveling business, and in most cases it is the same.

What is the fine for illegal trade?

Illegal trade refers to commercial activities that the entrepreneur did not notify the local administration and tax authorities about.

Any person selling goods on the street, regardless of whether he is registered as an individual entrepreneur, makes transactions with buyers. Of course, we are not talking about one-time cases that occasionally take place in spontaneous flea markets, but about actions performed with the aim of systematically generating income. Selling goods without documents in a price range of 500-2000 rubles. without permission and notification of the authorities entails the following administrative and legal consequences provided for in Article 14 of the Code of Administrative Offenses of the Russian Federation:

- Fine imposed by a magistrate’s court on an individual: 2,000 – 2,500 rubles;

- For an official: 4,000 – 5,000 rubles;

- Organizations: 40,000 – 50,000 rub.

In particular,

- Conducting business activity without registration (including street sales) – a fine from 500 to 2000 rubles;

- Responsibility for trading without a license, if its availability is mandatory (for example, alcoholic beverages) - a fine of 2 to 50 thousand rubles. with confiscation of goods;

- Violation of licensing conditions - a fine from 1,500 to 40,000 rubles;

- The same, but in rough form - a fine from 4 to 50 thousand rubles. with deprivation of the right to engage in individual entrepreneurship for a period of up to three months.

The right to draw up a protocol on an administrative offense is enjoyed by employees of the patrol service, tax inspectorate, inspectorate for trade and quality of goods, consumer protection and antimonopoly structures.

Taxation and reporting

Each entrepreneur chooses his own taxation regime. For this purpose, the simplified tax system, UTII, patents or OSNO can be used. Each type has its own characteristics, and the size of the tax, the ease of reporting, and the need to use a cash register depend on this choice.

Thus, to conduct trade, it is necessary to obtain different permits issued by various government agencies. For this purpose, certain documents are prepared, and confirmation of the legality of the activity is also prepared.

If you work without permits, this risks significant administrative liability, represented by significant fines.

When buying products on the street, the buyer must be sure that they are safe for health, but this is not the only reason why it is necessary to obtain permission. The retail space must be properly equipped to ensure the safety of customers.

The permit is issued by the local administration, and you should apply there first. But before submitting an application, you must first determine how the trade will be conducted: from a stall, tent or kiosk. They do not have a separate room for buyers, but at the same time it occupies some area.

You can also engage in mobile trading using carts and light vehicles.

Then select, in your opinion, a suitable place where you plan to organize a trading place. According to Russian legislation, any registered entrepreneur has the right to apply to the authorities to obtain a small plot of land for trading activities for rent, for a certain fee.

Please note that if you are going to rent land for commercial activities, you cannot use it, for example, for car parking.

Sequence of actions to obtain a permit for street trading:

- Register as an individual entrepreneur or legal entity, choose a taxation regime: simplified tax system or UTII.

- Register with the pension and insurance fund if you intend to hire employees.

- Submit an application to the local administration department dealing with street trading issues. The following package of documentation must be attached to the application:

- A map of the area to indicate the future location of the retail facility.

Original and photocopy of the certificate of registration as an individual entrepreneur or legal entity.

- Original and photocopy of a certificate from the tax office stating that tax registration has been carried out.

- For legal entities - original and photocopy of the organization's charter.

- Original and photocopy of the applicant's general passport.

- Documentary confirmation of the absence of tax debts to the state.

- The issue of obtaining permission can be considered within 10 working days from the date of submission of the application. An entrepreneur may be allowed or denied street trading.

- If the decision is positive, then the entrepreneur receives a passport to the outlet. If the entrepreneur is refused, then he is given the minutes of the meeting, which spells out all the reasons for the refusal to the applicant. Such reasons include non-compliance with traffic safety requirements, poor sanitary conditions or non-compliance with environmental requirements.

- Lease agreement for the site where the retail outlet will be located.

- If additional technical means are used for street trading, for example, in the production of cotton candy or the sale of inflatable balls, a technical examination of the equipment and an expert opinion on the possibility of use in the process of economic activity are required.

- If there are gas or water supply pipes on the site, then conclusions from these organizations on the safety of using the site for commercial purposes.

- Medical examination of the state of health, medical record of the employee of the outlet.

Permits can be issued only in places designated for these purposes; they are determined by the territorial plan, which is approved by the administration.

All this concerns trade in unlicensed goods, but if trade in alcoholic products is intended, then additional permits for this economic activity are required.

If trade operations will be carried out using a light vehicle, then it is necessary to have a conclusion on the technical condition of the transport, a conclusion from the sanitary and epidemiological station with permission to use it for trade purposes.

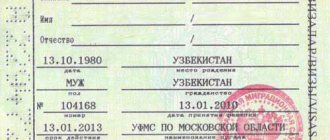

It is also necessary to provide a list of goods that will be sold on the street, and an agreement on the removal of garbage that will inevitably appear during the work process. If foreign citizens are expected to be hired, their registration documents and work permits will be required.

You can independently choose the tax regime when registering with the tax office; it must be indicated when applying for a permit:

- UTII, imputed tax is paid. It is determined based on the location of the outlet and the area of the premises. If the total area is 5 m2, then the established profit will be 9,000 rubles, this amount is multiplied by 6%, the tax amount payable is obtained. But there is also a correction coefficient, which is established by local governments. Tax is paid every quarter, and a declaration based on the results of activities is submitted at the same time. To switch to another type of taxation, they submit an application to the tax authority at the place of registration of the retail facility to change the tax regime.

- With a patent taxation system, you first need to obtain it; the validity period can vary from six months to a year. If trade will be carried out only in the warm season, then you can obtain and pay a patent, that is, a tax, for this period. Under this tax regime, no reporting is required, since the tax is paid upon the purchase of a patent.

- USN, this regime offers a choice of tax payment system: income minus expenses, or only taxation of income. It is better to choose the first option, then the tax amount will be calculated based on actual indicators. A declaration of income received is submitted at the end of the reporting period, and the tax amount can be paid in stages. But with this type of taxation, actual confirmation of profit is required, and this is only possible if you have cash registers registered with the tax office.

We suggest you read: Where to complain about illegal trade

Fines and sanctions for small retail trade without permission:

- If trade is carried out without organizing an individual entrepreneur or other type of economic activity - the amount of the fine is from 500 to 3000 rubles.

- If trade is carried out in unidentified or unauthorized goods, the fine for an individual entrepreneur is 1-3 thousand rubles, for a legal entity from 10 to 30 thousand, if there are no permits - 10-20 thousand.

- If economic activity is carried out in a place other than the one for which the permit was issued, from 500 rubles to 2.5 thousand.

- If the product is not licensed, for example, the sale of children's clothing requires a mandatory license, the fine will range from 500 to 2000 rubles. And in some cases, for example, selling alcoholic beverages without a license, entails penalties including confiscation and payment of 20 to 100 times the minimum wage in the form of fines.

The taxation procedure is chosen by the participant in trading activities at the stage of registration as a legal entity or individual entrepreneur. So, in 2020, participants can use the following taxation methods:

- Carrying out activities on the basis of a received patent. A patent is permission to trade, granted for a limited period of time. Typically, this duration varies from six months to 12 months. Payment of the cost occurs when registering a patent, therefore, in the future, when carrying out trading activities, there is no need to transfer tax to the state. On the one hand, this is beneficial, but on the other hand, the legal entity will have to immediately find a large sum to pay for the cost of the patent.

- A simplified taxation system is the most profitable option for small entrepreneurs and individual entrepreneurs. The advantage of this method is that the legal entity pays tax only from the profit amount. First, the total amount of income is calculated, from which expenses are calculated. After this, tax is calculated from the difference received. In this case, the tax is not very high, but the individual entrepreneur will have to regularly prepare certificates, calculating profits and expenses.

- Fixed tax, which is the same for all outlets. The amount of deductions is calculated based on the location of the retail outlet, as well as the area of the retail stall.