We make calculations

To get this indicator, you need to divide net profit by the amount of all expenses. Naturally, we take the same period of time for the first indicator and for the second. The calculation formula looks like this:

RP = BP / SA * 100%. We decipher: RP - profitability of the enterprise; BP - the amount of balance sheet profit. To calculate it, you need to take the amount of revenue for a certain period of time, subtract the cost of production and various organizational expenses. CA is the value of assets. Here you need to add up the cost of production assets, current and non-current assets.

Profitability by itself can say little about the development of a company. Judging the performance of a business based on numbers alone will not be entirely reasonable. This issue needs to be considered in its entirety. Therefore, it is important to calculate and analyze operating benefits as well as return on assets and sales. Let's take a closer look at the first one.

Types of profitability and their coefficients, as well as calculation options with comments

The profitability of the entire enterprise is influenced by various factors, which are also subject to evaluation. Accordingly, the following main types are distinguished:

- ROA (return on assets). The profitability of an enterprise is determined by the invested funds.

- ROE (return on equity). The return on internal investment (own funds) is determined.

- ROS (return on sales). Displays the share of profit in each monetary unit received.

- ROL (return on staff). Shows the level of professional training of personnel and the optimal use of it.

There are also other profitability ratios: ROM (products), ROIC (invested, permanent capital), RONA (net assets) and so on. Thus, in order to calculate a specific profitability ratio, you should take the general basic formula as a basis and carry out the calculation by analogy, substituting the required values.

For example, if you need to calculate return on equity, the calculation formula could be as follows:

In addition, this coefficient can be calculated in other ways. For comparison, below is another calculation option, which is made before taxes are paid.

Important! In such calculations, the net profit indicator is mostly used.

The remaining indicators are essentially not significant. Meanwhile, one more significant point should also be noted. The most optimal is the ratio of equity capital with the profit that remains after payments (tax, interest), i.e. calculation according to the first formula. If you take the entire amount of profit during calculation (i.e., calculate using the second formula), then the final profitability ratio of equity capital will be clearly overestimated.

How to calculate production profit

No enterprise can do without this indicator. This is the main characteristic of production efficiency. Calculation steps:

- We take the balance sheet and “get” the balance sheet profit from there.

- We calculate the average annual cost of fixed assets. To do this: we add up fixed assets as of the 1st day of each month. Then we add up the fixed assets at the beginning and end of the year. Then divide the resulting amount by two. Divide the total number by 12 - the number of months in a year. If you take for the reporting period not a year, but another time period, then divide by the appropriate number of months.

- From the company’s balance sheet we again “get” the average cost of working capital.

- Finally, we move on to calculating production profitability. To obtain this parameter, it is necessary to divide the balance sheet income by the average annual cost of working capital.

Common mistakes when determining enterprise profitability

Mistake 1. Often, when conducting financial and economic monitoring, many specialists try to identify and draw an analogy between profit and profitability. Meanwhile, these are different quantities, absolutely not identical.

It is practically impossible to fully assess the efficiency of an enterprise only on the basis of data on profit, as well as revenue and sales volumes. To obtain a reliable estimate, a more detailed analysis is required by calculating profitability. We can say that this is one of the key indicators. It is with its help that you can find out, for example, what profit one ruble invested in production can give, etc.

How to calculate return on assets

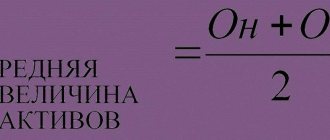

This indicator allows you to see how well the company's capital is performing. It should not be very low, as this will indicate that capital is not working. It also does not have to be very high, since it may cause a lack of reserve capital, which is also bad. Calculated as follows:

- We extract the sales volume for a certain period from the financial statements.

- We determine the cost of production.

- We calculate operating costs for the same period.

- To the obtained cost and expense indicators we add the amount of tax payments that are paid to the budget. Subtract the amount received from the total sales volume. We have a net profit.

- From the financial statements we extract the amount of total assets with which to divide the net profit.

What is the profitability of an enterprise in simple words and how to calculate it?

Enterprise profitability is an indicator that demonstrates how much added value can be obtained from each monetary unit invested in the company.

In simple words, if we abstract from the details, it turns out that if a businessman’s revenue is 1000 rubles, and expenses are 500 rubles, and profit, accordingly, is 500 rubles. (1000 rubles minus 500 rubles), then the profitability of the company of such an enterprise is 100%. (500 divided by 500, and all this multiplied by 100%).

You can find out what the average number of employees is and see a sample report on this indicator in this article.

Formula and examples for calculating profitability

In a simplified form, the formula for calculating the profitability of an enterprise looks like this:

P/Z*100%

Where:

- P – profit

- Z – all costs of creating a product.

For a clearer understanding of the calculation formula, it is proposed to consider several simple examples.

Let her earn 100,000 rubles from selling her products. All company costs (resources, equipment, labor, (including management personnel) and infrastructure) amounted to 80,000 rubles.

Step-by-step instructions and tips for doing your own accounting for individual entrepreneurs are here.

Dear readers! We constantly write relevant and interesting materials to our FBM online magazine, subscribe to our Yandex-Zen channel!

Profit is equal to the difference between revenue and costs: 100,000 rubles. minus 80,000 rub. equals 20,000 rubles. Calculation of the profitability of the Bukinist enterprise using the above formula will look like:

20,000 rub./80,000 rub.*100%=25%

Thus, the profitability is 25%

Table of initial data for factor analysis of enterprise profitability.

The last example: let’s say that for a certain period I received an income of 600,000 rubles. The costs of producing goods in the same period amounted to 200,000 rubles. Then the profit (the difference obtained after subtracting expenses from revenue) will be equal to:

600,000 rub. minus 200,000 rub. = 400,000 rub.

So, there is:

- Profit - 400,000 rubles.

- Costs – 200,000 rub.

This is interesting: What phone number to call the Moscow Credit Bank?

The profitability calculation will look like:

400,000 rub./200,000 rub.*100%=200%

In this case, the profit is two hundred percent.

In reality, there may be many costing options. If the company opened quite recently (less than a year), then it simply does not make sense to calculate the profitability of the enterprise, since the turnover of the initially advanced capital takes a period of several years.

You can read about the procedure for distributing shares of LLC participants here.

Scheme: What is the profitability of an enterprise?

Where and when is this indicator used?

- When managing a company. Knowing the value of the enterprise's profitability indicator for a certain period of time, the manager can determine, through analysis of the components of its formula (profit and expenses), where there are problems.

- Forecasting possible profits. Having information about the average profitability of an enterprise, a manager can predict with sufficient accuracy how much profit he will receive.

- Justification of investment projects. Such a summary indicator as the profitability of an enterprise is the most powerful argument for potential investors: having an idea of the expected amount of investment and the average profitability of the enterprise, an investor can easily calculate for himself the future benefits of an investment project.

- If the enterprise is a subject of trade. The fact is that the profitability of an enterprise, along with liquidity, is one of the most important categories that affects the value of the company.

What documents are needed when applying for a job and how to prepare them correctly, you can find out in our new publication at the link.

Scheme: Model of formation of enterprise profitability.

https://youtu.be/ePkFyRPRO9I

How to calculate return on sales

If your production and asset indicators are at a good level, but the overall profitability of the enterprise upsets you, perhaps the problem should be looked for in sales:

- We calculate sales revenue for the reporting period.

- We extract net profit from the accounting documents.

- We divide the amount of net profit by sales revenue and get the desired indicator.

To get the most complete picture of the current state of affairs, compare the return on sales for one reporting period with the same for another period. If a parameter is constantly decreasing or there has been a sharp decline in one of the periods, this is a serious reason to conduct a deep economic analysis.

Basic formula for calculating enterprise profitability

There is a general simplified universal formula, a certain basis according to which you can calculate and evaluate the level of profitability of an enterprise. It is easy to use and is most often used when planning profits, i.e. for the future. When calculating using this formula, data from accounting (statistical) reporting for specific periods is used. The calculation scheme will be as follows.

Thus, you will first need to calculate the enterprise’s profit for a specific period and determine the indicator whose profitability is assessed. This could be, for example, equity capital or assets of the enterprise. Next, using these values, the required profitability ratio is calculated using the formula indicated above.

Let's say, relatively speaking, the total income of the enterprise is 12 million. rubles, and total expenses (acquired assets) – 10 million roubles. rub. Then the calculation of profitability using the basic formula will be as follows: (12 million - 10 million) / 10 million x 100% = 20%.

In general, it should be noted that profitability can be calculated in different ways. The calculation option depends partly on the industry in which the company operates, as well as the goals of the analysis. That is, depending on what needs to be assessed: the financial capabilities of the enterprise, its ability to repay debts in a timely manner, or it is necessary to conduct a detailed analysis of the financial situation, etc.

What characterizes the production profitability indicator

Production profitability is a coefficient reflecting the relationship between profit on the balance sheet and the average annual price of production working capital. The main source for settlement transactions is the balance sheet. The indicator can also be represented by a profitable value, which accounts for each ruble spent in the production of products (for each unit invested in the formation of the cost of the product).

Profitability shows the features of the economic efficiency of the enterprise, as well as the effectiveness of the functioning of its main divisions. It turns out that within the framework of this criterion, there is a reflection of how effectively the property part of the organization is used.

Key formulas for return on sales

Formula for profitability of goods production

Product profitability is used in several ways:

- Effective sales of products,

- Profitability of products in the form of certain goods,

- Profitability from an individual product.

The profitability of sold products is assumed to be the ratio of its initial price, that is, the funds invested in its production, to the profit received from its sale.

All calculations are made according to the following formula: RPT=(CP-NS)/NS*100, where

- RPT – profitability of goods sold,

- CPU – the price of products set by the enterprise for sale,

- NS – initial cost of goods.

The profitability ratio of products in the form of individual goods characterizes the material investments in the production and sale of one unit of goods.

There is a standard formula by which you can make the calculation: RPVT=(CP-NS)/CP*100, where

- CP – the price of products set by the enterprise for sale,

- NS – initial cost of goods,

- RPVOT is the profitability of products in the form of a specific product.

Profitability calculation

If we talk about the profitability of an individual product, this means the relationship between the profit from the sale of one individual product and its initial cost. That is, the difference between its selling price and cost.

ROOP=P/NS, where

- ROOP is the profitability of one individual product,

- P – profit,

- NS – initial cost.

Profit is a joyful factor for any business owner and plays an important role in the development of the entire business as a whole. However, its value does not make it possible to accurately determine how profitable and profitable the organization’s activities are. To analyze the entire work of available resources and make an accurate calculation of income, profit and operational efficiency, the enterprise profitability formula will help. Its use will guarantee successful business development.

Top

Write your question in the form below

Why is the profitability of an enterprise calculated?

The profitability of an organization’s activities is a value determined on the basis of the Balance Sheet data of the enterprise under study. This is a coefficient that is equal to the ratio of balance sheet profit from sales of goods (products, services, works) to the average annual cost of all available investment capital. Information about the profitability of the company is necessary for the following reasons:

| The value of profitability information | additional information |

| The indicator gives an idea of how efficiently the company operates | No standard values for the profitability ratio have been established, and therefore the good/unsatisfactory performance of a company should be judged after comparing the calculated values with the industry average. |

| It becomes possible to identify and assess the degree of influence of various external and internal factors on profit margins | This analysis is carried out using factor models of profitability. |

| Analysts can find out whether production is growing or regressing | To obtain such information, you should select a certain period and analyze profitability indicators over time. |

Where to get the numbers for calculations

The information necessary for the calculation can be partially obtained from financial reporting data, and partially from accounting analytics. Thus, the value of balance sheet profit is stated in the income statement, or more precisely, in line 2300 of Form 2 “Profit (loss) before tax.”

Thus, based on the balance sheet data, the production profitability ratio can be calculated using the following formula (an example of a calculation in this case is extremely simple, so we will not give it):

Krp = line 2200 (Form 2) / line 2120 (Form 2) * 100%