Accounting entries for the deposit when opening and closing it

In accordance with PBU 19/02 (clauses 2, 3), deposit funds in accounting are shown as financial investments. They are registered at their original cost, which is the amount of money deposited in a bank account.

To account for the deposit, according to the Chart of Accounts, two accounts can be used:

- account 58 intended for financial investments;

- account 55 reflecting funds in special accounts in banking institutions.

Subaccounts are opened for these accounts: 58-5 “Bank deposits (deposits)” and 55-3 “Deposit accounts”. The method chosen by the enterprise to account for the movement of money on the deposit must be fixed in the accounting policy.

When opening a bank deposit and returning money from it, you must use the following transactions:

| Dt | CT | |

| Crediting money to a deposit | 58 (55-3) | 50, 51, 52, etc. |

| Closing the deposit | 50, 51, 52, etc. | 58 (55-3) |

Attention! Regardless of the chosen option for accounting for deposits (on account 55 as cash or on account 58 as part of financial assets), they must be reflected in the reporting as financial investments (clause 41 of PBU 19/02).

https://youtu.be/TQG-M82dES4

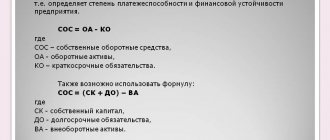

Long-term financial investments on the balance sheet

To form them, 91 counts are used. The appearance and movement of reserves is reflected by the posting: Dt 91 – Kt 59. The total amount of the reserve is taken into account as part of other expenses (PBU 19/02). The financial balance sheet contains assets that have certain characteristics enshrined in the legislation of our country. His investments must be entered in line 1240, located in the “Current assets” block to record short-term investments. However, their period should not exceed 1 year. Below is a breakdown of balance line 1240.

What is the procedure for reflecting short-term deposits taken into account as part of the organization’s financial investments in the notes to the balance sheet and the financial performance statement when preparing reports for 2020?

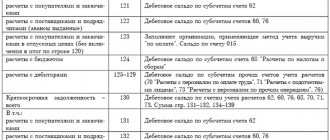

The table should reflect the movement and structure of arrears at the beginning and end of the reporting and previous years. At the same time, the table format allows you to see the whole picture of debt formation and repayment.

Interest is accrued on the last day of each calendar month and on the date of its closure, while accounting entries are generated in the accounts:

- Debit account 76.09 and credit account. 91.01 “Other income”.

Payment of accrued interest is reflected in the accounting entry:

- Debit account 51 “Current account” and credit account. 76.09.

Interest on deposit: accounting entries

To account for interest accrued on the deposit, subaccount 91-1 “Other income” is used. They are reflected differently depending on the accrual method specified in the agreement with the bank: simple or complex (with capitalization).

When calculating simple interest, account 91-1 corresponds with account 76 “Settlements with other debtors and creditors.” When calculating interest on a deposit, the following entries must be made:

- Dt 76 Kt 91-1 – interest is accrued on the deposit;

- Dt 51 Kt 76 – accrued interest is credited to the company’s account.

With compound interest, the deposit amount increases. In accounting, they belong to other income and are shown in account 91-1 in correspondence with the selected account for the deposit itself: 55 or 58. When capitalizing (attaching to the deposit amount) accrued interest, the income on them is recorded as follows: Dt 58 (55-3) Kt 91-1.

Examples

Pobeda LLC transferred money in the amount of 2.5 million rubles to a deposit account on April 1, 2020. According to the agreement, the deposit period is 1 year, i.e. The bank must return the investment on March 31, 2020.

Situation 1. Simple interest is accrued monthly at a rate of 9% per annum, starting from the day following the date of transfer of money to the bank for deposit, until and including the day the investment is returned to the investor.

The accountant, taking into account the opening, closing of the deposit and interest on the deposit, must make the following entries:

| Date of operation | Accounting entry | Amount, rub. | |

| 04/01/2018 | Transfer money to deposit | Dt 58 Kt 51 | 2 500 000 |

| 04/30/2018 | For April, interest was accrued on the deposit (from 04/02/2018 to 04/30/2018) (2,500,000 x 9% / 365 x 29) | Dt 76 Kt 91-1 | 17 877 |

| If the bank pays interest accrued on the deposit every month on the 1st day: | |||

| 05/01/2018 | Receipt of interest from the deposit account for April | Dt 51 Kt 76 | 17 877 |

| 03/31/2019 | Return of the deposited amount from the deposit account | Dt 51 Kt 58 | 2 500 000 |

| If the bank pays interest in a lump sum at the end of the deposit period: | |||

| 03/31/2019 | Receipt of interest from the deposit account for the entire deposit period | Dt 51 Kt 76 | 224 384 |

| 03/31/2019 | Return of invested funds from the bank | Dt 51 Kt 58 | 2 500 000 |

Situation 2. Compound interest is calculated at a rate of 9% per annum with monthly capitalization on the last day of each month. Interest is paid to the investor simultaneously with the return of the invested amount at the end of the entire period - after a year. The accountant of Pobeda LLC will make the following entries on the deposit:

| Date of operation | Accounting entry | Amount, rub. | |

| 04/01/2018 | Transferring money to the bank for deposit | Dt 58 Kt 51 | 2 500 000 |

| 04/30/2018 | Accrual of interest on the deposit for April (from 04/02/2018 to 04/30/2018) (2,500,000 x 9% / 365 x 29) | Dt 58 Kt 91-1 | 17 877 |

| 05/31/2018 | Accrual of interest on the deposit for May (from 05/01/2018 to 05/31/2018) ((2500000 + 17877) x 9% / 365 x 31) | Dt 58 Kt 91-1 | 19 246 |

| 06/30/2018 | etc. monthly | Dt 58 Kt 91-1 | 18 768 |

| 07/31/2018 | 19 537 | ||

| 08/31/2018 | 19 686 | ||

| 09/30/2018 | 19 197 | ||

| 10/31/2018 | 19 983 | ||

| November 30, 2018 | 19 487 | ||

| 12/31/2018 | 20 285 | ||

| 01/31/2019 | 20 440 | ||

| 18 603 | |||

| 03/31/2019 | 20 739 | ||

| 03/31/2019 | Return of the deposit amount by the bank and payment of interest (2,500,000 + 233,848) | Dt 51 Kt 58 | 2 733 848 |

Which line reflects short-term financial investments?

» » » Assets The current form of the balance sheet, which is submitted to the tax office, was approved by Order of the Ministry of Finance dated July 2, 2010 No. 66n. Its basis is the balance sheet lines, which reflect the balances transferred from the accounting accounts.

Therefore, for correct preparation, it is important not only to keep accounting records correctly and completely, but also to understand the information from which accounts each line of the balance sheet reflects.

Our consultation will help you figure this out.

Below is a complete breakdown of the 2020/2020 balance sheet lines. Moreover, each line is specified according to the most characteristic accounts for it, which are reflected in it. Of course, the specifics of economic activity in practice may leave their mark on this correspondence.

Also, the order of formation of accounting reports, as well as the reflection of certain indicators, is influenced by the accounting policy for accounting purposes adopted by the company.

The following is a breakdown of the balance sheet lines for the accounts in two tables - by asset and liability of the balance sheet.

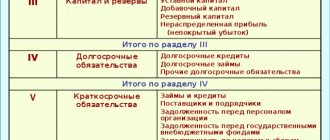

Name of indicator Code Data of which accounts are used Algorithm for calculating the indicator Intangible assets 1110 04 “Intangible assets”, 05 “Amortization of intangible assets” Dt 04 (excluding R&D expenses) – Kt 05 Results of research and development 1120 04 Dt 04 (in terms of R&D expenses) Intangible search assets 1130 08 “Investments in non-current assets”, 05 Dt 08 – Kt 05 (all in terms of intangible search assets) Tangible search assets 1140 08, 02 “Depreciation of fixed assets” Dt 08 – Kt 02 (all in terms of tangible search assets) Fixed assets 1150 01 "Fixed assets", 02 Dt 01 - Kt 02 (except for depreciation of fixed assets accounted for in account 03 "Income-generating investments in tangible assets" Income-generating investments in tangible assets 1160 03, 02 Dt 03 - Kt 02 (except for depreciation of fixed assets funds accounted for in account 01) Financial investments 1170 58 “Financial investments”, 55-3 “Deposit accounts”, 59 “Provisions for impairment of financial investments”, 73-1 “Settlements on loans provided”

Popular

Accounting reporting Deadlines for submission of reports in 2020: table

Payments to staff Funeral benefits in 2020

Personal Income Tax Certificate 2-NDFL: new form 2019

Maternity leave Maternity benefits in 2020

Statistical reporting Statistical reporting

Personal income tax Help 2-NDFL: new form-2018

Environmental payments Submission of the SME report for 2020

Personnel records management Production calendar 2019 with holidays and weekends

Insurance premiums of the Pension Fund of the Russian Federation Sample of filling out SZV-STAZH and ODV-1

Insurance contributions to the Social Insurance Fund Confirmation of the type of activity in the Social Insurance Fund 2020: deadlines

Transport tax Transport tax rates by region 2018 (table)

Taxes and fees Accountant calendar: 2020

Pension Fund insurance premiums ODV-1 - new form

Insurance premiums of the Pension Fund of Russia How to find out the SNILS number

Deposit concept

A deposit is the transfer of funds to a bank at interest.

Accounting for deposits is maintained on accounting account 55, and a separate subaccount 3 is opened. Earlier we said that subaccount 1 accounts for letters of credit, and subaccount 2 for checks. Analytical accounting on account 55 is maintained separately for each deposit.

The transfer of money to the deposit is reflected by posting D55/3 K51.

Interest received from the bank for the use of deposit funds is included in other income; in accounting, the accrual of interest is reflected by entry D76 K91/1, then interest on the deposit is transferred to the current account, and in accounting entry D51 K76 is drawn up.

When the deposit is closed, the funds are transferred back to the current account, the return of money is formalized by posting - D51 K55/3.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Income from participation in other organizations

A bank deposit (bank deposit) refers to funds or securities deposited in a bank on behalf of an individual or legal entity, who is charged a certain percentage for this. Acceptance of an organization's deposit is accompanied by the opening of a deposit account at the bank. The date of reflection of non-operating income is determined by the payer on the date of recognition of income in accounting, and in relation to income for which in paragraph 3 of Art. 128 of the Tax Code indicates the date of their reflection - on the date specified in paragraph 3 of Art. 128 NK.

Line 070 in parentheses reflects other expenses in the amount of interest that the organization must pay on its own bonds and bills, loans and borrowings received.

The section “Decoding of individual profits and losses” provides a breakdown of individual profits and losses received (identified) by the organization during the reporting period, in comparison with data for the same period of the previous year.

Postings on deposit (account 55.3)

| Debit | Credit | Operation name |

| 55/3 | 51 | Transfer of funds to deposit |

| 76 | 91/1 | Interest accrued on the deposit |

| 51 | 76 | Accrued interest was transferred to the current account |

| 51 | 55/3 | Transfer of funds to a current account when closing a deposit (return of deposit money) |

This concludes the topic of cash accounting.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Video lesson “Deposit Accounting”

Let's summarize: we figured out how cash and non-cash funds are accounted for, looked at the accounting of transactions on a foreign currency account, looked at how accounting account 55 is used, what is taken into account in account 55 “Special accounts”: we looked at the concept of a letter of credit, how calculations are carried out checks and finally looked at the concept of deposit.

Now from the topic of cash accounting we move on to another important and large topic: Fixed assets. Let's consider how accounting occurs for the receipt of fixed assets, disposal, how depreciation is calculated, how revaluation, inventory, and repair of fixed assets are carried out. Rate the quality of the article. We want to become better for you: If you have not found the answer to your question, then you can get an answer to your question by calling the numbers ⇓ Legal Consultation free Moscow, Moscow region call

One-click call St. Petersburg, Leningrad region call: +7 (812) 317-60-16

Call in one click From other regions of the Russian Federation, call

One-click call

Terms and concepts

Financial investments - These are assets (investments in assets) owned by an organization that are not directly located in the enterprise, but are capable of generating income, at the same time there is a risk of losing these assets partially or completely.

Accounting for financial investments is regulated by PBU 19/02 ACCOUNTING FOR FINANCIAL INVESTMENTS.” This PBU covers the following points:

- Conditions for accepting assets as financial investments.

- What assets are not recognized as financial investments.

- Evaluation of financial investments.

- The procedure for disposal of financial investments.

- Income and Expenses on financial investments.

- Depreciation of financial investments.

- Disclosure of information in reporting on financial investments.

- Examples of calculating the value of retired financial investments are given.

To accept assets as financial investments, the following conditions must be met:

- Documenting.

- Financial risks.

- The asset must have the ability to generate income.

Financial investments do not include:

- Treasury shares purchased from shareholders for resale or cancellation.

- Bills issued by the organization of the drawer to the seller, bills issued are reflected in account 60 sub-account “Bills issued”, and bills received in account 62 sub-account “Bills received”

- Fixed assets intended for rent.

- Precious metals, etc.

Financial investments include:

- Securities.

- Contributions to the authorized capital of other organizations.

- Deposits.

- Deposits under a simple partnership agreement.

- Loans issued.

- Purchased accounts receivable.

One type of security is a Share. And there are many more securities.

Promotions, in turn, are:

1a) Ordinary.

1b) Privileged (give the right to receive a fixed dividend)

2a) Registered (contains the name of the holder and is in the register).

2b) To bearer.

3a) At par price.

3b) At market value. (No comments).

Also, one type of securities is a Bond (Read on the internet our lesson on accounting and not the securities market :))

There are 2 types of financial investments:

-Short-term.

-Long-term.

Accounting for deposits as cash equivalent in accounting

Cash equivalent is the value of property reduced to the amount of money at the current price, taking into account the price of financial claims, as well as other non-monetary services.

A deposit represents money or various types of securities that are deposited with a credit institution for savings, or for the acquisition of income or for another specially intended purpose. Investors, that is, depositors can be either ordinary citizens of any country or enterprises and institutions of various directions. If any organization has free funds, then this enterprise can increase its capital by depositing funds and receiving interest payments along the way.

Procedure for accounting for short-term deposits in the balance sheet

Quote (Tuluva): Help me deal with a short-term deposit. On December 31, 2020, the organization placed funds on a time deposit (early termination of the deposit agreement is prohibited) for a period of 12 days. at a percentage I have a question. In the balance sheet, this deposit will be reflected on line 1250 as cash equivalents or on line 1240 as financial investments. In 2020 The organization has already placed funds on deposit, but for periods of 6 months or more. up to 11 months and these deposits were accounted for as financial investments. The chief accountant writes that such a deposit should still be reflected on line 1240 (if interest is provided on the deposit, then line 1240, if not, then 1250), but I have doubts, because this deposit can be understood as a highly liquid short-term financial investment with an insignificant the risk of changes in value (after 12 days the organization will receive exactly the amount that it deposited + interest), and this is already a cash equivalent. Hello. If you look at the Procedure for filling out the Balance Sheet, then: - line 1240 reflects “Financial investments (except for cash equivalents)”, namely: Balance of accounts 58 “Financial investments” in terms of short-term investments (minus the balance of account 59 “Reserves for depreciation of financial investments” relating to short-term financial investments); 73 “Settlements with personnel for other operations” (regarding interest-bearing loans with a repayment period of less than 12 months after the reporting date); — line 1250 reflects “Cash and cash equivalents”, namely: Balance on accounts 50 “Cash” (except for the balance on the sub-account “Cash Documents”); 51 “Current accounts”; 52 “Currency accounts”; 55 “Special accounts in banks” (except for amounts included in financial investments); 57 “Translations on the way.” What do the terms “equivalent” and “cash equivalent” mean? An equivalent (from the Greek “equivalent”) is a separate object, a group of objects or a certain number of them, which are equivalent or correspond to other objects according to any specific characteristics and can express or replace them. Cash equivalents are highly liquid financial investments that can be easily converted into a known amount of cash and are subject to an insignificant risk of changes in value. For example: demand deposits; short-term securities, bills; preferred shares acquired shortly before the announced maturity date, etc. From the above examples it is clear that the goal of the monetary equivalent is not to exaggerate, but to preserve it, therefore interest is out of the question. A similar meaning is contained in PBU 23/2011 “Cash Flow Statement”: “5. The cash flow statement is a summary of cash and highly liquid financial investments that can be easily converted into a known amount of cash and are subject to an insignificant risk of changes in value (hereinafter referred to as cash equivalents). Cash equivalents may include, for example, demand deposits opened with credit institutions.” The inability to withdraw investments at any time contradicts the concept of highly liquidity. For what purpose did you place funds in a time deposit? Receiving interest on a financial investment is profit. Is the final result of such an investment equal (equivalent) to the amount of funds invested? What is “insignificant risk of changes in value”? If you, for example, purchase short-term government securities, then by the time they are sold there is a risk that their value will decrease or increase. Is there such a risk when investing funds at interest on a fixed deposit? On the contrary, you initially know that you will make a profit. That's the whole difference. Therefore, it would be correct to reflect the short-term interest-bearing deposit on line 1240 of the Balance Sheet.

Tasks

The main objectives of any deposit are:

- The deposit must be returned to its depositor. This factor must be confirmed and guaranteed by a document;

- The investor must receive profit in the form of interest.

Acceptance of deposits can only be carried out by those banks that have permission for this type of activity. Only banking institutions can provide a guarantee for the return of deposits and fulfill agreements on time based on preliminary negotiations.

Advice: cooperation with other institutions (non-banking) is dangerous, in this case the investor is not provided with the necessary guarantees. Partnerships with such institutions are not advisable.

Where are financial investments reflected on the balance sheet?

If a taxpayer discovers inaccurate information in the tax return submitted to the tax authority, as well as errors that do not lead to an underestimation of the amount of tax payable, he has the right to make the necessary changes to the tax return and submit an updated tax return to the tax authority in the manner established by Art. 81 of the Tax Code of the Russian Federation (clause 1 of Article 81 of the Tax Code of the Russian Federation).

Therefore, it is logical to adjust the tax base for income tax during the period of early termination of the contract.

According to civil legislation, under a bank deposit agreement, a bank that has accepted a sum of money (deposit) received from a depositor undertakes to return it and pay interest on it under the conditions and in the manner prescribed by the agreement.

Maxim Yuzvak considers the contradictory positions of the Russian Ministry of Finance on the issue of application of the simplified system by non-profit organizations (Letter of the Ministry of Finance dated January 21, 2020 ...

Accounting accounts for deposit investments

Cash or a deposit that is transferred to the account of a banking institution is a financial deposit. When placed, these investments are reflected in accounting records (entries) in their original volume. The financial deposit is equal to the amount of funds that are credited to the deposit account.

Funds placed into savings as investments may be shown on the debit side:

- Account - special bank accounts (number 55);

- Account – deposit accounts (number 55.03);

- Account – financial investments (number 58).

Accounting for deposit

Interest accrues monthly. They are included in other income of the reporting period of the enterprise. They must also be displayed in accounting every month until the expiration of the contract with the banking institution.

In accordance with the section “Income of the organization”:

- In the income account of this institution (debit) under number 76, interest accruals are reflected;

- When creating an accounting entry, credit account number 91 is used.

In the tax system, the amount that is placed in a bank deposit account is not an expense of the organization or income when the funds are returned to the investor.

Read today in paid access

Income related to participation in the authorized capitals of other organizations is reflected in line 080 “Income from participation in other organizations.” In accordance with the bank deposit agreement, the organization transferred funds in the amount of 2,000,000 rubles to a deposit account in the bank on March 17. for a period of 183 days at 7% per annum. According to the terms of the agreement, interest on the deposit amount is calculated monthly on the last day of each month of the agreement, and their payment is made simultaneously with the return of the deposit amount upon expiration of the bank deposit agreement. After the expiration of the period established by the agreement (September 16), the deposit is closed, the funds placed on it and the interest accrued on the deposit are transferred by the bank to the organization’s current account.

For each group of cash flows, determine the inflow and outflow of funds, as well as the result of their movement for the reporting period. If it is not possible to clearly classify a cash flow, classify it as a group of cash flows from current operations. This is established by paragraphs 12 and 13 of PBU 23/2011. Today, two different positions have emerged on the issue of classifying investments in deposits and income from them as investment activities. The insurance supervisory authority proposes, depending on the procedure for registering deposits, to distribute income on them into investment and other.

Displaying the return of deposit resources to the investor

The banking institution must return the funds to the depositor upon expiration of the period for placing deposit resources. In this case, a transaction is created inverse to the crediting of money when opening a deposit account:

- Debit 51 credit 55.03.

Deposit agreements may have different terms and conditions. There are investments for which interest payments are made after the term of the current contract has expired, upon return of the principal amount of money. In this case, the accounting entries will differ from those entries when funds are paid monthly.

Unless the deposit agreement specifies that interest will accrue at the end of the reporting period, there is no assurance at this point that cash and cash equivalents will increase.

The banking institution pays the investor interest on the investment amount in the amount determined in accordance with the bank agreement. The amount of interest cannot be changed in any way.

If the deposit is made in the name of a third party, an important criterion for this agreement will be an indication of the organizational and legal form of the legal entity in whose favor the deposit is made.

In accounting, no matter for what period of time the company enters into a deposit agreement, the reflection of interest deductions on deposits will be the same. That is, according to the terms of the agreement, interest accruals occur at the end of a certain period. In this case, the company has the right to receive profit in the form of interest payments.

In accounting, all transactions related to the deposit are reflected depending on the term and type of deposit.

Important: for enterprises that are subject to a single tax, interest received from the bank on a deposit is included in the single tax base. If an enterprise is a single tax payer, then it must make payments for work performed and services provided exclusively in cash. For legal entities, banking institutions offer three types of deposits: open, closed, safe.

An enterprise can achieve financial stability thanks to the conditions offered by banking institutions. The main thing is to manage your money correctly and wisely.

Reflection of deposit transactions in financial statements

„... Turning to the issue of tax accounting, it should be remembered that the procedure for accounting for income in the form of interest, including under bank deposit agreements, is defined in Article 328 of the Tax Code of the Russian Federation...” In Focus → Banking → Deposits → Reflection of transactions on deposits in financial statements

In the current regulatory documents on deposit accounting there is a contradiction in the procedure for recording and reflecting deposits. According to the Chart of Accounts, accounting for funds invested in bank deposits is carried out in subaccount 55.3 “Deposit accounts”. According to paragraph 3 of PBU 19/02 “Accounting for financial investments”, approved by order of the Ministry of Finance of Russia dated December 10, 2002 No. 126n, deposits are classified as financial investments. Thus, the question arises: in which account should the deposit be accounted for and on which line should it be reflected in the balance sheet?

Current legislation allows an organization to independently choose the accounting method, and it can be enshrined in the accounting policy and disclosed in the explanatory note to the financial statements. Please note that, regardless of the accounting method, the organization must maintain analytical accounting of deposits for each deposit.

We will offer several options for reflecting deposits in accounting accounts.

1. Deposits, regardless of their type, are reflected in a special account 55.3 “Deposit accounts”. At the same time, it is recommended to organize separate accounting by types of deposits - time deposits, demand deposits, certified by a certificate of deposit, etc.

2. Deposits, regardless of their type, are reflected in account 58 “Financial investments”. According to many experts, this reflection of deposits is the most appropriate. In this case, accounting for deposits should be organized in a separate sub-account.

According to paragraph 2 of PBU 19/02, in order to accept assets for accounting as financial investments, it is necessary that the following conditions be simultaneously met:

- the presence of properly executed documents confirming the existence of the organization’s right to financial investments and to receive funds or other assets arising from this right;

- transition to organizing financial risks associated with financial investments (risk of price changes, risk of debtor insolvency, liquidity risk, etc.);

- the ability to bring economic benefits (income) to the organization in the future in the form of interest, dividends or an increase in their value (in the form of the difference between the sale (redemption) price of a financial investment and its purchase value as a result of its exchange, use in repaying the organization’s obligations, an increase in the current market value and so on.).

Funds invested in deposits fully meet the requirements of this provision: 1) the deposit is formalized by a bank account agreement; 2) at the time of opening a deposit, funds are temporarily removed from circulation, since the organization cannot actually manage them. An exception may be called demand deposits; 3) during the period when the organization’s funds are in deposits, it bears risks associated with the activities of a particular bank and the functioning of the market as a whole; 4) the main purpose of opening a deposit is to generate income. The bank is obliged to pay interest on deposits in accordance with the terms of the bank deposit agreement.

3. Mixed accounting depending on the types of deposit. Let's give an example of accounting for deposits in different accounts. Deposits certified by certificates are reflected in account 58 “Financial investments”. Deposits that are not certified by certificates are reflected in a special account 55.3 “Deposit accounts”.

>If demand deposits are included in the “Cash” item, then the movement of funds between the current and deposit accounts is not reflected in the cash flow statement.

When addressing the issue of tax accounting, it should be remembered that the procedure for accounting for income in the form of interest, including received under bank deposit agreements, is defined in Article 328 of the Tax Code of the Russian Federation. In accordance with this article, the taxpayer, on the basis of analytical accounting of non-operating income and expenses, breaks them down in the form of interest on securities, under bank account agreements, bank deposits, etc.

Just as in accounting, there are several options when reflecting deposit transactions in financial statements.

1. Reflection of deposits, regardless of type, as part of the group of indicators “Financial investments”.

2. Reflection of deposits depending on the type: for time deposits, including those certified by certificates, as part of the group of indicators “Financial investments”; for demand deposits – as part of the “Cash” item.

Let's pay attention to the following. If demand deposits are included in the “Cash” item, then the movement of funds between the current and deposit accounts is not reflected in the cash flow statement.

Interest on deposits is reflected in the income statement in the item “Interest receivable” and in the statement of cash flows in the item “Interest received”. At the same time, we note that according to IFRS, deposits are reflected as follows:

- demand deposits – as part of cash;

- time deposits in banks - as part of short-term or long-term financial investments.

In the reporting of insurance organizations, a special item has been introduced as part of other investments to reflect deposits. In form No. 1-insurer this is line 142 “Deposit deposits”, in form No. 5-insurer – line 335 “Deposit deposits”.

In reporting, deposits are reflected depending on the purpose of opening a deposit account. In general, deposits should be reflected on the appropriate line. In the case of a demand deposit, the insurer must determine for itself the main purpose of opening it and, accordingly, reflect it in line 142 “Deposits” or 260 “Cash”.

According to Order No. 67n, the amount on line 335 of form No. 5-insurer must be greater than or equal to the amount on line 142 of form No. 1-insurer. In our opinion, this means that line 260 of form No. 1-insurer can reflect part of the deposits, which, for the purposes of forming form No. 5-insurer, are included in line 335. Thus, in form No. 1-insurer, data on deposits is distributed according to their types, and in form No. 5-insurer they are reflected on one line, regardless of the type.

- >International standards allow interest received to be classified in any way, provided that the classification chosen will be used on an ongoing basis.

Income from deposits in the form of interest is reflected in Form No. 2-Insurer and in Form No. 4-Insurer.

In practice, one of the controversial issues is the classification of interest on deposits.

The problem is that the interest received can be attributed to core activities (as they are related to current activities) and to investment activities (as they are the result of investing funds). In any case, the insurer must proceed from the priority goals of opening a deposit.

International standards allow interest received to be classified in any way, provided that the classification chosen will be used on an ongoing basis.

Thus, interest received on deposits can be reflected in Form No. 2-Insurer on lines 021 and 181 as investment income and (or) on line 211 as other income not related to investments. However, attention should be paid to the requirements of Order No. 113n of the Ministry of Finance of Russia dated December 8, 2003 “On the forms of financial reporting of an insurance organization and reporting submitted in the manner of supervision.” According to paragraph 40 of this order, the item “Income from investments” shows the amount of income in the form of interest received from investments in assets reflected in the balance sheet of the insurance organization under the group of items “Investments”. In accordance with paragraph 44, under the article “Other income, except income related to investments”, interest is reflected on the credit organization’s use of funds held in the organization’s account with this credit organization, as well as the amount of interest on deposit premiums with reinsurers. That is, this article does not include interest on bank deposits, which, as we said above, do not relate to bank accounts. In our opinion, in this case, the insurer has the right to independently decide to reflect interest on deposits, since the list of other income is not closed.

In Form No. 4-Insurer, the receipt of the specified income is reflected:

- on line 070 “Other income” or on free lines 180 and 190 as cash flows from current activities;

- and (or) on line 240 “Interest received” or on free lines 330–340 as cash flows from investment activities.

In this case, for free lines, the name of the line must be entered, for example, “Interest received on deposits,” “Interest received on certificates of deposit.”

If the insurer does not carry out compulsory health insurance operations, then line 460 of column 3 “Cash balance at the end of the reporting period” of form No. 4-insurer should be equal to line 260 of column 4 of form No. 1-insurer. Otherwise, the insurer must provide an explanation of the reasons for the discrepancy in the explanatory note.

In addition, deposits, being an asset accepted to cover insurance reserves and the insurer’s own funds, are reflected in Form No. 7-Insurer and Form No. 14-Insurer.

Section 11 of Form No. 7-Insurer and Form No. 14-Insurer reflects all deposits owned by the insurer, including demand deposits. Line 100 of Section 1 reflects the total amount of deposits, line 101 of Section 1 – the amount of deposits certified by a certificate of deposit. Income from deposits is reflected on similar lines in sections 18.1 and 18.2.

- Income received from deposits not certified by certificates is classified as non-investment income.

According to Order No. 67n, the following relationships are established:

- line 100 of section 1 of form No. 7-insurer must be less than or equal to the sum of lines 142 and 260 of form No. 1-insurer. This means that deposits reflected in investments and cash are accepted to cover insurance reserves and own funds;

- the sum of lines 020, 040, 050, 070, 080, 085, 090, 101, 108 of subsection 18.1 and lines 020, 050, 090 of subsection 18.1.1 must be less than or equal to line 020 of form No. 2-insurer. A similar relationship has been established for types of insurance other than life insurance. This means that only income received from certificates of deposit is recognized as investment income. The supervisor's position is that only certificates of deposit are recognized as securities. Then it is unclear how deposits are classified (without specifying the procedure for their registration) as other investments in Form No. 1-insurer. In this case, it may be recommended to reflect income in accordance with established relationships without correlating them with the indicators of form No. 1 - insurer;

- the sum of lines 105, 106, 110, 111, increased by the difference between lines 100 and 101 of subsection 18.1, must be less than or equal to line 210 of form No. 2-insurer. A similar relationship has been established for types of insurance other than life insurance. This means that income earned on non-certified deposits is classified as non-investment income.

Relationships similar to those given above have been established for form No. 14-insurer.

Thus, the insurer must decide to record deposit transactions depending on the purpose of their opening. In this case, the requirements of Order No. 67n must be taken into account, which establishes strict interconnections, non-compliance with which will lead to a violation of the relationships and the need to reflect the reasons for this in the explanatory note. The reasons indicated by the insurer based on the results of consideration by the insurance supervisory body may be accepted, or may be regarded as a violation of the requirements for reflecting indicators in reporting.

Also in focus:

- Interest paid on deposits That is, even in case of early termination of a bank deposit agreement at the initiative of the depositor, the bank does not have the right to refuse the latter to pay interest, much less collect a penalty from the client, reducing the amount of funds deposited by him

- Deposits The first usually includes deposits - for a long term, the second for a period of 1 - 3 months, and the third - for a period of 3 - 9 months

- The deadline for fulfilling the bank's obligations under a demand deposit. The conclusion about the non-application of this norm can also be made by the wording of paragraph 1 of Article 837 of the Civil Code of the Russian Federation, according to which, under a bank deposit agreement of any type, the bank is obliged to issue the deposit amount or part thereof upon the first request of the depositor, with the exception of deposits made legal entities on other return conditions stipulated by the contract

- Types of deposits According to the right to withdraw funds, deposits are divided into three types: deposits with a minimum non-withdrawable balance, demand deposits and time deposits, all three types have their own disadvantages and advantages

Increasing capital: accounting for ruble deposits and interest on them

1.

What terms of a bank deposit agreement are most important for an accountant. 2. How to reflect the deposit and interest on it in accounting and tax accounting.

3. How to take into account the consequences of early termination of a bank deposit agreement.

Having a financial airbag, that is, a certain reserve of funds, is the “golden” rule of both personal and corporate finance. However, simply keeping the nth amount of money in reserve in your account is extremely unprofitable.

As you know, money should work and bring... money.

That is why competent managers try to place free funds in financial investments. One of the most common types of financial investments is a bank deposit, or deposit. And there are at least two reasons for this. Firstly, opening a deposit does not require special knowledge and skills in the field of investing.

And secondly, a deposit is traditionally considered one of the least risky ways to invest money (all other things being equal). What an accountant should know about the accounting for bank deposits and interest on them, and what “pitfalls” this seemingly simple operation may hide, we’ll look into this article. The main document that serves as the basis for recording a bank deposit and interest on it in accounting is the bank deposit agreement.

Checking the correctness of the contract, as well as the legal nuances and consequences of the transaction, is rather the task of a lawyer. An accountant, as a rule, is only interested in some of the terms of the contract, on which the accounting reflection of the deposit depends. So, what should an accountant pay close attention to:

- Deposit term. A bank deposit can be opened for a certain period or on demand (Clause 1, Article 837 of the Civil Code of the Russian Federation). The period for which the deposit is opened depends on the order in which it is reflected in the financial statements: as part of long-term or short-term financial investments.

- Type of deposit: replenishable or non-replenishable.

Depending

Reflection in the accounting of a deposit in a bank

Login to the site Registration Login for registered users: Close Login via Previously, you logged in via Password recovery Registration Password recovery Forum Forum

Lorayn (asker) 0 points

| ||||||||||||||