Difficulties in determining deferred income (DBP)

To a layman it may seem that determining future income is not difficult. For example, creditor organizations owe certain funds, the repayment deadline is already approaching, logic dictates that the money will come to the account. Does such profit relate to DBP? Or another example: an order has been received for a large batch of goods, which means they paid good money for it, is this DBP?

In fact, both of these examples do not illustrate deferred income in an accounting sense.

Accounting cannot count money that is still in prospect of being received; this contradicts the very meaning of accounting, which operates on already completed, and not at all possible, transactions.

In the first case, the income is only inferred; until the debt is paid, it cannot be entered into any accounting accounts. In the second example, ownership of the goods occurs at the moment of its transfer to the buyer (shipment), so that income will occur only after payment and transfer of ownership. There is no talk about future income. Such and similar situations do not fall under the purview of accounting, but within the sphere of planning.

Deferred income is the receipt of an asset or the reduction of a liability resulting from transactions in the current accounting period, but reflected in the statements of other periods that have not yet occurred.

https://youtu.be/0bZbnKki15w

Upcoming income under the leasing agreement

When, under the terms of a leasing agreement, property is recorded on the lessee’s balance sheet, the difference between the total amount of lease payments and the cost of the leased property in the lessor’s accounting is reflected as follows (clause 4 of Appendix No. 1 to Order No. 15 of the Ministry of Finance dated February 17, 1997):

| Dt 76 “Settlements with various debtors and creditors” - Kt 98 |

When the lease payment is received, deferred income is written off. Namely, the part of the income of these periods attributable to him (clause 6 of Appendix No. 1 to Order of the Ministry of Finance dated February 17, 1997 No. 15):

| Dt 98 - Kt 90 “Sales” |

What objects belong to the DBP

Profit received “in advance” can be attributed to several cases of receipt of income. The main feature by which this type of income can be classified as DBP is that it can, in full accordance with the law, be “stretched” over several accounting periods, that is, this asset will be used to generate profit not only now, but also in the future. .

NOTE! All incoming funds that are recommended by the DBP are specified in regulatory (methodological) documents. An accountant should not expand their list on his own.

Recommendations for DBP are presented in the following regulatory documentation:

- clause 9 of PBU 13/2000 “Accounting for state aid” – on accounting for targeted financing as a DBP;

- clause 29 of the Methodological Guidelines for the Accounting of Fixed Assets speaks of reflecting gratuitously received finances as a loan on the DBP account;

- clause 4 of the Instructions on the reflection of leasing operations in accounting - on the presentation of leasing differences as DBP;

- Chart of accounts for accounting financial and economic activities - about the presence of account 98, specifically designed to reflect DBP;

- Order of the Ministry of Finance of the Russian Federation No. 66n dated July 2, 2010 “On the forms of financial statements of organizations” - on the reflection of financial statements in the balance sheet in the section “Short-term liabilities”.

- Rent. The lease agreement may provide for payment in advance for a certain time. A security deposit, which is paid at the beginning of the lease, but is offset for its last month, can also be recognized as deferred income.

- Advance payments are funds transferred under a contract for goods or services that have not yet been provided to the buyer (in advance) on account of subsequent payments. DBP will be recognized if the advance is made more than 1 accounting period in advance.

- Subscription (prepayment) to periodicals.

- Sale of tickets for various events, performances, performances.

- Revenue from subscriptions and long-term obligations , for example, income from the transportation of passengers who bought a “pass” for a quarter or a year, subscription fees for communication services, etc.

- Sponsorship "gifts". For a long time, gratuitous receipts provided for in the gift agreement were attributed to the period of receipt, and tax was also reflected and paid on this profit. But if we consider this asset as a long-term asset that will “work” for the company for several years, then it can quite legitimately be considered as deferred profit. This also includes grants received.

- Funds from the budget received to cover costs.

- Funds allocated for specific purposes that are not fully used (fund balances in account 86 “Targeted financing”).

- When leasing, the difference between the amount of lease payments and the cost of the property leased (it must be on the balance sheet of the recipient of the property).

- Probable return of previous shortages . If a loss has been incurred, it can be irrecoverable (when the guilty party has not been identified) or it can be attributed to accounts receivable (when the amount is planned to be collected from the financially responsible person). In the second case, payment of such a shortfall may also be considered DBP.

- Leasing difference. If the company is a lessor, then the difference between the value of the property leased and the total amount of lease payments is also recognized as DBP. In this case, it does not matter that the property is already on the balance sheet of the lessee.

FOR YOUR INFORMATION! If fixed assets are received as a gift in this way, then depreciation in future periods will not be charged for them (otherwise it would level out the “profit” from deferring profits for the future), but the transfer of part of the DBP to current expenses is recorded. Thus, the cost will not include depreciation, which in this case will act as a transfer of expenses incurred earlier.

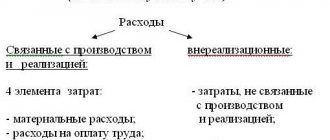

Liability balance

Authorized capital

- this is the amount of funds initially invested by the owners to ensure the statutory activities of the organization; The authorized capital determines the minimum amount of property of a legal entity that guarantees the interests of its creditors

Extra capital

— a liability item on the balance sheet, consisting of the following elements:

- share premium

- the difference between the sale and par value of the company's shares; - exchange rate differences

- differences when paying for a share of the authorized capital in foreign currency; - the difference when revaluing fixed assets

is the difference when the value of fixed assets changes.

Reserve capital

- the size of the enterprise’s property, which is intended to place undistributed profits in it, to cover losses, repay bonds and repurchase shares of the enterprise, as well as for other purposes.

Accounts payable

- the debt of a subject (enterprise, organization, individual) to other persons, which this subject is obliged to repay.

Reserves for future expenses

In order to evenly include upcoming expenses in production or distribution costs, the organization can create reserves for: upcoming payment of vacations to employees; payment of annual remuneration for long service; payment of remuneration based on the results of work for the year; repair of fixed assets; production costs for preparatory work due to the seasonal nature of production; upcoming costs for land reclamation and other environmental measures; upcoming costs of repairing items intended for rental under a rental agreement; warranty repairs and warranty service; covering other anticipated costs and other purposes provided for by the legislation of the Russian Federation, regulations of the Ministry of Finance of the Russian Federation.

Contractor is a legal entity or individual (including an individual entrepreneur), who, by virtue of a concluded contract, undertakes to perform certain work and deliver it to the customer, and the customer undertakes to accept the work performed and pay for it within the time period stipulated by the contract. Under a contract concluded for the manufacture of a thing, the contractor transfers the rights to it to the customer.

The relationship between the buyer and the supplier is formalized by a purchase and sale agreement, and the relationship between the customer and the contractor is formalized by a contract.

Accounting for settlements with suppliers and contractors is carried out in accordance with the Federal Law “On Accounting” No. 129-FZ. The methodological basis for organizing the accounting of settlements with suppliers establishes the rules for documenting the receipt, storage, release of goods and the reflection of commodity transactions in accounting and reporting, and is an element of the system of regulatory regulation of accounting of inventory items.

The following calculations are taken into account on this account:

1. For received inventory items, accepted work performed and services consumed, including the provision of electricity, gas, water, etc., as well as for the delivery or processing of material assets, payment documents for which have been accepted and are subject to payment through the bank.

2. For inventory items, works and services for which payment documents have not been received from suppliers or contractors, i.e. so-called uninvoiced deliveries.

3. For surplus inventory items identified during their acceptance - when the actual quantity of incoming items exceeds the amount indicated in the suppliers’ payment documents.

Thus, the subject of the contract is the received inventory, accepted work performed and services consumed, including the provision of electricity, gas, water, etc.

Settlements with suppliers and contractors are made both in non-cash form and in cash through the Company's cash desk.

The main document for settlement relationships with suppliers is an invoice, which serves as the basis for issuing relevant bank payment documents for the transfer of debt: payment requests, letters of credit, payment orders, settlement checks.

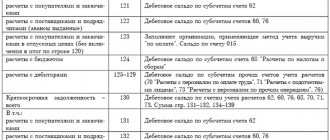

Accounting for settlements with suppliers and contractors is preliminarily kept in the register of settlements with suppliers, in which all entries are made on the basis of supplier invoices, receipt documents and bank payment documents.

In the journal-order form of accounting, expenses with suppliers are recorded in journal-order No. 6. In this journal-order, synthetic accounting of settlements with suppliers is combined with analytical accounting. Analytical accounting of settlements with suppliers during settlements and the procedure for scheduled payments is carried out in statement No. 5, the data of which at the end of the month is included with the general results for corresponding accounts in journal order No. 6.

Analytical accounting for account 60 is maintained for each submitted invoice, and settlements in the order of scheduled payments are maintained for each supplier and contractor.

The construction of analytical accounting should ensure the receipt of data on debts to suppliers: for payment documents for which the payment period has not yet arrived; for settlement documents not paid on time; for uninvoiced deliveries; advances issued; on bills issued, the payment period of which has not yet arrived; on overdue bills; for a commercial loan received, etc.

Accounting for settlements with suppliers and contractors within a group of interrelated organizations, about the activities of which financial statements are prepared, is kept separately on account 60.

List of used literature

1. Civil Code of the Russian Federation

2. Tax Code of the Russian Federation

3. Federal Law “On Accounting” dated November 21, 1996 No. 129 - F3.

4. Agafonova M.N. Accounting in retail trade: samples of filling out documents: a practical guide / GrossMedia, 2008, ROSBUKH, 2008

5. Alekseeva G.I., Alaverdova T.P., Bogomolets S.R.: Accounting / ed. S.R. Bogomolets: textbook.

M.: Market DS, 2006. - 752 p.

6. Babaev Yu.A. Financial accounting: Textbook for universities - M.: University textbook, 2006. - 525 p.

7. Bochkareva I.I. Accounting: Textbook. Ed. I'M IN. Sokolova. — 2nd ed., revised. and additional - M.: TK VELBY, ed. Prospect, 2007. - 776 p.

8. Zakharyin V.R. Accounting Theory: Textbook. - M.: INFRA-M: FORUM, 2003. - 304 p.

9. Kondrakov N.P. Accounting: Textbook. allowance. — 5th ed., revised. and additional - M.: INFRA-M, 2007. - 717 p.

Why allocate DBP

The matching principle that guides accounting states that income must be consistent with the expenses that generated the income. Sometimes a business receives assets, that is, income that is not specifically related to the current accounting period, because the expense is spread over a longer time. Theoretically, the funds could have been received over a long period, but they all arrived at once. In such situations, accountants prefer to report profit in an amount not exceeding the income of the current period, and transfer funds received that are not related to it to the DBP subaccounts.

Why do this, because you can immediately write down the entire asset received as profit? Yes, it is possible, but we should not forget that the amount of profit is directly proportional to the tax base. And if there is a legal opportunity to reduce it this year, why increase it by income that will only be used in the future?

EXAMPLE. The organization rents out real estate. She was paid rent for three years at once. The asset is there. If you record all of it in this year’s income, the amount of the income tax base will be increased. If you take into account only the payment for the current year as profit, then the remaining funds must be taken into account as DBP, reflecting them in the balance sheet of profit in the next two years, thus proportionally distributing the tax base.

Balance sheet asset

Intangible assets

- a non-monetary asset that has no physical form.

Fixed Assets (Fixed Assets)

(or

Fixed Production Assets

(FPF)) - fixed assets of an organization reflected in accounting or tax accounting in monetary terms.

"Construction in progress"

is the amount of unfinished capital investments.

Profitable investments in material assets

- investments of an organization in part of the property, buildings, premises, equipment and other valuables that have a tangible form, provided by the organization for a fee for temporary use (temporary possession and use) in order to generate income

Long-term financial investments

- investment of free funds of the enterprise, the maturity of which exceeds one year: - funds allocated to the authorized capital of other enterprises; — funds used to purchase securities of other enterprises; — long-term loans issued to other enterprises; and so on.

Deferred tax assets

represent a part of deferred income tax, the purpose of which is to reduce the amount of tax that must be paid to the budget in the reporting period.

Fixed assets

— assets with a useful life of more than one year: long-term financial investments, intangible assets, fixed assets, other long-term assets.

Material and production

Inventories are assets used as raw materials, materials, etc. in the production of products intended for sale (performing work, providing services), purchased directly for resale, and also used for the management needs of the organization.

Value added tax on purchased assets

- an account intended to summarize information about the amounts of value added tax paid (due to payment) by the enterprise on acquired assets.

Short-term financial investments

- short-term (for a period of no more than one year) financial investments of an enterprise in income-generating assets (shares, bonds and other securities) of other enterprises, associations and organizations, funds in time deposit accounts of banks, interest-bearing bonds of state and local loans, etc. - are the most easily realizable assets.

Where are deferred income reflected?

Special account 98, which is called “Deferred Income,” is designed to reflect all types of deferred profits. The instructions for the Chart of Accounts allow you to open a number of sub-accounts for this account, specified by DBP objects:

- “income that will be received in future accounting periods”;

- “gratuitous receipts” – gifts, sponsorship, etc.;

- “future receipts for past shortfalls identified in earlier periods”;

- “the difference between the cost of recovery according to the balance sheet and the amount payable by the guilty party”, etc.

In the balance sheet, a special line 1530 is intended to account for this type of profit.

ATTENTION! It can reflect only those incomes that are recognized by the DBP in the regulatory documents of this organization.

Active or passive?

Are deferred receipts an asset or a liability when reflected on the balance sheet? Line 1530 reflects the item “DBP” as a balance sheet liability, despite the fact that it takes into account income.

The reason is that this line has a direct connection with another line, also related to the liability “Retained earnings (uncovered loss)”. It records the profit that the organization “owes” to its owners. But in practice, there are often situations when the debt to the owners has not yet arisen, but the money has already arrived on the balance sheet. For example, money was received as funding from the budget. They should be classified as “cash” assets. How to balance a liability? These are not retained earnings, because the organization has not yet done anything of what they were intended for, which means they have not yet become a profit. The profit from them is only in the future, so it is appropriate to include them in the liability line “Future income”. As this money is spent, that is, expenses are recognized, the amounts from the DBP liability will be transferred in parts to the Retained Earnings liability.

We carry out accounting

To reflect the DBP, the credit of account 98 “Deferred Income” and correspondent accounts are intended for accounting for finances and settlements with counterparties.

To write off amounts of income from future periods when this very “future” occurs, the debit of this account (98) is used, as well as the correspondence of the account in which the income was recorded (90 or 91, this determines the type of receipt).

Subaccounts that define a specific DBP object also provide for the corresponding correspondence:

- “Gratuitous receipts” – 08 “Investments in non-current assets”, 86 “Targeted financing” (loan 91 “Other income and expenses”);

- “Forthcoming receipts of debt for shortfalls for past periods” - 94 “Shortfalls from loss and damage to valuables”, 73 “Settlements with personnel for other operations”, subaccount “Reimbursement of material damage” (credit 91 “Other expenses”);

- “The difference in the amount of recovery from the perpetrator and the book value” - 73 “Settlements with personnel for other operations” (credit 91 “Other expenses”).

Inventory asset or liability

We also emphasize that the term “intangible asset” in the understanding of the norms of paragraph 4 of P(S)BU 8 means a non-monetary asset that does not have a tangible form and can be identified. In addition, an intangible asset is included in the balance sheet if it is probable that future economic benefits associated with its use will be available and its value can be measured reliably.

At the same time, it should be noted that, in accordance with the norms of paragraph 9 of P(S)BU 8, expenses for creating one’s own brands are not recognized as intangible assets, but are reflected as part of sales expenses, since the purpose of creating one’s own brand is the successful promotion of goods and services on the market.

Thus, if all criteria for the recognition of intangible assets are met, the costs of creating the object of the right to a trademark in accounting can be included in the initial cost of intangible assets, and not attributed to the expenses of the period. In this case, the initial cost of trademark rights may include:

• the amount of fees paid upon registration; • the amount of state duty upon receipt of the certificate; • cost of patent attorney services; • cost of services of various specialists (payment to an advertising agency for development, designer services, etc.).

However, it should be noted that the norms of paragraphs 63, 64 of IAS 38 “Intangible assets” do not allow the recognition of trademarks created by the enterprise itself as intangible assets, since the costs of their creation cannot be distinguished from the costs of developing the business as a whole.

Please note that if an enterprise acquires rights to a trademark under an agreement on the transfer of exclusive property rights, then, based on the norms of paragraphs 4, 5 of P(S)BU 8, the enterprise forms the initial cost of intangible assets in subaccount 154 “Acquisition (creation) of intangible assets” and after the trademark is put into operation, it is reflected in subaccount 123 “Rights to commercial designations.”

The amount of depreciation is taken into account as part of sales expenses.

This is interesting: Certificate of acceptance of transfer of a trademark sample

If an enterprise uses a trademark (for example, on the basis of a license agreement), then in this case it pays royalties, which, according to the norms of paragraph 7 of P(C)BU 16 “Expenses”, are recognized as expenses of the period simultaneously with the recognition of the income for which they were incurred. Expenses that cannot be directly associated with income of a certain period are reflected as expenses of the reporting period in which they were incurred.

That is, if royalty amounts depend on sales or production volumes, the royalty amount is included in the production cost of the product. When these products are sold, income from the sale and, accordingly, expenses (including the amount of royalties) incurred to generate income are recognized. Royalties for the use of the corresponding rights used for administrative needs are reflected as part of administrative expenses, for sales expenses - as part of sales expenses.

Elena Ivanova, certified auditor, Accountant 911

Let's understand the assets and liabilities of the enterprise

In accounting, there are special concepts “assets” and “liabilities”. Both are an important component of the balance sheet and represent the most convenient way to summarize information about the activities and financial position of an organization.

Everything that an enterprise has is divided into assets that generate profit and liabilities that participate in the formation of the former. It is important to learn to distinguish between them, to understand what this or that enterprise object is.

Asset and liability balance

The concepts under consideration are the main components of the balance sheet - the main report, which is drawn up in the accounting process at the enterprise. The balance sheet is depicted in the form of a table in which assets are located on the left side and liabilities on the right. The sum of all positions on the left side is equal to the sum of all positions on the right side. That is, the left side of the balance is always equal to its right side.

Equality of assets and liabilities on the balance sheet is an important rule that must be followed at any time.

If equality is not met when drawing up the balance sheet, it means that there is an error in the accounting that needs to be found.

In order to correctly draw up a balance sheet, you need to understand what belongs to assets and what to liabilities.

Next, let's look at these concepts in more detail. How are they interconnected and how do they differ from each other? Why is an asset equal to a liability? How to understand what a particular property or liability is?

Assets as an element of accounting

These are the resources of an organization that it uses in the process of economic activity, the use of which in the future implies profit.

Assets always display the value of all tangible, intangible and monetary assets of the company, as well as property powers, their content, placement and investment.

Examples of business assets:

- Fixed assets;

- Securities;

- Raw materials, materials, semi-finished products;

- Goods;

- Finished products.

All this is property that the enterprise will use in the course of its operation in order to generate economic profit.

Asset classification

According to the form of the functional composition, they are divided into material, intangible and financial.

- Material refers to objects that are in material form (they can be touched and felt). These include company buildings and structures, technical equipment and materials.

- By intangible we usually mean that part of the production of an enterprise that does not have a material embodiment. This can be a trademark or a patent, which also take part in the organization’s office work.

- Financial - refers to various financial instruments of the company, be it cash accounts in any currency, accounts receivable or other economic investments with different terms.

According to the nature of participation in the production activities of the enterprise, assets are divided into current (current) and non-current.

- Current assets are used to carry out the company’s operational processes and are completely consumed in one full production cycle (no more than 1 year)

- Non-negotiable -

they take part in office work repeatedly, and are used exactly until the moment when all resources are transferred into the form of products.

According to the type of capital used, assets are:

- Gross, that is, formed on the basis of own and borrowed capital.

- Net, which implies the formation of assets only from the company’s own capital.

According to the right of ownership of assets, they are divided into leased and owned.

They are also classified by liquidity, that is, the speed of their transformation into a financial equivalent. In accordance with such a system, the following resources are distinguished:

- Assets with absolute liquidity;

- With high liquidity;

- Medium liquid;

- Low liquidity;

- Illiquid;

Long-term assets include land plots, various types of transport, technical equipment, household and industrial equipment, and other company supplies. Assets of this type are reflected at their cost of acquisition less accrued depreciation, or, in the case of land and buildings, at a price determined by a professional expert.

Liabilities of the enterprise and their participation in production activities

The liabilities of an enterprise mean the obligations that the company has undertaken and its sources of financing (including its own and borrowed capital, as well as funds attracted to the organization for some reason).

The equity capital of an enterprise with any form of ownership, except for state ownership, contains in its structure the authorized capital, shares, shares in various business companies and partnerships, proceeds from the sale of company shares (primary and additional), accumulated reserves, public finances in the organization.

For state-owned enterprises, the structure includes public financial resources and deferred deductions from revenues.

The structure of funds borrowed consists of capital for which this or that property is pledged, regardless of whether the mortgage is issued or not, loans received from banking institutions, bills of various types.

This is interesting: List of well-known trademarks in the Russian Federation

Summarize.

What refers to the assets of the enterprise:

- Fixed and production assets;

- Movable and immovable property;

- Cash;

- Inventory assets;

- Securities;

- Accounts receivable

What refers to the company's liabilities:

- Authorized capital;

- Credits and borrowings from other individuals and legal entities;

- Retained earnings;

- Reserves;

- Taxes;

- Accounts payable.

Difference between liability and asset

The difference is their different functions; Each of these elements of the balance sheet illuminates its own aspect of office work. However, they are closely interrelated.

When an asset increases, the liability necessarily increases by the same amount, that is, the debt obligation of the enterprise increases. The same principle also applies to liabilities.

For example, if a new loan agreement is concluded with a bank, assets automatically increase, as new finances are received by the organization, and at the same time the enterprise has a liability - debt to the bank. At the moment when the organization repays this loan, there will be a decrease in assets, since the amount of funds in the enterprise’s account will decrease, and at the same time, liabilities will also decrease, since the debt to the bank will disappear.

It is from this principle that the equality of liabilities and assets of an enterprise follows. Any change in the former entails a change in the latter by the same amount and vice versa.

Accounting and auditing terms - Audit-it.ru

Deferred expenses (FPR) are expenses incurred by the organization in the previous and/or reporting periods, but subject to inclusion in the cost of products (works, services) in subsequent periods of the organization's activities.

Without them, it is impossible to generate income in the future. At the same time, we note that deferred expenses exist only in accounting.

How to recognize deferred expenses

The task when accounting for deferred expenses is to differentiate the costs incurred by the organization into expenses and assets, and then identify a separate independent object - deferred expenses.

The determining factors for recognition of an asset are its control by the organization and the possibility of obtaining economic benefits from it, that is, an influx of cash. An asset will bring economic benefits when it can be:

- used separately or in combination with another asset in the process of production of products, works, services intended for sale;

- exchanged for another asset;

- used to pay off an obligation;

- distributed among the owners of the organization.

This definition allows you to attribute certain costs to deferred expenses as an asset.

And the accountant should formulate criteria for such attribution (by type of cost, taking into account the specifics of the industry) and consolidate them in the accounting policy.

What costs are classified as deferred expenses?

Costs incurred by the organization in the reporting period, but relating to the following reporting periods, are reflected in the balance sheet in accordance with the conditions for recognition of assets established by regulatory legal acts on accounting, and are subject to write-off in the manner established for writing off the value of assets of this type.

Accounting regulations provide for only two types of costs that should be recognized as deferred expenses:

- costs incurred in connection with upcoming construction work. For example, materials transferred to the construction site;

- licensed software (software).

In addition, an organization may recognize deferred expenses in other cases.

This is usually done if none of the Accounting Regulations says how to account for a certain type of expense, but, in the accountant's opinion, these costs should be written off as expenses gradually over several years.

Traditionally, in accounting, costs are taken into account as deferred expenses, which in tax accounting are written off as expenses gradually. These are, for example, costs for product certification and costs for voluntary health insurance (VHI).

What costs should not be reflected as deferred expenses?

Advances issued, incl. subscription costs.

It is not necessary to take into account both deferred expenses and expenses for payment of vacation pay, incl. if a reserve was created for vacation pay, but its amount turned out to be insufficient.

In this case - just as in a situation where the reserve was not created at all - vacation pay is accrued as a debit to cost accounts (20 “Main production”, 25 “General production expenses”, 26 “General expenses”, etc.).

Accounting for deferred expenses

Accounting for deferred expenses is kept in account 97 “Deferred expenses”.

The debit of account 97 reflects the costs incurred (for example, to obtain a certificate), and the credit shows the gradual write-off of these costs as expenses (for example, during the validity period of the certificate).

The entries for accounting and writing off expenses of future periods will be as follows:

| Wiring | Operation |

| D 97 - K 51(60) | Costs are accounted for as deferred expenses |

| D 20 (26, 44, 91) - K 97 | Expenses include the share of future expenses related to the current period |

Tax accounting of deferred expenses

The Tax Code of the Russian Federation establishes that expenses are recognized in the reporting (tax) period in which these expenses arise based on the terms of transactions.

In other words, in order to determine the period for writing off expenses in tax accounting, the taxpayer must be guided by the terms of the documents used to document the transaction.

If it follows from the documents that expenses relate to several reporting periods, then the taxpayer must take them into account when taxing profits throughout this entire period.

For example, the amount of a one-time payment for the right to use a trademark is included in taxable expenses in equal payments during the term of the license agreement.

If it is impossible to determine from the available documents the period to which the expenses relate, then the organization must determine this period independently.

Reflection of deferred expenses in the balance sheet

The balance sheet reflects deferred expenses:

- or as a separate article in the group of articles “Inventories”;

- or as a separate group of articles in the “Current assets” section.

At the same time, the balance sheet indicates the debit balance of this account (balances of expenses that have not been written off as of the end of the reporting period).

Inventory of deferred expenses

Inventory of deferred expenses is a reconciliation of turnover and balances on account 97 with data from primary documents (accounting certificates for writing off deferred expenses).

This is done in order to ensure that future expenses are written off in a timely and correct manner.

The result of the inventory is documented in an act in form N INV-11.

An inventory of deferred expenses is carried out as part of the annual inventory.

Deferred expenses (FPR): details for an accountant

- Income and expenses of deferred periods: procedure for recognition and accounting ... and expenses of deferred periods. Instruction No. 157n prescribes taking into account the following as income and expenses of future periods..., which are not income (expenses) of future periods. Budget accounting. Accounting for income and expenses of future periods is carried out according to ... 50 262 Deferred expenses for benefits for social assistance to the population Deferred expenses reflected according to ... advances are not income (expenses) of future periods; 3) income and expenses of future periods are recorded in the accounts...

- Deferred expenses - examples according to the accounting rules of 2020... period and “excess profit” in the next one. Deferred expenses (FPR) are the costs of production.... What costs are classified as deferred expenses? According to the accounting regulations... expenses can be included in deferred expenses, and after the launch of serial... OKUD 0504833). How is the inventory of future expenses carried out? The inventory of the BPO is carried out within the framework of... 2020. (10 months) Proper accounting of future expenses allows you to: Effectively distribute costs across...

- Simplified tax system “income minus expenses”: modernization of an intangible asset in the form of software previously created on its own ... account 97 “Deferred expenses” is intended. The list of deferred expenses is open, that is ... the organization has the right to reflect any ... as deferred expenses, or on account 97 “Deferred expenses” with subsequent straight-line write-off ...

- Purchasing software under a sublicense agreement: how to take into account ... in the accounting of the user (licensee) as deferred expenses and are subject to write-off within ... 14/2007). The specific procedure for writing off deferred expenses is not determined by the Chart of Accounts... Credit 60 (76) - deferred expenses reflect the costs associated with the acquisition...: In accounting account 97 “Deferred expenses” the organization takes into account acquired non-exclusive...

- Review of changes in accounting (budget) statements ... assets; deferred expenses – the account balance 0 401 50 000 “Deferred expenses” is reflected. Previously... it was indicated above, the amounts of income (expenses) of future periods, as well as reserves, previously included ... “Transactions with liabilities” Section “Income” Expenses of deferred periods (account 0 401 50 000 ...

- Payment for vacation at the expense of the created reserve ... ;401 50,000 “Future expenses” (see letters No. 02 ... x 450 rub.) - for future expenses. In the accounting of a budgetary institution ... period, but related to expenses of future periods 2,401 50 ... Insurance premiums related to expenses of future periods have been accrued (3,154,500&# ... Inclusion of deferred expenses in current expenses Expenses for payment of vacation pay 2 ... 401 50,000 “Future expenses.” 3. The procedure for creating a reserve...

- Changes in the financial statements for 2020 ... (non-current) assets. The section includes deferred expenses. Let us present the considered changes in the form..., performance of work, provision of services 150 Deferred expenses 160 Total for section 1... includes data on income and expenses of future periods, as well as on reserves for future periods... (account 0 401 40 000); deferred expenses (account 0 401 50 000 ...

- Violations identified by the Federal Treasury as a result of inspections ... are reflected in the debit of the account as deferred expenses and are subject to attribution to the financial ... to which they relate. Accounting for deferred expenses is carried out in the context of types of expenses ... periods that were not taken into account in the “Deferred Expenses” account (clause 8.3 of Letter No. ... for the purchase of an MTPL policy for deferred expenses 1,401 50,226 ... 26,730 9,200 Deferred expenses are allocated to expenses of the current period. Operation ... the policy was used for 4 months. Expenses of future periods will be reduced by 3,066 ...

- Application of the GHS “Rent” in an educational institution ... 0 401 40 121 Deferred expenses (lost profits) when providing property were recognized ... Previously accrued income and deferred expenses from the provision of the right to free use were adjusted ...

- The procedure for accounting for expenses for setting up an accounting program…. In particular, expenses are classified as deferred expenses only on the condition that such ... in the accounting records of the user (licensee) as deferred expenses and are subject to write-off within ... accounts is account 97 “Deferred Expenses”. However, in paragraph 39 ... refer, therefore they cannot be recognized as deferred expenses. Costs for setting up computer programs...

- Annual forms of financial statements have been updated...account 0 401 50,000 “Deferred expenses” 190 Amount of lines 030, 060...periods”; – 0 401 50 000 “Future expenses”; – 0 401 60 000 “Reserves ... to the account 0 401 50 000 “Deferred expenses” accumulated during the reporting period. Index …

- Violations in the field of accounting (budget) accounting ... are reflected in the debit of the account as deferred expenses and are subject to attribution to the financial ... to which they relate. Accounting for deferred expenses is carried out by type of expense... in account 401 0 “Future expenses”. Such expenses were included by the institution in ... expenses under the subscription agreement for deferred expenses 1 01 0 ... ;30 12 00 Deferred expenses were allocated to expenses of the current period. Operation …

- Accounting for the costs of creating and maintaining the AU website ... for current expenses or for deferred expenses (depending on whether ... the procedure for assigning such expenses to deferred expenses, then in accordance with ... 0 401 50 226 “Deferred expenses for other periods expenses, services" ... development accounted for as deferred expenses are subject to write-off in equal shares ... rights to the software as deferred expenses. During the period of use ... - 50,000 The assignment of deferred expenses to general business expenses is reflected (monthly in ...

- Checking the accounting of intangible assets ... are reflected as deferred expenses in the debit of account 0 401 50 000 “Deferred expenses”. Data ... in the accounting (budget) accounting of deferred expenses is regulated within the framework of the accounting policy ... the policy of the federal government institution, deferred expenses are recognized as expenses of the current financial ... .00 The monthly assignment of deferred expenses to the financial result of the current ... is reflected as deferred expenses in the debit of account 0 401 50 000 “Future expenses”. [1 …

- How to account for the costs of software products? ... the composition of the expenses of the current financial year (deferred expenses) in the manner established by the institution in ... previously and taken into account as part of the expenses of future periods, for the financial result of the current ..., the database must be entered into the composition of deferred expenses by the institution in the accounting ... Debit Credit Amount, rub. Deferred expenses are reflected in the amount of the acquired non-exclusive right... 15,000 The monthly attribution of deferred expenses to the financial result of the current period is reflected...

Source: https://www.audit-it.ru/terms/accounting/raskhody_budushchikh_periodov_rbp.html