A taxpayer who in the past 2020 used paid medical services, paid for expensive treatment, or, alternatively, purchased prescription drugs from the approved list with his own funds, is entitled to receive a refund of 13% of the corresponding costs.

We are talking about providing a social deduction for personal income tax to a citizen who has paid for any medical services.

In order to legally return the paid income tax, an individual will need to correctly draw up a 3-NDFL report, attach the necessary papers to it, and then send all this documentation as a single set to the local office of the fiscal department (FTS).

Under what circumstances can a personal income tax deduction be issued for an individual’s medical expenses? How is the 3-NDFL declaration formed in this case? When should it be provided to the relevant Federal Tax Service authorities? All these issues require more detailed consideration.

Features of receiving a deduction for treatment

You can get a full refund of the amount spent on treatment only if it is classified as expensive. The list of such types of medical services is indicated in the text of Decree of the Government of the Russian Federation No. 201 of March 19, 2001.

If the treatment is not expensive, expenses accepted for deduction are limited to the amount of 120,000 rubles. You should know that this amount is taken into account along with other expenses incurred during this period - for training, payment of funds for the funded part of the pension, voluntary pension insurance and non-state pension provision.

You can get an income tax refund for your treatment, as well as for your husband (wife), children, and parents. You can use this right within three years from the date of incurring expenses for medicines and treatment.

How to submit 3-NDFL for a tax refund for treatment

Example No. 2. For 2020, Z. F. Petrogradov received income in the amount of 560 thousand rubles, having paid personal income tax in the amount of 72,800 rubles. That same year, he was undergoing hospital treatment, for which he paid 58,000 rubles. Having submitted the declaration, Petrogradov Z.F. will return 7,540 rubles (58,000 x 13%).

If a deduction is issued for the treatment of relatives, documentary evidence of family ties is required (marriage certificate, birth certificate, etc.). The contract for the provision of medical services must be issued to the taxpayer, and not to the client for whom the treatment was paid.

What documents are required to fill out the declaration?

Let's consider an example of drawing up a declaration to receive a deduction for dental treatment as payment for low-cost medical services. You can download the program for preparing the 3-NDFL declaration on the website of the Federal Tax Service of the Russian Federation. It should be borne in mind that a separate program is filled out for each period, i.e. To receive a deduction for 2020, you need to install the “Declaration 2018” program, for 2020 – “Declaration 2017”, etc.

To fill out a declaration for treatment, you will need the following documents:

- Copy of the passport;

- Copy of TIN certificate;

- Certificate of income for the reporting period (2-NDFL).

This will be enough to complete the program. The remaining documents are attached to the finished declaration and are provided for verification by the tax office. This:

- Application for deduction;

- Payment documents on treatment expenses (copies of receipts);

- License of a medical institution (in this example, from a dental clinic);

- Certificate in the form of the Ministry of Health regarding payment for dental treatment;

- Agreement with a dental clinic for the provision of services with all attachments, additional. agreements (copies).

If you plan to return income tax for the treatment of a relative, then photocopies of the following documents are attached to the main package:

- Birth certificates of minor children;

- Evidence of your birth (if expenses were incurred for the treatment of the parent);

- Document on marriage (if the spouse’s treatment was paid for).

So, you need to get an income tax refund for dental expenses that were incurred in 2020. The necessary documents have been collected, all that remains is to enter the data into the downloaded program and fill out the declaration.

New declaration form 2019

To successfully process a refund of funds paid through the Federal Tax Service, you must fill out exactly the 3-NDFL form that is current.

Please note that this declaration form is frequently updated.

The current template used by individuals to fill out in the current year 2020 for reporting in 2020 has changed and is regulated by order of the fiscal department No. ММВ-7-11/ [email protected] , registered on 10/03/2018.

about the new 3-NDFL declaration form here.

Download the new 3-NDFL form for registration in 2020 - excel.

How to fill out the personal income tax return (13 percent) correctly?

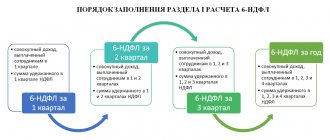

In order to partially compensate an individual’s expenses for treatment using the personal income tax deduction, it is necessary to fill out and provide the following pages of 3-personal income tax:

- title page (introductory part, on page 1);

- first section of the form (resulting data, on page 2);

- second section of the form (tax base/amount, on page 3);

- first appendix (for domestic sources of income of an individual, on page 4);

- second appendix (for foreign sources of income of an individual, on page 5);

- fifth appendix (for calculating the social deduction, on page 8).

The recommended procedure for entering the necessary information into 3-NDFL is as follows:

- Stage I: the income of an individual is recorded (first application).

- Stage II: tax deduction is calculated (fifth appendix).

- Stage III: the tax base and the amount of income tax are calculated (second section).

- Stage IV: the amount of tax refund is specified (first section).

- Stage V: general information is entered (introductory part).

How to create the First Application?

This application contains information about the domestic sources of income (income, earnings) of the applicant’s individual in the reporting year 2020. These can be either the citizen’s employers or other sources.

The following lines are filled in for each employer source:

- 010 – the tax rate is entered (the value is 13 percent in this case);

- 020 – the corresponding type of income received is coded (value 07 – for an individual’s salary);

- 030-050 – these fields contain specific values of TIN, KPP and OKTMO for the corresponding employer (source);

- 060 – the exact name of the source of income is written here (individual/legal entity);

- 070 – shows the amount of income received by an individual from this source (employer);

- 080 – shows income tax withheld from income received in field 070, at the rate specified in field 010.

An example of filling out the first application of the declaration:

How to apply for the Fifth Appendix?

Here the amount of social tax deduction for paid expenses of an individual taxpayer for medical services is directly calculated.

These may be monetary costs associated with the purchase of medications, medical operations and medical procedures, and the use of other medical services.

The first subparagraph of this appendix cannot be completed in this situation, since it is used to compensate for personal income tax through standard deductions.

The second subparagraph of this appendix in the declaration is filled out by the individual applicant solely for monetary expenses for expensive treatment (the list of such services is regulated by a special government decree, and in field 110 of this appendix the amount of the corresponding expenses is indicated).

The third subparagraph of this appendix in 3-NDFL must be completed for other types of paid medical care.

It should be noted that in this part of the application, not all proposed fields must be filled out, but only those that are related to treatment and the purchase of medications. These could be the following lines:

- 140 – the amount of the tax deduction is reflected in the amount of the individual’s actual expenses for treatment for a specific reporting year (cannot exceed the actual amount of expenses incurred, taking into account the regulated restrictions - 120,000 rubles for one’s own treatment and 50,000 rubles for the medical care of a relative);

- 180 – the amount of social deduction to be used is prescribed (cannot exceed the amount of regulated restrictions);

- 181 – fill in the amount of personal income tax deduction that has already been used by an individual during the reporting year by notifying the Federal Tax Service through the employer;

- 190 – the final deduction value is determined here (the value of the 181-field is subtracted from the sum of the values of the 110-field and 180-field);

- 200 – the value of the 190 field is transferred here if an individual is not expected to receive standard deductions.

Sample of filling out the fifth Appendix 3-NDFL for treatment:

Example of the design of the Second Section

Guided by the information in the tax return appendices described above, the individual applicant fills out the following fields in this section of 3-NDFL:

- 001 – 13% (thirteen percent) is registered;

- 002 – value 3 is entered;

- the income value from field 070 of the first application is transferred to field 010 and field 030;

- 040 – the social deduction amount transferred from the 200 field of the fifth application is filled in;

- 060 – the tax base is calculated (the value of field 040 is subtracted from the value of field 030);

- 070 – the amount of income tax to be paid is determined (the value of field 060 is multiplied by the value of field 001);

- 080 – the amount of transferred and withheld tax is indicated (the value from field 080 of the first application is transferred);

- 160 – the amount of income tax to be refunded from the budget is calculated (the value of field 080 is subtracted from the value of field 070).

An example of filling out the second section of 3-NDFL:

First section

In this part, the individual indicates the following data:

- 010 – symbol 2 is written here (corresponds to tax refund);

- 020 – BCF value (corresponding);

- 030 – OKTMO value (corresponding);

- 050 – income tax refundable is indicated (the amount reimbursed to an individual from the budget as a social deduction for the actual payment for treatment and medicines).

Title page

The title page of the reporting form 3-NDFL is filled in with information about the individual taxpayer (full name, passport information, place of residence, contact information, residence status), the reporting period, as well as other data provided by the template.

It should be clarified who exactly submits this declaration - the citizen-taxpayer himself or his authorized representative.

Filling example:

Setting conditions

You should act sequentially, filling out the tabs from top to bottom, although you can move freely through the sections. The top tab on the left is “Set conditions”. Since the 3-NDFL of a resident of the country is being filled out, we select the appropriate item.

Next, select the inspection number where the declaration is submitted. You need to select the one you need from the drop-down list (for example, 7701 - Federal Tax Service Inspectorate No. 1 for Moscow).

Since 3-NDFL for treatment is filled out for the first time, the adjustment number is indicated - 0. When submitting a clarifying declaration, indicate number 1.

In the OKTMO value field, you need to indicate a code indicating belonging to a specific city, town, etc. This code can be obtained from the Federal Tax Service website or from your income certificate (clause 1 “Data about the tax agent”).

Next, you need to select the taxpayer attribute. An ordinary taxpayer who is not engaged in private activities selects the “Other individual” item.

After this, we put a tick on the available income, part of which we plan to return from the budget.

In the “Reliability Confirmed” field, you need to select the item according to which you submit the deduction declaration personally or trust a representative - an individual.

Sample of filling out 3-NDFL when returning tax on treatment

- The applicant, after paying for the treatment, contacts the accounting department and presents the necessary documents.

- The accountant will arrange for a refund of the 13% that was previously deducted for income tax purposes.

- In addition to the basic salary, the employee receives funds in the amount of income tax.

- 010 – indicate the value “1” or “2” (for the return of budget funds);

- 020 – enter the value “182 1 01 02010 01 1000 110”;

- 030 – depending on the location of the taxpayer it will vary; OKTMO will be found out at the declarant’s address;

- 050 – enter the tax deduction amount.

Entering information about the declarant

The next tab “Information about the declarant” contains information about the taxpayer, his passport data, phone number.

Field "Full name" is filled in with the declarant’s TIN, date and place of birth.

The country code inside the citizenship line is set automatically.

Before entering your passport data, you need to select the type of document in the drop-down list:

After this, the lines indicating the series, number, and date of issue of the passport are filled in.

In the last line you need to enter your phone number.

How much should I expect?

The legal limit established for the amount of medical expenses is one hundred twenty thousand rubles. We remind you that not the entire named figure is returned, but only 13% of it. It is easy to calculate that every year a citizen can count on a social benefit equal to 15,600 rubles. This limit does not apply to expensive treatment.

Of course, it is not the payer himself who decides whether his medical “care” is expensive - the decision on this right can only be made by the medical institution, which will issue the appropriate official paper for the tax authorities. Such a certificate will indicate code “2”, which will notify the Federal Tax Service that the treatment is recognized as such. Despite the fact that there is no limit for expensive treatment, the payment is also fixed at thirteen percent of the total amount. You should also not forget about the classic “stopper” for tax deductions - you can receive in a year as much money as you transferred to the state budget as a personal income tax payer.

Let's look at an example. Ivan Sergeevich Plokhoy required expensive treatment. As a result, he paid a check for two hundred thousand rubles. During the year that Plokhoy spent so much, he earned 45,000 rubles every month. Social relief, according to the law, should amount to 26,000 rubles and he will receive a deduction in full, since he paid an annual income tax in the amount of 70,200 rubles (5,850 rubles monthly). It is easy to understand that the amount of tax paid is two and a half times greater than the amount of the deduction received.

Income data

The “Income received in the Russian Federation” tab is filled out based on the type of income. The program offers four types of bets:

- 13% - income received from the employer, incl. an individual (except for dividends);

- 9% (not dividends);

- 35%;

- 13% - dividends.

If you receive wages under an employment contract or civil servants' agreement, you should choose the first rate - 13%:

Then select the source of income payments. To do this, click the “+” icon and then enter information about the employer from the 2-NDFL certificate (item 1 “Data about the tax agent”).

Don't forget to check the box at the bottom of your employer information to calculate your deductions based on that source.

Then you can start depositing your monthly income. To do this, go to the bottom block, click on the “+” icon:

A window appears with income information. They are transferred from certificate 2-NDFL, paragraph 3 “Income taxed at the rate of 13%”. From the table presented in the certificate you can find the code and amount of income, as well as deductions, if any.

Select the code from the drop-down list:

We enter the amount of income received in accordance with 2-NDFL, put the month number in order:

If the work is carried out not under a labor contract, but under a GPC (civil law) agreement, you need to choose a different code:

If you took paid leave in the reporting year and were awarded financial assistance, you need to reflect this in the declaration by selecting the code and deduction amount:

Thus, we fill out each month of the reporting year. The list should look like this:

Important! Income for each month, including deductions, must correspond to the data specified in the 2-NDFL certificate. The total amount of income in the last line must also be the same in the declaration and in the certificate from the employer.

We manually enter the taxable amount of income, as well as taxes - calculated and withheld based on information from 2-NDFL.

After entering information about your income, you can begin filling out the deductions tab.

Example of filling out 3 personal income tax for dental treatment

The tax base (code 060) is taxable income, minus all deductions provided, that is, in order to find its value, paragraph 4 and paragraph 5 of this section must be subtracted from paragraph 3. If you multiply the tax base by the tax rate of 13%, you will get the value of the tax calculated for payment, which is entered in the field with code 070.

For example, Ivanov receives an annual income from Alpha LLC equal to 350,000 rubles; the personal income tax paid this year is equal to 45,500 rubles. In the same year, he incurred expenses for dental prosthetics in the amount of 50,000 rubles, in this case the amount of the deduction will be calculated as follows: 50,000 rubles * 13% = 6,500 rubles.

Deductions

The tax deduction for treatment is a social one, so you need to go to the appropriate block:

In the line “Provide social tax deductions” you need to check the box, then start filling out the lines to display the amount spent on treatment.

Here you should consider three examples of filling out a declaration for dental treatment:

- Varlashina L.A. in 2020, she spent 150,000 rubles on dental treatment, for which she has payment receipts, and the services were provided by a licensed dental clinic. The certificate of payment for medical services indicates code 1 - this means that the treatment is not expensive, therefore, it must indicate the amount of expenses not exceeding 120,000 rubles.

Therefore, you need to fill out the “Treatment” line and indicate the maximum possible amount – 120,000 rubles:

Personal income tax paid by the employer Varlashina L.A. for 2020 to the budget amounted to 58,207 rubles, and this suggests that she has the right to receive the maximum possible deduction amount of 15,600 rubles at a time. When filling out a declaration for treatment, you can see how it will look when printed. To do this, click the “View” tab:

Based on the specified amounts of income and treatment expenses, the program will calculate the amount of tax deduction. You can see it when viewing the document on page 2:

- Example two: Varlashina L.A. in 2020, I spent 80,000 rubles on dental treatment, and in the certificate of payment for medical services, as in the first case, code 1 is indicated. Expenses do not exceed the limit of 120,000 rubles, so in the “Treatment” line you need to indicate exactly this amount:

In this case, the amount of the refunded amount from the budget will be less (80000x13%=10400), which can be checked on page 2 of the declaration:

- Third example: Varlashina L.A. in 2020, I spent 80,000 rubles on dental treatment, which is not expensive. But, in addition to this, at the same time she spent 150,000 on another type of treatment, which is included in the list of expensive ones (the dental clinic’s certificate contains code 2). The declaration indicates both types of expenses, and using code “2” the declarant can receive a deduction that goes beyond 120,000 rubles:

The total deduction for the year will be 29,900 rubles:

Social tax benefits

Article No. 219 of the Tax Code of the Russian Federation states that all taxpayers can receive social deductions for tax payments. This refers to income taxed at a 13 percent rate. Unlike other types of deductions, social deductions can be obtained exclusively at the tax office at the payer’s place of residence. The main point is filing a personal income tax return for the specific year in which the following expenses were incurred. A person who underwent treatment and purchased medications in 2016 is required to strictly submit a declaration in 2020 if he really wants to return the money.

A person who underwent treatment and purchased medicines in 2016 is required to strictly submit a declaration in 2020 if he really wants to return the money

The tax payer must submit documents certifying that the treatment or purchase of drugs was actually carried out on the basis of the doctor’s recommendations, that the services or purchases were paid for by him. It is important that the medical institution has a license, and that all payment documents and contracts are in order. Until 2010, the package of documents included a written application requesting a refund, but now it has been abolished - the deduction will be issued by default. Now let’s take a closer look at the cases in which you can count on social deductions for treatment.

Reference

It will be possible to return part of the expenses in cases where a Russian citizen received paid health-related services or purchased medications. It does not matter in which hospital the person was treated - public or private. The deduction can be issued not only to one’s own person. The state allows you to receive benefits for paid treatment of your spouse, parents or minor children. Social benefits are extended to inpatient treatment, outpatient visits, diagnostic and therapeutic visits, disease prevention, rehabilitation, as well as cash contributions for voluntary health insurance policies.

Important point! If we are talking about expensive vital medical care, the expenses are accepted by the tax authorities without restrictions. In normal situations, the return limit is one hundred twenty thousand rubles.

How to save and print the declaration

At any time when filling out the 3-NDFL declaration for treatment, you can save the document. To do this, click on the “Save” button at the top of the window:

It happens that you need to fill out several declarations for different people, and this requires saving them under different names. In this case, the completed document is saved under the desired name in *dc7 format.

After filling out the electronic version of the declaration, it must be printed in two copies: the first remains with the tax inspector for verification, the second with the declarant.

To print a document, click the appropriate button:

Before printing the declaration, it is recommended to check it for possible errors. To do this, you need to select the button in the top panel of the program:

After checking, the program displays a window indicating errors and recommendations for correction or a mark of successful verification:

Each sheet of the printed declaration must be signed and dated. The rest of the documents required to claim the deduction are attached to it and are submitted for verification by the Federal Tax Service at the place of registration of the personal income tax payer.

How to fill out 3-NDFL for a refund for treatment

The entire package of documents is sent to the tax office at the place of residence. For declarations submitted only for the purpose of tax refund, there are no restrictions on the deadline for submission - 3-NDFL can be submitted during the entire year following the reporting year. If you also declare your income along with the deduction, the declaration must be submitted by April 30 of the following year. The tax refund procedure can take you up to four months: a desk audit lasts 3 months and another month is allocated for the refund of tax overpayments (clause 2 of Article 88; clause 6 of Article 78 of the Tax Code of the Russian Federation).

Please note that you can only get a tax refund for those periods when the treatment was actually paid for. It is permissible to claim a deduction several years after payment, but a refund is possible only for the last 3 years. For example, the treatment took place in 2020, but the deduction was declared only in 2020. In this case, you can return the tax paid in 2020, 2014 and 2020.

Documents for the tax office

To report his desire to receive social benefits, a citizen must appear at the inspectorate at his place of registration. The visit will be more fruitful if you immediately bring the necessary documents:

- A certificate confirming payment for medical services or pharmacy products.

- Agreement for the provision of services by the clinic (in the name of the applicant).

- Payment confirmations (checks, transfers, etc.).

- A copy of the organization's license to provide medical care.

- Certificate in form 2-NDFL from the place of employment.

- Declaration in form 3-NDFL.

Filling out the last document is an important point. To receive a tax deduction, the certificate must be completed correctly, otherwise the tax office will refuse to reimburse the money you spent and you will have to bear the costs without government support.

Sample of filling out the declaration

Filling out form 3-NDFL is not easy at first glance. With enough attention, even a person doing this for the first time can cope with this. The main thing is to be careful and monitor any inaccuracies that may lead to denial of social benefits. To receive it, a citizen must fill out these parts of the declaration:

- title page;

- sections 1 and 2;

- sheets A and E1.

Title page of the declaration with payer data

The main page should not raise any questions, since the payer’s personal data is entered there (as in a passport). You need to fill out the TIN according to the data from the 2-NDFL certificate. The adjustment number is the numbering of already submitted declarations. If the declaration is submitted for the first time, we set the value “0”; accordingly, the second declaration will have the value “1” and so on in order.

The code “760” always designates the payer as an individual. The value “34” means that the citizen submits a declaration for the year; in the case of a deduction for treatment, we leave this figure as indicated, further indicating for which year the document is being submitted. The tax authority code can be found on the official website of the Federal Tax Service, where from the list it is easy to select a specific branch of the department to which a person sends documents.

We have prepared instructions for filling out Section 1 and Section 2 (it is about calculating the financial base) in the form of a convenient table.

Decoding data to fill out the first and second sections

Let's look at filling out sections using an example. Let’s say that in 2020, Ivan Sergeevich Bolshakov sought dental care, spending 62 thousand rubles. During this year, Bolshakov earned 550 thousand 330 rubles, for which he law-abidingly paid a 13 percent tax. Now the citizen wants to receive payment for the treatment received.

Filling out the first section of 3-NDFL

Tax payments from Bolshakov’s salary allow you to receive a full deduction from the amount of treatment of 8 thousand 60 rubles. It is this amount that the person indicates in the appropriate field. The budget classification code remains unchanged as in the table above. Bolshakov must copy the OKTMO code from the certificate in form 2-NDFL issued at the workplace.

Filling out the second section of 3-NDFL

Next, Bolshakov begins to fill out sheets “A” and “E1”. In them, he indicates at what rate his wages were taxed (13%) and indicates the type of income code (value “06” - salary under an employment contract). The name and details of the employer are also indicated, which can also be easily obtained by looking at the 2-NDFL certificate.

Filling out sheet A 3-NDFL

The last sheet does not require serious attention, since it contains the same amount - the one that Bolshakov spent to cure his teeth. As we remember from the example, it is equal to 62 thousand rubles, this figure must be entered on the “E1” sheet.

When receiving a deduction for treatment, only item No. 3 about social deductions is filled in on sheet E1

To prevent you from getting confused when filling out the main sheets, which indicate the calculation of the deduction amount, as well as data on sources of income, you can use a “cheat sheet”.

Hint for filling out lines in sheets “A” and “E1”

After reviewing the fields to fill out and our guide, you should not experience any discomfort when filling out this important document.

You can also fill out the paper required to receive social benefits through the State Services portal.

Instructions for filling out a declaration at State Services

To use the gosuslugi.ru portal, you must go through the registration procedure (you must have your passport and SNILS at hand), and then confirm your identity by coming with the document to any bank branch, MFC or other point indicated on the portal.

When the user has access to his personal account and the ability to use online services, he must go to the “Service Catalog” section in the top line of the site and select the “Taxes and Finance” category.

The “Taxes and Finance” section allows you to quickly create a declaration for social tax purposes

Next, you need to click on the item “Acceptance of tax returns (calculations)” and select the option “Providing a tax return for personal income tax.” The next step is to select the “Generate declaration online” option.

The checkbox indicates the option you are interested in

After selecting a service, you need to click on the blue “Get service” button and the system will automatically redirect the user to the filling page. To fill out 3-NDFL online, you need to click on the “Fill out a new declaration” button at the bottom of the page.

The button you need to click is at the very bottom of the page

After you make the indicated click, a panel will appear in the window where you will be asked to select the year of the tax return and click on the “Ok” button. Complete the required actions by clicking on the circle located next to the year that suits you, and then on the button. You can see what the panel in question looks like in the screenshot below.

Window for selecting the year to fill out the declaration

After specifying the year of the declaration, the service will load a page on which you can select two main tabs:

- declaration;

- signatory

Choose the first option and start entering data in the fields that open.

1. First of all, you will be asked to enter a value in the “adjustment number” cell. The following options are possible:

- if the declaration is submitted for the first time, enter the number “0” inside the cell;

- when resubmitting the clarifying document, indicate the number “1” and so on.

The more clarifying documents there are, the larger the correction number becomes.

2. Next, in the “Taxpayer Information” column, from the drop-down list you will be asked to select the option that is relevant for your case. Click on the list and select the “Other Individual” category.

Correction number - data on declarations previously completed in the reporting year, taxpayer category - other individual

3. After you finish filling out the first page, proceed to entering information in the “Income” section. On the side of the window that opens in the browser, you will see a hint stating that at this stage you only need to enter into the declaration:

- those incomes for which you are required to provide reporting;

- income for which you are claiming a tax deduction.

Cells for entering information are divided into three parts:

- source of money;

- the amount of funds that was paid to you;

- actions.

The source of income payment is any company, individual entrepreneur, etc. In general, an organization that became your employer and paid you money for your work.

The service automatically selects a category of income for entering information, the taxation percentage for which is 13%. If you received other funds, you can change the category yourself by selecting the one you need from the list on the page.

Enter information about income

To enter information in the columns we are considering, you must keep your 2-NDFL certificate on hand. You can transfer information from it online using an additional function of the service, or copy data from a paper version.

- The “Source of income” column implies entering the following information about the organization that paid you the money for which you are applying for a deduction.

- In the “Amount of Income” cell, you must indicate the amount of money you received from the selected source.

4. After the data has been entered, save it and go to the next page - “Deductions”. Here you need to indicate the category of deduction that you are going to receive. Since the main topic of our article is the deduction received for treatment, it is necessary to select the “social” category among the presented groups.

Treatment tax refund is classified as social deductions

On this page, you must check the box labeled “Provide social tax deductions.” Please note that the following is a list of cells that require you to enter the amount of expenses you have made for:

- charity;

- child education;

- receiving medical services;

- receiving expensive medical services;

- voluntary personal insurance;

- conducting qualification assessment.

Enter the amount you spent on treatment in the appropriate column. Just below, the system will require you to enter the social deduction codes that were already provided to you by the tax agent. If the receipt of funds or reduction of the tax base has already taken place, once again carefully look at the 2-NDFL certificate and enter the code indicated in it.

Enter information consistently and carefully

5. When completing filling out the declaration, go to the “Results” tab. This page will display the following information:

- the full amount of income received by you;

- tax base;

- the amount of tax calculated for payment;

- the amount of tax collection that must be returned from the state budget;

- the amount of money that will need to be paid into the budget.

You can use the received data in the form of a declaration:

- download to computer;

- export;

- form into a single document for sending to the tax service.

Select the option that is most convenient for you and click the “next” button.

The final stage is represented by viewing the deduction information. If you did everything correctly, instead of the number 0 rubles, you will see the amount due for refund.

The instructions presented show that the procedure for filling out 3-NDFL online to receive a deduction for treatment is intuitive. Even if now it seems to you that you might be confused, once you start working with the service, you will understand that it is absolutely easy to fill out 3-NDFL on your own for deduction for treatment, spending very little time on it.

Video - Example of filling out a declaration in Form 3 of personal income tax for treatment

Fresh materials

- Certificate of non-admission to the apartment, sample EVERYTHING THAT CONCERNES THE COMPANY BURMISTR.RU CRM system APARTMENT.BURMISTR.RU SERVICE FOR REQUESTING EXTRACTS FROM ROSSREESTR AND CONDUCTING…

- Balance sheet of JSC Accounting (financial) statements of enterprises 39,149.84 billion rubles — JSC VTB CAPITAL 4,892.93 billion…

- Tax planning Tax planning in an organization Tax planning can significantly affect the formation of the financial results of an organization,…

- Exemption from VAT Notification of the use of the right to exemption from VAT Notification of the use of the right to exemption from VAT...