When to fill out TORG-12

The delivery of purchased inventory items is formalized using the TORG-12 invoice.

This document is prepared by the supplier. If the purchased goods are subject to VAT, then an invoice is additionally sent to the customer. For the supplier, this invoice is a document according to which inventory items are written off and sold. For the customer, on the contrary, this is confirmation of the purchase of goods and materials and the basis for their registration. A unified form of invoice bidding 12 has been developed; you can download the excel form for free later in the article, it will be useful in your work.

Return note form: and samples

Invoice TORG-2:

Invoice TORG-12:

The proposed form allows you to record the necessary parameters for the returned goods or products. Also record the product parameters. Providing an opportunity to avoid troubles in court proceedings. In this case, points such as:

- "shipper";

- "consignee";

- "provider";

- "payer"

They will allow you to identify the entire sequence of delivery of goods. Making it possible to identify those responsible for poor-quality delivery or cases of damage during transportation or loading of products.

The “Bases” paragraph will allow you to understand the reason for the return of goods and products and return shipment, indicating additional documentation and nomenclature of the entire batch or individual products. At the same time, there is a separate table that will indicate: the number of products, units of measurement, cost and all transportation costs.

Additionally, photocopies of invoices and quality certificates, if any, are attached to this form for the selected batch or individual products. Giving the opportunity to verify the reasons and options for non-compliance specified in the “Bases” paragraph.

Watch the video on how to create a return note:

https://youtu.be/tFeod1Q4uuY

0

Which form should I use to fill out?

The formal form and rules for filling out are regulated by Resolution of the State Statistics Committee of the Russian Federation dated December 25, 1998 No. 132. However, if the supplier needs to adjust the current form, for example, adding new details, rows and columns, then, in accordance with Part 4 of Art. 9 of Law No. 402-FZ of December 6, 2011, he can make additions to the unified form or use a self-developed form. Below is the current TORG-12 consignment note; the Excel form can be downloaded for free.

IMPORTANT!

It is prohibited to remove details from the unified form!

Design in 1C: video instructions

How to correctly fill out the form in the 1C program:

https://youtu.be/Mr57BTNSOiA

A waybill (TN) in the TORG-12 form is drawn up when registering the release (sale) of goods. This primary document is issued in two copies, the first of which remains with the seller and serves as the basis for writing off sold products, and the second is transferred to the buyer and used when registering goods.

Thus, TN is used to formalize the transfer of ownership of goods and other material assets from one person to another.

Procedure for filling out the invoice

IMPORTANT!

The document is drawn up by the supplier in two copies - one copy for each party. If the goods are shipped using the services of a transport company, then it is necessary to prepare a third copy.

Since July 1, 2017, an electronic format has been developed and approved: TORG 12 invoice online (Order of the Federal Tax Service dated November 30, 2015 No. ММВ-7-10/). The transfer is carried out via telecommunication channels, which allows you to quickly provide primary documentation at the request of both the customer and the tax inspector. You can prepare a document online using specialized accounting services and resources.

In the TORG 12 consignment note, a sample of which can be downloaded at the end of the article, it is mandatory to fill in the details reflected in Art. 9 402-FZ. We will tell you how to draw up TRADE 12 (we suggested Excel above) in accordance with the rules adopted in 2020.

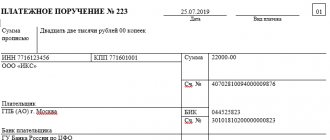

Step 1. The first step of filling out is to assign a serial number to the invoice and indicate the date.

Step 2. Fill in the contact information of the supplier (“Seller”) and customer (“Buyer”). Then the “Base” is entered - the contract (agreement), in accordance with which the goods and materials are supplied. You also need to fill out the code part in the header - indicate all the necessary codes from the All-Russian Classifiers.

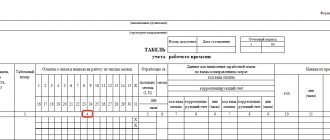

Step 3. As soon as the invoice details are filled in, the responsible person of the supplier begins to prepare the calculation (tabular) part. The qualitative and quantitative characteristics of the supplied inventory items are entered into it step by step according to column numbers:

- Serial number.

- Name of goods and materials.

- Product coding.

- Unit of measurement.

- Code of measuring unit according to OKEI.

- Tara.

- The number of items located in the package.

- Total number of packages.

- Weight of goods and materials with packaging.

- Weight of goods without packaging.

- Price of one unit of production.

- The cost of purchased goods and materials excluding VAT.

- The VAT rate set for the supplier.

- Tax amount for each product item.

- The cost of the purchased goods including VAT.

Step 4. In the columns “Total” and “Total on invoice” the total cost of the purchased products is noted.

Step 5. A very important point for the supplier is to fill out the deadlines for shipment and receipt of goods and materials. They will be confirmation that the delivery took place without violation of the terms of the contract.

Step 6. Filling is complete. In order for the invoice to take effect, it must be signed. On the seller's side, signatures are placed by the manager, chief accountant and employee responsible for shipping the products. On the part of the customer, the financially responsible person of the customer organization signs in the lines “Cargo accepted” and “Cargo received”. Signatures are certified by enterprise seals. However, if institutions officially operate without a seal (Federal Law No. 82 dated April 6, 2015), then a stamp may not be affixed to the documentation.

IMPORTANT!

If the goods are returned to the supplier, the buyer also fills out the TORG-12 invoice. The rules for drawing up the document remain unchanged.

Samples of the TORG 2020 - 2018 series

In practice, enterprises very often use invoices from the TORG series:

- 12 – for the transfer of goods, raw materials, equipment and other property assets to the counterparty (any legal entity or, less commonly, private individuals);

- 13 – for the transfer of valuables within one enterprise (both within one warehouse and between different separate divisions);

- 14 – to record the fact of release by small enterprises engaged in small retail trade.

They have a similar form, but the individual graphs are slightly different because they are used in different situations.

TRADE 12

In fact, since 2013, the single, previously valid form has been abolished. However, many enterprises continue to use the same old form, which is not at all contrary to the law. The document is drawn up when goods are sold to the buyer. In this case, most often the buyer is a legal entity, although it is acceptable to use the form when selling to individuals.

When filling out the column, it is important to understand that it will subsequently be used in accounting. Therefore, even the absence of one piece of information will no longer be valid, which may lead to sanctions if a deficiency is discovered during verification:

- title and date of compilation;

- Company name;

- Name;

- natural and monetary measurement of units;

- positions of the releasing and accepting person;

- signatures, transcripts of signatures;

- Stamp of the company.

The header indicates the document serial number, as well as:

- In the column “Consignor” the name of the company that sent the cargo is given. Usually the supplier itself acts as this company, so the content of the relevant information is duplicated.

- Information about the structural unit is recorded only in cases where the goods were shipped from a separate unit of the supplier.

- The “Consignee” column provides details of the company that received the cargo.

- In the “Payer” column - details of the company that paid for the purchase: contact details, legal address, bank account details and bank name, INN, BIC.

- The code is entered in accordance with the OKPO classifier.

- In the “Base” line, the wording “Agreement” is usually given, and “Invoice” is also allowed.

- They usually do not enter anything by type of transaction, but if the company has adopted an internal classification of types of business transactions, they provide the appropriate wording.

The rules for creating a list of goods are described in the table.

| columns | how to fill out |

| 1 | serial numbers in the list |

| 2 | full name of the item in accordance with the nomenclature system adopted by the company, as well as characteristics (grade, article, brand - separated by commas) |

| 3 | the field usually remains empty (or you can put a dash), however, if it is impossible to unambiguously identify one or another object by the name of the position, then an additional code is given |

| 4,5 | the unit of measurement is prescribed in the form of a code according to the OKEI system |

| 6 | in most cases, a dash is placed here; less often, “wooden box”, “cardboard packaging”, etc. are indicated. |

| 7,8 | Usually a dash is also placed in this field, and the total quantity is written in line 10 |

| 9 | gross mass should be indicated only if necessary; in most cases, the column is also crossed out |

| 10 | here the total quantity of all goods supplied is indicated in the units of measurement that are accepted |

| 11 | here is the exact price of one unit excluding VAT |

| 12 | here is the price for the entire lot, excluding VAT |

| 13,14 | the VAT amount and rates are given |

| 15 | here is the amount of the entire batch including VAT |

As a result, the total quantities are indicated:

- records (rows);

- places;

- cargo mass;

- masses;

- price.

Sign:

- Chief Accountant;

- the employee who authorized the leave;

- the employee who directly released the property.

TRADE 13

An invoice of this form is sent in all cases when goods are moved within the same company - for example, they move from the area of responsibility of one employee to the area of responsibility of another or simply change location. The registration procedure is essentially the same.

TRADE 14

This form of document is used in cases where product reports are not prepared:

- vendors in trays;

- from carts;

- from distributions;

- other small retail outlets.

Frequent errors when filling out and responsibility

The most common mistake is missing printing. Yes, it is not included in the list of mandatory details under 402-FZ and in most cases it is not necessary to include it. But in the case of TORG-12, the seal is provided for by the form itself, so it must be present. If it is not there, then tax authorities may not credit VAT - this is a common cause of disagreements with the tax office. The case when a seal is not required is when the consignee accepted the goods by proxy, certified by the organization’s seal. To avoid problems, attach the power of attorney to the invoice and keep both documents.

The second problem is the lack of someone’s signature. Make sure that all parties sign the invoice. If a theft occurs, it will be difficult to prove anything and find the culprit. In such a situation, both the seller and the consignee may face criminal liability.

Features of drawing up an invoice for goods

In accordance with general practice, the bill of lading form may be completed by one of the authorized persons:

- seller;

- consultant (manager);

- storekeeper;

- carrier;

- cashier;

- accountant;

- directly by the director or individual entrepreneur.

After registration, one copy of the document is transferred to the receiving party (buyer or customer), and the other is sent to the accounting department of the enterprise for further processing.

There is no single form of invoice for the supply of inventory items. The form can be developed by the organization itself; in addition, the compiler can use any of the forms presented on the Internet, and in order to make sure that his actions are correct, he can familiarize himself with the sample filling out. The latter are also in abundance on the Global Network; The main thing is not to use obviously outdated documents that do not reflect modern realities.

The invoice for the goods, unless there was a separate agreement between the client and the supplier, is issued at the time of conclusion of the transaction. Otherwise, the document, since this is not regulated by the legislator, can be drawn up and signed both in advance and retroactively. This is not an offense, however, in order to avoid misunderstandings, especially when subsequently filing a claim in court, it is still recommended to draw up and sign a delivery note along with the main documents accompanying the transfer of goods from hand to hand.

The procedure for filling out the goods invoice form:

- At the top of the sheet you should indicate the date the document was issued. It can be drawn up in advance, but it acquires legal force only after the signatures of the parties to the transaction are affixed; This date, as the most important, must be cited.

- Just below is the serial number of the invoice according to the internal numbering of the seller (supplier), updated every year.

- Next is information about the recipient (buyer, customer):

- if this is a legal entity - the full and abbreviated official name of the organization, basic details and registration numbers and address;

- if this is an ordinary citizen or individual entrepreneur - last name, first name, patronymic, optionally - TIN and residential address.

- The next block contains information about the person issuing the invoice:

- official names, full and short;

- registration numbers (TIN, KPP, OGRN), statistical codes;

- payment details;

- full postal address including zip code;

- contact information: phone number, email address, accounts on social networks and instant messengers, and so on.

- In the main table (in columns from right to left):

- in the first (“item number”) - the serial number of each of the positions presented in the list;

- in the second (“Name”) - the trade name accepted at the enterprise or in the distribution network for each type of product sold;

- in the third (“Units of Measurement”) - units used in determining the quantity of goods supplied: kilograms, cubic meters, liters, cuts, pieces, boxes, and so on;

- in the fourth (“Quantity”) - the number of products transferred to the consumer (customer), for each item separately;

- in the fifth (“Price”) - the market price of a unit of each product (you will first need to calculate the cost of the goods, which is not included in the invoice);

- in the sixth (“Amount”) - the total cost of products for each item, obtained by multiplying the prices and quantities indicated in the previous columns.

- Below (under the “Amount” column, but outside the table) is the total amount for all items, taking into account value added tax and separately the amount of VAT.

- The final block contains the signatures of the financially responsible person transferring the goods and the receiver (buyer).

Important : although it is not necessary to affix the seller’s seal or stamp on the delivery note form, it is recommended to do so; this will subsequently allow the document to be used with greater confidence during legal proceedings.

Filling out online

You can find many services on the Internet that allow you to make and print online forms. Most web resources offer this service free of charge. After registration, the user will be able to create and save documents. In the future, using the saved invoices, new primary documentation is filled out automatically. To do this, you will need to select one of the previously saved forms. The functionality of the system allows you to calculate the price of a unit of production and the final cost; the remaining lines of the electronic document are filled out automatically.

https://youtu.be/7L9ltStjToM

How to fill out the TTN by the shipper

The person who ships the products acts as a shipper; he is required to download the TTN form for free in Form 1-T and fill it out.

Start your design with the header:

- Enter the series and serial number of the primary. Indicate the date of drawing up the TTN.

- Shipper - the person who shipped the goods. Fill in the details in strict accordance with the constituent documents.

- The consignee is the entity that receives the shipment sent. Record information about the recipient in accordance with the supply agreement or constituent documents.

- The payer is the entity that pays for the shipment in accordance with the terms of the contract. Enter the payer's payment details based on the contract or agreement.

We go to the commodity section of the consignment note. Here we record all available data on the transported batch of products, goods, and cargo. This part of the document discloses information about the name, quantity, price and value, packaging and other characteristics of the product. In essence, this is duplication of information that is required to be filled out in a standard delivery note. When registering a TTN, it is not necessary to issue a simple TTN - all the information has already been disclosed.

IMPORTANT!

The company has the right to provide separate rules for registering a TTN. For example, with regard to deciphering information about a consignment of goods, disclose the information in the appendix, supplementing form 1-T with the specialized form TORG-12.

If the items of transported products do not fit on one page of the consignment note, then additional sheets 1-T are drawn up. As much as is required to reflect the full picture of the consignment of goods. Please note that you will have to indicate the number of pages and their sequence under the tabular part of the product section.

Next, the general delivery values are recorded. It is necessary to disclose information about the cost of the goods, weight, number of places. Additionally, provide information about applications, certificates and product specifications, if available.

Then the TTN is signed by representatives of the shipper:

- the manager or other authorized representative of the company who gave direct permission (instruction) for shipment;

- chief accountant, who reflected financial indicators;

- the employee who carried out the shipment.

On the right side of the product section the following marks are placed by the receiving party:

| Cargo receiver | What to write in TTN |

| The cargo is received by the transport company | Enter the details of the power of attorney of the driver who accepts the shipment. Then the driver signs the document, confirming that the cargo has been received for transportation. |

| The cargo is received by the recipient's representative | Please indicate your full name. and the position of representative of the consignee. Take his signature. These marks are filled in when the consignment of goods has already been shipped to the recipient, and the responsible employee (storekeeper) will check the delivery’s compliance with the terms of the contract. |

Let's sum it up

The delivery note is issued by the financially responsible person directly upon transfer of the product to the buyer. The document must be completed in at least two copies - for the seller and the client. There is no unified form of invoice: each organization or individual entrepreneur can develop their own template or use those found on the Internet.

When filling out the invoice form for goods, you should provide the full official names of the supplier and recipient, in the main table - the name and quantity of each type of product, and below - the total amount including VAT. The document must be certified by the signatures of both parties. It is not necessary to affix the seal or stamp of an individual entrepreneur or LLC, but it is advisable: this will make it easier to operate the invoice if it is necessary to file a statement of claim in court.

Nuances of filling out some invoices

The consignee may be a branch of a legal entity or a separate division. In this case, in the line “Consignee” you need to indicate the details of the division or branch, and in the “Payer” - the name and details of the parent company.

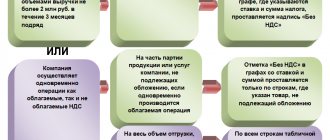

When recording data in the “Tax rate” column, you need to remember for tax accounting purposes, if the enterprise is on the simplified tax system or is exempt from VAT, you need to write “Without VAT”, if it applies types of activities for which the rate is 0% - 0 %.

Upon receipt of the goods by the buyer, the TORG 12 invoice can be signed by a person who is not its manager. In this case, it is necessary to attach a power of attorney to the delivery note, and fill in its details and personal data of the person signing it in the lower right corner.

What is an invoice

An invoice is a document confirming the issuance and acceptance of inventory items (material assets) from one business entity to another. Without this form, counterparties (individual entrepreneurs, legal entities) will not be able to complete the transaction. The buyer will not be able to deliver the products on arrival, and the seller will not be able to write them off from the warehouse.

Formation of documentation

The document must contain the following information:

- name of the business entity that generated the strict reporting form;

- date of;

- Full names, positions and signatures of employees involved in the transfer and acceptance of goods;

- list of products;

- measuring units;

- quantitative characteristics;

- unit cost of goods and materials;

- total price and other information.

In the practice of business document flow, a counterparty can issue the following types of invoices:

- paper;

- electronic.

In accordance with paragraph 1 of Art. 6 Federal Law of the Russian Federation No. 63 of 04/06/2011, documents on electronic and paper media are equivalent if there are signatures of the responsible persons. Electronic signatures are used for invoices in electronic form.

Documentation on paper is issued in 2 copies. One of them is transferred to the buyer, the other is stored in the accounting department. The document is certified by the signatures of both parties to the transaction. If an error is found, it can be corrected. Adjustments must be additionally certified by the signatures of the seller and buyer.

The online invoice is generated in one copy and consists of 2 files. The seller enters information in 1 of them, the buyer fills out the 2nd. Each file is certified by electronic signatures of counterparties.

Note! Transaction participants do not have the opportunity to make adjustments to online forms. If errors have been identified, then an act on the discovery of the inaccuracy should be drawn up and agreed upon with other counterparties.

In addition to businessmen, some government agencies are interested in the availability of invoices. Fiscal authorities control the correctness of the document. If inaccuracies are detected, penalties are applied to the business entity.

The presence of waybills is checked by traffic police officers in the case of cargo transportation. Throughout the entire route, inspectors have the right to check the vehicle, the goods being transported and the correctness of the documentation for them. The parameters of the transported cargo must fully comply with the information contained in the document. The rules for transporting goods do not change depending on the type of vehicle. Invoices will have to be issued for any type of transportation.

Signatures of the parties in TORG-12

The relevant fields must be signed by the responsible persons of both parties in their own hand (on paper). Facsimiles cannot be placed on primary documents. Tax authorities will exclude such expenses from those that reduce the buyer’s profit base (letter of the Ministry of Finance of Russia dated April 13, 2015 No. 03-03-06/20808).

On the part of the seller, TORG-12 is signed:

- In the line “Cargo release allowed” - the head of the organization (another person authorized by order of the director).

- In the line “Chief (senior) accountant” - the chief accountant or other accounting employee authorized to issue an invoice.

- In the line “Cargo released” - the employee who actually released the goods from the warehouse.

On the part of the buyer, the consignment note signs:

- In the line “Cargo accepted” - the employee who accepted the cargo at the place where the goods were transferred, other than the warehouse of the buyer (consignee). For example, when accepting inventory items at the seller’s or shipper’s warehouse, this line can be signed by an employee of the buyer or a representative of a transport company hired by the buyer.

Attention! A power of attorney is issued to individuals receiving cargo on behalf of the buyer, the details of which are indicated in the line “By power of attorney No. __ dated __ ____”.

- In the line “The cargo was received by the consignee” - the financially responsible employee who accepted the goods at the buyer’s warehouse.

The stamp on TORG-12 is not a mandatory requirement and is placed upon availability.

In the date fields, indicate the actual terms of shipment (acceptance), since they must coincide with the real ones. That is why it is more advisable to draw up an invoice either immediately at the time of shipment or after its completion.

Print TORG-12 in two copies, one for each side.

You can fill out TORG-12 using the link below.

Print TORG-12 in 2 copies, 1 for each side.

You can fill out TORG-12 using the link below.

The shelf life of the TORG-12 invoice in the organization is 5 years.

Modern services allow you to fill out TORG-12 online. Let's consider where to fill out TORG-12 in real time.

Rules for filling out the tabular part of TORG-12

In the tabular part of TORG-12, transfer the data about the shipped goods from the contract or specification for it:

- name of goods and materials;

- quantity;

- units;

- price;

- price without VAT;

- VAT amount;

- amount including tax.

Important! The name of the goods and materials must be in Russian (letter of the Ministry of Finance of Russia dated May 18, 2017 No. 03-01-15/30422). Combined spelling is allowed only for a brand name, for example, Samsung VC20M25 vacuum cleaner.

The “Product code” field can be left blank, as this is an optional detail. But to fill out this indicator, you can transfer the code from OKPD2, approved. by order of Rosstandart dated January 31, 2014 No. 14-ST.

TORG-12 allows for the indication of services provided to the buyer of goods (for example, services for loading and unloading goods and materials). In this case, the delivery note signed by the buyer confirms the provision of services (determination of the Supreme Arbitration Court of the Russian Federation dated September 30, 2010 No. VAS-12600/10 in case No. A32-44893/2009-57/533).

Subscribe to our newsletter

Read us on Yandex.Zen Read us on Telegram