Income tax: deadlines for filing returns 2020

The general rule for filing returns by taxpayers is enshrined in paragraph 1 of Art. 289 of the Tax Code of the Russian Federation: the declaration is submitted at the end of each reporting and tax period.

Deadlines for filing income tax returns (clauses 3 and 4 of Article 289 of the Tax Code of the Russian Federation):

- no later than 28 calendar days from the end of the relevant reporting period;

- no later than March 28 of the year following the expired tax period.

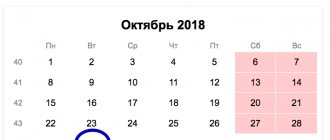

If the reporting period falls on a weekend, the deadline is considered to be the nearest working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

Example

The deadline for submitting the income tax return for 2020 is set to 03/28/2020 inclusive. But it falls on a non-working Saturday, which means it will be postponed to Monday, i.e. to 03/30/2020. But when submitting a report for the 1st quarter of 2020, you need to report exactly on time, that is, before 04/28/2020 inclusive.

NOTE! Due to the introduction of a non-working day regime from March 30 to April 30, 2020, the deadlines for filing income tax returns falling in March-May have been extended by three months (see Government Resolution No. 409 dated April 2, 2020). Read more about this.

Income tax returns used in 2020 can be found in this article.

The article “What is the procedure for filling out an income tax return (example)” will help you correctly prepare your income tax return.

Submit income tax 2020 - Electronically and on time

Entrepreneurs in the modern world have many worries. In addition to running a business, you need to find time to account for taxes, correspond with tax authorities, submit applications and submit reports. Not everyone is able to personally handle documentation. After all, the process requires a lot of time to work with papers, go to tax offices and other distracting actions.

However, there is a way out of the situation. It is now possible to submit reports to the tax office via the Internet. Recently, this form was an unusual novelty, but has now become a common way of working. This greatly simplifies life, frees up a lot of time and eliminates the need to leave an enterprise or business unattended.

Income tax due dates 2018

No later than April 28, for the first quarter.

For the half-year, the deadline is July 30.

October 29 – end of payment for 9 months.

Organizations that pay an advance on actual profits every month must do so no later than the 28th of each month. The exceptions are June (until the 30th) and September (until the 29th). Sending reports via the Internet will help you avoid delays and the troubles associated with them. Contact our company and you won’t have to keep the rules of tax organizations in mind.

Our capabilities

Possibility to send income tax and any report via the Internet.

You can work remotely, from your office or home.

We will provide the necessary response documents.

We will check it, correct errors, or fill it out ourselves and send it to the file.

All information is securely protected, stored on the server and can be provided upon your request.

Qualified employees will advise on any questions that arise.

Submitting your income tax return for you at a minimal cost.

These are just some of the factors in favor of contacting us.

Necessary actions

One-time submission of reports via the Internet in Moscow may vary in cost. Depends on whether you have an electronic signature. In some cases, only a power of attorney is needed. We will clarify all points. You just need to fill out a form with your personal information.

After this, sign the forms: a power of attorney from the Federal Tax Service and an agreement concluded by the two parties. To ensure that your online report is successful, please send us the signed forms. You will also need a report file and a scan of the manager’s seal and signature.

After this, you will receive payment information.

To have access to fast and convenient electronic reporting Moscow, please contact ReportMaster. Call or order feedback, get answers to your questions! We will help you and free up time for relaxation!

For violating the deadlines for submitting reports, the manager or chief accountant will be fined, and failure to comply with the deadlines for submitting tax returns will entail fines imposed on the organization. Responsibility for this violation of the deadlines for submitting tax returns is provided for in Article 119 of the Tax Code of the Russian Federation.

Moreover, regardless of the period of delay with the declaration, the amount of the fine is 5% of the unpaid amount of tax, but not more than 30% of the untransferred amount of tax on the declaration and not less than 1000 rubles.

According to the Tax Code of the Russian Federation in Russia, there are different ways of calculating and paying taxes. One of the most common among them is payment of advance payments.

At the same time, when calculating advance payments, accountants do not always do everything smoothly, and, as they say, without a hitch. Sometimes, especially for beginners, some questions and problems arise.

Before proceeding to a detailed analysis of the schemes for calculating advance payments, let us define this concept itself.

The deadline for paying income tax for the 1st quarter of 2020 is April 28. Those who transfer monthly advances from actual profits pay for March no later than this date.

If monthly advances are made from the profits of the previous quarter, this is also the deadline for the first payment for the second quarter. Income tax on income from the main business (at a rate of 20%) can only be calculated based on the results of the tax period - the year.

This year, numerous amendments came into force that affected the work of companies.

But we already know about new tax and accounting changes from 2020. We have collected them in this article. So, in 2018 the following changes in legislation will come into force: Calculation of insurance contributions to the tax office. From 2020, insurance premiums will be administered by the Federal Tax Service.

The Tax Code establishes deadlines for paying taxes and deadlines for submitting tax reports.

Federal laws determine the deadlines for submitting financial statements.

reporting to the Pension Fund and Social Insurance Fund. If the average number of employees exceeds 100 people, tax returns must be submitted electronically. The exception is VAT returns.

Advance payments for income tax in 2020: who pays, when, what the consequences are for being late with advances. Examples of calculating advance payments and samples of payment slips for payment of advances.

The list of taxpayers who transfer only quarterly advance payments for income tax based on the results of the 1st quarter, half a year and 9 months is given in paragraph 3 of Article 286 of the Tax Code of the Russian Federation.

Tax changes introduced to the Tax Code by the Law of Ukraine dated December 24, 2014. No. 909-VIII, generally evoke positive emotions, although there was a small fly in the ointment. Judge for yourself: 1. From January 1, 2020, monthly advance payments have been cancelled.

But with one caveat - before December 31, 2020, you will need to pay one more advance payment in the amount of 2/9 of the tax amount determined in the declaration for the 3 quarters of 2020.

Advance payments for income taxes in 2020 can be paid in several ways, but the company does not always have a choice. We have discussed in detail all the methods of paying advances on profits in 2020 in this article.

At the end of each reporting period, taxpayers determine the amount of the advance payment for income tax (clause 2 of Article 286 of the Tax Code of the Russian Federation). In this case, different options for paying advance payments for income tax are possible.

Advances on profits must be calculated and transferred in a special order.

About the methods of paying and calculating advance payments for income tax in 2020, see this article. Advance payments on profits directly depend on the tax, which the company calculates from income reduced by the amount of expenses (Article 286 of the Tax Code of the Russian Federation). Let's tell you in more detail who pays advances on profits in 2020, what payments can be and how to calculate them.

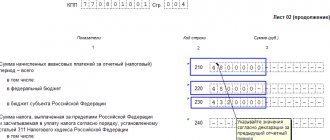

The amount of advances for income tax is determined at the end of each reporting period (clause

2 tbsp. 286 Tax Code of the Russian Federation)

All companies and individual entrepreneurs need to submit some kind of statistical reporting. And there are so many forms of this reporting that it’s not surprising to get confused in them.

To help respondents, Rosstat has developed a special service. using which you can determine what statistical reporting needs to be submitted to a specific respondent.

However, unfortunately, this service does not always work correctly.

The Federal Tax Service has approved a new procedure for obtaining a deferment (installment plan) for payments to the budget.

Article 246 of the Tax Code of the Russian Federation defines income tax payers as:

- companies on OSN, regardless of the volume and availability of profit;

- foreign companies operating through representative offices in the Russian Federation;

- foreign organizations recognized as residents of the Russian Federation.

The profit declaration is submitted to the tax authority at the place of registration of the taxpayer on paper. If the average number of employees for the last year did not exceed 100 people, then the declaration is submitted using electronic reporting systems (clause 3 of Article 80 of the Tax Code of the Russian Federation), for example, SBIS Electronic reporting or 1C: Reporting.

Income tax declaration for organizations with branches and separate divisions. Organizations that have separate divisions at the end of 2020 must report income tax at their location and the location of each of their separate divisions. The taxpayer can submit these reports at different times, but the deadline for submission is March 28, 2019.

By the way, if a separate division is registered in the same subject of the Russian Federation as the parent organization itself, there is no need to report to the division’s inspectorate. It is enough to report only at the location of the organization itself, having previously submitted the appropriate notification to the inspectorate at the location of the unit, so that the tax authorities do not lose you.

Income tax return for a consolidated group of taxpayers. The responsible participant in the consolidated group is required to report to the Federal Tax Service. The general deadline for submitting the income tax return for 2020 is March 28. The Tax Code of the Russian Federation does not provide for any special features in this case.

If the consolidated group managed to change the participant responsible for filing reports and registered these changes with the tax authorities before December 31, 2020, then the obligation to report at the end of the year is assigned to the new responsible participant. If such a participant changed in January 2020, then he will make the first annual income tax calculation based on the results of 2020.

Declaration of a tax agent on income in favor of a foreign legal entity. If a Russian organization pays income to a foreign organization, then it is obliged to submit a special tax calculation on the amounts of income paid to foreign organizations and withheld taxes based on the results of 2020 in the form approved in Appendix 1 to the order of the Federal Tax Service of Russia dated March 2, 2016 No. ММВ-7-3/ [email protected] until March 28, 2020.

Similar requirements for the presentation of this calculation are imposed on foreign organizations registered with the Federal Tax Service on the territory of Russia.

This calculation is not related to the income tax return and is a separate document. However, the timing of their submission coincides.

Who reports monthly

If you pay tax on actual profit, then the reporting periods for you are a month, 2 months, 3 months, and so on until the end of the year (paragraph 2, paragraph 2, article 285 of the Tax Code of the Russian Federation). Therefore, you file monthly and annual returns.

The deadlines for submitting declarations based on the results of reporting periods are as follows (clauses 3 and 4 of Article 289 of the Tax Code of the Russian Federation):

- for January - no later than February 28;

- for 2 months (January–February) - no later than March 28 (in 2020 until March 30);

- for 3 months (January–March) - no later than April 28;

- and so on, ending on December 28 with a declaration for 11 months.

The year-end declaration is submitted within the general deadline - no later than March 28 of the following year. Moreover, even before submitting it, you begin a new reporting cycle. Accordingly, declarations for current reporting periods may be submitted earlier than last year’s annual declaration.

Sunlight is very important for the development and growth of every living organism on planet Earth. Everyone feels its shortage, especially during periods of decreasing daylight hours and increasing nights. These changes are cyclical in nature. Every year, the equinoxes are celebrated in spring and autumn, when the lengths of day and night are compared. In winter and summer, the duration of day and night time is not the same. In winter, the shortest day and the longest night are celebrated, and in summer, on the contrary, the longest day and the shortest night. Such days are called solstice days.

When will daylight hours increase in 2020?

Decreasing and increasing the length of daylight hours has become commonplace for people. However, when the day gets better, it brings much more joy. Everyone is waiting with great anticipation for the day to begin to increase. After all, for most people this is a kind of turn and approach to spring, even though the whole winter is still ahead.

The shortest day in 2020 falls on December 21st. On this day, the Sun crosses the longest point of the Earth's orbit, which causes the minimum duration of daylight hours. After this, daylight hours begin to gradually increase until June 22, and then decrease again in a cycle.

This date marks the longest day of the year and the shortest night. After the December solstice, sunlight begins to gain ground, increasing each day by a few minutes. On March 22, day and night will be equal in length. This will be the spring equinox. On this day, the earth's axis is tilted to the maximum towards the Sun, which is why a person can see it very low above the horizon. The intensity of the increase in daylight directly depends on the inclination of the Sun and the speed of its revolution.

It is worth noting that the increase in daylight hours after the winter solstice is not due to the fact that the sun rises earlier, but because it sets later. Thus, it turns out that the day begins to increase in the evening.

Why is this happening? This is all due to the elongated orbit in which the Earth rotates around the Sun, thus being a little closer to it. There may be a difference of more than one day between the moment when the Earth is as close as possible to the Sun and the day of the winter solstice.

What does increasing and decreasing the day mean for a person?

The human body is very sensitive to changes in daylight hours. It has been noted that in the months when the day is shortest, children born later suffer from schizophrenia. Previously, scientists associated this with a deficiency of vitamin D in the body of a pregnant woman, but recently scientists have put forward a version according to which the problem may lie in melatonin (the key hormone responsible for human biorhythms) and the mother’s body temperature.

The accumulation of melatonin in the body of the expectant mother becomes highest during the winter solstice. Her body temperature drops significantly on the night of December 21-22, and this negatively affects the formation of the future baby’s brain: the hippocampus becomes smaller, and dopamine is not transmitted properly. According to scientists, such consequences can be easily avoided. To do this, a pregnant woman just needs to compensate for the lack of sunlight with artificial sources.

Changing the length of daylight hours also has a detrimental effect on the already formed brain of an adult. Research at the University of Liege has shown that the brain is most active during the summer solstice and least active during the winter.

What does the December solstice mean for different peoples of the world?

Since ancient times, the winter solstice, which falls on December 21, has been a very important day. There are many traditions associated with it. Once upon a time, people called the first month of the year Kolyaden. At this time, the birthday of Kolyada, the sun god, was celebrated. Rich tables were set for the holiday, and various ceremonies and rituals were performed. The festivities turned out to be quite large-scale. People thus revered the deity and saw off the fierce winter.

https://youtu.be/ua2TqwHnIfc

One of the traditions that has come down to us is caroling. Guys and girls put on the most beautiful outfits and walked around all the houses, singing holiday songs and wishing people well and well-being. For this, the owners of the houses treated them to various delicacies. A special place on the table was occupied by wheat porridge, which was seasoned with nuts, dried fruits and honey. She was called a kolev. Wheels were burned on the streets, symbolizing the bright round Sun. Around the fires they danced and sang songs. In this way, people tried to help the much-desired Sun be reborn.

Traditions of different peoples have a lot in common, although they are carried out independently of each other. The main purpose of ritual actions is to try to gain the support of good forces for the coming year. The winter solstice was of particular importance to primitive people. This is due to the fact that they could not be sure of the future. People did not know how well they had prepared for winter and whether they had enough supplies to survive this period. During the first four months of the new year they often went hungry.

The celebration of the “half” of winter was the final celebration before the beginning of the difficult winter period. Almost all the livestock was sent to slaughter, since it was almost impossible to feed them in winter. That is why the largest amount of meat products was consumed during the solstice, which falls in winter.

Christians celebrate the Nativity of Christ on the winter solstice. Orthodox people celebrate this holiday two weeks later. On this day the Slavs honor Kolyada, and the Germans honor Yule. The Scandinavian peoples have a carnival dedicated to fire on the December solstice. The Chinese celebrate Dongzhi, thereby welcoming the imminent increase in the length of daylight hours and the addition of “positive energy.”

During the winter solstice, one of the traditions is taking warm aromatic baths. The Japanese believe that the aroma of citrus fruits improves health and prevents colds from entering the body. That is why on this day people leave citrus fruits in many baths and hot springs. A lot of ancient traditions have reached us.

As we see, sunlight plays a special role in the life of not only people, but also all living things on the planet. Everyone is looking forward to the first rays of sunlight to warm up after a long cold night. The ideal option for most would probably be if the nights were short and the days very long. But everyone has their own preferences. Therefore, we are content with what nature has given us.

Tax agent reporting on profits

Russian organizations are recognized as tax agents for income tax if they pay:

- interest on state and municipal securities to Russian organizations and foreign organizations with permanent representative offices in the Russian Federation (clause 5 of Article 286 of the Tax Code of the Russian Federation);

- income to foreign organizations that have permanent representative offices in the Russian Federation, not related to the activities of such representative offices (clause 4 of Article 286, subclause 1 of clause 4 of Article 282, clause 6 of Article 282.1 of the Tax Code of the Russian Federation);

- individual income to foreign organizations that do not have permanent representative offices in the Russian Federation (clause 1 of Article 309, clause 1 of Article 310 of the Tax Code of the Russian Federation);

- dividends to other Russian organizations (clause 3 of Article 275 of the Tax Code of the Russian Federation) or foreign organizations with permanent representative offices in the Russian Federation (clause 3 of Article 275, clause 6 of Article 282.1 of the Tax Code of the Russian Federation).

For information on how dividends are reflected in the declaration, read the article “How to correctly calculate the tax on dividends?”

Agents submit income tax calculations at the end of each reporting (tax) period in which they paid income (clauses 1, 3, 4 of Article 289, Article 285 of the Tax Code of the Russian Federation).

How and where to file a monthly income tax return

It is clear who submits the reports. But the Tax Code of the Russian Federation also describes specific methods for submitting such documents, violation of which will be punished. According to paragraph 3 of Art. 80 of the Tax Code of the Russian Federation, reports are submitted by:

- on paper, in person, by mail

or with the help of

a representative

; - in electronic form via TKS

- with the participation of an EDF operator or through the Federal Tax Service website.

A monthly income tax return (who submits one) can be sent both on paper and in the form of an electronic file if the organization has less than 100 people. If the average headcount is higher, then companies report online. The same method applies to the largest taxpayers

.

In case of violation of this rule ( delivery on paper, not in e-form ),

the fine is 200 rubles (Article 119.1 of the Tax Code of the Russian Federation).

Where do those who submit monthly income tax returns and those who do it once a quarter report? In both cases, the information is sent to the inspectorate at the location. If there is a division, you are allowed to choose where to send the information - at the location of the head office or branch.

In case of submission via TCS, the payer receives a notification about the acceptance (refusal of acceptance) of the declaration. When an organization submits a report on paper, the tax inspector who accepted it puts a signature, registration number and date of receipt on the copy.

For late payment - fine

For violation of the deadline for submitting the declaration, Art. 119 of the Tax Code of the Russian Federation provides for a fine. Its amount is 5% of the amount of tax not paid on time, subject to payment (additional payment) on the basis of this declaration, for each full or partial month of its failure to submit (but not more than 30% of this amount and not less than 1000 rubles).

Both income tax payers and tax agents are subject to liability.

Please note: the fine under Art. 119 of the Tax Code of the Russian Federation can only be imposed for overdue annual declarations. If you are late with the “profitable” declaration of the reporting period, the inspectorate has the right to fine you only 200 rubles. (under Article 126 of the Tax Code of the Russian Federation).

Read more about the liability provided for violating the deadlines for filing a declaration in this material.

In addition to taxation, administrative liability of officials is also possible. This may be a warning or a fine in the amount of 300 to 500 rubles. (Article 15.5 of the Code of Administrative Offenses of the Russian Federation). They are imposed by the court at the request of the tax inspectorate.

In addition to the fine, account blocking is also possible.

Results

The income tax return is submitted on the 28th day of the month following the reporting period, but if the due date falls on a non-working day, it is postponed to the next working day.

For information about reporting and tax periods for income tax, read the article “What is the tax and reporting period for income tax (codes)?”

The materials in the section of the same name on our website will always help you prepare your income tax return.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Decree of the Government of the Russian Federation No. 409 of 04/02/2020, the release of which accountants were eagerly awaiting, provides for the postponement of deadlines for submitting tax and accounting reports.

In this post we will tell you which reports can be submitted later than the usual deadline.

Exact date or not?

It is generally accepted that the date when the day begins to increase is December 22. In all calendars it is celebrated as Winter Solstice Day. But if we are absolutely precise and take into account all the modern research by astronomers and physicists, we will have to state this fact. The position of the sun does not change its inclination at all for several days before and after the solstice. And only 2-3 days after the solstice it can be stated that the time has come when daylight hours begin to increase.

So, if you follow scientific research, the answer to the question of when the day will begin to increase will be December 24-25. It is from this period that the nights become a little shorter, and the daylight hours become longer and longer. But at the everyday level, the information is firmly entrenched that the time when daylight hours begin to increase falls on December 22.

Scientists forgive such inaccuracy. After all, sometimes folk signs based on centuries-old observations are much more tenacious than the latest modern research.

Financial statements

By the time the President announced non-working days, not all accountants had time to draw up and submit their balance sheet for 2020. Someone planned to complete this work in the last days of the deadline, but they were deprived of this opportunity by cutting off access to the workplace. The situation was tense, the accountants were nervous.

After the release of the above-mentioned Resolution, these accountants breathed a sigh of relief. When reading the document literally, it followed that there was still a whole carload of time left to prepare accounting reports for 2020 - until June 30, 2020.

However, with the postponement of the accounting reporting period, some confusion arose. As it turned out later, people simply misunderstood. Yes, the deadline was moved up by 3 months, but not for everyone. The Ministry of Finance and the Federal Tax Service reported this in their joint letter dated 04/07/2020 No. 07-04-07/27289/VD-4-1/ [email protected]

Until June 30, 2020, only those who do not submit reports to GIRBO can submit a balance sheet. These are organizations whose information contains state secrets and those who are subject to economic sanctions of other states.

All other organizations must submit financial statements no later than May 6, 2020.

By the way, an accountant does not have to wait until the end of the non-working period in order to then hastily generate all the reports that were not completed on time.

Upload your 1C database to the cloud, and the lack of daily access to your office computer will no longer be a problem for you.

Make reports without leaving home!

Cloud 1C is easy, fast and inexpensive: register and start working.

Tariffs for renting 1C in the cloud from Scloud start from 760 rubles per month.

Tax reporting

As for tax reporting, the deadlines have been moved up for everyone, both for reports for 2020, which not everyone had time to submit by the time of this whole coronavirus mess, and for reports for the 1st quarter of 2020.

The only catch is that postponing the submission of reports does not affect the postponement of forty payments. Payments have their own deadlines, and reporting has their own deadlines.

For example, you can submit your UTII return for the 1st quarter of 2020 by July 20, and the tax must be paid by May 6.

New deadlines for submitting tax reports:

Table from the Federal Tax Service

To help taxpayers, the Federal Tax Service has developed a table that indicates the postponed deadlines for submitting reports and new deadlines for paying taxes.

Quarantine, self-isolation, non-working days - these are the realities of the present time to which accountants have to adapt.

Until recently, some colleagues were distrustful and wary of cloud-based 1C. But the world is changing. When an accountant is at home in self-isolation, and 1C is on a computer in a closed office, preparing reports becomes difficult.

Try 1C in the cloud. It's simple, convenient, and not expensive.

Try the cloud now

The longest night

If you want to get enough sleep, then December 22nd will be the most successful for you. Astronomers have noticed that the longest night is observed in the Northern Hemisphere on this day. And the very next day, when the day begins to increase, there will be more and more daylight hours.

On December 22, the sun rises above the horizon to its lowest height. There is a fairly simple scientific explanation for this. The Earth's orbit has an ellipsoidal shape. The Earth at this time is at the farthest point of its orbit. Therefore, the Sun in the Northern Hemisphere rises above the horizon to its minimum height in December, and the peak of this minimum occurs on December 22.

New deadlines for reporting

Let us remind you: by Resolution No. 409, for all organizations and individual entrepreneurs, the deadlines for submitting tax reports falling within the period from March 1 to May 31, 2020, were automatically extended by three months. The exception is the VAT return and insurance calculations for the first quarter of 2020 - they must be submitted no later than May 15.

Fill out and submit a VAT return and calculate insurance premiums via the Internet Submit for free

A “squeeze” from the Federal Tax Service table on the main reports is presented below.

Table 1

| Tax | Reporting period | Submission deadline | How long does it last? | New submission deadline |

| Income tax | for 2020 | 3 months | ||

| for the 1st quarter of 2020 | 3 months | |||

| for the first half of 2020 | Not transferable | |||

| VAT | for the 1st quarter of 2020 | until May 15 | ||

| Personal income tax | for 2020 | 3 months | ||

| Insurance premiums | for the 1st quarter of 2020 | |||

| for the first half of 2020 | Not transferable | |||

| Organizational property tax | for 2020 | 3 months | ||

| Transport tax | for 2020 | Not transferable | ||

| Land tax | for 2020 | Not transferable | ||

| USN for legal entities | for 2020 | 3 months | ||

| simplified tax system for individual entrepreneurs | for 2020 | 3 months | ||

| UTII | for the 1st quarter of 2020 | 3 months | ||

| Unified agricultural tax | for 2020 | 3 months | ||

Submit all tax returns online for free

New deadlines for payment of taxes (contributions) for SMEs from affected industries

Resolution No. 409 extended tax payment deadlines only for organizations and individual entrepreneurs that are included in the register of small and medium-sized businesses as of March 1, 2020 and belong to the industries most affected by the coronavirus. The list of such industries was approved by Decree of the Government of the Russian Federation dated 04/03/20 No. 434. It, in particular, included the hotel business, the provision of catering services and some types of household services, etc. Table 2 reflects information on the postponement of payment of basic taxes by small and medium-sized businesses enterprises from the most affected industries.

table 2

| Tax | Reporting period | Payment deadline | How long does it last? | New term |

| Income tax | for 2020 | 6 months | ||

| for the 1st half of 2020 | 4 months | |||

| VAT | for the 1st quarter of 2020 | Not transferable | ||

| Personal income tax (for individual entrepreneurs on OSNO) | for 2020 | 3 months | ||

| Insurance premiums (only for micro-enterprises) | for the 1st quarter of 2020 | 6 months | ||

| Organizational property tax | for 2020 | Not transferable | ||

| Transport tax | for 2020 | Not transferable | ||

| USN for legal entities | for 2020 | 6 months | ||

| USN (for individual entrepreneurs) | for 2020 | 6 months | ||

| UTII | for the 1st quarter of 2020 | 6 months | ||

| Unified agricultural tax | for 2020 | 6 months | ||