Basic version of income taxation and deviations from it

Clause 1 of Art. 284 of the Tax Code of the Russian Federation establishes the basic rate of income tax in 2020. in the amount of 20%. In the basic version, it is distributed between budgets as follows:

- Russian budget – 2%;

- regional budgets – 18%.

However, from 2020 to 2020, a different order is in effect, according to which the federal budget receives 3%, and regional ones - 17%

This deviation is established by the law of November 30, 2016 No. 401-FZ “On Amendments...”.

Also 20% tax is charged:

- From organizations producing hydrocarbons in a new offshore field.

- From controlling persons on the profits of controlled foreign companies.

For the last two categories, distribution between budgets does not apply; all 20% of the tax is credited to the federal budget.

Subjects of the Russian Federation have the right to lower rates for crediting to their budgets for certain categories of taxpayers. In general, the “regional” rate can be reduced to 13.5% (in 2017-2020 - to 12.5%), and for residents of special economic zones - to lower values.

In addition, reduced “regional” rates (from 0% to 10%) are applied to organizations participating in regional investment projects (clause 3 of article 284.3 and clause 3 of article 284.3-1 of the Tax Code of the Russian Federation).

Sample of filling out a payment form for income tax credited to the federal budget in 2020. can be downloaded here.

Other filling options will differ in the purpose of payment (type of budget) and BCC.

Reduced tax rate

In order for the preferential rate to be applied in the region, the authorities of the subject of the federation must adopt appropriate legislation. Federal regulations establish that the portion of the income tax credited to the republican budget for taxpayers established in regional legislation cannot be lower than 12.5%.

How to change mail.ru email address or name?

In addition, there is a certain group of taxpayers that operates in territories recognized as special economic zones. For them, the maximum tax rate is 13.5%.

In this case, the following rates apply:

- In relation to residents of special economic zones.

- When carrying out activities in the territory of a special economic zone located in the Magadan region.

- When carrying out activities in accordance with the legislation of the relevant entity on the territory of the Republic of Crimea and the federal city of Sevastopol.

In the latter cases, in order to apply a preferential rate, business entities must ensure separate accounting of indicators for:

- Income and expenses when carrying out activities in a special economic zone.

- Income and expenses when carrying out activities outside these territories.

Attention! However, it must also be taken into account that certain categories of taxpayers listed by law cannot enjoy preferential rates even when conducting activities in special economic zones. For example, during the extraction of hydrocarbon raw materials.

Taxation of dividend income

Income tax for 2020 in the form of dividends is assessed in accordance with clause 3 of Art. 284 Tax Code of the Russian Federation:

- For Russian organizations - 13% of income received both from residents of the Russian Federation and from foreign companies, as well as income from shares, the rights to which are certified by depositary receipts.

- For foreign companies – 15% of income received from participation in the capital of Russian organizations.

If a Russian organization owned more than 50% of the authorized capital of the paying company during the year before paying dividends, then income on them is taxed at a rate of 0%. If the payer of dividends is a non-resident company, then it should not be included in the so-called. “black list” of offshore companies (order of the Ministry of Finance of the Russian Federation dated November 13, 2007 No. 108n).

Taxation of income from debt obligations

Income tax for 2020 on debt obligations is calculated in accordance with clause 4 of Art. 284 Tax Code of the Russian Federation:

- In the amount of 15% for income on the following types of securities:

– government securities of member countries of the Union State, constituent entities of the Russian Federation and municipal securities;

– mortgage-backed bonds issued after January 1, 2007;

– bonds of Russian resident companies issued in the period 2017-2021. and traded on the organized market

– income received from trust management of mortgage coverage, if the relevant certificates were issued after January 1, 2007.

- The rate of 9% is valid for the following types of securities:

– municipal securities issued before January 1, 2007. for a period of more than 3 years;

– mortgage-backed bonds issued before January 1, 2007;

– income received from trust management of mortgage coverage, if the certificates were issued before January 1, 2007.

- Income from the following debt obligations is taxed at a 0% rate:

Payment deadlines

According to Art.

No. 284 of the Tax Code of the Russian Federation, the income tax rate is 20%, with some exceptions. The distribution of profits for the federal and regional parts for 2017-2024 is as follows:

- 3% of the accrued tax goes to the Federal Budget,

- 17% is transferred to local budgets of the Russian Federation.

This tax rate can be reduced by local governments for certain categories of taxpayers, but only to 13.5%.

Let's look at an example.

The company received a loan from a bank in the amount of 1 million rubles. in the current reporting period.

The prepayment amounted to 400 thousand rubles.

Sales revenue in the 1st quarter amounted to 1,770 thousand rubles, including VAT in the amount of 354 thousand rubles.

Raw materials and supplies were used in the production cycle - 560 thousand rubles.

The workers' wages amounted to 350 thousand rubles, insurance premiums from it amounted to 91 thousand rubles.

Depreciation – 60 thousand rubles, interest on a loan issued to another company – 25 thousand rubles.

The tax loss of the enterprise in the previous period amounted to 120 thousand rubles.

Expenses in this example for the 1st quarter of 2020 will be: 1086 thousand rubles. 25)

Taxable profit: 210 thousand rubles. ((1770 thousand rubles – 354 thousand rubles) – 1086 thousand rubles – 120 thousand rubles)

Amount of income tax: 42 thousand rubles. (210 thousand rubles * 20%), including for transfer to the federal budget - 4.2 thousand rubles, to local budgets - 37.8 thousand rubles.

Monthly advance payments due during the reporting period must be transferred no later than the 28th day of each month of such period.

How to pay less?

"Tax on professional income"

“Registration of self-employed citizens in 2020”

"Taxes and payments for individual entrepreneurs"

The peculiarity of the income tax is that the size of its rate is distributed between budgets of different levels - federal and regional. The basic rates are regulated by the Tax Code in paragraph 1 of Art. 284, but regional authorities are allowed to adjust their share of the tax downward.

the total rate is 20%, of which

- 3% goes to the federal budget;

- The remaining 17% goes to the budgets of the constituent entities of the Russian Federation.

Income tax rates in 2020, in the part allocated to regional budgets, cannot fall below the threshold value of 12.5%.

The above rules for the distribution of tax payments have been updated since the beginning of 2020 and will remain in effect until the end of 2020. Previously, up to 2020 inclusive, 2% was to be transferred to the federal budget, and 18% to the regional budget. At the same time, local authorities were allowed for certain categories of taxpayers to reduce the rate related to their sphere of influence to the level of 13.5% (amendments to the Tax Code of the Russian Federation were made by the law of November 30, 2016 No. 401-FZ and the law of November 27, 2017 No. 348-FZ).

Let’s assume that a company using OSNO and paying tax at the generally accepted rate of 20%:

- income in the 1st quarter of 2020 amounted to RUB 1,350,000;

- expenses accepted for taxation for this period are equal to 1,101,500 rubles.

Based on the results of economic activities for the quarter, the company received a profit in the amount of 248,500 rubles. (1,350,000 – 1,101,500), which is the taxable base for income tax. Tax payments must be made in the following amounts:

- 7,455 rubles will be allocated to the federal budget. (248,500 x 3%);

- 42,245 rubles will be transferred to the regional budget account. (248,500 x 17%).

A reduced income tax rate is provided for organizations participating in special economic zones (SEZ). In the regional part it cannot exceed 13.5% (the exact value is established by the decision of the authorities of the constituent entities of the Russian Federation), and in the federal part it is 2%. SEZ resident organizations are required to keep separate records of income and expenses in areas of activity carried out under preferential tax conditions (in the SEZ territory) and on a general basis (outside the special zone).

For corporate income tax, the 2020 rate for dividends can take the following values:

- 0%, if the Russian company, on the date of the decision to pay dividends, continuously owns at least 50% of the share in the capital of the source of payment for at least 365 days;

- 13% in relation to Russian companies - income received both from residents of the Russian Federation and from foreign legal entities, as well as dividends on shares certified by depositary receipts are taken into account;

- 15% in relation to dividends received by foreign companies on shares of Russian companies and from other participation in capital.

The income tax rate on transactions involving debt obligations can be equal to 15%, 9% or 0% depending on the type of securities and the period of their issue (clause 4 of Article 284 of the Tax Code of the Russian Federation).

An increased rate of 30% is applied to income from securities of Russian companies if they are accounted for by a foreign nominal or authorized holder, and information about the recipient of the income was not provided to the tax agent (clause 4.2 of Article 284 of the Tax Code of the Russian Federation).

The profits of foreign companies operating in the Russian Federation through permanent representative offices are subject to taxation in accordance with the general procedure. In the absence of representation, the rate may be 10% or 20%. In the first situation, we are talking about income received from the rental of vehicles and containers that are used for international transport. For all other income-generating transactions, a rate of 20% is provided (clause 2 of Article 284 of the Tax Code of the Russian Federation).

The zero rate of income tax for 2020 is provided for by law, including for the following Russian organizations:

- enterprises in the field of education and medical care (Article 284.1 of the Tax Code of the Russian Federation);

- agricultural producers and fisheries - in relation to the products produced by them (clause 1.3 of Article 284 of the Tax Code of the Russian Federation);

- participants of the Skolkovo project (clause 5.1 of Article 284 of the Tax Code of the Russian Federation);

- participants in investment projects of a regional scale - in terms of the federal rate (Article 284.3, 284.3-1 of the Tax Code of the Russian Federation);

- organizations focused on social services for citizens of the Russian Federation (Article 284.5 of the Tax Code of the Russian Federation);

- companies conducting tourism and recreational activities within the Far Eastern Federal District (Article 284.6 of the Tax Code of the Russian Federation).

A complete list of tax rates and companies for which it is possible to use reduced income tax rates is given in Art. 284 Tax Code of the Russian Federation.

Income tax is one of the main taxes and fees in the Russian Federation. The range of its payers is quite wide, but only organizations are included in it. This tax does not apply to individual entrepreneurs.

Organizations that pay income tax can include both Russian and foreign companies (Article 246 of the Tax Code of the Russian Federation). There are also beneficiaries, including organizations that are not recognized as payers or are exempt from paying income tax for various reasons.

For more information about who pays and who does not pay income tax, read the article “Who are income tax payers?”

The basic (general) income tax rate is set at 20% (clause 1 of Article 284 of the Tax Code of the Russian Federation). At the same time, for 2017-2020, the traditional division of this value into 2% to the federal budget and 18% to the regional budget has been replaced by a ratio of 3 and 17%.

READ MORE: What you can spend maternity capital on in 2019

However, when paying monthly advances in the 1st quarter of 2020, the rates should have been applied in the old (2 and 18%) values.

The 20% rate was introduced in 2009 and has not changed since then. At the same time, there have been changes recently regarding special rates. Thus, since 2014, an increased 30% rate on income on securities accounted for in securities accounts has appeared for those cases when the tax agent does not have certain information about the recipients of income (clause 4.2 of Article 284 of the Tax Code of the Russian Federation).

And in 2020, the rate on dividends received by Russian organizations was increased from 9% to 13% (subclause 2, clause 3, article 284 of the Tax Code of the Russian Federation). During the periods 2017-2018, the possibility of applying the 0% rate established for legal entities that meet certain parameters was expanded, and the possibility of additional rate reductions was introduced for some situations.

The tax period based on the results of which the final amount of income tax is calculated is the calendar year. It is divided into reporting periods, during and at the end of which advance payments are transferred.

Depending on the procedure chosen by the organization for calculating advance payments for income tax, reporting periods may be:

- I quarter, half year and 9 months;

- or 1 month, 2 months, 3 months and so on until the end of the year, if income tax is paid on the actual profit received.

Based on the results of both reporting and tax periods, income tax payers submit declarations.

For a sample declaration created on a valid form, see the article “Income tax for the 4th quarter - what is the due date?”

Income tax is a direct tax, and its size directly depends on the final financial result of the organization’s activities - profit, which is the object of taxation. For most Russian organizations, as a general rule, profit is considered to be the positive difference between the income received and the expenses incurred (Article 247 of the Tax Code of the Russian Federation).

As for income and expenses, they are divided into those taken into account for taxation (Articles 249, 250, 253, 264 of the Tax Code of the Russian Federation) and those not taken into account when calculating tax (Articles 251, 270 of the Tax Code of the Russian Federation).

In addition, for expenses taken into account in calculating the profit base, Ch. 25 of the Tax Code of the Russian Federation establishes a number of requirements (Article 252 of the Tax Code of the Russian Federation), compliance with which is mandatory in order to reduce the amount of income tax due to them.

Read about the specifics of determining an object for tax purposes in the material “What is the object of taxation for income tax?”

The principle for calculating advance tax payments and the total amount of income tax for a tax period is the same: their amount is determined based on the total tax base for the corresponding period and the tax rate. Moreover, in each subsequent reporting period, advance payments are calculated from the tax base determined on an accrual basis, and their amount payable for this period is determined taking into account the amounts payable for the previous reporting period.

| Types of income | Federal budget rate, % | Rate to the regional budget, % | Base |

| Income other than those listed below | 3 | 17 | Clause 1 of Article 284 of the Tax Code |

| Income in the form of interest on state and municipal bonds issued before January 20, 1997 inclusive | 0 | 0 | Subclause 3 of clause 4 of Article 284 of the Tax Code |

| Income in the form of interest on bonds of the state foreign currency loan of 1999, issued during the implementation of the novation of bonds of the domestic state foreign currency loan of series III | 0 | 0 | Subparagraph 3 of paragraph 4 of Article 284 of the Tax Code |

| Interest income on municipal securities issued for a period of at least three years before January 1, 2007 | 9 | 0 | Subparagraph 2 of paragraph 4 of Article 284 of the Tax Code |

| Interest income on mortgage-backed bonds issued before January 1, 2007 | 9 | 0 | Subparagraph 2 of paragraph 4 of Article 284 of the Tax Code |

| Income of the founders of the trust management of mortgage coverage received on the basis of the acquisition of mortgage participation certificates issued by the mortgage coverage manager before January 1, 2007 | 9 | 0 | Subparagraph 2 of paragraph 4 of Article 284 of the Tax Code |

| Income in the form of interest on government securities of member states of the Union State, government securities of constituent entities and municipal securities (except for the securities indicated above and interest income received by Russian organizations on state and municipal securities placed outside of Russia) | 15 | 0 | Subparagraph 1 of paragraph 4 of Article 284 of the Tax Code |

| Income in the form of interest on government securities received in exchange for government short-term zero-coupon bonds and placed outside of Russia | 15 | 0 | Subparagraph 1 of paragraph 4 of Article 284 of the Tax Code |

| Interest income on mortgage-backed bonds issued after January 1, 2007 | 15 | 0 | Subparagraph 1 of paragraph 4 of Article 284 of the Tax Code |

| Income of the founders of the trust management of mortgage coverage received on the basis of the acquisition of mortgage participation certificates issued by the mortgage coverage manager after January 1, 2007 | 15 | 0 | Subparagraph 1 of paragraph 4 of Article 284 of the Tax Code |

| Dividends received by Russian organizations from participation in other organizations, subject to simultaneous compliance with the following conditions: | 0 | 0 | Subparagraph 1 of paragraph 3 of Article 284 of the Tax Code |

| |||

| |||

| Dividends received by Russian organizations owning depositary receipts, subject to the simultaneous observance of the following conditions: | |||

| |||

| |||

| Dividends received by Russian organizations under other circumstances (not specified in subparagraph 1 of paragraph 3 of Article 284 of the Tax Code), as well as dividends on shares, the rights to which are certified by depositary receipts | 13 | 0 | Subparagraph 2 of paragraph 3 of Article 284 of the Tax Code |

| Dividends received by foreign organizations on shares of Russian organizations or from participation in the capital of organizations in another form | 15 | 0 | Subparagraph 3 of paragraph 3 of Article 284 of the Tax Code |

| Income from securities of Russian organizations (except for dividends), the rights to which are recorded in the securities accounts of foreign holders, authorized holders, as well as depository programs | 30 | 0 | Clause 4.2 of Article 284, Clause 9 of Article 310.1 of the Tax Code |

| Income in the form of dividends on securities of Russian organizations, the rights to which are recorded in the securities accounts of foreign holders, authorized holders, as well as depository programs | 15 | 0 | Clause 4.2 of Article 284, Clause 9 of Article 310.1 of the Tax Code |

| Income from the leasing or subleasing of ships and aircraft and (or) vehicles, as well as containers used in international transport | 10 | 0 | Subparagraph 2 of paragraph 2 of Article 284 of the Tax Code |

| Income from international transportation (including demurrage and other payments arising during transportation) | Subparagraph 7 of paragraph 1 of Article 309 of the Tax Code | ||

| Subparagraph 8 of paragraph 1 of Article 309 of the Tax Code | |||

| Income of a foreign organization received from the distribution in its favor of profits or property of organizations (individuals, associations), which are not dividends | 20 | 0 | Subparagraph 1 of paragraph 2 of Article 284 of the Tax Code |

| Subparagraph 2 of paragraph 1 of Article 309 of the Tax Code | |||

| Income from other debt obligations of Russian organizations | Subparagraph 3 of paragraph 1 of Article 309 of the Tax Code | ||

| Income from the use of intellectual property rights | Subparagraph 4 of paragraph 1 of Article 309 of the Tax Code | ||

| Income received from the sale of shares (shares) of organizations, more than 50% of whose assets directly or indirectly consist of real estate located on Russian territory, as well as financial instruments derived from such shares (shares), with the exception of shares traded on the organized securities market securities in accordance with paragraph 9 of Article 280 of the Tax Code | Subparagraph 5 of paragraph 1 of Article 309 of the Tax Code | ||

| Income from the sale of real estate located on Russian territory | Subparagraph 6 of paragraph 1 of Article 309 of the Tax Code | ||

| Income from leasing or subleasing property used on Russian territory | Subparagraph 7 of paragraph 1 of Article 309 of the Tax Code | ||

| Income from leasing operations (for example, from leasing property used in Russia) | Subparagraph 7 of paragraph 1 of Article 309 of the Tax Code | ||

| Fines and penalties for violation of contractual obligations by Russian organizations, government bodies and (or) executive bodies of local self-government | Subparagraph 9 of paragraph 1 of Article 309 of the Tax Code | ||

| Other similar income | Subparagraph 10 of paragraph 1 of Article 309 of the Tax Code | ||

| Income of agricultural producing organizations (including fishery organizations) | 0 | 0 | Clause 1.3 of Article 284 of the Tax Code |

| Profit of organizations participating in the Skolkovo project received after the loss of the right to be exempt from taxpayer obligations | 0 | 0 | Clause 5.1 of Article 284 of the Tax Code |

| Profit from the activities of educational organizations, including childcare services (except for dividends and income from transactions with certain types of debt obligations) | 0 | 0 | Clause 1.1 of Article 284 of the Tax Code |

| Profit from the activities of medical organizations (except for dividends and income from transactions with certain types of debt obligations) | 0 | 0 | Clause 1.1 of Article 284 of the Tax Code |

| Profit from the activities of organizations providing social services to citizens (except for dividends and income from transactions with certain types of debt obligations) | 0 | 0 | Clause 1.9 of Article 284 of the Tax Code |

| Profit from activities related to the production of hydrocarbons in a new offshore field | 20 | 0 | Clause 1.4 of Article 284 of the Tax Code |

| Profit of organizations participating in regional investment projects | 0 | 10 | Clause 1.5 of Article 284, Clause 3 of Article 284.3 of the Tax Code |

| Profit of organizations participating in regional investment projects that are not included in the register | 0–10 | Clause 1.5-1 of Article 284, Clause 3 of Article 284.3 of the Tax Code | |

| Profits of controlled foreign companies | 20 | 0 | Clause 1.6 of Article 284, Article 309.1 of the Tax Code |

| Profit of organizations participating in the free economic zone | 0 | No more than 13.5 | Paragraph 2 Clause 1.7, paragraph 3 Clause 1.7 of Article 284 of the Tax Code |

| Profit of organizations – residents of the territory of rapid socio-economic development and the free port of Vladivostok | 0 | No more than 5 within five years from the date of profit, no less than 10 over the next five years | Clause 1.8 of Article 284, Article 284.4 of the Tax Code |

| Profit of organizations participating in the special economic zone in the Magadan region | 0 | No more than 13.5 | Paragraph 7, paragraph 1 and paragraph 1.10 of Article 284 of the Tax Code |

| Profit received from the sale or other disposal (including redemption) of shares of Russian organizations (participatory interests in the authorized capital of Russian organizations), acquired starting from January 1, 2011, owned by the taxpayer for more than five years | 0 | 0 | Paragraph 1 Clause 4.1 of Article 284, Article 284.2 of the Tax Code, Clause 7 of Article 5 of the Law of December 28, 2010 No. 395-FZ |

| Profit received from the sale or other disposal (including redemption) of shares, bonds of Russian organizations, investment shares that are securities of the high-tech (innovative) sector of the economy | 0 | 0 | Paragraph 2 Clause 4.1 of Article 284, Article 284.2.1 of the Tax Code |

| Profit received from the implementation of an investment project in the territory of a special economic zone in the Kaliningrad region | 0 | 0 | Article 288.1 Tax Code |

| Within six tax periods from the date of receipt of the first profit | Within six tax periods from the date of receipt of the first profit | ||

| 1,5 | 8,5 | ||

| Over the next six tax periods | Over the next six tax periods | ||

| Profit received from tourism and recreational activities in the Far Eastern Federal District | 0 | 0 | Clauses 1 and 2 of Article 284.6 of the Tax Code |

| Profit received from activities in tourist and recreational special economic zones united in a cluster (subject to separate accounting of income and expenses associated with activities in the special economic zone and outside it) | 0 | No more than 13.5 | Paragraph 7 Clause 1 and clause 1.2 of Article 284 of the Tax Code |

| Profit received from activities in technology-innovative special economic zones (subject to separate accounting of income and expenses associated with activities in the special economic zone and outside it) | 3 | No more than 13.5 | Paragraph 5 and 7 Clause 1 of Article 284 of the Tax Code, clause 5 of Article 10 of the Law of November 30, 2011 No. 365-FZ |

| Profit of organizations - residents of special economic zones (except for tourism and recreation, united in a cluster, and technology-innovation zones) | 2 | No more than 13.5 | Clause 1.2-1, paragraph 7 clause 1 of Article 284 of the Tax Code |

MORE: Requirements for a bank guarantee under 44-FZ

| Types of income | Federal budget rate, % | Rate to the regional budget, % | Base |

| Income other than those listed below | 3 | 17 | clause 1 art. 284 NK |

| Income in the form of interest on state and municipal bonds issued before January 20, 1997 inclusive | 0 | 0 | subp. 3 p. 4 art. 284 NK |

| Income in the form of interest on bonds of the state foreign currency loan of 1999, issued during the implementation of the novation of bonds of the domestic state foreign currency loan of series III | 0 | 0 | subp. 3 p. 4 art. 284 NK |

| Interest income on municipal securities issued for a period of at least three years before January 1, 2007 | 9 | 0 | subp. 2 clause 4 art. 284 NK |

| Interest income on mortgage-backed bonds issued before January 1, 2007 | 9 | 0 | subp. 2 clause 4 art. 284 NK |

| Income of the founders of the trust management of mortgage coverage received on the basis of the acquisition of mortgage participation certificates issued by the mortgage coverage manager before January 1, 2007 | 9 | 0 | subp. 2 clause 4 art. 284 NK |

| Income in the form of interest on government securities of member states of the Union State, government securities of constituent entities and municipal securities (except for the securities indicated above and interest income received by Russian organizations on state and municipal securities placed outside of Russia) | 15 | 0 | subp. 1 clause 4 art. 284 NK |

| Income in the form of interest on government securities received in exchange for government short-term zero-coupon bonds and placed outside of Russia | 15 | 0 | subp. 1 clause 4 art. 284 NK |

| Interest income on mortgage-backed bonds issued after January 1, 2007 | 15 | 0 | subp. 1 clause 4 art. 284 NK |

| Income of the founders of the trust management of mortgage coverage received on the basis of the acquisition of mortgage participation certificates issued by the mortgage coverage manager after January 1, 2007 | 15 | 0 | subp. 1 clause 4 art. 284 NK |

| Dividends received by Russian organizations from participation in other organizations, subject to simultaneous compliance with the following conditions: ∙ share of participation (contribution) – at least 50%; ∙ continuous period of ownership of shares (deposit) – at least 365 days Dividends received by Russian organizations owning depositary receipts, subject to the simultaneous observance of the following conditions: ∙ depository receipts give the right to receive dividends in an amount that is at least 50% of the total amount of dividends; ∙ continuous period of holding depositary receipts – at least 365 days | 0 | 0 | subp. 1 clause 3 art. 284 NK |

| Dividends received by Russian organizations under other circumstances (not mentioned in subparagraph 1, paragraph 3, Article 284 of the Tax Code), as well as dividends on shares, the rights to which are certified by depositary receipts | 13 | 0 | subp. 2 p. 3 art. 284 NK |

| Dividends received by foreign organizations on shares of Russian organizations or from participation in the capital of organizations in another form | 15 | 0 | subp. 3 p. 3 art. 284 NK |

| Income from securities of Russian organizations (except for dividends), the rights to which are recorded in the securities accounts of foreign holders, authorized holders, as well as depository programs | 30 | 0 | clause 4.2 art. 284, paragraph 9 of Art. 310.1 NK |

| Income in the form of dividends on securities of Russian organizations, the rights to which are recorded in the securities accounts of foreign holders, authorized holders, as well as depository programs | 15 | 0 | clause 4.2 art. 284, paragraph 9 of Art. 310.1 NK |

| Income from the leasing or subleasing of ships and aircraft and (or) vehicles, as well as containers used in international transport Income from international transportation (including demurrage and other payments arising during transportation) | 10 | 0 | subp. 2 p. 2 art. 284 NK subp. 7 clause 1 art. 309 NK subp. 8 clause 1 art. 309 NK |

| 20 | 0 | subp. 1 item 2 art. 284 NK | |

| Income of a foreign organization received from the distribution in its favor of profits or property of organizations (individuals, associations), which are not dividends | subp. 2 p. 1 art. 309 NK | ||

| Income from other debt obligations of Russian organizations | subp. 3 p. 1 art. 309 NK | ||

| Income from the use of intellectual property rights | subp. 4 paragraphs 1 art. 309 NK | ||

| Income received from the sale of shares (shares) of organizations, more than 50% of whose assets directly or indirectly consist of real estate located on Russian territory, as well as financial instruments derived from such shares (shares), with the exception of shares traded on the organized securities market securities in accordance with paragraph 9 of Article 280 of the Tax Code | subp. 5 p. 1 art. 309 NK | ||

| Income from the sale of real estate located on Russian territory | subp. 6 clause 1 art. 309 NK | ||

| Income from leasing or subleasing property used on Russian territory | subp. 7 clause 1 art. 309 NK | ||

| Income from leasing operations (for example, from leasing property used in Russia) | subp. 7 clause 1 art. 309 NK | ||

| Fines and penalties for violation of contractual obligations by Russian organizations, government bodies and (or) executive bodies of local self-government | subp. 9 clause 1 art. 309 NK | ||

| Other similar income | subp. 10 p. 1 art. 309 NK | ||

| Income of agricultural producing organizations (including fishery organizations) | 0 | 0 | clause 1.3 art. 284 NK |

| Profit of organizations participating in the Skolkovo project received after the loss of the right to be exempt from taxpayer obligations | 0 | 0 | clause 5.1 art. 284 NK |

| Profit from the activities of educational organizations, including childcare services (except for dividends and income from transactions with certain types of debt obligations) | 0 | 0 | clause 1.1 art. 284 NK |

| Profit from the activities of medical organizations (except for dividends and income from transactions with certain types of debt obligations) | 0 | 0 | clause 1.1 art. 284 NK |

| Profit from the activities of organizations providing social services to citizens (except for dividends and income from transactions with certain types of debt obligations) | 0 | 0 | clause 1.9 art. 284 NK |

| Profit from activities related to the production of hydrocarbons in a new offshore field | 20 | 0 | clause 1.4 art. 284 NK |

| Profit of organizations participating in regional investment projects | 0 | 10 | clause 1.5 art. 284, paragraph 3 of Art. 284.3 NK |

| Profit of organizations participating in regional investment projects that are not included in the register | 0–10 | clause 1.5-1 art. 284, paragraph 3 of Art. 284.3 NK | |

| Profits of controlled foreign companies | 20 | 0 | clause 1.6 art. 284, art. 309.1 NK |

| Profit of organizations participating in the free economic zone | 0 | no more than 13.5 | para. 2 clause 1.7, para. 3 clause 1.7 art. 284 NK |

| Profit of organizations – residents of the territory of rapid socio-economic development and the free port of Vladivostok | 0 | no more than 5 within five years from the date of profit, no less than 10 over the next five years | clause 1.8 art. 284, art. 284.4 NK |

| Profit of organizations participating in the special economic zone in the Magadan region | 0 | no more than 13.5 | para. 7 clause 1 and clause 1.10 art. 284 NK |

| Profit received from the sale or other disposal (including redemption) of shares of Russian organizations (participatory interests in the authorized capital of Russian organizations), acquired starting from January 1, 2011, owned by the taxpayer for more than five years | 0 | 0 | para. 1 clause 4.1 art. 284, art. 284.2 Tax Code, paragraph 7 of Art. 5 of the Law of December 28, 2010 No. 395-FZ |

| Profit received from the sale or other disposal (including redemption) of shares, bonds of Russian organizations, investment shares that are securities of the high-tech (innovative) sector of the economy | 0 | 0 | para. 2 clause 4.1 art. 284, art. 284.2.1 NK |

| Profit received from the implementation of an investment project in the territory of a special economic zone in the Kaliningrad region | 0 within six tax periods from the date of receipt of the first profit | 0 within six tax periods from the date of receipt of the first profit | Art. 288.1 NK |

| 1,5 over the next six tax periods | 8,5 over the next six tax periods | ||

| Profit received from tourism and recreational activities in the Far Eastern Federal District | 0 | 0 | clauses 1 and 2 art. 284.6 NK |

| Profit received from activities in tourist and recreational special economic zones united in a cluster (subject to separate accounting of income and expenses associated with activities in the special economic zone and outside it) | 0 | no more than 13.5 | para. 7 clause 1 and clause 1.2 art. 284 NK |

| Profit received from activities in technology-innovative special economic zones (subject to separate accounting of income and expenses associated with activities in the special economic zone and outside it) | 3 | no more than 13.5 | para. 5 and 7 paragraph 1 art. 284 Tax Code, paragraph 5 of Art. 10 of the Law of November 30, 2011 No. 365-FZ |

| Profit of organizations - residents of special economic zones (except for tourism and recreation, united in a cluster, and technology-innovation zones) | 2 | no more than 13.5 | clause 1.2-1, para. 7 clause 1 art. 284 NK |

Taxation of income of foreign companies

If a non-resident company operates in the Russian Federation through a permanent representative office, then its profits are taxed on a general basis, similar to Russian organizations

If there is no representative office, then tax is levied depending on the type of income:

- In the amount of 10% - on income from the use or rental of vehicles for international transport.

- In the amount of 20% - for all other income of a foreign company, except dividends and income on debt obligations.

All tax amounts on dividends, debt obligations and income of non-residents who do not have a permanent establishment are credited to the federal budget (clause 6 of Article 284 of the Tax Code of the Russian Federation).

“Zero” income tax benefit

For certain categories of legal entities or types of income, there is a preferential income tax rate for 2020, namely 0%. Some cases of its application (for dividends and debt obligations) were discussed above.

In addition to them, the “zero” benefit applies in the following cases:

- For educational and medical organizations (Article 284.1 of the Tax Code of the Russian Federation).

- For residents of tourist and recreational economic zones united in a cluster - in terms of the tax credited to the federal budget.

- For agricultural and fisheries producers in terms of their agricultural products and their processed products.

- For participants in regional investment projects (clause 2 of Article 284.3, clause 2 of Article 284.3-1 of the Tax Code of the Russian Federation), participants in the free economic zone, residents of the priority development territory and the free port of Vladivostok (Article 284.4 of the Tax Code of the Russian Federation). For all categories listed in this paragraph, the benefit applies only to the “federal” part of the tax.

- For organizations providing social services to citizens (Article 284.5 of the Tax Code of the Russian Federation).

- For the Central Bank of the Russian Federation.

- For participants of the Skolkovo project after the termination of the use of the right to exemption and before exceeding the established limit (clause 2 of Article 246 of the Tax Code of the Russian Federation and clause 5.1 of Article 284 of the Tax Code of the Russian Federation).

- For income from operations from the sale or other disposal of participation interests in the authorized capital of Russian companies (clause 4.1 of Article 284 of the Tax Code of the Russian Federation).

Deadlines for paying income taxes in 2020 and filing reports

The tax system in Russia involves three categories of periods for paying tax on profits received and filing reporting documentation:

- Totals - for the past calendar year;

- Advance quarterly - for each reporting quarter;

- Advances per month - for each reporting month.

Depending on the type of business you have, you can choose quarterly or monthly payments. The former are considered more effective because they allow you to reduce the number of documents submitted to the Federal Tax Service, as well as immediately take into account profits and expenses for three months. On the other hand, there are several categories of companies that can make payments exclusively quarterly. These include:

- budgetary and non-profit organizations;

- foreign companies with permanent establishment;

- participants of partnerships, including investment ones.

When do you need to make tax payments?

According to the rules, advance quarterly income tax payments for the previous reporting year are made no later than March 28 of the following reporting year. For each quarter, payment is made no later than the 28th day of the following month after the reporting quarter. So, for example, for the 1st quarter of 2020 it is necessary to pay income tax by April 28, 2020, for the 2nd quarter (half year) by July 30, and for the 3rd quarter (9 months) by October 29.

Quarterly advance payments in practice are calculated as:

The amount of the quarterly advance (the one that must be paid) = Quarterly advance for the reporting period (for the entire period from the beginning of the reporting year) - Quarterly advance for the previous period (made for the previous quarter or quarters).

If you make advance monthly payments, your tax for the previous year is paid in the same way as the quarterly payment method. In turn, for each subsequent month, payments are made no later than the 28th day of the current reporting month. In this case, an additional payment is made quarterly for income not taken into account in the reporting periods.

Monthly advance payments are calculated based on the income tax calculated for the previous period. In this case, the total tax for the previous quarter is divided into three equal payments.

If, when paying income tax in Russia in 2020, you received an overpayment, which can be quite common when taking into account advance payments, you can request the tax service to send the excess towards future payments or other tax payments, or make a refund for an account opened with a credit institution.

Income tax reporting form

Reporting on the payment of income tax is provided in the form of a declaration. It is submitted to the Tax Service:

- at the place of registration (work) of the company;

- at the location of the branch or division of the company.

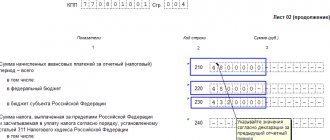

In 2020, the declaration form can be obtained on the Tax Service website. It includes:

- Title page 01 - here all data about the company (organization) is filled in;

- Subsection 1.1 (Section 1) - the amount of tax for the corresponding period is entered here;

- Subsection 1.2 - only for monthly payments;

- Sheet 02 - here the income and expenses on the basis of which the tax amount is calculated are indicated;

- Appendixes - explanations of income and expenses.

The income tax return for each reporting period is submitted to the Federal Tax Service by the 28th of the next month.

Fines for non-payment of income taxes in 2020

In a number of cases, accepted as a violation at the legislative level, the tax authorities may impose appropriate fines on you. They apply to the following situations:

- Late submission of a declaration to the Federal Tax Service - a fine of 5% of the amount of tax presented in the corresponding declaration;

- Violation of the established procedure for filing a declaration - a fixed fine of 200 rubles;

- Complete non-payment of taxes, incomplete payment or payment of taxes after the expiration of the deadlines specified by the rules - 20% of the amount owed;

- Refusal (failure to submit) to provide the tax authorities with documents to verify the tax reporting data of your enterprise - a fine of up to 10,000 rubles;

- Hiding real income or the presence of unreasonable expenses (fictitious data on expenses) - from 20% to 40% of the amount of the hidden tax.

Despite strict legislation, for most companies, income tax in Russia in 2020 can be optimized by various organizational and legal measures. First of all, this includes the possibility of switching to other types and special tax regimes. Also quite legal methods are: withdrawing part of the income by creating additional organizations, the registration form of which allows the use of simplified systems or preferential rates, transferring reconstruction contracts into contracts for major repairs, drawing up leasing agreements instead of sale and purchase and others, selected taking into account the specifics your activities.