Minimum wage: decoding the concept

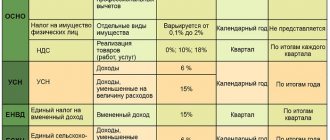

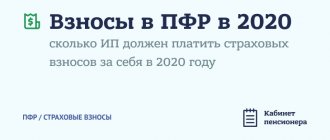

The acronym MROT, widely used since the 1990s, stands for minimum wage. And today the importance of this indicator is difficult to underestimate, because this is the basis from which the minimum amounts of sick leave and benefits for pregnant women are calculated, as well as mandatory insurance payments of self-employed persons for periods until the end of 2020 (from 2020 this link has been canceled).

For information about the amounts in which self-employed persons have been paying contributions since 2020, read the article “What insurance premiums does an individual entrepreneur pay in 2018-2019?” .

Previously, this universal indicator also served to calculate some taxes, fines and a number of obligations under civil contracts, in which the condition of linking to the minimum wage was introduced. But currently the minimum wage is not applied for these purposes.

Minimum wage and benefits

The minimum wage includes social benefits, except for sick leave and parental leave. For each type of benefit, amounts are calculated using the appropriate formula.

Maternity

The allowance for maternity and pregnancy leave depends on the employee’s length of service:

- work experience of more than six months with full-time work: the benefit is calculated from the average daily earnings and may exceed the minimum wage;

- less than six months of experience with full-time work: the monthly benefit calculation cannot exceed the monthly minimum wage.

The duration of standard maternity leave is 140 days. Taking this period into account, the minimum amount of maternity leave is calculated.

The amount of maternity benefit is calculated in three steps:

- Calculate average daily income:

Psr = Srp / (Drp - Dirp), where

- Psr - average profit per day;

- SRP - the amount of the employee’s income for the billing period;

- Drp - the number of days in the calendar for the calculated period;

- Dirp.

https://www.youtube.com/watch?v=upload

Spd = Psr * 100%, where

- SPD - daily allowance;

- Psr - average income per day.

Sd = Spd * db, where

- SD - amount of maternity leave;

- Spd - the amount of maternity leave per day;

- DB - period of maternity leave, or sick leave for pregnancy and childbirth.

Here we considered a standard situation with a minimum period of maternity leave and a singleton pregnancy. The legislation provides for other situations for maternity leave and child care.

| Situation | Number of days, term |

| Standard, singleton pregnancy | 140 |

| Standard, multiple pregnancy | 194 |

| Early labor | 156 |

| Residents of Chernobyl, singleton pregnancy | 160 |

| Residents of Chernobyl, early birth | 176 |

| Adoption of one child | 70 |

| Adopting more than one child | 110 |

Sick leave

Average daily salary according to the minimum wage = minimum wage * 24/730, where

- Minimum wage - minimum wage;

- 24 - number of months;

- 730 is the number of days.

So, the average daily minimum wage in 2020:

- 11 280 * 24 = 270 720;

- 270 720 / 730 = 370,85.

For each day of sick leave, the employee will receive 370 rubles 85 kopecks. If over the previous two years the employee took sick leave, then these days are subtracted from 730 days and, accordingly, the number of months is reduced.

But in order for a citizen to receive temporary disability benefits, the person’s total length of service must be at least six months.

Average salary according to the minimum wage = minimum wage / number of calendar days per month.

So, in 2020, a citizen will receive, for example, for April: 11,280 / 30 = 376 rubles for one day of sick leave.

Minimum wage in Russia

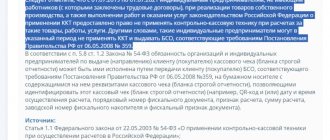

The Federal Law on the minimum wage is adopted by the State Duma of the Russian Federation annually. The essence of each new law comes down to amending Art. 1 and 2 of the Law “On Minimum Wages” dated June 19, 2000 No. 82-FZ. So, in Art. 1 indicates the new minimum wage established in the Russian Federation for the current year (for example, for the minimum wage in 2020, in force from 01.05.2018, - 11,163 rubles per month), and in Art. 2 determines the start of the new minimum wage (for example, the start of the 2018 minimum wage is 05/01/2018).

The minimum wage applied from January 1, 2019 is equal to the subsistence level of the working-age population for the 2nd quarter of 2018. Its value is 11,280 rubles.

The minimum wage established by the State Duma of the Russian Federation is called federal. In addition to the federal minimum wage, regional minimum wages may be established in the constituent entities of the Russian Federation.

Read about the dynamics of the federal minimum wage and the relationship between its value and the level of the subsistence level in the Russian Federation here .

How to properly increase wages to the new minimum wage in the regions

If an employee’s salary for full working hours is less than the new minimum wage or the regional or industry minimum, then it must be increased from January 1, 2020. Here are the options:

Option No. 1: salary increase

This option is not very convenient. After all, every time the minimum wage changes, you will have to issue not only an order to increase wages, but also change employment contracts, staffing schedules and other documents that mention the size of salaries. But if this option suits you, then we offer sample documents for downloading:

Also .

Option number 2: additional payment

Establish a special surcharge in a local act, for example, in a separate order or regulation on wages. After all, it is not the salary that is compared with the minimum wage, but the total salary. That is, salary plus bonuses and other benefits.

This method is easier. There is no need to edit employment contracts and other local acts every time the minimum wage changes. It is enough to establish a compensatory additional payment up to the minimum wage once, for example, in the regulations on wages.

What is included in the minimum wage

Art. 133 of the Labor Code of the Russian Federation provides that the salary of an employee who has worked a full month and fulfilled all his job duties cannot be lower than the minimum wage. Therefore, if an employer is checked to ensure that employees’ wages comply with the minimum wage approved for the current year, the inspector will check the level of the salary established for him with the minimum wage in force in the region.

Read about which of the components of the salary cannot be set less than the minimum wage in the material “Art. 135 of the Labor Code of the Russian Federation: questions and answers" .

Salary below the minimum wage: responsibility and fines

What is the importance of the minimum wage? There are many reasons. The first and most important point is that the amount of wages directly depends on it. An employer has no legal right to pay its employees below the minimum wage for full-time work.

This legislative requirement is enshrined in Article 133 of the Labor Code of the Russian Federation. The essence of the article boils down to the following: if an employee has worked a full month, being at work no less than the established working norm and having completed his work in full, his salary for the month cannot be set less than the amount of the approved minimum wage (minimum wage).

The official GIT resource explains that the amount of salary received by an employee may be lower than the minimum wage, however, provided that the employee has chosen a part-time work schedule or performs his job duties on a part-time basis. It is acceptable for the salary to be below the minimum wage.

Attention! Salary indexation calculator (Article 134 of the Labor Code of the Russian Federation).

In addition to the salary, the total salary also includes other accruals in accordance with Article 129 of the Code:

- compensation payments,

- various types of allowances,

- payments to stimulate employees.

It follows from this that, taking into account the allowances and incentives provided by law, the employee should not receive an amount less than the minimum wage.

If it turns out that, even taking into account additional payments, the employee is accrued an amount less than the minimum mandatory level, the employer will have to make an additional payment to equalize the amount.

Every employer should be aware that by paying its staff a salary less than the required minimum, it creates a significant legal risk. The inspection can check the organization's compliance with labor legislation regarding the amount of payments. Violations are subject to fines.

How to calculate sick leave from the minimum wage?

Read here what rights an employee has to additional professional education.

When to expect a salary increase for public sector employees in 2020, read the link: https://novocom.org/trudovoe-pravo/kogda-budet-povyshenie-zarplaty-byudzhetnikam-v-2018-godu-i-na-skolko.html

The Code of Administrative Offenses of the Russian Federation contains a separate provision for this offense in Part 6 of Article 5.27, according to which perpetrators face sanctions ranging from a warning to an administrative fine:

- the official guilty of the violation is obliged to pay 10-20 thousand rubles,

- if the legal entity is guilty person, sanctions are one step higher - 30-50 thousand rubles.

The repetition of such a violation implies a proportional increase in the scope of liability:

- The fine for officials will increase to 20-30 thousand. Disqualification for a period of 1-3 years may be used as a substitute for a fine,

- up to 50-100 thousand rubles for the guilty legal entity. faces.

Watch the video.

https://youtu.be/bzRidQtlI5Q

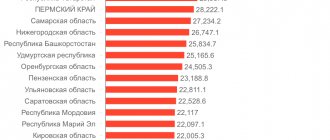

Minimum wage in 2018–2019 in the regions

The minimum wage established in the region cannot be less than the federal minimum wage. It is determined by an agreement between representatives of the government of a constituent entity of the Russian Federation, trade unions and employers. Employers in the region who have not submitted to the government of a constituent entity of the Russian Federation compelling reasons for not joining this agreement are required to apply the regional minimum wage when setting wages (Article 133.1 of the Labor Code of the Russian Federation).

To learn about the cases in which additional payment is made up to the minimum wage, read the article “Additional payment up to the minimum wage for external and internal part-time workers .

About the minimum wage in the region

Minimum wage – the lowest salary in the Russian Federation, incl. for work without qualifications or work experience. Article 133 of the Labor Code of the Russian Federation stipulates that the minimum wage cannot be below the level of the subsistence minimum (ML) in the country.

The PM is established depending on the volume of consumption of the most necessary goods and their prices. This is the minimum survival kit for a month. Therefore, it is logical that the salary should be the same.

The minimum wage is the amount that the employee is ultimately given in person. This does not include personal income tax of 13%, so your take-home salary may be less than the minimum wage. An employee can count on this money only if he has worked the entire month without a break and is employed full-time.

Tatarstan is famous for its enterprises; it is in the top 5 among the regions of the Russian Federation in terms of minimizing layoffs, salary delays, etc. The level of employee satisfaction is quite high. Several large spheres of production are developed in Tatarstan - science, the oil complex, and agriculture. The PM level is quite high. For such “expensive” regions it would be unfair to be guided by the level of the federal minimum wage. That is why Article 133.1 of the Labor Code of the Russian Federation provides for the right of the region to independently set the minimum wage. For this purpose, a tripartite commission is convened with the obligatory presence of representatives of the authorities, employers and workers. In Tatarstan, the Commission operates on the basis of:

- Resolutions dated December 22, 2004 No. 551;

- Law of the Republic of Tajikistan dated July 26, 2004 N 42-ZRT “On Social Partnership Bodies in the Republic of Tatarstan.”

After adoption, the Agreement in accordance with Law No. 27-ZRT dated 06.08.2003 is always published for public viewing in the newspapers “Vatanym Tatarstan”, “Respublika Tatarstan” and on the portals of the Governments of the Russian Federation and the Republic of Tatarstan (www.pravo.gov.ru).

Minimum wage in Moscow

In Moscow, the minimum wage is also established by signing a regional agreement between the capital government, local trade union associations and Moscow employers' associations. Currently, the agreement dated December 15, 2015, relating to the period 2016–2018, is in force. It stipulates that the minimum wage for Moscow is revised quarterly and brought to the subsistence level of the working population. However, if the cost of living decreases, then the minimum wage is not subject to reduction, but remains equal to that in force in the previous quarter.

In all other aspects, the minimum wage in Moscow is subject to the general requirements of the minimum wage legislation.

What is the minimum wage in 2018–2019 in Moscow

The minimum wage (Moscow) from 10/01/2017 was increased to 18,742 rubles. in accordance with the increase in the cost of living in the region (Resolution of the Moscow Government dated September 12, 2017 No. 663-PP).

Based on the results of the 3rd quarter of 2020, the cost of living in Moscow turned out to be lower than in the 2nd quarter of 2020, therefore the minimum wage has not changed since 01/01/2018 and amounted to 18,742 rubles. Since November 1, 2018, the cost of living in Moscow has increased slightly and amounted to 18,781 rubles. (Decree of the Moscow Government dated September 19, 2018 No. 1114-PP).

Definition and purpose

The subsistence minimum means the minimum income that allows a person to maintain health and provide him with acceptable living conditions for one month. PM represents the cost of a consumer basket consisting of essential products, goods and services. The cost is revised to take into account inflation once a quarter.

Federal Law No. 134-FZ of October 24, 1997 requires updating the value once every three months separately for workers, pensioners and children. For subjects, this document is a reference document in the development of similar regional regulations.

In the Republic of Tatarstan, the living wage is approved on the basis of:

- Law No. 92-ZRT dated July 20, 2005, dictating the procedure for determining the value,

- Law No. 62-ZRT dated July 13, 2013, which sets out the minimum food standard per person.

The law on increasing the minimum wage from January 1, 2020 in 85 regions of the Russian Federation - what do you need to know?

Results

The abbreviation MROT stands for minimum wage.

It is installed at both the federal and regional levels. The federal minimum wage increases 1–2 times a year. The regional minimum wage may be revised more often, but in any case cannot be less than the federal minimum wage. The size of this parameter determines the minimum salary level and the minimum amount of sick leave payments and child benefits. You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.