Home / Labor Law / Payment and benefits / Wages

Back

Published: 01/12/2018

Reading time: 9 min

0

3065

The minimum wage, also called the minimum wage, is established by the government at the federal level and is needed to regulate wages in Russia, as well as to determine various payments and benefits, the amount of which directly depends on the minimum wage (for example, the amount of sick leave, maternity benefits and childbirth, fines, taxes, fees and other payments).

The minimum wage changes almost every year due to inflation. From January 1 of this year it amounted to 7,500 rubles per month.

On July 1, 2020, the minimum wage will increase to 7,800 rubles per month.

- Minimum wage for the last 11 years

- How are things going in the regions?

- Minimum wage and living wage

Dear readers! To solve your problem, call hotline 8 or ask a question on the website. It's free.

Ask a Question

Increase in the minimum wage from July 1, 2020

From July 1, the minimum wage is 7,800 rubles. instead of 7500 rub. From this date, take the new minimum into account when calculating wages and benefits.

At the same time, constituent entities of the Russian Federation (regions) are given the right to establish on their territory a minimum wage that differs from the federal minimum wage (Article 133.1 of the Labor Code of the Russian Federation). The regional “minimum wage” is established by a tripartite agreement. It is agreed upon at the level of the government or administration of the subject (region, territory, autonomous district, etc.), associations of trade unions and associations of employers. So, for example, from July 1, 2020, the minimum wage in Moscow increased to 17,624 rubles. See “Minimum wage in Moscow from July 1, 2020.”

But what minimum wage should workers’ salaries be compared with – regional or federal? The answer is simple: compare the monthly payment with the “minimum wage” that is higher. The final amount must be in favor of the employee. At the same time, keep in mind that the totality of all payments established to the employee that make up his salary must be no less than the regional minimum wage (Article 129 of the Labor Code of the Russian Federation). That is, not only salary, but also compensation with bonuses.

Typically, the regional minimum wage is higher than the federal one. However, in July 2017, a situation cannot be ruled out when the federal minimum wage is higher than the regional one. So, for example, in the Arkhangelsk region the minimum wage is set for the entire 2020 - 7,500 rubles per month, and the federal one from July 1 - 7,800 rubles. It turns out that from July 1 in the Arkhangelsk region, for calculations and determination of earnings, it is necessary to take into account the federal minimum wage (7,800 rubles).

Also note that in addition to wages, the minimum wage affects three types of benefits:

- sick leave;

- for pregnancy and childbirth;

- for child care up to 1.5 years.

However, keep in mind that these benefits are considered from the federal, not the regional minimum wage. For more information, see “Benefits from July 1, 2020: new sizes.”

Minimum Rot in Novosibirsk in 2018

Today, the minimum wage in Russia is 11 thousand.

From January 1, the federal minimum wage will be equal to the subsistence minimum for the working population in Russia for the second quarter of the previous year, in other words - 11 thousand.

Accordingly, the minimum wage for residents of the Novosibirsk region will be 14 thousand. Let us recall that at the end of December last year a federal law was signed on a gradual increase in the minimum wage to the subsistence level.

VIDEO ON THE TOPIC: Putin: The minimum wage and the cost of living will be equalized from May 1, 2020

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call the numbers provided on the website. It's fast and free!

- The minimum wage for Novosibirsk residents exceeded 12,000 rubles from May 1

- New minimum wage from May 1, 2020 in the Novosibirsk region

- From January 1, 2020, the minimum wage in the Novosibirsk region will increase to 14,100 rubles

- Minimum wage (minimum wage) in the Novosibirsk region

- ads

- Mrot in the Novosibirsk region

- MMR in the Novosibirsk region from January 1, 2020

- Mrot in Novosibirsk from May 1, 2020

The minimum wage for Novosibirsk residents exceeded 12,000 rubles from May 1

The minimum wage has increased throughout the country since May 1, 2018, in accordance with the federal law signed by Vladimir Putin in March of this year.

The total federal minimum wage from May 1 is 11 rubles. In addition to salaries, this will affect payments in connection with childbirth, payment of maternity leave and childcare benefits for children up to one and a half years old for working citizens, as well as payment for sick leave.

At the same time, the new minimum wage will not affect the increase in social pensions, because the calculation of pensions is based on the subsistence level.

The allocation of support measures to the regions was announced twice - in March and April of the year. The total amount of support for the year for the Novosibirsk region will be, according to the government decree, thousand. According to Prime Minister Medvedev, an increase in the minimum wage will lead to a reduction in the difference between salary levels in the regions and will have a positive impact on demand.

According to his calculations, a proportional increase in salaries for all state employees would require ten times more budget funds. For some entrepreneurs, an increase in the minimum wage entails the withdrawal of salaries from the shadows.

Director of the Research Financial Institute of the Ministry of Finance, Vladimir Nazarov, in a commentary to RBC, expressed fears that private business may respond to an increase in the minimum wage by reducing the number of employees or transferring them to part-time work.

Advertising on RBC www. Sale of business. RBC Prize Economics of Innovation Health. USD Exchange Hide banners. Novosibirsk Your location?

The whole world. St. Petersburg and region. Vologda Region. Krasnodar region. Krasnoyarsk region. Nizhny Novgorod. Perm region. Technology and media. Your own business. Change region. Economics of Innovation.

Video playback error. Please update your browser. News feed. All news Novosibirsk. For the first time, the minimum wage in Novosibirsk will exceed the subsistence level. Anna Ivanova.

increase in minimum wage.

Sample letter. Contact Information. Advertising placement. Internship program. Regional versions. RBC newsletter. RBC Alerts. Legal information. Quotes of world financial instruments are provided by Reuters.

New minimum wage from May 1, 2020 in the Novosibirsk region

The minimum wage from January 1 of the year in the Novosibirsk region compared to other constituent entities of the Russian Federation will be significantly higher, taking into account regional coefficients.

We will tell you how much the salaries of employees in the non-budgetary and budgetary spheres will increase.

In the Novosibirsk region there is a minimum wage established in the region in accordance with federal law. In addition, a regional coefficient has been established in the region. We'll talk about this later.

Note to the table: updated minimum wage values for a specific date are highlighted in bold. The values are given in the Novosibirsk region for , , , , , years.

The minimum wage has increased throughout the country since May 1, 2018, in accordance with the federal law signed by Vladimir Putin in March of this year. The total federal minimum wage from May 1 is 11 rubles.

In addition to salaries, this will affect payments in connection with childbirth, payment of maternity leave and childcare benefits for children up to one and a half years old for working citizens, as well as payment for sick leave.

At the same time, the new minimum wage will not affect the increase in social pensions, because the calculation of pensions is based on the subsistence level.

From January 1, 2020, the minimum wage in the Novosibirsk region will increase to 14,100 rubles

This happened due to two regional coefficients established in the region. Activate trial access to the journal “RNA” or subscribe with a discount. During the year, the minimum wage increased twice: from January 1 and May 1.

This was done in order to bring the minimum wage closer to the cost of living. The minimum wage is the minimum amount that an employer can charge in favor of an employee. But in some cases, wages may be lower for legal reasons:.

The minimum wage may be higher than the minimum wage established by federal law from

Minimum wage (minimum wage) in the Novosibirsk region

You can view the minimum payment amounts for previous years in the chart. The minimum wage rate is set on the basis of agreements between the regional government and the union of entrepreneurs. Addresses of the labor inspection in Moscow in the Moscow region in St. Petersburg in the Leningrad region all regions. Legal advice Questions and answers Dismissal Salary.

Download the minimum wage table for all regions for the year.

News is updated daily. The latest Iskitim news on various topics. Here you will find news from politics, culture, sports, economics, incidents of Iskitim, Berdsk, Iskitim region.

ads

.

WATCH THE VIDEO ON THE TOPIC: The cost of living has increased

.

Mrot in the Novosibirsk region

.

In the year the minimum wage in the Novosibirsk region is set at rubles. View the minimum payment amounts for previous ones.

.

Mrot in Novosibirsk from May 1, 2020

.

.

.

.

Source: https://ekaterina-monastir.ru/zemelnoe-pravo/mrot-po-novosibirsku-v-2018-godu.php

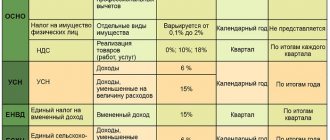

Minimum wage and taxes

Some employers set the employee's salary strictly in accordance with the minimum wage (no more and no less). However, if an employee’s salary is equal to the minimum wage, personal income tax and insurance premiums, including “for injuries,” should still be withheld from it. This is confirmed by legal norms:

- Personal income tax – articles 210 and 217 of the Tax Code of the Russian Federation;

- insurance contributions for compulsory pension (social, medical) insurance - Articles 420 and 422 of the Tax Code of the Russian Federation;

- insurance premiums for insurance against industrial accidents and occupational diseases (“injuries”) - Articles 20.1 and 20.2 of the Law of July 24, 1998 No. 125-FZ.

Salary below the minimum wage: responsibility and fines

Moscow employers (organizations and individual entrepreneurs) must set a salary no less than the Moscow minimum wage (RUB 18,742) only if they have joined the Moscow regional agreement. Those employers who, within 30 calendar days after the publication of the agreement, have not sent a written reasoned refusal to join to the labor authority of a constituent entity of the Russian Federation, will automatically join it.

Compare the total payment amount for the month with the minimum wage before you withhold personal income tax. That is, a person can receive less than the minimum wage.

Include in the minimum wage all bonuses and rewards included in the remuneration system. The exception is regional coefficients and bonuses; they are calculated above the minimum wage.

For wages below the minimum wage, fines are imposed without proper justification. The company, if the violation is the first, faces a fine from 30,000 to 50,000 rubles. If the violation is repeated – from 50,000 to 70,000 rubles. For an official, the sanctions are accordingly: a fine from 1000 to 5000 rubles. and from 10,000 to 20,000 rubles. or disqualification from one to three years.

Why is the minimum wage important? For many reasons. First of all, wages depend on it. The employer does not have the right to pay full-time employees a salary below the minimum wage, as stated in Art. 133 of the Labor Code of the Russian Federation: “The monthly salary of an employee who has fully worked the standard working hours during this period and fulfilled labor standards (job duties) cannot be lower than the minimum wage.”

GIT on its official website clarifies that wages may be less than the minimum wage if the employee works part-time or part-time. “The salary may be less than the minimum wage. In addition to salary, wages include compensation payments, various bonuses and incentive payments (Article 129 of the Labor Code of the Russian Federation).

The employer must understand that he is at great risk if his employees receive wages below the minimum wage. The labor inspectorate may fine him. According to Part 6 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation, such a violation entails a warning or the imposition of an administrative fine on officials in the amount of 10,000 to 20,000 rubles; for legal entities - from 30,000 to 50,000 rubles.

For repeated violations, the fine for officials ranges from 20,000 to 30,000 rubles. or disqualification for a period of one to three years; for legal entities - from 50,000 to 100,000 rubles.

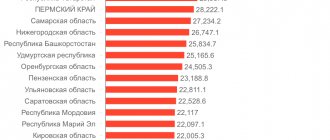

Minimum wage from July 1, 2020: table by region

Below we present a table with the minimum wage from July 1, 2020 (by region). Also, for convenience, the values are broken down by federal district.

| Central Federal District | ||

| Region | Minimum wage until July 1, 2020, rub. | Minimum wage from July 1, 2020, rub. |

| Belgorodskaya | Not lower than the subsistence level (for extra-budgetary sphere) | 8,368 (for enterprises financed from the regional and local budget) |

| 7800 (for enterprises financed from the federal budget) | ||

| 8046 (for enterprises financed from the regional and local budget) | ||

| 7500 (for enterprises financed from the federal budget) | ||

| Bryansk | 7500 | 7800 |

| Vladimirskaya | 8500 | 8840 |

| 7500 (for state employees) | 7800 | |

| Voronezh | Living wage | 7800 |

| Ivanovskaya | — | |

| Kaluzhskaya | — | |

| Kostromskaya | — | |

| Kursk | 9665 | |

| 7800 (for state employees) | ||

| Lipetskaya | 1.2 living wage | — |

| Moscow | 12500 | 13750 |

| 7,500 (for state employees) | 7,800 (for state employees) | |

| Orlovskaya | Living wage | 10000 |

| Ryazan | 7500 | 7800 |

| Smolenskaya | ||

| Tambovskaya | ||

| Tverskaya | ||

| Tula | 13000 | 13520 |

| 11,000 (for state and municipal institutions) | 11440 | |

| Yaroslavskaya | 9640 | 10026 |

| 8021 (for small and medium-sized businesses) | 8,342 (for small and medium-sized businesses) | |

| 7560 (for state employees) | 7,800 (for state employees) | |

| Moscow | 17561 | 17624 |

How is the minimum wage set in Moscow?

Employers have the legal opportunity to refuse the Moscow minimum wage and adhere to the federal minimum wage in Moscow in 2020. Your refusal must be sent within 30 calendar days from the official publication of the Moscow government decree on the new living wage. The refusal must be sent to the Moscow Tripartite Commission at the address: 121205, Moscow, st. Novy Arbat, 36.

| To the Head of the Moscow Public Relations Committee Address: 121205, Moscow, st. Novy Arbat, 36/9 A.V. Chistyakov from LLC "MOSTOVIK" INN 7708123456 KPP 770801001 Address (legal and actual): 125008, Moscow, st. Mikhalkovskaya, 20 |

REFUSAL to join the regional minimum wage agreement

Taking advantage of the right granted by Article 133.1 of the Labor Code of the Russian Federation, due to the lack of sufficient funds due to the formation and development of the organization, we notify you that MOSTOVIK LLC refuses to join the Moscow tripartite agreement for 2016–2018 between the Moscow Government and Moscow trade union associations and Moscow employers' associations dated December 15, 2020 No. 77-848.

Applications:

- protocol of consultations between MOSTOVIK LLC and the trade union;

- proposals of MOSTOVIK LLC on the timing of increasing the minimum wage of employees to the amount provided for by the Moscow tripartite agreement for 2016–2018 between the Moscow Government, Moscow trade union associations and Moscow employer associations dated December 15, 2020 No. 77-848.

| CEO | A.S. Fur |

| (position of the head of the enterprise) | |

| M.P. | |

| Chief Accountant | A.P. Lazareva |

In Moscow, as a subject of the Russian Federation, the amount of the “minimum wage” in relation to workers in non-budgetary areas of activity is regulated by an Agreement concluded by a tripartite commission. The commission includes the Moscow Government, representatives of trade union organizations and the Confederation of Employers (Agreement No. 77-1094 of October 1, 2018). The document is valid from 2020 to 2021.

In accordance with Art. 3.1 of the Agreement, the minimum wage in Moscow from January 1, 2019 must coincide with the minimum wage established for citizens working in Moscow. Since the minimum wage indicator for Muscovites is revised quarterly, the size of the minimum wage, following the revision of the minimum wage, is adjusted upward or left unchanged.

PM in the 3rd quarter decreased and amounted to 18,580 rubles for workers (Moscow Government Decree No. 1465 of December 4, 2018). In the 4th quarter of 2020, the monthly minimum wage continued to decline and amounted to 18,376 rubles for able-bodied citizens (Resolution No. 181-PP of March 12, 2019). The minimum wage in Moscow in 2020 remained at the level of the 2nd quarter of 2020.

| PM indicator for working Muscovites | Moscow minimum wage | Period |

| RUB 18,376 | RUB 18,781 — Moscow minimum wage from January 1, 2020 | 4th quarter 2020 |

| RUB 18,580 | RUB 18,781 | 3rd quarter 2020 |

| RUB 18,781 | RUB 18,781 | 2nd quarter 2020 |

Moscow is a huge metropolis and it is expensive to live in. Prices for food, non-food items, public transport, apartment rentals, and utilities are much higher than in the regions. Accordingly, it is simply impossible to live on the federal minimum wage in the capital. To do this, the Moscow authorities use the regional right to set their own minimum wage, which is set higher than the federal value.

| Region | Minimum wage in 2020, rub. |

| Moscow region | 14 200 |

| Leningrad region | 12 000 |

| Saint Petersburg | 18 000 |

| Kaliningrad region | 12 000 |

| Republic of Tatarstan | 12 000 |

For more information about the minimum wage in the Northern capital, read the article “Minimum wage in St. Petersburg.”

Let us highlight several situations when in Moscow in 2020, instead of the regional minimum wage, it is necessary to use the federal one (even if there was no refusal to join the agreement).

Federal minimum wage in 2019-2020

As Art. says 133 of the Labor Code of the Russian Federation, the minimum wage is fixed at the federal level. This means that it is impossible to set a payment less than the minimum wage.

But increasing this indicator is allowed at the level of constituent entities of the Russian Federation - as a result of the adoption of a regional regulatory act (Part 6 of Article 133 of the Labor Code of the Russian Federation). You can introduce your own regional minimum wage if a consolidating decision of the three branches of regional government is developed on this matter:

- government of a constituent entity of the Russian Federation (territory, region, republic, city);

- trade union association;

- Federation of Employers (Union of Industrialists, Entrepreneurs).

The text of the agreement reached is published in the regional media, after which it comes into force: all employers in the region must pay their employees no less than the established wage. The employer has the right to try to justify its position of disagreement with the regional minimum wage within a month.

EXCEPTIONS! Regional minimum wages should not be applied by those organizations that are financed from the federal budget, that is, state and municipal institutions, as well as those that are independently funded.

The minimum wage (minimum wage) at the state level is approved by the relevant federal law. The minimum wage is valid throughout Russia and cannot be less than the subsistence level of able-bodied citizens for the 2nd quarter of the previous year for the purpose of calculating wages (Article 1 of the Law “On the Minimum Wage” dated June 19, 2000 No. 82-FZ).

- from 10,000 to 20,000 rub. on officials;

- from 30,000 to 50,000 rub. for legal entities;

- from 1,000 to 5,000 rubles. for individual entrepreneurs operating without forming a legal entity.

If previously neither the social nor financial departments of the Russian Federation, nor parliamentarians could establish compliance with the minimum wage to the subsistence level, then in March 2020 the President of the Russian Federation signed Law No. 41-FZ dated 03/07/2018, the norms of which determined that from 05/01/2018 the minimum wage will be equal to the subsistence level of the working-age population for the 2nd quarter of last year.

Thus, the minimum wage as of May 1, 2018 was 11,163 rubles. The Ministry of Labor approved the cost of living for the 2nd quarter of 2018 in the amount of 11,280 rubles. And since the cost of living for the 2nd quarter of 2020 is equal to the minimum wage for 2020, then from 01/01/2019 the value of the federal minimum wage is 11,280 rubles.

The same applies to the minimum wage for 2020. It is equal to the cost of living for the 2nd quarter of 2020, which is 12,130 rubles. (see order of the Ministry of Labor dated 08/09/2019 No. 561n)

The minimum wage regulates not only wages, but also the amount of benefits (including maternity benefits), and until the end of 2020, the amount of contributions for individual entrepreneurs. Let's look at how the minimum wage changed over the period from 2013 to 2020.