Table of changes in the minimum wage value in the region

| date | Value, rub. | Normative act |

| from 01.01.2020 |

| Art. 1 of the Law of June 19, 2000 No. 82-FZ on the minimum wage. Agreement on the minimum wage in the Republic of Khakassia dated 03/05/2019. |

| from 01/01/2019 |

| Art. 1 of the Law of June 19, 2000 No. 82-FZ on the minimum wage. |

| from 05/01/2018 |

| Art. 1 of the Law of June 19, 2000 No. 82-FZ on the minimum wage. |

| from 01/01/2018 |

| Art. 1 of the Law of June 19, 2000 No. 82-FZ on the minimum wage. |

| from 01.07.2017 |

| Art. 1 of the Law of June 19, 2000 No. 82-FZ on the minimum wage. |

| from 01.07.2016 |

| Art. 1 of the Law of June 19, 2000 No. 82-FZ on the minimum wage. |

| from 01/01/2016 |

| Art. 1 of the Law of June 19, 2000 No. 82-FZ on the minimum wage. |

| from 01/01/2015 |

| Art. 1 of the Law of June 19, 2000 No. 82-FZ on the minimum wage. |

| from 01/01/2014 |

| Art. 1 of the Law of June 19, 2000 No. 82-FZ on the minimum wage. |

FILES

Note to the table: updated minimum wage values for a specific date are highlighted in bold. The values in the Republic of Khakassia for 2014, 2020, 2020, 2020, 2020, 2020, 2020 are given. These minimum wage values are applied in the cities of Abakan, Chernogorsk and other settlements of the Republic of Khakassia.

See also: - living wage in the Republic of Khakassia - minimum wage in other regions

NMK "Fund for the Development of Small and Medium Enterprises" on April 23, 2020 begins accepting applications for financial assistance to SMEs included in the list of economic sectors most affected by the worsening situation as a result of the spread of a new coronavirus infection in the Murmansk region, approved by Government Decree Murmansk region dated April 15, 2020 No. 217-PP.

Who can receive:

- an individual entrepreneur without employees for one-time compensation of costs in the amount of no more than 1 minimum wage (RUB 27,899);

- a small and medium-sized business entity for compensation of costs associated with paying wages to employees, a lump sum in the amount of 1 minimum wage (RUB 27,899) per employee, but not more than 5 minimum wages for SMEs.

What documents are required to apply:

Individual entrepreneur without employees:

- Statement

— A certified copy of the passport (certified in person by the owner of the passport)

— A document confirming the decrease in revenue in the period from March 25, 2020 to the date of filing the application in comparison with the same period until March 25, 2020. by no less than 30% (for example, a bank statement from a current account for the indicated periods)

SMSP for salary compensation:

- Statement

— A certified copy of the passport (certified in person by the owner of the passport)

— Bank statement from the current account confirming the decrease in revenue in the period from 03/25/2020 to the date of application in comparison with the same period until 03/25/2020. no less than 30%

— A copy of the monthly personalized report to the Pension Fund of the Russian Federation in the form SZV-M for the month preceding the month of filing the Application for financial support, with an acceptance mark (receipt of dispatch), with MANDATORY depersonalization of personal data of the Applicant’s employees

— The current staffing table of the Applicant, reflecting official salaries, regional coefficient and percentage bonuses of employees, with the mandatory depersonalization of their personal data.

What to pay attention to when applying:

— The full package of documents is accepted ONLY in electronic form via email (providing original documents is not required!)

— The email address specified in the application must match the email address from which the application came

— The payment is transferred ONLY to the current account of the individual entrepreneur/LLC.

Regulations on the procedure for providing financial assistance to individual entrepreneurs without employees

Regulations on the procedure for providing financial assistance to SMEs

More detailed information about the terms, procedure and conditions for providing support, as well as the procedure for submitting documents, can be found on the website business51.rf, and can also be obtained by calling the hotline.

About the minimum wage in the region

The minimum wage is used in the Russian Federation to regulate labor relations, as well as when determining the amount of disability payments. Thus, the tasks of the minimum wage are defined in Federal Law No. 82-FZ. In economics, the main function of the minimum wage is to restrain the desires of monopolistic companies to reduce rates for unskilled labor as much as possible.

In Russia, the minimum wage is tied to the cost of living - the subsistence minimum (LM). PM is the cost of material and intangible benefits that a working person must be able to pay in order to survive for a month. This list includes only the essentials, no frills.

Paying less than the minimum wage means dooming an employee to live below the poverty line. Because In essence, the PM is the price of a set of goods, then it is reasonable to assume that the PM varies from place to place due to differences in prices. The minimum wage is a federal indicator, its figure remains unchanged. But the minimum in the region must correspond to the local PM. Therefore, the Labor Code of the Russian Federation stipulates in Article 133.1: the administration of the subject is independent in resolving issues regarding the size of salaries.

In the Republic of Khakassia, a tripartite commission on social and labor cooperation was established to resolve labor tariff issues. Representatives of the authorities, trade unions and employers' associations discuss mutual interests and settle on a figure that satisfies everyone. An agreement on new minimum wages in different industries is mandatory for all employers in the region. For violation, companies face either a fine or criminal liability.

New minimum wage from January 1, 2020: table for all regions

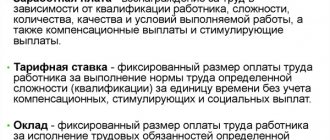

Sometimes the salary may be less than the minimum wage after January 1, 2020, since the salary includes not only the salary itself, but also compensation payments (for example, various allowances for working conditions), as well as incentive payments (for example, bonuses) (Art. 129 of the Labor Code of the Russian Federation).

Therefore, if in a month an employee receives, taking into account all allowances and incentives, an amount greater than or equal to the minimum wage, then this is quite normal. Organizations must set wages no less than the regional minimum wage if they have joined regional agreements. “By default”, those employers who, within 30 calendar days after the official publication of the agreement, have not sent a written reasoned refusal to join to the labor authority of a constituent entity of the Russian Federation, join the regional agreement. If such a refusal occurred, then compare salaries with the federal minimum wage. If the refusal was not sent, rely on the regional minimum wage (Part 8 of Article 133.1 of the Labor Code).

What do minimum wages and PM affect?

Citizens with an income per family member below the minimum subsistence minimum are recognized as low-income and receive various social support measures.

Recognition of a low-income family in the Murmansk region is the basis for:

- payment of monthly child benefit;

- assignment of benefits to the poor;

- receiving a monthly payment at the birth of the third and subsequent child until he reaches three years of age;

- targeted social assistance;

- a one-time benefit when a child enters first grade.

Minimum wage is the smallest amount below which wages cannot be set for full-time workers. In the amount of the minimum wage, citizens receive benefits for temporary disability, pregnancy and childbirth in the absence of earnings in the billing period.

What is the minimum wage (minimum wage) in St. Petersburg in 2019-2020?

The minimum wage in 2020 (by region)

If the salary of employees is less than the regional minimum wage, but higher than the federal minimum wage, then the salary will have to be revised upward to the minimum wage of the region, but only if the organization has joined the regional agreement on the minimum wage.

Using this online service, you can keep accounts for OSNO (VAT and income tax), simplified tax system and UTII, generate payments, personal income tax, 4-FSS, SZV-M, Unified Account 2020 and submit any reports via the Internet, etc. (from 350 r/month). 30 days free (now 3 months free for new users). With your first payment (via this link) three months free.

Minimum wage and cost of living in the Tula region for 2020

It is important to note that the cost of living data established for the 2nd quarter of the previous year, that is, 2020, are taken into account. In the Tula region, this figure for the working population was 10,486 rubles (according to Resolution No. 304 of 08/06/2020). At the same time, the income of a family of 3 people should not exceed 47,187 rubles.

We recommend that you read: Compensation for Leave Upon Dismissal 2020

After the adoption of Law No. 418-FZ of December 28, 2020, which establishes the amount of benefits for the first and second child, many are interested: 1.5 subsistence minimum in the Tula region - how much? The question is clear: not everyone has the right to receive a monthly payment, but only persons determined by law. These include citizens of the Russian Federation who had a child after January 1, 2020, but the average per capita family income does not exceed 1.5 times the subsistence level for the working population.

Living wage

In general, for all categories of persons, the current living wage is fixed by Decree of the Government of the Tula Region No. 446 dated October 29, 2018 for the 3rd quarter of 2020:

- per capita - 9,915 rubles,

- for workers - 10,627 rubles,

- pensioners - 8,508 rubles,

- children - 9,760 rub.

If we compare with the data for the same 3rd quarter of 2020 (Resolution No. 501 of October 30, 2017), we can notice an upward trend, albeit insignificant:

- per capita - 9,498 rubles,

- per worker - 10,194 rubles,

- per child - 9,310 rubles,

- for a pensioner – 8,137 rubles.

The resolution for the 4th quarter of 2020 has not yet been released, but is expected. For the 1st quarter of 2020, data will only be available closer to May.

To determine the living wage of a pensioner in the Tula region, a local law is issued. This is done in order to establish social supplements to pensions, the amount of which is lower than the PM value.

Regional law No. 90-ZTO dated October 25, 2018 established that the cost of living in the Tula region in 2020, from January 1, per pensioner will be 8,658 rubles. Act 77-ZTO dated October 26, 2017 stated that in 2020 this figure was equal to 8,622 rubles: an increase of 36 rubles.

Federal or regional

Article 133.1 of the Labor Code of the Russian Federation states that the constituent entities of Russia have the right to enter into an agreement on the minimum wage in accordance with economic conditions. Consequently, the minimum wage differs across Russian regions.

If there is a formalized agreement, employers and social services are required to use the local indicator to calculate:

- salaries;

- vacation pay;

- business trips;

- sick leave;

- benefits that are calculated based on average earnings, for example, for maternity and child care.

Photo: Mohamed_hassan / pixabay

The indicator applies to all residents of the region, city, etc., except for those:

- who works in federally funded organizations;

- whose employers officially refused to apply the local “minimum wage”.

Reference! The minimum wage established in the region of the Russian Federation cannot be less than the federal one. That is, in no locality in Russia, from 01/01/2020, a full-time salary can be calculated below 12,130 rubles.

If the regional value is rejected, the federal value is used for calculation, but taking into account the regional coefficient (RK), if it is established by law.

Let's look at examples:

- In the Astrakhan region. no additional documents were entered, but the RK was set at 1.35. Therefore, the minimum amount is 12,130 × 1.35 = 16,375.50 rubles.

- In the Karachay-Cherkess Republic, only the Federal Law is in force, so the payment is 12,130 rubles.

- In the Kemerovo region. a local document was signed providing for a 50% increase compared to the regional PM for the 2nd quarter. 2020 Therefore, in 2020 the figure will be 12,130 * 1.5 = 16,516.50 rubles.

- In Moscow, the lower limit is set at 20,195 rubles, which corresponds to the city subsistence level for 2 square meters. last year.

There is no procedure for joining the agreement. If the employer has not provided written notice within 30 days of the Commission's publication of the legislation, the employer is automatically deemed to have accepted the instrument and is required to comply with its provisions.

Minimum wage in the Tula region from January 1, 2020

From January 1, 2020, Tula employers have no right to pay wages lower than those established in the regional agreement (commercial organizations - 13,250 rubles per month, state and municipal institutions (organizations) of the Tula region - 11,440 rubles per month).

From January 1, 2020, the Federal minimum wage increased to the subsistence level in Russia and amounted to 11,280 rubles. The regional minimum is higher than the federal value, therefore employers of commercial companies, as well as state and municipal institutions of the Tula region must pay their employees in 2020 no less than 13,520 rubles and 11,440 rubles per month, respectively. Organizations financed from the federal budget need to focus on the amount of 11,280 rubles.

We recommend that you read: Seizure of the only home from a debtor in 2020

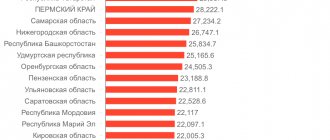

Minimum wage in 2020 from January 1: table by region

The monthly salary, subject to the temporary norm worked, cannot be less than the minimum wage. It is not the salary that is taken into account, but the total payments. They include the rate, bonuses, allowances and surcharges, but do not include northern allowances and regional coefficients (Part 2 of Article 146, Article 148 and Article 315 of the Labor Code).

Documentation support for work with personnel

- Meets the requirements of the professional standard “Human Resources Management Specialist”

- For passing - a certificate of advanced training

- Educational materials are presented in the format of visual notes with video lectures by experts

- Ready-made document templates are available that you can download and keep for your work

Mort in the Tula region in 2020

An increase in the minimum wage will affect wage increases. Please note that individual regions have their own minimum wage. The article contains a table of minimum wages from January 1, 2020 by region, broken down by city. For all the latest news about what the minimum wage will be from January 1, 2020, see our article. From January 1, the minimum wage is divided into: federal (valid throughout Russia) and regional (established in a specific region, always higher than the federal one). When raising employee salaries, companies must be guided by the regional minimum wage.

What will the federal minimum wage be from January 1, 2020 (the law was signed by Putin, latest news) From January 1, 2020, the minimum wage is equal to the subsistence level for the working-age population for the 2nd quarter of last year. This follows from Law No. 421-FZ. The draft of the Ministry of Labor on establishing a living wage for the 2nd quarter states that the cost of living for the working population for the 2nd quarter of 18 is 11,280 rubles. Therefore, the federal minimum wage from January 1, 2020 is 11,280 rubles. Starting with the salary for January 2020, the employer will not be able to pay an employee who has worked the monthly standard working hours a salary below 11,280 rubles. The increase in the minimum wage compared to May 1 was 117 rubles.

How is the cost of living calculated?

To determine the size of the subsistence minimum, the predicted value of the price index in the region is taken into account, as well as the prices of products that are included in the consumer basket. It represents the minimum list of goods, services and expenses that the average person needs for a normal life. It includes food, medicines, expenses for public transport and payments for housing and communal services, services, purchases of clothing, shoes and some other consumer goods. Food makes up half of the consumer basket. In fact, its value expression changes along with the growth of tariffs, prices of goods, and travel.

The law on increasing the minimum wage from January 1, 2020 in 85 regions of the Russian Federation - what do you need to know?

Minimum wage in 2020

Republic of Adygea (Adygea), Republic of Altai, Republic of Bashkortostan, Republic of Buryatia, Republic of Dagestan, Republic of Ingushetia, Kabardino-Balkarian Republic, Republic of Kalmykia, Karachay-Cherkess Republic, Republic of Karelia, Komi Republic, Republic of Crimea, Mari El Republic, Mordovia Republic, Republic of Sakha (Yakutia), Republic of North Ossetia - Alania, Republic of Tatarstan (Tatarstan), Republic of Tyva, Udmurt Republic, Republic of Khakassia, Chechen Republic, Chuvash Republic - Chuvashia;

From January 1, 2020, the minimum wage is equal to the subsistence level for the working-age population for the 2nd quarter of last year. This follows from Law No. 421-FZ. The draft of the Ministry of Labor on establishing a living wage for the 2nd quarter states that the living wage for the working population for the 2nd quarter of 2020 is 11,280 rubles. Based on this, the federal minimum wage from January 1, 2020 is 11,280 rubles.

Local features

The minimum size established in the Murmansk region, as in other Russian regions, is established on the basis of a decision of a tripartite commission. Traditionally, it includes an equal number of government representatives, employers and trade union members.

Each side provides 7 people. This procedure is regulated by the Law of the Murmansk Region No. 6-01-ZMO dated May 31, 1995. The list of districts and the coefficients that apply to them is contained in Letter of the Ministry of Labor No. 1199-16 dated June 9, 2003.

In Art. 5 of Law No. 579-01-ZMO of December 29, 2004 states that the regional coefficient is valid and widely used in the territory of the region under consideration. Its size is 1.5 for employees of organizations financed by the regional budget. If we talk about enterprises that are financed by local budgets, the coefficient is set by local authorities.

From January 1, 2020, the minimum wage in the Murmansk region exceeded the mark of 27,899 rubles. This is due to the fact that in relation to the federal indicator of 12,130 rubles, a regional coefficient is used - a multiplier of 1.5, as well as polar allowances of 80%. That is, in total, the minimum wage at the federal level is multiplied by 2.3, and employers do not have the right to pay lower wages.