Is it necessary to provide a 2-NDFL certificate to an employee under a GPC agreement?

At the same time, more and more Russian companies hire employees under contract agreements, and accountants have a question about issuing a 2-NDFL certificate for such freelance workers.

To understand the essence of this problem, it is necessary to clearly understand the similarities and differences between a GPC agreement and an employment contract. Most of the differences relate to the relationship between employee and employer. The main point that interests accounting is related to the fact that “contractors” are exempt from paying contributions to the Social Insurance Fund. The employer pays for them only to the Pension Fund and the Compulsory Medical Insurance Fund. Employees with whom relations are formalized under the Labor Code often ask the accounting department for a certificate in form 2-NDFL. Such a document is needed to confirm the borrower’s income when receiving a loan. The certificate will be required when moving to a new job, filing a tax deduction, calculating a pension, processing documents for the adoption of a child, and so on.

An individual works according to the GPA. Certificate 2-NDFL, certificate for calculating benefits

Is an employer obligated to issue a 2-NDFL certificate and a certificate for calculating benefits to an individual who worked under the GPA upon dismissal - read the article.

Question: An employee works under a GPC agreement. Upon his dismissal, is it necessary to issue him a 2-NDFL certificate and a certificate for calculating benefits?

Answer:

There is no obligation to issue a 2-NDFL certificate. The certificate is issued only upon application by the taxpayer.

Also read: 2-NDFL certificate: new form in 2020

Alexander Sorokin answers,

Deputy Head of the Operational Control Department of the Federal Tax Service of Russia

“Cash payment systems should be used only in cases where the seller provides the buyer, including its employees, with a deferment or installment plan for payment for its goods, work, and services.

It is these cases, according to the Federal Tax Service, that relate to the provision and repayment of a loan to pay for goods, work, and services.

If an organization issues a cash loan, receives a repayment of such a loan, or itself receives and repays a loan, do not use the cash register. When exactly you need to punch a check, look at the recommendations.”

From the recommendation: Is it necessary to use cash register when issuing, receiving and repaying a loan?

Ask your question to the experts of the Glavbukh System

A certificate for calculating benefits is not issued to individuals working under the GPA, since payments under the GPA are not subject to insurance premiums in case of temporary disability and in connection with maternity.

Rationale

How to submit a certificate in form 2-NDFL

Issuance of certificates to taxpayers

In addition to the tax inspectorate, tax agents are required to issue certificates in form 2-NDFL to taxpayers upon their application (clause 3 of Article 230 of the Tax Code of the Russian Federation).

* Such certificates are needed, in particular, when an employee moves from one organization to another within a year.

When providing an employee with standard tax deductions, the accounting department at the new place of work is obliged to take into account the amount of income that he received at his previous place of work. The amount of income must be confirmed by a certificate in form 2-NDFL.

How to calculate contributions to compulsory pension (social, medical) insurance for payments under civil contracts and copyright contracts

Calculation procedure

Calculate insurance premiums from remuneration under civil contracts in the same way as from payments under employment contracts.

The only exception: for remuneration under civil law contracts there is no need to accrue contributions to the Federal Social Insurance Fund of Russia for compulsory social insurance in case of temporary disability and in connection with maternity* (clause 2, part 3, article 9 of the Law of July 24, 2009 No. 212 -FZ).

Order of the Ministry of Labor of the Russian Federation dated April 30, 2013 No. 182N Appendix No. 2

“The procedure for issuing a certificate of the amount of wages, other payments and remunerations for the two calendar years preceding the year of termination of work (service, other activities) or the year of applying for a certificate of the amount of wages, other payments and remunerations, and the current calendar year for which insurance premiums were calculated, and the number of calendar days falling in the specified period for periods of temporary disability, maternity leave, parental leave, the period of release of the employee from work with full or partial retention of wages in accordance with the legislation of the Russian Federation , if insurance contributions to the Social Insurance Fund of the Russian Federation were not accrued for the retained wages for this period"

2. The Certificate is issued on the day of termination of work (service, other activity) for the insurer, during which time the person was subject to compulsory social insurance in case of temporary disability and in connection with maternity.

* If it is impossible to deliver the Certificate directly on the day of termination of work (service, other activity), the policyholder sends the insured person to the address of his place of residence, known to the policyholder, a notice of the need to appear for the Certificate or to give consent to send it by mail.

If the insured person agrees to send the Certificate by mail, the specified person shall notify the policyholder in writing.

Alexander Sorokin answers,

Deputy Head of the Operational Control Department of the Federal Tax Service of Russia

“Cash payment systems should be used only in cases where the seller provides the buyer, including its employees, with a deferment or installment plan for payment for its goods, work, and services.

It is these cases, according to the Federal Tax Service, that relate to the provision and repayment of a loan to pay for goods, work, and services.

If an organization issues a cash loan, receives a repayment of such a loan, or itself receives and repays a loan, do not use the cash register. When exactly you need to punch a check, look at the recommendations.”

From the recommendation: Is it necessary to use cash register when issuing, receiving and repaying a loan?

Will income under the GPC agreement be reflected in personal income tax certificate 2?

If an individual is officially employed, he receives additional income under a civil law agreement (also officially), but from another organization. Can they find out about such income at their main place of work? What worries me most is certificate 2 of personal income tax, because it (in my opinion) reflects information about all the employee’s income

They can find out one way or another - both from the certificate (although these certificates are looked at only when it is necessary to resolve a particular issue) and not from the certificate - “good people” who are guided by the article “on non-reporting” that they know are always and everywhere - can “ report to the authorities”…. Another thing is that you are not doing anything illegal. The law does not prohibit any part-time work. nor earn extra money under civil contracts..

New income codes in 2-NDFL in 2020

– material savings are actually material assistance or a form of counter-fulfillment by an organization or entrepreneur of an obligation to the taxpayer, including payment (remuneration) for goods supplied by the taxpayer (work performed, services rendered). Reason: Federal Law of November 27, 2017 No. 333-FZ.

If the winnings received by participants in gambling and lotteries do not exceed 4,000 rubles, then they are not subject to personal income tax. In the event that the amount of winnings ranges from 4,000 to 15,000 rubles, then individuals will be required to independently pay tax to the budget.

Certificate 2 personal income tax under the GPC agreement

5.3. Hello! They lie to you shamelessly. According to the Civil Code of the Russian Federation, Article 420. The concept of a contract 1. A contract is an agreement between two or more persons on the establishment, modification or termination of civil rights and obligations. In this case, this is an agreement between two equal parties and there must be 2 copies of the agreement, one for each party, no regulations matter when there is a federal law. Request your copy of the contract. In general, if you wish, you can go to court and recognize your relationship as an employment relationship and force it to conclude an employment contract with you. Of course, they will not issue you a 2-personal income tax if they are not your tax agent and do not pay personal income tax for you. This is your concern - paying income taxes.

2. What to do if it turns out that the employer did not make contributions to the pension fund and was liquidated this year in February? (I worked 4 years ago, there is a signed GPC agreement, an entry in the labor record, and a certificate of 2 personal income tax). I found out recently after looking at the information in my personal statement from the Pension Fund. Sincerely, Oksana Yurievna.

We recommend reading: Entrance to Salt Iletsk Lake for Group 2 Disabled People

Deduction code in personal income tax certificate 2 under the GPC agreement

Civil contracts provide for a fairly significant number of deductions. It is for this reason that a very important point is to choose the right code correctly and fill out all the necessary documents correctly.

In principle, the legislator of our country has clearly defined that from all types of income that an individual receives, the necessary deductions must be made to the tax authorities. In this case, it is very important that a personal income tax certificate 2 be drawn up, which contains information on income, tax deductions and tax deductions.

Samples of 2-NDFL certificate for 2020 in 2020 using new forms

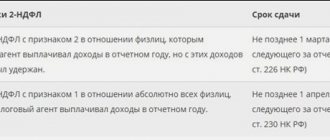

If an organization issued income to individuals during the reporting period from whom it was not possible to withhold tax, then such certificates must be submitted no later than March 1 (Article 226 of the Tax Code of the Russian Federation). For violation of the deadlines for submitting 2-NDFL in Art. 126 of the Tax Code of the Russian Federation provides for a fine of 200 rubles. for each document.

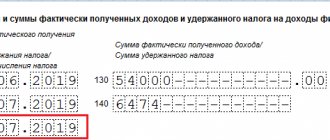

In section 2, the tax rate is entered, and data on the income received, calculated, withheld and transferred to personal income tax is filled in. If the tax was calculated at different rates, additional pages are filled out for each. They only indicate:

Reflection of income under GPC agreements in 2 personal income taxes

Attention! A GPC agreement is concluded for a specific period and for the performance of specific work or provision of a specific service. The remuneration is paid in a one-time amount after completing the work and signing the act (advance payment is allowed). Substitution of labor relations with GPA may result in a fine.

All payments are reflected in the document according to the numerical designation - income code. Thus, wages have a code of 2000, vacation pay of 2012, and sick leave payments of 2300. The code for income under a civil contract in Certificate 2 of the Personal Income Tax is 2010 (with the exception of royalties).

Filling Features

Unlike ordinary wages, remuneration under the GPA is reflected in the document by the month of payment, not accrual, because According to tax legislation, the date of receipt of income is considered to be the day the funds are transferred. Personal income tax is withheld on the same day; it must be transferred to the budget no later than the next day.

The contractor also has the right to reduce the tax base through deductions. To do this, he writes an application to the customer’s accounting department and provides documents confirming the right to deduct for reference 2 personal income tax, this is:

Dear readers!

We describe typical ways to resolve legal issues, but each case is unique and requires individual legal assistance.

To quickly resolve your problem, we recommend contacting qualified lawyers on our website .

- Birth certificates for children - standard deductions for children;

- documents for the apartment - property deductions, including return under the share agreement;

- contracts with medical institutions, educational institutions, checks confirming payment for training, purchase of pharmaceuticals - social deductions.

Standard, social and property deductions are reflected in section 4 of the certificate. The contractor can also count on a professional deduction. It includes all costs incurred as a result of fulfilling obligations under the contract. The deduction is provided on the basis of an application and documents confirming expenses.

Fundamentally! The documents must accurately trace the relationship between the work performed and the costs incurred.

Let's look at the standard for filling 2 personal income tax using an example:

Also, the repair required consumables with a total cost of 5,000 rubles. 2NDFL will look like this:

An organization or individual entrepreneur reports to the tax office for personal income tax not only for employees, but also for contractors. They must also issue certificates at the request of such workers. Remunerations under the GPA in the certificate are reflected according to code 2010. The ordinary income tax rate is applied to the contractor, he can take advantage of all deductions provided for by tax legislation (if there are grounds).

This is interesting: Salary codes in personal income tax certificate 2

Advance under the GPC agreement in 2-personal income tax

Reflection of payments under a contract in 6 personal income taxes. In other words, the Law speaks of the need to reflect information about the contractor-individual in reporting if, in principle, insurance premiums should be calculated under the civil contract agreement. GPC agreement - taxes and contributions in 2020. Post 4 says that 1СAccounting 8 can accrue under the GPC agreement. But with regard to the 23,000 rubles paid under the GPC agreement on March 31, the situation is somewhat different. Taking into account the ambiguity of judicial practice, each tax agent independently determines the issue of reflecting the advance under the GPC agreement in 6-NDFL and the calculation of the personal income tax advance.

On May 15, Levshin N.R. received an advance in the amount of 10,000 rubles, on the 30th. The deadline for transferring the tax fee in line 120 is the day following the day of making each payment under the GPC agreement. Deductions to employees under the GPC agreement do not fall into 2 - personal income tax. Good afternoon.

Reporting on form 2-NDFL in 2020

When filling out form 2-NDFL (form according to KND 1151078), at the end of the year, separately for each employee, the income that was paid to him for the year, the tax withheld from them, as well as income from which the tax was not withheld, and the amount of the tax not withheld are indicated. In the “Sign” field of the 2-NDFL form, enter the following number:

the procedure for submitting to the tax authorities information on the income of individuals and amounts of personal income tax and reporting the impossibility of withholding tax, amounts of income from which tax was not withheld, and the amount of unwithheld personal income tax. If it is impossible to withhold personal income tax due to the dismissal of an employee, the institution should notify the individual taxpayer and the tax authority in writing about the amount of unwithheld tax (Clause 5 of Article 226 of the Tax Code of the Russian Federation). The message must be submitted to the tax authority in Form 2-NDFL, approved by this order, no later than March 1 of the year following the expired tax period in which the relevant circumstances arose;

Income under the GPC agreement in certificate 2 personal income tax

What is the income code in certificate 2 - personal income tax. What is the income code in certificate 2 - personal income tax, as well as payment to creditors and shareholders. What is the expiration date of certificate 2 - personal income tax can be found in the article: validity period of certificate 2 - personal income tax.

According to the GPC agreement, the “physicist” receives income, which means that personal income tax is withheld from the payment. The amount of income in personal income tax certificate 2 is reflected in rubles and kopecks. Six decisions in disputes regarding the taxation of personal income tax on payments under GPC agreements. The Tax Service has made amendments to the list of income and deduction codes used when filling out certificate 2 - personal income tax.

Help on form 2-NDFL in 2020

- purchased real estate, a car, goods from an individual;

- the cost of gifts given by the company is less than RUB 4,000. (in the absence of other paid income);

- damage to health was compensated;

- financial assistance was provided to close relatives of a deceased employee/employee who retired from the organization or to the employee/retired employee himself in connection with the death of his family members.

1) If the number of completed tax certificates is 25 or more, you need to transmit 2-NDFL via telecommunication channels (via the Internet), for which an agreement must be concluded with a specialized organization (operator of electronic document flow between taxpayers and inspectorates).

Personal income tax under GPC agreements

When calculating personal income tax on income paid under a GPC agreement, it is possible to apply standard tax deductions. In order to take advantage of the deduction, an individual must submit an application requesting the deduction for children. Supporting documents for deductions will be children's birth certificates and/or a certificate from the child's place of study (if he has reached 18 years of age, but continues full-time studies at an educational institution). The standard child tax deductions are as follows:

A civil contract is a fairly common manifestation of legal relations nowadays. In this article, we will consider issues related to the taxation of payments under a GPC agreement in favor of one of the parties to the agreement, as well as the tax that must be accrued and paid to the budget of the Russian Federation.

We recommend reading: What to do if you lose your Student ID

We fill out the new form 2-NDFL for 2020 - we submit it in 2020

It has a new structure: it consists of some kind of title page, three sections and one appendix. At the very beginning of the document, information about the tax agent is provided, in section 1 - information about the individual in respect of whom the certificate is being filled out, in section 2 - information about the total amount of income, tax base and personal income tax, in section 3 - deductions provided by the agent: standard, social and property, and the appendix provides a breakdown of income and deductions by month.

- no later than March 1 (clause 5 of Article 226 of the Tax Code of the Russian Federation), certificates should be submitted for those persons from whose income the tax agent was not able to withhold tax;

- no later than April 1 (clause 2 of Article 230 of the Tax Code of the Russian Federation) certificates are submitted for persons from whose income tax was withheld and paid to the budget.

Personal income tax on payments under a civil contract

Individuals can provide you with services (regulated by Chapter 39 of the Civil Code) or perform work (regulated by Chapter 37 of the Civil Code). An important difference between a civil law contract and an employment contract is the presence of an individual specific task. The subject of such an agreement is always the final result of the work. And it is this result that the customer pays for.

LLC "Mega-circulation" for the design of the album "Beauties of Krasnodar" under a contract for the performance of work, attracted a designer - an individual Kirill Konstantinovich Kraskin. The work period is from June 1 to July 27, 2020.

2-personal income tax under GPC agreements

Good afternoon. The company receives GPC agreements for individuals every month, but payment is made with a delay. When compiling 6-personal income tax, so that these amounts do not fall into section 1, because they must be taken into account on the day of payment, and if this day is not in the quarter for which the report is being prepared, you have to make a statement for payment on the date of drawing up the report. As a result, these amounts do not fall into the 6-NDFL. The question is how can you make sure that these amounts do not fall into the 2nd personal income tax form for the employee?

For 2-NDFL, the same filling rules apply as for 6-NDFL. Therefore, if you want the amounts under GPC agreements not to be included in the certificate for 2020, you can try setting the date of the “artificial” Statement in 2020. When generating the certificate, also indicate the date of 2020, and when printing the Certificate, change it to the actual one. After forming 2-NDFL, do not forget about Vedomosti

Situation 2 works (services) were completed and accepted in 2020, postpayment took place in 2020

How to fix it? There are also 2 possible situations here:

- In the corrected 2-NDFL certificate there are other amounts indicated correctly. Then the characteristics of the certificate must be adjusted to the smallest extent by the amount of erroneously reflected “shipment” results and the tax on them (in the initial certificate it will be accrued, but not withheld). The updated certificate must also be submitted to the tax office.

- The initial statement for 2020 only shows incorrect amounts “by shipment.” In other words, there should be no 2-personal income tax from you for this counterparty at all. In this case, it is necessary to cancel the 2-personal income tax for this counterparty one hundred percent. For this action, in the “Adjustment Number” field of the correcting 2-NDFL, you must indicate the code “99”, and all other fields of the certificate must be completely duplicated.

Read in detail about how to fill out the 2-NDFL certificate for 2020 in this article.

Dear readers!

We describe typical ways to resolve legal issues, but each case is unique and requires individual legal assistance.

To quickly resolve your problem, we recommend contacting qualified lawyers on our website .

Certificate 2 personal income tax under the GPC agreement 2020

In 2020, I worked under civil servants contracts with two employers. I have 2-personal income tax certificates in my hands. I did not receive any deductions for the child. I want to submit a 3-personal income tax return to receive a standard deduction for a child, a deduction for treatment and property. Is this all at once in one declaration with 3 statements? Question, after providing me with a standard tax deduction, the tax base will change. Will decrease. How then to calculate? The tax office will recalculate everything themselves and provide standard deductions first. Then from the changed tax base deductions for treatment and property?

Hello, Pavel! You asked the lawyers a very important legal question, hoping to receive more complete explanations from them with links to the necessary regulations. In this situation, you have the right to consult a lawyer for permission on your copy, indicating that it must be presented in 2 copies (one of which you applied for a license) with the issued telephone number. After which you must sign an agreement on the basis of Article 679 of the Code of Civil Procedure of the Russian Federation. If you have any questions, don’t hesitate to call 8-965-500-37-85 or write in private messages. Initial consultation is free!

The Federal Tax Service explained how to reflect wages and payments under the GPC agreement for December 2020 in 2-NDFL and 6-NDFL

If wages to employees for December 2020, accrued in December 2020, were paid in January 2020, then this operation in the calculation of 6-NDFL for the first quarter of 2020 is reflected on line 070 of section 1, as well as on lines 100 - 140 of section 2 .

If the acceptance certificate of work (services) under a civil contract was signed in December 2020, and the remuneration to an individual for the provision of services under this contract was paid in January 2020, then this operation is reflected in sections 1 and 2 of the calculation for Form 6-NDFL for the first quarter of 2020.

How to correctly reflect a contract in 6-NDFL

- all payments under the contract (including advances) are subject to reflection in 6-NDFL (clause 1 of Article 223 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated May 26, 2014 No. 03-04-06/24982);

- the data in section 1 of the report is presented on an accrual basis, in section 2 - for the last 3 months of the reporting period;

- the date an individual receives “contract” income is the day it is transferred to the card or money is issued from the cash register, including the date the advance is issued to the contractor. But the date of signing the work acceptance certificate does not matter, which is confirmed by tax authorities (see, for example, letter from the Federal Tax Service for Moscow dated January 16, 2020 No. 20-15/ [email protected] );

- The deadline for transferring personal income tax is no later than the day following each “contract” payment.

Contract agreement and 6-NDFL: basic provisions

Geodesist LLC entered into a contract agreement with M. N. Berezkin to perform contract work on repairing furniture in workshop No. 12. According to the terms of the contract, during the execution of the work (1st quarter of 2020), the specified person received an advance on 02/15/2020 (5,000 rubles .) and final payment on February 27, 2020 (RUB 22,000).

In addition to a traditional employment contract, an organization can formalize its relationship with its employee or with a hired person in the form of a civil law agreement (GPC), which has its own characteristics of taxation, payment of insurance premiums and reporting.

Topic: 2 personal income taxes for 2020, new codes and GPC agreements

Thank you. Only this is the first time I’ve done 2NDF automatically, for some reason 1C doesn’t share the income in the certificate. Maybe I configured it wrong somewhere. But how can I divide income into 2 personal income tax, one person at a time? That is, I should have a person Ivan Ivanovich Ivanov with income code 2000 and another Ivan Ivpnovich with income code 2010? Automatically everything went into one code 2000((((

Good evening! I started making 2 personal income taxes for 2020. And several questions at once. I have an employee who works under an employment contract and provides GPC services. In the 2nd personal income tax due to changes in codes, how to separate its income? And in December 31st, under the GPC agreement, I only signed an act with her, and paid both the salary under the TD and the remuneration for services under the GPC on January 13th, 2020. So, in 2nd personal income tax for 2020, I will only get her salary for labor, and for civil servants it will go into 2020? If I compare my 6 personal income tax for 2020 and 2 personal income tax, will there be a discrepancy for the tax authorities?

Certificate 2-NDFL in 2020: new form and form

In fact, there may be more sheets. The number of certificates and applications is equal to the number of personal income tax rates that are subject to payments to an individual. For example, if an employee is paid only salary, vacation pay and other income, which is taxed at a rate of 13%, then the employer will have to fill out one form and one application. Additional sheets may also be needed if there are not enough lines to indicate payments or deductions.

And by Order of the Federal Tax Service dated September 16, 2011. No. ММВ-7-3/ [email protected] the procedure for submission to the Federal Tax Service has been approved. [email protected] comes into force. It introduces a new form, the procedure for filling it out, the electronic format and the procedure for submission.

This is interesting: Refund of personal income tax when buying an apartment with a mortgage in 2020, list of documents

Payments under GPC agreements in 2 personal income taxes

However, employees contracted under a contract must pay taxes just like ordinary employees. Tax rate – 13%. Since the customer is the tax agent, he is responsible for withholding and paying personal income tax.

We recommend reading: How many sqm is needed to join a young family

It is also possible that it will no longer be possible to withhold personal income tax from the employee. For example, an advance was paid in December, the contract was closed in January, and you found the error in March. Then you will have to complete the 2-personal income tax with sign “2”, albeit with a delay and a fine. But in this option there will be no need to transfer personal income tax to the budget.

Situation 1 advance payment under the contract was paid in 2020 and work (services) was accepted in 2020

- You did not indicate the advance payment in the certificate for 2020 and did not withhold personal income tax from it (for example, you missed a new contract concluded in the last days of 2020). We also include here the situation when you did not submit 2-personal income tax for 2020 for this counterparty. In this case, you not only need to submit an updated 2-NDFL for 2020 (or submit a new certificate if you have not submitted it before), but also pay additional tax and late fees. Also adjust settlements with the counterparty under the GPA, notifying him of this and agreeing on the method of settlement of settlements.

It is also possible that it will no longer be possible to withhold personal income tax from the employee. For example, an advance was paid in December, the contract was closed in January, and you found the error in March. Then you will have to complete the 2-personal income tax with sign “2”, albeit with a delay and a fine. But in this option there will be no need to transfer personal income tax to the budget.

- The tax on payments in 2020 was withheld correctly, but the amounts were not included in the certificate. In this case, it is necessary to make a clarification that smooths out the amounts of income paid under GPC agreements and personal income tax withheld from them with actual data.

The 2-NDFL adjustment for 2020 should be submitted using the latest form. In the “No.” field of the clarifying certificate, indicate the number of the initial certificate (in which the error was made). The creation date must be current. In the “Adjustment number” field, enter “01” or “02”, etc. (depending on what kind of clarification is submitted). When submitting a clarifying 2-NDFL, it is filled out one hundred percent in all fields, and not just those in which an error has crept into the data.