Regulatory regulation of insurance premium payments

Tax Code of the Russian Federation Part 2 Chapter 34. – the obligation of employers to make insurance payments

Federal Law of December 15, 2001 N 167-FZ regulates compulsory health insurance

Federal Law of 04/01/1996 N 27-FZ on the implementation of duties for personalized accounting in the OPS system

Federal Law No. 125-FZ dated July 24, 1998 is aimed at regulating compulsory social insurance for employees

Order of the Federal Tax Service of Russia dated October 10, 2016 N ММВ-7-11/ [email protected] establishes contribution reporting forms, completion and submission

Letter of the Federal Tax Service of Russia dated July 18, 2017 N BS-4-11/ [email protected] and dated June 28, 2017 N BS-4-11/ [email protected] recommends a procedure for correcting errors in reporting contributions

The payer exchanges documents electronically using an electronic digital signature and if the necessary hardware and appropriate software are available.

LLC "Electronic Express" A. Paukov

What does the code tell you?

First of all, a number of codes will indicate the taxation system. Codes 01, 02, 03 - indicate OSNO, simplified tax system and UTII, respectively.

Some codes will tell the Federal Tax Service about the type of activity. For example, code 06 is indicated in the reporting of IT companies, and code 11 is used by charitable foundations.

Why does the tax inspectorate know these codes? Using the code, the Federal Tax Service will be able to understand what tariff is applied by the policyholder when calculating contributions, and check the correctness of the calculation of contributions in the submitted reports.

Control of reporting information

For the purpose of timely and correct reporting on insurance premiums, a verification program has been developed containing control ratios that must be observed when submitting the DAM in electronic form. So, before sending the report, you can check it using the program posted on the official website of the Federal Tax Service. This program checks mathematical calculations, but the personalized data of the insured person also plays an important role.

Obligations of contribution payers according to data on the insured person

The payer's responsibilities also include the provision of accurate and documented information on the persons in whose favor the insurance is provided.

Thus, section 3 of the DAM must be filled out by the payer for all insured persons in whose favor funds were accrued under labor and civil law contracts. For each person, information about his personalized data and remuneration amounts is filled out separately.

https://youtu.be/CxYQPQp4pcM

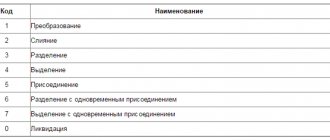

Classification of codes

Conventionally, tariff codes can be divided as follows:

- codes 01-03 - standard tariffs, they are used by insurers on OSNO, simplified tax system and UTII, paying insurance premiums at standard tariffs;

- codes 04-16 – preferential rates, they are used by policyholders who, in accordance with Article 427 of the Tax Code of the Russian Federation, pay premiums at reduced rates; these codes can be divided into categories: 04-06 - reduced rates for all funds;

- 08-12 - partial exemption from payment;

- 07 and 13-16 - payment of contributions under special conditions and completely exempt from payment;

- 21-27 - for policyholders with hazardous working conditions;

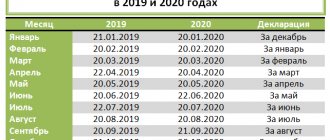

Deadline for submitting RSV

For the 3rd quarter of 2020, the DAM must be submitted no later than October 30; otherwise, a fine may be imposed on the organization or individual entrepreneur, and the Federal Tax Service may block accounts if the DAM is not submitted within 10 days after October 30.

Also, the report is recorded as not submitted if there are errors in it, of which the Federal Tax Service informs the policyholder. Upon receipt of an electronic notification within 5 days, the DAM with errors must be corrected and submitted, and if corrections are submitted within the specified period, the date of acceptance is fixed on the day of the initial submission of the DAM, but if the notification is sent by mail, then the corrected DAM must be submitted within 10 days from the date of its sending.

If no payments were made to employees, then you need to submit a zero RSV within the established time frame. In case of failure to submit the DAM, a minimum fine of 1000 rubles is imposed. even though there should have been no contributions.

Codes of reduced tariffs for payments to all funds

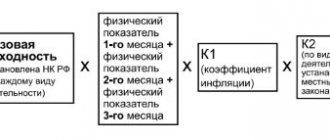

The corresponding reduced tariffs in force in 2020 - 2024 are (as we noted above, within the established maximum contribution amount):

- for payments to the Pension Fund - 20%;

- payments to the Social Insurance Fund - 0%;

- payments to the FFOMS - 0%.

Non-profit and charitable companies on the simplified tax system have the right to apply these tariffs (clause 7, clause 1, clause 3, clause 2, clause 7, article 427 of the Tax Code of the Russian Federation)

- companies on the simplified tax system working in the field of intellectual developments (code 04 according to Appendix 5 to the Procedure for filling out the KND form 1151111);

- companies operating in special economic zones (code 05).

Organizations working in the field of information technology outside special economic zones (code 06) are entitled to pay preferential contributions in 2017–2023:

- for contributions to the Pension Fund - 8%;

- contributions to the Social Insurance Fund - 2%;

- contributions to the FFOMS - 4%.

General procedure for filling out section 3 of the RSV

When receiving a notification from the Federal Tax Service to provide clarifications or explanations on the personal identification data of insured individuals (error code - 0400500003), which are reflected in Section 3 of the DAM, it must be adjusted as follows:

- For each insured person with identified inconsistencies, personal data from the previous calculation is reflected in the lines of subsection 3.1, and 0 is entered in lines 190-300 of subsection 3.2

- also for this insured person, the correct data is reflected in subsection 3.1 and lines 190-300 of subsection 3.2, if necessary, correct indicators are entered

- if necessary, adjustments are made to the information in Section 1 of the DAM

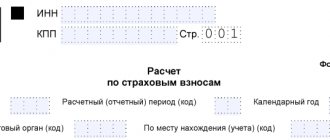

Specifying summary data for the payer

A notable change occurred in the form of the title page of the Calculation.

It applies to organizations that have a separate division. The current Calculation form provides fields for indicating a code in connection with the reorganization or liquidation of an organization and for indicating the TIN and KPP of such a reorganized (liquidated) organization.

https://www.youtube.com/watch?v=ytcreatorsru

Now it will be necessary to indicate the code even when depriving authority (closing) of a separate division. And it is the TIN and checkpoint of such a unit that will also need to be indicated.

It is strange that the title page no longer indicates that in relation to the reorganized organization, the TIN and KPP must be indicated as in the current form. The corresponding field is now called “TIN/KPP of a deprived (closed) separate unit.” It should be taken into account that in this field you still (if necessary) need to indicate the TIN and KPP of the reorganized organization (which were assigned to the organization before the reorganization by the tax authority at its location).

According to clause 3.12 of the Procedure, the indicator “Deprivation of authority (closing) of a separate division (code)” is reflected by payers if it is necessary to submit an updated Calculation for a separate division, which was previously vested with the authority to accrue payments and remunerations in favor of individuals, and by the time the updated Calculation is submitted lost these powers.

Federal Law No. 325-FZ of September 29, 2019 introduced an amendment to this paragraph, which will come into force on the said date. In accordance with it, payment of insurance premiums and settlements thereon at the location of a separate division must be made under the additional condition that a current account has been opened for this division.

Let's assume that a separate division had a current account in 2020, but not in 2021. Then, from 2021, it should be deprived of the right to pay insurance premiums and report on them. And if in 2021 it becomes necessary to submit an updated Calculation in relation to this unit for one of the periods of 2020, then, apparently, you will have to enter the indicated indicator, indicating the code “9”, which for this case is supplemented with Appendix 2 to the Procedure.

Such an updated Calculation is submitted to the tax authority at the location of the organization (clause 2.21 of the Procedure).

But if an updated Calculation is needed for 2020 or an earlier period, it must be taken into account that, in accordance with paragraph. 5 clause 1.2 of the Procedure for recalculating the amounts of insurance premiums during the period of an error (distortion), the updated Calculations are submitted to the tax authority in the form that was in force in the settlement (reporting) period for which the amounts of insurance premiums are recalculated.

We also note that the title page contains the field “Calculation (reporting) period (code)”, which is filled out in accordance with the codes defining the billing (reporting) period given in Appendix 3 to the Procedure.

In this application, additional codes will appear for individual entrepreneurs and heads of peasant farms, which they will have to indicate when deregistering in this capacity when submitting the Calculation for the first quarter (code “83”), for six months (code “84”), nine months ( code “85”), year (code “86”).

We also note that the sheet “Information about an individual who is not an individual entrepreneur” is excluded from the Calculation. It was filled out by individuals who are not individual entrepreneurs, who did not indicate their TIN in the calculation (see Letter of the Federal Tax Service of Russia dated December 28, 2016 No. PA-4-11/25227). They had the right to do so on the basis of clause 7 of Art.

At the same time, in accordance with clause 6.8 of the Procedure, individuals fill out the Calculation on a general basis if they make payments and rewards to other individuals (insured) persons.

A notable change has appeared in Section 1 “Summary of the obligations of the insurance premium payer”.

The payer of insurance premiums in the new field 001 will first have to indicate which of the two types of payers he belongs to by entering the appropriate code:

- “1” – if the payer actually made payments and other remuneration in favor of individuals in the last three months of the billing (reporting) period;

- “2” – if the payer in the last three months of the billing (reporting) period did not actually make payments and other remuneration in favor of individuals (in relation to all employees).

The rest of Sect. 1 The calculations have not changed. However, there are several clarifications in subsection. 1.1 “Calculation of the amounts of contributions for compulsory pension insurance” and 1.2 “Calculation of the amounts of insurance contributions for compulsory health insurance.”

https://www.youtube.com/watch?v=ytdevru

Thus, in lines 030 of these subsections it is necessary to indicate the amounts of payments and other remuneration calculated in favor of individuals. It is clarified that these are payments and other remuneration accrued in favor of individuals in accordance with Art. 420 of the Tax Code of the Russian Federation, that is, those that are subject to insurance premiums.

Line 040 requires you to indicate the amount not subject to insurance premiums. It is clarified that this is an amount not subject to insurance premiums in accordance with Art. 422 of the Tax Code of the Russian Federation and international treaties.

Similar changes were made to the corresponding lines of other subsections of Section. 1.

In addition, in subsection. 1.1 and 1.2, a new line 045 has appeared, in which it is necessary to indicate the amount of expenses accepted for deduction in accordance with clause 8 of Art. 421 Tax Code of the Russian Federation.

This provision deals with the costs associated with the extraction of income received under an author's order agreement, an agreement on the alienation of the exclusive right to the results of intellectual activity, specified in paragraphs. 1 – 12 p. 1 tbsp. 1225 of the Civil Code of the Russian Federation, a publishing license agreement, a license agreement on granting the right to use the results of intellectual activity specified in the named subparagraphs of the Civil Code of the Russian Federation.

In the current Calculation form, such expenses should have been included in lines 040 of subsection. 1.1 and 1.2, but now you don’t need to do this. But when determining the taxable base, these expenses must be deducted from the value indicated in line 030, along with amounts not subject to taxable contributions (line 040).

More on the topic: Work experience for calculating pensions

There is one less field in the subsection. 1.3.2 section 1 Calculations. This subsection calculates the amounts of contributions for compulsory pension insurance at an additional rate for certain categories of insurance premium payers specified in clause 3 of Art. 428 Tax Code of the Russian Federation.

There will be no more field “Basis for filling”, that is, this subsection is filled out based on the results of a special assessment of working conditions or certification of workplaces. It is understood that now only the results of the special assessment should appear here.

But this did not affect the procedure for carrying out this calculation.

In Appendix 2 to Section 1 of the Calculation, a new field “Payer Tariff Code” has appeared. This refers to the tariff code used by the payer in accordance with the tariff codes of insurance premium payers in accordance with Appendix 5 to the Procedure.

If more than one tariff was applied during the billing (reporting) period, then the calculation includes as many as appendices 2 to section. 1, how many tariffs were applied during this period with the exception of lines 070 – 090 (clause 10.1 of the Procedure). Lines 070 – 090 reflect information in general about the payer of insurance premiums. It is clarified that the participants in the pilot project, line 070 of Appendix 2 to Sec. 1 is not filled out because they do not bear the corresponding expenses.

In this application, in addition to the total number of insured persons, in the new line 015 it will be necessary to indicate the number of individuals from whose payments insurance premiums were calculated.

But from the base for calculating insurance premiums (line 050 of Appendix 2), it is now necessary to allocate only the amount of payments and other remuneration accrued in favor of foreign citizens and stateless persons temporarily staying in the Russian Federation, except for persons who are citizens of member states of the Eurasian Economic union (new line 055).

In section 3 of the Calculation “Personalized information about insured persons,” field 010 “Indication of cancellation of information about an insured person” will now appear.

It indicates “1” when canceling previously submitted information on the insured person, as well as when adjusting data on lines 020 – 060. When providing the Calculation for the first time, this field is not filled in.

Example when an employee changes his full name

If, after making adjustments to the RSV, a refusal is again received with the same error code 0400500003, you can check yourself:

- On the Federal Tax Service website nalog.ru the “Find out TIN” service, legal entities have the opportunity to verify the information available to the organization and the Federal Tax Service

- clarify SNILS according to already accepted reports, sometimes technical problems occur

- For foreign workers, you need to clarify that the full name is reflected in Latin or Cyrillic and also the series and number are written without a space

If an employee has changed his personal data and the DAM was returned to the employer with error code 0400500003, then you can suggest that the employee go to the Federal Tax Service to verify and update the data. At the same time, it must be taken into account that this is not a defect of the individual; therefore, in order for the Federal Tax Service not to impose penalties, it is also necessary to attach copies of documents of the employee whose data has changed to the corrected report.

In a situation where an employee quits and the Federal Tax Service returns the payment in respect of this employee, the employer must update the information and submit copies of documents to the Federal Tax Service.

Eliminating error 0000000002 in the declaration

First of all, you need to make sure that the file name is identical to the identifier inside the file. The identifier should also not have the .xls extension at the end of the file. This is very important and can be the key reasons for the error.

The error itself “The declaration (calculation) contains errors and has not been accepted for processing” with code 0000000002 when sending means that your calculations inside the document still contain inaccuracies. Therefore, open the document and double-check your data. When you do this and are one hundred percent sure that the calculations are correct and the document does not contain any errors, then you need to write a letter to technical support asking for help.

Similar error: 0400300003 The requirement for the presence of an element (attribute) depending on the value of another element (attribute) was violated.

Error while making corrections

In the updated DAM, it is necessary to fill out the sections from the primary calculation, taking into account the changes made. In section 3, when clarifications are made, only those employees for whom changes are made are included. In line 001 of section 3 for all employees the adjustment number “1—” is reflected, and the data from the original data is transferred to subsection 3.2. For an employee with incorrect personal data, section 3 is filled out twice:

- information from subsection 3.1 is duplicated with errors

- Correct personal information is filled in

New application under old number

https://www.youtube.com/watch?v=ytcopyrightru

The current Calculation form contains Appendix 6 to Section. 1, it is intended to calculate compliance with the conditions for the application of a reduced tariff of insurance premiums by payers specified in paragraphs. 5 p. 1 art. 427 Tax Code of the Russian Federation.

We are talking about organizations and individual entrepreneurs using the simplified tax system, the main type of economic activity (classified on the basis of activity codes in accordance with OKVED 2) of which are the types of activities listed in paragraphs. 5 p. 1 art. 427 Tax Code of the Russian Federation.

However, the reduced insurance premium rates no longer apply to these taxpayers. Therefore, Appendix 6 now calculates compliance with the conditions for applying the reduced rate of insurance premiums by payers specified in paragraphs. 7 clause 1 art. 427 Tax Code of the Russian Federation. These are non-profit organizations (with the exception of state (municipal) institutions), registered in the manner established by the legislation of the Russian Federation, applying the simplified tax system and, in accordance with the constituent documents, carrying out activities in the field of social services for citizens, scientific research and development, education, healthcare, culture and art (activities of theaters, libraries, museums and archives) and mass sports (with the exception of professional).

In their current form, such non-profit organizations conduct calculations in Appendix 7 to Section. 1 Calculations.

It is clarified that the first column of the application is filled out only for the year preceding the year the organization switched to paying insurance premiums at reduced rates.

When filling out line 040, it is necessary to take into account (now this is reflected in this form) that the amount of income from the types of economic activities specified in paragraph. 47, 48, 51 – 59 pp. 5 p. 1 art. 427 Tax Code of the Russian Federation.

In Appendix 7 to Section. 1, now the calculation of compliance with the conditions for applying the reduced tariff of insurance premiums by the payers specified in paragraphs will be made. 15 clause 1 art. 427 Tax Code of the Russian Federation.

More on the topic How to correctly draw up an application for the return of goods from a buyer: sample

Such payers are Russian organizations engaged in the production and sale of animated audiovisual products produced by them, regardless of the type of contract and (or) provision of services (performance of work) for the creation of these products.

RSV: other codes reflected in the calculation

In addition to the above information, the calculation of insurance premiums reflects the following information in encoded form:

Articles on the topic

Since 2020, the list of insurance premium payers entitled to reduced rates has been significantly reduced. No changes have been made to the insurance premium calculation form, but tax authorities have issued official clarifications regarding filling out the form, mainly relating specifically to the payer’s tariff code. We'll tell you which code to use for accountants in 2020. These clarifications were agreed upon by the Simplified magazine with the tax authorities, so it is safe to use them.

Due to changes in the list of policyholders entitled to reduced insurance premium rates, legislators edited the list of payer rate codes used in reporting. Codes “08”, “09”, “12” when filling out line 001 of Appendix 1 of Section 1 of Calculation of Insurance Premiums are no longer used.