- home

- Reporting

Conducting any activity for the purpose of making a profit is nothing more than business. And it, in turn, can be small, medium and large. Individual entrepreneurs work in the first two of these segments. Of course, their incomes are incomparable with the profits of large players, but on the other hand, the legislator puts significantly less tax and administrative pressure on them. For example, reporting, if a simplified taxation system is chosen, takes a minimum of effort and costs. However, it should be noted that individual entrepreneurs encounter various situations throughout their activities, including those related to the suspension of work. How to go through this period calmly and interact correctly with the competent authorities? And, simply put, how to submit zero reporting for an individual entrepreneur?

Who submits a single (simplified) tax return

The right to report in a simplified manner arises only if the following conditions are simultaneously met (clause 2 of Article 80 of the Tax Code of the Russian Federation):

- there was no turnover in bank accounts and cash registers;

- there is no object of taxation for the corresponding taxes.

Thus, a single declaration is most often submitted by beginning entrepreneurs who do not yet have any transactions. Also, filing a simplified declaration is likely during periods of downtime or suspension of the company’s activities.

It makes sense for companies to submit a single declaration on OSNO. Organizations using the simplified tax system submit a declaration according to the simplified tax system; if necessary, it is zero. For example, in the absence of income, a homeowners association submits a zero declaration under the simplified tax system under the simplified tax system.

single (simplified) tax return free of charge

filling out a single (simplified) tax return

Deadlines for filing zero reports

- We have already indicated above when and how to submit zero individual entrepreneur reports to the tax office - the deadlines are the same as for entrepreneurs on the simplified tax system working as usual (end of April next after the reporting year).

- Individual entrepreneurs do not submit a report to the Pension Fund for themselves, but insurance premiums must be paid. Including the Pension Fund and the Federal Compulsory Medical Insurance Fund.

Attention! The reporting documentation must be submitted in two copies, one of which, with the tax stamp, the entrepreneur keeps for himself. If the reporting is sent by mail, then it is necessary to keep a postal receipt indicating the sending of a valuable letter, as well as an inventory of its contents, certified by a postal stamp.

https://youtu.be/VGnHKpkjX9U

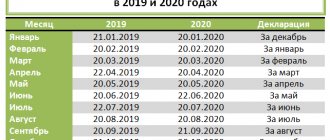

Reporting deadlines

A single (simplified) declaration is submitted both on paper and electronically (with an average number of more than 100 people).

The declaration is submitted quarterly.

for 2020 - until 01/20/2020 inclusive;

for the 1st quarter of 2020 - until 04/20/2020 inclusive;

for half a year - until July 20, 2020 inclusive;

9 months - up to 10/20/2020 inclusive.

Try submitting your reports through the Kontur.Extern system. 3 months free use all features!

Try it

Example of correct filling

How to submit a tax return via the Internet for individual entrepreneurs - where to do it

It is very simple to issue a zero declaration of individual entrepreneur. It is important to consider some requirements:

- Printed, capital letters are used for filling.

- Information is entered manually or typed electronically. The font used is Courier New, size 18.

- Amounts are indicated in full, kopecks are not included.

- Information is entered with a black gel pen.

- All information is entered without errors. Data cannot be crossed out or corrected.

- The letters fit into their cells.

- There should be no empty cells. They are marked with dashes.

- A dash is also placed in the field labeled “Checkpoint”.

- For zero deduction amounts, a dash is placed in the cell.

- All pages are numbered consecutively.

- The pages are not stitched.

Note! The zero declaration consists of several sheets. The title page is filled out by all entrepreneurs.

Next, the sheets are filled out by each entrepreneur separately. It depends on the tax system he uses. For example, if an entrepreneur:

- uses the simplified “income” taxation system, then he only needs to fill out sections 1.1; 2.1.1;

- pays the trade fee, then he additionally fills out section 2.1.2;

- uses a simplified system, where he pays 15% of net profit, then he fills out sections 1.2, 2.2.

Entrepreneurs operating under the simplified taxation system do not fill out Section No. 3.

Initially, each entrepreneur must fill out a title page. It consists of several sections.

Only correct information is entered on the title page."

It includes:

- "INN". It is located in the taxpayer’s certificate or entrepreneur’s registration documents.

- "Checkpoint". The entrepreneur puts a dash in this field.

- "Adjustment number." A different digital designation is entered in this field. It depends on what type of declaration the entrepreneur fills out.

If he:

- fills out the declaration for the first time, then the number “0” is entered in the paper;

- changes information in an already completed paper, then the number “1”, “2” is entered.

- "Taxable period". Various digital designations are also entered here.

For example, if an entrepreneur contributed:

- “34”, then he submits a planned declaration for a certain reporting period;

- "50". This figure is entered if the entrepreneur ceases his business activities;

- "95". This figure is entered into the paper when the entrepreneur submits information about his previous activities, and then he switches to another taxation system;

- "96". This figure is used when an entrepreneur worked under the simplified tax system, stops working under this system, but does not abandon his professional activities.

- "Reporting year". This indicates the reporting period for which the businessman submits information to the Tax Authority.

- "Tax authority". The authority where the user submits the papers is indicated here.

- "Code". If an entrepreneur works in a simplified manner, then here he needs to enter the number 120.

- "Taxpayer". Here the client indicates his full name. All information is entered on a new line. Moreover, all letters must be capitalized. Each letter must be written on its own line.

- "OKVED code". This information is contained in the extract from the Unified State Register of Individual Entrepreneurs.

- “Form of reorganization, liquidation (KOD).” The entrepreneur puts a dash in this line.

- “TIN/KPP of the reorganized organization.” Nothing fits here either.

- "Phone number". Here the entrepreneur indicates a telephone number where Tax Authority employees can contact him.

Note! Below, the entrepreneur counts the number of completed pages and enters the number in the line.

He also needs to count the number of application pages. They also need to be added to the line. Additionally, the user must confirm the correctness of the entered data. Here he can put the date of filling out the paper and his signature.

- “Name of the taxpayer’s representative organization.” The entrepreneur does not enter anything here.

An important section for entrepreneurs paying 6% tax

Section 1.1

It is filled out by entrepreneurs who pay 6% of their income.

Here he enters:

- "INN".

- "Page number". Here the businessman enters the number “002”.

- "OKTMO Code". Here you enter the code of the locality where the entrepreneur lives. Moreover, if the code contains 8 digits, then you must also put a dash in the empty lines.

Lines from 020 to 110 are filled with dashes.

Below, the entrepreneur puts the date of filling out the paper and his signature.

An important section for entrepreneurs paying 15% tax

Section 1.2

This is the second page that entrepreneurs who receive net profit must fill out and pay 15% on it.

Enter here:

- "INN".

- "Page number". The number “002” is indicated here.

- "OKTMO Code". The locality code is indicated here.

Lines from 020 to 110 are filled with dashes. Below is also a signature and the date the paper was filled out.

Third important page for entrepreneurs paying 6% tax

Section 2.1.1

This is the third sheet, which is filled out by entrepreneurs working under a simplified taxation system and paying the state 6% of their profits.

The TIN is entered at the top, the checkpoint is filled in with a dash.

In the “page number” section the number “003” is placed.

In the category “Taxpayer Identification” the numbers “1”, “2” are entered.

And it fits in:

- “2” if the entrepreneur has no employees;

- “1” if the businessman has employees.

Lines from 110 to 113, from 130 to 133, from 140 to 143 are filled in with dashes.

In lines 120 to 123, enter the number “6.0”. This is a bet.

Section for entrepreneurs paying 6% tax

Section 2.1.2

It is also filled out by entrepreneurs working under simplified conditions and paying 6% to the state.

This section includes 2 sheets.

The TIN is indicated here, the checkpoint is not included. In the “page number” category it is written “004”, “005”. Next, the user puts dashes everywhere.

The main section for entrepreneurs working on a simplified basis and paying a tax of 15%

Section 2.2

It is filled out by entrepreneurs who pay 15% and also work under a simplified tax regime.

Lines from 210 to 253, from 270 to 280 are filled in with dashes.

In lines 260 to 263 the tax rate is entered, i.e. "15".

Note! There is no zero declaration for UTII and OSNO.

You can download the declaration and see a sample of how to fill it out on a specialized website.

Moreover, the entrepreneur must download the zero declaration that suits him. So declarations are declarations according to:

- USN.

- UTII.

- BASIC.

- VAT.

Filling procedure

A single (simplified) tax return includes two sheets.

The first sheet, like most declarations, contains standard details: TIN, KPP, tax authority code, company name, etc.

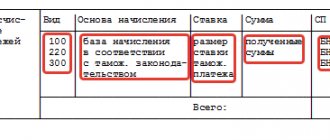

In addition to the usual details, in the simplified declaration you should fill out a small table, indicating the names of taxes for which there were no objects of taxation.

In the table on the first sheet for each tax, you must indicate the number of the head of the Tax Code of the Russian Federation, which established the tax.

You should also indicate the tax period code:

- code 3 for quarterly taxes (for example, VAT);

- codes 3 (1 quarter), 6 (six months), 9 (9 months) and 0 (year) indicate taxes for which they are reported on an accrual basis (for example, income tax).

In column 4 of the table, you need to note the quarter number in the format “01”, “02”, “03”, “04” (only for quarterly taxes).

In the tabular section, only four types of taxes can be noted. If there are more taxes, you need to fill out two sheets 001.

Page 002 of the single (simplified) declaration is intended to be filled out by individuals; organizations and individual entrepreneurs do not fill it out.

Detailed instructions for filling

How to fill out a zero declaration

You can fill out a zero declaration under the simplified tax system for 2020 using online services, special programs or manually. Calculations will not be carried out in it, since there is no data for them. And all other information must be present.

On the title page, fill in the following as usual:

- INN and KPP of the taxpayer;

- correction number: set to 0;

- reporting year: the year for which the declaration is submitted is reflected;

- tax period: usually set to 34, during reorganization - 50;

- Federal Tax Service code: indicate the code of the Federal Tax Service to which the document is submitted;

- OKVED: reflected according to Rosstat;

- taxpayer's name and telephone number;

- the total number of pages in the completed declaration;

- the accuracy of the information is confirmed by the director of the company or entrepreneur (indicate full name and signature);

- the date of approval of the declaration is indicated;

- the seal (if any) is placed in place of “M. P.".

On the second page (section 1.1 or section 1.2), selected depending on the applied object of taxation (income or income minus expenses), the final results of calculating tax payments will be shown. In our case, they will turn out to be zero, reflected in the declaration with dashes in accordance with the requirement of clause 2.4 of the order of the Federal Tax Service of Russia dated February 26, 2016 No. ММВ-7-3 / [email protected] But here you should indicate the values of OKTMO codes corresponding to the territorial affiliation of the taxpayer.

Using the same principle, data should be entered into the main section of the declaration, which is also selected for completion in accordance with the applicable object of taxation (section 2.1.1 or section 2.1.2):

- the codes specified in the section are filled in;

- instead of digital indicators, dashes are placed;

- The numbers indicate the value of the tax rate in force in the region.

Sections 2.1.2 and 2.2 will be completed only by those whose object of taxation is income minus expenses. The principle of entering data into them is the same: the necessary codes (TIN, KPP) are filled in, and instead of digital indicators, dashes are placed.

Section 3 in the zero declaration does not need to be completed.

Thus, the zero declaration is filled out according to the general rules with the only exception: the figures related to the indicators that form the tax base will be replaced by dashes. Therefore, there is no need to have a special sample to fill out a declaration under the simplified tax system - income 2020 zero or a similar declaration under the simplified tax system “income minus expenses”. They can use a regular declaration.

For examples of filling out the simplified taxation system (STS) declaration for both types of taxation objects, see the link.

Responsibility for late submission

Since the simplified declaration includes information on a number of taxes, fines are charged for each of them (letter of the Ministry of Finance dated November 26, 2007 No. 03-02-07/2-190).

In general cases, the fine is 5% of the tax amount, but not less than 1,000 rubles. Since taxes are zero when filing a simplified declaration, the fine for failure to submit a declaration on time will be equal to 1,000 rubles for each tax (Article 119 of the Tax Code of the Russian Federation).

Also, violation of the deadline for filing a declaration or failure to submit it may entail a fine of 300–500 rubles for an official of the organization (Article 15.5 of the Code of Administrative Offenses of the Russian Federation).

What is a zero declaration of individual entrepreneurs?

Many of us have the desire to have our own business, but the burden of being an individual entrepreneur can be overwhelming. Competition, liquidation, bankruptcy or closure of a business - no matter how things go in the business, reporting to the tax authorities must be provided without fail; ignoring this obligation is strictly prohibited.

It is considered quite normal that an individual entrepreneur is in a state of temporary inactivity. In other words, its commercial and economic activities may not be carried out. However, in this case, a zero declaration of the individual entrepreneur is submitted, which is submitted to the appropriate tax office at the place of registration of his own business. This rule applies to entrepreneurs of all categories and fields of activity.

A zero declaration of individual entrepreneurs allows you to show regulatory authorities that the company actually exists, reports, but has been inactive for some time. The essence of this type of declaration is that a tax base will not be formed, but evidence of lack of income will be taken into account and reflected. This is extremely important, since the indicators of the tax base are used to calculate payments received to the state treasury.

In what cases is it rented and by whom?

Such reporting is provided for processing by the Federal Tax Service by enterprises or individual entrepreneurs who have nothing to reflect in the statement for a certain period of time. In practice, the situation arises due to the cessation of commercial activities on a temporary basis.

The document can be submitted not only in the absence of profitability, but also in the following specific cases:

- absence of any cash transactions;

- drawing up acts confirming the completion of work;

- generation of invoices.

If an entrepreneur or company manager does not have information about transactions on current accounts for the tax period, then he must contact the bank and request a corresponding statement.

Even payment for banking services for using an account or withdrawing a certain amount through a cash desk is recognized as a movement of money. In practice, zero forms are not used in such situations.

Form 85 EUND is regulated by law.

During the reporting period, there should be no cash flows from responsible payers. For all fees paid within the framework of the regime used, taxable objects cannot be established.

Read: When does an individual need to pay taxes in 2020?

Procedure for filing a tax return