- Created: 2017-11-15 08:31:00

- Tags: ecology

The first quarter and the following month of April is the time for environmental reporting in 2020 for natural resource users, enterprises in other fields, and entrepreneurs.

Environmental legislation is very dynamic, so we offer you a detailed overview of the types of reports, indicating their deadlines and features. The article examines environmental reporting 2018 at the federal and regional levels using the example of the Nizhny Novgorod region. For convenience, the types of environmental reports are presented in chronological order. Please note that the article presents reports sent to Rosprirodnadzor and Rosstat concerning commercial enterprises and entrepreneurs.

Who is required to submit the Declaration and pay for the NVOS?

The declaration is submitted by tax payers. If your organization, in accordance with Federal Law No. 7-FZ, is not required to pay a fee for the tax assessment, then you do not need to submit a Declaration of payment for the tax assessment.

And yet, who is obliged to pay for the NVOS ? At the moment, we can say with confidence that the payers are legal entities and individual entrepreneurs carrying out economic activities on objects of categories I – III, and that objects of category IV are exempt from paying for the tax assessment. At the same time, business entities are exempt from paying for the disposal of municipal solid waste (MSW), the fee for which is paid by regional MSW management operators. In addition, it is possible for a number of waste disposal facilities (WDO) to obtain a decision from the territorial body

Rosprirodnadzor on eliminating negative impacts on the environment, allowing to reduce the amount of fees for the organization as a whole.

It would seem that we have gone through the procedure for registering NVOS objects, received a category and then everything, as in Federal Law No. 7-FZ, but not everything is so simple. Rosprirodnadzor has repeatedly clarified that calculations of fees for environmental impact assessment are not directly related to the definition of the facility providing environmental assessment, i.e. with registration of objects of the NVOS. Therefore, it is not yet clear what to do for objects that have been refused registration as not providing NVOS. The situation is aggravated by the fact that in 2016 there were no regional MSW management operators. Federal Law No. 486-FZ of December 28, 2016 “On Amendments to Certain Legislative Acts of the Russian Federation” established a transition period until January 1, 2019 for the introduction of public services for the management of solid waste and the establishment of a unified tariff on the territory of the constituent entities of the Russian Federation. Thus, until the date of approval of the unified tariff and the signing of agreements between the constituent entities of the Russian Federation and regional MSW operators, payment for the placement of MSW is carried out by business entities whose activities generate municipal solid waste.

What do we have as a result? With a high degree of probability, it can be argued that in 2020, all business entities must pay the fee for the 2020 IEE, regardless of the registration of IEE objects and the categories assigned to them. An exception may be small offices where the lease agreement clearly states that the payment for waste removal is paid by the lessor, who has entered into contracts for waste removal and is the payer of the fee for the NVOS.

Sanctions for failure to submit environmental reports or violation of their deadlines

The legislator motivates organizations and individual entrepreneurs to submit reports on time using the whip method - threatening penalties if the order is violated.

The regulatory authorities have enough leverage:

- Art. 13.19 Code of Administrative Offenses of the Russian Federation. Failure to provide information or its submission after the expiration of the established period is regarded as a violation of the procedure for submitting statistical reporting and is punishable by penalties for legal entities of up to 70 thousand rubles, for officials - up to 20 thousand rubles;

- Art. 8.5 Code of Administrative Offenses of the Russian Federation. According to this norm, a violation is regarded as a deliberate concealment or distortion of environmental information. Fine - up to 6 thousand rubles for the responsible person in the organization and up to 80 thousand rubles - for the enterprise itself;

- P. 8.2 Code of Administrative Offenses of the Russian Federation. Affects SMEs whose operations generate waste. Sanctions - up to 30 thousand rubles for a responsible employee, up to 250 thousand rubles or administrative suspension of activities for a period of up to ninety days - for an organization, up to 50 thousand rubles or administrative suspension of activities for a period of up to ninety days - for individual entrepreneurs;

- P. 19.7 Code of Administrative Offenses of the Russian Federation. If the inspector regards it as failure to provide information, if its submission is required by law, then the violator will face the most “mild” punishment - up to 500 rubles for an official, up to 5 thousand rubles for a legal entity.

The Regional Code of Administrative Offenses of the Nizhny Novgorod Region provides for liability under Art. for violation of the procedure for submitting environmental reports to the Ministry of Ecology. 5.17. It provides for a fine of up to 10 thousand rubles per employee of the enterprise. In relation to the organization, the regional legislator is more severe than the federal one - the fine can reach 100 thousand rubles with a minimum threshold of 50 thousand rubles.

Declaration form and electronic submission to the Rosprirodnadzor portal?

On February 22, 2020, Order of the Ministry of Natural Resources dated January 09, 2017 No. 3 “On approval of the Procedure for submitting a declaration on payment for negative impact on the environment and its forms” was registered with the Ministry of Justice and published, i.e. came into force.

The fee for the IEE must be paid no later than March 1 . Starting from 2020, a penalty in the amount of 1/300 of the Bank of Russia key rate .

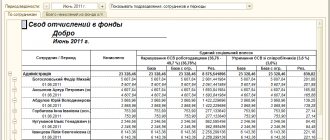

The fee is paid separately for four environmental components: emission fee, APG emission fee, discharge fee and waste disposal fee. Each with its own BCC (budget classification code). It should be taken into account that if advance payments were made and, for example, there was an overpayment for waste, then it cannot be automatically included in the payment for emissions, because These components are paid according to different BCCs. The calculated total amounts of the fee for payment for the reporting period (lines 151 - 154 of the Declaration) are subject to payment; the amounts of the fee for return and/or offset (lines 161 - 164) should not affect the amount of the current payment .

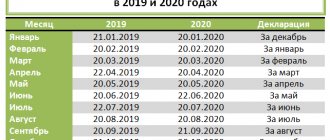

Order of the Ministry of Natural Resources No. 3 determines the form of the Declaration itself, which must be submitted no later than March 10 .

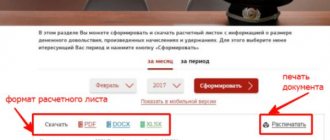

The declaration can be submitted on paper or in the form of an electronic document. Starting from 01/01/2017, the Rosprirodnadzor portal pnv-rpn.ru stopped accepting reports; it will only be available for viewing previously submitted reports until 06/30/2017. Now the State Services portal located at lk.fsrpn.ru is used to receive reports. To submit reports, you must have an account on the State Services portal.

Regional environmental reports for 2020

Reporting has been established for SMEs operating in the field of waste management and subject to regional supervision. It is provided in paper form from February 8 to March 8 in accordance with the order of the Ministry of Ecology of the Nizhny Novgorod Region dated February 3, 2020 No. 53 directly to the regional department or to its interdistrict departments.

Legal entities and individual entrepreneurs whose work generates waste (including MSW) are required to submit information to the regional waste cadastre. The deadline for sending the report is March 1. Regulatory framework:

- Order of the Ministry of Ecology of the Nizhny Novgorod Region dated December 15, 2011 No. 990;

- Resolution of the regional government of July 25, 2008 No. 306.

We can't find fee rates for pollutants

New payment rates were approved by Resolution No. 913, which brings the rates into line with the Order of the Government of the Russian Federation dated 06/08/2015 No. 1316-r “On approval of the list of pollutants for which state regulatory measures in the field of the environment are applied.”

The currently available permits for emissions and discharges were issued without taking into account Order No. 1316-r, which significantly reduces the list of pollutants and, as a consequence, the payment rates for them. For emissions and discharges of pollutants for which there are no payment rates, starting from 2020, you do not need to pay, even if these pollutants are indicated in the permits.

The current practice of using fee rates for pollutants with similar characteristics is unlawful . Thus, in the Letter of Rosprirodnadzor dated January 16, 2017 N AS-03-01-31/502 “On consideration of the appeal” it was said that “...substances such as abrasive dust, carbon (soot), iron oxide, due to their physical properties , related to solid particles, it is advisable to take into account the emissions as suspended substances.” This and the requirements previously applied by the administrators of the fee for the NVOS to pay for pollutants that are not in Resolution No. 344 are recognized by the courts as illegal. As an example, we can cite the decision of the Arbitration Court of the Khanty-Mansiysk Autonomous Okrug dated January 31, 2014 in case No. A75-2131/2013.

Who must submit a declaration in 2020

The Declaration of Negative Impact on the Environment for 2020 must be submitted by persons obligated to pay a fee for negative impact on the environment in accordance with Article 16.1 of the Federal Law of January 10, 2002 No. 7-FZ “On Environmental Protection”. reported on the Rosprirodnadzor website. Payments for environmental pollution, in turn, are required to be paid to the budget by all organizations and individual entrepreneurs that use facilities in their activities that have a negative impact on the environment. In this case, the applied tax regime (STS, OSNO or UTII) does not matter (Article 23 of the Federal Law of June 24, 1998 No. 89-FZ, Article 28 of the Federal Law of May 4, 1999 No. 96-FZ). Moreover, it does not matter on what right organizations or individual entrepreneurs use the object of negative impact (whether the object is owned or leased).