When filling out certificates of paid income and withheld tax 2-NDFL, tax agents are guided by the order of the Federal Tax Service dated October 2, 2018 No. ММВ-7-11/ [email protected] In addition to the personal data of an individual, the income received and codes for them are indicated in the designated reporting fields . In this article we will talk about “income” codes in 2020, and to make it easier to navigate the general register, we will provide a breakdown of income codes in the 2-NDFL certificate, which are most often needed in the work of employers - entrepreneurs and companies.

Encoding purposes

Numerical designations are entered for various reports. 2-NDFL certificates are no exception. The full name of each income would take up a lot of space on the report form, and also complicate the automated processing of certificates. The income code in the 2-NDFL certificate has become a necessary tool for compressing the information indicated, but at the same time containing the amount of data necessary for control.

The law provides for different withholding tax rates for different types of income. The income code in 2-NDFL is important for monitoring the correctness of the withholding of personal income tax. Tax deductions are also tied to a certain income - for example, a non-taxable part of a material benefit or a share of the cost of gifts. Different sources of payments may not have complete information on one recipient, and the Federal Tax Service checks and charges additional tax if the non-taxable amount in the income of each taxpayer is exceeded. It is important to accurately enter the income code in the 2-NDFL 2020 certificate - it is related to the tax obligations of the persons for whom the information is submitted.

Income codes 2002 and 2003 with decoding

But bonuses for the purpose of coding income as wages are not recognized, although they are named in Article 129 of the Labor Code of the Russian Federation as part of remuneration. Moreover, bonuses are reflected in tax registers and in 2-NDFL certificates in three different codes.

The main code is 2002. It is used for awards that simultaneously satisfy three conditions:

- the payment is not made at the expense of profits, earmarked proceeds or special-purpose funds;

- the payment is provided for by law, labor or collective agreement;

- the basis for payment is certain production results or other similar indicators (i.e. indicators related to the employee’s performance of his or her job duties). This circumstance must be confirmed by an order for payment of the bonus.

Code 2003 reflects bonuses (regardless of the criteria for their assignment) and other remunerations (including additional payments for complexity, intensity, secrecy, etc., which are not bonuses), which are paid from special-purpose funds, targeted revenues or profits organizations.

For other bonuses, code 4800 must be used.

Also see: “Taxes on premiums: we calculate personal income tax and contributions, take them into account in expenses, and reflect them in reporting.”

https://youtu.be/E8XyjdWi8fw

Main types of “income” codes

To make it easier to navigate, we will divide the most used codes into several types.

Payments for labor relations:

- The income code “2000” in the 2-NDFL certificate is used for data on employee salaries and maintenance, allowances for military personnel, excluding those listed in clause 29 of Article 217 of the Tax Code (remunerations under GPC agreements are not included here).

- Bonus in 2-NDFL - more than one income code is provided, since bonuses can be based on different sources of formation. Amounts are included in employer expenses in different ways, so you will have to choose based on the following conditions:

income code “2002” in 2-NDFL is indicated if accrual depends on production results, and remuneration is provided for by local acts and labor legislation;

- the income code “2003” in the 2-NDFL certificate is applied to bonuses paid from profits, target sources, and special-purpose funds.

- code “2014” – payment of severance pay, average earnings during the period of employment, as well as compensation to management exceeding 3 times (6 times in the Far North) the average salary;

Other payments

For other income, it is also necessary to indicate for what and on what basis the funds were paid. There are a lot of codes, so it is more correct to check the entire list given in order No. ММВ-7-11/387. For some types it is easy to select the required value, for example:

- For dividends - income code “1010” in the 2-NDFL certificate is needed if dividends were transferred to the company’s participants in the reporting year.

- The income code “2010” in the 2-NDFL certificate is used for remuneration to individual contractors under GPC agreements (except for royalties).

- The income code “2720” in the 2-NDFL certificate indicates the value of the gifts given to the recipient.

Other codes are longer and more difficult to understand. For example:

- Income code "2510» In the 2-NDFL certificate, an entrepreneur or company indicates if they:

paid for the employee the cost of any goods (work, services), including expenses for utility bills, study, food, and recreation;

- paid for the acquisition of personal property rights.

- if this is only a rental of the car itself, then the meaning of the applied code is “2400»;

For payments that cannot be classified into other categories, use the income code in 2-NDFL “ 4800 ”. Such income, for example, includes payment for downtime, daily allowances in excess of the taxable limit, as well as all others for which it is not possible to find a different value.

Read also: Citizenship (country code) in 2-NDFL

The table below shows income codes for 2-NDFL (2019) - a complete list of them in accordance with Order No. MMV-7-11/387.

Income code in the 2-NDFL certificate: from 1200 to 1240

| Revenue code | Decoding |

| 1200 | Income received in the form of other insurance payments under insurance contracts |

| 1201 | Income received in the form of insurance payments under insurance contracts in case of payment for the cost of sanatorium and resort vouchers |

| 1202 | Income received in the form of insurance payments under voluntary life insurance contracts (exception: voluntary pension insurance contracts) in the case of payments that are associated with the survival of the insured person to a certain age or period, or in the event of the occurrence of another event (exception: early termination of the contract ), in terms of the excess of the amounts of insurance premiums paid by the taxpayer and increased by the amount calculated by sequentially summing the products of the amounts of insurance premiums paid from the date of conclusion of the insurance contract to the day of the end of each year of validity of such a voluntary life insurance contract (inclusive), and in force in the corresponding year of the average annual refinancing rate of the Central Bank of the Russian Federation |

| 1203 | Income received in the form of insurance payments under voluntary property insurance contracts (including civil liability insurance for damage to the property of third parties and/or civil liability insurance of vehicle owners) in terms of excess of the market value of the insured property, or expenses necessary for repairs/ restoration of this property (if no repairs were carried out), or the cost of repair/restoration of this property (if repairs were carried out), increased by the amount of insurance premiums paid to insure this property |

| 1211 | Income that is received in the form of amounts of insurance premiums under insurance contracts, if these amounts are paid by employers for individuals from the funds of the employer or from the funds of an organization/enterprise or individual entrepreneur that is not an employer in relation to those individuals for whom insurance premiums are paid |

| 1212 | Income received in the form of redemption/cash amounts paid under voluntary life insurance contracts, subject to payment in accordance with the insurance rules and terms of the contracts upon early termination of voluntary life insurance contracts |

| 1213 | Income received in the form of cash/redemption amounts that are paid under voluntary pension insurance contracts and are subject to payment in accordance with the insurance rules and terms of the contracts upon early termination of voluntary pension insurance contracts |

| 1215 | Income received in the form of redemption/cash amounts paid under non-state pension agreements and subject to payment in accordance with the insurance rules and terms of the agreements upon early termination of non-state pension agreements |

| 1219 | The amounts of insurance contributions in respect of which the taxpayer was provided with a social tax deduction provided for in subclause 4 of clause 1 of Art. 219 of the Tax Code of the Russian Federation, taken into account in the event of termination of a voluntary pension insurance agreement |

| 1220 | The amounts of insurance contributions in respect of which the taxpayer was provided with a social tax deduction provided for in subclause 4 of clause 1 of Art. 219 of the Tax Code of the Russian Federation, taken into account in the event of termination of a non-state pension agreement |

| 1240 | Amounts of pensions that are paid under non-state pension agreements concluded by organizations or other employers with Russian non-state pension funds, as well as the amount of pensions that are paid under non-state pension agreements concluded by individuals with Russian non-state funds in favor of other persons |

These are the payment codes in the 2-NDFL certificate. Depending on the type of payment, a specific encoding is indicated.

Choosing an income code: example situations

The current directory offers a wide selection of options for profit received from the employer, but in current practice the following codes are recognized as the most popular:

- Type of income 2000 - denotes the wages received by specialists for the performance of assigned functions, the monetary allowance of military personnel. The code is not used to indicate payments under civil contracts.

- 2010 - used to reflect in the certificate payments received by an individual from a company or individual entrepreneur under the GPB (with the exception of remuneration to authors of works).

- Code 2300 - used to reflect payments for sick leave. Opposite the numerical designation, the accountant writes down the amount of benefits transferred to the specialist during the period of incapacity.

- 2012 – indicated opposite the amounts of vacation pay transferred to the company’s personnel.

Important! The value “2012” is used in situations where a working specialist goes on paid vacation. If the accountant paid the dismissed employee compensation for unpaid vacation, you need to use the designation “4800”.

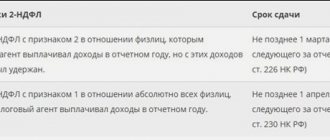

2-NDFL for tax authorities: who, to whom and when

When filing 2-NDFL reports, starting from 2020, new filling out rules apply. It was last year 2020 that the Federal Tax Service decided (Order of the Federal Tax Service of Russia dated October 2, 2018 No. ММВ-7-11/ [email protected] ) to separate the form for individuals and for regulatory authorities

. Starting from 2020, form 2-NDFL is submitted to the Federal Tax Service, and employees are provided with a certificate of income of an individual. In the future, the article will focus specifically on the form that is submitted to the tax authorities.

For periods up to 2020

The old form 2-NDFL is submitted to the Federal Tax Service.

On each sheet of form 2-NDFL, the company’s TIN and KPP are filled in, and the page number is also indicated. Next, the company fills out the general part of the form

. It is filled in:

- the year for which the reporting is presented;

- form attribute (1 or 2 – tax agent, 3 or 4 – legal successor of the liquidating company);

- adjustment number (00 – primary, then – by adjustment number, 99 – canceling);

- code of the tax authority in which 2-NDFL is submitted;

- company name, OKTMO and telephone number.

additional fields are used to fill in these characteristics

.

Next, sections of the certificate are filled out, which indicate information about employees and people who received payments (dividends, civil contracts, copyrights, and others). In section 1

are filled in:

- last name, first name and patronymic of employees and other persons who received income from this enterprise;

- TIN;

If the enterprise does not know the employee's tax identification number, then this field can be found through a special service on the Federal Tax Service website or left blank.

- date of birth and citizenship (country code for Russia is “643”);

- taxpayer status (tax resident individual code – “1”);

- document code (Russian citizen passport code – “21”).

What income is not subject to personal income tax?

These include, for example:

- maternity benefits (clause 1, article 217 of the Tax Code of the Russian Federation);

- legally established compensations paid as compensation for harm in case of damage to health, reimbursement of expenses for improving the professional level of employees, for the performance by the employee of his work duties, incl. on a business trip (clause 3 of article 217 of the Tax Code of the Russian Federation);

- statutory compensation paid to an employee in connection with dismissal (severance pay, earnings for the period of employment, compensation to the manager, his deputies, chief accountant), if the total amount of payments does not exceed three times the average monthly salary. Or six times the amount if the employee resigns from an organization located in the Far North or equivalent areas (clause 3 of Article 217 of the Tax Code of the Russian Federation);

- material assistance paid to family members of a deceased employee (clause 8 of article 217 of the Tax Code of the Russian Federation);

- material assistance paid to persons affected by a natural disaster or emergency circumstances (clause 8.3 of article 217 of the Tax Code of the Russian Federation);

- compensation to employees and members of their families for the cost of sanatorium-resort (non-tourist) vouchers to sanatorium-resort and health-improving organizations located on the territory of the Russian Federation. To exempt such compensation from personal income tax, they must be paid from the funds remaining at the disposal of the employer after payment of income tax or tax paid when applying a special regime (clause 9 of article 217 of the Tax Code of the Russian Federation);

- payment for medical services provided to an employee or members of his family from the net profit of the employing organization (clause 10 of article 217 of the Tax Code of the Russian Federation);

- the amount of tuition fees for an employee for basic and additional educational programs in Russian organizations conducting educational activities, or foreign organizations that have the right to conduct educational activities (clause 21 of Article 217 of the Tax Code of the Russian Federation);

- gifts, the cost of which does not exceed 4,000 rubles. per year received by an employee or other person from an organization or individual entrepreneur, as well as financial assistance up to 4,000 rubles. per year received by an employee or former employee (now a pensioner) (clause 28 of article 217 of the Tax Code of the Russian Federation);

- compensation of employee expenses for paying interest on loans for the purchase or construction of housing (clause 40 of article 217 of the Tax Code of the Russian Federation).

A complete list of income exempt from personal income tax is given in Art. 217 Tax Code of the Russian Federation. By the way, it's closed.

Payments not subject to personal income tax are such for all citizens, regardless of their status - resident or non-resident (Letter of the Ministry of Finance dated June 18, 2010 No. 03-04-06/6-125)

Income codes in the 2-NDFL certificate: from 1530 to 1554

| Revenue code | Decoding |

| 1530 | Income received from transactions with securities (securities) that are traded on the organized securities market |

| 1531 | Income received from transactions with securities not traded on the organized securities market |

| 1532 | Income received from transactions with derivative financial instruments traded on an organized market and the underlying asset of which are stock indices, securities or other derivative financial instruments, the underlying asset of which are securities or stock indices |

| 1533 | Income received from transactions with derivative financial instruments not traded on an organized market |

| 1535 | Income received from transactions with derivative financial instruments that are traded on an organized market and the underlying asset of which is not securities, stock indices or other derivative financial instruments, the underlying asset of which is securities or stock indices |

| 1536 | Income received from transactions with securities not traded on the organized securities market, which at the time of their acquisition met the requirements for traded securities |

| 1537 | Income in the form of loan interest received from a set of repo transactions |

| 1538 | Income in the form of interest received in the tax period under a set of loan agreements |

| 1539 | Income received from operations related to the opening of a short position that is the object of repo operations |

| 1540 | Income received from the sale of participation shares in the authorized capital of organizations |

| 1541 | Income received as a result of the exchange of securities transferred under the first part of the repo |

| 1542 | Income received in the form of the actual value of a share in the authorized capital of an organization, which is paid when a participant leaves the organization |

| 1544 | Income received from transactions with securities traded on the organized securities market, accounted for on an IIS (individual investment account) |

| 1545 | Income received from transactions with securities not traded on the organized securities market, recorded on the IIS |

| 1546 | Income received from transactions with derivative financial instruments that are traded on an organized market and the underlying asset of which is stock indices, securities or other derivative financial instruments accounted for on the IIS |

| 1547 | Income received from transactions with derivative financial instruments that are not traded on the organized securities market accounted for on the IIS |

| 1548 | Income received from transactions with derivative financial instruments that are traded on an organized market and the underlying asset of which is not securities, stock indices or other financial instruments of futures transactions, the underlying asset of which is stock indices or securities accounted for on the IIS |

| 1549 | Income received from transactions with securities not traded on the organized securities market, which at the time of their acquisition met the requirements for traded securities accounted for on the IIS |

| 1550 | Income received by a taxpayer upon assignment of rights of claim under an agreement in shared construction/investment in shared construction or under another agreement related to shared construction |

| 1551 | Income in the form of interest on a loan, which is received from a set of repo transactions accounted for on the IIS |

| 1552 | Income in the form of interest received in the tax period under a set of loan agreements accounted for on the IIS |

| 1553 | Income received from operations related to the opening of a short position, which is the object of repo transactions accounted for on the IIS |

| 1554 | Income received as a result of the exchange of securities transferred under the first part of the repo, accounted for on the IIS |

All tax agents who carry out transactions of sale/exchange/purchase of securities must reflect the income in the personal income tax report. Income code 1530 in the 2-NDFL certificate is intended precisely for this.