Bookmarked: 0

Whether an individual can take out a loan for housing is a question that worries many novice businessmen. In most cases, a mortgage is the only way to purchase your own apartment or house. The procedure for obtaining such a loan for an entrepreneur is slightly different. To get a loan, you need to know how an individual entrepreneur confirms his income in a year. Since without official documents, obtaining a mortgage is almost impossible.

Profit confirmation procedure

The main difference between an individual entrepreneur is that he works for himself. An individual entrepreneur has income that he can dispose of at his own discretion. However, the entrepreneur does not have the main condition for a loan - salary.

A logical question arises: how can an individual entrepreneur confirm his income if he cannot provide a 2-NDFL certificate?

Basic documents confirming the income of an individual entrepreneur:

- tax return (certificate 3-NDFL);

- bank account statement;

- excerpt from the Unified State Register of Individual Entrepreneurs.

The bank may request additional papers that directly or indirectly indicate the presence of net profit and expenses of an individual entrepreneur:

- balance sheet;

- income and expense report.

It is important for the bank that all profits are clean, and that the businessman can disclose them without any problems. Therefore, all documents are carefully checked by responsible employees and the security service. If any point is in doubt, they will ask you to explain where the entry came from. If a businessman cannot document this or that article, then the decision on the mortgage will be negative.

On video: 260,000 rub. from the state. My experience

https://youtu.be/SfVkbSOA8cc

Features and nuances

Most government bodies allow the possibility of submitting a certificate in any form, provided that all information necessary for monitoring is included in it. However, before preparing the document, you should ask the receiving organization whether it has internal regulations on the procedure for preparing and submitting the certificate. When compiling it, only reliable data should be entered. An incorrectly completed document may result in penalties and criminal prosecution.

Confirmation of individual entrepreneur’s income on OSN and simplified tax system

For business entities that are in the main tax regime, confirming net profit for a mortgage is not difficult. It is enough to provide a tax return 3-NDFL with a mark from the fiscal service. Moreover, entrepreneurs annually report on their profits to the Federal Tax Inspectorate.

This document contains the following information:

- all profits;

- expenses that affect the size of the tax base;

- personal data of the entrepreneur.

But how can an individual entrepreneur confirm his income to the bank when receiving a mortgage if the entrepreneur is under a different tax regime? Because it is not always enough for banks to provide a tax return for the previous year or for the reporting period.

Let's try to figure out how to confirm the income of an individual entrepreneur using the simplified tax system. Business entities that are on the simplified tax system are required to maintain their own book of income and expenses. Information is displayed here that helps determine the real profit of a businessman. A notarized copy of the book is suitable for the bank.

Additionally, payment documents may be needed:

- incoming and outgoing cash orders;

- bank account statement;

- agreement.

If an entrepreneur works without a cash register, then the first two documents are not needed. For the tax inspectorate, individual entrepreneurs who are on the simplified tax system also submit annual reports. The bank may require a second copy of the declaration as an additional document.

On video: Investing in real estate documents/nuances

Certificate of income from individual entrepreneur sample

The law does not regulate the form of income document for an entrepreneur. Therefore, the document can be drawn up in any form, taking into account the inclusion of mandatory information that must be taken into account by the authorized body when granting a privilege. It should reflect:

- personal and tax data of the entrepreneur;

- legal coordinates of the individual entrepreneur;

- registration document number;

- Contact details;

- the amount of revenue for the estimated time period;

- date of preparation of the document;

- entrepreneur's signature.

For some government agencies, a tax return may be provided instead of a certificate.

Confirmation of individual entrepreneur's profit on UTII and PNS

How to confirm the income of an individual entrepreneur on UTII? Credit organizations know that the declaration that a businessman submits to the tax office every year does not reflect the real picture of his profit.

The Ministry of Finance recommends choosing one of the following confirmation methods:

- using primary documentation;

- switch to a simplified profit accounting scheme.

In addition, each individual entrepreneur on UTII keeps records of profits on his computer or on paper. However, such records do not constitute documentary evidence of profit for the bank. Accordingly, the question arises of how to prove to the bank that the individual entrepreneur is solvent. For this purpose, a special book is created, which is assigned the status of an internal accounting register. The book form is established depending on the preferences of the business entity.

On video: Case. BUSINESS MORTGAGE: REAL ESTATE ON CREDIT

The document must contain the following information:

- Name;

- date of its registration;

- data of an individual entrepreneur (full name, registration number, TIN);

- the period for which records are kept;

- signature of the business entity.

All records are kept in chronological order. Each entry must have its own serial number and name. A copy of the document certified by a notary is proof of profit for the bank. Typically, such a document is maintained by entrepreneurs who work without a current account. Most businessmen who are on the PSN ask the question how to confirm the income of an individual entrepreneur on a patent in a year?

Here the situation is the same as for an entrepreneur on UTII. It is necessary to keep a book of income. You can also provide a bank account statement.

On video: They didn’t give me a MORTGAGE

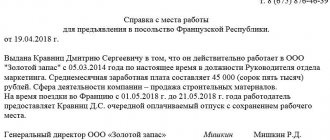

Where to get an individual entrepreneur income statement

An individual entrepreneur can obtain an income statement using the bank’s online service. On the bank’s website in the client’s Personal Account, you will need to order an extract from the individual entrepreneur’s current account. Next, you need to certify the received statement with a seal at the bank branch.

An individual entrepreneur also has the right to make a certificate of employment and salary for himself, but only the company’s accountant has the right to sign it. It is necessary to attach to the certificate certificates of company registration and tax registration.

If a declaration of income is not enough when traveling abroad, you can obtain information from the tax authorities about other additional income of an individual entrepreneur. In this case, it is necessary to submit an application to the tax authority at the place of registration of the business. The certificate must be issued by the Federal Tax Service within 30 days.

Income certificates have a certain validity period (need to be clarified at the Consulate). In any case, they should be received shortly before the planned trip abroad. It is necessary to take into account that if there is the slightest inaccuracy in the documents provided, corrections, or false information, entry into the country will be denied. It is also possible to be blacklisted; in the future, you will be denied a visa to many countries.

As a last resort, if it is not possible to confirm your income level, you may receive a sponsorship letter. The sponsor must guarantee payment of all expenses while in a foreign country. You will need to provide a copy of your passport and documentary evidence of the sponsor's income.

FAQ

How can an individual entrepreneur obtain a 2-NDFL certificate?

A certificate of income of individuals in form 2-NDFL is filled out only by tax agents. Those. issued by the employer to its employees. An individual entrepreneur cannot apply for 2-personal income tax for himself, because... is not a tax agent. If an entrepreneur combines his own business with hired work, he receives a 2-NDFL certificate from the accounting department at his place of work. At the same time, income from individual entrepreneurs and from the place of work can and should be summed up to obtain a mortgage.

How can an individual entrepreneur receive a deduction for the purchase of housing using the simplified tax system?

The tax deduction applies only to personal income tax payers. If an individual entrepreneur applies special tax regimes (STS, patent, UTII) and does not pay personal income tax, then he cannot take advantage of the deduction. A deduction is possible if an individual entrepreneur applies the general regime and pays personal income tax or works for hire and the employer pays personal income tax to the budget for him.

The amount of business income must be known not only for correct taxation, but also in many other cases. For example, it is required for an entrepreneur to obtain a loan from a bank, for a foreign entrepreneur to provide information to the migration service, to confirm the right to state benefits for entrepreneurs with children, etc. Those who apply different taxation systems for individual entrepreneurs determine income in accordance with the rules of the Tax Code of the Russian Federation. Let's look at them.

Certificate of income in the bank form for individual entrepreneurs on the simplified tax system: accounting for income and expenses

Individual entrepreneur working on the simplified tax system

If a businessman is on the simplified taxation system ( USN ), then his income is also displayed in the declaration. It is necessary to make a photocopy of this document and put a mark in the Federal Tax Service Inspectorate regarding the acceptance of the Federal Tax Service Inspectorate’s declaration. You can submit this document to any budget institution, banking organization, and so on.

Important: However, each government agency has its own operating regulations, which are prescribed by the administration of the city, district or region. Also, many government agencies work according to instructions issued by law.

Therefore, some government agencies may require additional confirmation of the receipt of funds:

- A businessman working on the simplified tax system must keep a ledger of income and expenses.

- This journal contains all the necessary data in order to determine the receipt of funds for an individual entrepreneur.

- Take a photocopy - if a government agency asks you to provide this Book to confirm profits, then naturally the magazine itself does not need to be given anywhere. You can make photocopies of the necessary pages, have them certified by a notary and submit them to a government agency.

- If this is not enough for a financial institution. In this case, it is worth providing primary payment documentation that will confirm the receipt. These include incoming bank statements, which track the movement of money across current accounts, contracts, and so on.

If you have opened your own business using the simplified tax system, be sure to keep a ledger of income and expenses. After all, at any time you may need to provide information about the movement of your funds.

What is paper

In the usual form, there is no certificate indicating the income of an individual entrepreneur. Russian legislation does not provide for this concept. Instead, there is a document that confirms the solvency of an individual entrepreneur: a tax return.

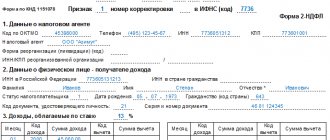

The tax return, regardless of the form of taxation, is filled out in form 3-NDFL. Sample form on the right. The paper itself is issued to the tax and duties inspectorate at the place of registration of the individual entrepreneur.

The paper must have a mark indicating that it has been accepted by the tax office. This is the only document thanks to which an individual who has opened an individual entrepreneur can confirm the stability and level of his income.

What information does it contain?

For the tax return, the entrepreneur prepares a report that covers the following aspects:

- Name of paper.

- Start of conducting.

- Place.

- Entrepreneur's details (Last name and initials, registration number and Taxpayer Identification Number).

- The time that the report covers.

- Personal signature.

In addition, it contains information about business transactions:

- Date of.

- Operation name.

- Operation number and date.

- Indicators of the ratio of income and expenses (in monetary terms).

Each entry has its own serial number.

Sample income certificate

What should an individual entrepreneur do on the simplified tax system?

How can an individual entrepreneur write a certificate for himself when no one issues this document? The declaration displays information about the profit of the individual entrepreneur. After making a copy of the document, you need to put the appropriate mark of acceptance. This document can be submitted to all authorities where proof of income is needed.

Any government body is guided by administrative regulations. For some services, it is not enough to submit a declaration confirming the receipt of profit. Therefore, it is imperative to maintain KUDIR. The accounting book must display all financial transactions of the individual entrepreneur. The amount of income must additionally be confirmed by primary documents. An entrepreneur must take into account the difference between being on UTII and the simplified tax system.

How long is a profit certificate valid?

Each authority has its own requirements that they impose in relation to the validity period of the certificate. The documents provided are valid for the entire period that begins after the reporting period. However, it is better to clarify how long the certificate will be valid at a particular institution.

It is more practical to confirm the receipt of profit by an individual entrepreneur in a year using a declaration. You need to be prepared for the fact that you will have to supplement the package with other documents and statements, depending on the tax system used by the individual entrepreneur. Therefore, it is recommended to pay attention to recording all income, collecting and storing incoming documents.