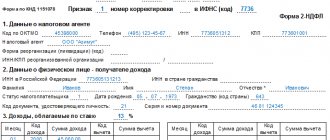

A citizen may need a certificate in form 2 of personal income tax for personal purposes, regardless of his employment and ability to work, but the question arises, where can I get a certificate of income if I don’t work? A student, pensioner, or individual registered with the Central Employment Center may need a document to apply for a loan or state benefit. Who and where should I contact to receive a form reflecting income for the required period? And can all unemployed people file 2 personal income taxes?

What does it look like

Such an extract may be needed during subsequent employment if the employer needs to explain where the gap in work experience comes from. A certificate is also required when applying to various government authorities, for example, when applying for benefits and benefits.

The document reflects the following information:

- FULL NAME. of an individual, his date of birth and address.

- Information that he is registered on the labor exchange.

- Date of status assignment.

- Information about receiving unemployment benefits. The payment period and benefit amount are indicated, broken down by month.

At the end of the form, the director and accountant of the employment center put their signatures. Visas are certified by a round seal of the institution.

To officially recognize a person as unemployed, you will need to present a certain set of papers, which includes:

- national passport;

- documentation indicating education or advanced training;

- work book, if available;

- papers confirming the end of employment;

- certificate of earnings for the last three months, if the citizen worked.

Notification of salary changes

8682 In some cases, the management of organizations is forced to change the salaries of their employees downward. The law allows this, but only if staff are notified of the upcoming changes in advance.

FILES Salaries of employees may decrease due to both internal and external reasons. Internal ones most often include financial problems of an enterprise caused by production difficulties - interruptions in the production of goods, a decrease in its volume, quality, etc. as well as ineffective management or unsuccessful reorganization of the company.

External reasons - loss of established contacts with suppliers of raw materials or distributors of finished products, also leading to a budget deficit for the company, changes in legislation, etc. Regardless of the circumstances under which the administration decides to reduce wages, it must adhere to a certain procedure in this matter, which includes mandatory written notification to staff. Employees whose salary is being reduced must be notified of this at least two months before the change comes into force.

It is believed that this time is enough for the employee to decide whether to remain in the same place, but under new, less favorable working conditions, or look for another job. At the same time, in the notification, the employer is obliged to offer the employee all available alternative available vacancies that correspond to his level of qualifications (in case he wants to remain in the company, but when moving to another position).

If there are no such vacancies, this must also be noted in the notification.

If the employee nevertheless decides to quit (and such an option when the salary is reduced is by no means uncommon), then in addition to the money actually earned by him at the time of dismissal, he is entitled to compensation for unrealized vacation and payment of severance pay in the amount of average earnings for two weeks.

In the case where a person agrees to a reduction

Description

A person who has lost his job can contact the Employment Center to find a new one. This organization:

- Pays unemployment benefits.

- Engaged in employment of citizens.

- Refers for retraining.

Obtaining a certificate is a free public service.

Unemployment benefits are two-time payments every month to citizens who register and re-register in the system once every thirty days.

However, not only those who need a new job can turn to the Employment Center for help. This organization also issues certificates to those categories of citizens who do not have unemployed status.

You can apply for this document:

- Citizens of the Russian Federation.

- Foreign citizens.

- Stateless persons.

The main condition will be the provision of all official papers.

You should come for this document on the days when citizens are received, so it would be better to find out the Center’s work schedule in advance.

Where to get it

Receipt:

- Employees of the Employment Center located at your place of residence issue a certificate of non-receipt of unemployment benefits.

- The receipt period should not be more than four working days.

You should write your information legibly if you are filling out the application by hand. This will help to avoid mistakes when drawing up the document.

Documents to be received

In order for you to be issued such a paper, you must collect the following documents:

- Statement of the established form.

- A document identifying your identity (passport).

- Work record book (read how to obtain an extract from the work record).

No more documents are needed.

You can order this paper only by applying in person with the documents. It is not possible to place an order through the website.

document

- Help: samples (Full list of documents)

- Search for "Help" throughout the site

- “Certificate of no income from labor, entrepreneurial and other activities for a participant in the state program to assist the voluntary resettlement of compatriots living abroad to the Russian Federation.”doc

- Documents downloaded

Entered into the database

Corrections have been made to

- Treaties

- All documents

- Holidays and weekends calendar for 2019

- Small business registration is useful

- How to draw up a contract yourself

- OKVED code table

On our website, everyone can find a contract or a sample document of interest for free; the database of contracts is updated regularly. Our database contains more than 5,000 contracts and documents of various types. If you notice an inaccuracy in any agreement, or the impossibility of the “download” function of any agreement, please contact us using the contact information. Have a good time!

Today and forever

— download the document in a convenient format! A unique opportunity to download any document in DOC and PDF absolutely free of charge. Only we have many documents in such formats. After downloading the file, click “Thank you”, this helps us form a rating of all documents in the database.

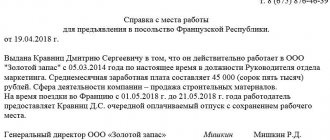

Where you might need it. Filling Features

Help required:

- To apply for housing and communal services subsidies.

- To receive a lump sum benefit upon the birth of a child.

- Regional charges per child.

- To receive other social benefits (monthly child benefits).

In order to be eligible for any government assessments, this document is required.

You might be interested. Certificate of average earnings:

Filling Features

A certificate confirming the lack of registration as unemployed and non-receipt of benefits is drawn up on the letterhead of the Employment Center. This document should contain the following information:

- Full address and name of the Employment Center.

- Name of the official paper.

- Last name, first name, patronymic of the citizen to whom the document is issued.

- His date of birth.

- Passport details.

- Home address (read about actual address).

- The text of the document confirming that the citizen is not registered with the Employment Center and does not receive benefits.

- Where is the document submitted?

- Position, surname, name, patronymic and signature of the person who issued the certificate.

- Date of issue.

There are no clear instructions regarding the form for filling out this document, so some details may change.

Filling example

To obtain a certificate, a citizen should write an application addressed to the director of the Employment Center, here is a sample.

Results, a certificate from the Employment Center confirms the fact of non-receipt of assistance from the state in the form of monthly payments.

Where can I get a certificate stating that I am not working?

Questions

1. Where can I get a certificate stating that I do not work and do not receive child benefits for 2 years.

1.1. You can get a certificate of receipt of payments for your child from social security. You can get a certificate from the employment center stating that you are not working.

2. Where can I get a certificate stating that I am not working?

2.1. There are no such certificates. If you do not work officially and in order to resolve some issue it is necessary to confirm this fact, then you will be presented with a work book, from which it is clear whether you are working or not.

2.2. Dear Victor Wilms, since you are asking your question on the Russian portal, and specifying Germany, Cologne as your place of residence, you should definitely clarify which law your question relates to: German or Russian. If you need to obtain a certificate for German law and a certificate in Germany, then the answer of Russian lawyers 1) misleads you, 2) does not comply with the norms of German law and 3) since foreign lawyers, according to (RBerG), cannot advise on issues of German law at all, the answer is meaningless . Here's what you should know if your question relates to German law: The issuance of a document confirming the fact that a citizen in Germany is not working and the agency to which a request for issuing such a document should be addressed depends on the reasons for the lack of work, namely: - if in connection with unemployment - then department 1, - if due to temporary disability - then body 2, - if in connection with limited ability to work (disability) - department 3, - if in connection with the implementation of independent activities - then body 4 , - if due to the lack of permission to work in Germany - then body 5, - if due to sufficient provision of own funds (no need for work) - then body 6. As you can see, the answer to your question “where to get a certificate” in Germany it depends on why you are not working. I would be glad if my answer helped you navigate German labor, social and migration law.

3. How and where can I get a certificate stating that you are on maternity leave if you have never worked?

3.1. It depends what you mean by “maternity leave.” This concept is not legally defined. The Labor Code of the Russian Federation only knows maternity leave or parental leave. However, as a general rule, only those who work have the right to these holidays.

3.2. Maternity leave is popularly called “maternity leave”. If you mean this, then you will not be able to get such a certificate anywhere if you did not work officially and, accordingly, were not on such leave.

4. Where can I get a certificate stating that I am not working?

4.1. To do this, you need to take your passport, work book and apply for a certificate at the local employment center.

5. Where can I get a certificate stating that I am not working?

5.1. Hello. To do this, you need to take your passport, work book and apply for a certificate at the local employment center. Good luck. IN.

5.2. Good afternoon In the employment center.

6. Where can I get a certificate stating that I am not working?

6.1. Obtain a certificate of no income from the tax office. Register with the labor exchange and ask them for a certificate about this.

6.2. Hello! You can contact the Employment Center. Documents required to obtain a certificate: original work record book, original passport, application. This certificate is issued within 3 working days.

7. Please tell me where I can get a certificate stating that I am not working.

7.1. A work record book can confirm this fact or a certificate from the employment center.

7.2. Good afternoon. You need to register with the employment center and obtain this certificate from them if you are a citizen of the Russian Federation.

8. Where and how can I get a certificate stating that I do not work and did not receive a lump sum payment for the birth of a child?

8.1. At the social security authorities at the place of residence and only there, providing a work book.

9. My husband was found dead at work. He died during non-working hours. The morgue report does not indicate where he was found or where his death occurred. And the question itself is this: his mother-in-law wants to sue his work, and to be paid an amount, about a million, or something... Can we sue? Or will they sue us for libel? Although, you can get a paper from the investigative committee about where his body was found.

9.1. It is not a problem to sue Article 3 of the Code of Civil Procedure of the Russian Federation. The problem is to prove the legality of one’s claims, Article 56 of the Code of Civil Procedure of the Russian Federation. In this case, there are no grounds for the employer to reimburse 1 million rubles.

9.2. Good afternoon Here you need a cause-and-effect relationship between the death of your husband and the employer, place of work, time of work. You say you died at work, but not during working hours. I advise you to contact a lawyer or advocate so that you can assess all the circumstances.

10. Where can I get a certificate stating that I am on maternity leave? If I don't work. And I’m not a member of the labor exchange.

10.1. Contact the Social Security Fund.

10.2. You receive social benefits after the birth of a child, right? So get a certificate of payment of benefits. Why do you need this certificate? Where should I submit it? The one who demands must voice the certificate form.

11. Please tell me I need a certificate stating that I am not employed anywhere, I don’t work, where can I get it?

11.1. In the Central Employment Service, you are not registered as unemployed. There is no record of work in the labor record right now. The Pension Fund does not contribute to pensions, there is no income.

12. Hello, my husband works unofficially, I don’t work at all, I need to apply for child benefit. Where can I get a certificate of income for 12 months and that he has not previously received child benefit?

12.1. Can't get it anywhere. Falsifying documents can land you in the dock.

12.2. Let him get a job or go to the labor exchange. Without these certificates, benefits will not be assigned.

13. Please, I would like to apply for the status of a low-income family. My dad lives with us (60 years old, doesn’t receive a pension yet), he doesn’t work, he lives at our expense. You can provide information to the MFC about the fact that in addition to us, our father also lives in the family and whether he will be counted when calculating the cost of living. And if you need to provide it, what kind of certificate should you provide stating that it does not work and where can I get it?

13.1. Well, that means your father will still receive a pension this year. In the second half of this year, since the pension will be issued six months later. By the way, he can register with the Employment Center and receive unemployed status. A certificate stating that you are not working can be obtained from the pension fund - an extract from your personal account.

Outside of taxes Some payments to employees are not taxed, so there is no need to provide a 2-NDFL calculation for these payments either. These include:

- Payments upon dismissal. There is no need to worry if the dismissal occurred at the beginning of the reporting period. Payments upon dismissal are not taxed. But if the employee was entitled to compensation for unused vacation, then it is impossible to do without replenishing the tax base. When making calculations regarding vacation, 2-NDFL will have to be submitted during the reporting period, even if the employee quit.

- Travel expenses for employees. But they should not exceed 700 rubles per day when traveling on business in Russia and 2,500 rubles per day when sending an employee to foreign countries.

Components of the document Actually, the letter will consist of just one phrase. Everything else is a “mandatory program” accepted in business communication.

Letter stating that there is no obligation to submit 2-NDFL calculations

Info The chief accountant and the head of the enterprise sign the document and attach to it a certificate from the bank confirming that there was no movement of money in the account. The letter to the FSS contains the following information:

- Address of the territorial body of the FSS.

- Company name.

- Details and addresses of the legal entity.

- Indication that there is no cash flow and no payroll for employees.

There are several cases when a citizen is required to present a certificate of his income. For example, when applying to a banking organization for a mortgage or consumer loan.

The question immediately arises: where can I get a certificate of income if I don’t work? The certificate form has the index 2-NDFL. Most likely, you are working and simply receiving a “gray” salary - that is, unofficial. In this case, you can discuss all this with your boss.

Letter of absence of activity In practice, there are often situations when an organization cannot conduct financial and economic activities for a long period of time. The head of the enterprise, when preparing documents with the territorial tax authorities, the Russian pension fund or the social insurance fund for filing mandatory reporting, undertakes to provide the listed bodies with information letters stating the absence of activity. A notification of this type is issued on the letterhead of a legal entity, indicating the period during which no activity was carried out and attaching documents confirming this circumstance. An organization, in order to reduce costs while not carrying out business activities, can send documents to the reporting authorities confirming that the company’s work has been suspended.

Periodicity

In the vast majority of cases, 2-NDFL calculations are submitted once a year. Information is provided for each employee who is registered in the organization separately. The deadline for this is April 1. Moreover, if this date falls on a weekend, then the “border” becomes the weekday preceding this date.

Moreover, it is interesting that simultaneously with hiring an employee, a legal entity or individual entrepreneur automatically agrees to provide appropriate reporting to the tax authorities. All responsibility for this process lies with the head of the company.

Thus, the letter stating that there is no obligation to provide a 2-NDFL calculation is also sent only once a year.