ACCOUNTING OF CASH OPERATIONS AND CASH DOCUMENTS

CASH ACCOUNTING

TOPIC

The procedure for storing and spending funds at the cash desk is established by the instruction of the Central Bank of the Russian Federation dated October 4, 1993 No. 18 “Procedure for conducting cash transactions in the Russian Federation.”

To make cash payments, each organization must have a cash register and maintain a cash book in the prescribed form.

Conducting cash transactions is entrusted to the cashier, who bears full financial responsibility for the safety of accepted valuables.

In the cash register you can store amounts of money within the limit established by the bank for paying small business expenses, issuing advances for business trips and other small payments.

Exceeding the established limits at the cash desk is allowed only for three working days during the period of payment of wages to the organization's employees, temporary disability benefits, scholarships, pensions and bonuses (in the Far North - 5 days).

The receipt of money into the cash register and the issue from the cash register are documented with incoming

The cashier records all transactions involving the receipt and expenditure of funds in a cash book, which must be numbered, laced and sealed with a wax or mastic seal.

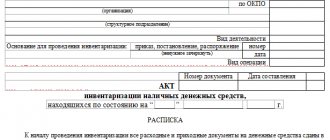

Within the time limits established by the head of the organization, as well as when cashiers change, a sudden audit of funds and other valuables in the cash register is carried out.

Cash stored in the cash register is accounted for in the active synthetic account 50 “Cashier”.

The debit records the receipt of funds in the cash register, and the credit records the outflow of funds from the cash register.

Sub-accounts can be opened for account 50 “Cashier”:

50-1 “Organization cash desk”;

50-2 “Operating cash desk”;

50-3 “Cash documents”, etc.

In subaccount 50-1 “Cash of the organization” the cash in the cash register is taken into account. If an organization carries out cash transactions with foreign currency, then sub-accounts are opened to account 50 “Cash” for separate accounting of the movement of each cash foreign currency.

In subaccount 50-2 “Operating cash desk, ” the presence and movement of funds in the cash registers of commodity offices (piers) and operational areas, stopping points, river crossings, ships, ticket and baggage offices of ports, train stations, etc. are taken into account. This sub-account is opened by organizations if necessary.

Subaccount 50-3 “Cash documents” takes into account postal and bill stamps in the organization’s cash desk, paid air tickets, state duty stamps and other monetary documents.

123Next ⇒

Date added: 2014-02-09; ; Does the published material violate copyright? | Personal data protection |

Didn't find what you were looking for? Use the search:

https://youtu.be/xYXSr1PV3CY

Cash discipline in 2020

In order to understand the concept of “cash discipline”, you first need to understand the difference between the terms “Cash register” and “Cash desk”:

Cash register (CCT)

– this is a device necessary for

receiving

funds from your customers, and in some cases, issuing them (for example, returning goods). There can be any number of such devices and each of them must have its own reporting documents.

Enterprise cash desk (operating cash desk)

– this is the totality

of all cash transactions

(reception, storage, issue). The cash register receives revenue received, including from the cash register. All cash expenses related to the activities of the enterprise are made from the cash desk, and money is handed over to collectors for further transfer to the bank. The cash register can be a separate room, a safe in the room, or even a drawer in the desk.

So, all cash transactions must be accompanied by the execution of cash documents, which is usually meant by compliance with cash discipline.

Cash discipline

is a set of rules that must be followed when carrying out operations related to the receipt, issuance and storage of cash (cash transactions).

The basic rules of cash discipline are:

Who must comply

The need to maintain cash discipline does not depend on the availability of a cash register or the chosen taxation system.

Even if you do not have a cash register (for example, you fall into the exceptions from Article 2 of Law 54-FZ), you must still follow the rules of cash discipline. There is only one rule here - if there is cash flow, then cash discipline must be observed.

However, since June 2014, a simplified procedure for maintaining cash discipline

, which most affected individual entrepreneurs. Now individual entrepreneurs are no longer required to maintain a cash register on a par with organizations and draw up cash documents (PKO, RKO, cash book). Entrepreneurs only need to generate documents confirming the payment of wages (payroll and payslips).

Also, according to the simplified procedure, individual entrepreneurs and small enterprises (number of employees no more than 100 people and revenue no more than 800 million rubles per year) are no longer required to set a limit

cash balance at the cash register.

All rules of cash discipline are listed in the instructions of the Bank of Russia (Instruction No. 3210-U dated March 11, 2014 and Instruction No. 3073-U dated October 7, 2013).

Cash documents

Cash desk operations must be carried out by an authorized employee (cashier); in his absence, these functions can be performed by a manager (IP). If there are several cashiers, a senior cashier is appointed.

Cash documents must be prepared by the chief accountant or another appointed official (manager, individual entrepreneur, cashier, etc.), with whom an agreement has been concluded for the provision of accounting services.

In 2020, cash transactions are documented with the following documents:

- Receipt cash order (PKO) – filled in every time receipt of money at the cash register

. If cash is issued by check or BSO, then it is allowed to draw up a PKO for the total amount of cash received for a working day (shift).Note. Since July 2020, SSR (strict reporting forms) have been generated at cash registers. It is prohibited to use printed BSOs instead of checks.

- Expenditure cash order (RKO) - filled in when issuing money from the cash register

. When receiving an order (for example, from an employee who went to buy office supplies), the cashier must make sure that the cash register order is signed by the chief accountant (manager) and check the employee’s identification documents. - Cash book (form KO-4) – data on each incoming and outgoing cash order is entered into the book. At the end of the working day, the cashier must check the cash book data with the data in cash documents and display the amount of cash remaining in the cash register. If there were no cash transactions during the day, the cash book will not be filled out.

- Accounting book (form KO-5) - filled out only if the enterprise employs several cashiers. Entries in the book are made during the working day at the time of transfer of cash between the senior cashier and cashiers and are confirmed by their signatures.

- Payroll and payroll – are prepared when issuing wages, stipends and other payments to employees.

1.8. Storing cash in the cash register.

№ 18.

In accordance with this document, organizations, regardless of organizational and legal forms and scope of activity, are required to store available funds in banking institutions.

Organizations make settlements for their obligations with other organizations, as a rule, non-cash through banks, or use other forms of non-cash payments established by the Bank of Russia in accordance with the legislation of the Russian Federation.

To make cash payments, each organization must have a cash register and maintain a cash book in the prescribed form.

Cash transactions are carried out by a cashier, who, when hired, must be familiar with the rules for conducting cash transactions and with whom a liability agreement is concluded. The cashier bears full financial responsibility for the safety of all valuables accepted by him (cash, monetary documents). A temporary replacement of a cashier is carried out by written order of the head of the enterprise. An agreement on financial liability is also concluded with the employee replacing the cashier. If the volume of cash flow at the cash register is small, it is advisable to assign cashier duties to one of the enterprise employees in a combination manner. In small organizations that do not have a cashier on staff, the latter’s duties can be performed by the chief accountant or another employee by written order of the head of the organization, subject to the conclusion of a liability agreement with him.

Cash received by organizations from banks is spent for the purposes specified in the check (for the payment of wages, for business needs, for travel expenses).

In the cash register you can store small amounts of money within the limit set by the bank to pay for small business expenses, advances for business trips and other small payments. Limits on the balance of cash in cash registers and norms for the use of proceeds are established by banking institutions in agreement with the heads of these enterprises. In excess of the limit, cash can be kept in the cash register only during the payment of wages and benefits to employees of the enterprise for a period of no more than 3 working days (in the Far North - no more than 5 days), including the day the money is received from the bank.

Without limiting the norms, cash can be spent from the proceeds of enterprises that have constant revenue (for example, trade, public catering, etc.). Enterprises are required to deposit all cash in excess of the limit to the bank.

To establish limits on the balance of cash in the cash register, the procedure and terms for submitting proceeds to the bank, enterprises submit a special application-calculation to the bank at the beginning of the first quarter. In this application, the enterprise shows the monthly volume of cash receipts, the expected expenditure from the proceeds in cash, the amount of average daily revenue (based on the number of working days of the organization), the procedure and timing for submitting the proceeds to the bank, and the cash balance limit.

The cash balance limit is set:

- for enterprises that have cash revenue and hand over cash to bank institutions or enterprises of the State Committee for Communications of Russia every day at the end of the working day - in the amounts necessary to ensure the normal operation of enterprises from the morning of the next day;

- for enterprises that have cash revenue and hand over cash to bank institutions or enterprises of the State Committee for Communications of Russia the next day - within the limits of average daily cash revenue;

- for enterprises that have cash revenue and donate cash to banking institutions or enterprises of the State Committee for Communications of Russia not daily, - depending on the established deadlines for delivery and the amount of cash revenue;

- for enterprises that do not have cash revenue - within the limits of the average daily cash expenditure (except for wages, social benefits and scholarships).

12Next ⇒

Date added: 2013-12-13; ; Copyright infringement?;

Recommended pages:

Grounds for issuing money to an accountable person

Employees are allocated money for the targeted use of funds in the interests of the organization. Subject to the issuance of funds from the cash register, organizations are guided by the rules for operating cash register systems.

To receive these accountable funds, the employee presents one of the organization’s documents provided for by internal regulations:

- order (order) from the manager to issue money

- an employee’s application to provide him with an amount for reporting, which is drawn up in any form and signed by the manager

Such a document must indicate:

- Full name of the employee who needs to register the disbursement of funds

- purpose of issuing money

- sum

- the period for which the funds are issued (necessary for the deadlines for generating the report of the accountable person)

When issuing funds from the cash register, depending on the amount, sometimes the money cannot be issued immediately due to their absence, the cash balance limit, in this case, the manager indicates a certain period for issuance in the order or in the statement. Typically, accountable amounts are transferred to a bank card in most cases.

The funds received for reporting are the debt of the individual (employee of the organization) to the organization.

Expert of the Legal Consulting Service GARANT A. Kireeva

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Cash limit. The concept and rules for calculating the cash balance.

The cash register limit is the maximum amount of cash that the company has the right to leave in the cash register at the end of the working day. Funds exceeding the established limit must be transferred to the bank at the end of the day. If previously the cash register limit was determined by one of the banking institutions, today the enterprise is not obliged to notify the bank about the size of the limit, deciding independently how much amount should remain in the cash register during non-working hours. The cash limit is established so that, if necessary, the enterprise has the opportunity to quickly use the required amount for business needs, as change funds (if we are talking about a retail outlet), as an advance for a business trip, etc. The cash limit is calculated taking into account several factors, including the operating mode of the enterprise and the specifics of its activities, distance from the bank, the volume of cash receipts and expenditures. A business entity can determine the cash limit based on the amount of average daily revenue. Even if the established limit exceeds its maximum volume, it is not the inflated amount that will be taken into account, but the average revenue per day.

The cash limit does not need to be agreed upon and approved by the bank!

Bank of Russia Regulation No. 373 dated 10/12/2011

In determining the cash limit, the duration of the bank’s operation plays a role, as well as the agreement existing between the bank and the organization on collection. As for the deadline for depositing funds, this issue is previously discussed with the bank. If the cash register limit is not entered, it should be considered zero. The reasons why a cash balance limit is not set are not taken into account. If after the end of the working day there is money remaining in the cash register that exceeds the limit, it is defined as over-limit. Being an internal matter of the enterprise, the calculation of the cash limit in the cash register, as noted above, should not be agreed upon with the bank. But if during the check there is an amount at the organization’s cash desk, the amount of which differs from the limit, it will be accepted as the limit. Based on this amount, the over-limit will be calculated for the entire period of storage of funds. The fact of exceeding the limit is fraught with the introduction of penalties in relation to the business entity. The cash limit is calculated for the enterprise and for each of its separate divisions separately, approved by internal regulations. During the year, the amount of the limit may change if there are grounds for this (for example, cash turnover may increase). In excess of the approved limit, cash may be kept in the cash desk for the payment of wages, scholarships, pensions and similar payments. If there is no reason to leave the money in the cash register, and the organization does not have time to deposit it in the bank, the excess amount can be given to one or several employees on account (for example, for household needs), returning it to the cash desk on the next working day. If the established deadlines for using cash are exceeded, the company will also face the threat of fines. For an organization just starting its activities, for the first three months of operation the cash limit is set according to forecast calculations, subsequently subject to revision. As a rule, adjustments to the maximum amount left in the cash register occur two weeks after the end of the three-month period. Some businesses have the right to operate without establishing a cash limit. These include banks, religious organizations (monasteries, religious educational institutions, etc.) that do not carry out production or other business activities.

Formulas for calculating the cash limit

1. For enterprises receiving cash for goods sold or services provided:

L = V/ P * Nc,

where: L — cash balance limit in rubles; V is the volume of cash receipts; P —calculation period for which the volume of receipts is taken into account (no more than 92 working days); Nc - the period of time between the days of delivery to the bank (no more than 7 working days).

Example: Mir KKM LLC (retail trade, opening hours from 9-00 to 21-00, closed on Sunday). Revenue for 3 months: March - 1 million rubles, April - 900 thousand rubles, May - 1.2 million rubles. In just 3 months (92 days) - 3.1 million rubles. The proceeds are deposited in the bank the next day at 12 noon. Thus, the cash register limit will be 67,000 rubles. (3,100,000: 92 days x 2 days)

2. For enterprises that do not receive cash for goods sold or services provided:

L = R / P * Nn,

where: L — cash balance limit in rubles; R is the volume of cash disbursements, excluding amounts intended for wage payments; P – billing period for which the volume of issues is taken into account (no more than 92 working days); Nn - the period of time between the days of receiving cash from a bank check (no more than 7 working days).

Example : LLC "World of KKM" (services, opening hours from 10-00 to 18-00, closed on Saturday and Sunday). Cash costs for a week (5 days) - 40,000 rubles.

Fines

For violation of cash discipline, the Code of Administrative Offenses (Article 15.1 of the Code of Administrative Offenses) establishes a fine:

- for an organization - 40,000–50,000 rubles,

- for management - 4,000–5,000 rubles.

The list of violations includes:

- cash settlements with other organizations in excess of the established amounts;

- non-receipt (incomplete receipt) of cash to the cash desk;

- failure to comply with the procedure for storing available funds;

- accumulation of funds in the cash register in excess of established limits.

Organizing the cash register

12Next ⇒

Lecture No. 2 Cash transactions.

Regulatory regulation of cash transactions.

Cash transactions include operations to receive and spend cash directly from the organization's cash desk.

The main regulatory documents regulating the conduct of cash transactions are:

— Regulations on the rules for organizing cash circulation on the territory of the Russian Federation dated 01/05/98.

— The procedure for conducting cash transactions in the Russian Federation. approved by the decision of the Board of Directors of the Central Bank of the Russian Federation dated September 22, 1993

— Federal Law No. 54-FZ of May 22, 2003 “On the use of cash register equipment when making cash payments”

These regulatory documents provide

— Availability of a specially equipped cash register room

— Maintaining a cash book and other cash documents

— Using cash registers when making payments to the population

— Storing available funds in banking institutions

— Spending cash received from banks strictly for the purposes specified in the check

— Storing cash at the cash desk within the limits established by the servicing bank.

Organization of the cash register.

To receive, store and spend cash, an enterprise must have a cash register. The cash desk is a generalized unit that carries out and processes all cash transactions. In practice, a cash register most often includes a main cash register and a number of operational cash desks. Operational cash desks are used to accept cash from the population for goods sold using cash registers. The main cash register must have an isolated room that meets the requirements for safety and reliability in storing funds. All cash must be stored in fireproof metal cabinets.

The company's staff includes a cashier position, who is financially responsible for the safety of all valuables accepted by him. The hiring of a cashier is formalized by order of the head of the organization. After hiring a cashier, an agreement on full financial responsibility is concluded with him. On its basis, the cashier is responsible for the safety of funds in the cash register, the correct execution of cash documents and maintaining the cash book, as well as for damage caused to the enterprise, both as a result of intentional actions and as a result of dishonest attitude towards their duties. The absence of an agreement on full liability excludes the possibility of collecting the shortfall in full.

In small enterprises that do not have a cashier on staff, his duties can be performed by the chief accountant or another employee on the written order of the head of the organization, subject to the conclusion of an agreement with him on full financial responsibility.

The cashier is prohibited from entrusting his work to other persons.

Access to the cash desk premises by persons not related to its work is prohibited.

Cash transactions are controlled by commercial banks that serve the enterprise.

Cash withdrawal from the cash register

Accounting for cash transactions in theoretical and practical aspects

2.2 Cash withdrawal from the cash register

Cash can be issued from the company's cash desk to employees for the following purposes:

· reporting on business and operating expenses;

· in order to reimburse expenses incurred by the employee from personal funds for the needs of the enterprise (by decision of the manager);

· for travel expenses;

· for payment of wages;

· for the payment of social insurance benefits and scholarships;

· for issuing loans and similar purposes.

The company usually receives funds from the servicing bank. Cash is issued by the bank on the basis of a special form document approved by it - a check. A check is an order from an enterprise to the bank to issue the amount of money specified in it from the enterprise’s current account.

Checks (check books) are issued to an enterprise by a bank on the basis of an application drawn up in the prescribed form. When filling them out, the company indicates the purpose of the expenses for which the funds are issued. Cash received by enterprises from banks is spent for the purposes specified in the check (clause 4 of the Procedure for conducting cash transactions in the Russian Federation, approved by decision of the Board of Directors of the Bank of Russia dated September 22, 1993 No. 40 (hereinafter referred to as the Procedure)).

Enterprises that sell goods (services) for cash and have constant cash revenue, regardless of organizational and legal forms and scope of activity, in agreement with the banks that serve them, can spend this revenue on wages and payment of social and labor benefits, purchase of agricultural products , purchasing containers and things from the population, as well as for travel expenses, purchase of office supplies, payment of indignation of losses under insurance contracts for individuals (clause 7 of the Procedure).

Enterprises issue cash on account for business and operating expenses, as well as for the expenses of expeditions, geological exploration parties, authorized enterprises and organizations, individual divisions of economic organizations, in amounts and for periods determined by the heads of enterprises.

Employees of an enterprise receiving funds for business and operating expenses must be familiar in advance with the regulatory restrictions on cash circulation, as well as the requirements for documenting such transactions.

Cash payment limits

When purchasing inventory items and paying for work (services) provided in cash, you should take into account the established limits for cash payments between legal entities.

In accordance with Art. 4 of the Federal Law of December 2, 1990 No. 394–1 “On the Central Bank of the Russian Federation (Bank of Russia)”, the Bank of Russia is entrusted with the function of establishing the rules for making payments in the Russian Federation.

In pursuance of this provision, letters of the Central Bank of Russia dated September 29, 1997 No. 525 and dated January 29, 1998 No. 02–14–4/310 established and are currently in force the maximum amounts for cash payments between legal entities in the amount of 3,000 rubles per payment , and for consumer cooperation enterprises for goods, agricultural products, and raw materials purchased from legal entities - in the amount of 5,000 rubles in one payment. At the same time, in accordance with clause 1 of the Explanations on certain issues of the “Procedure for conducting cash transactions in the Russian Federation” and the conditions for working with cash (Letter of the Central Bank of March 16, 1995 No. 14-4/95), under the term “one payment” refers to cash settlements between one legal entity and another legal entity for purchased inventory items on the same day using one or more monetary documents within established limits.

The specified regulatory restrictions are mandatory for all legal entities. For making cash payments with other enterprises, institutions and organizations in excess of the established maximum amounts, a fine of 2 times the amount of the payment made is provided (clause 9 of Decree of the President of the Russian Federation of May 23, 1994 No. 1006).

At the same time, according to the Letter of the Central Bank of November 24, 1994 No. 14–4/308, clause 9 of Decree No. 1006 does not apply to legal entities receiving the payment.

Measures of financial responsibility for making cash payments in excess of the established maximum amounts are applied unilaterally to a legal entity making a payment to another legal entity.

The issuance of cash on account for expenses associated with business trips is made within the limits of the amounts due to business travelers for these purposes.

Documentation requirements.

Persons who have received cash on account are obliged, no later than 3 working days after the expiration of the period for which they were issued, or from the day of their return from a business trip, to submit to the accounting department of the enterprise a report on the amounts spent and make a final payment for them.

The issuance of cash on account is subject to the full report of the specific accountable person on the advance previously issued to him.

The transfer of cash issued on account by one person to another is prohibited.

Advance reports on the amounts spent and accompanying supporting documents submitted by accountable persons are subject to an accounting check in the accounting department, and the correctness of the documents, the expediency of the expenses and their compliance with the purpose of the advance are also checked. Advance reports verified by the accounting department are approved by the head of the enterprise.

Cash issuance from the cash desk of an enterprise is carried out according to cash receipt orders (form No. KO-2) or other properly executed documents (pay slips (settlement and payment statements), applications for the issuance of money, invoices, etc.) with the imposition of a stamp on these documents with details of the cash receipt order. Documents for the issuance of money must be signed by the manager, chief accountant of the enterprise or persons authorized to do so.

In particular, wages, payment of social insurance benefits and scholarships are made by the cashier according to payroll (settlement and payment) statements without drawing up a cash receipt for each recipient, and in enterprises with a large number of divisions or serviced by centralized accounting departments, these payments can be made according to written order of the head of the enterprise (decision, resolution) by persons other than cashiers (with whom an agreement on full financial liability is concluded and who are subject to all rights and obligations established by the Procedure for cashiers).

To record money issued from the enterprise's cash desk to an authorized person (distributor) for the payment of wages, and to return the balance of cash and paid documents, the cashier maintains a Book of Accounting for Money Accepted and Issued by the Cashier (Form No. KO-5). The issuance and return of money and paid documents are formalized by signatures.

On the title page of the payment (settlement and payment) statement, an authorization inscription on the issuance of money is made, signed by the head and chief accountant of the enterprise or persons authorized to do so.

In a similar manner, one-time issuances of money for wages (when going on vacation, illness, etc.), as well as the issuance of deposited amounts and money on account for expenses associated with business trips, to several persons can be processed.

One-time payments of money for wages to individuals are made, as a rule, using cash receipts.

In centralized accounting departments, one expense cash order is drawn up for the total amount of wages paid, the date and number of which are indicated on each payroll (settlement and payment) slip.

The issuance of money to persons who are not on the payroll of the enterprise is carried out according to cash receipts issued separately for each person, or according to a separate statement based on concluded agreements.

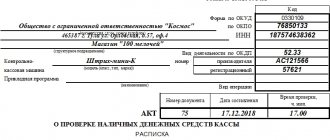

Example.

On June 22, an employee of the enterprise was given an amount of 100 rubles for the purchase of stationery under RKO No. 60. On June 25, the employee submitted an advance report on the purchase of stationery in the amount of 54 rubles. 50 kopecks Documents (KKM receipt and sales receipt) confirming the expenses incurred were attached to the advance report. The amount of unused advance payment is 45 rubles. 50 kopecks returned to the enterprise's cash desk under PKO No. 45.

In accounting, this operation will be reflected as follows:

· Dt sch. 71 — Set count. 50 - 100 rub. — accountable amounts were issued from the cash register;

· Dt sch. 26 — Set count. 71 - 54 rub. 50 kopecks — stationery goods have been received;

· Dt sch. 50 — Set count. 71 - 45 rub. 50 kopecks — return of unused advance.

Appendix 2 shows how the cash order is filled out for the example under consideration.

In cases where the statements, invoices and other documents attached to the cash receipts orders contain the authorization inscription of the head of the enterprise, his signature on the cash receipts receipts is not required.

When issuing money according to an expenditure cash order or a document replacing it to an individual, the cashier requires the presentation of a passport or other document identifying the recipient, writes down the name and number of the document, by whom and when it was issued.

A receipt for receipt of money can only be made by the recipient personally in ink or with a ballpoint pen indicating the amount received: rubles in words, kopecks in numbers. When receiving money according to a payroll (settlement and payment) statement, the amount in words is not indicated.

The cashier issues money only to the person indicated in the cash receipt order or a document replacing it. If a power of attorney is provided in the prescribed manner, in the text of the order after the last name, first name and patronymic of the recipient of the money, the accounting department indicates the last name, first name and patronymic of the person entrusted with receiving them. If the issuance of money is carried out according to a statement, before the receipt of money, the cashier makes the inscription: “By power of attorney.” The power of attorney remains in the documents of the day as an attachment to the cash receipt order or statement.

Expense cash orders and documents replacing them must be filled out by the accounting department clearly and clearly in ink, a ballpoint pen, or written out on a machine (writing, computing). No erasures, erasures or corrections are permitted in these documents.

Expenditure cash orders indicate the basis for their preparation and list the documents attached to them.

The issuance of cash receipts or documents replacing them in the hands of persons depositing or receiving money is prohibited.

Cash orders can be issued only on the day they are issued.

When receiving cash receipts or documents replacing them, the cashier is required to check:

a) the presence and authenticity of the signature of the chief accountant on the documents, as well as the permitting inscription (signature) of the head of the enterprise or persons authorized to do so;

b) the correctness of the documents;

c) the presence of the applications listed in the documents.

If one of these requirements is not met, the cashier returns the documents to the accounting department for proper processing. Expense cash orders or documents replacing them are immediately signed by the cashier after the money is issued, and the documents attached to them are canceled with a stamp or the inscription “Paid” indicating the date (day, month, year).

The issuance of money from the cash register, which is not confirmed by the recipient's receipt in the cash receipt order or other document replacing it, is not accepted to justify the balance of cash in the cash register. This amount is considered a shortage and is collected from the cashier. Cash that is not confirmed by cash receipts is considered cash surplus and is credited to the income of the enterprise.

Expense cash orders or documents replacing them, before transfer to the cash desk, are registered by the accounting department in the logbook for registering incoming and outgoing cash documents (Form No. KO-3). According to the generally accepted rule, the numbering of expense (receipt) cash orders begins from the beginning of the year with serial number 1 (one), and so on until the end of the year.

Expense cash orders issued on payment (settlement and payment) statements for wages and other payments equivalent to it are registered after their issuance.

Registration of expense cash documents can be carried out using computer technology.

Reflection on the accounting accounts of the most common transactions associated with the issuance of cash from the cash desk of an enterprise will look like this:

· Dt sch. 10 — Set count. 50 — purchased materials have been paid for;

· Dt sch. 12 — Set count. 50 — purchased IBP with cash payment;

· Dt sch. 26 — Set count. 50 - various general business expenses were paid in cash;

· Dt sch. 31 — Set count. 50 - deferred expenses paid from the cash register (for example, subscription to printed publications, etc.);

· Dt sch. 41 — Set count. 50 – purchased goods have been paid for;

· Dt sch. 51 — Set count. 50 - funds from the cash register are credited to the current account;

· Dt sch. 57 — Set count. 50 - funds were transferred from the cash register to the collector;

· Dt sch. 60 — Set count. 50 - part of the debt to suppliers was paid in cash;

· Dt sch. 70 — Set count. 50 - amounts of accrued wages issued from the cash register;

· Dt sch. 71 — Set count. 50 - accountable amounts were issued from the cash register;

· Dt sch. 73 — Set count. 50 - reflects the amount of the loan provided to employees;

· Dt sch. 76 — Set count. 50 - various amounts were issued from the cash register (according to writs of execution), the debt to other creditors was repaid;

· Dt sch. 94 — Set count. 50 - repayment of short-term loans.

Conclusion

cash cash register

The use of cash in settlements is regulated by the Federal Law “On the use of cash register equipment when making cash payments and (or) settlements using payment cards”, the Regulations on the rules for organizing cash circulation on the territory of the Russian Federation, the Procedure for conducting cash transactions in the Russian Federation etc. These regulatory documents provide for several basic elements of state control over the movement of cash.

Primary accounting documents are necessary, first of all, to confirm the reliability of the facts of business transactions. According to the Federal Law of November 21, 1996 No. 129-FZ “On Accounting”, business transactions are reflected in the accounting registers only on the basis of primary accounting documents drawn up in the prescribed manner. Their absence or incorrect execution can lead to unreliable balance sheet data, and, as a consequence, to administrative and tax consequences.

The procedure for conducting cash transactions provides for:

¨ presence of a cash register and maintenance of a cash book;

¨ storage of available funds in bank institutions;

¨ spending cash received from banks for the purposes specified in the check;

¨ storage of cash at the cash desks of organizations within the limits established by the banking institutions servicing them in agreement with the heads of the organizations.

Cash transactions are recorded on account 50 “Cash”.

Accounting at YugStroySistema LLC is carried out in accordance with the “Regulations on Accounting and Reporting in the Russian Federation”. The enterprise is a legal entity, has separate property, an independent balance sheet, current and other accounts in banking institutions, a seal with its name, letterheads, a company name, a trademark (service mark). The cashier accountant is directly involved in the organization of cash transactions, whose responsibilities include accounting for employee salaries.

The company's cash register is located in a separate, specially equipped room. Only the cashier himself has access to the safe. Duplicates of keys are kept by the chief accountant of the enterprise. The established cash limit at the cash desk at YugStroySystem LLC for 2007 is 100,000 rubles. Cash transactions of the enterprise do not exceed the limit established by law in the amount of 100,000 rubles.

Cash goes to the cash desk of YugStroySystem LLC:

- when received from paid consumers, buyers, customers for work rendered, services and goods sold;

- when received from accountable persons upon return of the unused balance of funds received on account;

- upon receipt from employees of the organization in repayment of material damage caused, issued loans and advances, excessively received wages.

One of the disadvantages in introducing cash transactions is the deposit of cash exceeding the cash limit independently to the bank's cash desk.

List of used literature

1. Civil Code of the Russian Federation. Part one dated November 30, 1994 No. 51-FZ (as amended on February 2, 2006).

2. Labor Code of the Russian Federation of December 30, 2001 No. 197-FZ (as amended on May 9, 2005).

3. Tax Code of the Russian Federation. Part one from 07/31/1998 No. 146-FZ. Part two from 05.08.2000 No. 117-FZ (as amended on June 30, 2006).

4. Federal Law “On Accounting” of November 21, 1996. No. 129-FZ.

5. Federal Law of May 22, 2003 No. 54-FZ “On the use of cash register equipment when making cash payments and (or) payments using payment cards.”

6. Directive of the Central Bank of the Russian Federation dated November 14, 2001 No. 1050-U limits the amount of cash payments between legal entities for one transaction.

7. Regulations of the Central Bank of the Russian Federation dated January 5, 1998. No. 14p “On the rules for organizing cash circulation on the territory of the Russian Federation.”

8. Order of the Ministry of Finance of Russia dated January 15, 1997 No. 2 “Procedure for reflecting transactions with securities in accounting.”

9. Accounting provisions “Expenses of the organization” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated 05/06/1999 No. 33n.

10. Regulations of the Central Bank of October 9, 2002 No. 199-P “On the procedure for conducting cash transactions in the Russian Federation” (as amended on June 1, 2004).

11. The procedure for conducting cash transactions in the Russian Federation, approved by the Decision of the Board of Directors of the Central Bank of the Russian Federation dated September 22, 1993 No. 40.

12. Borodina V.V. “All about cash transactions: a practical guide.” Book world. 2005. – 142 p.

13. Galitsky V.Yu. "All about cash transactions." GrossMedia 2006 - 160 p.

14. Glushkov I.E. Accounting in a modern enterprise. An effective guide to accounting. Moscow, “KNORUS”, Novosibirsk, “EKOR”, 2001. - 797 p.

15. Gukkaev V.B. “Cash registers and strict reporting forms.” — M.: ZAO Publishing House “Glavbukh”. - 2002. - 208 p.

16. “Documentation of cash transactions.” - M.: Berator-Press, 2002.-112 p.

17. Zhuravlev V.N. "Cash transactions" Tax-info, 2007 – 116 p.

18. “Cash operations and cash registers.” Book service, 2005 – 272 p.

19. “Cash transactions.” M.: Status-Quo, 2005 – 156 p.

20. Kozlova E.P. Accounting in organizations. - M.: Finance and Statistics, 2000. - 720 p.

21. Komissarov M. Plastic cards. Some implementation issues // Banks and technologies, 1998, No. 2, 196 p.

22. Kondrakov N.P. Accounting. Tutorial. M.: Infra-M. 2005. - 717 p.

23. Myakota V., Rudyak Y., Kuznetsov V. “Cash transactions.” 2007 - 304 p.

24. Nesterov V.I. “Accounting and conducting cash transactions.” DIS. 2005 – 160 p.

25. Regulatory basis of accounting: Collection of official materials / Preface and compilation by A.S. Bakaev. - M.: Accounting, 2004 - 125 p.

26. New register of cash registers / V.V. Vasilyeva. – M.: GrossMedia: ROSBUKH, 2007 – 128 p.

27. Sokolov Yu. A. “Cash transactions.” 2nd ed., revised. and additional Alfa Press, 2003 – 116 p.

28. Fedotov A.V. "Accounting for cash transactions." Glavbukh, 2001 – 128 p.

29. Yutskovskaya I.D., Cash circulation in organizations // Financial and accounting consultations. 2005.-No. 2. – 13 p.

Application

| Unified form No. KO-3 Approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88 | ||||||||||||

| Code | ||||||||||||

| OKUD form | 0310003 | |||||||||||

| LLC "YugStroySystem" organization | according to OKPO | 07848 | ||||||||||

| structural subdivision | ||||||||||||

| Logbook | ||||||||||||

| incoming and outgoing cash documents | ||||||||||||

| 2009 | ||||||||||||

| cashier | Vernykh O.O. | |||||||||||

| job title | Full Name | |||||||||||

| Receipt document | Amount, rub. cop. | Note | Expense document | Amount, rub. cop. | Note | |||||||

| date | number | date | number | |||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | |||||

| 07.08.09 | 45 | 45-50 | Return | 07.08.09 | 60 | 100-00 | For report | |||||

Accounting for cash transactions in theoretical and practical aspects

Information about the work “Accounting for cash transactions in theoretical and practical aspects”

Section: Accounting and Auditing Number of characters with spaces: 43784 Number of tables: 1 Number of images: 0

Similar works

Accounting for cash transactions (using the example of OJSC Zernogradagrokhimservice, Rostov region)

147512

8

5

... using the example of one of the enterprises. In the next chapter, we will attempt to analyze the conduct of cash transactions using the example of the surveyed enterprise OJSC Zernogradagrokhimservice. 3. ECONOMIC FEATURES OF CASH OPERATIONS IN OJSC “ZERNOGRADAGROKHIMSERVIS” 3.1. Organization of accounting of funds at the cash desk of the enterprise To carry out cash transactions in ...

Audit of settlement and cash transactions of the credit organization OJSC "Novosibirsk Municipal Bank"

213598

16

2

... documents for each movement of funds Yes, payment orders, memorial orders No This is how individual elements of the audit of cash settlement operations of credit institutions are carried out. The next paragraph contains an analysis of the cash settlement operations of the Novosibirsk Municipal Bank. 3.3 Analysis of cash settlement operations of a commercial bank When analyzing cash settlement operations ...

Methodology for auditing cash transactions

65492

4

0

... as long as there are no facts. At the end of the audit planning process, the General Plan and the Audit Program must be documented and endorsed in the prescribed manner [1; p. 199]. 3. Audit of cash transactions using the example of Luch LLC 3.1 Drawing up a plan and program for auditing cash transactions An audit of the organization’s cash transactions is carried out in the following...

Accounting and audit of cash transactions

101145

12

0

... and accounting for cash transactions allows us to conclude that at Muromsky LPK LLC, accounting for cash transactions is carried out in accordance with the required norms and rules of Russian legislation. No deficiencies in documentation were visually identified. SECTION 3. AUDIT OF CASH OPERATIONS 3.1 Purpose, objectives, information base of cash audit and regulatory…

Accounting for cash transactions

An agreement is concluded between the enterprise and the bank, according to which the cash limit is established. The cash register limit is a limit on the balance of money that can be in the cash register at the end of the day. Enterprises that do not have a limit must deposit all cash in the bank every day.

In excess of the established limit, funds can be kept in the cash register only on the days of payment of wages, pensions, travel allowances, etc. within three working days, including the day you receive money from the bank.

In turn, the Central Bank of the Russian Federation regularly sets a limit (restriction) for cash payments between legal entities for one transaction per day. Currently, this limit is 100,000 thousand rubles.

For non-compliance by organizations with the conditions for working with cash, as well as non-compliance with the procedure for conducting cash transactions, measures of financial responsibility may be applied to them.

12Next ⇒

Date added: 2015-10-06; | Copyright infringement

Recommended content:

Related information:

Search on the site:

The procedure for storing, issuing and receiving cash at the organization's cash desk

The procedure for accepting, storing and issuing cash is regulated by the Letter of the Central Bank of the Russian Federation dated October 4, 1993. No. 18 “Procedure for conducting cash transactions in the Russian Federation”

.

To make cash payments, each enterprise must have a specially equipped cash register. There are certain requirements for the equipment of cash registers of enterprises:

— the cash register room must be isolated;

— the doors to the cash register must be closed from the inside during transactions;

— there must be metal bars on the windows of the room in which the cash register is located;

- money and securities must be stored in a safe or fireproof cabinet, which must be sealed by the cashier at the end of work;

— duplicate keys to the safe must be kept in a bag sealed by the cashier with the head of the enterprise;

— there must be an alarm in case unauthorized persons enter the cash register premises.

After issuing an order to hire a cashier, the head of the organization must, against receipt, familiarize the cashier with his responsibilities, the procedure for conducting cash transactions, and then enter into an agreement on full financial responsibility.

It is prohibited to delegate the duties of a cashier to other persons. If it is necessary to temporarily replace him, the manager must draw up a written order, after which another person will perform the duties of the cashier. At the same time, concluding an agreement with him on full financial responsibility is mandatory.

If a cashier suddenly falls ill, then the values must be counted by another cashier in the presence of the chief accountant and the head of the enterprise.

The amount of cash that a company can leave in the cash register at the end of the working day is limited by the cash balance limit in the cash register. The size of the limit is set by the bank servicing the enterprise, based on the volume of cash turnover of the enterprise, taking into account the peculiarities of its mode of operation, the procedure and timing of depositing cash at banking institutions, as well as ensuring their safety and reducing counter transportation of valuables. The limit is set annually. To do this, you must provide the bank with the appropriate calculation using special form No. 0408020 “Calculation for establishing a cash balance limit for an enterprise and issuing permission to spend cash from the proceeds received at its cash desk.” The size of the limit can be revised during the year (for example, in case of changes in the volume of cash turnover, conditions for the delivery of proceeds). To do this, you need to write a letter to the bank in any form indicating the reasons and attach a new calculation for setting the limit. If an organization has several current accounts in different banks, then the payment must be submitted to one of them.

Operations performed in the military premises

The cash pick-up point performs the following operations:

- issuance of cash (euro, US dollars, Russian and Belarusian rubles);

- accepts non-cash payments for utilities and other services, mobile communications (if special software is installed in the bank branch);

- provides the opportunity for bank clients to replenish their settlement (current) account through a bank payment card or by depositing cash.