Why do you need a cash verification report?

Cash in the cash register is checked periodically. Moreover, most often, inspections are sudden. The initiative for such control actions can come from both the management of the enterprise and the supervisory authorities.

Regardless of who organized the inspection, an act is drawn up based on its results. They fit into it

- the amount that should be in the cash register according to accounting documents,

- as well as the amount that actually turned out to be available when the inspectors counted it.

In this way, the financial and cash discipline of the company is monitored, facts of official violations, abuses, shortages, etc. are revealed. illegal phenomena.

Audit report of funds in the cash register

Let us note that the standard form with the title “Cash Audit Report” has never been approved by the financial department. The State Statistics Committee has put into effect the primary form INV-15 “Cash Inventory Act”, and although it is not mandatory today, it is still used in work, documenting the results of the audit, which does not contradict the law, since audit and inventory are the procedures are similar, and the purpose of both is to verify that the amount of cash in the cash register matches the accounting information.

We emphasize that each company has the right to develop and apply its own cash audit act. Often, the INV-15 form serves as a high-quality template. We will focus on the INV-15 form, as it is universal and most frequently used.

Who checks the cash register?

If the audit is carried out within the company, then a commission consisting of at least three people is created for this event. Usually, directors are included in it by a separate order

- accountant,

- management representative,

- head of one of the structural divisions of the organization.

The financially responsible employee must also be present during these actions, but he is not included in the commission.

In cases where the inspection is carried out as part of on-site tax control, inspectors from the supervisory department are also added to all the above-mentioned persons.

Store internal audit report

Internal audit report of the store. O., positions, if any) has drawn up this Act on the following: 1. In the period from »» to »» in the store located at the address: , on the basis of the Order dated »»

An internal audit was carried out. (indicate the type of audit being carried out) 2. As a result of the audit, it was established (the facts of the presence or absence of shortages of inventory items, as well as facts of excess inventory items are indicated): . 3. This Act is drawn up and signed in 2 copies, one copy is handed over to the head of the organization, the second to the store manager.

What consequences can an audit have?

If, based on the results of control measures, no violations are revealed, and the cash matches to the last penny what is indicated in the documents, then, of course, there will be no consequences. But if during the inspection it turns out that there is less or more money in the cash register (this also happens) than there should be in accordance with the reporting papers, disciplinary action will most likely be imposed on the financially responsible persons (starting from a remark, a reprimand and up to dismissal). In addition, there will likely be a demand from management to reimburse the missing funds.

Tax inspectors fine the enterprise and its senior officials for surpluses or shortages.

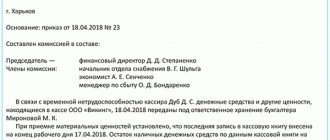

How to conduct a cash register audit

The audit report is drawn up by the audit commission based on the results of the cash register audit. This is due to the great responsibility for the circulation of funds and other valuables that are in the cash register of the enterprise and legal requirements. The audit commission is appointed by the head of the enterprise by issuing an order. After issuing an order to conduct an audit of the enterprise’s cash register, it must be communicated to all members of the commission, as well as the chairman of the commission. In order to make sure that all members of the commission are familiar with the order, they must put their signature at the end of the order.

It is imperative to notify the cashier himself that the cash register will be audited, since he is responsible for the cash register being audited.

Before starting the audit of the cash register, the chairman of the commission announces to all members of the commission and the cashier the contents of the document on the basis of which the audit of the cash register is carried out. After this, anyone present can offer their reasons that there are reasons why the cash register audit may be cancelled. If there are no such grounds, then the audit commission begins to audit the company’s cash register.

An audit of the cash register is carried out only in the presence of all members of the commission, the financially responsible person, namely the cashier, and other interested parties. During the cash register inspection, accompanying documents may be drawn up that will record the procedure for carrying out the inspection.

Sample act on checking cash in the cash register

If you need to create a cash check report at the cash register, and you have never done it before, the above tips will help you. Also look at a sample of filling out the document: here a unified form is taken as a basis, which can also be used for internal control measures.

- First enter

- full company name,

- her address,

- as well as the structural unit whose cash register is being checked.

- In the table on the right side of the form, enter

- OKPO and TIN of the enterprise,

- the type of his activity according to OKPD (also in the form of a code).

- Please provide information about cash register equipment below:

- its name,

- and two numbers: from the manufacturer and registration.

Similarly, fill in all other lines and cells in this part as necessary.

- Next, indicate the document number, the date of the inspection and its exact time (down to minutes).

- Also make sure that the cashier makes a receipt in the act stating that his personal money is not in the cash register at the time of the check.

- Next is a table where you enter

- results of verification actions, including readings of the cash register counter at the beginning of the working day and at the time of verification,

- the difference (which is in the cash register),

- information about accounting data, identified shortages or surpluses.

- At the end, the document must be signed by all persons present during the inspection, including a tax employee (if the inspection is carried out on the initiative of the supervisory authority), a representative of the company’s management, a cashier, and the head of a structural unit.

- Below is the amount that is in the cash register and which is transferred to the financially responsible employee (i.e., the cashier), and his signature is affixed.

If the inspectors consider it necessary, they can make their comments under the table. If they are not there, this must also be noted accordingly.

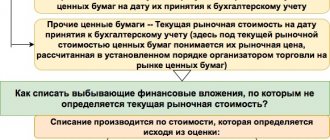

The cash register inventory is carried out in accordance with the order of the Ministry of Finance of Russia dated June 13, 1995 No. 49 “On approval of methodological instructions. "(Methodological instructions).

Do not forget to sign agreements on full financial responsibility with materially responsible employees (MREs) who have access to funds and documents. If such an agreement is not concluded, then if a shortage is identified, the organization will not be able to withhold the full amount of damage from the employee (Articles 241 - 244 of the Labor Code of the Russian Federation).

Cash register check report

Home / Samples / Act / The page contains a sample document “Cash Inspection Act” with the ability to download it in doc format. Document type: Act In order to save a sample of this document to your computer, follow the download link. Document file size: 16.5 kb

An audit of the cash register is carried out to verify the compliance of transactions carried out through it with state legislation.

The cash register is audited by a special commission, which consists of several members and a chairman.

After completing the audit, the commission draws up a cash register inspection report (or cash register audit report).

The first thing that is indicated in the document, on the basis of which the check was carried out (usually on the basis of an order). It is also indicated that the employee responsible for maintaining the cash register was present during the inspection. The name of the organization in which the audit is taking place, as well as the date of the audit, must be indicated.

What follows is a detailed report on the state of the cash register at the time of the inspection (the balance in the cash register is indicated, etc.).

Below are the signatures of the commission members, as well as the signature of the person familiar with the results of the audit. It is indicated in how many copies the act was drawn up and to whom they were delivered.

When is the procedure required?

Inventory of cash in the cash register is carried out:

In other cases, the cash register inventory (2018) is carried out within the time frame established by the manager by his order.

CHECKING CASH OPERATIONS IN BUDGETARY INSTITUTIONS: METHODS, PROCEDURES, CHARACTERISTIC ERRORS

Result of cash check: shortage ____________________ rubles. surplus ____________________ rub. Reference: latest numbers of cash orders: for receipt N ___ in the amount of _______________________________ rubles. for consumption N ___ in the amount of _______________________________ rub. 2. COMMODITY AND MATERIAL VALUES 2.1. Registered as _______________________________________________ rub. 2.2. Presented _____________________________________________________ rub. 3. INCLUDING STRICT REPORTING FORMS 3.1. ________________________________________________________________________ 3.2. ________________________________________________________________________ 3.3. ______________________________________________________________________________ 4. INCLUDING SECURITIES 4.1. ________________________________________________________________________ 4.2. ______________________________________________________________________________ The presence of strict reporting forms and inventory items corresponds (or not) to accounting data. Backup keys for fireproof cabinets and door locks of the cash register are stored in a sealed bag _________________________________________________________ (where, with whom) 5. STATE OF SECURITY OF THE CASH PREMISES - availability of security and fire alarms ________________________________ - compliance with the requirements for the technical strength of the cash register premises ______ ___________________________________________________________________________ - ensuring the safety of funds during their transportation _________ ___________________________________________________________________________ 6. COMMISSION'S PROPOSALS AFTER THE RESULTS OF THE INSPECTION ___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________ Chairman of the Commission ___________ (signature) Members of the Commission: ___________ (signature) ___________ (signature) Financially responsible person _________________________ (position, signature) Aware of __________________________ (head of the organization) __________________________ (date)

Comments:

The generated report opens as a spreadsheet document, which can then be printed. The report provides a list of both posted and non-posted cash documents recorded in the Cash register for a given period. By clicking the “Refresh” button, you can update the contents of the report. Click the “Settings” button to change the report output parameters. The report can also be generated in the “Cashier” document journal using the “Cashier Reports” button, as well as . in the document journal “Cash desk” by clicking the “Reports” button.

Thus, as a result of automation of cash transactions, the amount of routine manual work is reduced and thereby frees up working time for analyzing completed transactions, providing the opportunity to quickly obtain reporting registers and information about cash balances and their intended use

2.3. Organizing and conducting cash audits and monitoring compliance with cash discipline

Mastering the methodology for checking cash transactions in budgetary institutions, and in particular in health care institutions, is important for several reasons. Firstly, cash is one of the most mobile and easily realizable assets of an organization. In addition, monetary transactions are massive and widespread. All this makes this area of the institution’s economic activity the most vulnerable from the point of view of various violations and abuses.

Cash movement is carried out through cash transactions. Among them, the main ones can be identified - the issuance of funds for wages, for payment of administrative and business expenses, to accountable persons, etc.

Checking the accounting of cash transactions is a mandatory component of audit programs and inspections of budgetary institutions. Its goal is to identify violations and abuses in the accounting of cash in a budgetary institution, and to prevent errors and inaccurate information in reporting.

The procedure and timing of cash register inventory in 5 steps

Step 1. First, an order from the manager is issued, which defines:

- timing;

- location;

- areas and objects that will be inspected;

- composition of the inventory commission.

Such an order can be drawn up using form No. INV-22 (you can download its unified form at the end of the article).

It should be remembered that any decision - either to use standardized forms or to abandon them and develop your own documents - must be enshrined in the accounting policy.

If the enterprise is large enough and, for example, has stores in different cities, then inventory commissions are created to simultaneously control all cash registers. The commission must consist of at least two people.

It must include:

- representatives of the organization's management;

- accountant;

- other specialists.

Who does the cash register inventory?

The inventory of the cash register is carried out by a permanent inventory commission (clause 2.2 of Methodological Instructions No. 49). Its composition is fixed by order (resolution, order) of the head of the organization (clause 2.3 of Methodological Instructions No. 49). It includes:

- administrative and management personnel;

- accounting workers;

- security workers and other specialists (economists, lawyers, engineers, technicians, etc.);

- representatives of the company's internal audit service, third-party specialists (for example, employees of independent audit organizations, etc.).

At the same time, a financially responsible person should not be included as a member of the commission or made its chairman. Otherwise, it will turn out that the cashier is checking himself. Then the whole point of checking is lost.

If there is a large amount of work to be done, then a working commission can also be created to carry out an inventory, also by order (resolution, decree). If you need to check a little, then the audit commission can also check the cash register, i.e. there is no need to create an inventory commission.

We invite you to familiarize yourself with: Sample counterclaim under an MFO loan agreement

In a situation where there is only one employee on staff, an order to appoint an inventory commission is not issued. The creation of such a commission implies the presence of at least 2 people in its composition - a chairman and members (clause 2.3 and clause 2.4 of Methodological Instructions No. 49). Therefore, in an organization that only has a director, it will not be possible to form an inventory commission.

Note! The company is not obliged to annually reissue the order on the composition of the inventory commission if its composition remains unchanged.

In accordance with clause 2.3 of Methodological Instructions No. 49, the order is registered in the logbook for recording and monitoring the implementation of orders to conduct an inventory.

Procedure Objectives

First of all, an audit of cash transactions of individual entrepreneurs should make accounting as transparent as possible so that regulatory authorities can always analyze compliance with legislation in the field of cash accounting. If an individual entrepreneur accepts money from the population or enterprises, or pays in cash himself, each transaction must be formalized in the prescribed manner and reflected in the cash book.

The cash book is opened for a period of one year; it must be laced, numbered and sealed with the seal of an individual entrepreneur. The book records data on all issued cash receipts and expenditure orders. At the end of the day, month, quarter or year, an inventory of the actual cash balance is carried out and reconciled with the cash book data.

The audit of cash transactions becomes especially relevant for individual entrepreneurs using the simplified tax system or the basic tax system, that is, when the amount of tax payable depends on the actual income received and expenses incurred.

Entrepreneurs on a taxation system such as UTII are not required to monitor cash flows so carefully and can conduct audits less frequently (for example, once a year). This is due to the peculiarities of tax calculation. Its value does not depend on the actual income received and the actual expenses incurred; it is imputed.

The tasks of auditing cash transactions include identifying facts of theft or abuse of official position by the entrepreneur’s employees. In this case, a sudden inventory is carried out and a report is drawn up.

Audit report, sample

- Mandatory points of the audit report

Audit of safety of fixed assets, registration of inventory results. Audit of operations to change the value of fixed assets, repairs and operations of their movement. The procedure for implementing audit materials.

Regular verification of the results of work with cash payments is carried out using a cash register audit report. The sample can be downloaded for free via a direct link.

Regular verification of the results of work with customers for cash payments is carried out using an audit report

cash registers. Supermarkets and retail chains with a large flow of retail customers are faced with the need to constantly monitor the cash register.

Thanks to the audit report, you can record funds in writing and compare them with the goods passed through the tape. On this free resource page you can find the document discussed.

Let's consider its features and main design criteria.

Since the main purpose of the audit is verification, it is advisable to entrust its implementation to the commission. A pre-formed team distributes responsibilities and performs certain actions.

Members of the collegial body are authorized to do this by a special order or order from their superiors. Before the audit begins, the chairman must set the agenda for the event and list the participants.

After this, each of those present has the right to make any comments and statements. If they are absent, the study begins immediately.

Mandatory points of the audit report

:

- Visa of the head, name of the institution, stamp in the upper right corner;

- Name of the local act, number and date;

- The basis for the study, the composition of the commission;

- Listing of facts established by the collegial body;

- Recording shortages and other results;

- Actual cash balance;

- Cover letter to management and accounting department, attachments;

- Signatures and transcript of each participant.

Each company and institution builds its audit regulations differently.

Form KM-9 (Cash Cash Verification Act) - and form

One institution simply counts the money on the spot and records it in the accounting journal, attaching a cash tape. Another devotes the whole day to this, closing the organization and posting a notice with the inscription “Revision”.

The audit paper is drawn up in simple written form in the required number of copies. Based on the results of the work, everyone present must put a personal signature and full name.

Existing disagreements and inconsistencies are indicated by separate points.

Date: 2016-01-29

- No materials were found based on the specified criteria.

Drawing up an audit program and carrying it out. Audit of safety of fixed assets, registration of inventory results. Audit of operations to change the value of fixed assets, repairs and operations of their movement. The procedure for implementing audit materials.

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

- Audit of cash transactions

The procedure and rules for storing, spending and accounting for cash in the cash register, tasks for auditing cash transactions. Sources of information and audit procedure, inventory and audit of funds. Checking the timeliness and completeness of the receipt of money.

test, added 01/12/2010

- Audit of the organization of accounting for the sale of finished products (using the example of OJSC Glubokoe Milk Canning Plant)

Theoretical and practical methods for auditing the organization of accounting for the sale of finished products (works and services) and settlements with buyers and customers. The procedure for drawing up a plan and program for auditing implementation, preparing materials for auditing operations.

Source: https://3zprint-msk.ru/akt-revizii-obrazec/

Order of conduct

The procedure for conducting a cash register audit is established by law and includes the following stages:

- The entrepreneur signs an inventory order. It must indicate the date when the cash register audit is carried out, the deadline for its completion, and list the names and positions of the persons who are part of the inventory commission.

- The order must also be signed by all members of the commission and the person financially responsible for the safety of the enterprise’s funds. That is, before the procedure begins, the cashier must be familiarized with such an order against signature and only after that proceed with the inventory.

- A special form lists all the funds in the cash register at the time of inventory in the form of a banknote inventory. The form is signed by all members of the commission that audits the cash register and the financially responsible person.

- The form data is verified with cash balances according to accounting data.

- Based on the results, an act is drawn up describing the results of the inventory. This may be an act on the discovery of a shortage, an act on the posting of surpluses, or an act stating that the amount of funds actually in the cash register corresponds to the accounting data of the individual entrepreneur.

- After establishing the actual state of affairs, an order can be signed to capitalize the surplus or an order to withhold the shortage from the financially responsible person. In the second case, the cashier must write on the order that he is familiar with it. It is also recommended to obtain a written explanation from him about the reasons for the shortage of cash.

The procedure for recording the inspection results, what are the features

All information that was obtained during the audit must be reflected in a special form, which has the name - audit act. Correction of errors is possible only on the basis of an audit report.

The legislation does not provide for a unified form of the internal audit report, therefore the enterprise must independently develop the form and approve it in its accounting policies. It can be edited for different purposes.

The audit report must contain information such as:

- Full name of the enterprise;

- The day of drawing up the audit report;

- The reason for the audit and the issuance of the act itself is indicated;

- List of ongoing events;

- Name of operations;

- During what period was the audit carried out?

- Full name, positions of responsible persons, as well as their signatures.

It is also not prohibited to draw up additional annexes to the act. After the audit, a list of identified errors and violations is compiled, and the auditor makes a number of recommendations for their elimination. Those responsible must report within three days. This must also be recorded in the act. If the audit report is missing at least one of the required details, then the submitted act will lose legal force. And if a deficiency is identified under this act, it will not be possible to recover the deficiency from the financially responsible person.

Audit commission report: sample

So, the act is drawn up based on the results of an audit of the financial and economic activities of the organization.

There is currently no unified form mandatory for use by all companies. There is a standard that auditors can use as a guideline.

Typically, an audit report consists of:

- name of the act;

- dates of compilation;

- introductory part;

- descriptive part;

- conclusions and proposals;

- signatures of auditors.

The name of the act is needed to understand what the document is about.

The date of compilation must coincide with the date of the audit.

The introductory part indicates the purpose, objectives and basis for the audit. As a rule, the basis is the corresponding order of the director or a decision of the shareholders’ meeting. The chairman and members of the audit commission are listed, as well as the documents that will be checked.

The narrative indicates what was determined as a result of the inspection.

The auditors sum up the results of the audit and make their proposals.

The drawn up act is signed by all members of the commission.