Recently, payments using corporate cards have become commonplace for most businesses. These payment instruments are easy to use.

Accounting for corporate cards is quite simple. Experienced accountants, as a rule, do not have any problems recording transactions. Difficulties may arise when compiling a report on a corporate card by the employee to whom it was issued. Next, we will consider the features of reflecting operations.

Features of the operation

Replenishment is made by bank transfer. To do this, a payment order is sent to the banking organization.

Funds can only be spent using the card. This can be either regular non-cash transactions or cash issuance.

Corporate cards are not subject to payment limits established by the Central Bank for cash payments. Meanwhile, banking organizations, guided by the recommendations of the Central Bank, can set an issuance limit. For example, on a Sberbank corporate card the maximum amount is 100 thousand rubles/day.

What expenses can be paid by card?

Let's talk about what kind of goods, services and work you can pay for, taking into account your organization. If you have an LLC, then it is very important to understand that any expense made using a corporate card, in fact, like all expenses in your organization, must be economically justified. This means that it must correspond to the type of activity of the enterprise, and must also be aimed at further generating profit.

Let's give an example. If you are a transport organization that provides transport services, then it is logical that your expenses will not include another cost item (beds, mirrors, felt boots, etc.). That is, such expenses will not be accepted for tax accounting; with their help you will not be able to reduce the tax base.

Please note that you can spend money on corporate needs, such as buying phones for your employees. However, if you purchase expensive iPhones or wide-screen TVs, then this expense should also have a value. Let’s say you need a TV to place it in front of the entrance and broadcast advertising, introduce potential customers to the company’s products, notify about discounts and promotions, etc. .

Advantages of payment instruments

The following advantages of using corporate cards can be noted:

- Control of employee spending. Firstly, all transactions will be reflected in the company’s account. Secondly, a corporate card report is generated, which reflects all expenses incurred for a specific period.

- Possibility to use funds at any time. Access to money in the account is available 24 hours a day.

- Prompt card blocking in case of problems.

- Possibility to use funds on business trips abroad. There is no need to purchase foreign currency when traveling outside the Russian Federation. At the same time, from Russia you can quickly top up the account of an employee located abroad.

- Significant time savings when booking and paying for tickets and hotel rooms.

Corporate card and currency control

Owners of corporate cards often wonder whether they can use it abroad. We will try to answer this question in detail and clearly.

Of course, you can use a business card abroad (even a ruble one). Companies engaged in foreign economic activity (FEA) very often send their employees on business trips to different countries.

Write-off of funds is carried out as follows. The posted employee pays for purchases with a card in the currency of the country where he is located. Funds are debited in rubles at the internal exchange rate of the bank where the current account is opened and the business card is issued. And here it is important to correctly reflect these expenses in the report.

How to account for these costs

After an employee returns from a business trip, he provides documents to justify expenses. However, please note that in the country where you sent the employee, there may be a different accounting procedure, but at the request of the client, the seller will always provide at least a cash receipt.

To accept foreign documents for registration, they must be translated into Russian. If it is not possible to hire a translator, you can do it yourself. The main thing is to understand the expense item, cost, quantity, and also what kind of organization sold the product or provided the service.

Exchange difference

Please note that the data between the actual payment that you made outside the territory of the Russian Federation and the data reflected in the accounting will differ. According to the norms of our legislation, all accounting is carried out in rubles, despite the fact that the payment was received in foreign currency, in accounting the advance report must be generated in rubles.

Cash is reflected in accounting on the date of approval of the advance report. They must be approved not at the rate of your bank, but at the rate of the Central Bank. Therefore, you may experience exchange rate differences. Firstly, due to the fact that the rates of the Central Bank and your servicing banking organization are different. Secondly, you will have a different date. This will be attributed to the exchange rate difference either positively (income) or negatively (expense).

Important nuances

Corporate cards for legal entities are issued for specific employees of the enterprise, i.e. they are personalized.

Reflection of transactions in accounting for corporate cards is carried out, as a rule, in a separate account.

A bank account can be opened in both rubles and foreign currency. In the first case, there is no need to open an additional foreign currency account. According to Central Bank Regulation No. 266-P, payment by corporate card can be made in a currency different from the account currency. When receiving, for example, dollars, the bank’s system will convert the required amount (automatically convert rubles into dollars).

Drawing up internal documents

After choosing corporate cards and concluding an agreement with the bank, it is necessary to develop local company regulations regulating the accounting of corporate cards and money control.

To carry out accounting and control over the movement of a corporate card and funds on card accounts, you must:

- Introduce appropriate elements into the accounting policy of an economic entity;

- Develop appropriate regulations or provisions in the form of a separate annex to the accounting policies.

It is optimal to draw up an internal document defining the rules for using electronic payment instruments. It's good to include:

- Types of funds spent;

- Limit on transactions, namely non-cash payments, cash payments, restrictions per day, month;

- Deadlines for submitting reports for the use of funds;

- What documents must be attached to the report on the use of funds;

- responsibility and procedure for collecting funds if the accountable person does not report on time.

Instead of a separate act, you can include the rules for corporate cards in other local documents, for example, in the regulations for the enterprise on regulating the payment of business trips, the issuance of money for reporting, and the submission of advance reports.

The list of employees who have the right to use corporate cards is determined by order or instruction of the manager. It is advisable to sign agreements with employees on full financial responsibility. In this case, the employer will be able to recover from employees the missing funds on the card in full (Article 242 of the Labor Code of the Russian Federation). In the absence of an agreement, the maximum amount of damage subject to compensation cannot exceed the average monthly salary (Article 241 of the Labor Code of the Russian Federation).

Spending goals

Regulatory acts establish a list of operations that can be carried out in foreign currency using a corporate card:

- Receiving cash foreign currency abroad of the Russian Federation to pay for hospitality and travel expenses.

- Payment of expenses (representative/travel expenses) in trade/service organizations in foreign currency outside Russia.

Other transactions are considered illegal. Monitoring compliance with the list is carried out by the banking structure.

Local document of the organization

The enterprise must develop an act defining the basic rules for the use of corporate cards. In this document you need to establish:

- List of operations and expenses that are allowed to be performed by an employee.

- Limits on settlements.

- The procedure for submitting a report on a corporate card.

- Information about the inadmissibility of disclosing the PIN code to third parties.

- The period within which the employee is required to provide an advance report on the corporate card. In the same paragraph, it is advisable to list the documents that will confirm the information.

Besides:

- The order of the manager determines the circle of employees who have the right to receive corporate cards.

- Liability agreements are concluded with the relevant employees.

- Employees who hold cards must be familiar with the procedure for using cards against signature.

The return and issuance of payment instruments is maintained in a special ledger.

Payment procedure and expense limit

To ensure that the work with cards within the company is smooth, it is recommended to monitor the use of corporate card resources by employees. For this purpose, it is possible to approve a local act regulating the card payment scheme and the frequency of drawing up reports on money spent.

The internal regulations for using a corporate card perform a number of tasks:

- minimizes the risks of disputes with tax authorities in matters of withdrawing cash from cards;

- approves a list of situations in which the employer has the right to file claims against the responsible employee for misappropriation of money, identified shortages or abuses;

- makes the process of withholding card shortages from guilty parties as transparent and understandable as possible.

In the rules for the use of corporate cards approved by the enterprise, it is necessary to fix limits on various types of spending actions, approve the list of employees allowed to access money on plastic cards, and establish a time frame for such access. The local act must contain a template for a report on spending funds from the card and the deadline for submitting it to the accounting department. Employees who are authorized to make payments using corporate cards must issue a receipt to keep the PIN code for the card secret from third parties.

NOTE! In the internal regulations on the procedure for using corporate payment cards, it is necessary to provide a section to describe the measures of liability for violations of a financial nature for personnel authorized to use corporate plastic cards.

If a company has opened a credit card or debit card with an overdraft, then the money limit established on it can be increased at the expense of the resources of the servicing bank. In this case, the company will have loan obligations to the financial institution.

REMEMBER! A loan is classified as received only after cash or non-cash credit money has been written off. It is at this moment that short-term credit obligations should be reflected in accounting in the amount of the used credit limit.

Accountable persons, provided they use corporate cards, are not subject to the limits established by the Central Bank in Directive No. 3073-U dated October 7, 2013.

Features of reflection

Accounting for the current account is carried out at the enterprise on the account. 55. A subaccount 55.4 is opened for it.

If the account has a minimum balance, it is advisable to create second-order subaccounts: “Minimum balance” and “Payment limit”.

If an organization has opened several accounts (for each card), then subaccount 55.4 is created for each of them. If several cards of different employees are issued for one account, who make payments within the general limit, the need to maintain analytical records in the context of holders is determined by the enterprise independently.

In cases where a corporate card is linked to a single current account, it is advisable to create a subaccount for the account. 51 or 52.

Money from the card goes nowhere...

Corporate cards are at hand for accountants. And this plus sometimes turns into a minus - there may well be a temptation to spend the company’s money as if it were your own. This is usually characteristic of the top officials of the company (especially if they are also business owners), who often spend money with CC without thinking. But, as practice shows, ordinary employees can also sin when paying with such a card in a cafe, store, etc. What then?

If the amounts are returned quickly, this does not lead to any special problems. Personal income tax and insurance premiums will not have to be charged from them (letter of the Ministry of Finance of Russia dated February 1, 2018 No. 03-04-06/5808). If you want to rein in those who from time to time borrow money from the company in this way, then you can designate such transactions in the LNA as interest-bearing loans. This usually works.

However, the money may well not come back. And here options are already possible. The consequences will depend on whether the company wants to get them back.

Transaction accounting

For convenience, the rules for reflecting transactions are presented in the table:

| db | CD | Purpose | Confirmation |

| 55.4 | 51 | Transfer of the payment limit amount and minimum balance (in rubles) from the enterprise’s account to a card account (ruble) | Payment order, bank statement. |

| 55.4 | 52 | Transfer of the payment limit and minimum balance in foreign currency from a foreign currency account to a corporate account. | Payment document, bank statement. |

| 55.4 | 67,66 | Receipt of credit funds to the card account on the date of one-time crediting, if a corresponding agreement has been concluded with the banking structure | Bank order, bank statement. |

| 55.4 | 66 | Receipt of credit funds to the card account on the day of payment with credit funds from a banking organization in the absence of the enterprise’s own money, if an overdraft agreement has been signed with the bank | Bank statement, warrant. |

| 91.2 | 51, 52 | Payment of bank commissions for registration, issue, and servicing of the card | Bank statement, accounting certificate. |

| 91.2 | 66 | Accrual of interest on a loan provided using a corporate card | Bank statement, accounting statement. |

| 66 | 51,52 | Transfer of funds to repay a loan or interest on a loan received in connection with the use of a card | Payment order (document), bank statement. |

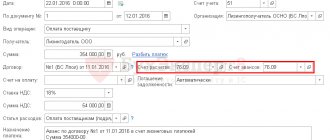

To reflect the replenishment of a corporate card in 1C, the document “Write-off from account” is used. It is located in the “Bank and Cashier” section.

Do I need to bring money to the cash register?

In fact, paying for company expenses using a corporate card is not much different from paying in cash received at the cash desk for reporting. And the corporate card itself is often called a cash card (Cash-Card), which translated from English means “card for cash payments.” For this reason, accountants often doubt how to show in accounting the transfer of money from a bank account to a corporate card. Do I need to first credit the money to the cash register and then issue the money to the employee, or can I immediately show the transfer of funds to the employee, bypassing the cash register? The answer to this question depends on how the employee used the card.

If an employee paid using a card, that is, transferred money from a corporate card directly to the supplier, then there is no need to enter the funds into the cash register. And even if the cardholder first withdrew money from an ATM and then paid in cash, but did not deposit the money at the cash register, account 50 “Cashier” will still not be used.

At the same time, the employee formally received the money on account, so it should be posted to account 71 “Settlements with accountable persons.”

Example 1

The holder of the corporate card linked to the company's current account is employee Karasev. Using the card, he transferred 11,800 rubles. (including VAT at the rate of 18% - 1,800 rubles) to pay for stationery for the sales department. To confirm these expenses, Karasev submitted checks, invoices and invoices to the accounting department.

The accountant made the following entries:

DEBIT 71 CREDIT 51 – 11,800 rub. — transferred from the current account for Karasev’s reporting; DEBIT 10 subaccount “Stationery of the sales department” CREDIT 71 – 10,000 rub. — accountable funds are used to purchase stationery; DEBIT 19 CREDIT 71 – 1,800 rub. - VAT included.

Do your accounting for free using the web service

Then Karasev withdrew 5,900 rubles from an ATM and purchased stationery for the purchasing department in cash (the cost of the goods is 5,000 rubles and VAT at a rate of 18% is 900 rubles). To confirm these expenses, Karasev submitted checks, invoices and invoices to the accounting department. The accountant made the following entries:

DEBIT 71 CREDIT 51 – 5,900 rub. — transferred from the current account for Karasev’s reporting; DEBIT 10 subaccount “Stationery of the purchasing department” CREDIT 71 – 5,000 rub. — accountable funds are used to purchase stationery; DEBIT 19 CREDIT 71 – 900 rub. - VAT included.

But if an employee withdrew money from the account using a corporate card and brought the entire amount (or part of the funds) to the organization’s cash desk, you must first show the transfer of funds for reporting, and then reflect them on account 50 “Cashier”.

Example 2

The holder of the corporate card linked to a special card account is employee Piskarev. 50,000 rubles were transferred to his card. Piskarev withdrew this amount and handed it over to the organization’s cash desk.

The accountant made the following entries:

DEBIT 55 subaccount “Piskarev Card” CREDIT 51 - 50,000 rub. — transferred from the current account to Piskarev’s corporate card; DEBIT 71 CREDIT 55 subaccount “Piskarev Card” - 50,000 rubles. — withdrawn from the corporate card by Piskarev; DEBIT 50 CREDIT 71 - 50,000 rub. - credited to the organization's cash desk.

Submit your financial statements to the Federal Tax Service and Rosstat for free via the Internet using new formats

Accounting for settlements

There are two options for reflecting transactions: simplified and academic.

Their features are shown in the tables. Simplified method

| db | CD | Purpose | Confirmation |

| 71 | 55.4 | Reflection of the amounts of work, services, goods paid for by card, as well as cash withdrawn from the card by holder (accountable employees) as of the date indicated in the bank statement | Bank statement with transcript attached for corporate cards. |

| 10, 15, 25, 20, 26, 44, 40, etc. | 71 | Reflection of paid materials, work, services, in accordance with the advance report presented by the employee with supporting documents attached, as of the date the report was submitted. | Invoices, tickets, receipts, checks, originals of slips, ATM receipts, etc. |

Academic option

| db | CD | Purpose | Confirmation |

| 10, 20, 26, 44, etc. | 71 | Reflection of materials, work, services paid for with a corporate card in accordance with the report with supporting documentation as of the date of its provision | Tickets, receipts, original slips, terminal receipts, etc. |

| 71 | 57 | Reflection of a transaction made on a card, but not accounted for in a bank account | Accounting information. |

| 57 | 55.4 | Reflection of the amount of paid goods, works, services, cash withdrawn from the card, broken down by accountable persons on the day they are reflected on the bank statement | Bank statement with card breakdown. |

If the date of the corporate card report coincides with the day the transaction is reflected in the bank statement, postings are made according to the first option.

Additionally, for both options, the amount of damage should be taken into account:

| db | CD | Purpose | Confirmation |

| 73.2 | 55.4 | Reflection of the amount of material damage resulting from the employee’s failure to present supporting documents or in connection with the use of card funds for personal needs | Bank statement, accounting certificate. |

| 50, 70 | 73.2 | Compensation for damage by an employee through the company’s cash desk or deduction from earnings | Accounting statement, receipt order. |

Learning to work with corporate cards (1C: Accounting 8.3, edition 3.0)

Lessons on 1C Accounting 8 >> Bank and cash desk

2018-02-06T11:33:48+00:00

| Is the article outdated and in need of revision? |

In this lesson we will look at the reflection in 1C: Accounting 8.3 (edition 3.0) of transactions with corporate cards.

A corporate card is a bank card linked to an organization’s card account.

Typically, an organization opens a special card account in a bank and links the required number of bank cards, which are called corporate, to this account.

The organization transfers funds from its main current account to this card account, and employees who are issued corporate cards withdraw money from these cards for their own account .

Then employees report on the expenditure of funds withdrawn from corporate cards using advance reports .

The advantages of corporate cards are obvious:

- costs and time for issuing funds for reporting are reduced

- the risk of losing cash is reduced

- it becomes possible to withdraw funds from the card in the desired currency (an irreplaceable thing when traveling abroad)

- control over the spending of funds appears online (for example, using a mobile application)

- it becomes possible to set limits both for the card account in general and for corporate cards in particular

- there is an opportunity to make purchases on the Internet

Requirements when working with corporate cards:

- funds withdrawn from the cards cannot be used for settlements with employees for wages and in general for any social payments

- An agreement is concluded with the bank on the issuance and servicing of corporate cards, to which is attached a list of employees who will use these cards

At the same time, as one of the readers corrected me, it is possible to withdraw cash using a corporate card and deposit it into the cash register for payment of wages.

Let me remind you that this is a lesson and you can safely repeat my steps in your database (preferably a copy or a training one), the main thing is that the version of the database is 1C: Accounting 8.3, edition 3.0.

To work with a card account in accounting, account 55 “Special accounts in banks” is used.

| Dt 55.04 Kt 51 Transferred money from the main current account to the card account. Dt 71 “Ivanov” Kt 55.04 Employee Ivanov withdrew money from a corporate card for reporting. Dt 91.02 Kt 55.04 Bank commission for cash withdrawal. Dt 20 Kt 71 “Ivanov” Employee Ivanov reported on the use of funds. |

Let's now look at these same operations in the “troika” (1C: Accounting 8.3, edition 3.0).

Corporate card report: example

The employee who received the funds for the report must provide a document detailing all the expenses incurred. Supporting documents are attached to it. The corresponding regulations are established in the Procedure approved by the Central Bank.

By order of the State Statistics Committee of 2001, the standard report form AO-1 was approved.

The form, however, does not contain lines in which transactions on corporate cards can be reflected. You can correct the situation in two ways:

- Complete the standard form. As established in the Procedure, the organization has the right to add additional lines to the unified form.

- Develop the form yourself. Unified forms from 01/01/2013 are not considered mandatory for enterprises. The corresponding provision follows from Federal Law No. 402.

Let's look at an example. The employee was issued a Sberbank corporate card, on which 50 thousand rubles are available. He was instructed to buy a multifunctional device, the cost of which was 110 thousand rubles. In accordance with the payment order, 65 thousand rubles were transferred to the card. After purchasing the device, the balance was 5,000 rubles.

An enterprise accountant supplements the standard report form with several lines. First of all, columns are provided to reflect the amounts of funds on the date of start using the card:

- "Card balance." This line is filled in if the employee did not hand over the payment instrument.

- “Issue of card No...”. This line indicates information if the payment instrument was issued before the task was executed.

The balance on the card is recognized as equal to 0 according to the conditions of the example, since the employee was given the card before executing the order. The line “Card Issued” indicates its number and available amount.

To reflect the replenishment of funds, the “Payment order” column has been added to the report. The date and document number are indicated here.

The “Total” line should contain the amount of the balance on the issued card and the amount of the additional transfer. According to the conditions of the example, the total total is 115 thousand rubles.

The back of the report should list the documents with which the employee confirms the expenses made. The employee must indicate the date of the expense and the amount.

The procedure for non-cash replenishment of the balance on a corporate card

If there are not enough funds on the corporate card for an accountable employee to complete a payment transaction, then the accountant can top it up by transferring the required amount from the current account.

Let's take a closer look at an example:

Petrova O.P. A corporate card was issued with funds available in the amount of 30,000 rubles. Petrova was given the task of buying equipment for the organization, the cost of which is 50,000 rubles. The director of the company ordered the transfer of 25,000 rubles to Petrova’s corporate card. For this purpose, the company’s accountant sent a payment order to the bank and the specified funds were transferred from the company’s account to the card. After Petrova bought the equipment, 5,000 rubles remained on the card. Let's figure out how to draw up an advance report in this case (

Cash withdrawal

When developing a report form, it is necessary to provide for a situation where an employee will not be able to pay for services or goods by bank transfer. Accordingly, the employee will have to cash out the required amount.

To reflect such operations, the following lines are added:

- "Taken from the map."

- “Cash expended.”

- “Entered onto the card via the terminal.”

- "Cash balance."

All transactions with funds are reflected on the front part of the report.

Receipt for document receipt

The reporting employee must provide a report to the accountant or the head of the enterprise. After this, the document is checked and then approved by the director of the organization.

Goods and services purchased by the employee are accounted for. The employee receives a receipt for acceptance of the report - the bottom part of the form. If it is not provided for in the form developed by the enterprise, the receipt is drawn up in any form.

Opening an account

To create an account with corporate cards, the company will first need the documents necessary to open a regular account. In addition, you must write an application, the form of which is provided by the bank. It is written for each employee-card holder. Documents by which the relevant employees are identified are also attached. We are talking, in particular, about a passport, as well as documents confirming the employment relationship with the enterprise (copy of the contract). The bank may require other documents if necessary.

Debt payment is not red

First, let’s figure out exactly when an accountable person must answer to the organization. For a business trip - within three working days from the date of return from such a business trip (clause 26 of the Regulations, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749). As for the amounts spent with the CC for other purposes, the company should set the deadline for reporting on them itself, fixing it in the LNA.

So, the amount has been withdrawn from the corporate card, the hour has come, and the employee has no clue: there was no advance report with supporting documents.

Let's say the organization is not eager to collect money from the accountable.

Then, on the date of the decision to forgive the company’s debt, insurance premiums must be charged on it and personal income tax must be withheld (letter from the Federal Tax Service of Russia for the Moscow Region dated September 14, 2018 No. 16-10 / [email protected] ).

Is it possible to write off the amount of forgiven debt as a tax expense? Alas, the financial department is against it (see letters dated September 12, 2016 No. 03-03-06/2/53125 and dated April 4, 2012 No. 03-03-06/2/34). But there is good news - the contributions accrued in this case will still reduce the company’s taxable profit on the basis of subclause. 1 and 45 paragraph 1 art. 264 Tax Code of the Russian Federation. The Ministry of Finance of Russia gives the go-ahead for this (letters dated 02/05/2018 No. 03-03-06/1/6290, dated 06/28/2017 No. 03-03-06/1/40670).