Gross salary - what does it mean?

Most often, citizens hear the above foreign terms for the first time during an interview with a potential employer. For example, when discussing remuneration, an employer may use the word “gross,” which is translated from English as “full.” Quite often, job candidates do not specify the meaning of this word for fear of appearing ignorant. And then, having agreed to the conditions proposed by the boss, they are disappointed when they receive as a reward for their work an amount less than what was agreed upon at the interview. To avoid such situations, you need to know gross salary - what it means.

Let's answer the question gross salary - what is it? When looking for a job, applicants pay great attention to such a thing as the amount of wages. Employers know this. Therefore, in order to attract the largest number of candidates for a vacancy, they often indicate a larger salary in advertisements. This is the so-called gross salary, which is the amount without deduction of income tax. In Russia it is often called “dirty”. The employer can indicate it in the contract when hiring the employee, but in fact pay him less money at the end of the month. That is, the boss bets that the person in need of work is unfamiliar with this concept.

Therefore, in order to avoid getting into trouble, the amount of remuneration for work should be discussed at the interview.

Gross salary: what does it mean and how to calculate - what is the difference between gross and net

The main criterion when choosing a vacancy for an employee in most cases is salary; this is a natural requirement, since everyone wants to receive decent compensation for their work and time.

In developed countries with a fully functioning infrastructure and social security system, there is taxation - the withdrawal of funds from the working-age and socially protected population to support various government institutions and structures.

https://youtu.be/wWYc1i5JaoY

For various purposes, the employee himself and organizations that control money circulation in the labor market may need both salary data excluding tax (gross salary) and vice versa (net salary). In connection with these subtleties, even a person far from financial issues should know what a gross salary is, how it differs from net, and how such information can be useful in the future.

Not only an accountant of any organization, an employer or a tax employee needs to know the difference between these two concepts.

An ordinary taxpayer usually does not ask questions about how mandatory income tax is calculated from his honestly earned money, and in vain - an unscrupulous employer can take advantage of this ignorance, receiving additional money for someone else’s ignorance.

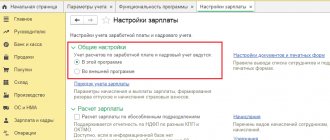

It is important! Income tax in the Russian Federation is 13% of the salary amount indicated in the vacancy. The employee himself does not take any part in the tax filing process; this is the responsibility of the employer, who collects this interest monthly from all officially registered employees and transfers it to the tax office.

In all organizations with “white” wages, employees receive their salaries after deducting 13% income tax

A gross salary for an employee exists only on paper, since he will receive money only after the automatic deduction of this tax, in the form of a net salary. Net translated from Italian means “clean”, which outside the sphere of professional financial slang has acquired the synonym “white” - anyone has heard expressions like “white salary” or “work for a white salary”.

First of all, the gross salary is indicated in the job description. That is, if, when viewing salary information, you see, for example, 50,000 rubles, this is not yet a net salary, the amount without deducting taxes.

It is not customary to indicate the “net” amount in advertisements (this is not a rule - sometimes the employer indicates the amount of the “white” salary, which is reported next to the figure), so you must take this fact into account when applying for a job.

The ability to calculate gross will be greatly needed when drawing up a competent resume.

It is customary for the applicant to indicate the amount of the desired salary in net, so that the employer, in turn, independently adds tax interest and finds out for himself the potential costs of such an employee.

If you want to find a job without any exceptional skills in your field or have incomplete education, try calculating the gross in advance based on the funds you would like to receive net.

It is important! If the amount is too large and unprofitable for the employer, think about lowering the requirements or improving your own qualifications.

Also, awareness of the level of your basic income without taking into account tax deductions may be necessary when trying to take out a loan from a bank that requires such data.

Not all organizations issuing loans are interested in the gross salary of the borrower (especially those who specialize in microloans or work illegally), but when concluding an agreement for a large amount or making a serious purchase in installments through a bank, be prepared for the fact that such information will be required.

It is important! The concept of gross salary can only exist in the case of official, legal employment of the employee. Otherwise, the fact of hiring a person is not registered anywhere, which means that no deductions go to the tax office.

In case of illegal employment, the employer does not make contributions to the tax authorities.

Unfortunately, many employers prefer to hide the fact of hiring from the state, thus saving this 13% tax.

https://youtu.be/J-WYSIlLYkI

The applicants themselves agree to such vacancies with no less pleasure, although this is associated with some risks (an illegal worker cannot count on labor protection, protection from illegal dismissal, compliance by the employer with all working conditions in accordance with current legislation and a full social package), since the cost of such offers is slightly higher than the average market price. In case of illegal employment, only the net salary is indicated.

Usually no one has any problems with this side of the salary - this is the money that the employee receives for his personal use every time he is paid his earnings in cash or to a bank account.

Sometimes the applicant immediately sees the size of his net salary, as mentioned above, and sometimes he finds out only during the first issue.

It is important to note that income tax is deducted only from the employee’s “bare” salary, without taking into account bonus payments and other additional money, which in the same colloquial language is called “gray”.

It is important! Often, an employer, in order not to pay large taxes, prefers to set a small gross salary (and, accordingly, net) and submit the amount declared at the time of hiring using such gray methods, this is due to some controversial issues in taxation.

This does not make “gray” income illegal, it is simply that it is often not regulated by law, is irregular and depends on the personal working qualities of an individual employee, the financial success of the organization for the month/quarter, or on the initiative of the employer directly or several.

You definitely need to know the exact size of your net salary if:

- Salary is not fixed and for some reason differs from month to month;

- A significant part of the salary is issued “gray”, and you cannot always track the net salary.

If, with such complex ways of receiving wages, you do not keep track of where and how much you were paid, you may simply be cheated, and the fault for this will not necessarily be the employer, but, for example, the accounting department. Such cases are rare, but they do happen, take care of yourself through basic financial literacy if you have any suspicions.

Every employee should know how to protect themselves from payroll fraud

Even if fraud has already occurred, by understanding the principles of income tax withdrawal, you can protect yourself, prevent yourself from being misled, and are likely to be able to defend your rights. Sometimes basic knowledge is enough to protect yourself, for which, due to the reluctance to understand your own salary, you have to turn to a specialist, often an expensive one.

If, when writing your resume, after indicating your desired net salary, you indicate that this is the amount you want to receive after deducting all tax payments, you will significantly reduce the number of conflicts and misunderstandings with employers, saving your time and theirs. A financially literate employee earns respect from the employer, but a fraudster is not interested.

Counting algorithm

For information about the amount of your gross and net income, you can always contact the accounting department or directly to the employer if there are no separate structures for payments, but there is also the opportunity to figure it out on your own. There are the simplest algorithms, with them you can easily find the desired value if you know at least one adjacent one. Even basic math skills are no longer needed, just use a calculator.

This is the simplest thing. Since the well-known amount of income tax in the Russian Federation is 13% of the salary, it is necessary to find this number in order to subtract it from the “dirty” salary before tax. For example, here and in subsequent calculations we will take 50,000 rubles.

Some modern calculators (built into a phone, computer or on the Internet) have a function for automatically calculating a percentage of an amount, but if you do not have the opportunity to use such, then there is a universal formula for a mathematical proportion.

We invite you to read: Debtor bankrupt, what to do

Any employee can calculate net, knowing gross, using a special formula or an online calculator

https://youtu.be/VPgD0eHwST8

Values:

- 50,000 – the size of your gross salary;

- 100% – the same thing, only in percentage terms;

- x is the amount of income tax from your gross salary that needs to be found;

- 13% is the total percentage of income tax.

We get the following formula: 50,000 (p) x 13 (%) / 100 (%). This means that gross was multiplied by the total percentage of income tax, and then divided by 100% to equalize the amount. Result – 6500 rubles. This is exactly the amount of income tax on a gross salary of 50,000. In order to get a similar result with a different amount, simply substitute the desired value into the formula.

Now you just need to subtract the found tax amount from gross, and you will get 43,500 rubles - the amount of your net salary.

Sometimes such data may be needed, so you need to know the universal formula for calculating salary including tax just in case, especially since it is very simple.

Here, the average person who does not have the skill of calculating complex fractional numbers will need a calculator.

Gross = Net / 0.87

In other words, to find out your full salary before income tax, you need to divide the amount you receive in your hands by a numerical coefficient of 0.87. It is difficult to make a mistake in such one-step calculations, but just in case, it is worth checking the result against the documents so as not to create confusion in the papers - it can seriously harm you in the future.

Every person should be financially literate

Searching for a job is rarely a pleasant experience, especially if the applicant is inexperienced or is in a difficult life situation, that is, vulnerable.

Such problems in life should in no case be aggravated by incompetence in basic financial matters - it is better to understand once the difference in wages with and without taxation than to later experience difficulties on payday or expose yourself in a bad light to the employer.

: gross and net

Calculation example

Above we answered the question: net and gross salary - what is it. Gross is the amount of wages before tax deductions established by current legislation. Now we’ll tell you how to calculate the net amount that the boss will hand over to the employee at the end of the working month.

The difference between these types of payroll is directly related to the income tax that is withheld from gross payments. Therefore, the tax rate is decisive:

- for residents of the Russian Federation the rate is 13%;

- for non-residents the rate is 33%.

To understand how much an employee resident of the Russian Federation will receive, you need to subtract 13% from the gross salary. For example, if the contract specifies the amount of 40,000 rubles, then the employee will receive 34,800. The calculation is as follows: 40,000 rubles. — 13% = 34,800 rub. The worker will be deducted 5,200 rubles.

The difference is significant, so if, when considering vacancies, you were attracted by the salary indicated in the advertisement, you should not rejoice ahead of time. Specify whether the employer means gross or net.

Salary Net

The term Net translated from English means “clean” . Actually, this is the amount of wages that an employee receives on a card or in cash. You can calculate the amount of Net remuneration if you know the size of the Gross salary and the rates of taxes and other deductions that apply in the country in accordance with the Tax Code, labor and pension legislation.

Withholdings, in addition to the mandatory income tax in all countries, may be as follows:

- Health insurance.

- Pension contributions (mandatory and/or voluntary).

- Alimony.

- Administrative fines.

- Recalculation of overpaid amounts.

- Repayment of previously issued amounts (loans, advances).

This is not a complete list of deductions. their validity and size are clarified with the accountant performing payroll calculations. In addition, there are tax benefits for certain categories of employees, for example, former military personnel, disabled people, guardians, as well as the presence of so-called “dependents” - minor children.

The income tax rate for employees who are foreign citizens is most often higher than for residents of the country.

https://youtu.be/H1_GJEKH3vA

Gross and Net: calculation example

To understand how Gross and Net wages are calculated, we will give several examples of calculating both quantities.

We calculate gross income.

Example 1.

Employee A has a salary of 35,000 rubles. He does not receive any additional allowances.

His gross payout is 35,000.

Example 2.

Employee B was assigned a salary of 42,500 under the employment contract. He also receives 10% of his salary every month for his years of service. For special working conditions, he is entitled to a payment of 5,000 rubles every month.

Employee B's gross payments were:

42500+10%=46750

46750+5000=51750

51,750 rubles of dirty payments.

Example 3.

Employee C is paid according to the tariff level of 53,500. Since he lives in the Far North region, he is entitled to a regional bonus of 2.0. In addition, he receives a monthly bonus of 25% of his grade.

The dirty wages of employee C will be:

53500*2,0=107000

25% of 53500=13375

107000+13375=120375 gross payments.

Now, based on the examples given, let’s calculate net payments. What a person should receive in his hands.

Example 1a.

Employee A was credited 35,000 rubles. He has the right to a tax deduction of 400 rubles. 13% tax is deducted from the remaining amount.

35000-400= 34600

34600-13%=30102

Employee A will receive 30,120 rubles. It should be understood that this amount will be divided into an advance and a main payment.

Example 2a.

Employee B was credited 51,750 rubles. Since this employee has two minor children, he receives a tax deduction of 1000 for each child and 400 rubles. to myself.

51750-2400=49350

49350-13%=42934.5 rubles.

Example 3a.

Employee C received 120,375 rubles. He receives a tax deduction of 400 rubles, and is also obliged to pay monthly alimony for one child in the amount of 25% of what he receives.

120375-400= 119975

119975-13%=104378,25

104378,25*25%=26094,56

26094.56 are alimony deductions, but they do not affect the size of your net salary. The net income for employee C is 104,378.25 rubles.