Home / Labor Law

Back

Published: 05/27/2020

Reading time: 11 min

0

183

Before starting work, the employee and employer are required to sign an employment contract, which reflects the rights and obligations of the parties. This is a basic document that the parties can refer to in case of disputes. It reflects such aspects as job responsibilities, work and rest schedules, and wages. The presence of an employment contract guarantees the employee his right to compulsory social insurance for all employees.

- Features of the employment contract. Why is it important to pay attention to its conditions?

- Salary

- Labor functions

- Work and rest schedule

- Working conditions

- Compulsory social insurance

- Summary: what to look for when signing an employment contract

Dear readers! To solve your problem, call hotline 8 or ask a question on the website. It's free.

Ask a Question

What clauses of the employment contract should employees pay attention to in order to protect their rights if necessary?

Features of the employment contract. Why is it important to pay attention to its conditions?

No one can force an employee to work where he does not like and with working conditions that are not suitable for him. Therefore, you need to carefully read the terms of the employment contract. Working without signing an official contract is quite risky, since such an employee can be fired without good reason and he is deprived of a whole range of guarantees according to the norms of the Labor Code.

The employer, under an employment contract, undertakes to provide work that is part of the labor function and ensures proper working conditions, and to pay wages on time and in full. In return, the employee undertakes to perform the labor function specified in the contract.

When signing an employment contract, you need to take into account that only official written documents have legal force - an oral agreement is invalid. The contract must be signed within 3 days after starting work.

Before signing the document, the employee needs to pay attention to 5 points of the employment contract that protect the rights of the employee:

- salary;

- labor functions;

- work and rest schedule;

- working conditions;

- compulsory social insurance.

Benefits of social insurance for employers and employees

Social protection of an employee is an important way to protect his civil rights. It allows employees and their relatives to feel confident if they lose their ability to work. Social insurance has obvious advantages:

| + employees | + managers |

| Good level of pensions | Opportunity to motivate staff |

| Going on maternity leave, receiving a decent benefit | Transparency in the delivery of salaries, absence from tax authorities |

| Good payments in case of an insured event, 100% sick leave compensation | |

| Employee understanding of their importance |

Related article: Features of compulsory insurance in the Russian Federation

Companies that provide compulsory/voluntary insurance coverage create better conditions for their employees than their competitors.

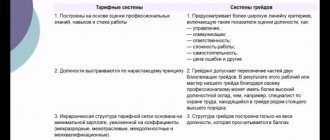

Salary

The current employee remuneration system is a mandatory condition of the employment contract under Art. 57 of the Labor Code (LC). Based on Art. 136 of the Labor Code, the employee must clearly understand on what day he will receive his salary, in what amount, and what will be the compensation for delayed salary . The employer pays wages in the manner specified in the employment contract.

Wages are the employee’s remuneration for work depending on the qualifications, quality and quantity of work performed (according to Article 129 of the Labor Code). The parties determine the amount of wages by agreement; it is not limited by law. The only thing guaranteed by law is the payment of wages in the amount of at least the regional minimum wage.

According to the Labor Code, an employee is guaranteed payment of wages at least 2 times a month. When an employee is dismissed, payment is made to him on the day of dismissal, but not later. Vacation pay is paid at least three days before the vacation, and not after it.

When dividing wages into salary and bonus parts, the employee needs to familiarize himself with the documents that regulate the payment of bonuses. If the employer pays a bonus only at his own discretion, then the employee’s rights are infringed, and if the bonus is not paid, he will not be able to demand compensation for damages. Therefore, you need to try to clarify the conditions and indicators of bonuses in the company (what the bonus is paid for), whether non-payment of the bonus is allowed, and whether the company has a provision on bonuses.

If the employment contract specifies only part of the promised earnings (in other words, we are talking about a “gray” salary or a salary “in an envelope”), then the employee needs to be aware of all the risks of this state of affairs. When signing such an agreement, the employee puts himself in a vulnerable position and in case of any conflict with the employer risks :

- Don't get paid.

- Don't get vacation pay.

- Do not receive social benefits related to education, childbirth and pregnancy, sick leave pay, severance pay in case of staff reduction.

It is important to take into account that the employer’s ability to arbitrarily change the existing employee remuneration system is quite limited. All changes must be agreed upon with the employee, in accordance with Art. 72 TK. If an employee does not agree to worsening the terms of payment for his work, then he can refuse the employer’s offer without any sanctions.

But in the case when the employer, due to organizational and technological conditions, can no longer pay the employee in the same amount, then it is allowed to change the amount of payment at the initiative of the employer on the basis of Art. 74 TK. In this case, the employer is obliged to notify the employee of upcoming changes no later than 2 months in advance. If the employee does not agree to continue working under the new conditions, and the employer cannot offer an alternative, then he has the right to terminate the employment contract on the terms of payment of severance pay.

The employee should know that, according to the provisions of Art. 134 of the Labor Code, his salary must be regularly indexed taking into account inflation processes . Rostrud in its explanations emphasized that indexation is mandatory not only for state and municipal enterprises.

Any delays in wages are outside the legal framework. The employer is obliged to compensate the employee for the damage caused to him as a result of the delay and pay compensation for each day of delay. The minimum amount of compensation is 1/300 of the Central Bank key rate for each day of delay. The employee has the right to suspend work until the debt is fully repaid. If there is a delay of more than 15 days, the employee has the right, with prior notice to the employer, to suspend work until he is paid the full amount of his due earnings (based on Article 142 of the Labor Code).

In addition to the employment contract, information about wages may be contained in a collective agreement or regulations on wages, in particular, on advance payments, final payments, stipulated bonuses and compensations.

Based on the results of the month, the employee is given a payslip with accruals and deductions.

When can an employer deprive an employee of bonuses?

Labor functions

Based on Art. 21 of the Labor Code, an employee can be involved in performing only the work and labor duties that are specified in the employment contract. According to Art. 57 of the Labor Code, the labor function refers to the mandatory conditions of the employment contract . Labor functions include:

- employee position;

- his profession or specialty;

- type of work assigned.

Quite often, the contract itself does not include a list of the employee’s responsibilities and job functions, so as not to overload the text of the document, but is written in the job description attached to the contract. To confirm the fact that the employee has read the job description, he must sign it.

The job description is not one of the mandatory documents, so its absence will not constitute a violation of the employee’s labor rights. But this document is quite useful. From it you can find out what powers are granted to the employee in his position, what its functionality is, and what liability threatens for failure to perform a job function. The job description can prescribe the order of subordination and interaction of persons in a certain position.

The nature of an employee's responsibilities will largely depend on whether the employee is part of executives, operations management, or top management. For performers, the instructions include a clear range of responsibilities, a step-by-step algorithm regarding the time frame and in what form the work duties are performed. The instructions of operational managers are less detailed, and mainly describe the range of tasks to be solved, and the procedure for their execution remains the area of responsibility of the manager. Top management job descriptions are the least formalized and usually consist of goals: for example, strategic planning, development of new business areas, etc.

An employee has the right not to agree to do anything that is not specified in his job description, and changing duties is permissible only with his consent . To change job descriptions, the parties sign an additional agreement. Providing an employee with work is the direct task of his employer. If an employer refuses to pay an employee in the absence of orders, this is illegal. For unlawful removal, transfer to another position or dismissal, compensation may be claimed.

Job functions should be as specific as possible and not contain abstract formulations.

If an employee is asked to perform some functions outside of his main duties, he can ask for additional payment or refuse. All requests must be recorded in writing.

How can you complain about your boss to the Labor Inspectorate?

Work and rest schedule

To work productively, employees need rest. Based on Art. 108, art. 114 Labor Code employees are guaranteed vacation, time off and breaks.

All employees are entitled to basic annual leave, during which they are paid an average salary. A number of workers can count on extended leave, others – on additional paid leave (workers in hazardous industries, the Far North, etc.).

Every week an employee can count on a weekend. If an employee has worked overtime, he can take time off. During the working day, the employee has the right to a lunch break. It lasts at least 30 minutes, but can be revised upward.

An employer does not have the right to force people to work on days off, prohibit them from having lunch, or reduce their vacation pay.

The Labor Code separates concepts such as “working time” and “rest time”. Working time is the time during which an employee must perform his or her job duties in accordance with the current labor regulations and the contract signed by the parties. Working hours may also include other time intervals that are included in working hours according to the Labor Code and other regulations. For example, temporary intervals for heating and rest of workers who work outdoors during the cold season (under Article 109 of the Labor Code).

The normal working day is 40 hours a week (according to Article 91 of the Labor Code). Working hours for certain categories may be reduced: up to 35 hours for disabled people of groups 1-2 or up to 36 hours for people with hazardous working conditions. By agreement with the employer, the employee can work part-time. Some categories of workers are guaranteed part-time work by law: pregnant women, one of the parents, etc. (under Article 93 of the Labor Code).

When establishing a working day schedule, the employer should include the following points:

- What is the length of the working week?

- How long does the shift last?

- Start and end time of work.

- Time for breaks from work.

- Number of shifts per day.

- Alternation of working and non-working days.

All specified working time indicators should be specified in internal regulations or a collective agreement.

The employee’s rest time is given attention in Art. 106, 107 TK . Rest time includes breaks during the day, daily rest, weekends, non-working holidays and vacations.

The day off for a five-day work week is necessarily Sunday, and the second day off is determined by the employer: usually it is Saturday.

There are also holidays that are determined at the government level and included in production calendars.

Voluntary health insurance for employees

The insurer under the supplementary health insurance system in the Russian Federation is a company that is interested in insuring able-bodied persons. The funds come from the company's revenue, while the accounting of payments is regulated by a contract that the company enters into with the clinic, which acts as an insurer.

Voluntary health insurance for a company is accompanied by a number of advantages:

- You can create more attractive working conditions for employees by caring for them and thereby motivating them to work more and more;

- Create an advantage over other companies in the eyes of job seekers, this is especially true for small businesses starting their work;

- Reducing the tax base.

Working conditions

Chapter 36 of the Labor Code obliges the employer to provide employees with a safe workplace and labor protection. The workplace should be safe not according to the employer, but based on current regulations. For example, noise and radiation standards must be observed, free equipment must be used, etc. The employee must receive all the necessary protective equipment: gloves, masks, gowns, mats, etc.

Working conditions of the employee according to the standards of Part 2 of Art. 209 Labor Code is the sum of factors in the working environment and the labor process that affect the performance and health of workers. According to Art. 22, 212 of the Labor Code, the employer’s responsibilities include providing complete and reliable information about the workplace, as well as guaranteeing safe working conditions to employees. The workplace is understood as the place where an employee must be present in connection with the performance of work functions.

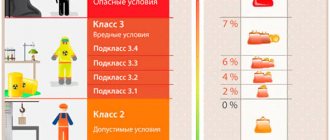

Working conditions are determined based on the results of a special labor assessment. The need for such an assessment is indicated in Art. 212 TC and FZ-426 of 2013 “On special assessment of working conditions.” A special assessment is an independent examination to identify harmful production factors and the magnitude of their deviations from the standard, assess their impact on an employee, and assess the effectiveness of using collective (individual) protective equipment.

Based on Art. 209 of the Labor Code, harmful and dangerous working conditions include those if production factors can lead to illness or injury to an employee.

The result of a special assessment of working conditions (SOUT) is the establishment of their classes depending on the harmfulness and danger:

- optimal (class 1) – working conditions are safe for the employee, there are no harmful or dangerous factors in the workplace;

- acceptable (class 2) – there are harmful factors, but they affect the employee within normal limits;

- harmful (class 3) – exposure to harmful factors is higher than permissible;

- dangerous (class 4) – hazardous working conditions, work in which threatens the life of the employee and carries the risk of acute occupational diseases.

Depending on the working conditions, the rates of insurance premiums that the employer pays for employees for injuries are determined. Based on Art. 57 of the Labor Code, the employee must be notified of harmful and dangerous working conditions, as well as guarantees and compensation for this. The specified information is included in the employment contract.

Workers are also guaranteed the right to annual preventive examinations. During these examinations, their health is checked, taking into account occupational risk factors, and conclusions are drawn regarding the possibility of work.

Labor protection is provided by the state. The employee will have to undergo safety training.

Compulsory social insurance

The presence of an employment contract automatically provides for the employee’s right to compulsory social insurance (under Article 420 of the Tax Code). After concluding an employment contract, the employer becomes the insurer and must pay insurance contributions to the Social Insurance Fund for his employee . They are paid not from the employee’s funds, but from the employer’s salary fund.

The right of an employee to compulsory social insurance in practice means the possibility of receiving paid sick leave, maternity leave, the right to rehabilitation and medical treatment for injuries sustained at work.

If there is an official salary, contributions are paid by the employer without fail: there is no point in keeping track of this for the employee. Payment of contributions is controlled by government agencies.

Social insurance of an employee is an important way to protect his labor and civil rights. It allows the employee to feel protected in case of temporary or complete loss of ability to work.

There are two groups of employee social insurance: insurance against temporary disability, insurance against industrial accidents and occupational diseases.

When insuring against temporary disability, the insured event is, for example, the birth of a child, pregnancy, sick leave due to one’s own illness or the need to care for a child. At the birth of a child, monthly child care benefits are paid from the fund. During pregnancy, an employee has the right to go on maternity leave approximately in the seventh month of pregnancy. At the same time, she is entitled to compensation for lost earnings in the amount of 100% for a period of at least 140 days. If an employee falls ill, the Social Insurance Fund partially compensates the employer for the costs of sick leave compensation.

Contributions in case of temporary disability are transferred to the Social Insurance Fund in the amount of 2.9% of the salary monthly no later than the 15th day of the next month.

Insurance for injuries and occupational diseases does not have a clear tariff .

It depends on the risk group of working conditions and can reach 0.4-8.6% of salary. In this case, workers are insured against permanent disability due to an adverse industrial event, permanent disability or death while working. When an insured event occurs, employees are entitled to benefits due to an occupational disease or work injury.

Employee social insurance: what is it?

Art. No. 236 of the Labor Code of the Russian Federation requires: all employees must be subject to OSS. This responsibility lies entirely with the employer. Each type of insurance has its own established rates, the volume of which depends on the type of taxation adopted in production. Some managers, as a supplement to compulsory social insurance for personnel, provide guarantees in the form of voluntary insurance.

Insurance subjects: who are they?

Partners or other “players” equated to insurance are subjects of OSS. Every person experiences situations that require government assistance.

Insurance protection for employees

Social insurance of employees is regulated by Art. No. 212 of the Constitution of the Russian Federation. Employers are required to provide such insurance protection to their employees at work. The law guarantees the following types of payments:

Operating principle of OSS

Compulsory social insurance for employees is built taking into account the principle of non-strict equivalence. The established liability for insurance payments operates according to the principles:

The key source of financial investments in favor of various funds is contributions received from compulsory insurance.

Payments of insurance premiums must be made by the following insurers:

- those who make deductions and other payments to employees;

- those in private practice do not provide employee benefits.

OSS was introduced as an additional form of social protection for able-bodied citizens. If a person loses the opportunity to work, loses his job, the main breadwinner, then the obligations for social protection fall on the shoulders of the state.