Citizens performing their professional duties at any enterprise have the right to receive annual paid leave under employment and fixed-term employment contracts. Failure to fulfill the employer's obligations to provide employees with leave under a fixed-term employment contract violates the current provisions of Art. 291 Labor Code of the Russian Federation.

Often, fixed-term employment contracts are concluded in the following cases:

- replacing a temporarily absent employee, for example, during maternity leave or long-term sick leave;

- the need to perform seasonal work, in particular, when improving the territory of the municipality, repairing roads, etc.;

- liquidation of emergency situations or accidents in which the involvement of full-time employees is an insufficient measure;

- the need to introduce any elective position, etc.

A fixed-term employment contract can be replaced with an open-ended one if the employee and employer are interested in further cooperation.

An employment contract with an employee of an organization is recognized as fixed-term under the following circumstances:

- The duration of the agreement between the employee and the employer is more than five years.

- For some reason, the contract does not specify the duration of the employee’s work.

- The contract was extended, i.e. extended.

- The agreement was concluded without taking into account the provisions of Art. 59 Labor Code of the Russian Federation.

The procedure for calculating vacation pay when concluding a fixed-term employment contract differs slightly from the standard formula used by employers with permanent employees, but in any case, a citizen has the right to rest.

Vacation according to TC

The duration of leave when concluding a fixed-term employment contract is determined by Art. Art. 291.293, 295 of the Labor Code of the Russian Federation, as well as Letter of the Ministry of Labor dated January 1, 2002 No. 625-ВВ.

Vacation according to the Labor Code of the Russian Federation is calculated as follows:

- In the case of concluding a temporary employment contract for a period of up to six months to perform seasonal work, vacation pay is calculated according to the principle of 2 working days of vacation for 1 month of work. When calculating in this way, weekends and holidays are not taken or paid on vacation days.

- To perform work for a period of more than two months, not related to the time of year, the calculation is based on the principle of 2.33 days of rest for each month of work, i.e. According to the minimum rest time established by law for a year of work, it is 28 calendar days.

Every working citizen has the right to rest, however, in the case of a temporary contract, the employer can provide leave with subsequent dismissal upon expiration of the agreement. Most often, this method of dismissal is practiced after an employee has been hired for seasonal work. If the employee has been hired for more than several years, then he can apply for leave after six months of work.

How to calculate vacation pay

Contract duration: 2 months or more (non-seasonal work)

For a “fixed-term” employee whose contract is concluded for two months or more (and the work is not seasonal), vacation pay should be calculated in the same way as for an employee with whom an open-ended employment contract has been signed. Namely: first you need to calculate the average daily earnings, and then multiply it by the number of calendar days of vacation (for more details, see “Crib sheet for calculating salaries, vacation pay and sick leave”).

Example 1

The employment contract with the employee Kuptsov was concluded for a period of 12 months (from August 1, 2020 to July 31, 2020). During this period, Kuptsov received a monthly salary of 40,000 rubles. Kuptsov had no vacations, sick leave or absenteeism.

From August 1, 2020, Kuptsov was granted leave of 28 calendar days followed by dismissal. The accountant determined that the calculation period for calculating vacation pay is the period of time from August 1, 2020 to July 31, 2018. During this time, Kuptsov earned 480,000 rubles (40,000 rubles x 12 months). Average daily earnings are 1,365.19 rubles (480,000 rubles: 12 months: 29.3). Kuptsov's vacation pay amounted to 38,225.3 rubles (1,365.19 rubles x 28 days).

Contract duration is up to 2 months (or seasonal work)

As mentioned above, if an employment contract is concluded for a period of seasonal work, or for a period of up to two months, leave is granted at the rate of two working days for each month of work. In this case, the average daily earnings is the accrued salary divided by the number of working days according to the calendar of a six-day working week (Article 139 of the Labor Code of the Russian Federation). This value must be multiplied by the number of working days of vacation.

Example 2

The employment contract with employee Barinov was concluded for a period of seasonal work, which lasted three months (from July 1 to September 30, 2018). During this period, Barinov received a monthly salary of 32,000 rubles. Barinov had no vacations, sick leave or absenteeism.

From October 1, 2020, Barinov was granted leave of 6 working days (3 months x 2 working days) followed by dismissal. The accountant determined that the calculation period for calculating vacation pay is the period of time from July 1 to September 30, 2020. During this time, Barinov earned 96,000 rubles (32,000 rubles x 3 months). The number of working days according to the six-day working week calendar was: in July - 26, in August - 27 and in September - 25. Total: 78 workers. days (26 working days + 27 working days + 25 working days).

The accountant determined that Barinov’s average daily earnings are 1,230.77 rubles (96,000 rubles: 78 working days). Vacation pay amounted to 7,384.62 rubles (1,230.77 rubles x 6 working days).

Calculate your salary and vacation pay for free, taking into account all current indicators for today

Types of vacations

When concluding a fixed-term employment contract, a future employee of the organization must independently familiarize himself with all the provisions. Particular attention should be paid to the rules for granting leave and the amount of compensation for it. Depending on the type of leave, the rules for its provision and payment may vary significantly.

Annual

Annual paid leave is provided to all employees of the organization with whom an employment contract has been concluded on a fixed-term or indefinite basis. The only exception to the rules for providing rest is the conclusion of a civil contract, in which the guarantees of the Labor Code of the Russian Federation do not apply to the employee. As a general rule, every working citizen must have 28 days of rest annually, which are certainly paid.

For employees on a fixed-term basis, whose duties do not exceed two months, leave is calculated on the basis of 2 working days for each month worked. The same principle applies to calculations in case of employment for any season.

Annual leave for conscripts, if their work time is more than two months and is not seasonal, is calculated according to the general rule for compiling leave.

Additional

The labor legislation of the Russian Federation does not regulate the provision of additional leave to temporary workers, which means that this type of leave is provided on a general basis based on the actual time of work.

The general grounds for providing time for rest are regulated by Ch. 19 of the Labor Code of the Russian Federation, the rules and features of the provision of additional leaves are regulated by articles 116-119 of the Labor Code of the Russian Federation, while their duration is calculated in calendar days and is not limited to any established limit. The legislation establishes the minimum amount of additional rest for an employee, depending on the rights to provide it.

In the case of additional leave, employees working in the Far North are given 24 days of rest for the previous year of work. This means that when performing duties under a fixed-term employment contract, such employees will be provided with additional leave at the rate of 2 calendar days per month of work. The calculation occurs in a similar way under other circumstances, i.e. the total additional vacation time is divided by the number of months in a year and multiplied by the number of months that the employee worked in the organization.

Maternity leave

Providing maternity leave to employees with whom fixed-term employment contracts have been concluded is regulated by Art. 261 Labor Code of the Russian Federation.

Providing maternity leave to employees working on a fixed-term basis follows the general rule, with the exception of the following features:

- If the contract expires during the employee’s pregnancy, the employer, if there are grounds confirming the pregnancy, is obliged to extend the contract until the birth or until the expiration of maternity leave.

- When extending the agreement before childbirth, the woman is obliged to provide the employer with a certificate of pregnancy, but not more often than once every three months.

- In the case of carrying out labor activities under a fixed-term contract after childbirth, the employer may terminate the employment contract based on the expiration of its validity.

Termination of labor relations with a pregnant woman is not allowed, even if a fixed-term employment contract is concluded for a certain period, with the exception of cases of liquidation of the organization.

Training

Art. 59 of the Labor Code of the Russian Federation establishes the possibility of fulfilling labor duties for full-time and part-time students of secondary specialized and higher educational institutions. The legislator specifies that students can be hired for a seasonal period or at any other time and for any period.

The rights of student workers are regulated by Art. 59 of the Labor Code of the Russian Federation, however, if the training period is completed, the rights of these employees are regulated by the general rules and guarantees established by labor legislation. Student employment is carried out on a temporary basis, usually until he graduates from the educational institution, due to the need to comply with labor legislation.

At the same time, the right to rest for such workers is regulated by the general rules for granting leave to conscripts, while the possibility of taking out study leave during the period of validity of a fixed-term employment contract completely depends on the employer or the collective agreement, if there is one at the enterprise.

The obligation to provide study leave to an employee working on a fixed-term basis is not legally established, therefore such provisions must be prescribed individually or discussed with the employer during employment.

Procedure for applying for vacation compensation for a fixed-term employment contract

Employment contracts are one of the most important documents between an employee and an employer. There are several types of contracts:

1. Fixed-term contracts - concluded for a certain period, but not more than five years; if neither party expresses a desire to terminate it and the employee continues to work, it automatically becomes unlimited

2. Perpetual – contracts that do not have a specific period of validity

The procedure for providing compensation is the same for both a fixed-term and an open-ended employment contract, namely:

- The employee must submit a free-form application for compensation addressed to the manager, indicating the reason why he is entitled to it

- If approved by the boss, his visa is issued

- The next stage is the publication of an order, which indicates to whom compensation is awarded and for what.

- A note is made on the personal card indicating that the vacation has been replaced by compensation and the basis.

- Then the accrual and payment occurs

Vacation under a certain type of contract

Vacation is a mandatory attribute of labor relations; it is regulated by labor legislation and is provided to each employee of the organization with whom it is concluded.

Within the framework of the Labor Code of the Russian Federation, vacation is a continuous rest for an employee from performing his professional duties for a certain time established by labor legislation or an agreement between an employee of the enterprise and the employer.

Vacation can be divided into several types, each of which is regulated independently and is provided depending on the current situation:

- annual basic, provided once a year to an employee of an enterprise for a period of at least 28 days;

- additional, which is provided depending on working conditions and is also paid by the employer;

- unpaid leave provided at the request of the employee in connection with any circumstances, in particular, the occurrence of any family difficulties, etc.;

- targeted leave provided by the employer at the request of the employee for a certain period due to certain purposes, for example, educational or maternity leave.

Any employed citizen has the right to leave, regardless of the duration of the employment contract. Cancellation of leave, as well as calling an employee out of it or replacing it with a compensation payment, is possible only if the employee of the organization himself expresses such a desire. At the same time, an employee of an organization cannot rest less than the minimum established by law.

In accordance with Art. 122 of the Labor Code of the Russian Federation, the right to leave for an employee arises after the expiration of a six-month period of work at a specific enterprise, however, taking into account a fixed-term employment contract, the right to rest can arise both according to general rules and after the expiration of the agreement.

Payments due to employees upon dismissal

When cooperation with a person ceases, on the day of his departure he receives a work book, a certificate of income (2-NDFL), and also a payment. What is included in this concept :

- severance pay;

- vacation compensation;

- earnings.

Thus, the calculation of compensation for the dismissal of employees working under a fixed-term contract occurs in the same way as when a permanent employee leaves. They are subject to the same taxes (income and insurance contributions) as for open-ended employment.

Important! an agreement, even one concluded for a certain period, can be recognized as indefinite if the employer does not warn in writing about the impending expiration of the cooperation period at least two weeks before the day of the proposed dismissal!

For unused vacation

Payments for unused vacation are due to any person who has worked for the company for at least one month, i.e. even if he worked under a fixed-term contract for less than 2 months, then this also applies to him. According to current legislation (Article 291 of the Labor Code), for each month a person has the right to two days off .

So, if an employee leaves after 2 months of work, he receives compensation based on the average daily earnings for each day of the expected vacation.

The peculiarity of this payment is that a “month worked” is considered if the period spent in the company is more than fifteen days. That is, even in this case, the dismissed person will have the right to vacation compensation. However, if this period is less than fifteen days by at least one day, compensation is not due.

To calculate average monthly earnings, a coefficient of 29.3 is used. This number should be multiplied by the number of days in a particular period - this will be the amount of additional compensation.

Below is a useful video on the topic of required payments upon dismissal:

Earnings

This is a sum of money equivalent to the established amount of earnings for the period that passed from the previous payment of wages to the immediate dismissal.

Severance pay

In labor legislation, this term refers to a payment determined by the norms of the Labor Code or a fixed-term contract . Roughly speaking, this is money intended to ensure that the employee has something to live on while he is looking for a new job, if he has not yet found one, or maybe he has found it, but it turned out to be completely different from what was promised during the interview.

The amount of this compensation depends on the reason for which cooperation with the citizen is terminated. So, for example, if the reason was:

- failure to pass certification and, as a result, inadequacy for the position;

- according to the medical report, continuation of work is impossible;

- the former employee was reinstated at work (Article 83, clause 2 of the Labor Code);

- a citizen is drafted into the Armed Forces (Article 83, paragraph 1 of the Labor Code);

- the organization moves to another location, but the citizen refuses to move,

then the benefit amount will be equivalent to the average two-week earnings of this person.

If termination of cooperation with a citizen occurs ahead of schedule due to circumstances beyond the control of the employee himself - for example, the company ceases to exist or there is a reduction in staff (Article 81 of the Labor Code, clauses 1 and 2), then the average salary will be paid within two months after care And only if, after resigning, the citizen registers at the labor exchange within the next two weeks and he will not be able to get a new job within the next month and a half.

However, there is one “but” - all this is due to a person if cooperation with him is terminated before the expiration of the contract and, so to speak, for good reasons.

Attention! If the reason was one’s own desire (Article 80 of the Labor Code) or an agreement of the parties (Article 77 of the Labor Code), then the citizen is not entitled to any severance pay (unless otherwise stated in the text of the said agreement).

This is precisely the reason why an employer can, in the event of a threat of bankruptcy looming over the company, strenuously insist on leaving “on his own.” Or propose an agreement between the parties - of course, verbal, because he is not going to implement it. Therefore, you need to write such a statement only if it is really more profitable to do just that.

Vacation pay

In accordance with Art. 123 of the Labor Code of the Russian Federation, employees of the organization authorized by the employer draw up a vacation schedule, which must be approved no less than two weeks before the start of the new year.

The trade union body, if it is approved at the enterprise, or the employer personally, in the absence of authorized units in the organization, participates in the formation of the schedule. This document reflects all the necessary information about the duration and features of vacations, which must be familiarized to each employee of the enterprise.

When establishing labor relations under a fixed-term agreement for a short period of time, the employer usually provides rest at the end of its validity, paying the employee the required payments. Vacation pay must be paid at least three days before the start of the vacation, and if these three days fall on a weekend, then before the start of the weekend.

General information

Before determining the amount of payments for leave upon termination of employment, it is necessary to study in detail the options for concluding a contract and the reasons for its cancellation. All this information will help the dismissed employee receive all the compensation due by law, and the employer will avoid possible litigation.

https://youtu.be/EdKgyxMWq3Q

Terms of the agreement

Vacation compensation upon dismissal under an employment contract (fixed-term) can be received by a former employee of the enterprise only if the document was concluded legally. The Russian Labor Code provides for the possibility of drawing up an agreement that is not only limited by a time frame, but also indefinite. In most cases, the first option is used, which allows the employer to fire an unprofessional employee immediately after the document expires.

When concluding a fixed-term employment agreement, not only the expiration dates of its validity must be specified, but also the reasons that prevent the execution of an open-ended contract. Russian legislation provides for a maximum duration of such an agreement, which is 5 years. However, if the employee justifies the trust of the company owner and conscientiously fulfills his job duties, then the possibility of extending cooperation is provided.

Conditions under which a fixed-term employment contract can be concluded:

- The work performed is seasonal (heating season, harvest, tourist season).

- A short period of time required to complete a specific order (from 50 to 60 days).

- A permanent employee is absent for a long period (due to maternity leave or official illness).

- A company or firm is created to perform a specific task that requires a limited amount of time.

- If a permanent employee has been elected to an elective position and will hold office only for a certain period.

- An employee is undergoing training or internship at the enterprise.

- The employee is sent from the employment center to perform public duties.

- When conscripted into civil service, which is an alternative to military service.

Reasons for registration

The Russian Labor Code clearly states the grounds on which a fixed-term employment agreement can be concluded. Any other reasons for its registration will be considered illegal. Due to such erroneous actions, both interested parties may suffer.

The basis may be:

- An entrepreneur who owns a company with no more than 30 employees expresses a desire to hire one more person.

- The worker has the opportunity to perform the functions assigned to him only for a certain time. This situation includes the inability to work indefinitely for medical reasons or due to reaching retirement age.

- The work must be performed in conditions with difficult climatic conditions (the Far North or similar regions). This rule applies only if the employee needs to move from his permanent place of residence.

- Organization of activities aimed at eliminating the consequences of disasters, accidents, natural disasters and other emergency situations.

- Hiring people who work part-time in any other public or private institution.

- If the employee is a full-time student.

https://youtu.be/cD3g7S7EAqg

Reasons for breaking the labor relationship

In order to understand whether it is necessary to pay compensation upon dismissal under a fixed-term contract, you should consider the possible reasons for the early termination of the employment relationship. All of them are listed in Article 79 of the Labor Code of Russia and are legal grounds for cancellation of a document.

The main reasons for the termination of cooperation between an employee and the owner of the enterprise:

- There is no way to pre-calculate the completion date of the work. In this case, after fulfilling the scope stipulated by the contract, the employer has the right to cancel the document.

- Expiration date. In this case, the employee must be notified by the company management three days before the end of the contract. This option does not apply to cases where the contract was drawn up for the period of absence of a permanent employee.

- End of a pre-agreed period. This only applies to work that is seasonal in nature.

- The departure of a permanent employee, for the period of whose absence a contract was signed.

An employee performing his labor duties under a fixed-term contract has the right to sever relations with the employer at any time (at his own request) before the agreed date. In addition, you can resign by agreement of the parties.

In some cases, the reason for the cancellation of an employment contract is a violation of the company’s charter or a serious offense that entails negative consequences for the employer. However, the most common reason for dismissal is company liquidation or staff reduction.

Situation 1

Ivanova I.I. got a job in an organization for the improvement of urban areas during the spring-summer period for a period of 4 months, according to a schedule of 6 days of work and 1 day of rest. In May she worked 28 days, in June – 27 days, in July – 26 days, in August – 28 days. Her salary was 28,345 rubles per month, taking into account the deduction of income tax.

Upon expiration of the agreement, she should receive:

2 days of rest ×4 months of work = 8 working days of rest

Due to the peculiarity of assigning leave for seasonal work, such employees are given rest time in working days, and not in calendar days.

To calculate the amount of vacation pay, you must take into account the following data:

Total period of working days for the entire duration of the agreement:

28+27+26+28=109 working days for the entire period

Total salary received:

28,345 ×4 months=113,380

Average daily earnings:

(Total salary)/(Total number of working days)=(113,380)/109≈1040 rubles per day

To calculate vacation pay, the following formula is used:

Average daily earnings ×number of rest days=1040 ×8=8 320

After the expiration of the fixed-term employment contract, Ivanova I.I. will receive 8 working days of rest and 8,320 rubles as vacation pay.

Payment of severance pay

This form of accrual is a payment that is mandatory and provided for by the modern labor code. It is issued while searching for a new place of employment.

The amount of benefits due depends on the reasons on which the employment contract was cancelled. Typically this is an amount equivalent to an employee’s salary for a standard two weeks. Payment will be made only under the following conditions:

- The person did not pass the required certification.

- The employee is not suitable for the position he occupies.

- Having medical conditions that prevent you from working.

- The person whose position was occupied by the employee took up the position.

- Compulsory service in the Russian army.

- Company relocation and employee refusal to follow.

If the employment contract was terminated for reasons beyond the control of the employee, the full amount of compensation will be paid. The amount in this case will be transferred within two calendar months from the date of dismissal.

If a person registers with the employment center, the payment of benefits is automatically extended. But the main condition here is the absence of a new job.

Situation 2

With Lapshina M.A. A fixed-term employment contract was concluded for a period of two years. Her salary is 53,210 rubles per month. She takes regular annual leave, which according to the law is 28 calendar days.

To calculate vacation pay, you will need the following information:

The employee's annual earnings were:

53,210 rubles × 12 months = 638,520 rubles

Average daily earnings:

(638,520 rub.)/(12 months) ÷29.3≈1816 rubles per day

29.3 is the average number of days in a month, which is established by labor legislation.

The amount of vacation pay in this case will be:

Average daily earnings ×number of rest days=1816×28=50,848 rub.

Lapshina M.A. will receive 50,848 rubles as vacation pay and 28 calendar days of rest from performing work duties.

Additional holidays for conscripts

In addition to the annual basic leave, the right to which is granted to all workers without exception, labor legislation provides for various types of additional leaves - with a fixed-term employment contract, any employees who have formalized an employment relationship for a short period of time have the right to them.

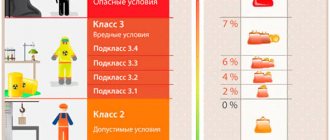

Labor legislation provides for several types of additional leave, which are paid in the same way as the main one:

- for harmful/dangerous working conditions (Article 117 of the Labor Code of the Russian Federation) - at least 7 days;

- for performing certain types of work (Article 118 of the Labor Code of the Russian Federation) - the minimum duration depends on the type of work and is established at the legislative level separately for each type;

- for an irregular working day (Article 119 of the Labor Code of the Russian Federation) - at least 3 days.

Establishing a certain period during which the employment agreement will be valid is not a basis for refusing the worker any of the listed types of leave. The legislator does not establish requirements for the procedure for determining its duration, which means that the calculation of the number of vacation days will be determined according to the general rule set forth in Art. 115 Labor Code of the Russian Federation.

For example, if an employee works in hazardous conditions, for which the law requires 14 days of rest, in a month he will be able to earn 14 / 12 = 1.17 days. Thus, if the contract is concluded for 7 months, along with the main paid leave, the employee will be able to receive another 1.17 × 7 = 8 days of rest.

Situation 3

Between Berdnikov A.V. and the Tsvet organization concluded a fixed-term employment contract to perform welding work in Norilsk. The contract period was 8 months from February 1, 2016. The employee's salary was 121,254 rubles per month.

Since the duration of the employment contract is more than two months, and they are not related to seasonal work, the calculation of the amount of vacation and vacation pay will occur according to standard formulas.

To determine vacation pay, you will need the following data:

Total salary for the billing period:

121,254 rubles per month × 8 months of validity of the agreement = 970,032 rubles.

Duration of labor relations in days, where 29.3 is the average monthly number of days:

29.3 ×number of months of work = 29.3 × 8 months = 234.4 days

Average daily earnings:

(Total salary)/(Average contract duration in days) = 970,032/234.4 = 4,138.4 rubles per day

Since Berdnikov worked for less than a year, the duration of his vacation will be:

(28 cal days)/(12 months)×8 months of work=18.7

Additional paid leave provided to workers in the Far North under Art. 321 of the Labor Code of the Russian Federation, is 24 calendar days.

Based on this, the following calculation can be made:

(24 cal days)/(12 months)×8 months of work=16 days of additional rest

Berdnikov will receive vacation pay for his annual main vacation:

19 (rounded) days ×4,138.4=78,629.6 rubles

Vacation pay for additional leave will be:

16 days of additional rest ×4,138.4=66,214.4 rubles

The total amount of vacation pay will be:

78,629.6+66,214.4=144,844 rub.

Labor legislation does not prohibit combining several vacations into one period or dividing them into several parts, however, in the case of a temporary employment contract, it is recommended to either go on vacation immediately before its end or receive compensation. In any case, vacation pay will be paid.

Varieties

The above rules apply to the most common, annual, type of leave. In addition to this, an employee may need the following types of rest:

- additional;

- maternity leave;

- training.

If an employee is entitled to additional vacation days, under a fixed-term contract under the Labor Code of the Russian Federation they must also be taken into account. This should be done in proportion to the time of employment, that is, divide the required number of days by 12 and multiply by the number of months actually worked.

Maternity leave

The rights of pregnant employees are not limited in any way by the duration of the employment agreement. The employer will have to provide the woman with the required time after her request. It will be possible to cancel a contract with a subordinate only after giving birth.

It is important to know! During the maternity leave, the woman will have to provide a medical certificate confirming pregnancy. But it cannot be required more often than once every 3 months. The organization is not obliged to keep an employee’s place while caring for a child under 3 years of age if the agreement has expired before that time.

Training

Citizens of the Russian Federation can also receive study leave under a fixed-term employment contract. This time includes additional days for passing the session. If the exam period falls during the term of the agreement, the employer will need to release the employee. In the event that a subordinate voluntarily renounces the right to days off, monetary compensation is not required.

Compensation for days off work upon dismissal

Compensation payments upon dismissal can be received by all employees of the organization, regardless of the duration of the contract, therefore such provisions also apply to conscripts. The procedure for calculating compensation payments is identical to calculating the amount of vacation pay and amounts to a similar amount.

The conclusion of a fixed-term employment contract obliges the employer to comply with the established rules for providing leave for employees of the organization. The employer's reluctance to comply with labor law is a good reason to contact the Labor Inspectorate to check the legality of his actions.

Procedure for paying compensation for unused vacation

IMPORTANT!! Compensation is provided for vacations exceeding twenty-eight days

The main leave is entitled to every employee who has worked for half a year at the enterprise; its duration is twenty-eight calendar days.

Compensation is due to an employee who has earned additional leave in excess of these days. The following cannot claim compensation:

1. Before going on maternity leave, a pregnant woman does not have the right to receive it, only upon dismissal

2.Not adults

3.For employees of authorities and customs

The employer is responsible for taking employees on vacation; he does not have the right not to allow employees to go on vacation for more than two years in a row, and failure to pay compensation leads to a fine and administrative liability.

Procedure for calculating compensated vacation days

To calculate the number of days of unprovided vacation that are subject to compensation, it is necessary to determine the total vacation period.

To do this, the number of years, months and days worked in a given company under a fixed-term employment contract is calculated.

Given that the employment contract sets specific terms, it would seem easy to calculate this number, but there are certain terms that are excluded from this length of service:

- unpaid leave of more than 14 days per year (up to 14 days inclusive - not taken into account)

- maternity leave, which can be issued for any family member and for any period

- days the employee is absent from the workplace without valid reasons (absenteeism)

Having calculated the vacation period for a fully worked period of work in the organization, the sum of days of vacation that is due for this period of work is calculated.

The number of vacation days used by the employee is calculated.

How to apply?

Registration of paid leave for both permanent and temporary employees involves the preparation of the following documents:

- vacation schedule;

- notification;

- employee statement;

- manager's order;

- note-calculation.

Since the vacation schedule is drawn up two weeks before the start of the next year, the employer has doubts about whether those hired for a period of less than 1 year should be included in it.

It is necessary to include a conscript employee in the schedule, since at the time of drawing up the document he is on the organization’s staff and has a legal right to rest. In addition, this temporary employee can become permanent by agreement of the parties or if the employment contract is recognized as indefinite in court.

There is no single form of notification of upcoming leave. Each manager chooses for himself how it is more convenient for him to notify his subordinate. It is important to do this two weeks before the start of the holiday. The employee must submit an application at least 3 days before the planned vacation, since during this period the accounting department must pay vacation pay.

The corresponding order, drawn up in form T-6, allows you to make all payments to the employee before rest. The calculation note is a double-sided form of the T-60 form. In this document, the accountant records the amount of payment due to the employee. If an employee goes on vacation as scheduled, there is no need to write a vacation application.

Is vacation included in the temporary employment contract?

Reasons for termination The reasons for termination of a fixed-term employment agreement are prescribed in Article 79 of the Labor Code, and these are:

- the end of the period with a preliminary warning to the employee from his immediate management about future dismissal no later than three days in advance, except in cases where the contract is drawn up during the absence of the main employee;

- after completion of the established scope of work in accordance with the contract, if the completion date could not be predicted in advance;

- in the event of the employee for whose replacement this employment agreement was drawn up returning from vacation or sick leave;

- at the end of the designated period, if the fixed-term contract was drawn up for seasonal work.

Article 79.

- The need to perform seasonal or temporary work.

- Performing work that is urgent or outside the organization's core business.

- Carrying out work necessary to expand production, if there is reason to believe that this expansion or the work itself is temporary.

- Carrying out work for the purpose of professional training or internship for new company employees.

- Hiring an employee to perform some temporary work, in the absence of information about the end of the period for their implementation.

- Hiring an employee who is a retiree, part-time worker, or full-time student.

- Hiring an employee for the position of chief accountant or director.

- Hiring an employee after a specialized competition to fill a position.

- The employee worked for three full months – June, July and August.

- The number of months worked is multiplied by two working days for each of them (3 months × 2 days), which is equal to 6 working days.

- Accordingly, leave will be granted for 6 working days.

And the entire vacation will be 7 calendar days - from 09/01/2016 to 09/07/2016, taking into account the Sunday day off on September 4. - Attention

Payment will be made within 6 working days, and the vacation itself lasts 7 calendar days.

It is necessary to take into account that when calculating the duration of leave under a fixed-term employment contract, non-working holidays are not taken into account and are not paid. In this case, the norm of labor legislation is applied - Art.

The procedure for calculating the amount of compensation paid upon dismissal

The procedure for calculating the amount of compensation payments is similar to the procedure for determining the amount of vacation pay paid to an employee when taking annual leave.

To calculate the exact amount of compensation, you must:

- Determine the number of vacation days.

- Calculate the number of days worked and the amount of earnings received during this time.

- Determine the average daily earnings, for which you need:

- divide the amount of salary received by the total number of days worked if vacation is provided in working days;

- divide the amount of earnings by the number of months worked, the result by 29.3 (average monthly number of calendar days), if vacation is calculated in calendar days.

- Multiply the resulting value by the number of vacation days earned.

Vacation pay calculation

The principle of financing vacation under a fixed-term contract is directly related to the amount of his average salary. The latter is calculated in accordance with Art. 139 Labor Code of the Russian Federation. The average salary must be multiplied by the number of vacation days. The resulting value will be the amount of funds that the employer must allocate.

Example

A fixed-term contract was concluded with employee Shelyagina I.S. to perform seasonal work. Starting in April 2020, Shelyagina worked for 6 months in a row. The monthly salary was 50,000 rubles.

In September of the same year, the contract came to an end. It's time to calculate vacation pay. How much does the employer ultimately have to pay?

First you need to calculate the average salary. To do this, you need to know Shelyagina’s total income that she received for the entire period of seasonal work: 50,000 rubles. × 6 months = 300,000 rubles. Now you can calculate the average income per day. Employee Shelyagina worked honestly for 154 working days.

| April | 26 days |

| May | 24 days |

| June | 25 days |

| July | 27 days |

| August | 26 days |

| September | 26 days |

In total, she received 300,000 rubles: 154 days. = 1948.05 rubles for one working day. When Shelyagina worked for 6 months, she was entitled to a vacation of 6 months. × 2 days/month = 12 days. Vacation pay will be: 12 days. × 1948.05 rubles/day = 23,376.6 rubles.

The same principle of calculation is also valid for those “conscripts” whose employment agreements are concluded on standard terms. In other words, they do not fall under the previously mentioned exceptions to Art. 115 Labor Code of the Russian Federation.

For example, Shelyagina worked for the same 6 months, but no longer in seasonal work. Let's say she replaced another employee in an organization. In this case, vacation pay would be calculated differently. Instead of 12 days, the employee was entitled to at least 28. And then the employer’s costs would be 28 days. × 1948.05 rubles/day = 54,545.4 rubles.