Mat size help

There are cases when a manager, on his own initiative, decides to support the family of the deceased financially.

This may be provided for by local regulations at the enterprise. The exact amount of payment is negotiated personally with relatives and the director or specified in the employment contract. However, the funeral benefit, as a type of insurance coverage, is a fixed amount. Payments are made to both foreigners and persons with temporary registration located on the territory of the Russian Federation.

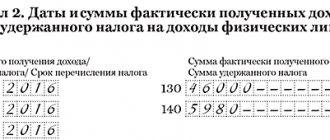

The basic amount of compensation for burial according to the Federal Law is about 4 thousand rubles. It is indexed every year. In 2020, the final amount is set at 5,946 rubles.

Tax rules

Personal income tax with mat. assistance is not charged if the payment is made to close family members. In the case of distant relatives, compensation is not assessed if it does not exceed 4,000 rubles. Otherwise, the tax is set as the difference between the specified rate and the benefit amount. These transactions must be taken into account in the organization’s accounting department.

Payments to a deceased employee and how to process them

To receive financial assistance, you need to collect a certain package of documents and submit it to the local Social Security office. However, if the deceased was a pensioner, a veteran of the Great Patriotic War, a minor, or worked at an enterprise, then the papers should be submitted to another place.

When an employee of an enterprise dies, the accounting department should terminate the employment contract, regardless of whether it was fixed-term or indefinite.

For this procedure, relatives must provide the following certificates:

- death certificate;

- work book with a notice of dismissal;

- an executive document on behalf of the company, which confirms the dismissal of an employee due to his death.

The date of termination of the contract must correspond to the date of death indicated in the provided certificate.

The procedure for dismissing a deceased employee is as follows:

- Management issues a dismissal order. The basis is the provided package of papers.

- The order is officially registered in the appropriate Enterprise Journal.

- The accounting department makes an entry in the work book and issues it to close persons.

- The finance department makes the necessary payments.

If the relatives have already buried the person and did not have time to receive the mat. assistance, they can submit a corresponding application to the employer in order to receive compensation. It will be issued to the person who spent money on the funeral and confirmed the financial transactions with documents or checks.

An application can only be submitted within 4 months after the death of a citizen.

How to receive a payment for the sick leave of a deceased person

I believe that the chief accountant is generally entitled to an expensive pension. I work in a joint-stock company, the overload is enormous... Difficulties on the path of an accountant: techniques to minimize them If the benefit was assigned before May 1, 2018, an increase in the minimum wage will not affect its size in any way.

N... What benefits from the Social Insurance Fund will increase from May 1, 2020 “Dunno on the Moon”, N. Nosov, 1964” - Who are these police officers? — asked... Will online cash registers ruin small and medium-sized trading businesses in Russia, and now a legal entity can file a civil claim against an individual? The claim is filed by the state.

In the face of cash... How 2.7 million of the company's tax debts were recovered from a freelance accountant-pensioner on a "subsidy" basis. Anonymous, you wrote: Anonymous, you wrote: If automation and setup is such a challenge for you... Will online cash registers ruin small and medium-sized retail businesses? business in Russia He is silent about the fact that working pensioners are being robbed, with downcast eyes.

Sick leave is always issued from the first day of a person’s visit to a medical institution until the moment of recovery. In the event of the death of a patient, the sick leave is closed on the day the death occurred.

Receiving payments during this period is the legal right of every person. Therefore, death in this case does not cancel the occurrence of the insured event.

And accordingly, payments according to the law must be accrued from the moment the sick leave is opened until the day the person died, inclusive. This applies to any employee.

With regard to pregnant women, everything is not so clear. In many ways, the period will depend on the period when the child’s death occurred. According to order No. 624n of the Ministry of Health and Social Development of the Russian Federation dated April 26, 2011:

- If a pregnancy is terminated before 21 weeks, not maternity leave is given, but regular sick leave.

- At 22-30 weeks it is already considered maternity leave. Therefore, payments will be allocated accordingly. Moreover, depending on the duration of sick leave, the employer is obliged to pay for the entire recovery period.

Also, many are interested in the issue of parental leave and lump sum birth payment. If death occurs after payment, then it does not need to be returned.

But if before that, the woman is obliged to submit the appropriate documents, since she no longer has rights to these funds.

Leave also ends from the moment the child dies, although it is paid up to and including the day of the baby’s death.

Important! A woman is entitled to payments one way or another, but their type and amount depends on the situation. In addition to sick leave, they usually also include compensation for funeral expenses if the child died after childbirth or was stillborn.

A sick leave certificate is issued in the event of the death of an employee in the same way as during recovery. The difference is that in the reasons for discharge, code 34 is entered in the “Other” item and the date of death is indicated. Relatives receive this sheet, and then they need to contact the deceased’s employer with it.

The employer, in turn, makes the payment by issuing this sick leave. In addition to sick leave, relatives are required to provide documentation that confirms the degree of relationship, as well as a certificate of cohabitation. In the case of spouses or dependents, cohabitation is not a requirement, even if the persons are registered at different addresses.

You can submit a certificate of incapacity for work and an application to receive the funds due under it within 4 months from the date of the person’s death. If all the deadlines have expired and no one has applied for these payments, then they are deposited and included in the estate of the deceased.

Important! The death of an employee is not a factor that cancels the right to receive the funds earned by the deceased.

For women whose pregnancy and childbirth ended in the death of a child, sick leave is issued according to the usual rules.

Moreover, depending on the situation, it will last for a certain period. Accordingly, it will be paid by the employer and/or the Social Insurance Fund. If a woman leaves sick leave early, it is interrupted.

Receiving both such payments and wages is a priori impossible under the law.

Payments

What is required to receive such payments? First of all, it is important to contact a medical institution, which will issue a certificate of incapacity for work and a certificate of death of the person/child. Next, a death certificate is issued.

With this documentation, you must go to your place of work and write an application, providing copies of documents proving your relationship with the deceased, as well as, if necessary, a certificate of cohabitation, which is obtained from the housing and communal services department.

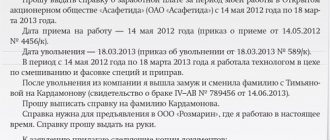

In order to receive sick leave payments, as well as other funds that the deceased did not receive in the course of their work, relatives must contact the organization where he worked and provide the following documents:

- Application for receipt of salary and compensation for the period of illness up to and including the day of death (written by hand or submitted in printed form);

- Applicant's identity card;

- Death certificate of the employee;

- Documents indicating relationship with the deceased.

Women who have suffered the death of a child after childbirth or during pregnancy are required to submit a sick leave certificate and, at the request of the HR department, a death certificate.

Who are they supposed to rely on?

Payments of this kind are due to the following categories of citizens:

- Spouses;

- Mother or father;

- Children;

- Persons who were dependent on the deceased;

- Adopted persons.

If any are not announced, then the due payments (including for vacations not taken) are included in the inheritance of the deceased after 4 months.

How to get them

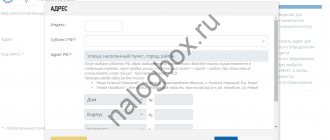

The funds due to the deceased are transferred to relatives according to the details specified in the application. The details include the account number to which funds need to be sent and the name of the bank.

When the employer completes the documentation and the accounting department completes all payments due to the case, including wages, vacation time, and sick leave, the funds will be credited to the account.

When dismissing a specialist, the company is obliged to accrue wages for days worked, compensation for unpaid vacation and other payments due. The amount is given to family members of the deceased: husband or wife, children or parents (adoptive parents). After three days from the date of dismissal, payments are deposited.

If the specialist’s relatives apply for money, the organization is obliged to issue it within a week. The procedure is accompanied by documents: a written statement from the recipients of funds, a copy of the death certificate and papers confirming the relationship.

If the deceased has no close relatives, the salary is included in the estate.

E.A. Shapoval, lawyer, PhD. n. How to pay and take into account sick leave benefits closed due to the death of an employee. The employer is obliged to pay the amounts of social insurance benefits not received in connection with the death of an employee. 5 tbsp. 15 of the Law of December 29, 2006 No. 255-FZ; clause 1 art. 1183 Civil Code of the Russian Federation:

- family members who lived together with the deceased - spouse, parents, children, adopted children, adoptive parents. 2 Investigative Committee of the Russian Federation;

- disabled dependents, regardless of cohabitation with the deceased.

At the same time, recently some branches of the Social Insurance Fund have not accepted expenses for the payment of benefits to family members of the deceased on sick leave closed due to the death of an employee.

The fund proceeded from the fact that he himself did not present sick leave to the employer and no benefits were accrued to him during his lifetime. And the deceased is no longer insured.

This means that such a certificate of incapacity for work is not subject to payment.

Sick leave for a deceased employee: how is the death of an employee on sick leave indicated? When a person dies during an illness, the hospital or clinic worker must note the following information on the sick leave certificate:

- In the corresponding section, in the line “Other”, the code “34” is entered, indicating “died”.

- Next comes the day of death.

- There are no marks in the “Get Started” line.

Important! Filling out sick leave in the organization where the deceased worked will be similar to filling out sick leave for an employee who has started work. The exception is that the last day for which payment is due will be the day on which the employee died.

In this regard, accountants have questions regarding registration of dismissal, how to pay sick leave for a deceased employee, unpaid wages, and taxation. The answers to these questions can be found in the article.

How to fire a deceased employee When a member of the work team dies, you need to terminate the employment agreement under which he was signed, regardless of whether it is fixed-term or indefinite.

In order to properly formalize the termination of the contract, the following documentation is required:

- Death certificate issued by relatives at the registry office.

- An order or order that an employee is dismissed due to his death.

- Record of dismissal in the labor record.

Important! The date on which the agreement with a deceased employee is terminated is the date indicated in the document indicating his death.

Last salary At the time of the death of an employee, the employer may have a debt to him. Payments that have not been transferred are:

- wage;

- compensation for missed vacation;

- unpaid disability benefits.

Based on Article 141 of the Labor Code of the Russian Federation, family members or dependents of the deceased may receive unpaid wages. In this case, the dependent person does not necessarily have to be part of the employee’s circle of relatives. Article 141. Issuance of wages not received by the day of the employee’s death The right to receive funds is stated in paragraph 1 of Article 1183 of the Civil Code of the Russian Federation. Article 1183.

Actions in case of death of an employee while on sick leave

To ensure the rights guaranteed by the Constitution of the country and legislative acts, when accepting a job, the owner (or a person authorized to manage the activities of the organization) enters into an agreement with the future employee.

The basic requirements for the terms of an employment contract, which should be in its content, are listed in Art. 57 Labor Code of the Russian Federation.

In addition to information about opponents, it stipulates:

- time and place of action;

- rights and obligations of the parties;

- working hours, working conditions and validity periods (urgent, unlimited, temporary);

- the amount and methods of remuneration based on the results of the work done;

- cases of compulsory insurance (for the possibility of receiving social benefits in old age or if there is sufficient insurance coverage, when working conditions are recognized as particularly dangerous, harmful to life and health, benefits for days of incapacity for work or the birth of a child);

- other conditions provided for by the collective agreement, local legal acts, which do not worsen the rights of the employee in comparison with legislative norms in the field of labor.

An employment contract, despite its validity period, can be terminated at any time.

The reasons when legal relations are terminated can be conditionally divided into three groups:

- at the request or forced personal circumstances of the employee himself;

- when the initiative to part with an employee who does not suit the employer is taken by the head of the enterprise (owner);

- the need to terminate the contract does not depend on the will of the parties.

Norms Art. 83 of the Labor Code of the Russian Federation provides a list of reasons when an employee is fired due to a coincidence, regardless of the fact that neither he nor the manager showed such initiative.

The sixth paragraph of this article provides for the termination of an employment contract if a person in an employment relationship with the enterprise dies or is declared missing or dead by a decision of the judicial authorities.

When an employee is dismissed, in accordance with the provisions of Art. 140 of the Labor Code of the Russian Federation, on the last working day a person must receive all amounts due to him.

These include:

- wages for hours worked after the last payments;

- monetary compensation for unused days of paid leave;

- required incentive payments;

- remaining unpaid amounts of benefits during incapacity for work;

- severance pay (if provided for by law in connection with this reason for dismissal);

and others.

Funds are paid through the organization's cash desk personally to the former employee, or transferred to the bank account of a financial institution specified by him.

A lot of questions arise:

- on how to draw up documents on the dismissal of an employee if he has died;

- is it worth accruing temporary disability benefits for the time when he was undergoing treatment (according to the sick leave) until the day of death;

- to whom should the funds due to the deceased employee be transferred?

You will find the answers by reading our article.

Preparation of documents and settlements with family members of a deceased employee

“Human Resources Department of a Commercial Organization”, 2012, N 6

PREPARATION OF DOCUMENTS AND SETTLEMENTS WITH FAMILY MEMBERS OF A DECEASED EMPLOYEE

Sometimes the following situation arises: an employee of an organization has died, and his death is not related to an industrial accident. This happens quite rarely, and therefore HR and accounting workers may have various questions related to the preparation of certain documents. In the article we will tell you how to correctly draw up documents on the termination of employment relations and calculations related to such an employee.

In accordance with clause 6, part 1, art. 83 of the Labor Code of the Russian Federation, the employment contract is subject to termination due to the death of the employee. In this case, the employer is obliged to issue an order to terminate the employment contract in form T-8, approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 N 1 “On approval of unified forms of primary accounting documentation for recording labor and its payment” (hereinafter referred to as Resolution N 1). The document that serves as the basis for termination of the employment contract will be a copy of the death certificate. As a general rule, the day of termination of an employment contract in all cases is the employee’s last day of work, with the exception of cases where he did not actually work, but in accordance with labor legislation, he retained his place of work (Article 84.1 of the Labor Code of the Russian Federation). The employment contract must be terminated on the day of the employee's death. Before the specified day, the employer in the work time sheet (form T-12, approved by Resolution No. 1) indicates the days of absence of this employee with the letter code “NN” - “failure to appear for unknown reasons (until the circumstances are clarified)” or the digital “30”. Please note that these days are not subject to payment unless relatives present a certificate of incapacity for work.

Employment history. According to clause 43 of the Rules for maintaining and storing work books, work books and duplicates of work books not received by employees upon dismissal or in the event of the death of an employee by his immediate relatives are stored until required by the employer in accordance with the requirements for their storage established by the legislation of the Russian Federation on archival affairs . Currently, the Order of the Ministry of Culture of Russia dated August 25, 2010 N 558 “On approval of the List of standard management archival documents generated in the process of activities of state bodies, local governments and organizations, indicating storage periods” (hereinafter referred to as the List) is in force. According to Art. 664 of the List, unclaimed original personal documents, in particular work records, are stored for 75 years.

Approved by Decree of the Government of the Russian Federation of April 16, 2003 N 225.

We make payments due to a deceased employee

Let us remind you that according to Art. 140 of the Labor Code of the Russian Federation, upon termination of an employment contract, the employer is obliged to pay the employee all amounts due to him, and to make these payments on the day of the employee’s dismissal. These include:

- unpaid wages;

— compensation for used vacation;

- amounts due to the employee in the event of dismissal;

— payment of temporary disability benefits (if the employee was on sick leave and was presented with a certificate of incapacity for work);

- other amounts provided for by the labor and collective agreement.

If the employee did not work on the day of dismissal, then the corresponding amounts must be paid no later than the next day after the dismissed request for payment is presented. As for the salary not received by the employee due to his death, it is issued to members of his family or to a person who was dependent on the deceased on the day of his death. Payment of wages is made no later than a week from the date of submission of the relevant documents to the employer (Article 141 of the Labor Code of the Russian Federation).

For your information. In case of violation of what is specified in Art. 141 of the Labor Code of the Russian Federation for the period of payment to the relatives of the deceased, Art. 236 Labor Code of the Russian Federation. It says that if the employer violates the established deadline for payment of wages, vacation pay, dismissal payments and (or) other payments due to the employee, the employer is obliged to pay them with interest (monetary compensation) in an amount not less than 1/300 of the current the time of the refinancing rate of the Central Bank of the Russian Federation from amounts not paid on time for each day of delay, starting from the next day after the established payment deadline until the day of actual settlement inclusive.

So, to pay money to the relatives of a deceased employee, the employer must:

— a written statement from a relative about the payment of amounts due to the deceased employee;

— death certificate of the employee;

- an identification document of the applicant, as well as a document confirming the fact of relationship with the employee (if the identification document does not contain the necessary information).

Let us recall that family members are spouses, parents and children (adoptive parents and adopted children) (Article 2 of the RF IC). In addition, according to Chap. 15 of the RF IC, family members also include brothers and sisters, grandparents, grandchildren, stepson and stepdaughter, stepfather and stepmother.

In practice, a situation may arise when several relatives of a deceased employee contact the employer at once. In this case, the employer can give the required amounts to the first family member who contacted him or the person who was dependent on the deceased on the day of death, since the Labor Code does not say anything about this. If relatives contact the employer at the same time, the issue of issuing amounts can be resolved either by agreement of the parties or in court.

What documents must be completed when paying amounts due to a deceased employee to his relative? This amounts to:

— a settlement note in form T-61, which is approved by Resolution No. 1;

- payroll sheet in forms T-49 or T-51, approved by Resolution No. 1. Note that this sheet must be completely filled out for the deceased employee, that is, indicating his personnel number, position, tariff rate and reflecting other calculations .

Note! The recipient of these amounts must sign in the “Money received” column of the payroll slip.

According to paragraph 1 of Art. 1183 of the Civil Code of the Russian Federation the right to receive amounts of wages and equivalent payments, pensions, scholarships, social insurance benefits, compensation for harm caused to life or health, alimony and others that were subject to payment to the testator, but were not received by him during his lifetime for any reason sums of money provided to a citizen as a means of subsistence belong to the members of his family who lived together with the deceased, as well as his disabled dependents, regardless of whether they lived together with the deceased or did not live. In this case, demands for payment of the required amounts must be presented within four months (clause 2 of Article 1183 of the Civil Code of the Russian Federation). If the persons specified in paragraph 1 of Art. 1183, did not contact the employer for payment of funds within the prescribed period, these amounts are included in the inheritance and are inherited on the general basis established by the Civil Code. In such a situation, the employer can transfer these amounts to the notary’s deposit (Article 327 of the Civil Code of the Russian Federation).

Taxation of amounts due to a deceased employee

Personal income tax. According to paragraph 1 of Art. 226 of the Tax Code of the Russian Federation, Russian organizations from which taxpayers receive income, in particular in the form of remuneration for the performance of labor or other duties, work performed, service rendered, are recognized as tax agents in relation to such income. They are required to calculate, withhold from the taxpayer and pay the amount of personal income tax. Moreover, in accordance with paragraph 4 of Art. 226 tax agents are required to withhold the accrued amount of tax directly from the taxpayer’s income upon their actual payment.

In addition, by virtue of clause 2 of Art. 230 of the Tax Code of the Russian Federation, tax agents submit to the tax authority at the place of their registration information on the income of individuals and the amounts of accrued and withheld taxes annually no later than April 1 of the year following the expired tax period, in form 2-NDFL.

We note that in accordance with paragraphs. 3 p. 3 art. 44 of the Tax Code of the Russian Federation, the obligation to pay taxes and (or) fees terminates with the death of an individual - the taxpayer or with recognition of him as deceased in the manner established by the civil legislation of the Russian Federation.

However, until the day of the employee’s death, the employment contract is valid and payments made to his relatives are made on the basis of this contract, which means they are remuneration (Article 57 of the Labor Code of the Russian Federation).

In addition, as mentioned above, wages not received by the day of the employee’s death are issued to members of his family or to a person who was dependent on the deceased on the day of his death. Payment of wages is made no later than a week from the date of submission of the relevant documents to the employer (Article 141 of the Labor Code of the Russian Federation).

From the above norms of the Labor and Tax Codes it follows that the organization is obliged to make payments related to wages not received by the employee on the day of death, no later than a week from the date family members submit the relevant documents. In this case, the tax agent withholds personal income tax upon actual payment of income (except for the amounts listed in Article 217 of the Tax Code of the Russian Federation), and also submits information in Form 2-NDFL to the tax authority at the place of its registration in the generally established manner.

Such clarifications are presented in the Letter of the Federal Tax Service for Moscow dated July 16, 2009 N 20-15/3/ [email protected]

Insurance contributions to extra-budgetary funds. According to Part 1 of Art. 7 of Law N 212-FZ, the object of taxation of insurance premiums for payers of insurance premiums are payments and other remuneration accrued by payers of insurance premiums in favor of individuals within the framework of labor relations and civil contracts, the subject of which is the performance of work, provision of services, under copyright agreements order, in favor of the authors of works under agreements on the alienation of the exclusive right to works of science, literature, art, publishing license agreements, license agreements on granting the right to use works of science, literature, art, including remunerations accrued by organizations for managing rights on a collective basis in favor of the authors of works under agreements concluded with users (with the exception of remunerations paid to persons specified in clause 2, part 1, article 5 of this Law).

Federal Law of July 24, 2009 N 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund.”

Thus, since payments to family members of the deceased are made on the basis of an employment contract with him, these amounts are subject to insurance contributions to extra-budgetary funds on a general basis, but taking into account Art. 9 of Law N 212-FZ, which names the amounts that are not subject to taxation by these contributions (for example, temporary disability benefits).

Similar conclusions can be drawn regarding the calculation of insurance premiums for compulsory social insurance against industrial accidents and occupational diseases. Such contributions are calculated on these payments on the basis of clause 1 of Art. 20.1 of Law N 125-FZ, but taking into account the provisions of Art. 20.2 “Amounts not subject to insurance contributions” of this Law (for example, temporary disability benefits).

Federal Law of July 24, 1998 N 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases.”

Income tax. According to Art. 255 of the Tax Code of the Russian Federation, the taxpayer’s expenses for wages include any accruals to employees in cash and (or) in kind, incentive accruals and allowances, compensation accruals related to working hours or working conditions, bonuses and one-time incentive accruals, expenses associated with the maintenance of these employees, provided for by the norms of the legislation of the Russian Federation, labor agreements (contracts) and (or) collective agreements. In particular, payment costs include:

- amounts accrued at tariff rates, official salaries, piece rates or as a percentage of revenue in accordance with the forms and systems of remuneration accepted by the taxpayer (clause 1 of Article 255);

— monetary compensation for unused vacation in accordance with the labor legislation of the Russian Federation (clause 8 of article 255);

- other types of expenses incurred in favor of the employee, provided for by the employment contract and (or) collective agreement (clause 25 of article 255).

Thus, amounts paid to family members of the deceased are included in expenses when determining income tax under the above points.

Registration of a certificate of incapacity for work after the death of an employee

We are all mortal.

Sometimes the most ridiculous cases, even an acute respiratory disease, can shorten a person’s life.

Labor legislation norms Art. 183 of the Labor Code of the Russian Federation guarantees the receipt of benefits for days of incapacity for work by the employee, upon provision of sick leave certificates duly documented in the established forms issued by medical institutions.

Doctors cannot always cure a patient.

When an officially employed person goes to a medical institution, a sick leave sheet is opened, which is closed upon his recovery so that he can be provided to the organization where he works for the calculation of cash benefits.

The certificate of incapacity for work is filled out in accordance with the established Procedure, approved by Order No. 624n of the Ministry of Health and Social Development of the Russian Federation, issued on June 29, 2011 and in force today, taking into account the changes made on July 2, 2014 by Order No. 348n.

According to clause 61 of the Procedure, in the line where the date is indicated when the employee, after illness, can begin work after being recognized as able to work, a dash is placed if he died while on sick leave.

In case of death of a person, the following line “other” must be completed indicating the two-digit code “34” and the date of death.

Until one of the relatives and friends of the deceased provides a certificate of incapacity for work to the enterprise where he worked before illness and was in an employment relationship during the incapacity, no action can be taken by the employer.

The code “NN” or the digital code “30” is entered in the time sheet until relatives (close people) bring the sick leave directly to the organization’s human resources department.

Only after this is the information in the record sheet corrected, and the employer fills out a form for a certificate of incapacity for work as usual.

The sick leave serves as the basis for calculating cash benefits for all days of life while the person was undergoing treatment.

How to register

The employee of the medical institution who issued the certificate of incapacity for work puts code 34 in the “Other” line. He informs that the employee has died. After this, the date of death recorded in the certificate is established. The “Get Started” field remains empty.

In general, the employer issues sick leave according to standard rules and scheme. The document states:

The only difference: the day you receive your sick leave benefits. The date of death must be indicated here. Also see “How to fill out sick leave for an employer: sample 2020.”

Termination of labor relations

According to paragraph 6 of Art. 83 of the Labor Code of the Russian Federation, the death of an employee is grounds for termination of an employment contract.

Having received documented confirmation of death, the employer issues a written order (order) to terminate contractual obligations, indicating the cause of death of the employee.

The date of issue of the order (after receiving the documents) may not coincide with the date of termination of the employment contract (day, month, year of death).

A corresponding entry is made in the work book.

Despite the fact that there is no fundamental difference in the wording “the employee is fired” or “the contract is terminated,” it is considered incorrect to use the term dismissal in relation to the deceased.

In this case, there is no need to present the order to anyone under signature; the manager’s visa is sufficient.

A work record book can be issued to relatives upon a written application for processing social benefits (for example, survivor's pensions for minor children), or sent to the archives.

If no one has applied for the funds due to the deceased, they are sent to the deposit of the enterprise.

If the deceased employee worked in a region participating in the pilot project

Then the employer pays only its part of the benefit (for the first three days of illness), and for the rest of the benefit, family members will need to contact the Social Insurance Fund office, which serves the employer of their deceased relative.

Source: Current Accounting

Expertise of the article: Svetlana Myagkova, GARANT Legal Consulting Service, professional accountant-expert

If an employee submitted sick leave late, due to which he was mistakenly paid for extra work days, then the company can recalculate wages and make adjustments to accounting. She is not required to submit “clarifications” on insurance premiums in this situation.

In many large organizations with a large number of employees, the following situation may arise: an employee reported illness after the company had already submitted reports to the Federal Social Insurance Fund of Russia for this period. At the same time, he was mistakenly paid for sick days as working days. What is the best way to deal with this situation—should I make corrections to the accounting?

Double payment is not allowed

The employee has the right to present sick leave for payment within 6 months from the date of its closure. In this case, the company must pay benefits for it along with the next salary (Part 1, Article 12, Part 8, Article 13 of the Federal Law of December 29, 2006 No. 255-FZ).

Please note: temporary disability benefits are assigned to an employee to compensate for lost earnings during a period of illness (subclause 2, clause 1, article 7 of the Federal Law of July 16, 1999 No. 165-FZ). It is impossible to pay an employee both benefits and wages for these days (post. FAS ZSO dated 01/25/2010 in case No. A45-9720/2009, FAS DVO dated 02/27/2010 No. F03-778/2010).

Therefore, if an employee actually worked during a period of illness (and these days were paid to him as working days), then the Federal Social Insurance Fund of Russia will simply not accept expenses for such sick leave as offset.

It’s another matter if the employee was absent due to illness, but for some reason this became clear after payroll was calculated and reports were submitted. And here the company has several options for solving the problem.

Let it be as it is

If the amount of expenses for “late” sick leave is small, then it is easier for the company not to accept it for payment and not to make corrections to the accounting.

But keep in mind: if this sick leave is somehow discovered during an income tax audit, then companies may be charged additional tax, as well as penalties and fines for economically unjustified payments to an employee during illness and excess amounts of insurance premiums.

Claims can be avoided if the collective or employment agreement with employees provides for additional payment up to actual earnings during the period of illness. In this case, the amount of the additional payment can be taken into account as labor costs when calculating income tax (letter of the Ministry of Finance of Russia dated December 8, 2010 No. 03-03-06/2/209).

Corrections without “clarification”

But if the error is related to “rolling over” sick leave, then the company will most likely have to make corrections to the accounting. For example, if only the first days of such sick leave, which occurred at the end of the quarter, were paid incorrectly.

And if, as a result of recalculation, the amount of the difference turns out to be quite insignificant and the income tax return for this period has not yet been submitted, then you can only limit yourself to making corrections in accounting.

Example

After the company submitted reports on insurance premiums for the first half of 2011, the employee brought in sick leave, which was opened on June 29 and closed in July. On June 29 and 30, the company mistakenly paid him as working days - in the amount of 3,000 rubles. The company's accountant made a recalculation for June and drew up an accounting certificate (let's say the amount of benefits for June is 600 rubles). At the same time, the company decided to attribute the excess amounts paid to the employee to other expenses, and accrue temporary disability benefits only for July. Based on this certificate, the following entries are made in accounting:

DEBIT 20, 26, 44 CREDIT 70

– 2400 rub. (3000 – 600) — part of the erroneously accrued salary for June was reversed;

DEBIT 20, 26, 44 CREDIT 69

– 1020 rub. (RUB 3,000 × 34%) — part of the erroneously calculated insurance premiums for June was reversed;

DEBIT 91-2 CREDIT 70

– 2400 rub. — the erroneously accrued salary amount was taken into account as other expenses;

DEBIT 91-2 CREDIT 69

– 1020 rub. — the erroneously calculated amount of insurance premiums is taken into account as other expenses.

In this case, the amount of extra expenses is 3,420 rubles. (2400 + 1020) - must be excluded from the income tax calculation for the first half of the year (or June) 2011. Since this error led to excessive payment of insurance premiums, the company is not obliged to submit “clarifications” to the Federal Tax Service of Russia and the Pension Fund of the Russian Federation.

Corrections with "clarification"

If, as a result of recalculation, the difference between the amount paid to the employee and the amount of benefits turned out to be large, then it makes sense to offset the excess amounts paid and submit “clarifications” on insurance premiums.

Example

After the company submitted its reports for the first half of 2011, the employee brought a four-day sick leave, closed on June 30. For the period from June 27 to June 30, there was no note on sick leave on the report card, so the company paid him for these days as working days. The amount of payment for these days was 16,000 rubles.

The company's accountant recalculated for June and drew up an accounting certificate. The amount of sick leave benefits is 4,000 rubles. including 1000 rubles at the expense of the Russian Social Insurance Fund).

DEBIT 20, 26, 44 CREDIT 70

– 16,000 rub. — excessively accrued salaries for June were reversed;

DEBIT 20, 26, 44 CREDIT 69

– 5440 rub. (RUB 16,000 × 34%) part of the insurance premiums for June was reversed;

DEBIT 20, 26, 44 CREDIT 70

– 3000 rub. sick leave benefits for June have been accrued (at the expense of the employer);

DEBIT 69 CREDIT 70

– 1000 rub. — sick leave benefits for June have been accrued (at the expense of the Russian Social Insurance Fund).

The company can offset any excess amounts paid to the employee against the salary for July. In this case, there is no need to make accounting entries: it is enough to accrue the employee’s salary for July in a smaller amount based on the data in the accounting certificate.

And in order to offset the excessively transferred amount of insurance premiums, you need to submit “clarifications” to the Pension Fund of Russia and the Social Insurance Fund of Russia for the six months, as well as make changes to the personalized accounting information.

In addition, the company must submit an updated income tax return for the first half of the year (June) 2011. and pay additional penalties.

Tax audits are becoming tougher. Learn to protect yourself in the Clerk's online course - Tax Audits. Defense tactics."

Watch the story about the course from its author Ivan Kuznetsov, a tax expert who previously worked in the Department of Economic Crimes.

Come in, register and learn. Training is completely remote, we issue a certificate.

Procedure for obtaining funeral benefits

Taking into account the above, when considering issues related to the payment of temporary disability benefits not received by the insured person during his lifetime, members of his family living with the deceased, as well as his disabled dependents, we recommend that you be guided by this letter. See Letter of the Federal Social Insurance Fund of the Russian Federation dated 07/08/2015 N 02-09-11/15-11127 “On the issue of payment of temporary disability benefits not received by the insured person during his lifetime” (together with “Information on the issue of payment of temporary disability benefits not received the insured person during his lifetime"). The courts also take into account the fact of cohabitation, which is confirmed by a stamp in the passport or even the testimony of witnesses (rulings of the Primorsky Regional Court dated 04/08/2014 in case No. 33–2783, Krasnoyarsk Regional Court dated 05/19/2014 No. 33–4603/2014).

Payments upon dismissal due to death

Important The organization is obliged to pay wages not received by the employee during his lifetime for the time actually worked.

Compensation for unused annual leave at the time of dismissal is also subject to payment. They are accrued in the usual manner on the basis of a calculation note drawn up in accordance with the dismissal order.

The Civil Code gives the right to family members to receive other amounts that were the means of subsistence for the deceased. Based on Article 1183, the enterprise is also obliged to provide benefits for sick leave, maternity leave, and child care benefits, if they were not received by the employee during his lifetime.

When sick leave ends in the death of an employee, the medical institution issues a certificate of incapacity for work to family members or dependents. The employer is obliged to assign and pay benefits for sick leave submitted after termination of the employment contract.

To receive the funds due, relatives must contact the employer within 4 months from the date of death. If this deadline is missed, all specified funds will be included in the inheritance.

The organization has the right to withhold from wages the amount of overpaid vacation pay, according to the calculations in the calculation note.

An employee died while on sick leave

When filling out a sick leave certificate, employees of the medical institution where the employee was treated enter code 34 in the “Other” column. It means that the patient has died. The date of death is written next to it according to the issued certificate. The “Start work” field does not contain data: the employee will not be able to return to work duties.

Filling out the certificate of incapacity for work by the responsible persons of the employing company is carried out according to the standard algorithm. The document states:

- Company name;

- type of employment contract (indefinite or fixed-term);

- TIN and SNILS of the employee;

- The time period for which temporary disability benefits are due;

- amount of benefit to be transferred;

- Full name of the head of the organization and chief accountant.

The end of the benefit accrual period is considered to be the date of the citizen’s death, confirmed by a certificate.

Do I need to calculate and transfer benefits?

If an employee dies while on sick leave, the employing company does not lose the obligation to calculate and transfer the due temporary disability benefits. According to current legislation, recipients of funds may be:

- relatives of the deceased who lived with him in the same apartment (husband, wife);

- disabled dependents, regardless of their place of actual residence.

Before issuing funds due, the accountant is obliged to request documents from the relatives of the deceased confirming the right to receive benefits.

Sick leave for a deceased employee is calculated using a standard algorithm. The average salary of a specialist is multiplied by the number of days on the certificate of incapacity for work. A percentage of the amount received is paid according to the employee’s insurance length (from 60 to 100%). Funds are transferred in any case, whatever the reasons for the death of the citizen.

The law gives the relatives of the deceased four months to come and claim the benefits they are entitled to. If they do not report to the company within this period, the amount is subject to deposit and inclusion in the total amount of the inheritance.

If the deceased specialist lived in a constituent entity of the Russian Federation included in the Social Insurance Fund pilot project, the employer pays sick leave benefits only for the first three days of illness. The remaining period of incapacity for work is “repaid” by the Fund after an application from the relatives of the deceased.

Additional payments after the death of an employee

Relatives of the deceased may be paid financial assistance if it is established in the local regulations of the organization itself, an employment contract or an order of the manager. It is impossible to oblige a company to issue additional funds on the basis that such practice is common.

Important: A citizen who has paid for a funeral is entitled to receive a social benefit for burial by the company that was the insurer of the deceased under compulsory medical insurance.

The basis for it is Law No. 8-FZ of January 12, 1996. To receive this benefit, the employer must provide:

- Statement from the person who paid the funeral expenses.

- A certificate or certificate issued by the civil registry office.

Please note: The manager's request to provide documentary evidence of expenses incurred is illegal.

The amount of the benefit is established on the basis of the list of funeral services and is 4 thousand rubles with the addition of the indexation amount. The coefficient by which the benefit is indexed is established annually by the Government of the Russian Federation.