General concepts about an employment contract

Employment contract: differences from civil law

The employee and the manager regulate labor relations on the basis of legislative acts and other legal documents, while the execution of the employment contract is not left aside. The employment relationship is not valid without the conclusion of contractual obligations.

The contract specifies what work the employee must perform, and the conditions for performing the job function and compensation for special conditions must be provided. Contractual obligations also include extracts from collective obligations, local acts and agreements, which, in turn, set out norms from labor legislation, the amount of the established salary, as well as the regulations of the enterprise.

The labor obligation in some way relates to civil law, since it sets out all the information regarding the work being performed.

Several differences between a labor and civil law document:

- The employee works on the basis of the qualification assigned to him under an agreement concluded with the employer, and under another agreement he fulfills his duties until the desired result is achieved, for example, until the completion of construction of the facility.

- The employee only performs the work himself according to the employment agreement.

- The employee’s duties are subject to internal work regulations, in accordance with the labor obligation, and if violations occur, such circumstances are punished disciplinary or administratively. Failure to comply with the requirements of another agreement leads to civil liability before the law.

- The conditions for the performance of labor duties are established by the employer.

- The remuneration is paid according to a civil law agreement, and the salary is calculated according to the labor agreement.

Article 306. Changes in the terms of the employment contract determined by the parties by the employer

(as amended by Federal Law No. 90-FZ of June 30, 2006)

The employer - an individual notifies the employee in writing of changes in the terms of the employment contract determined by the parties at least 14 calendar days in advance. At the same time, the employer - an individual who is an individual entrepreneur, has the right to change the terms of the employment contract determined by the parties only in the case when these conditions cannot be maintained for reasons related to changes in organizational or technological working conditions (part one of Article 74 of this Code).

(as amended by Federal Law No. 90-FZ of June 30, 2006)

Why do you need an employment contract?

Based on the requirements of legislative documents, it is recommended to consider the contract from three aspects simultaneously:

- characterizes the relationship between employer and employee, that is, the document contains reference norms to articles from the Labor Code of the Russian Federation and other regulatory documents;

- after signing the document, the citizen automatically becomes an employee of this organization;

- from the legal side, legal relations and obligations between the parties are established for the entire period.

These are characteristic features of an employment contract; relationships are regulated with their help. Contractual obligations are bilateral.

An employee is a citizen who has reached the age of 16, but there are also cases when an agreement is concluded with 15-year-olds, this is permitted at the legislative level. It is possible to enter into contracts with persons who have reached the age of 14, subject to the provision of light labor and consent from their parents or their representatives. It is worth noting that there is no upper age limit for concluding a work contract; the main thing is that the employee meets all the criteria, that is, has passed a medical examination.

Concept and types of subjects of labor law

Subjects of labor law are recognized as participants in social relations that form the subject of labor law.

The legal status of subjects of labor law is determined by: 1) labor legal personality; 2) the totality of fundamental (statutory) rights and obligations recognized by the Constitution of the Russian Federation and labor legislation; 3) liability for failure to fulfill assigned duties.

In relation to employees and their representatives, it is necessary to emphasize the existence of legal guarantees of labor rights.

Labor legal personality is a special property of subjects of labor law, their ability to have rights and obligations (legal capacity), to contribute through their actions to the acquisition of rights and create legal obligations for themselves, as well as to bear responsibility for offenses committed (legal capacity).

Legal personality is a prerequisite for endowing the subject of labor law with subjective rights and obligations, that is, it gives individuals, organizations and bodies the opportunity to participate in legal relations.

Statutory (fundamental) rights and obligations are original and inalienable. They are enshrined in the Constitution of the Russian Federation and laws.

Many labor rights are recognized by the international community as fundamental human rights.

Statutory rights form the basis of a complex of subjective, that is, rights and obligations belonging to the subject.

Subjective rights can be established not only by laws and other regulatory legal acts, but also by agreements, collective agreements, local regulations, and employment contracts.

Implementing a social (protective) function, labor law attaches great importance to establishing the legal status of workers and their representatives and creates a system of guarantees for the implementation of the rights granted to them.

Legal guarantees are organizational and legal means of real implementation of subjective rights established by laws and other regulatory legal acts.

Guarantees, in essence, are mechanisms for the implementation of established rights.

An important element of the legal status of the subject of labor law is liability for failure to perform or improper performance of duties.

Labor law distinguishes between the disciplinary and financial liability of the employee and the financial liability of the employer for damage caused to the employee.

Just as labor relations are the main relations of the subject of labor law, so the employee and the employer and their representatives represent its main subjects.

In most cases, workers' representatives are trade unions, and employers' representatives are employers' associations.

Main points of the employment agreement

What is the employment contract about: main points

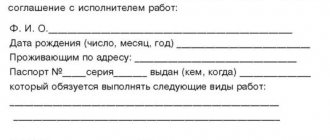

To correctly draw up an employment contract, you need to know some nuances, including what information to include:

- the full initials and surname of the employee, as well as full information about the organization with which the employment contract was concluded;

- name and data from documents according to which the identity of the future employee is established. This could be a passport or military ID;

- number of the power of attorney of the representative from the employer who is given the opportunity to sign the contract;

- place of conclusion and date of conclusion of the contract;

- indicate the place where the work activity will be carried out;

- full name of the position in accordance with the staffing table, including profession and type of work;

- establishing the start date of the employment contract;

- what kind of remuneration is provided (amount of payment, compensation and allowances);

- regulated lunch and break breaks;

- guarantees from the employer that the employee will be socially insured;

- other conditions stipulated by the contract;

- when conducting training at the expense of the enterprise, it is necessary to indicate the period of work;

- what conditions of financial support are provided, for example, pensions and insurance;

- what responsibilities of an employee exist based on the requirements of local regulations of the enterprise.

If it is necessary to enter additional information, as well as if some conditions in the contract are changed, it is necessary to draw up an additional agreement. The conditions specified in the latest document must not contradict the requirements of the law.

For example, these could be:

- information specifying the employee’s place of work;

- what probationary period is provided;

- on the inadmissibility of disclosing information.

Taxation of entrepreneurs

Typically, an entrepreneur must pay the following taxes:

- Income tax on the salary of each employee;

- Pension Fund insurance contribution for compulsory pension and health insurance is paid from the salary of each employee. This contribution guarantees that the company’s employee will be able to receive a pension in the future. Its size will mainly depend on how much the entrepreneur transfers and on the length of service;

- Payment of social insurance premium. This contribution is paid due to the fact that the employee may temporarily lose capacity for work or some kind of accident may occur to him at work. When such situations occur, the state provides certain payments to such a person.

In addition, the entrepreneur will have to provide certain reports to each fund and body, depending on the requirements of a particular organization.

| Similar articles | |

| What are the ways to make money on the VKontakte social network? [contents] Almost every Russian person is registered on the popular and well-known social network Vkontakte, but few know that with the help of... | |

| Successful and effective earnings - reselling articles [contents] In the modern world, every electronic resource needs high-quality and unique content, so articles, ... | |

| What are Bitcoins and how to invest in them? [contents] What is Bitcoin? Bitcoin is a special monetary unit that is decentralized, which means that there is no specific center of issue for it... | |

Types of contracts depending on validity period

There are several nuances that are used when drawing up a contract. Based on the duration, there are employment contracts of the following nature:

- Indefinitely. If there is no validity period in the contract, this means that the document is valid for an indefinite period. That is, if you need to terminate the relationship, then you should do everything in the prescribed manner in accordance with the law.

- Fixed-term agreements. They are concluded for a period not exceeding five years, and it may be concluded specifically for the performance of the type of work specified in the document.

You also need to know that the document must indicate the duration of time for which the contract must be concluded, and also state the reasons on the basis of which it is not allowed to conclude a fixed-term contract. The list of these reasons is fixed at the legislative level and can be adjusted and expanded.

Based on what criteria a permanent contract cannot be concluded, the decision remains with the employer.

When agreeing on a bilateral contract, the employer's representative does not have the right not to hire an employee who does not sign open-ended contractual obligations, unless this is related to professional achievements.

Association of employers as a subject of labor law

Employers have the right, without prior permission from state authorities, local governments, and other bodies, to create an association of employers on a voluntary basis in order to represent the legitimate interests and protect the rights of their members in the field of social and labor relations and related economic relations in relations with trade unions and their associations, government bodies, local governments.

An association of employers is a form of non-profit organization based on the membership of employers (legal entities and (or) individuals).

The legal status of an association of employers is determined by the federal law of November 27, 2002 “On Associations of Employers” and other federal laws.

Associations of employers can be created according to territorial, regional, sectoral, intersectoral, territorial-sectoral characteristics.

An employers' association is created based on the decision of the founders.

The founders of an employers' association can be at least two employers or two associations of employers.

The legal capacity of an association of employers as a legal entity arises from the moment of its state registration in accordance with the federal law on state registration of legal entities.

The rights and obligations of employers' associations are enshrined in the federal law “On Employers' Associations”.

Yes, Art. 13 of this law includes among the rights of employers' associations: the right to form a coordinated position of members of the employers' association on issues of regulation of social, labor and related economic relations and to defend it in relations with trade unions and their associations, government bodies, and local government bodies; coordinate with other associations of employers the position of the association of employers on the regulation of social and labor relations and related economic relations; to defend the legitimate interests and protect the rights of its members in relations with trade unions and their associations, government bodies, and local governments; take the initiative to conduct collective negotiations on the preparation, conclusion and amendment of social partnership agreements; give its representatives the authority to conduct collective negotiations on the preparation, conclusion and amendment of agreements, participate in the formation and activities of relevant commissions for regulating social and labor relations, conciliation commissions, labor arbitration to resolve collective labor disputes; make, in accordance with the established procedure, proposals for the adoption of laws and other normative legal acts regulating social and labor relations and related economic relations and affecting the rights and legitimate interests of employers; take part, in accordance with the established procedure, in the implementation of measures to ensure employment of the population; conduct consultations (negotiations) with trade unions and their associations, executive authorities, local governments on the main directions of socio-economic policy; receive from trade unions and their associations, executive authorities, local governments the information they have on social and labor issues necessary for conducting collective bargaining in order to prepare, conclude and amend agreements, and monitor their implementation.

According to Art. 14 the association of employers is obliged to: conduct collective negotiations in the manner established by federal laws, conclude agreements with trade unions and their associations on agreed terms; fulfill concluded agreements regarding the responsibilities of the employers' association; provide its members with information about agreements concluded by the association of employers and the texts of these agreements; provide trade unions and their associations, executive authorities, local governments with information available to the association of employers on social and labor issues necessary for conducting collective bargaining in order to prepare, conclude and amend agreements, and monitor their implementation; exercise control over the implementation of agreements concluded by the association of employers; to facilitate the fulfillment by members of the association of employers of obligations stipulated by agreements, as well as collective agreements concluded by employers who are members of the association; perform other duties provided for by the charter of the association of employers.

An association of employers is liable for violation or failure to fulfill agreements concluded by it insofar as it relates to the obligations of this association, in the manner prescribed by the legislation of the Russian Federation and these agreements.

An association of employers is not liable for the obligations of its members, including their obligations under agreements concluded by this association of employers (Article 15); in this case, members of the association of employers bear responsibility (Article 9).

Termination by an employer of its membership in an association of employers does not relieve it of liability for violation or failure to fulfill obligations stipulated by agreements concluded during the period of the employer’s membership in the said association.

An employer who joined an association of employers during the period of validity of agreements concluded by this association is liable for violation or failure to fulfill the obligations provided for in the agreements (Article 9).

About fixed-term contracts

When do you need a fixed-term employment contract?

Fixed-term contracts are drawn up in the following cases:

- The duration must initially be discussed and established. For example, persons involved in parliamentary activities, heads of university departments or governors fall into this category.

- Contractual relationships are also established for a relatively specific period. The organization determines the scope of work that needs to be performed on the basis of this agreement.

- Conditionally fixed-term contractual relationships are concluded with those persons who will occupy the position of a temporarily absent employee. For example, a specialist is on maternity leave and there is a need to hire another employee to fill his position.

The reasons for concluding these types of contracts are regulated by labor legislation.

Some examples of concluding fixed-term contractual relationships:

- for the period of seasonal or temporary work;

- if the work is planned outside the Russian Federation;

- when work goes beyond daily activities;

- when carrying out work to eliminate the consequences of the situation resulting from unforeseen circumstances;

- with citizens with whom temporary relationships have been established, these include disabled people or pensioners;

- if work is carried out in the Northern regions;

- with creative professionals;

- with crew representatives;

- with students in higher and secondary educational institutions;

- when working part-time;

- in other cases.

Varieties depending on the nature of contractual obligations

The nature of the contractual relationship is divided as follows:

- The contract is on a permanent basis. The conclusion of such a relationship assumes that the employee works for this employer, in accordance with the established work regulations. In this case, the work book is kept by the employer.

- At the same time. The employee performs the work assigned to him regularly, and the completion takes time free from his main activity. Contractual relations can be concluded both with a third-party employer and with the one with whom the main contract was concluded. The conclusion of such agreements is possible with any number of enterprises. But there are some exceptions, for example, a sports coach can only enter into this agreement with his employer.

- Temporary job. This is when the work is not permanent and the duration of its execution does not exceed 2 months. For example, a designer is hired to prepare a design project before the work is completed. If this work assumes a permanent position, then hiring a temporary job will not be considered legal.

- Performing seasonal work. The contractual obligations state that the work is seasonal in nature, namely, the performance of these functions is relevant only during the season. This could be harvesting crops or snow.

- Agreement with the direct employer. It occurs if it is necessary to have cooks, teachers or secretaries on staff. An open-ended or temporary contract is drawn up in writing with mandatory registration with self-government bodies.

- Contractual obligations with persons engaged in work from home. The document must clearly state what materials will be used for the work, including who will purchase them. It can also be stated here that family members can also take part in this work.

Contractual relations depending on the size of the task performed

Employment contracts are divided according to the size of the task performed

Contracts are divided based on the size of the task being performed:

- Main place of work. An employee carries out production activities while being in one place, that is, he does everything that is specified in the contract.

- At the same time. Such rules for concluding contractual relations apply when an employee performs production tasks in addition to his main job, but it is stipulated that the time allocated for this work is no more than 4 hours daily.

Activities carried out part-time by agreement of the parties differ significantly from combination activities, including increasing the range of services and increasing the volume of work. That is, if it is necessary to combine professions, then the work is added, and if the service area increases, then the load on the employee during the shift is added.

Part-time work activities are carried out at one place and require the same time of work; registration requires a written agreement from the employee to the main contract.

General provisions

In resolving disputes related to labor activity, it is necessary to use exclusively the provisions of the law, namely the Labor Code of the Russian Federation. In it you can find answers to many topics of interest.

What is the nature of the work in the employment contract:

- Mobile.

- Traveling.

- "On my way".

- Other.

This is the main classification.

This classification is presented in Article 57 of the Labor Code. It is possible to specify the nature of the work in the contract (fixed-term or open-ended) between the employee and the employer, but the Labor Code does not contain detailed wording and examples of different types of work. Therefore, the characteristic is often indicated either by a joint decision of the employee and the employer, or is indicated according to the preferences of the employer. Other regulations may also be used to help determine the nature of the work.

The Labor Code also contains another classification of work by nature:

- Home-based.

- Seasonal.

- Temporary.

- Public service.

- For an individual.

- At the main place.

- At the same time.

This classification is no less important than the previous one for concluding an employment contract and determining the length of the working day, the number of days off, the availability of vacation and payment of vacation pay, and the presence/absence of government subsidies.

Employment contracts depending on the type of employer

Contractual relations are also divided according to the type of employer representatives:

- Legal entity. This is an agreement with an organization or enterprise to perform the tasks set out in the document. Such agreements are the most common.

- Individual. Labor relations are established with a private entrepreneur or his representative. At the legislative level, it is required that an entrepreneur be at least 18 years old. He is also required to fill out work books and pay contributions to pension and insurance funds.

You can enter into fixed-term contracts, but the number of employees in the company should not exceed the established criteria. If the labor of a mercenary is used for personal interest, then the document must be registered with the authorities at the place of registration.

Labor Relations. Resolution of individual labor disputes

No employer is immune from the occurrence of a labor dispute. Moreover, sometimes a dispute arises after the dismissal of an employee. We will consider the features of resolving individual labor disputes (for employers - individuals) in this article.

Let us remind you that employers are individuals in accordance with Art. 20 of the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation) are divided into two categories:

- individuals registered in the prescribed manner as individual entrepreneurs and carrying out entrepreneurial activities without forming a legal entity, as well as private notaries, lawyers who have established law offices, and other persons whose professional activities in accordance with federal laws are subject to state registration and (or) licensing, who have entered into labor relations with employees in order to carry out the specified activities. Please note that individuals who, in violation of the requirements of federal laws, carry out the specified activities without state registration and (or) licensing, who have entered into labor relations with employees for the purpose of carrying out this activity, are not exempt from fulfilling the obligations assigned by the Labor Code of the Russian Federation to employers - individual entrepreneurs ;

- individuals who enter into employment relationships with employees for the purpose of personal service and assistance with housekeeping (hereinafter referred to as employers - individuals who are not individual entrepreneurs). Note that such workers can be nannies, caregivers for sick family members, secretaries, tutors, drivers, cooks, gardeners, etc.

It should be taken into account that individuals who are not individual entrepreneurs who have reached the age of 18 years have the right to enter into employment contracts as employers, provided that they have full civil capacity, as well as persons who have not reached the specified age - from the day they acquire full civil capacity.