Why is a GPC agreement concluded?

It's quite simple. This is very beneficial for the employer:

- There is no need to fulfill the duties provided for by labor legislation: providing vacation, paying sick leave, monitoring labor safety and being responsible for violations in this area, etc.

- There is no need to make contributions for the employee to the Social Insurance Fund or the Compulsory Medical Insurance Fund to the pension fund. There is no need to act as an employee’s tax agent, withhold personal income tax from his income and transfer money for the employee.

Art. 702 of the Civil Code of the Russian Federation talks about what a contract is. According to it, one party orders the execution of some work, and the other undertakes to carry out what was agreed upon.

Without going into the legal jungle, let’s explain simply: in a civil contract, it is not the process that is important, but the result. It does not matter how or when the contractor performs the work, it is important that the result is achieved by the deadline referred to in the agreement.

That is, the GPC agreement provides certain advantages to the employee:

Articles on the topic (click to view)

- What to do and where to go if you are not paid upon dismissal

- What to do if you are laid off at work

- What to do if the employer does not want to fire at his own request

- What to do if the date of the dismissal order is later than the date of dismissal

- What to do if the employer does not give the work book after dismissal

- What to do if you didn’t work officially, you were fired, you didn’t get paid

- What is the employer obliged to give the employee on the day of dismissal?

- no need to observe labor discipline;

- you can work whenever you want and where it is most convenient.

But the disadvantages are obvious: a complete lack of social security. If the contractor gets sick, then that's his problem. He shouldn’t count on a good pension in the future either, because the customer does not make any contributions to the Pension Fund.

Attention: “disguising” labor relations as civil law is an illegal activity. The employee, at any time, can apply to the court with a claim to recognize the existing relationship as an employment relationship. And with a very high probability they will win the case.

This is important to know: Filling out a work book upon dismissal: sample 2020

Looking for an answer? It's easier to ask a lawyer!

If the contract has a condition for early termination - a 15-day warning, therefore, after your written notice of termination of the contract, the contract will be terminated after 15 days.

But, it seems to me, your contract can be considered an employment contract. If you obey the internal labor regulations, then your relationship can be considered an employment relationship. But even if the relationship is an employment relationship, the employer must be notified of the termination of the contract 2 weeks in advance.

With respect, Nadezhda.

Hello, Anastasia. It is impossible to quit under a contract. If a work contract has been concluded, the only question can be about its termination. Under a contract there cannot be an employer. It is impossible to combine them together.

In addition, a contract is concluded to perform some work and its result should be the creation of the subject of the contract. You mixed incompatible things in your question. Specify what kind of contract you have - a contract or an employment contract.

Client clarification

It is the termination of the contract. I didn't formulate my question correctly, sorry.

November 28, 2014, 00:05

Requirements for mandatory work of 14 days in case of voluntary dismissal apply to employment contracts, but this does not apply to contract agreements. If you received a payment, you don’t have to show up, I’m sure no one will go to court against you, since the employer himself violated the law by not formalizing this as an employment relationship.

Client clarification

I didn’t receive a settlement, I didn’t write a termination agreement

November 28, 2014, 00:15

Good evening, Anastasia!

1. Notify the Customer in writing of the termination of the contract with a receipt stamp (be sure to include the date of acceptance of the document)

Find out what: Court order: what is it and what to do with it? (sample and document template)

2. Sign the agreement to terminate the contract

3. Perform work within the time (days) agreed with the Customer in the agreement on termination of the contract

The contractor has the right to refuse to perform the contract only in cases provided for by law or the contract.

Termination of a work contract at the initiative of the contractor is a consequence of the customer’s failure to fulfill counter-obligations under the work contract.

Firstly, if the customer, warned by the contractor about the unsuitability or poor quality of the material, equipment or technical documentation provided by the customer, does not replace the unsuitable or poor quality material, equipment or technical documentation within a reasonable time.

Secondly, if the customer, warned by the contractor about possible adverse consequences for the customer of following his instructions on the method of performing the work, does not change the instructions on the method of performing the work.

Thirdly, if the customer, warned by the contractor about other circumstances beyond the contractor’s control that threaten the suitability or durability of the results of the work performed, or making it impossible to complete it on time, does not take the necessary measures to eliminate the circumstances that threaten its suitability.

The fact of the customer's warning must be properly documented - for example, a copy of the warning with a note of receipt by an authorized employee of the customer (namely an authorized employee, and not just an employee).

Step-by-step instructions: how to resign under a GPC agreement

- We prepare a notice of termination of the contract.

- We send it to the customer by letter with a notification and a description of the attachment.

- We are waiting for the notification to return from the recipient.

- We compensate the customer for losses.

Attention: the case may end in court. But, as a rule, the deal is terminated without problems. Questions may arise regarding compensation for losses.

Better option

The employee, according to the Labor Code of the Russian Federation, performs a labor function. Of course, the result is important, but the main thing is to do your job efficiently every day.

Expert opinion

Novikov Oleg Tarasovich

Legal consultant with 7 years of experience. Specializes in criminal law. Member of the Bar Association.

The contractor, for example, can do nothing for two weeks, but in the last three days he can work harder and achieve the desired result. There is no final result, therefore there are losses.

If the GPC agreement “masks” the employment relationship, then it is better to act as follows:

- We go to court with a claim to recognize the relationship as an employment relationship.

- We get a solution.

- We submit a letter of resignation.

It is possible that you will have to endure detention. But this method is more profitable. You do not need to compensate for losses; you can receive compensation for vacation and salary from your employer.

Thus, the GPC agreement does not provide for dismissal. The agreement can only be terminated. There is no power-subordination relationship between the parties. They are equal. But, if there was a “disguise” of labor relations, then you need to prove this and quit in accordance with the requirements of the Labor Code of the Russian Federation.

No fixed salary

In accordance with Art. 19 of the Labor Code, the employment contract specifies the employee’s tariff rate (salary), additional payments, allowances and incentive payments. At the same time, the law requires that wages be paid to the employee at least twice a month (in the case of an employment contract - at least once a month). In a contract, the price is determined by agreement of the parties , and can be either fixed or approximate, i.e. The final price can be determined upon completion of the work . On the one hand, this means the opportunity to charge more money for your services than the salary of a full-time employee; on the other hand, there are no guarantees or stable payments; all risks pass to the side of the contractor.

Civil contract: what is it?

This document represents cooperation between the employer and the applicant, in which the performer receives payment for a pre-approved amount of work. Its second name is a contract.

The GPC contract is good for the employer because:

- a person works without official employment;

- there is no need to enter data into the work book;

- he is not obliged to pay sick leave and vacation pay.

However, the contractor, just like the employer, is not relieved of the obligation to pay taxes.

For the performer this is personal income tax (income tax, which on average is 13%), and for the employer - unified social tax (for 2020 - 34%). Although entries are not made in the work book, the contract provides for work experience, which gives the employee the opportunity to retire due to age.

This is important to know: Can an employer fire you from a job without reason?

In addition, as noted earlier, the employer pays a percentage to the pension fund, from which we can conclude: the maintenance of pension policy for a regular employment contract and a GPC document are identical. However, this is where the similarities end.

For example, for relationships concluded under an employment contract, the key condition for the employee is the fulfillment of the agreed conditions throughout the entire working time until the moment of settlement. The document, which is of a civil law nature, is based only on the certificate of completion of work, based on which the calculation and payment of wages to the contractor is carried out.

In other words, the customer pays for the amount of work completed. It is also worth noting that during the validity of this document the contractor has a free work schedule, and therefore overtime is not paid.

Payment under a contract upon dismissal

If the contract does not provide for advance payment for the work performed or its individual stages, the customer is obliged to pay the contractor the agreed price after the final delivery of the work results, provided that the work is completed properly and on time, or with the customer’s consent ahead of schedule.

In cases of unlawful withholding of funds, evasion of their return, or other delay in their payment, interest on the amount of the debt is subject to payment. The amount of interest is determined by the key rate of the Bank of Russia in force during the relevant periods.

These rules apply unless a different interest rate is established by law or agreement.

In this case, you should be guided by the terms specified in the contract. There is a civil legal relationship between you and the customer, not an employment relationship.

I would be grateful for your feedback

As of August 6, 2019, amendments to PBU 1/2008 “Accounting Policies of Organizations” come into force. Thus, in particular, it has been established that in cases where federal standards do not provide for a method of accounting for a specific issue, a company can develop its own method.

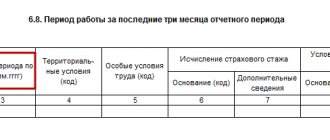

Recently, the Altai branch of the Pension Fund of the Russian Federation issued an ambiguous information message regarding the rules for submitting SZV-M.

In cases of unlawful withholding of funds, evasion of their return, or other delay in their payment, interest on the amount of the debt is subject to payment. The amount of interest is determined by the key rate of the Bank of Russia in force during the relevant periods. These rules apply unless a different interest rate is established by law or.

In this case, you should be guided by the terms specified in the contract.

There is a civil legal relationship between you and the customer, not an employment relationship. I would be grateful for your feedback

The provisions of the Labor Code do not apply to persons performing work under civil law. Therefore, you do not need to write a letter of resignation.

Find out what: Employment contract with a worker - sample and description

Termination of the contract occurs on the conditions specified herein. See the section Termination or early termination. If an organization has entered into a civil contract with an employee who is on the staff of this organization, then the employee must perform work under the concluded contract during working hours.

How are contract and employment contracts drawn up?

Both types of agreements are concluded in writing and signed by both parties. There is no need to register agreements anywhere, but the state will learn about them: the new counterparty will appear in tax reporting, and personal income tax will be transferred for the employee.

Documents for registration. In any case, you will need passports to sign contracts. If both parties are individuals, simply show each other your passports. The head of the legal entity signing the agreement must have a power of attorney or an order authorizing him to act without a power of attorney. A legal entity also requires certificates of state registration and tax registration.

When concluding an employment contract, an employee will need:

- employment history;

- TIN;

- military ID;

- diploma, certificate, certificate of educational level;

- additional documents (for example, a certificate of no criminal record when applying for a teaching position).

We suggest you read: How to correctly respond to a client’s claim

When concluding a contract, it is advisable to check the contractor’s charter, whether he has licenses and permits: whether he can engage in contract work.

Enter the site

RSS Print

Category : Labor law Replies : 14

You can add a topic to your favorites list and subscribe to email notifications.

« First ← Prev.1 Next → Last (2) »

| tayanka.tanya |

| I got a job at the Spetsservice Merchandising organization on November 12, 2014. under a contract (for a trial period of two months), for the position of merchandiser. On the 20th of December I was paid my salary for November. I extended the contract for December (since all their contracts are concluded exclusively for a month), and then for January. As stated in the contract, in order to receive payment for the work performed, you need to sign the acceptance certificate for the work performed (no later than the 20th day of the calendar month following the reporting period, the reporting period is considered to be the duration of the contract. Remuneration to the employee is paid no later than 5 calendar days. days after signing the acceptance certificate). 14 days before the expiration of the contract, I notified the director that I would not renew the contract. The contract was concluded until January 31, 2015. I have a salary for December. they did not pay, explaining that the suppliers had not paid us, and at the time of the end of the contract they had not paid me either. I went to the office and asked for two months’ worth of documents to be signed, but they didn’t give me anything. The director hides, doesn’t answer calls... the office is completely ignored!!! I contacted state control and the labor inspectorate, but even there they shrugged their shoulders, because... I have a contract, and it does not apply to labor law. What should I do? Help me please! |

| I want to draw the moderator's attention to this message because: Notification is being sent... |

Lawyer, Lithuania, Vilnius [email protected] Lithuania, Vilnius Wrote 1044 messages Write a private message Reputation: -51 | #2[46887] February 9, 2020, 20:37 |

Notification is being sent...

International lawyer. Protection and representation in all courts of the EU countries and Belarus. Lawyers of the European Union can practice throughout the union, and lawyers of Lithuania can also practice in Belarus.| tayanka.tanya [email hidden] Belarus, Minsk Wrote 6 messages Write a private message Reputation: | #3[46896] February 10, 2020, 7:20 |

Notification is being sent...

| Lawyer, Lithuania, Vilnius [email protected] Lithuania, Vilnius Wrote 1044 messages Write a private message Reputation: -51 | #4[46926] February 10, 2020, 1:16 pm |

Notification is being sent...

International lawyer. Protection and representation in all courts of the EU countries and Belarus. Lawyers of the European Union can practice throughout the union, and lawyers of Lithuania can also practice in Belarus.| Lynx [email hidden] Belarus, Minsk Wrote 755 messages Write a private message Reputation: 122 | #5[47233] February 16, 2020, 15:32 |

tayanka.tanya wrote:

...both here and there unanimously say that this is a civil law relationship, and it is necessary to file a claim in court...

What they say about the trial is correct. Without seeing the contract itself, it is difficult to say unequivocally what exactly the relationship is. There may be: 1) ordinary civil legal relations regulated by the Civil Code (here you can only go to court, since the contractor (you) and the customer are independent entities not bound by labor relations. Participants in civil legal relations acquire and exercise their civil rights of their own will and in own interests), 2) or a civil contract within the framework of Decree 314 (this fact must be proven in court, and based on the court decision, then apply the Civil Code and Decree 314 to put pressure on the customer). You still won’t get away from the court (the police don’t deal with such cases). Or you will have to wipe yourself off and say goodbye to the reward. Now send all unsigned acts to the customer by mail with a registered notification (be sure to save the mailing notification of their receipt by the customer - it will be needed later in court as evidence). And for the acts, fill out a covering letter in which you indicate which acts you are sending, and also indicate the reason why you are sending them (for example, due to the failure to sign previously submitted acts and the absence of a reasoned refusal to sign them). Keep a copy of the letter as well. And try to find funds for the claim. If you win, you will receive more than the cost of the claim (do not forget that in case of non-payment or untimely remuneration, the executor has the right to additionally charge either penalties or index the unreceived remuneration depending on the type of relationship)

I want to draw the moderator's attention to this message because:Notification is being sent...

Jazz was called music for the rich, jazz was called music for the poor, but jazz always remained music for the smart... (c)| Darpol [email hidden] Belarus Wrote 1778 messages Write a private message Reputation: 155 | #6[47235] February 16, 2020, 16:08 |

Notification is being sent...

| tayanka.tanya [email hidden] Belarus, Minsk Wrote 6 messages Write a private message Reputation: | #7[47289] February 17, 2020, 2:16 pm |

Notification is being sent...

| Darpol [email hidden] Belarus Wrote 1778 messages Write a private message Reputation: 155 | #8[47292] February 17, 2020, 2:57 pm |

Quote:

who indicated the amount of debt under the contract, a penalty for late payment of salary and interest for the use of other people's funds (in accordance with Article 366 of the Civil Code of the Republic of Belarus).

Excuse me - did you calculate the fines in accordance with which legal regulations? in accordance with the contract? what did you refer to?

I want to draw the moderator's attention to this message because:Notification is being sent...

| tayanka.tanya [email hidden] Belarus, Minsk Wrote 6 messages Write a private message Reputation: | #9[47297] February 17, 2020, 15:07 |

Notification is being sent...

| Darpol [email hidden] Belarus Wrote 1778 messages Write a private message Reputation: 155 | #10[47299] February 17, 2020, 15:09 |

Notification is being sent...

« First ← Prev.1 Next → Last (2) »

In order to reply to this topic, you must log in or register.

Indefinite employment contract

Such an agreement is concluded for an indefinite period. Experts say that it is more profitable for an employee to enter into an open-ended employment contract.

Advantages for the employee : stability, because the employer cannot fire you due to the expiration of the contract. In this case, the employee has the right to resign at his own request at any time. You just have to notify your boss about your dismissal a month in advance.

Disadvantages for the employee : there are no additional measures of material incentives, like a contract: additional leave and an increase in the tariff rate. In addition, if the employer violates his duties, the employee may resign, but in this case the employer is not obliged to pay compensation.

Pros for the employer: there are no additional incentives for the employee, such as additional vacation or salary increases. An employer can fire an employee, although this requires valid reasons, for example, absenteeism, systematic failure by the employee to fulfill his duties, or showing up at work under the influence of alcohol or drugs.

Cons : the employment contract is concluded for an indefinite period. And an employer cannot fire an employee without good reason.

Risks on the side of the performer

According to Art. 656 of the Civil Code of the Republic of Belarus, under a contract, one party (contractor) undertakes to perform certain work on the instructions of the other party (customer) and deliver its result to the customer within a specified time period , and the customer undertakes to accept the result of the work and pay for it . The work is performed at the contractor's risk , unless otherwise provided by law or by agreement of the parties.

Work under a contract can be combined with work for the employer. Therefore, such legal registration can be used for part-time work. At the same time, if you need to go to work according to a certain schedule, obey the rules of the employer, and regularly perform work in your specialty, then you must insist on concluding an employment contract.

General procedure for dismissal

Regardless of the grounds for dismissal, it is formalized by order.

After issuing an order signed by the manager, the employee must familiarize himself with this document against signature.

If the employee does not want to confirm familiarization with the order with a signature, personnel service employees draw up an act on the employee’s refusal to sign.

The order also makes a note that the subordinate refused to sign this document.

On the last working day, the manager is obliged to ensure that the dismissed employee is given a work book and the final payment is made to him.

At the request of the employee, he is also given all documents related to his work at this enterprise: a copy of the dismissal order, a certificate of work, copies of orders for transfers to other positions during the period of work, extracts from the work book.

In the work book, a record of dismissal is made exactly with the wording of an article of the Labor Code or other federal regulatory act.

If on the last day of work the employee was not at work or he refuses to receive the work book and all payments, the employer must send the employee by mail a notice that he needs to come to the company to receive the work book and settlement payments.

A former employee can ask the employer to send the work record book by mail. But if the dismissed employee did not give consent to send this document, management, on its own initiative, does not have the right to send the work book by mail.

Only after submitting the notification will the manager not be held responsible for the delay in issuing the work book.