Travel for police officers on leave

Similar topics If you find it difficult to formulate a question, call, a lawyer will help you: Free from mobile and landline Free multi-channel phone If you find it difficult to formulate a question, call a free multi-channel phone, a lawyer will help you 1. Is travel paid for a police officer to a sanatorium and resort treatment if used? discounted travel on main vacation. 1.1. Hello, Sergey! Travel is paid to the place of further treatment (rehabilitation) in a sanatorium-resort organization of the federal executive body in the field of internal affairs only if referred for further treatment (rehabilitation) by a medical commission (military medical commission) of a medical organization of the federal executive body in the field of internal affairs (h .

This is important to know: Leave for personal and family reasons for employees of the Ministry of Internal Affairs is granted under Federal Law 342

5 tbsp. 3 Federal Law of the Russian Federation dated July 19, 2011 No. 247-FZ).

2. I am a police officer who wrote a report on leave with subsequent dismissal.

Question 1: Are travel expenses to a holiday destination more than twice a year subject to payment? Answer: Based on Art. 57 Federal Law of November 30, 2011 No. 342-FZ

“On service in the internal affairs bodies of the Russian Federation and amendments to certain legislative acts of the Russian Federation”

(hereinafter referred to as Federal Law No. 342-F3) an employee of internal affairs bodies who has not exercised his right to basic leave within the period specified in the schedule, leave must be granted at a time convenient for him before the end of the current year or during the next year.

Taking into account the above, payment for vacation travel for the past year will be legal during the current year if this social guarantee was not used by the employee.

When providing basic leave for the current year, he will also be paid for travel expenses.

Question 2: Are the travel expenses for vacation payable to a family member of an internal affairs officer traveling to the vacation location separately from the employee? Answer: In accordance with Part.

List of benefits

List and rules for providing benefits to employees of the Ministry of Internal Affairs

are given in Chapter 8, Article 46 of the Law under discussion.

So, according to this regulatory act, a citizen of the Russian Federation serving in the Russian police deserves the following benefits:

- Travel without payment on air, water, and railway transport exclusively during service within the boundaries of the jurisdictional territory upon presentation of a certificate of an employee of the internal affairs bodies;

- Upon presentation of a certificate, movement on any public transport (urban, suburban or local) and transportation without payment of a detained person. Outside the city limits, delivery of a detainee can be carried out by passing transport;

- Benefits are provided for employees of the Ministry of Internal Affairs in terms of receiving out-of-turn places in children's camps, kindergartens and schools at their place of residence;

- In 2020, benefits for police officers were retained for obtaining a travel pass, which applies to any category of transport within the city and beyond, excluding private taxis;

- An employee of the Ministry of Internal Affairs is provided with benefits for accommodation in hotels and the issuance of a travel pass out of turn during business trips, confirmed by a travel document and a certificate of an employee of the Ministry of Internal Affairs.

Article 45 of the same Chapter says that a police officer has the opportunity to:

- receive free medical care;

- manufacture and install dentures;

- Receive free medicines and medical products with a prescription or doctor’s prescription.

An honorary employee of the Ministry of Internal Affairs of Russia is not provided with additional categories of benefits, but a monthly salary increase of 10% is determined. Download

Medical benefits for family members

Some privileges also extended to the relatives of the policeman.

For example, according to Article 45 of the Law under discussion, the following have the right to take advantage of medical care in subordinate medical institutions and sanatoriums:

- Children under the age of majority;

- Second spouse;

- Disabled children, including those who have reached the age of majority, if the disability was acquired before the age of 18;

- Dependents and those living with a police officer;

- Children under 23 years of age who are studying full-time at technical schools and institutes.

Do you need information on this issue? and our lawyers will contact you shortly.

Entitlement to vacation and related benefits

In October 2020, some adjustments to the Labor Code of the Russian Federation came into force.

Before these changes were made to the Law, law enforcement officers had the right to demand that the state compensate for travel expenses to the place of vacation and home at the end of it.

Today this option is only partially available.

. Only police officers living in the Siberian, Ural and Far Eastern Federal Districts, in the Far North, deserve to receive such a privilege.

The full cost of travel for an employee of the Ministry and unemployed members of his family on all types of transport (excluding private taxis) is compensated only in case of a vacation in Russia.

The state also reimburses the cost of baggage transportation.

, whose weight is up to 30 kilograms.

If a Ministry employee plans to travel instead of taking a vacation in his own car, then compensation is paid based on travel along the shortest route. An application for compensation must be submitted no later than three days before departure.

During their service, a law enforcement officer is paid compensation for the use of a personal car, but only for the purpose of performing official duties or while going on vacation.

Privileges to pay for kindergarten... lost

In January 2012, the fifth paragraph of Article 46 of Chapter 8 of the Law of the Russian Federation “On Police” became invalid.

According to this clause, benefits were paid for the maintenance of children who attended preschool educational institutions of state and municipal ownership.

Now Ministry employees pay for services provided by kindergartens on a general basis

(Clause 5 of Article 65 of the Federal Law “On Education”).

Thus, for the training and upbringing of children in a preschool educational institution, a Russian police officer deserves compensation in the amount of

:

- 20% - for the first child;

- 50% - second child;

- 70% - the third and the rest.

Payment of travel for police officers and members of their families: new rules

Important September 13, 2012

Information about the adoption of this document was published in the July issue of the magazine in the “News” section. Today we will look at its provisions in detail. General provisions Scope of application of the document.

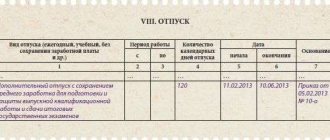

Order No. 514 regulates the following issues: 1) payment to police officers and their family members for the cost of travel to the place of treatment or medical examination and back to the place of follow-up treatment

Order of the Ministry of Internal Affairs of the Russian Federation of May 16, 2012

N 514 “On approval of the Procedure for paying travel to employees of the internal affairs bodies of the Russian Federation and members of their families, as well as paying monetary compensation for expenses associated with paying for travel to family members and parents of a deceased (deceased) employee of the internal affairs bodies of the Russian Federation” (as amended and additions)

Order of the Ministry of Internal Affairs of the Russian Federation of May 16, 2012

“On social guarantees for employees of internal affairs bodies of the Russian Federation and amendments to certain legislative acts of the Russian Federation”

— I order: 1. To approve the attached payment for travel to employees of the internal affairs bodies of the Russian Federation and members of their families, as well as payment of monetary compensation for expenses associated with the payment of travel to family members and parents of the deceased (deceased) employee of the internal affairs bodies of the Russian Federation. 2. Establish that the procedure for reimbursement of expenses associated with the transportation of employees of internal affairs bodies, military personnel of internal troops, citizens of the Russian Federation dismissed from service (military service), and members of their families, as well as their personal property, approved by the Ministry of Internal Affairs of Russia dated 22 August 2003

Who is compensated?

Employees who can benefit from compensation for travel expenses to a place of rest are:

- those who work in government agencies in the Far North or areas close to it;

- those who study in institutions with state accreditation;

- people of retirement age who have worked in the North (every three years);

- employees of the Ministry of Internal Affairs, police, National Guard (annual payment).

Important! The process of making payments, processing and documentation is prescribed by law. There are two important documents to refer to:

- Article 325 of the Labor Code of the Russian Federation;

- Order of the Ministry of Internal Affairs No. 154.

These documents present the procedure for providing benefits both for the employees themselves and for their family members.

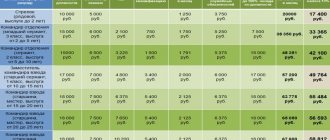

The table below provides information by position.

| Job title | Kind of transport | ||||

| air | railway | nautical | river | Automotive | |

| Senior staff | Airplane business class or 1st class | In a double compartment of a soft train carriage of any category | In a first category cabin | In the "Lux" cabin | On a bus with soft reclining seats |

| Senior command staff | Economy class only | In a four-seater compartment of a train carriage of any category | In a second category cabin | In a first category cabin | On a bus with soft reclining seats |

| Private, junior, mid-level | Economy class | In a four-seater compartment of a train carriage of any category | In a third category cabin | In a second category cabin | On a bus with soft reclining seats |

Payment for vacation travel for employees of the Ministry of Internal Affairs

N 667 “On the procedure for reimbursement of expenses associated with transportation, as well as registration, use, storage and handling of military transportation documents in the system of the Ministry of Internal Affairs of Russia”**, is not applied by the internal affairs bodies of the Russian Federation.

3. Control over the implementation of this order is assigned to the Deputy Ministers, who are responsible for the relevant areas of activity.

And about. Minister of the Army General

* Collection of Legislation of the Russian Federation, 2011, No. 30, Art. 4595; N 46, art. 6407; N 49, art. 7020.

** Registered with the Ministry of Justice of Russia on September 12, 2003, registration No. 5071, taking into account changes made by orders of the Ministry of Internal Affairs of Russia dated February 16, 2006.

What benefits are granted to pensioners of the Ministry of Internal Affairs based on length of service?

Just as during service, and when leaving the ranks of the Ministry of Internal Affairs, the employee retains the right to medical care in departmental medical institutions. They also have the right to purchase vouchers to health centers on preferential terms, paying only 0.25% of the total cost.

Employees who do not meet these parameters cannot qualify for a military pension; they are awarded a civil pension payment. For individual representatives, for special services to their homeland or injuries received in the performance of their duties, the state guarantees the honorary title “Veteran of Labor.”

11 Mar 2020 lawurist7 429

Share this post

- Related Posts

- Hectare in the Far East Site Map Cadastral Map

- How to Withdraw Money for a Third Party

- Travel benefits for pensioners and veterans in Nizhny Novgorod

- Young Family Solvency Confirmation Program

Payment for vacation travel for the child of an employee of the Ministry of Internal Affairs

Russian Federation family members and parents of the deceased (deceased employee) is carried out in accordance with the categories of travel established by subclause 12.2 of clause 12 of this Procedure.

23. Compensation for travel expenses for family members, as well as parents of a deceased (deceased) employee, is made on the basis of passports of family members or parents of the deceased (deceased) employee, death certificate, voucher for a sanatorium-resort institution, and attachment of the documents specified in paragraph 4 of this Procedure.

24. The financial support unit at the last place of service of the deceased (deceased) employee provides compensation for travel expenses for family members, as well as the parents of the deceased (deceased) employee to the burial place of the deceased (deceased) employee and back, including outside the territory of the Russian Federation ( once a year).

Most common mistakes

Mistake #1: If both spouses are employees.

If both spouses are employees, travel expenses are paid to each spouse at the place of duty. In this case, expenses are not paid to spouses as family members of the employee. Payment for travel expenses of their family members is made at the place of service of one of the spouses on the basis of a certificate issued at the place of service of the other spouse, which indicates that no money was issued at the place of service for travel of family members.

Error No. 2. If payment is made by bank transfer (for example, on the website), then you only need to pay with a card of a police officer, the Ministry of Internal Affairs or the National Guard. It is often mistakenly paid using the card of a relative, for example, a wife. No compensation will be provided in such a case.

Thus, compensation for travel to a place of rest for police officers, the Ministry of Internal Affairs and the National Guard is established by law. An advance is usually paid and used to calculate the shortest route to a specified destination. Upon the employee's return, the collected supporting documents can be used to clarify costs. If such documents are not submitted, you will not be able to receive full compensation and the cost of using your personal car.

After the end of the vacation and reappearance at the workplace, the employee provides all the necessary documents, after processing of which the final calculation of the amount spent will be made.

Compensation for travel on vacation to employees of the Ministry of Internal Affairs

Question 1: Are travel expenses to a holiday destination more than twice a year subject to payment?

Answer: Based on Art. 57 of the Federal Law of November 30, 2011 No. 342-FZ “On service in the internal affairs bodies of the Russian Federation and amendments to certain legislative acts of the Russian Federation” (hereinafter referred to as Federal Law No. 342-F3) to an employee of the internal affairs bodies who has not exercised his right to the main leave is within the period specified in the schedule; leave must be granted at a time convenient for him before the end of the current year or during the next year.

This is important to know: Transferring the cash register while the cashier is on vacation

Taking into account the above, payment for vacation travel for the past year will be legal during the current year if this social guarantee was not used by the employee.

Situations in which compensation is not provided

Compensation may not always be provided. There are exceptions to these situations:

- if an employee indicates several vacation places. One specific route should be indicated: for example, Vladivostok-Sochi. If several routes are specified, only one of them will be paid for;

- Holidays at foreign resorts are not paid. This is due to the need to support local tourism in the country. Since employee benefits are provided from the state budget, only vacations within the country are paid;

- if family members are working citizens, then compensation will not be made.

Important! Payment of compensation is carried out only for cases when the vacation is planned on the territory of the Russian Federation.

Payment for vacation travel will not be made in the following cases:

- the applicant himself does not belong to the preferential category of citizens to whom the subsidy is intended by law. That is, his work activity does not relate to the conditions of the Far North (or equivalent territories), or he does not serve in the police, the Ministry of Internal Affairs or the National Guard;

- the employee works less than the time established by law for granting leave (six months);

- supporting documents were not provided to the accounting department. If they were lost, then for restoration you need to contact the company or carrier to obtain certified copies;

- if compensation occurs as part of parental leave, it is not paid;

- The benefit applies to family members and dependent persons.

Payment for travel to the place of vacation for employees of the Ministry of Internal Affairs

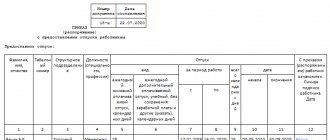

In order to receive compensation for travel to a vacation spot, you must follow a certain algorithm:

- The first step is to submit a report and attach supporting documents to it;

- The report is approved by the HR department and the head of the department;

- The employee is paid the preliminary cost of travel;

- Upon returning from vacation, the employee submits a document confirming expenses;

- After this, the accounting department recalculates the cost, after which, if necessary, the employee is paid up to the full cost, or the unspent advance is returned to them.

Procedure for submitting a report

Important! The report must be submitted before departure on vacation, 3 days before it starts.

At the same time, it must contain information such as the employee’s full name, type of vacation, its duration and destination, departure date, type of travel. In addition, documents about other family members going on vacation are attached to the report. These must be copies of marriage and birth certificates of children. But such documents, as a rule, are already stored in the personnel department, so a certificate of family composition may be attached to the report. The HR department is the first to mark the report. She confirms that the employee is going on vacation in accordance with the schedule they have drawn up. After this, the report is approved by the employee’s immediate supervisor. Accounting makes calculations of the estimated amount of travel, based on the type of transport and place of rest (

Payment for travel and vacation abroad for employees of the Ministry of Internal Affairs

Payment (compensation) for travel costs is carried out based on actual expenses, but not higher than the cost of travel for the travel categories established by this Procedure.

10. Payment (compensation) for the cost of travel by personal transport is made upon documentary confirmation of the fact of stay at the place of vacation, treatment, medical examination, follow-up treatment (rehabilitation) in a sanatorium-resort organization of the federal executive body in the field of internal affairs, medical and psychological rehabilitation, burial in the amount of actual expenses incurred to pay for the cost of consumed fuel, but not higher than the cost of travel, calculated on the basis of fuel consumption standards established for the corresponding vehicle and based on the shortest route.

(Clause 10 as amended by Order of the Ministry of Internal Affairs of Russia dated December 16, 2015 N 1183)

Preferential vacation

According to Article 325 of the Labor Code of the Russian Federation, compensation for the cost of travel and luggage transportation to and from the place of use of vacation: Organizations financed from the federal budget also pay the cost of travel and luggage transportation to the place of use of the employee’s vacation and back to non-working members of his family (husband, wife , minor children actually living with the employee) regardless of the time of vacation use.

2. Payment for travel to and from vacation is made depending on the actual use of one or another type of transport: air, railway - in a compartment car of a fast train; water - in cabins paid according to groups V - VIII of tariff rates on ships of the sea fleet and in cabins of category III on ships of the river fleet; public vehicles (except taxis). If the employee used personal transport for travel, payment is made at the lowest cost of travel by the shortest route and in the presence of documents confirming the vacation in another area. In addition to travel, the employer pays the cost of luggage weighing up to 30 kg.

Payment for vacation travel for employees of the Ministry of Internal Affairs in 2020

In this regard, there are sufficient legal grounds for paying the employee expenses associated with travel from the place of additional leave granted simultaneously with the main leave within the dates specified in the order, or on weekends (holidays) immediately following the end date of the additional leave , to the place of vacation, in case of his departure earlier than the date specified in the vacation certificate, if the employee’s departure day is a general weekend (holiday), or on the last working day before the vacation at the end of the working time division established by the internal rules of the office.

Question 7: Is a pensioner of the Ministry of Internal Affairs of Russia entitled to compensation for expenses associated with travel for inpatient treatment to a medical institution of the Ministry of Internal Affairs of Russia?

Answer: In accordance with Art.

of the Russian Federation, included in the Ural, Siberian or Far Eastern Federal District, or outside the territory of the Russian Federation, as well as one of his family members, the cost of travel to the place of the main (vacation) vacation on the territory (within) the Russian Federation and back is paid once per year, unless otherwise provided by federal laws or regulatory legal acts of the President of the Russian Federation or the Government of the Russian Federation.

However, the social guarantee for payment of the cost of travel to the place of the main (vacation) vacation does not apply to an employee on parental leave for up to 1.5 years or up to 3 years, since these types of leaves cannot be provided to him.

- when traveling by public transport (except taxis) to a railway station, pier, airport and bus station - a ticket containing the details established by the rules for the carriage of passengers;

- when traveling by personal transport - KKM receipts from gas stations, other documents established by the legislation of the Russian Federation.

To pay expenses associated with the travel of a family member, an employee’s report with the attachment of the above documents, copies of documents confirming the degree of relationship, or a certificate from the personnel department (department) on the composition of the family, as well as a certificate, is submitted to the head of the body, organization, or unit of the Ministry of Internal Affairs system. an organization financed from the federal budget about the lack of payment of travel expenses for a family member of an employee, if such a right is established by legislative or other regulatory legal acts of the Russian Federation ( clause

Documents confirming travel expenses

Depending on what type of transport the employee chooses to go to the place of rest and back, the list of documents confirming expenses will also depend (Order No. 514). For example:

- When going on vacation in a personal car, the employee will need to provide receipts for fuel, a certificate from the destination, as well as a copy of the registration certificate and license;

- Train travel is confirmed by tickets;

- Traveling by plane - boarding passes, tickets and payment documents confirming payment.

Payment for vacation travel for an employee of the Ministry of Internal Affairs

Law No. 247-FZ [1]

Family members of an employee are:

1) a spouse who is (were) in a registered marriage with an employee;

2) minor children, children over 18 years of age who became disabled before they reached the age of 18, children under the age of 23 studying full-time in educational institutions;

3) persons who are (were) on the full pay of an employee (a citizen of the Russian Federation, dismissed from service in the internal affairs department) or who receive (have received) assistance from him, which is (was) for them a permanent and main source of livelihood, as well as other persons recognized as dependents in the manner established by the legislation of the Russian Federation.

Expenses to be paid (compensation).

Clause 2 of Order No. 514

establishes that the persons indicated above (clause.

Relocation compensation

In case of change of place of service, an employee of the Ministry has the right to the following payments:

- Compensation for the cost of transporting 20 tons of things;

- Payment of “lift” (a police officer’s salary plus another quarter of this amount per moving family member);

- Compensation for travel expenses for all family members;

- Payment of daily allowances for the period of time spent traveling to the destination.

Dear readers!

We describe typical ways to resolve legal issues, but each case is unique and requires individual legal assistance.

To quickly resolve your problem, we recommend contacting qualified lawyers on our website.

Legal Aid Center We provide free legal assistance to the population

How many days of rest will also depend on your length of service. In addition, officials of the internal affairs bodies are on duty in investigative and operational groups, patrol the streets at night, and so on. Each such duty is compensated by days of rest. And if the employee is a donor, then he also receives additional days.

We recommend reading: Monthly Benefit for Chernobyl Survivors and Family Members

Additional time is also provided for length of service. To find out how many days of rest will be, you should know exactly your preferential length of service. After all, some services count one year of work as one and a half years of service. When the period of service exceeds 10 years, the employee will receive an additional 5 days. After 15, his rest will increase by another 5 days and so on.