What is state duty

In Art. 333.16 of the second part of the Tax Code of the Russian Federation, the legislator answered the question of what a state duty, or state duty, is - this is a fee levied on citizens or legal entities when applying to government agencies to perform legally significant actions. Such actions are listed by law; each of them has its own fee from the applicant in favor of the state.

The state duty is established and regulated by Chapter 25.3 of the Tax Code of the Russian Federation. It refers to federal taxes, that is, regional authorities do not have the right at their level to establish any rules regarding state duties. But most of the funds are transferred to local budgets.

How received funds are distributed between budgets is specified in the norms of the Budget Code of the Russian Federation. According to the general principle set out in Art. 50 of the Budget Code of the Russian Federation, state duty is credited to the federal budget, for which there is no established rule for crediting to the regional budget. In practice, based on 61.1 - 61.6, this means that the majority of funds go to the local budget of the constituent entity of the Russian Federation. The federal budget includes amounts paid for the consideration of a case in arbitration, the Supreme or Constitutional Court, for the registration of legal entities or the registration of changes made to the constituent documents of legal entities. In accordance with the law, when a state tax is collected from the local budget by a court decision, this is legal, although the tax is federal.

Reduction of state duty and deferment

When paying the state fee you can:

- reduce the payment amount;

- receive installment (deferred) payment.

Situation: can the court completely exempt the plaintiff from paying state fees?

Yes, it can, if a reduction in the amount of the state duty or a deferment (installment plan) does not give the plaintiff the opportunity to go to court due to a difficult financial situation. This conclusion is contained in the ruling of the Constitutional Court of the Russian Federation dated June 13, 2006 No. 272-O.

Decisions of the Constitutional Court of the Russian Federation act directly and do not require confirmation or departmental instructions (Article 79 of the Law of July 21, 1994 No. 1-FKZ). One of the types of decisions of the Constitutional Court is a determination (Article 71 of the Law of July 21, 1994 No. 1-FKZ). Therefore, courts are obliged to comply with the ruling of the Constitutional Court of the Russian Federation of June 13, 2006 No. 272-O without any additional clarification.

The decision to reduce the amount of the state duty can be made by the court based on the property (financial) situation of the payer (clause 2 of Article 333.20, clause 2 of Article 333.22 of the Tax Code of the Russian Federation).

The decision to grant a deferment (installment plan) is made by the department performing the legal action for which the state fee is paid (subparagraph 4, paragraph 1, article 63 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated November 11, 2009 No. 03-05-04-03/29 ).

The procedure for granting a deferment (installment plan) is established by Articles 64 and 333.41 of the Tax Code of the Russian Federation. In addition, it is clarified in the resolutions of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 11, 2014 No. 46 and March 20, 1997 No. 6. Despite the fact that the earlier resolution was adopted before the entry into force of Chapter 25.3 of the Tax Code of the Russian Federation, it does not contradict the current legislation regarding the provision of a deferment (installment plan) for the payment of state duties.

Payers

The payer of the state duty can be any person - both legal and natural. We become duty payers when:

- we apply for the performance of legally significant actions to the authorities authorized to perform them (including a notary or the court);

- We act as defendants in courts (at any level), where the decision is not made in our favor, and the plaintiff in the case is exempt from paying state fees.

The simplest example: paying a fee when filing an application for marriage or divorce at the registry office, when receiving a copy of a birth certificate, etc.

What is the state duty paid for?

The state duty is paid for the performance by state bodies of legally significant actions in relation to the citizen or organization that applied for their commission.

Legally significant actions for which a fee must be paid are listed in the Tax Code.

In Art. 333.17 – 333.33 of the Tax Code of the Russian Federation indicates what the state duty is paid for:

- when applying to courts - both arbitration and general jurisdiction, to magistrates;

- when applying to the Constitutional Court of the Russian Federation and constitutional (statutory) courts of the constituent entities of the Russian Federation;

- when contacting a notary to perform notarial acts (for example, drawing up a power of attorney);

- for state registration of acts of civil status (registration of marriages, births, deaths, divorces, etc.);

- upon receipt of passports of Russian citizens and foreign passports;

- when acquiring Russian citizenship;

- for state registration of computer programs, databases;

- for state registration of medicinal products;

- for state registration of legal entities, political parties, media, issues of securities, property rights, vehicles;

- for the right to use the names “Russia”, “Russian Federation” and words and phrases formed on their basis in the names of companies;

- for the right to export cultural property;

- for issuing permits for the export from the territory of Russia, for the import into its territory of species of animals and plants falling under the Convention on International Trade in Endangered Species of Wild Fauna and Flora;

- other legally significant actions.

The specifics of paying state duty depending on the type of legally significant actions performed, the category of payers or other circumstances are established by Articles 333.20, 333.22, 333.25, 333.27, 333.29, 333.32 and 333.34 of the Tax Code of the Russian Federation.

Where to transfer the state duty

The state duty must be transferred to the budget at the location of the body (person) that performs certain actions (clause 3 of Article 333.18 of the Tax Code of the Russian Federation). For example, if a person has purchased real estate, the state fee for registering rights to real estate must be paid at the place of registration of the acquired object (Clause 4, Article 2 of Law No. 122-FZ of July 21, 1997).

Details for which the state duty must be transferred to the budget are posted on stands in the territorial divisions of Rosreestr, tax inspectorates, migration service departments, traffic police departments, etc. (see, for example, letter from the Federal Tax Service of Russia for Moscow dated May 26, 2005 No. 12-07/38288).

You need to transfer the state fee on your own behalf. This follows from the provisions of paragraph 1, paragraph 8 of Article 45, as well as Article 333.17 of the Tax Code of the Russian Federation.

Situation: is it possible to pay the state fee through a representative (for example, a lawyer or law firm)?

Yes, it is possible, but if the payment documents indicate the last name, first name, patronymic and signature of only the person represented by the lawyer.

You need to transfer the state fee on your own behalf. This follows from the provisions of paragraph 1, paragraph 8 of Article 45, as well as Article 333.17 of the Tax Code of the Russian Federation. A similar point of view was expressed in paragraph 1 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 11, 2014 No. 46.

At the same time, Chapter 4 of the Tax Code of the Russian Federation allows the taxpayer (payer of fees) to participate in tax legal relations through a legal or authorized representative (clause 1, 4 of Article 26 of the Tax Code of the Russian Federation). From this we can conclude that a representative of the payer can also transfer state duty to the budget. In this case, proof that the taxpayer has paid the state duty will be the papers attached to the payment documents confirming the status of the representative (for example, a power of attorney).

In its ruling dated January 22, 2004 No. 41-O, the Constitutional Court of the Russian Federation indicated that representation in tax legal relations means that the representative acts on behalf and at the expense of the represented person’s own funds. Therefore, payment documents for tax payment must come from the taxpayer (payer of the fee) and be signed by him. Tax (fee) amounts must be transferred at the expense of the taxpayer (fee payer). At the same time, it is important that from the submitted payment documents it can be clearly established that the tax (fee) was paid by this particular taxpayer (payer) and precisely at the expense of his own funds.

Thus, a person’s representative (for example, a lawyer) can transfer the state duty to the budget. However, the payment documents must contain the last name, first name, patronymic and signature of the person he represents (the principal). Moreover, it is impossible for the payer to include both the lawyer and the principal on the receipt at the same time. Since it should be clear from the payment documents that the state duty was paid by this person and precisely at the expense of his own funds.

A similar point of view is reflected in letters of the Ministry of Finance of Russia dated September 24, 2013 No. 03-02-08/39610, dated July 20, 2010 No. 03-05-04-03/79.

Advice: there are facts indicating that when applying to the arbitration court, a representative can transfer the state duty from his own funds (for example, from his bank account).

In practice, the state duty is paid most often through branches of Sberbank of Russia, whose tellers do not care who deposits the money: the person indicated on the receipt or someone else.

At the same time, the Presidium of the Supreme Arbitration Court of the Russian Federation, in information letter No. 118 dated May 29, 2007, concluded that when applying to the arbitration court, a representative can transfer the state duty at his own expense (for example, from his bank account). The main thing is that the payment documents indicate that in this case he is acting on behalf of the person he represents (for example, they may indicate the details of the power of attorney). A similar point of view is reflected in the letter of the Federal Financial Markets Service of Russia dated April 10, 2008 No. 08-VM-03/6834. Some arbitration courts adhere to the same position (see, for example, the resolution of the Federal Antimonopoly Service of the Ural District dated July 24, 2008 No. F09-5175/08-S4).

Payment procedure and terms. Refund of state duty

The state fee is charged for a subsequent legally significant action and is therefore paid in most cases before it is completed. The Tax Code specifies the following deadlines for payment of duties:

- when applying to the courts - before filing a request, petition, application, statement of claim, complaint;

- when applying for notarial acts - before performing notarial acts;

- when applying for the issuance of documents (duplicates) - before the issuance of these documents (duplicates);

- when applying for an apostille - before the apostille is affixed;

- when applying for state registration of rights, restrictions, agreements, etc. - before submitting the relevant applications, and if they were submitted electronically - before accepting them for consideration;

- when performing other legally significant actions - before submitting applications and (or) documents to perform such actions or before submitting the relevant documents.

Defendants who lose a court dispute contribute funds to the budget after the court decision enters into legal force on a voluntary basis (Article 318 of the Tax Code of the Russian Federation establishes a period of 10 days from the moment the decision enters into force), otherwise the amount must be forcibly collected by bailiffs with the payment of an enforcement fee.

The specifics of paying state duty for taking actions to develop state policy and legal regulation in the field of production, processing and circulation of precious metals and precious stones are established in Article 333.32 of the Tax Code of the Russian Federation.

The Tax Code of the Russian Federation does not indicate how the state duty is paid, the basic principles of payment:

- is carried out in the manner established by the authorized body in instructions, administrative regulations;

- carried out in banks through an operator or terminal, an ATM, if there is such a possibility and the government agency will accept the check as a payment document, or online (through the website or application of banks, for example, Sberbank Online), if this is allowed;

- the details are indicated by the government agency, they can be found on the official websites of the courts, the tax office, and can be checked in the branches;

- in some cases, confirmation of payment is not required when applying; the government agency checks the deposit of funds independently (for example, when submitting applications to the registry office); when filing a statement of claim in court, an application to the Federal Tax Service for registration of a legal entity, you will need to attach the original payment document (receipt, check);

- the applicant or another person has the right to contribute funds; the other person does not have the right to demand the return of the deposited funds.

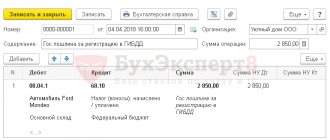

The state duty is paid in cash or non-cash form at the place where the legally significant action was performed. Document confirming payment:

- receipt - if the fee was paid in cash; issued either by a bank, or by an official or cash desk of the government agency to which the payment was made;

- payment order with a bank mark - if the fee was paid in cashless form.

Foreign organizations, foreign citizens and stateless persons pay state fees in accordance with the general procedure.

Deferment or installment payment of the state duty is granted for a period of up to one year at the request of the interested person. Interest is not charged in case of installments.

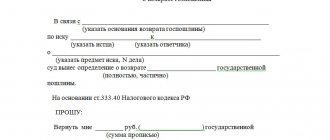

Paid state duty may be returned in the following cases:

- If it is overpaid (the amount of payment is greater than the established fee).

- If the court returned the application or complaint, refusing to consider it.

- If the notary refuses to perform notarial acts.

- If a person refuses to perform an action for which a state fee has been paid, before contacting a government agency.

- If a citizen is denied a passport (in cases specified by law).

- In some other cases.

IMPORTANT!

The fee paid for state registration of rights to real estate, transactions with it, registration of a legal entity in case of refusal of state registration cannot be returned.

To return the amount of the state duty, you must, within 3 years from the date of payment, submit an application to the state body performing the actions for which this duty was paid. The application is accompanied by a receipt confirming payment, a decision to return the complaint, claim, leave them without consideration, etc. The overpaid amount must be returned within 1 month.

IMPORTANT!

The state fee is not paid if changes to the document are caused by an error made through the fault of the body or official who issued the document.

Courts of general jurisdiction, justices of the peace, arbitration courts, the Constitutional Court of the Russian Federation and constitutional (statutory) courts of constituent entities of the Russian Federation are given the right to exempt the payer from paying state duty, based on his property status.

IMPORTANT!

An exception was made for residents of Crimea and the federal city of Sevastopol. When exchanging Ukrainian documents for Russian ones (driver's license, registration certificates for real estate, etc.), there is no need to pay a state fee (clauses 29-31 of Article 333.25 of the Tax Code of the Russian Federation). If you lose a new document or need to reissue it, you will have to pay a state fee.

In fact, no state, when forming its budget, can do without using fees and duties in its tax system. And although the amount of collected duties in the state budget, as a rule, does not occupy a significant place, nevertheless, they are given important independent financial significance.

Duties, unlike taxes, are intended only to cover the costs of a government agency, and not to generate income. Fees and fees do not have the financial significance of taxes. When paying a duty or fee, there is always a special purpose (for what exactly the duty is paid) and special interests (the payer, to one degree or another, directly feels the remuneration of the payment). Taxes can also have a special purpose (targeted taxes), but they are never individually (directly) reimbursable. In this sense, fees and charges are individual payments. But since the government is obligated to provide the bulk of its services regardless of the recipient's ability to pay, government costs cannot be covered by individual entitlement payments. “The principle of the rule of law rejects the commercialization of public administration and limits the costs associated with the provision of services by the state in response to effective demand.” The purpose of collecting a duty or fee (duty principle) is only to cover, without loss, but also without net income, the costs of the institution, in connection on whose activities a duty is levied. But this principle is not always observed in practice. Quite often, the service fee exceeds the costs associated with it. Moreover, in a number of cases, it is not the payment that is established in order to cover expenses, but the action itself is recognized as mandatory for the sake of collecting payment. This statement is true, for example, with regard to the introduction of various registrations, etc. This circumstance indicates that duties and fees, although levied in connection with the provision of individual services, cannot be considered as payments for obligations, contractual payments. These are monetary duties levied on an individual basis in connection with a service of a public legal nature. It should be especially emphasized that the duty or fee is paid not for the service, but in connection with the service, moreover, with the one provided by the state body, acting in the general interests, realizing its state power functions. Thus, the payment of a fee when filing a claim in court is associated with the right of a particular person to judicial protection, but is determined by the socially useful function of the court - maintaining the regime of legality. The fee does not ensure the existence of a government agency, since it can be financed from other sources. On the contrary, the collection of duties is conditioned by the implementation of its functions by any government body. The nature of duties and fees requires the use of different principles in determining the amount of payment than those used in taxation. Taking into account the solvency of a person in this case cannot be decisive, because it will lead not to the establishment of equality, but to its violation. Indeed, persons receiving the same service would pay different amounts of duty. Therefore, the amount of the duty or fee is determined based on the nature and size of the service (the principle of equivalence) and is usually established in a specific amount. The monetary amount may not be equivalent to the expense incurred in connection with the provision of the service. However, this does not mean absolute freedom in determining the amount of payment. The amount of the duty or fee, firstly, must be justified. When determining their amounts, one cannot proceed only from financial considerations - the size of the amounts must be compared with the purposes for which the payments are established. In cases where the payment is not reasonably comparable with the benefit received by the payer or with the expense incurred by the public body, the duty principle should be considered violated. The size of the duty or fee, secondly, should not limit the ability of citizens to use basic constitutional rights, the ability to receive certain services from government bodies, since these rights are provided to citizens regardless of making any payments. The types of duties are different. There are fees collected in connection with the provision of administrative services (for example, for consideration of an application for obtaining or terminating citizenship); fees charged for granting any right (for example, for issuing hunting permits); duties levied as compensation for certain expenses of society in the interests of specific individuals (for example, duties from owners of large-capacity vehicles that have an increased destructive effect on roads). There are also duties levied in certain areas of government activity: judicial, customs, notary, etc. In Russian legislation, there are three types of duties: state, registration, customs. State duty is charged for a number of services in favor of the payer - acceptance of statements of claim and other documents by the court, performance of notarial acts, registration of civil status acts, issuance of documents, etc., as well as for the granting of special rights (for example, the right to hunt. Registration fees are charged when when a person applies for a patent for an invention, industrial design, utility model, etc. Customs duties are levied when performing export-import transactions.The Tax Code of the Russian Federation names individuals and organizations as state duty payers (Clause 1, Article 333.17 of the Tax Code RF). The object of levying a state duty must be understood as a legally significant action, the commission of which gives rise to an obligation for the interested party to pay a duty. With the adoption of the Tax Code of the Russian Federation, the list of legally significant actions for which the payment of a state fee is provided for has been significantly expanded. This list includes such actions for which fees or other payments were previously levied, for example: for the right to use the names “Russia”, “Russian Federation” and words and phrases formed on their basis in the names of legal entities, a fee was previously levied; the license fee was charged for performing actions related to licensing; Assay fees were charged for marking products made of precious metals with the state assay mark and related actions; now all of the above actions must be paid with a state fee. The Tax Code of the Russian Federation presents the following groups of legally significant actions: - actions related to the consideration of cases in courts of general jurisdiction by magistrates; — actions related to the consideration of cases in arbitration courts; — actions related to the consideration of cases by the Constitutional Court of the Russian Federation, constitutional (statutory) courts of the constituent entities of the Russian Federation; — notarial actions; — actions related to state registration of acts of civil status and other legally significant actions performed by civil registry authorities and other authorized bodies; — actions related to the acquisition of Russian citizenship or renunciation of Russian citizenship, as well as entry into the Russian Federation or departure from the Russian Federation; — actions for the official registration of a program for electronic computers, a database and an integrated circuit topology; — actions related to the implementation of federal assay supervision; — state registration, as well as other legally significant actions. The deadlines for payment of the state duty are established in paragraph 1 of Art. 333.18 of the Tax Code of the Russian Federation. As a general rule, the state fee is paid either before performing actions (for example, before performing notarial actions) or before submitting applications and other documents to perform legally significant actions. Chapter 25.3 contains a number of exceptions to this rule. Thus, the state duty is paid within 10 days from the date of entry into legal force of the court decision: - by persons acting as defendants in the courts, if the court decision is not made in their favor and the plaintiff is exempt from paying the state duty (subclause 2, clause 1, art. 333.18 of the Tax Code of the Russian Federation) - if it is difficult to determine the price of a claim at the time of its presentation to a court of general jurisdiction, to a magistrate, the amount of the state duty is preliminarily established by the judge with the subsequent additional payment of the missing amount of the state duty based on the price of the claim, determined by the court when resolving the case (subclause 9 p. 1 Article 333.20 of the Tax Code of the Russian Federation) - upon additional payment of the state duty in the event of an increase by the plaintiff in the amount of the claim (subparagraph 10, paragraph 1 of Article 333.20 and subparagraph 3, paragraph 1 of Article 333.22 of the Tax Code of the Russian Federation) - upon additional payment of the state duty, in the event if the court goes beyond the limits of the claim (subparagraph 10, paragraph 1, article 333.20 and subparagraph 3, paragraph 1, article 333.22 of the Tax Code of the Russian Federation) The deadlines for paying the state duty established by the Tax Code of the Russian Federation may be changed by the body performing a legally significant action, at the request of an interested person for a deferment or installment payment of the state duty in the manner established by Art. 333.41 of the Tax Code of the Russian Federation. The state fee must be paid at the place where legally significant actions were performed. According to the Civil Code of the Russian Federation, payments on the territory of the Russian Federation are made by cash and non-cash payments (Article 140 of the Civil Code of the Russian Federation). This rule is enshrined in the general part of the Tax Code of the Russian Federation (Article 58 of the Tax Code of the Russian Federation) and is duplicated in the article regulating the procedure for paying state duties. Proof of payment of the state duty in cash is: - a receipt issued to the payer by the bank; - a receipt issued to the payer by an official or the cash desk of the body to which the payment was made. Only upon provision of the specified evidence confirming the payment of the state duty to the relevant budget, the authorized body (official) has the right to take a legally significant action in relation to the payer. Before the entry into force of Chapter 25.3 of the Tax Code of the Russian Federation, foreign organizations that do not have ruble accounts, branches, or representative offices in the Russian Federation, individuals who are not tax residents of the Russian Federation, were given the right to pay state duty through authorized representatives-residents of the Russian Federation who have currency and ruble accounts. The obligation to pay the state duty arises: - in the case of an application to perform legally significant actions provided for by the Tax Code of the Russian Federation; - if these persons act as defendants in courts of general jurisdiction, arbitration courts or in cases considered by magistrates, and if the court decision is not made in their favor and the plaintiff is exempt from paying state duty in accordance with the Tax Code of the Russian Federation. The paid state duty is subject to partial or full refund in the event of: 1) payment of a state duty in a larger amount than provided by law; 2) return of an application, complaint or other appeal or refusal to accept them by the courts or refusal to perform notarial acts by authorized bodies and officials. the previous decision was made and the original document on payment of the state duty is attached to the repeated claim; 3) termination of proceedings in the case or leaving the claim without consideration by a court of general jurisdiction or an arbitration court. When concluding a settlement agreement before a court decision is made by the arbitration court, 50 percent of the amount of the state duty paid by him must be returned to the plaintiff. This provision does not apply if the settlement agreement is concluded in the process of executing a judicial act of the arbitration court. The paid state fee is not subject to refund if the defendant voluntarily satisfies the plaintiff’s demands after the latter applies to the arbitration court and a ruling is made to accept the application for proceedings, as well as when the settlement agreement is approved by a court of general jurisdiction; 4) refusal of persons who have paid the state fee to perform a legally significant action before contacting the authorized body (official) performing (performing) this legally significant action; 5) refusal to issue a passport of a citizen of the Russian Federation for leaving the Russian Federation and entering the Russian Federation, certifying in cases provided for by law, the identity of a citizen of the Russian Federation outside the territory of the Russian Federation and on the territory of the Russian Federation, a refugee travel document. The state fee paid for the state registration of marriage, name change, corrections and changes in civil status records is not refundable if the state registration of the corresponding civil status act was not subsequently carried out or corrections and changes were not made in the civil status records civil status. Refund of the overpaid (collected) amount of state duty is made upon the application of the payer of the state duty submitted to the tax authority at the place of the action for which the state duty was paid (collected). The application can be submitted within three years from the date of payment of the overpaid (collected) amount of state duty. Attached to this application are: decisions, rulings and certificates of courts, organizations carrying out actions for which the state duty is paid (collected), about the circumstances that are the basis for a full or partial refund of the overpaid (collected) amount of the state duty, in appropriate cases - acts tax audits of organizations and officials, as well as payment orders or receipts with a genuine bank mark confirming payment of the state duty, if the state duty is refundable in full, and if it is partially refundable, copies of the specified payment documents . Refunds of the amount of overpaid (collected) state duty are made at the expense of the budget into which the overpayment occurred. Upon termination of the state registration of a right, restriction (encumbrance) of a right to real estate, a transaction with it, on the basis of relevant statements of the parties to the agreement, half of the paid state duty is returned. Refunds of paid state fees in cases where court decisions are made in whole or in part not in favor of state bodies, local governments or officials are made at the expense of the budget into which the payment was made. The payer of the state duty has the right to offset the overpaid (collected) amount of the state duty against the amount of the state duty payable for performing a similar action. This offset is made upon the payer’s application submitted to the body or official to whom he applied to perform a legally significant action. An application for offset of the amount of overpaid (collected) state duty may be filed within three years from the date of the relevant court decision on the return of the state duty from the budget or from the date of payment of this amount to the budget. The application for offset of the amount of overpaid (collected) state duty shall be accompanied by: decisions, rulings and certificates of courts, organizations carrying out actions for which the state duty is paid, about the circumstances that are the basis for a full refund of the state duty, as well as payment orders or receipts with an authentic bank mark confirming payment of the state duty. The functions of ensuring compliance with the provisions of tax legislation are assigned to the tax authorities. They check the correctness of calculation and payment of state duty in state notary offices, civil registry offices and other bodies and organizations that carry out actions in relation to payers, for the implementation of which state duty is charged in accordance with the current tax legislation.

State duty amounts

In the Tax Code, the amount of state duty is established for each type of legally significant action; it also depends on the category of payers. All sizes are established in articles 333.19, 333.21, 333.23, 333.24, 333.26, 333.28, 333.30, 333.31, 333.32, 333.32.1, 333.32.2, 333.33 of the Tax Code of the Russian Federation.

The specifics of paying state duty on various grounds are regulated by Articles 333.20, 333.22, 333.25, 333.27, 333.29, 333.34 of the Tax Code of the Russian Federation.

IMPORTANT!

From January 1, 2021, the amount of the state fee for conducting bankruptcy proceedings for an individual depends on the status of the applicant. For an individual, its amount will be 300 rubles, for a legal entity - 6,000 rubles. These changes are provided for in the new edition of paragraphs. 5 p. 1 art. 333.21 of the Tax Code of the Russian Federation, they were introduced by Federal Law No. 407-FZ of November 30, 2016. Previously, when filing an application to declare a debtor insolvent, both organizations and citizens had to pay a state fee of 6,000 rubles, but since 2017, citizens have paid an amount 20 times less than legal entities for the bankruptcy procedure.

Enrollment

According to the Budget Code of the Russian Federation, which budget the state duty goes to depends on its purpose.

100% of the state duty is credited to the budget of the constituent entities of the Russian Federation:

- in cases considered by constitutional (statutory) courts;

- for performing notarial acts;

- for state registration of interregional, regional and local public associations, their branches, for state registration of changes to their constituent documents;

- for state registration of regional branches of political parties;

- for state registration of a vehicle pledge agreement, including the issuance of a certificate and its duplicate;

- for the issuance of a qualification certificate granting the right to carry out cadastral activities;

- for issuing a certificate of state accreditation of the regional sports federation;

- for registration of mass media, the products of which are intended for distribution primarily in the territory of a constituent entity of the Russian Federation, for issuing a duplicate certificate of such registration;

- for actions of authorized bodies related to licensing the use of subsoil plots of local significance;

- for the actions of authorized bodies related to licensing the procurement, processing and sale of non-ferrous and ferrous scrap metals;

- for the provision of licenses for the retail sale of alcoholic beverages issued by executive authorities of the constituent entities of the Russian Federation;

- for actions of executive authorities of constituent entities of the Russian Federation related to licensing and accreditation of educational institutions;

- for granting a license for the production, storage and supply of alcohol-containing non-food products, in part made from confiscated raw materials;

- for issuing accreditation certificates in order to recognize the organization’s competence in the relevant field of science, technology and economic activity to participate in control activities;

- for the actions of executive authorities of the constituent entities of the Russian Federation in affixing an apostille on documents on education, academic degrees and titles;

- for the issuance by the executive authority of a constituent entity of the Russian Federation of a special permit for the movement on roads of vehicles transporting dangerous, heavy and (or) large-sized cargo.

100% of the state duty is credited to the settlement budget:

- for the performance of notarial acts by officials of local government bodies of the settlement authorized to perform notarial acts, for the issuance by the local government body of the settlement of a special permit for the movement of a vehicle transporting dangerous, heavy and (or) large-sized cargo on a highway.

100% of the state duty is credited to municipal budgets:

- in cases considered by courts of general jurisdiction, justices of the peace (with the exception of the Supreme Court of the Russian Federation);

- for state registration of vehicles, including temporary registration at their place of residence, for issuing various certificates to car owners, etc.;

- for issuing permission to install an advertising structure;

- for the issuance by a local government body of a municipal district of a special permit for the movement of a vehicle transporting dangerous, heavy and (or) large-sized cargo on a highway;

- for the performance of notarial acts by officials of local government bodies of a municipal district, authorized in accordance with the legislative acts of the Russian Federation to perform notarial acts in a populated area that is located on an intersettlement territory and in which there is no notary.

The budgets of city districts and municipal districts, federal cities of Moscow, St. Petersburg and Sevastopol are subject to crediting the state duty for the provision of licenses for the retail sale of alcoholic beverages issued by local governments at a rate of 100%.