In the judicial authorities, the state duty awarded by the court is immediately calculated and assigned; what it is and how to pay it can also be found out on site or on the official website. The same rules for paying state fees for magistrate lawsuits, city (district) courts, courts of a constituent entity of the Russian Federation, and the Supreme Court of the Russian Federation.

It is necessary to understand, in accordance with the law, how much the state fee is to pay to the courts of general jurisdiction or to the magistrate’s court when filing a claim; how the amount is determined depending on the direction of cases, in appealing decisions. Payment benefits are also indicated in the Civil Procedure Code.

What is the state duty to court?

State duty is a fee established by the state, which the payer is obliged to pay when filing a claim in court.

The state duty is determined as legal expenses; this is enshrined in Article 88 of the Code of Civil Procedure of the Russian Federation, Article 103 of the Code of Arbitration Procedures of the Russian Federation. The CAS and the Code of Civil Procedure establish procedures for determining the cost of a claim and cases of additional payment of fees. The provisions of procedural codes are established by the procedure for the distribution and collection of legal expenses, including the state duty paid when filing a claim.

The total cost of the state duty, the procedure for its payment, the conditions for providing preferential positions, possible deferment, installment plans and refund of the duty are established by the chapters of part 2 of chapter 25.3 of the Tax Code of Russia.

What is the state duty awarded by the court?

Reading time 5 minutes Ask a lawyer

faster.

It's free! Font size:

A+ | A−

The state duty awarded by the court is the collection of a mandatory fee paid by the plaintiff when filing a petition, but directed at the same time to the defendant. This is possible if the court makes a decision in favor of the initiator of the process.

In this case, the losing party receives a notification from the bailiffs demanding payment of the duty.

Such precedents occur when a citizen has debts to any government agencies or banking institutions.

State duty in a broad sense is a monetary fee that any citizen or legal entity is obliged to pay in the event of filing a claim with the bodies of arbitration, constitutional courts and courts of general jurisdiction. Also, such fees require payment when receiving some government services. For example, when registering property rights or conducting an official marriage ceremony.

Moreover, it will not be possible to evade paying the state duty, because without a receipt confirming the monetary transaction, the citizen’s application will simply not be accepted for consideration. An exception is made for certain categories of persons with beneficiary status.

Repayment of the fee is carried out at any banking institution through a cash desk or through Internet banking. Also, a number of organizations provide special terminals for the convenience of visitors.

Payment Features

When filing a claim that has claims of both a non-property and property nature, the state duty, which is established for claims of a property nature, and the state duty, which is established for claims of a non-property nature, are paid simultaneously. When filing a counterclaim, the cost of the state duty is calculated according to the general rules.

If the plaintiff increases the amount of the claim, the missing amount of state duty is paid in accordance with the increased amount of the cost of the claim. If the plaintiff reduces the requirements, the amount of the overpaid state duty may be returned upon his application.

After filing a claim for the division of property that is in common ownership, and during the filing of a claim for the separation of a share from the said property, for recognition of the right to a share in the property, the amounts in the general court of state fees are calculated in the following order:

- if disputes regarding the recognition of the plaintiff(s) ownership of property have not been previously resolved by the court - based on the amount of this property (the price of the statement of claim);

- if the court previously makes a decision recognizing the plaintiff(s) ownership of the designated property, the state duty awarded by the court is 200 rubles, this is also recorded in the Civil Procedure Code.

If the heirs file claims to claim the property they own with a share, the state duty is paid in the manner established when filing a claim of a property nature that is not subject to assessment, if disputes regarding the recognition of ownership of this property by the court have previously been resolved.

If claims for divorce and division of the jointly acquired property of a husband and wife are filed with the court, the state duty is paid in the amounts established for both claims for divorce and property claims.

The courts retain the right, based on the financial situation of the payer, to reduce the amount of state duty with a deferment of its payment, providing an installment plan in the manner prescribed by law.

Payment Features

Payment of the state fee involves some tricks that the plaintiff should familiarize himself with before sending the statement of claim. For example, if the content of the claim concerns issues of both property and non-property spheres, then the applicant will have to pay a double fee:

- firstly, the plaintiff will need to pay a state fee, which is intended for non-property claims;

- secondly, the plaintiff will need to spend on state fees focused on property claims.

The calculation of each of the state fees is made on the basis of generally accepted rules, which also applies to counterclaims that come from the defendant.

Property claims can be either with or without an appraisal

Change of claims

Sometimes during the trial, the plaintiff decides to add new items to the list of claims. This increase in the initial list also implies an increase in the state duty, which entails the need to pay additionally the uncovered part of the amount. The opposite rule is also true - if the plaintiff for some reason refuses some of the claims, he has every right to demand the return of part of the funds.

Reducing or increasing claims affects the cost of state duty

Common property

Another difficult issue is related to the division of property that is in common ownership. Filing a claim of appropriate content involves dividing property into shares in court. Such circumstances suggest their own logic for paying state duty:

- if disputes regarding the establishment of ownership rights to the plaintiff’s property have never previously involved judicial intervention, the amount of the state duty is calculated based on the size of the property that appears in the statement of claim;

- if the courts have already participated in making the appropriate decision recognizing the plaintiff as the owner of the property (more precisely, the share indicated in the claim), then the amount of the state duty becomes a fixed amount equal to 200 rubles.

The amount of the state duty when considering issues related to the division of property depends on whether this case has been considered previously

Divorce

Often, divorcing spouses file two lawsuits at once:

- claim for divorce;

- claim for division of jointly acquired property.

In such circumstances, spouses are also forced to pay double state duty - for claims aimed at divorce and for claims affecting property issues.

In the event of a divorce, spouses pay double the state fee, since the court considers two cases at once

Court fees in 2020

The amount of the state fee is determined depending on the application submitted to the court. If the claims are of a property nature, then the fee is calculated using the following formulas based on the value of the claim:

- when the cost of the claim is up to 20,000 rubles. The state duty is 4%, but not less than 400 rubles;

- when the cost of the claim is above 20,000 rubles, but up to 100,000 rubles. the amount of the state duty is determined in the amount of 800 rubles; on amounts exceeding 20,000, 3% is charged;

- with a claim value of 100,000 rubles. but not more than 200,000 rubles. state duty amount is 3200 rubles; from an amount greater than 100,000 rubles. 2% is taken;

- if the cost of the claim is from 200,000 rubles, but not more than 1,000,000 rubles. the duty amount will be 5200 rubles; from an amount above 200,000 rubles. 1% is charged;

- if the value of the claim is greater than 1,000,000 rubles, the amount of the state duty is determined in the amount of 13,200 rubles. and 0.5% of the cost that exceeds 1,000,000 rubles, with no more than 60,000 rubles.

Administrative claims come with a similar calculation of state duty. When filing a claim for divorce in court, a fee is paid in the amount of 600 rubles. In the process of filing claims that arise from alimony obligations, the state fee to the court will be 150 rubles.

When the court makes a decision to collect alimony both for the maintenance of children and for the maintenance of the plaintiff, the amount of the state duty is doubled.

- When the applicant submits an application for a court order to the magistrate, he pays a state fee in the amount of 50% of the cost that must be paid when filing a corresponding statement of claim.

- If the plaintiff goes to court with a claim of a non-property nature or the claim is not subject to assessment, when filing a complaint in the supervisory order, the state duty for citizens will be 300 rubles, and organizations will pay a state duty of 6,000 rubles.

- In the process of filing an appeal or cassation complaint, citizens pay a state fee in the amount of 150 rubles, organizations - 3,000 rubles.

- In the process of filing an administrative claim to challenge legal acts in court for citizens, the state fee is 300 rubles; legal entities pay 4,500 rubles; a similar amount of fees in challenging a non-normative act of the highest authority of the Russian Federation.

- Applying to the courts with an application under special proceedings has a state fee of 300 rubles.

How to find out the details for paying the state fee to the court

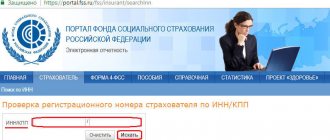

Details for paying state fees to the court play a major role when applying to the court and paying for government services. You can find the details of the state duty on the website of the authority where the application is submitted.

The conditions for paying state fees are the same for the magistrate’s court, city (district) courts, and courts of a constituent entity of the Russian Federation. Since January 1 last year, the amount of the state duty has increased, but the data on the amount of state duty to court for 2021 remains relevant.

Details of the amount of state fees to the court

To be indicated when paying state fees to any court:

- Banking system: Treasury Committee of the Ministry of Finance.

- Payment code: each court has its own.

- Payment can be made at the post office or any bank

KBK 108126 – code for the budget classification of the state fee, which is levied on statements of claim filed in court, applications for legal proceedings, complaints/statements for special proceedings, applications for court orders, applications for judicial acts and their re-issuance, cassation, appeals, petitions on the review of judicial acts in the order of supervision and other documentation.

KBK 204113 budget classification code - other fines, sanctions, penalties, penalties imposed by government agencies financed from the republican budget, with the exception of revenues from organizations in the oil sector.

BCC 108125 is credited to the republican budget. The fee is included in claims filed in court against government agencies and is calculated on official documents for affixing an apostille issued by the judicial authorities.

State duty KBK 108125 is credited to the republican budget.

- Claims are filed against government agencies. 2. Apostilles are affixed to official documents issued by the judicial authorities.

Calculations of state fees in magistrates' courts can also occur using the portals of the magistrates' court information space or the magistrates' court website.

The state fee for the magistrate's court is determined after entering the following data:

- name of the court that accepts the application;

- court precinct number;

- type of claim or statements;

- plaintiff status.

Payment nuances: mortgage, patent

When paying state fees, in some cases there are certain subtleties that must be taken into account when issuing a receipt. This concerns the formation of the cost of a certain action.

- In one case, this may be a fixed contribution, which is determined by law and does not change regardless of who the payer is.

- In the second case, we are talking about the prices of lawsuits. The amount of the fee depends directly on how much you need to pay to file the application.

Registration of a mortgage

Since 2014, there is no fee for registering a mortgage. Just as this does not happen when repaying a loan. Before this, an agreement of this category was required to be registered in the state register.

It was considered officially concluded from that moment, but because of this, many delays often arose that prevented quick and trouble-free repayment.

Patent fee

A patent is a document whose main purpose is to certify ownership of a specific invention. Receipt of this paper requires payment of a state fee.

The procedure for payment and refund in case of overpayment is established in the relevant resolution. It determines all the important nuances, knowledge of which guarantees timely payment.

Two categories of citizens are exempt from paying the fee when obtaining a patent:

- An individual is disabled or a hero of the Second World War or other battles that took place on the territory of the former USSR. This is also true for citizens who are the sole author of a particular invention.

- Collective request for a patent, provided that each author of the invention is a WWII veteran.

Benefits when paying state duty

Claimants do not pay state duty for the following claims:

- labor disputes;

- adoption of children;

- collection of benefits;

- collection of alimony;

- compensation for harm to health;

- compensation for harm from crimes;

- complaints against bailiffs;

- unlawful criminal prosecution;

- demand for the protection of children's rights;

- non-property demands in defense of the rights of people with disabilities;

- appointment of hospitalization in a psychiatric hospital.

The fee is not paid if the value of the statement of claim is less than one million rubles by the following categories of payers:

- public organizations of disabled people;

- disabled people of groups 1 and 2;

- consumer rights plaintiffs;

- by veterans in protecting personal rights under veterans laws;

- pensioners on claims against pension institutions.

Citizens do not pay state fees when filing appeals and cassation complaints regarding decisions on divorce. State fees to courts are not paid by state authorities and local governments.

The state duty awarded by the court is 200 rubles for which

333.36 Tax Code of the Russian Federation.

The state duty is determined as legal expenses; this is enshrined in Article 88 of the Code of Civil Procedure of the Russian Federation, Article 103 of the Code of Arbitration Procedures of the Russian Federation.

The CAS and the Code of Civil Procedure establish procedures for determining the cost of a claim and cases of additional payment of fees. The provisions of procedural codes are established by the procedure for the distribution and collection of legal expenses, including the state duty paid when filing a claim.

- when the cost of the claim is above 20,000 rubles, but up to 100,000 rubles. the amount of the state duty is determined in the amount of 800 rubles; on amounts exceeding 20,000, 3% is charged;

- if the value of the claim is greater than 1,000,000 rubles, the amount of the state duty is determined in the amount of 13,200 rubles.

- when the cost of the claim is up to 20,000 rubles. The state duty is 4%, but not less than 400 rubles;

- with a claim value of 100,000 rubles. but not more than 200,000 rubles. state duty amount is 3200 rubles; from an amount greater than 100,000 rubles. 2% is taken;

- if the cost of the claim is from 200,000 rubles, but not more than 1,000,000 rubles. the duty amount will be 5200 rubles; from an amount above 200,000 rubles. 1% is charged;