The previously planned split of the payment into contributions from payments within and above the limit in 2020 was not implemented. Pension contributions at the additional rate are paid divided into 2 payments in accordance with the category of employees. Deadlines for payment of insurance contributions to the Social Insurance Fund In the Social Insurance Fund, mandatory social contributions are paid, calculated at a rate of 2.9% on remunerations not exceeding the limit for 2020 set at 718,000 rubles. In this case, the calculated amount can be reduced by the amount of paid social benefits and hospital compensation. The payment deadlines are approved by the fifth paragraph of Article 15 of Law No. 212-FZ - until the 15th day inclusive of the next month. If this date falls on a weekend, the deadline will be postponed to the next working day. The payment is made in one amount; a sample payment form can be found on the FSS website.

Deadlines for payment of insurance premiums

Additional tariffs for insurance premiums in 2020 Category of payers PFR FFOMS FSS Total Payers specified in paragraphs. 1 clause 1 art. 419 of Law No. 400-FZ in relation to payments to individuals named in paragraph 1 of paragraph 1 of Art. 30 of this law 9% — — 9% Payers specified in paragraphs. 1 clause 1 art. 419 of Law No. 400-FZ in relation to payments to individuals named in paragraphs 2-18 of paragraph 1 of Art. 30 of this law 6% - - 6% Note: additional contributions are paid regardless of the limits of 1,021,000 and 815,000. However, companies that have assessed working conditions can pay additional.

contributions to pension insurance at special rates (clause 3 of Article 428 of the Tax Code of the Russian Federation). Procedure and deadlines for paying insurance premiums Insurance premiums to the Federal Tax Service and the Social Insurance Fund must be transferred monthly no later than the 15th day of the next month.

When are insurance premiums considered to be paid?

Insurance premiums are recognized as paid on the day when the credit institution received a payment order to transfer such payments to the current account of the Treasury of the Russian Federation. This “payment” can be presented either by the payer of insurance premiums or by another person, namely:

- entity;

- individual entrepreneur;

- an individual not engaged in business.

This point is provided for in paragraph 1 of Art. 45 of the Tax Code of the Russian Federation. An important point is that there must be enough funds in the current account of the company or other person to make the payment, and the payment order itself must be filled out in accordance with all the rules. Otherwise, the bank employees will not accept it.

The rules for filling out payment orders are specified in the Regulations of the Central Bank of the Russian Federation dated June 19, 2012 No. 383-P, as well as in the Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n. To learn how to correctly fill out a payment order for the transfer of insurance premiums, read this article.

It is not allowed to pay insurance premiums in any other way. Payment using payment terminals or by transfer without opening a current account is not provided for by law (according to Letters of the Ministry of Finance of the Russian Federation dated May 20, 2013 No. 03-02-08/17543, dated June 21, 2010 No. 03-02-07/1 -287).

However, the obligation to pay insurance premiums can be fulfilled without transferring funds. The debt is considered repaid on the day when the Federal Tax Service decided to offset the previous overpayment against the current transfer of contributions. Debt on insurance premiums is not considered repaid if:

- an economic entity or other person has withdrawn a previously submitted payment order from a credit institution;

- the “payment” contains incorrect bank details of the Treasury of the Russian Federation, for example, the current account number or the name of the recipient’s bank. Such errors lead to the fact that money is not credited to the budget, but is returned to the payer’s account;

- There are not enough funds in the current account to transfer insurance premiums.

These rules are established by paragraph 4 of Art. 45 of the Tax Code of the Russian Federation.

Insurance premiums. who is obliged to pay and when?

Deadlines for payment of insurance premiums for individual entrepreneurs The second paragraph of Article 16 of Law No. 212-FZ determines that premiums should be paid:

- Until December 31 inclusive of the current year - contributions to compulsory medical insurance and compulsory health insurance with income less than 300,000 inclusive (at rates of 5.1% and 26%, respectively).

- Until April 01.04 inclusive of the next year - contributions to mandatory pension insurance from income from 300,000 (1% of the excess).

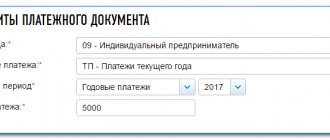

Deadlines for payment of insurance premiums for individual entrepreneurs in 2020 Type of deductions Amount of income, rub. Formula for calculating the contribution Amount of contribution, rub. Payment period Pension Up to 300,000 minimum wage * 12 * 26 19356.48 Until 12/31/16 Over 300,000 minimum wage * 12 * 26 + 1% * income from 300,000 Within 8 * minimum wage * 26 Until 04/01/17 Medical minimum wage * 12 * 5.1 3796.85 Until 12/31/16 KBK for payments KBK for payments Rate the quality of the article.

When do you not need to pay payroll taxes?

Mandatory pension and medical contributions for 2020 are transferred by individual entrepreneurs to the tax office at their place of residence.

Voluntary contributions to social insurance, as before, are paid to the territorial branch of the Federal Social Insurance Fund of Russia at the place of registration. This follows from Article 431 of the Tax Code of the Russian Federation and paragraph 5 of Article 4.5 of the Law of December 29, 2006 No. 255-FZ. The individual entrepreneur’s obligation to pay fixed insurance premiums for 2017 will be considered fulfilled from the day when:

- The individual entrepreneur has submitted a payment slip to the bank for the transfer of fixed insurance premiums for 2020 (if there are sufficient funds in the bank account for this, and the correct BCC is indicated in the order);

- The individual entrepreneur paid cash to the bank, to the cash desk of the local administration or to the branch of Russian Post as insurance premiums for 2017 (provided that the correct BCC is indicated in the payment document);

- The Pension Fund of the Russian Federation or the Social Insurance Fund decided to offset against payments for 2020 excessively transferred (collected) insurance premiums (penalties, fines on them).

Please pay insurance premiums for 2020 in separate payment documents:

- for compulsory health insurance;

- for compulsory pension insurance.

If an entrepreneur decides to pay voluntary social insurance contributions for 2020, then they must also be transferred in a separate payment document. This follows from paragraph 2 of Article 432 of the Tax Code of the Russian Federation, Article 22.2 of the Law of December 15, 2001 No. 167-FZ.

The employer (customer) is obliged to transfer to the budget:

- Personal income tax: from wages - no later than the day after the last part is paid, from payments under civil contracts - no later than the day after they are transferred. Personal income tax on vacation pay and sick pay - until the end of the month during which they were paid (clause 6 of Article 226 of the Tax Code of the Russian Federation).

- All insurance premiums (both those collected by the Federal Tax Service and those transferred to the Social Insurance Fund) - until the 15th day of the month, which follows the date when the labor payments subject to contributions were made (clause 3 of Article 431 of the Tax Code of the Russian Federation, clause 4 Article 22 of Law 125-FZ).

The legal provisions establishing until what date salary taxes must be paid in 2020 to state funds have been unified. They are the same for both payments under an employment contract and compensation under civil law agreements.

If the deadline for paying salary tax in 2020 falls on a weekend or holiday, then payment can be made on the next business day.

The “taxes” we have considered are charged on any salary or payment under a civil contract with an individual. An exception is the salary paid to a foreigner who has a passport of a country with which Russia has entered into an agreement on the avoidance of double taxation.

For example, let’s look at how this issue is regulated by the Agreement between Russia and Germany “On the Avoidance of Double Taxation” dated May 29, 1996.

In accordance with paragraph 2 of Art. 15 of the Agreement, German employees of Russian companies, like Russians working in Germany, have the right not to pay personal income tax (in Germany - income tax) if they:

- Stay on the territory of the relevant foreign countries for no more than 183 days within 12 months by the time the salary is paid. At the same time, a German employee in Russia is obliged to provide his employer with confirmation issued at the representative office of the Ministry of Finance that he is a resident of the Federal Republic of Germany and does not have to pay personal income tax in the Russian Federation (letter of the Federal Tax Service of Russia for Moscow dated March 4, 2010 No. 20-14/3/022678) .

- They receive compensation for labor exclusively from a foreign company (which does not have branches in the country where they work).

This means that the Russian company does not need to pay insurance premiums on the salary of a German employee, since he receives income from abroad.

Let us note that the specified conditions for taxation of foreign workers are quite typical for international agreements such as those concluded between Russia and Germany. Similar provisions are enshrined, for example, in paragraph 2 of Art. 15 of the Convention between the Governments of Russia and France “On the Avoidance of Double Taxation” of November 26, 1996.

“Salary taxes” are personal income tax and insurance contributions (under compulsory pension, social and health insurance programs). In cases provided for by law, they are not accrued on the salaries of foreign workers. The deadlines for paying personal income tax for employers under the Labor Code of the Russian Federation and for customers of work under civil contracts differ.

Deadlines for payment of insurance premiums for individual entrepreneurs The second paragraph of Article 16 of Law No. 212-FZ determines that premiums should be paid:

- Until December 31 inclusive of the current year - contributions to compulsory medical insurance and compulsory health insurance with income less than 300,000 inclusive (at rates of 5.1% and 26%, respectively).

- Until April 01.04 inclusive of the next year - contributions to mandatory pension insurance from income from 300,000 (1% of the excess).

Deadlines for payment of insurance premiums for individual entrepreneurs in 2020 Type of deductions Amount of income, rub. Formula for calculating the contribution Amount of contribution, rub. Payment period Pension Up to 300,000 minimum wage * 12 * 26 19356.48 Until 12/31/16 Over 300,000 minimum wage * 12 * 26 1% * income from 300,000 Within 8 * minimum wage * 26 Until 04/01/17 Medical minimum wage * 12 * 5.1 3796 ,85 Until 12/31/16 KBK for payments KBK for payments Rate the quality of the article.

Online magazine for accountants

Attention

Violation of the payment deadlines entails the accrual of a penalty, the amount of which is determined as the unpaid amount multiplied by the days of delay and 1/300 of the refinancing rate. Payment of insurance premiums if an organization is closed or reorganized When the organization or individual entrepreneur of the employer ceases its activities, it is necessary to fill out a calculation for each type of contributions for the time period from the beginning of the year until the day the calculation is generated and submit it to the appropriate fund before the day the application for closure of the activity is submitted.

The difference between the amount of the contribution from the calculation and the amount already paid is subject to transfer within fifteen days from the date of transfer of the calculation to the fund. If the company is reorganized, then all obligations, including the payment of insurance premiums, are transferred to the legal successor.

Deadlines for payment of insurance premiums in 2020

Payments included in tax legislation since 2017 are administered by the Federal Tax Service of Russia, and compulsory social insurance against industrial accidents and occupational diseases remains under the control of the FSS. According to the provisions of Article 8 of the Tax Code of the Russian Federation, insurance premiums are included in a separate obligatory payment and their concept, as well as the definition of taxes and fees, is enshrined in law. The Tax Code defines them as mandatory payments:

- for compulsory pension insurance;

- for compulsory social insurance in case of temporary disability and in connection with maternity;

- for compulsory health insurance.

However, it is also important to timely transfer the payment for insurance against industrial accidents, which remains a non-tax payment, to the budget, as well as the three payments listed above.

How tax is calculated and paid depending on insurance premiums of individual entrepreneurs

The simplified tax system tax is calculated and paid once a year, however, you have the obligation to calculate and pay advance tax payments quarterly.

At the time of writing (2018), insurance premiums for individual entrepreneurs are:

- compulsory pension insurance - 26,545 rubles;

- compulsory medical insurance - 5,840 rubles.

Total 32,385 rubles.

For 2020, see contributions here >>>

These are fixed insurance premiums for individual entrepreneurs, and there is also 1% of income over 300,000 rubles. per year, but this is a separate topic for another article. Here we consider why it is more profitable to pay insurance premiums for individual entrepreneurs quarterly.

Calculation example

So, let’s assume that in the 1st quarter your income amounted to 75,000 rubles, in the second - 80,000 rubles, in the third - 70,000 rubles, in the fourth 75,000 rubles. And you decided to pay the individual entrepreneur’s insurance premiums in one large amount at the end of the year. Then:

- Based on the results of the 1st quarter. The advance payment will be 75,000 * 6% = 4,500 rubles. You must pay this amount to the tax office. If you do not pay, there will be a late fee.

- At the end of the six months, the advance payment will be 155,000 * 6% = 9,300 rubles. The amount minus the first advance payment you paid, i.e. 9300-4500=4800 rubles, you must pay to the tax office.

- Based on the results of 9 months, the advance payment will be 225,000 * 6% = 13,500 rubles. The amount minus the first and second advance payment you paid, i.e. 13500-9300=4200 rubles, you must pay to the tax office;

On December 20, you pay pension insurance contributions of 32,385 rubles, and after that you calculate the annual tax.

75000+80000+70000+75000=300000 rub. is the annual income.

300000*6%=18000 rub. is a calculated tax.

You can reduce this tax by the amount of pension contributions paid in this period. If you are an individual entrepreneur without employees, then the tax is completely reduced.

It turns out that you don’t have to pay tax for the year! And you have already paid 13,500 rubles. during a year.

Of course, this money will not be lost; it will be considered an overpayment of taxes. You will be able to take them into account next year, but why such difficulties? Some will say that this is not the way to pay advance payments. If this number does not work, you are required to pay advance payments, otherwise a penalty will be charged.

How does the tax office know about this? So you yourself provide her with all the information in the declaration, and it will contain data on calculated advance payments and paid insurance premiums:

So what to do? Pay insurance premiums quarterly.

Insurance premiums for employees in 2020

If the last day coincides with a weekend or holiday, the final due date for payment of contributions is postponed to the next working day. Payment of pension insurance contributions In 2020, all payments for pension insurance must be made in one payment order using KBK 182 1 0210 160.

You can find out the remaining payment details of the Federal Tax Service necessary for payment using this service. Payment of health insurance premiums In 2020, the budget classification code for the transfer of health insurance premiums is 182 1 02 02101 08 1013 160.

You can find out the remaining payment details of the Federal Tax Service necessary for payment using this service. Thus, other remunerations in favor of individuals include:

- payment under civil contracts, the subject of which is the performance of work or the provision of services;

- payment under copyright contracts in favor of the authors of the works themselves;

- payments under agreements on the alienation of the exclusive right to works of science, literature, art, publishing license agreements, licensing agreements.

Employers calculate the amounts due for payment during the calendar year (settlement period) based on the results of each calendar month in the manner specified in Article 431 of the Tax Code of the Russian Federation. Consequently, the deadline for paying insurance premiums in 2020 comes monthly for employers. Features of payment by individual entrepreneurs Special deadlines for payment are established for individual entrepreneurs.

Advance vicissitudes of social tax

The Tax Code provides for the payment of preliminary payments for the unified social tax during the reporting period. What controversial issues do employers have to face when transferring advance payments to budgetary and extra-budgetary funds?

Monthly obligations The tax period under the Unified Social Tax is the calendar year, the reporting periods are the first quarter, half a year and 9 months (Article 240 of the Tax Code). In addition, based on the results of each calendar month, taxpayers calculate monthly advance tax payments (clause 3 of Article 243 of the Tax Code). Payment of monthly payments is carried out in separate payment orders to the federal budget, the Social Insurance Fund, the Federal and Territorial Health Insurance Funds no later than the 15th day of the following month. Monthly payments under the UST are calculated based on the actual base that has developed from the beginning of the tax period to the past month.