Who is eligible to receive benefits and payments?

The category of older people is defined differently in different countries. Thus, WHO (World Health Organization) experts include people over the age of 80, or living alone, suffering from serious illnesses, or living on a minimum benefit from the state, into the group of elderly people at high risk. According to WHO standards, such people need observation and qualified assistance.

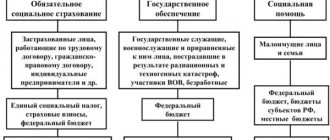

In Russia, issues of state pension provision by age are regulated by Federal Law dated December 15, 2001 N 166-FZ “On state pension provision in the Russian Federation”. According to this law, under normal conditions the age of eligibility for a pension is 55 years for women and 60 years for men. However, the legislation establishes several types of social security, on which the conditions of state social security depend.

In addition to labor (insurance) pensions, the assignment of which depends on a number of conditions (availability of length of service, pension points, proof of earnings, etc.), all elderly people who have reached retirement age will not be left without state assistance. In this regard, the following categories of recipients of payments and benefits are distinguished:

- social old-age pensions - women who have reached 60 years of age and men who have reached 65 years of age, who are unemployed and have lived in Russia for at least 15 years;

- social services – single and elderly people living alone who require care;

- subsidies for housing and communal services – low-income elderly people;

- benefits for housing and communal services , registration of compensation for care by another person - those who have reached the age of 80 years.

As you can see, an elderly person will not be left without a livelihood, even if he does not work and is not entitled to receive a labor pension.

What benefits are provided by law?

Social old age pensions

As noted above, the state guarantees pensions to all citizens who have reached a certain age. The main source of income for Russian pensioners is insurance pensions. However, to receive them, a person must have a certain insurance period (currently it is 9 years , and by 2024 it will reach 15 years), as well as a certain number of pension points. Many people reaching old age, for various reasons, do not have the necessary length of service, and for them the state provides a system of social pensions.

The old-age social pension is assigned to all women who have reached the age of 60 and all men who have reached the age of 65 who have lived for at least 15 years in Russia (for representatives of the indigenous peoples of the North, 55 and 60 years, respectively). The size of the social pension was indexed on April 1, 2021 and is now 5,180.24 rubles per month. However, the size of the social pension can be increased in the following cases:

- in the area where the pensioner lives, a regional coefficient has been established, by the amount of which the payment is increased;

- at the time of reaching 60 (65) years of age, the pensioner received a disability pension. The social old-age pension in this case will not be lower than the previously received pension;

- the cost of living in the region where the pensioner lives is higher than the size of the social pension. In this case, the pension is increased to the subsistence level.

The last point is the most important in terms of establishing social pensions. Thus, the cost of living in Russia as a whole is set at the beginning of 2021 at 8,726 rubles per month, which is higher than the old-age social pension. At the same time, in different regions the cost of living may be higher or lower than this value. The lowest value in 2021 was noted in the Tambov region - 7,489 rubles, the highest - in the Chukotka Autonomous Okrug - 19,000 rubles . If the cost of living in a region is lower than the national value, a federal social supplement (FSD) is made to the social pension; if it is higher, a regional social supplement (RSD).

It is important that when determining the amount of additional payment to the social pension, all income of the pensioner received from the state is taken into account:

- directly assigned social pension;

- if available - monthly cash payment (MCB), including a set of social services (NSS);

- additional payments for material support;

- additional social support measures at the regional level;

- compensation for housing and communal services, transport costs and others.

Thus, any person who has reached retirement age will be able to qualify for payments in the amount of the subsistence minimum, even if he does not have insurance coverage.

Subsidies and benefits for housing and communal services

Citizens of retirement age, like other citizens of Russia, if they have a low income, can apply for subsidies to pay for housing and communal services . The main condition is that the amount of payment for housing and housing and communal services must be more than 22% of the amount of income. This applies to both single citizens and families (in this case, the percentage is calculated from the total income of all family members). The assignment of subsidies is regulated by Article 159 of the Housing Code of the Russian Federation.

To assign a subsidy, it does not matter where the pensioner lives - in his own housing, under a social tenancy agreement, or in private housing. Also, a subsidy can be assigned to pensioners who are members of a housing cooperative. The main condition for assigning a subsidy is the absence of arrears in payment for housing and communal services.

The subsidy is assigned in the amount of the difference between the actual payment for housing and communal services and an amount equal to 22% of the pensioner’s income. It is transferred to the specified current account and is established for a period of 6 months to a year. It is important that regions can reduce the threshold payment for housing and communal services below 22%.

Since the subsidy is compensation for payment for housing and communal services, the pensioner must pay all utility bills in full and avoid delays.

When a person reaches the age of 80, he has the right to additional assistance from the state. In terms of paying for utilities, elderly people have the opportunity to pay for utilities with a 50% discount.

Additionally, compensation for contributions for major repairs is established. According to the law, regions must compensate 50% of paid contributions to persons over 70 years of age, and completely exempt persons over 80 years from paying contributions. In order to receive an exemption from paying contributions for major repairs, the following conditions must be met:

- reaching 80 years of age;

- able-bodied citizens should not be registered in the premises;

- a pensioner should not work;

- the building should not be recognized as unsafe.

Tax benefits

Tax benefits for pensioners are divided into federal and regional . At the federal level, retirees do not pay property taxes on the property they own. This benefit applies to all real estate owned by the pensioner. Pensioners are also exempt from paying personal income tax.

At the level of constituent entities of the Russian Federation, tax benefits for land tax and transport tax are established. Benefits, depending on the region, consist of either complete tax exemption or reduced tax rates.

State social services

Due to age, not every elderly person can take care of themselves; many require periodic or constant help from other people. For this category of the population, the legislation suggests using social services.

For older people, the law provides for the following types of social services:

- home service - providing assistance with the purchase and delivery of food, medicine, assistance in cleaning the apartment, accompaniment to the hospital;

- semi-stationary social services - the opportunity to visit relevant institutions for day or night stay, receiving social services, medical care, food and rest, maintaining social activity;

- inpatient services – boarding houses, boarding houses and similar institutions for the elderly;

- urgent social services in inpatient institutions or at home - hot meals, clothing, shoes, assistance with housing, legal assistance;

- social advisory assistance - legal assistance, assistance in organizing leisure time, consultations on other issues.

For women over 55 and men over 60 who need outside help, these services are free.

For older people (over 80 years old), there is the opportunity to receive additional benefits - free vouchers for treatment, home visits by a medical professional, medical care out of turn, compensation for part of the cost of medicines and prostheses.

Caring for a disabled pensioner

Elderly people often need outside help, which they cannot always get. To make it easier to find a person who will provide proper care, the law provides compensation for such a person. The amount of compensation is 1200 rubles , which are added to the pension.

Anyone can be entitled to compensation, regardless of whether they live with or are related to the person who needs care. Only those who already have another job or receive other social benefits cannot receive the payment. In addition to the cash payment, those caring for an elderly person are assigned 1.8 pension points per year, which is equivalent to a salary of about 15,000 rubles per month.

Social work with the elderly

Note 1

Social work with elderly people as a social group is carried out at two levels: at the macro and micro levels.

The macro level is characterized by activities and measures taken at the state level and considering older citizens as part of society: taking into account the interests of older citizens in the formation of public policy; creation of funds to support the elderly; development of special government programs; development of the social insurance system; formation of a comprehensive system of services for older citizens, including advisory, psychological, medical and other types of assistance.

Social services provided by social security institutions are carried out at the micro level.

Finished works on a similar topic

- Course work Social services for older citizens 450 rub.

- Abstract Social services for older citizens 220 rub.

- Test work Social services for older citizens 240 rub.

Receive completed work or specialist advice on your educational project Find out the cost

Basic principles of activity in the field of social services for older citizens:

- provision of state guarantees;

- continuity of various types of social services;

- ensuring accessibility and equal rights when receiving social services;

- the priority of measures for social adaptation of the elderly population;

- the focus of social services on the individual needs of older citizens.

Social security for older citizens, along with the health care system, in the context of major political, socio-economic, moral and psychological changes in society, should provide support for the elderly, since they cannot cope with most of their problems on their own. A large number of older citizens need social services to help them adapt to changes in functionality.

Personnel of social institutions engaged in serving older citizens must possess techniques of socio-psychological influence, as well as knowledge related to social security in the fields of psychotherapy, psychology, medicine, rehabilitation, gerontology, law, and economics.

Do you need proofreading or review of academic work? Ask a question to the teacher and get an answer in 15 minutes! Ask a Question

The activities of social workers should be aimed at preventing crisis situations, and, if they arise, at regulating them; to assist in the formation of self-esteem in older people, increasing awareness of their rights.

Registration procedure and required documents

Assigning a social old-age pension is simpler than a similar procedure for an insurance pension, since there is no need to provide information about length of service and collect certificates from archives. To apply for a social pension, it is enough to contact the branch of the Pension Fund of Russia or the nearest multifunctional center (MFC) after reaching the appropriate age and provide the following documents:

| 1 | application for a social old-age pension |

| 2 | documents confirming the identity, citizenship and age of the applicant - passport |

| 3 | for representatives of small peoples of the North (who have the right to a social pension 5 years earlier) - a certificate issued by the community of such people |

| 4 | documents confirming the place of stay or actual residence on the territory of the Russian Federation. In most cases this is a passport |

It is important that only citizens who do not carry out labor or other activities (which are counted in the insurance period) can apply for an old-age social pension.

The assignment of subsidies to compensate old-age pensioners for the cost of housing and communal services is carried out under the following conditions:

- the amount of payment for housing and communal services exceeds 22% of the amount of income;

- presence of Russian citizenship and residence at the place of application;

- no debts for utilities.

To apply for a subsidy, you need to contact the social welfare department at your place of residence and provide the following documents:

| 1 | identification documents for everyone living in the apartment, SNILS |

| 2 | ownership documents or social tenancy agreement |

| 3 | information about family composition and relevant documents |

| 4 | cadastral passport or other document with characteristics of housing |

| 5 | certificates of absence of debt for utility services |

| 6 | information about the income of all family members (for example, a 2-NDFL certificate from the place of work) |

You will also need to provide bank account details to which the subsidy amount will be credited.

The subsidy is assigned with some restrictions: according to the period (from six months to a year), according to housing standards per person (the subsidy is not awarded for “extra” square meters).

50% discount on housing and communal services , as well as compensation for contributions for major repairs, you must also contact the social protection department or the MFC and provide the necessary documents.

It is important that for contributions for major repairs, compensation is provided for the amounts paid: this means that beneficiaries are required to pay the full amount of contributions every month, then they receive compensation.

To accept an elderly person for social services, you must provide the following documents to the social protection department:

| 1 | Statement |

| 2 | Passport |

| 3 | conclusion of a medical institution on health status and absence of contraindications |

| 4 | certificate of pension amount |

| 5 | if there are benefits - a document confirming the right to them |

| 6 | certificate of family composition |

| 7 | income certificates for family members |

Not every person can qualify for social services; there are contraindications for health reasons (mental illness, alcoholism, tuberculosis, sexually transmitted diseases, etc.).

To apply for compensation for caring for a disabled citizen, the person who will provide care must contact the Pension Fund office and provide the following documents:

| 1 | application for compensation |

| 2 | statement of consent from the person who will be cared for |

| 3 | passports of both applicants |

| 4 | work book and certificate from the Employment Center of a person caring for a disabled person |

| 5 | certificate from the Federal Tax Service indicating that the caregiver does not have a registered individual entrepreneur |

| 6 | if care is provided by a minor - permission from parents and guardianship authorities |

To get advice on any type of social assistance for an elderly person, you can contact the department of social protection of the population or the MFC at your place of residence, where you will be advised on issues of interest and applications will be accepted.

Description of Federal Law 122

Federal Law No. 122 “On Social Services for Elderly Citizens and Disabled Persons” has lost its force. Now, instead of it, Law No. 442 “On the Fundamentals of Social Services” applies. It was adopted by the State Duma on December 23, 2013, and came into force on January 1, 2015. Last changes were made on July 21, 2017.

Federal Law No. 442 defines:

- Responsibilities of organizations that serve elderly citizens and other disabled persons;

- Issues in the economic, legal and organizational spheres;

- The rights of institutions that engage in government activities;

- Responsibilities/rights of disabled and elderly people.

This Federal Law applies to stateless persons and foreign citizens with permanent residence in the territory of the Russian Federation. Also covered by the Federal Law are individual entrepreneurs and legal entities that provide support to citizens.

The law consists of 10 chapters and 37 articles.

Brief content of Federal Law No. 442:

- Chapter 1 - Describes the general provisions of this Federal Law;

- Chapter 2 - Lists the powers of government bodies of the Russian Federation in the field of social security;

- Chapter 3 - Lists the responsibilities and rights of recipients of social services (elderly and disabled people);

- Chapter 4 - Lists the rights and responsibilities of suppliers;

- Chapter 5 - Describes how to provide services;

- Chapter 6 - Lists the forms and types of services for elderly and disabled people;

- Chapter 7 - Describes ways to organize the provision of social services to the elderly and disabled;

- Chapter 8 - Lists methods of payment for public support provided;

- Chapter 9 - Monitors the quality of service to the social needs of society;

- Chapter 10 - Describes transitional and final provisions.

Check out the Law on Fingerprint Registration

Download

The rules for servicing the elderly and disabled are listed in the Constitution of the Russian Federation. They are aimed at observing human rights and respecting the dignity and personality of every citizen of the Russian Federation.

Basic principles of Federal Law No. 442:

- Providing social services to all persons, regardless of: Age;

- Nationalities;

- Language;

- Races;

- Origin;

- Attitudes towards religion;

- Living place.

Personal information about the citizen receiving support is confidential. It may not be passed on to third parties. For the disclosure of confidential information, the service is held liable, which is provided for by this Federal Law. Dissemination of such data is possible only after consent from the recipients of social media. services for the elderly and disabled.

To download Federal Law No. 422 with amendments and additions, follow the link .

Latest changes in legislation

The main part of the annual changes in legislation regarding social pensions concerns their indexation . Thus, in April 2021, pensions were increased by 4.1% , and in 2021 indexation is planned by 2.4%. According to the law, pensions must increase in line with inflation, but this was not always observed.

Also, since 2015, there have been annual changes in the rules for calculating insurance pensions. To receive an insurance pension in 2018, you must have at least 9 years of insurance experience and 13.8 pension points. Until 2025, each year these values increase by 1 year and 2.4 points, respectively. Consequently, an increasing number of people will only be able to claim social old-age pensions.

In addition, changes in recent years have also affected benefits for major repairs for people over 70 and 80 years old. Thus, until January 1, 2019 , there will be a conflict when older people living with disabled people were deprived of benefits.

According to the new law, which comes into force at the beginning of 2021, the list of beneficiaries is expanding and regions will be able to compensate for contributions for major repairs of this category of elderly people.