Checking act

Recording an inspection activity means drawing up and approving a document such as an inspection report.

Moreover, if the inspection is carried out by a government agency (Ministry of Internal Affairs, Rospotrebnadzor, etc.), the act has a strictly approved form and procedure for filling out. Violations in the inspection procedure may lead to the lifting of sanctions through the filing of an administrative claim. In that article we will talk about how to independently draw up an inspection report for internal control purposes. For example, in relation to a separate unit, department work, etc. Here you can learn about the nuances of the document and find out where to find the procedure for conducting verification activities.

Checking act

https://youtu.be/sAIS7H1bPDI

The procedure for conducting a survey of living conditions according to the order of the Ministry of Education of the Russian Federation

According to the legislative framework, an examination of the living conditions of citizens is carried out to clarify the circumstances indicating that the parents of their minor children are inadequately provided for.

Inspection of housing helps to identify violations of the rights of minor citizens of the Russian Federation in the following cases:

- in the event of the death of parents and the transfer of guardianship rights to close relatives;

- when the mother and father are deprived of parental rights;

- in case of parental incapacity;

- when parental rights in relation to a child are limited;

- in case of prolonged failure of parents to fulfill their duties in relation to young children;

- to receive social assistance and subsidies.

Checking living conditions and subsequent drawing up of a report is also necessary in cases where parents refuse to send their children to educational institutions or register with social services or medical institutions.

According to the legislation of the Russian Federation, regular examinations are carried out by guardianship authorities located at the actual place of residence of the unfavorable (incompetent) family. In some cases, the inspection is carried out by employees of medical and social organizations.

According to the order dated January 10, 2019, it is necessary to conduct an examination of conditions when guardianship authorities, educational and medical institutions receive complaints about a specific family and suspicions of failure by the mother and father to fulfill their direct responsibilities. According to the legislation of the Russian Federation, the guardianship authorities must conduct the first inspection within 3 days from the date of receipt of the complaint.

Example of an inspection report

Limited Liability Company "Star of Aurora"

TIN 495396164 OGRN 64125414645,

legal address: 628424, Russia, Surgut, lane. Magistralny, 18, of. 16

Checking act

April 15, 2020 city of Surgut

Time for drawing up the act: 12 hours. 30 min. (local time)

Check start time: 11 a.m. 15 minutes. (local time)

Check end time: 12 hours. 25 min. (local time)

April 15, 2020 by a commission consisting of:

Chairman of the Commission: Deputy General Director of the Limited Liability Company "Star of Aurora" (hereinafter referred to as the Company) Alexander Dmitrievich Paramanov

Members of the commission: head of the personnel department of the Company Usmanova Veronika Arkadyevna, specialist of the financial department of the Company Olga Valerievna Dyakova,

based on the order of the General Director of the Company dated April 10, 2017 No. 168

an inspection of the work of a separate division of the Company was carried out at the address: Russia, Surgut, st. Privokzalnaya, 49 (Magistral shopping center).

Present: the head of a separate division, Konstantin Sergeevich Zinoviev, and Valentina Vasilievna Krivoruchenko, a salesperson.

At the time of the inspection it was established:

- In accordance with the requirements of Rospotrebnadzor, a consumer corner, price tags, and product labeling were created in a separate division

- Labor discipline is observed in full by all employees, medical books are available for each employee

- In accordance with the order of the General Director No. 48 dated 01/09/2017 and power of attorney for signing documents No. 49 dated 01/09/2017, a rental agreement for the premises was drawn up and complies with sanitary requirements.

- Working with a cash register complies with the requirements of the legislation of the Russian Federation.

Based on the results of the inspection, the commission concluded that the work in the separate division of the Company is proper and that the Rospotrebnadzor Office for Khanty-Mansi Autonomous Okrug-Yugra is ready for a scheduled inspection.

The act was drawn up in 2 copies, 1st copy. sent to the General Director, 2nd copy. handed over to the head of a separate division.

Chairman of the commission Paramanov Alexander Dmitrievich

Usmanova Veronika Arkadyevna

Dyakova Olga Valerievna

Deadlines for compilation, to whom it is handed over

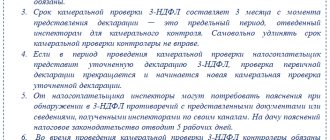

If we talk about the procedure itself, it can last no more than 2 months - in practice, it takes no more than a few days.

The report must be drawn up no later than two months after the end of the inspection.

As for clarifications and objections, they must be formed within the next month.

There are situations when the verification may be extended. This includes:

- translation of papers or examination;

- situations when information from foreign companies is needed.

However, even if we take into account the above-mentioned cases, the inspection cannot last longer than six months. Moreover, this period is fixed at the level of law. On the day when the control is completed, the authorized employee of the organization is issued a special certificate.

As for the frequency of inspections, if we are talking about unscheduled inspections, they are performed in the following cases:

- if a previously issued prescription has expired;

- if the organization received a complaint from citizens.

If we talk about a scheduled inspection, then it can be carried out no more often than once every three years.

If this deadline was violated, then the entrepreneur has every right not to provide tax documents and production premises for inspection. In addition, the inspection is obliged to notify the entrepreneur three days before the start of the procedure of its arrival. After the signed act is certified by the persons who performed the audit, it is handed over to the taxpayer who was audited. If the latter refuses to take the document, then appropriate notes are made on it.

When is an inspection report drawn up?

You will find the forms of verification acts and the procedure for carrying out activities by public authorities in departmental orders, as well as the norms of the Federal Law of December 26, 2008 No. 294-FZ “On the protection of the rights of legal entities and individual entrepreneurs in the exercise of state control (supervision) and municipal control " The procedure for appealing such documents is set out in orders (administrative regulations). Recommendations for drawing up an administrative claim to challenge a decision of an authority are posted on our website.

If you need to draw up an act of checking the employee’s activities, then you need to refer to the norms of the Labor Code of the Russian Federation. Most acts regarding employees are drawn up as part of internal inspections in compliance with the requirements of Art. 193 Labor Code of the Russian Federation. On the website you can find a sample Certificate of absence from work, refusal to sign, refusal to receive, etc.

When should the act be prepared?

The starting date for determining the development period of the document is the day of signing the above certificate. If inspectors checked the work of one legal entity without subsidiaries and branches, the on-site inspection report must be prepared within two months, no later. And in the case of a consolidated group of individuals or a group of companies, the period increases to three months. In this case, inspectors are obliged to inform the legal entity/individual or its representative that the document has been drawn up and obtain appropriate confirmation of receipt (receipt).

Also, on the finished act, in addition to the signatures of the tax service employees who participated in the audit, there must be a signature of the head of the enterprise or the person replacing him. A refusal to issue this signature is acceptable if the inspector, in your opinion, made a mistake or distorted the facts. In this case, the document is marked with a refusal, and the legal entity/individual entrepreneur has the right to file an objection to the on-site inspection report.

Contents of the inspection report

An act is a document drawn up by a commission. It can be approved by order of the head, or can be formed on the spot. The basis for the inspection is most often the administrative act of the manager, which is indicated in the basis.

A document is issued on the official letterhead of the organization and contains the name (verification report), date, place and time of preparation. It is advisable to indicate the start and end date of the verification activity.

The main content of the document is an indication of the full name. and the positions of the commission members, the basis for the inspection, the persons present, what was established, the commission’s conclusions and signatures.

The inspection report may lead to an internal inspection of individual employees and, as a result, disciplinary action.

Clarifying questions on the topic

how to withhold an overpaid bonus as a result of incorrect application of the collective agreement

Article 137 of the Labor Code of the Russian Federation: Wages overpaid to an employee (including in the event of incorrect application of labor legislation or other regulatory legal acts containing labor law norms) cannot be recovered from him, except in cases of: counting error; if the body for consideration of individual labor disputes recognizes the employee’s guilt in failure to comply with labor standards (part three of Article 155 of this Code) or downtime (part three of Article 157 of this Code); if the wages were overpaid to the employee in connection with his unlawful actions established by the court.

How exactly do tax officials formalize the results of an on-site audit ↑

The procedure for drawing up an act based on the results of a tax audit is carried out in accordance with the regulations established by law. Violating it is not allowed.

The person being inspected can familiarize himself with it and then monitor compliance with legal regulations. All conflict situations must be resolved through the courts.

It is worth familiarizing yourself with the following questions in advance:

- within what time frame should it be drawn up - if unscheduled, if planned;

- procedure for reporting results;

- completed example;

- if typos are found.

In what time frame should it be compiled?

The duration of the on-site inspection itself, regardless of the type of organization and other important factors, is carried out no longer than 2 months.

This period is established by current legislation. The on-site tax audit report must be prepared no later than 2 months from the date of completion of the audit.

However, there are a number of situations when it is permissible to extend the period of an on-site inspection. This list includes the following:

- if you need to obtain any data from foreign organizations;

- when it is necessary to conduct an examination, translate documentation.

But even if the above reasons exist, the duration of such a check cannot be more than 6 months. This point is fixed at the legislative level.

On the day the inspection is completed, a special certificate must be generated and issued to an authorized employee of the enterprise.

Unscheduled

An unscheduled tax audit is carried out in the following cases:

- if there are complaints from citizens;

- in case of expiration of a previously issued order.

After completing the inspection procedure, a special act must be issued. It is compiled within 60 days.

It will be possible to formulate objections and explanations within the next 30 days.

All standard rules established by the NAP (Tax Code of the Russian Federation, resolutions of the Federal Tax Service) apply to inspections of this type.

Legislative justification

The drawing up of the act is determined by the type of inspection that is documented:

- Internal . Such checks are carried out by representatives of the company itself. They are needed to promptly eliminate violations that may lead to sanctions. The form of acts is usually determined by internal regulations adopted in a particular company. There are relatively few requirements for such documents.

- External . Such activities are carried out by government agencies: the Ministry of Internal Affairs, Rospotrebnadzor, and so on. External audits are subject to extremely stringent requirements. They are also presented to the documentation. The specifics of processing the results of the audit are contained in Article 16 of Federal Law No. 294 “On the protection of the rights of legal entities and individual entrepreneurs within the framework of state control” dated December 26, 2008. The external inspection report is drawn up in the approved form. If the drafting rules are violated, the company will be able to challenge the imposed sanctions.

IMPORTANT! It is recommended that the rules for drawing up an internal audit report be recorded in the company’s accounting policies. It is on the basis of this accounting policy that documents accompanying the event will be drawn up.

What should the living conditions inspection report contain, sample filling

The act of checking the living conditions of the family is drawn up in free form. Its structure may vary depending on the purpose of creating the regulatory document.

Form

Sample of filling out a housing inspection report

There are standard data used to fill out the act, regardless of the purpose of its preparation:

- date of signing the document;

- name of the city or town in which the family lives;

- information about the members of the commission who were involved in checking living conditions;

- family residence address;

- information about the size of the plot, the presence of a vegetable garden, additional territory, information about the number of rooms in the house, information about the floor on which the apartment is located;

- information about the organization that maintains the housing stock;

- detailed information about the condition of the house: information about accidents or dilapidation, material of construction;

- data about the rooms: their area, finishing condition, lighting data;

- information about the type of apartment: separate or communal;

- information about the improvement of the premises with water, gas, heating, sewerage;

- information about the owners and shareholders of the premises and those registered in it;

- information about how long the family lived in the apartment or house: what year they moved, where they were registered before moving;

- availability of registration of parents in the city of residence: purposes of moving, availability of registration, estimated time of the family’s stay within a specific locality;

- employment of family members: self-employed, officially employed, information about additional sources of income, amount of earnings;

- additional information about the family: information about close relatives (if there have been criminal convictions, repeated administrative charges).

At the end, the commission members render their verdict, sum up the inspection of living conditions and put their signatures. The applicant will also need to sign the document.

Act on external inspections

The rules for drawing up an act are fixed in Article 16 of Federal Law No. 294. Paragraph 1 of Article 16 states that based on the results of the inspection, a report must be drawn up in 2 copies. Its form is approved by the Government of the Russian Federation. According to paragraph 2, the document must contain the following information:

- Date and place of creation of the document.

- The name of the government agency that is conducting the inspection.

- The number of the order or instruction on the basis of which the event is carried out.

- Full name of the officials responsible for the inspection.

- Name of the person being checked.

- Date and time of the event.

- Information about the results of the inspection.

- Information about violations discovered during the event.

- Information about familiarization or refusal to familiarize with the act.

- Signatures of the people who conducted the event.

What kind of document is this, legal regulation

As mentioned earlier, one of the responsibilities of the tax authority is an on-site inspection.

To do this, Federal Tax Service employees go directly to the location of the enterprise. For such control, a truly serious violation of the law is necessary - for example, if a company constantly submits zero reports and at the same time records a loss. Based on the results of the tax audit, a special act is issued, which will indicate the following data:

- errors that were found in accounting and tax accounting;

- requirements for their elimination.

This document contains the following subsections:

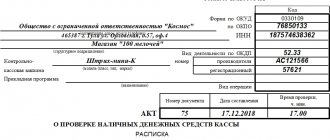

- name of the act and serial number;

- the date when it was compiled;

- in relation to whom the check was carried out;

- reasons for its implementation;

- list of documentation that was submitted for control;

- for what specific tax and during what period the audit was carried out;

- the total duration of the procedure;

- activities carried out during its course;

- what exactly the inspectors found (descriptive part);

- conclusions and results of the inspection, a list of identified violations;

- a list of persons who performed it;

- a place for the signature of the inspectors, as well as the responsible person who receives this act.

At the end of the document there must be a stamp with a transcript.

If we talk about legal regulation, then the check should be carried out in accordance with the following legislative norms:

- Article No. 83 of the Tax Code of the Russian Federation, which describes the procedure for maintaining records of legal entities.

- Article No. 89 of the Tax Code, which describes where and how an on-site audit should be carried out.

- Article 91, which states that the taxpayer is obliged to provide the tax authorities with free access to all papers and premises that are related to the procedure.

- Article 93, which states that the Federal Tax Service has the right to request data from counterparties.

- Article 100, which states exactly how the report should be filled out during and after the inspection.

Act on internal inspections

Internal audits are divided into many types. For example, these are the following events:

- Audit.

- Inventory.

- Internal inspection of an employee.

- Inspection of an industrial accident or emergency.

It must be taken into account that when taking inventory and writing off valuables, separate forms of acts are required. For all other types of inspection activities, a regular inspection report is drawn up.

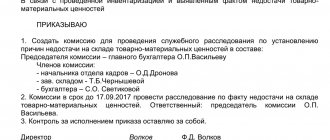

The act must be drawn up by the commission. The latter is formed on the basis of an order from the head of the company. The commission should include key specialists of the company. The inspection itself is carried out on the basis of the order of the manager.

The act is issued on the official letterhead of the company. It is necessary to enter the name of the document and the time of registration. It is also recommended to record the start and end dates of the review. The document reflects the full names of the commission members and their positions.

FOR YOUR INFORMATION! The report is drawn up as part of an internal audit. Based on this, the employee may be subject to disciplinary action.

Main nuances in drawing up an objection

To date, there is no strictly established sample of an objection to a tax audit report. Employees of enterprises and organizations can draw up a document in any form, based on their understanding of it.

In this case, it is advisable to take into account some office work norms and rules for writing business documentation. In particular, the objection must indicate:

- addressee, i.e. the name, number and address of the exact tax office to which the objection is sent,

- sender information (company name and address),

- number of the objection and the date of its preparation.

In the main part it should be indicated

- the act in respect of which an objection is being drawn up,

- describe in detail the essence of the claim, including all available reasons and arguments.

The document must refer to the laws that confirm the correctness of the author of the objection and indicate all additional papers attached to it (marking them as a separate attachment).

How to draw up a report based on the results of internal financial control

Articles on the topic

An act is a document that is widely used by government agencies to document the results of subsequent control. The form of the act can be borrowed from a higher department, or you can develop your own or draw up reports in any form.

From the article you will learn

- What sections does the internal control results report consist of?

- How to draw up an internal control results report

Useful material in the article

Sample internal financial control audit report Download

Descriptive part of the act based on the results of internal financial control

The descriptive part of the act, as a rule, contains a statement of violations identified during the inspection, or reports their absence. Each fact of violation must be documented. Therefore, in the description of violations it is necessary to indicate links to supporting documents.

It is recommended to group the results of checking different types of operations or the results of different control procedures into separate sections (subsections). To improve perception, the material of the act can be presented in tabular form.