Sample job description for accountant-auditor

General provisions

- An accountant-auditor is one of the specialists.

- An employee is appointed to the position of ________________ upon the recommendation of the chief accountant of the business entity. Registration for a position occurs through the issuance of an order.

- An employee hired as an accountant-auditor reports to the chief accountant.

- A person with a higher economic education or secondary specialized education, with experience in a similar position of 1 or 3 years, respectively, can be appointed to this position.

- An employee hired for this position must know:

- forms and methods of accounting in the company;

- legislative acts, orders and instructions, methodological, regulatory documentation and other documents related to the organization and maintenance of accounting in the company;

- economic and financial legislation of the Russian Federation;

- correspondence and accounting chart of accounts;

- sequence and rules for conducting documentary checks and audits;

- market methods of management;

- methods of organizing and maintaining document flow in the company;

- rules for working with computer technology;

- provisions of labor legislation;

- VTR rules;

- labor protection rules at the enterprise;

- safety regulations, fire regulations.

- During his work, the accountant-auditor must rely on:

- current legislation of the Russian Federation;

- company charter;

- orders of employees who are his immediate supervisors;

- this document;

- VTR rules.

- During the absence of an accountant-auditor from the workplace (due to vacation or illness), the manager appoints another employee in his place, to whom the duties, rights and responsibilities of the auditor are transferred.

Job responsibilities

An employee hired for the position of accountant-auditor must perform the following labor tasks:

- In accordance with current regulations and instructions with special tasks, carry out planned documentary audits of the economic financial activities of the company and its divisions that are on the individual balance sheet, for accounting of property, liabilities, and business operations.

- Record and formalize the results of the audit in a timely manner and send them to the appropriate authorities to take the necessary measures.

- Provide management of the inspected facility with instructions to eliminate detected violations and errors and conduct control audits of completed actions.

- Regulate the correctness of accounting for inventory, fixed assets, financial assets received by the organization, timely reflection of transactions related to their movement in accounting accounts.

- Regulate the organization of accounting and inventory in the company's divisions.

- Regulate the adherence to cost estimates, consumption of fuels and lubricants, electricity, finances.

- Regulate the reporting procedure based on primary documentation.

- Take the necessary measures to use modern technical means in work.

- Participate in the creation and adoption of measures aimed at increasing the efficiency of use of financial resources, savings, and strengthening control over the financial and economic activities of the company.

- Regulate the work of enterprise employees in the field of reporting and accounting.

- Carry out official assignments from your immediate supervisor.

- Comply with the rules of VTR and other regulations of the company; labor protection and fire safety requirements.

Rights

An employee hired as an accountant-auditor has the following rights:

- Receive guarantees from the state prescribed in the labor legislation of the Russian Federation.

- Request from structural divisions and employees of the company information necessary to perform their job functions.

- Have access to documents defining his rights and responsibilities in the company, criteria for assessing the quality of work.

- Propose to management measures to improve work related to his job responsibilities; encourage employees subordinate to him to do their job well; bring to justice subordinates who violated labor and production discipline in the company.

- Get acquainted with the draft decisions of his superiors regarding his work activities.

- Request from company management and other employees the assistance necessary to complete work tasks.

- Improve your professional qualifications.

Responsibility

An employee holding the position of an accountant-auditor bears the following responsibilities:

- For dishonest performance of one’s labor functions prescribed in the job description, or their complete failure to perform them - within the framework of the provisions of the current labor legislation of the Russian Federation.

- For material damage caused to the company - in accordance with the provisions of current labor and civil legislation.

- For crimes in the workplace - in accordance with the provisions of the current Code of Administrative Offenses of the Russian Federation, the Civil Code of the Russian Federation, and the Criminal Code of the Russian Federation.

I. General provisions

- An accountant-auditor belongs to the category of specialists.

- For the position:

- An accountant-auditor is appointed by a person who has a secondary vocational education (education) without requirements for work experience or special training according to an established program and work experience in accounting and control of at least 3 years;

- An accountant-auditor of category II is appointed by a person who has a higher professional (economic) education without presenting requirements for work experience or a secondary vocational (economic) education and work experience as an accountant-auditor for at least 3 years

- Accountant-auditor of category I - a person who has a higher professional (economic) education and work experience as an accountant-auditor of category II for at least 3 years.

- Appointment to the position of accountant-auditor and dismissal from it is made by order of the director of the enterprise upon the recommendation of the chief accountant.

- The accountant-auditor must know:

- 4.1. Legislative acts, regulations, orders, orders, other guidance, methodological and regulatory materials on the organization of accounting and reporting.

- 4.2. Forms and methods of accounting and analysis of economic activity at an enterprise.

- 4.3. The procedure for conducting documentary audits and verification of the correctness of accounting of property, liabilities and business transactions.

- 4.4. Organization of document flow and the procedure for documenting and reflecting on accounting accounts transactions related to the movement of fixed assets, inventory and cash.

- 4.5. Plan and correspondence of accounts.

- 4.6. Financial and economic legislation.

- 4.8. Basics of economics, organization of production, labor and management, basics of organizing mechanized processing of economic information.

- 4.9. Market methods of management.

- 4.10. Rules for the operation of computer equipment.

- 4.11 Labor legislation.

- 4.12.

How to draw up a document in a company

Job responsibilities and requirements for education and experience of an accountant-auditor can be taken from the following sources:

- Professional standard “Accountant”, approved by order of the Ministry of Labor dated February 21, 2020 No. 54154. There is no separate professional standard for an accountant-auditor, so you can write down the responsibilities suitable for this position.

- Unified qualification directory for positions of managers, specialists and employees. It has a section dedicated to the position of “accountant-auditor”, where all the necessary information for each category of specialist is indicated.

You can also contact the employee’s immediate supervisor when creating instructions. He will present a list of the subordinate's job responsibilities.

For your information! The development of this paper in the company is usually carried out by lawyers, legal advisers, and personnel department employees.

The document consists of several basic sections. Additional ones can be added to them at the request of the employer or if necessary. The basic ones include: “General provisions”, “Official responsibilities”, “Rights” and “Responsibility”. Additional: “Signature right”, “Relationships within the organization”, “Working conditions”, “Performance assessment”, etc.

III. Rights

The accountant-auditor has the right:

- Get acquainted with the draft decisions of the enterprise management concerning its activities.

- Make proposals for improving work related to the responsibilities provided for in these instructions.

- Within your competence, inform your immediate supervisor about all shortcomings in the activities of the enterprise (structural unit, individual employees) identified in the process of fulfilling their official rights and responsibilities and make proposals for their elimination.

- Request personally or on behalf of the manager from employees of departments of the enterprise information and documents necessary to perform his job duties.

- Involve specialists from all (individual) structural divisions in solving the tasks assigned to him (if this is provided for by the regulations on structural divisions, if not, then with the permission of the manager).

- Require the management of the enterprise to provide assistance in the performance of their official duties and rights.

Document Sections

Let's look at the main sections.

General provisions

This section establishes qualification requirements for an accountant-auditor. It also lists what knowledge and skills the employee needs to have, what rules and regulations to follow in the workplace, and who will replace him in case of illness or rest.

Job responsibilities

This section must be written with special attention. All the employee’s job functions are listed here. They need to be written down in detail and clearly so that the employee does not have any complaints against management in the future. It is important that these responsibilities are consistent with the knowledge and skills listed in the previous section.

Rights

An accountant-auditor in the workplace will have standard rights: to receive the necessary documentation and information, to receive social guarantees, to participate in the life of the company, to offer to punish or reward his subordinates, to improve his own professional level.

Responsibility

Each offense is not described in detail. They only indicate the types of violations and what type of liability is due for them. Misdemeanors include material damage, crimes during work, and poor quality work. And liability can be disciplinary, civil, administrative and criminal.

The essence and significance of the position of accountant-auditor

In order to minimize or completely eliminate errors and violations committed in accounting, the company may have the position of an accountant-auditor on its staff. At its core, an accountant-auditor is an internal audit specialist.

However, not every company needs to hire an audit accountant. This position is most typical for companies with a multifaceted organizational structure, with many branches and a significant number of accounting employees on staff.

Accountant for the implementation of duties

Type of finished document

After the manager decides that the text of the instructions is ready, the document is sent for printing. What the completed job description should look like:

- Name of the business entity and its details (legal address, INN, KPP, OGRN, telephone).

- “Approved” stamp for the head of the company.

- Title of the document.

- Job description text.

- Workers' signatures.

Attention! The document is printed on the organization's letterhead. The number of copies is not recorded anywhere. You can create two: for the employee and for the HR department.

Recording the responsibilities of an accountant-auditor in the company’s internal documentation

The hiring of an employee, taking into account the requirements of Russian legislation, must be carried out by signing an employment contract. This document sets out basic information about the employee and employer and the basic conditions for cooperation between the parties.

To record the responsibilities assigned to an employee holding a particular position in the company, a certain document is provided, which is classified as internal administrative documentation - a job description.

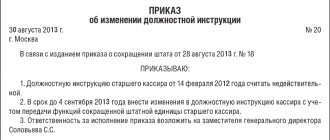

This document reveals not only the direct responsibilities assigned to a company employee, but also the required level of qualifications to perform the work, as well as the rights of the employee and the degree of his responsibility in the event of possible violations. The adoption of a job description is carried out by issuing a corresponding order from the head of the organization.

Using job descriptions allows a company to:

- Record a specific list of responsibilities for each position approved in the organization’s staffing table;

- In written format, reflect the organization’s requirements for the qualifications of citizens;

- Establish the degree of responsibility that employees will have to bear in the event of violations.