What is a tax deduction?

Tax deduction is an amount that reduces the amount of income (tax base) on which tax is paid. In some cases, a tax deduction means the return of part of previously paid income tax for an individual, for example, in connection with the purchase of an apartment, expenses for treatment, education, etc.

In total, the Tax Code provides for 6 groups of tax deductions:

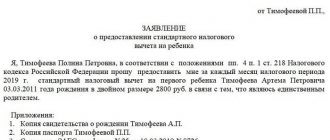

- Standard tax deductions (Article 218 of the Tax Code of the Russian Federation).

- deduction for the taxpayer;

- deduction for a child.

- Social tax deductions (Article 219 of the Tax Code of the Russian Federation).

- on expenses for charity;

- on training costs;

- on expenses for treatment and purchase of medicines;

- on expenses for non-state pension provision and voluntary pension insurance, voluntary life insurance;

- on expenses for the funded part of the labor pension.

- when selling property;

- when purchasing property.

Today we will talk about property tax deductions.

Types of property tax deduction

When buying a home, there are 2 types of property deductions:

- for the purchase of real estate.

- to pay interest on a mortgage loan.

| To purchase | To pay interest on the mortgage |

| Purchase after 01/01/2014 13% from 2 million (per person), but not more than 260 thousand rubles. The remainder can be transferred to other objects. Both spouses can receive the deduction. | 13% personal income tax from 3 million rubles. Both spouses can receive the deduction. The remainder of the deduction cannot be transferred to other objects. |

Deduction for expenses for the purchase of real estate

If the purchase was made after 01/01/2014, then a deduction is provided in the amount of 13% of the amount of 2 million rubles. (limit per person). A tax refund is possible on several real estate properties, but within the limits of 260 thousand rubles. In this case, both spouses can claim a deduction for one piece of real estate.

Those. when buying an apartment worth 4 million rubles. spouses can receive a deduction for it in the amount of 260 thousand x 2 = 520 thousand rubles.

Example: Spouses Sergey and Svetlana bought an apartment with a mortgage for 5 million rubles in 2021. The apartment was registered as joint ownership for two people. Each of them has 13% personal income tax = 5,000,000/2*0.13 = 325,000 rubles. But they will only receive 260,000 rubles each, because... This is the maximum amount allowed.

If the apartment was purchased before January 1, 2014, and the buyer has already exercised the right to a deduction, it is impossible to receive a tax deduction a second time.

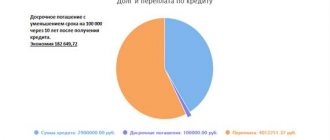

Expenses for paying interest on a mortgage loan

The benefit is provided to the taxpayer for one property; the remainder of the benefit cannot be transferred to other properties. You can return 13% of personal income tax from an amount not exceeding 3 million rubles.

The mortgage payer can return 3 million x 13% = 390 thousand rubles. from the amount of interest paid. Both spouses can claim the right to a deduction for a property within the limits of the mortgage interest actually paid, if they are personal income tax payers.

The family will be able to return up to 780 thousand rubles. Personal income tax on the amount of interest paid on a mortgage loan. But the remainder of this deduction cannot be transferred to other objects.

In total, you can return 520,000 + 780,000 = 1,300,000 rubles to the family budget.

Limitation period for Tax 3 Personal Income Tax

They also make fun of me, my dear. If you have a personal account, scan the request and write a letter via personal account, you are required to respond. And in the request (message) to submit a declaration there should be a phone number and full name of the performing inspector at the bottom left.

Yes, what does the court have to do with it? We are talking about the fact of failure to submit a declaration on time. The inspection indicated the fact of non-filing of the declaration. The payer's personal invoice is most likely the amount of the fine. The court will come later if he does not submit the declaration. But why bring it to this? You will still have to file a declaration and there is no way around it.

17 Sep 2021 lawurist7 439

Share this post

- Related Posts

- Is it possible to travel using someone else's electronic ticket in public transport?

- Who is considered a Chernobolets

- Benefits for pensioners of the Ministry of Internal Affairs when traveling by train

- In 2020, for construction subsidies for large families, how many family members should be

Statute of limitations for tax deductions

There is no statute of limitations for property tax deductions. If the apartment was purchased more than 3 years ago, then a deduction can be obtained from income received over the last 3 years preceding the year of application (submission of the application).

For example, if an apartment was purchased in 2004, and the application for refund was in 2021, then 2015, 2021, 2021 are taken into account.

The right to a deduction when purchasing an apartment in a new building appears from the year the apartment acceptance certificate is signed.

P Procedure for submitting clarifications on 2-NDFL and 6-NDFL

The employee lost the right to a standard deduction or received the right to a property deduction from the beginning of the year, and submitted the documents only in the middle of the year. The recalculation of personal income tax should be reflected in the calculation for the period in which the employee brought supporting documents. There is no need to submit an update for previous reporting periods (letter of the Federal Tax Service of the Russian Federation dated 04/12/2020 No. BS-4-11/6925, letter of the Federal Tax Service of the Russian Federation for Moscow dated 07/03/2020 No. 13-11/099595).

In what cases is an updated 3-NDFL declaration submitted?

Thus, three years have passed - all the best. The year 2014, for example, is no longer under the control of the tax authorities. Unless you have enough enthusiasm to pass the revisions during this period, then you will automatically receive a prize in the form of a camera camera, or even something more fun.

In addition, the tax deduction can include costs incurred for the purchase of building materials and renovation of the apartment (provided that it was rented out unfinished or rough). It is also allowed to compensate funds paid for the development of the project for work on connecting communications.

You may be interested in:: Benefits for military veterans for enrolling a child in school in the Nizhny Novgorod region

Is it possible to get a deduction for the purchase of housing for several apartments?

Until 2014, the property deduction limit was tied not only to the taxpayer, but also to the object. The deduction was given once in a lifetime and only for one piece of real estate. It was impossible to transfer the deduction to another object.

The law has changed since January 1, 2014. If real estate was purchased after January 1, 2014, the deduction limit is not tied to the object; the balance can be transferred to other objects.

For example, if in 2021 you bought an apartment for 1.5 million rubles. and returned the tax, then when purchasing another apartment in 2021, you will be able to use the remainder of the deduction and return another 65 thousand rubles.

When will you not be able to get a deduction?

- Housing was built or purchased at the expense of employers, other persons, maternal (family) capital, and budgetary funds;

- the purchase and sale transaction is concluded with a related party.

Interdependent persons are an individual, his spouse, parents (including adoptive parents), children (including adopted children), full and half-siblings, guardian (trustee) and ward (Article 105.1 of the Tax Code of the Russian Federation). Mother-in-law and mother-in-law are not interdependent persons.

Example: Petrova G.D. bought an apartment in 2021 for 2.1 million rubles, of which 453 thousand rubles. were paid for with a maternity capital certificate. For 2021, her income is 650,000 rubles, the amount of personal income tax paid is 84,500 rubles.

A personal income tax deduction cannot be provided to an individual for the amount of maternity capital. This means that the total deduction amount is:

2,100,000 – 453,000 = 1,647,000 rubles, Petrova G.D. will be able to receive: 1,647,000*0.13 = 214,110 rubles.

In 2021 Petrova G.D. will receive 84,500 rubles. (amount of personal income tax paid in 2017). Remaining amount0=129,610 rub. will be carried forward to subsequent tax periods.

The procedure for obtaining a deduction when purchasing real estate can be found here.

How long does the statute of limitations for taxes last?

However, to prevent vehicle owners from being tempted to abuse these provisions, the fiscal authorities, when detecting arrears in the payment of transport tax, impose penalties. If the owner of the car does not pay the debt he has incurred voluntarily, a lawsuit is filed against him. Moreover, the provisions of Article 48 of the Tax Code allow the collection of such debt at the expense of the taxpayer’s property. It is worth remembering that the fiscal service has the opportunity to go to court to forcefully collect transport tax only if its amount exceeds 3,000 rubles.

This is interesting: What is needed to obtain a Veteran of Labor of Buryatia

The grounds for requesting a deferment or installment plan for tax payments may be related to force majeure: the consequences of a natural disaster that destroyed a production workshop or retail establishment, the seasonal nature of the work, or the risk of bankruptcy in case of a one-time deduction of the entire amount of debt from the current account. An enterprise may also qualify for a deferment if its main customer or counterparty is a government agency that has not transferred funds for the execution of a government order on time.

Property deduction when selling property

The amount received from the sale of any property owned by an individual for less than 3-5 years is subject to personal income tax.

The taxpayer, by April 30 of the year following the reporting year, must submit to the tax authority at the place of residence a tax return in Form 3-NDFL in respect of income received from the sale of such property. For late submission of the declaration - a fine of 5% of the unpaid tax amount for each month of delay in submitting the declaration, but not more than 30% of the specified amount and not less than 1,000 rubles.

The period of ownership of property is counted from the moment the property is received into ownership. For objects purchased before 01/01/2016, the minimum tenure is 3 years. For them, after 3 years of ownership, there is no need to pay tax and file a personal income tax return when selling property.

For example, in 2021, the holding period for properties purchased before January 1, 2021 will be 3 years. If the property was purchased after January 1, 2021, the new rules apply.

According to Art. 217.1 of the Tax Code of the Russian Federation, income received by a taxpayer from the sale of real estate is exempt from taxation provided that such an object was owned by the taxpayer for a minimum period of ownership of the real estate or more.

The minimum ownership period is 3 years for real estate objects in respect of which at least one of the conditions is met:

- ownership of the object was received by the taxpayer by inheritance or under a gift agreement from a close relative;

- the property was obtained as a result of privatization;

- ownership of the object was obtained by the taxpayer - the rent payer as a result of the transfer of property under a lifelong maintenance agreement with dependents.

In other cases, the minimum maximum period of ownership of real estate is 5 years.

If it is not possible to apply tax exemption based on the period of ownership of the property, you can use the property tax deduction.

Amount of property deduction when selling property

| Type of property | The maximum deduction amount by which income can be reduced upon sale |

| Sale of residential houses, apartments, rooms, including privatized residential premises, dachas, garden houses or land plots or shares in them. | 1,000,000 rub. |

| Sale of other property (cars, non-residential premises, garages and other items). | 250,000 rub. |

If the taxpayer sold several pieces of property in one year, the specified limits are applied in the aggregate for all sold objects, and not for each object separately. During one calendar year, you can simultaneously use a deduction in the amount of RUB 1,000,000. and a deduction of 250,000 rubles.

If a person sold 3 apartments in one calendar year that were owned for less than five years, he can take advantage of a deduction in the amount of 1,000,000 rubles. The deduction is not tripled due to 3 real estate properties.

If a citizen sells two cars, his total property deduction is 250,000 rubles, regardless of the number of cars sold.

A property deduction associated with the sale of property can be applied within the established maximum amount of such a deduction an unlimited number of times.

When selling property, the taxpayer has a choice:

- take advantage of the property deduction;

- or reduce your income by the amount of actually incurred and documented expenses associated with the acquisition of this property.

It is impossible to simultaneously reduce income by the amount of property deduction and by the amount of expenses incurred in relation to one object.

Therefore, consider what is more profitable for you. Take advantage of all the tax benefits available to you and don't miss out on benefits for your budget!

Tax deductions do not apply to income received by individual entrepreneurs from the sale of property in connection with their business activities.

The procedure for providing a tax deduction when selling property can be found here.

about the author

Natalya Kolbasina has a higher education degree in “Economist in Accounting and Auditing” at the Crimean State Agrotechnological University. She improved her qualifications at Moscow State University. M.V. Lomonosov, ANO "Institute of Financial Planning" and the Financial University under the Government of the Russian Federation. He is a financial literacy consultant for the Russian Ministry of Finance project Vashifinance.rf. Experience of successful work in the financial sector – more than 20 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Limitation period for personal income tax

If the purpose of the claims by the tax authorities is to collect the amount of debt from the taxpayer, and not to hold him accountable for committing a tax offense, then in this case they are guided by the provisions of Art. 48 of the Tax Code of the Russian Federation.

This is interesting: Is it possible to cheat a pensioner out of a dacha for debts?

If the month has already expired, then you can go to court. In this case, the statute of limitations for taxes of legal entities and entrepreneurs is 3 years from the day when it became known about the excessive collection of tax or when the taxpayer should have known about it. Note that a taxpayer in a situation with an excessively collected tax can skip the stage of applying to the tax authority and immediately write an application to the court (clause 3.9 of Article 79 of the Tax Code of the Russian Federation).

Comments: 2

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Natalya Kolbasina

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Galina

04/20/2021 at 09:56 Two brothers had shared ownership of an apartment donated by their father; they were about to sell it when one of the brothers died. The son of the deceased takes over. This results in different tenure periods. How to sell the whole thing, wait another 3 years...?.

Reply ↓ Anna Popovich

04/20/2021 at 18:17Dear Galina, if you do not wait for the period of ownership, then the responsibility for paying tax will fall on the shoulders of the heir.

Reply ↓