Legal provisions regarding pensions for Soviet service

Special indexation of pension payments, called valorization , was carried out in 2009. The process affected pension capital formed in the Soviet and post-Soviet periods, up to 2002 No. 213-FZ dated July 24, 2009.

In 2021, another event occurred regarding Soviet pensions. This is an increase in the assessment of length of service , including non-insurance, accumulated by the employee since the times of the USSR. The indexation coefficient was 1.066 . The increase applies to all pensioners.

Recalculation of pensions for length of service acquired during this period in places belonging to the Far North, as well as in equivalent regions of the post-Soviet space, was made using compensation established by law and increased coefficients .

Conditions for increasing pensions for Soviet service

The period of labor activity of a citizen participating in the compulsory pension insurance system is conditionally divided into several segments:

- up to 1990 (inclusive);

- from 1991 to 2001 (inclusive);

- from 2002 to 2014 (inclusive);

- since 2015

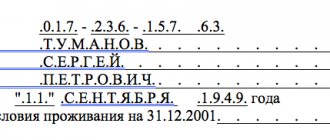

The period up to and including December 31, 2001 is conditionally counted as Soviet service. When assigning a pension, all the time during which a person worked is taken into account. The pensioner’s payment file may not contain documentary evidence of work for this period, since centralized personalized records began to be kept only in 2002.

Recipients of old-age or disability pensions may apply for a recalculation of their pension taking into account Soviet service.

The citizen must personally submit an application to the Pension Fund and confirm the work periods by providing the documentation missing in the payment file. He is required to recalculate his pension upward, taking into account:

- labor activity until 2002;

- preferential length of service during the USSR;

- non-insurance periods.

Confirmation of employment until 01/01/2002

When taking into account Soviet service for recalculating pensions, the Pension Fund employee takes into account the periods:

- employment as an employee or worker;

- the work of evacuated citizens on collective farms during the Great Patriotic War (WWII);

- individual labor activity;

- creative activities (cinematography, fine arts, literature);

- work as the chairman of a collective farm or his deputy on the direction of Soviet or party bodies;

- activities as a member of the fishing cooperative artel;

- work as a labor obligation;

- employment by members of collective farms and other cooperative organizations;

- service in paramilitary security, special communications agencies or in a mine rescue unit;

- other work if the person made contributions to state social insurance.

Periods of temporary disability, studies in secondary specialized and higher educational institutions, service in the armed forces and other law enforcement agencies, as well as stay in partisan detachments and in captivity are counted into the Soviet work experience for subsequent recalculation.

The total length of service includes the time spent actually caring for a group I disabled person who has become incapacitated due to a military injury.

Accounting for periods previously counted as preferential service

The pension for length of service in Soviet times can be increased by including periods that during the USSR were included in preferential length of service. For recalculation, the following work is taken into account:

- with harmful, dangerous and difficult working conditions (Lists 1 and 2);

- in elected positions in Komsomol and party organs, political departments and directorates;

- on water transport;

- in the regions of the Far North (RKS) and in equal territories (TKS);

- in leprosy and anti-plague institutions.

- 4 ways to slow down brain aging

- Long service pension for municipal employees

- Acetone smell from child's mouth

Non-insurance periods and recalculation of pension points

The time before retirement, when a citizen did not work or could not work due to objective circumstances, refers to the so-called “non-insurance periods”. For each full year, the applicant is entitled to a recalculation in the form of 1.8 PB:

- caring for a disabled person of group 1 and a disabled child;

- criminal punishment if the person was later rehabilitated;

- service in the army as a conscript soldier;

- receiving unemployment benefits;

- staying with a diplomatic spouse on the territory of another state (maximum duration – 5 years);

- moving to another area with a military spouse in the absence of the opportunity to get a job in the specialty;

- care for elderly people over 80 years of age.

Recalculation when caring for a child from birth to 1.5 years occurs taking into account the order of birth of the baby:

- for the first – 1.8 PB per year;

- the second – 3.6 PB per year;

- third and fourth - 5.4 PB per year.

The maximum duration of child care time taken into account in the length of service is limited to 6 years - one and a half years for each child. The maximum possible number of PBs is 24.3. For confirmation, you must provide birth certificates of children.

Who can apply for recalculation of the Soviet pension in 2021

Pensioners who began working under the Soviet Union can count on a bonus only if any period is not taken into account . This situation occurred in the absence of supporting documents at that time or the presence of corrections and errors in the work book.

It would also be a good idea to apply for recalculation to employees with experience whose threshold has exceeded 40 and 45 years for women and men, respectively. This is the maximum duration applied when calculating the pension. It is assumed that not all citizens documented the years they worked in excess of the norm.

In such circumstances, the Pension Fund is provided with unaccounted papers confirming the labor relations that arose during the Soviet period. There are no additional allowances or recalculations for such pensions in 2021.

Calculation features

Length of service accumulated before 2002 is an advantage that affects the amount of pension payments. The threshold of work experience before 2002 for women is 20 years , and for men - 25 years . When recalculating, each year exceeding the specified standards is taken into account.

The interest supplement for this period is calculated based on the pension capital.

Application of the experience coefficient

Pension payments are calculated taking into account the length of service coefficient , which at a threshold of 20 and 25 years for female and male workers, respectively, is 0.55 . Its maximum value is 0.75 .

If you have length of service that is below the established age limits, the indicator will decrease in proportion to the years worked. For example, a woman’s work experience before 2002 was 17 years. The coefficient in this case is calculated as follows: 0.55/20 x 17 = 0.47.

If the length of Soviet service exceeds the established standards, then, for example, for a man who worked 28 years before 2002, the service coefficient will be equal to: 0.55/25 = 0.62.

Increase for Soviet experience

According to the Decree of the President of the Russian Federation, all pensioners whose labor activity occurred in 1991-2001, since 2002, have been accrued by default a supplement to their pension capital in the amount of 10%. The length of service in this case does not matter.

In addition, if there are documents confirming official employment before 1991, pension accruals are made with the addition of 1% for each working year. If, for example, a citizen worked 6 full years before 1991, then the pension will be increased by 6%.

Calculation example

The citizen’s labor activity began in 1987. Until 2002, his work experience was 14 years, of which 4 years were during the USSR period.

Additional payments to pensions for the pre-reform period will be calculated taking into account the following indicators:

- average monthly salary for 2000-2001. — 1600 rub.;

- level of average earnings in the country for 2000-2001. — 1495 rub.;

- maximum coefficient - 1600 / 1495 = 1.1

- length of service coefficient - 0.55 / 25 x 15 = 0.31;

- average salary in the Russian Federation for the 3rd quarter. 2001 - 1697 rub.

Based on the data obtained, the size of the calculated pension of the Republic of Poland for 2001 is determined: 0.31 x 1.1 x 1697 = 579 rubles.

For subsequent calculations, the following all-Russian indicators are used for 2000-2001:

- the basic part of the pension payments of BP is 450 rubles;

- minimum MP pension - 660 rubles;

- The survival period for diabetes is 228 days.

If, when calculating the RP for 2001, its size was less than 660 rubles, in this case 579 rubles, then the amount of the SV insurance payment will be calculated using the formula MP - BP = 210 rubles.

The estimated pension capital of the RPK (210 x SD) is 47,880 rubles. On its basis, the bonus for length of service worked before 2002 is determined.

Then the part of the insurance pension earned during the Soviet period is calculated using the correction factor in force from 2002 to 2014: 5.6148 x SV = 1179.11. This result is divided by the cost of one point, set for 2015 at 64.1. The result is 18.39 points.

In 2021, when recalculating the Soviet pension, the following values are used:

- indexation coefficient – 1.066;

- the cost of one point in 2021 is 98.86 rubles.

The size of the allowance for the Soviet period is calculated as follows:

- valorization indexation: 0.1 + 1.066 x 0.04 = 0.14;

- valorization amount: (0.14 x 47880) / SD x 5.6418 = 165.86 rubles;

- conversion to points: 165.86 / 64.1 = 2.59;

- number of points taking into account indexation: 18.39 + 2.59 = 20.98;

- amount of pension increase in 2021 due to Soviet experience: 20.98 x 98.86 rubles. = 2,074.08 rub.

Converting work experience into pension points

Insurance contributions have been taken into account in pension points only since 2015. During the Soviet period, employees of the Pension Fund of the Russian Federation carried out the conversion of pension experience - the recalculation of income received into IPC. A special formula is used for this:

Number of pension points = amount of pension capital / cost of 1 PB (as of January 1, 2015).

In order to determine the amount of pension capital used for recalculation, it is necessary to make a series of calculations: in compliance with the following algorithm:

- Determine the experience coefficient (SC).

- Calculate the average monthly earnings coefficient (AMC).

- Calculate the amount of the estimated pension (RP).

- Carry out valorization.

- Apply a correction factor taking into account the indexations made.

Experience coefficient for calculating old-age pension

The value of the SC depends on the number of years of Soviet service. For men who have worked less than 25 years and women whose work experience does not exceed 20 years, the SC is 0.55. For each additional year above the established value, the applicant is entitled to an increase of 0.01.

Please note that the law limits the maximum value of the SK. Regardless of gender, length of service and nature of activity, it cannot exceed 0.75.

Example:

- The man has an official work experience of 16 years. Its SC will be 0.55.

- The woman worked for 23 years. Its SC is 0.58 (0.55 + 0.01 x 3 = 0.58).

- The woman’s work experience is 42 years. SC will be equal to 0.75. (0.55 + 0.01 x 22 = 0.77, which is more than the legally established indicator).

Salary coefficient

To determine the SSC, it is necessary to have data for any 60 months of employment. Having determined the average monthly income, the resulting value must be divided by the average salary for 2001–2002. in Russia (1,494.5 rubles). Regardless of the result obtained, the maximum ratio value is limited to 1.2. The exception is citizens who have experience in the RKS and PKS. Their KSZ varies from 1.4 to 1.9.

Example:

- The average citizen’s earnings for the selected period of employment was 1,600 rubles. KSZ = 1.07 (1,600 / 1,494.5 = 1.07).

- The average salary of the applicant for the selected time is 2,100 rubles. The KSZ will be 1.2 (2,100 / 1,454.5 = 1.4, which is higher than the legally established value).

- The average salary of a citizen with northern experience was 2,600 rubles. KSZ = 1.7 (2,8600 / 1,494.5 = 1.7).

Estimated pension value

Before calculating the estimated capital, it is necessary to determine the value of the RP. If the experience coefficient does not exceed 0.55, the formula is used:

RP = SK x KSZ x 1,671 – 450, where:

- 1,671 – average salary in the country for December 2001;

- 450 is the basic pension amount, which is determined by the law on labor pensions No. 173-FZ (12/17/2001).

The value (SC x KSZ x 1,671) cannot be less than 660. If during the calculation the amount received is lower, the value of the RP is determined at the minimum level - 210 rubles.

- Refrigerator seal - signs of damage or wear, repair and replacement at home

- Checking your phone by IMEI using a key combination in settings, on the device cover and the official website

- 7 things you should never do in the shower

When the applicant’s SC is higher than 0.55, the RP amount is calculated using a different formula:

RP = (SK x KSZ x 1,671 – 450) x St, where:

- ST for women = length of service before 2002, divided by 20;

- St. for men = length of service until 2002, divided by 25.

Important: if (SC x KSZ x 1,671) is less than 660, the value of 210 rubles is used in the calculation.

Example:

- A man has SV = 0.55, KSZ = 1.10. RP will be 560.96 rubles: (0.55 x 1.10 x 1,671) – 450 = 560.96.

- A woman has SF = 0.60 (25 years of experience), KSZ = 1.1. RP will be 816.08: (0.60 x 1.10 x 1,671 – 450) x (25 / 20) = 816.08 rub.

Valorization of pension points

The resulting value of the estimated pension is subject to a one-time increase - valorization. 10% is added to the RP amount. The valorization of a pension, taking into account Soviet experience - up to 1991 - involves an additional increase of 1% for each full year of work.

Example:

- RP = 600 rub. Experience before 1991 – 0 years. The valorization amount is 60 rubles. (600 x 10% = 60).

- RP = 600 rub. Experience before 1991 – 14 years. The valorization amount will be 144 rubles: 600 x (10% + 1% x 14) = 600 x 14% = 144 rubles.

The valorization of pension payments occurred for the first time on January 1, 2010. It affected all Russians - pension recipients who had work experience before 2002. The pension supplement was issued automatically, taking into account the information in the payment file. The goal is to recalculate payments to citizens whose pensions were accrued during Soviet times.