Work in progress - account in accounting

Main aspects of assessing work in progress and calculation formula

Cost increase factor

Work in progress account: what is the method for generating and writing off costs for losses

Work in progress in accounting - transactions transactions

In what account are balances recorded and how is work in progress from previous periods reflected?

Valuation of work in progress in tax accounting

Results

Work in progress - account in accounting

According to clause 63 of Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n “On approval of the Regulations on accounting…” in accounting, work in progress in accounting is considered to be products or work that have not completed the full cycle or all stages of the technological process. In addition, unfinished products include manufactured products that have not yet passed the necessary tests and technical acceptance or are not fully equipped.

According to paragraph 64 of the same order, the value of work in progress is reflected in accounting in several ways, namely by:

- planned or actual production cost;

- direct cost items;

- cost of used raw materials, semi-finished products and materials.

These methods relate to serial or mass production, and in single production, cost estimation is carried out on the costs actually incurred to manufacture the product.

According to paragraph 1 of Art. 319 of the Tax Code of the Russian Federation, work in progress is a product that is partially ready, that is, it has not gone through all the stages of technological processing that are provided for by the applied production process. Work in progress for tax accounting purposes includes not only products, but also semi-finished products of own production, as well as materials transferred to production if they have undergone any processing.

When accounting for work in progress, account 20 “Main production” is used, the debit of which collects all costs incurred during the production process. At the end of the month, the cost of finished products is written off from the credit of account 20, and the balance that remains in debit is work in progress.

If you have access to ConsultantPlus, check whether you correctly account for work in progress in accounting. If you don't have access, get a free trial of online legal access.

For more information about work in progress, see the material “Work in Progress in Accounting.”

Oil and gas abbreviations. Introduction to the subject

- Articles

- What a Translator Needs to Know

- Oil and gas abbreviations. Introduction to the subject

- 14.06.2019

- 3812

- 0

Lina Belonogova, a practicing simultaneous interpreter with 10 years of experience (English - Russian, oil and gas industry), reveals a useful list of oil and gas abbreviations.

In oil and gas translation there are a lot of abbreviations that are widely used, and which, without knowledge of the subject, can present difficulties for the translator, due to the specifics of the industry.

“At TBT it was discussed that BHA will be RIH with slower ROP that was indicated in the JSA.” Have you ever seen so many abbreviations in one sentence?

The fact is that traditionally in oil and gas, numerous processes, technologies and types of equipment have abbreviated names or are designated by abbreviations.

Using abbreviations saves time. Agree, it’s easier to say “ADB” instead of “Job Safety Analysis”. Or “ESP” instead of “electric centrifugal pump”.

True, this saving is relative. Because the same abbreviation can correspond to completely different concepts! For example, "ESP" stands for "Electrical Submersible Pump" and also stands for "Ensure Safe Production." Or “Software” is both “Software” and “Contractor”.

To correctly understand this or that abbreviation when translating, you need to refer to the context, but this, unfortunately, is not a panacea. And most often the translator has to “turn on his head” and solve puzzles...

Useful resources for translating oil and gas abbreviations

My advice, when faced with abbreviated names, is to look at resources where you can find the definition of oil and gas abbreviations. Here are some useful websites:

- • https://www.neftepedia.ru/dir/

- • https://www.megapetroleum.ru/sokrashheniya-naimenovanij-v-neftyanoj-promyshlennosti/

- • https://oilgasinform.ru/science/glossary/

True, there is one “but”. As a rule, abbreviations on such resources are given without translation. In addition, these dictionaries contain a lot of general abbreviations, which in practice are quite rare when translating documentation or at meetings.

So you definitely won’t find some specific abbreviations there.

Review of the most common oil and gas abbreviations

To help those who specialize in oil and gas translation, I've put together a cheat sheet: a quick overview of the most common oil and gas abbreviations and divided them into categories.

Small clarification. Please remember that the presence of an abbreviation in one language does not mean its presence in another.

Production facilities

| Abbreviation | Decoding | Translation | |

| UPN | Oil treatment plant | CPF | Central Processing Facility |

| PSN | Oil delivery point | CTF | Crude Transfer Facility |

| UPSV | Pre-water discharge installation | DHP | Dehydration plant |

| CGTU | Complex gas treatment plant | GPP | Gas processing/treatment plant |

| GTPP | Gas turbine power plant | PGP | Power Generation Plant |

| BKNS | Block cluster pumping station | BKNS | Water injection modular pump station |

| W.P. | Well pad | Well pad | |

| MPPS | Multiphase pumping station | MFNS | Multiphase pumping station |

Production processes

| Abbreviation | Decoding | Translation | |

| GIS | Well geophysical surveys | Well logging | |

| geological exploration | Geological exploration work | G.E. | Geology&Exploration |

| Cattle | Well overhaul | CWI | Completion and well intervention |

| PRS | Underground well repair | Well servicing | |

| PPD | Maintaining reservoir pressure | WI | Water injection |

| DNG | Mining of oil and gas | Oil and gas production | |

| SD | Shut down | Stop | |

| S.U. | Start up | Launch | |

Equipment names

| Abbreviation | Decoding | Translation | |

| ESP | Electric centrifugal pump | ESP | Electric submersible pump |

| BOO | Drilling rig | Drilling rig | |

| BRE | Emulsion separation unit | ETU | Emulsion treatment unit |

| UDH | Chemical dosing unit | CDU | Chemical dosage unit |

| AGZU | Automatic group metering unit | Wellpad metering unit | |

| OHL | Overhead line | Power lines | Power line |

| ESD | Emergency shutdown | GROOVE | Emergency protection system |

Technological transport

| Abbreviation | Decoding | Translation | |

| PPU | Steam mobile unit | Steam truck | |

| target audience | Cementing unit | Cement truck | |

| ATV | All terrain vehicle | All-terrain vehicle (GAZushka) | |

Documentation

| Abbreviation | Decoding | Translation | |

| ND | Work permit | PtW | Permit-to-work |

| ADB | Work safety analysis | JSA | Job safety analysis |

| PPR | Project of work production | Method statement | |

| PLA | Emergency Response Plan | ERP | Emergency response plan |

| TBT | Tool-box-talk | Briefing before starting work | |

| HO | Handover | Document on the transfer of cases (from shift to shift or from shift to shift) | |

Of course, this is not the entire list of oil and gas abbreviations, and it’s definitely not possible to fit all the abbreviations into one article. But I’m sure knowing these abbreviations will make your translation life much easier.

Lina Belonogova has worked for more than 7 years in the oil and gas industry. She worked with Gazprom, Salym Petroleum, Lukoil, Rosneft, Integra, Bashneft, Baker Hughes, Halliburton, etc., and also performed translations for the State Duma of the Russian Federation and the European Commission. In addition, Lina Belonogova is the founder of LinguaOil, the School of Oil and Gas Translation, as well as a speaker and participant in Translation Forum Russia.

Comments 0

To leave a comment, please log in or register

All articles

And you can’t argue: Lilianna Lungina

Crisis: what should a translator do, and is the oil crisis really that bad?

Professional Conduct of an Interpreter: Maintaining Image

Main aspects of assessing work in progress and calculation formula

The method that was chosen in the organization to determine the cost of products must be enshrined in the accounting policy. The financial result of the reporting period, as well as the amount of corporate income tax, largely depends on it.

Let's take a closer look at the methods for assessing work in progress that are used in accounting:

1. Valuation at planned (standard) cost

This method is based on the Standard Guidelines for the Application of the Standard Accounting Method dated January 24, 1983 No. 12, which reflects specific recommendations for application. It can be used in the production of complex products related to clothing, furniture, metalworking, engineering and similar industries with a long production cycle.

The accounting method at planned (standard) cost involves accurate accounting of available quantitative data on the balances of work in progress (hereinafter referred to as WP). It is based on the use of standards to account for all costs incurred, as well as deviations from standards in order to identify the causes and location of their occurrence.

Standard cost is a kind of accounting price, which is calculated for each group or type based on product cost calculations. In this case, the cost of work in progress is calculated as follows:

Cost of IR = Number of IR × Unit cost of IR.

2. Valuation at actual cost

With this method, a complete calculation of the cost of manufactured products is carried out, according to which the assessment of work in progress in accounting is done based on direct and indirect costs. This method should be applied to all types of products, and therefore it should be used if the enterprise has a fairly small range of products or works.

The actual cost of work in progress, as well as finished products, will be calculated using the formula:

Actual cost = direct costs + production overhead + general operating expenses.

3. Valuation based on the cost of raw materials

This method is also called the raw material method, and is most often used when production is considered material-intensive. At the same time, direct costs of raw materials and materials have the largest share in costs.

Read about accounting methods in the article “Basic methods of accounting for production costs.”

Stages of assessment of unfinished construction

The assessment of the ONS is carried out on the basis of technical specifications, an agreement with the owner or developer. For assessment activities, design, working and technical documentation, construction permits, and documents for the site are transferred. If the rights to the ONS have already been registered through Rosreestr, an extract from the Unified State Register is requested.

Study of rights to the object and site, reasons for termination of construction

The cost indicators of the ONS are influenced by the legal status of the site, the stage of construction of the building, and the reasons for the suspension or termination of construction. At the initial stage, specialists study:

- availability of ownership or lease rights to the site, the market price of land in the city and region;

- availability of construction permits and other documents allowing work to continue without additional approvals;

- the reason and date of completion of construction (for example, revocation of a construction permit due to violation of the joint venture or design documentation will significantly affect the results of the assessment);

- rights to ONS, if it was registered with Rosreestr.

Many factors can influence the outcome of the assessment. For example, if the OHC is located on a leased property, and the lease term is close to expiration, the owner may have serious problems with renewal. In this case, the final cost will be lower than that of a similar property on your own land.

Determination of the exact technical indicators of the ONS

The final cost of unfinished construction is directly affected by the technical characteristics of the building:

- the date of completion or suspension of work, as this affects wear rates;

- percentage of project completion, which affects the cost of completion;

- the degree of completion of each element of construction or work;

- the composition and quality of the actually erected structures (if, based on the results of the assessment, a decision is made to complete construction, replacement of materials and structures may be required);

- area, number of floors and other standard technical characteristics of the ONS.

Determination of technical indicators is carried out based on the results of surveys, submitted documents, estimates and calculations.

The assessment can be carried out at any stage of construction in progress

Selection and use of methods, assessment of ONS

According to the above rules, specialists must determine the assessment methodology and approach and justify them in the final document. The accuracy and correctness of the results obtained depends on this. During the assessment process, experts:

- analyze design, estimate and working documentation, determine the reliability and compliance of the actual volume of work performed;

- check the correctness of calculations, the reliability of the cost of materials and equipment;

- determine the reasons for deviations from the project and estimates;

- make a forecast of possible deviations from the design and estimate documentation as work continues.

Based on research and inspections, a conclusion will be drawn not only about the cost of the ONS, but also the choice of the optimal option for using the facility. Based on the results of the assessment, a decision can be made to complete the work on the original project, to preserve the completed part of the building and to complete construction according to new design documentation. The assessment may also lead to conclusions about the need for demolition (dismantling), cleaning the site and using it for another purpose.

Cost increase factor

It is necessary to talk separately about the cost increase coefficient, which is a characteristic of the increase in costs per unit of production as the technological cycle progresses. It is used when it is necessary to determine how certain costs that have dynamics increase, for example, wages, electricity, depreciation of fixed assets.

The rise factor (K) is calculated using the following formula:

K = Cost of a unit of production in NP / Total amount of production costs.

This is the most general formula that reflects the basic essence of the coefficient.

IMPORTANT! In practice, more complex calculations based on the above formula can be used for different types of production. This depends on the purpose of the calculation and the characteristics of the production process itself.

Technical specifications

- The VRG cable, whose characteristics were initially designed for operation primarily in stationary 660-volt AC power networks, can also operate without restrictions in DC power supply systems with a maximum operating voltage of up to 1 kV. There are also options with increased operating voltages of 1 and 3 kV.

- The cable differs from its functional analogues in its good resistance to short circuits, including repeated ones. It allows the possibility of a short-term increase in the temperature of the conductors up to 200 ° C with a maximum long-term temperature of 70 ° C at full load.

- Operating temperature range – from -50 to +50°С, maximum humidity 98% at a temperature not exceeding 35°С.

- The smallest bending radius is 7.5 outer diameters. The difference in heights along the laying route is not limited.

Work in progress account: what is the method for generating entries and writing off expenses for losses

At the end of the month, in order to identify the balance on account 20, you should take into account the costs that were incurred during the production process. It is necessary to understand that it accumulates all costs, both direct (attributable directly to the technological process) and indirect, also associated with production (general production and general economic).

The amount received in the debit of account 20 is the cost of manufactured products. It can be of 2 types:

- full, including direct, general production and general economic costs;

- reduced, including direct and general production costs.

IMPORTANT! The method for determining the cost of production must be enshrined in the accounting policy of the enterprise.

Then the generated cost of finished products is transferred to account 40 “Product Output”, account 43 “Finished Products” or account 90 “Sales”. Account balance 20 is work in progress.

Remains of work in progress can be used next month or written off to account 91.2 “Other income and expenses.” An example of such a situation is management’s decision that unfinished material assets in the future will not be used in the manufacture of products due to the abandonment of their production. Another situation may be the liquidation of the enterprise itself, and therefore the remaining unfinished products are written off as company expenses.

For more information about writing off work in progress, read the material “Procedure for writing off work in progress (nuances).”

Account correspondence

Unfinished construction of real estate assets is displayed at the time of the reporting calendar date in section 1 of the assets of the balance sheet as part of a complex item, which consists of residual funds in such accounts as 07 “Equipment to be installed”, 08 “Investments in non-current assets”, 60 “Payment for the services of contractors and the supply of materials to suppliers”, subaccount “Payment for issued advance accruals” - in the area of the balance of the advance payment transferred to both contractors and suppliers as payment for expenses directly related to construction work.

The process of accounting for financial costs for unfinished construction is carried out by developers who act as investors who are engaged in the construction of buildings for personal needs. In addition, accounting can also be kept by developers who act as customers, subject to the clauses of the agreement drawn up with investors to obtain the rights to ensure the organization of the process of construction of real estate.

If the construction process is carried out using the economic method, then the actual capital costs (purchase of building materials, payment of construction workers, operation and maintenance of special construction installations, mechanisms and vehicles) must be taken into account in account 08 “Investments in non-current assets”, as well as on the subaccount “Construction of fixed assets”.

The procedure for accounting for financial expenses for unfinished construction of real estate is carried out by the developer, who at the same time acts as an investor. This accounting is kept completely separate from the accounting of a commercial organization in the area of its main activity. All economic transactions related to the write-off of various costs are reflected in the debit of account 08.3 “Construction of fixed assets”.

Accounting for construction in progress in the accounting of an enterprise helps to minimize financial costs by understanding the level of financial investments in the construction of real estate and various activities associated with this process.

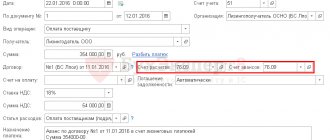

Work in progress in accounting - transactions transactions

As mentioned earlier, for accounting of work in progress, account 20 “Main production” is used. To account for all transactions, the following entries are made:

- Dt 20 Kt 02, 10, 23, 25, 26, 60, 69, 70 - costs attributable to the production of products or performance of work are taken into account;

- Dt 40, 43, 90 Kt 20 - the cost of finished products or work performed is written off.

The balance resulting from the debit of account 20 after write-offs is the amount of work in progress.

Read more about account 20 in the material “Costs in work in progress - main account.”

Accounting and tax accounting

Unfinished objects in the amount of costs incurred for their construction are taken into account on account 08 under subaccount 3. The account is active. Expense transactions are reflected in debit transactions. All amounts accumulated during the construction period are written off against the loan upon commissioning of the asset. Typical wiring:

- Contract work accepted by the customer – D08.3 – K60.

- D19 – K60 - reflects the amount of accrued VAT.

In the balance sheet form approved by Order of the Ministry of Finance dated July 2, 2010 No. 66n, the cost of unfinished construction is shown as part of fixed assets. Line 1130 is intended for this (section 1 in the reporting form asset). Additionally, a breakdown of the cost of unfinished objects is compiled.

If you decide to sell the unfinished building to third parties, VAT is charged on its value. The tax base is the size of the price reflected in the contractual documentation. The transaction is formalized by a purchase and sale agreement. The proceeds received are accounted for in the period in which the asset was transferred to the buyer on the basis of the act. Profit is shown by the date of registration of ownership rights by the party acquiring the object.

The sale will be accompanied by the preparation of the following corresponding records:

- D62 – K91.1 – posting confirming the recognition of income from the transaction for the sale of unfinished construction;

- D91.2 – K68 – reflects VAT accrued on the contract price;

- D91.2 – K08.3 – the cost of an unfinished asset that is being sold is taken into account.

FOR YOUR INFORMATION! The disadvantage of the current taxation scheme is evident for simplifiers. They will have to include the entire proceeds in the tax base, which will significantly increase the value of the tax liability.

In what account are balances recorded and how is work in progress from previous periods reflected?

So, from all of the above it is clear that the balance of work in progress is the balance of account 20, which is transferred from the end of the previous period to the beginning of the next. Thus, this amount does not leave the specified account if further use of work in progress in the technological process is planned.

It should be noted that if production has a long cycle, for example several months, then work in progress will move from one month to another until it reaches the readiness stage.

VAT for contract construction

An organization that carried out construction and installation works for its own needs with the help of a contractor has the right to deduct the VAT charged to it without waiting for the completion of capital construction. That is, at the time the objects are reflected on account 08, as the contractor presents invoices and certificates of work performed in the KS-2 form

VAT for economic construction method

Carrying out construction and installation work for one’s own consumption is recognized as an object of VAT taxation (clause 3, clause 1, article 146 of the Tax Code of the Russian Federation). When performing construction and installation work (C&E) for one’s own consumption, the tax base is determined as the cost of the work performed, calculated on the basis of all actual expenses of the taxpayer for their implementation, including the expenses of the reorganized (reorganized) organization (clause 2 of Article 159 of the Tax Code of the Russian Federation). Moreover, VAT is calculated on the last day of each tax period (quarter) (Clause 10, Article 167 of the Tax Code of the Russian Federation).

At the same time, accrued VAT is accepted for deduction (clause 6 of Article 171, clause 5 of Article 172 of the Tax Code of the Russian Federation). It turns out that VAT for construction on your own does not need to be transferred to the budget; it is equal to zero.

Example: A plant is building a workshop using an economic method; during the tax period, the amount of work amounted to 5 million rubles. The organization charged VAT in the amount of: 5,000,000 *18% =900,000 rubles.

Debit 19 Credit 68 - 900,000 rub. — VAT is charged on construction and installation work performed for own consumption. An invoice is drawn up (in 1 copy) and registered in the sales book.

Debit 68 Credit 19 - 900,000 rub. accepted for VAT deduction on completed construction and installation work. The invoice is recorded in the purchase ledger.

The object under construction is intended to be used in activities subject to VAT and is not intended for sale.

Valuation of work in progress in tax accounting

In accordance with Art. 319 of the Tax Code of the Russian Federation, work in progress in tax accounting means:

- products or work that have been produced but not yet accepted by the customer;

- balances of unfulfilled orders;

- semi-finished products of own production;

- raw materials or materials that have been sent to production and have undergone any processing.

The assessment of work in progress in tax accounting is carried out at the end of the month, using data on balances in quantitative terms by type of product, as well as the amount of direct costs incurred this month. Work in progress balances identified at the end of the tax period are carried forward to the beginning of the next one and are included in direct costs.

This transformation of work in progress into direct costs is possible if certain conditions are met, namely:

- The costs incurred must necessarily correspond to the products for the manufacture of which they were made. It is necessary to relate costs to a specific type of product, but if this is not possible, a mechanism for allocating costs across different types of products should be developed.

- The mechanism for allocating costs by type of product and the method for estimating work in progress balances must be enshrined in the accounting policy.

- This procedure for distributing costs by type of product must be used for at least 2 tax periods.

Find out about the tax consequences of operating an unfinished construction project in ConsultantPlus. Learn the material by getting trial access to the system for free.

Problems and difficulties in assessing unfinished construction

In the process of assessment activities on the ONS, the following problems and difficulties may arise:

- discrepancy between technical characteristics and scope of work performed with design and estimate documentation;

- lack of supply and demand market for ONS, which complicates the determination of the real market value;

- the complexity and volume of the object, which entails an increase in cost and a delay in the assessment period;

- lack of permits for the site or object, which will affect the accuracy of the assessment.

By contacting us, you will not have any problems receiving an objective and reliable report on the assessment of unfinished construction. We always guarantee the quality of our work and are responsible for its results!

Results

The following can be said about work in progress in accounting: these are material costs that have already gone into production, but have not yet gone through all stages of the production process, and therefore cannot be considered finished products.

The value of work in progress balances can be assessed using one of several methods, which must be enshrined in the accounting policies of the enterprise. You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Registration of ownership

In order to sell (transfer) an unfinished construction project, an organization is required to register ownership of it as a real estate asset (Articles 130, 131 of the Civil Code of the Russian Federation, Article 4 of Law No. 122-FZ of July 21, 1997).

Such registration is possible only if the contract with the contractor has already been terminated (clause 16 of the appendix to the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated February 16, 2001 No. 59). If ownership of an unfinished construction project is not registered, transactions with it are illegal (see, for example, resolutions of the Federal Antimonopoly Service of the Volga District dated March 21, 2006 No. A12-4486/05-C47, West Siberian District dated March 20, 2006. No. F04-1130/2006 (20855-A45-5), Volga-Vyatka District dated May 23, 2007 No. A43-29587/2006-28-626). This procedure follows from subparagraph 22 of paragraph 1 of Article 333.33 of the Tax Code of the Russian Federation, articles 16 and 25 of the Law of July 21, 1997 No. 122-FZ and paragraph 16 of the appendix to the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation of February 16, 2001 No. 59.