Let's get acquainted with the balance sheet items for 2020: their codes and explanations

New balance sheet assets (line 1100, 1150, 1160, 1170, 1180, 1190, 1200, 1210, 1220, 1230, 1240, 1250, 1260, 1600)

New balance liabilities (lines 1300, 1360, 1370 1410, 1420, 1500, 1510, 1520, 1530, 1540, 1550, 1700)

Assets of the old balance sheet (lines 120, 140, 190, 210, 220, 230, 240, 250, 290, 300) and its liabilities (lines 470, 490, 590, 610, 620, 700)

How to decipher balance sheet asset lines

Interpretation of individual balance sheet liability indicators

Line 12605 - what is it?

Where is line 2110 for revenue?

Results

Let's get acquainted with the balance sheet items for 2020: their codes and explanations

Everyone who has ever held a balance sheet in their hands, much less drawn it up, paid attention to the “Code” column. Thanks to this column, statistical authorities are able to systematize the information contained in the balance sheets of all companies. Therefore, it is necessary to indicate codes in the balance sheet only when this report is submitted to state statistics bodies and other executive authorities (Article 18 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, clause 5 of the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n). If the balance is not annual and is needed only by owners or other users, it is not necessary to indicate the codes.

Note! From 06/01/2019, the balance sheet form is valid as amended by Order of the Ministry of Finance dated 04/19/2019 No. 61n.

The key changes in it (as well as in other financial statements) are as follows:

- now reporting can only be prepared in thousand rubles, millions can no longer be used as a unit of measurement;

- OKVED in the header has been replaced by OKVED 2;

- The balance sheet must contain information about the audit organization (auditor).

The auditor mark should only be given to those companies that are subject to mandatory audit. Tax authorities will use it both to impose a fine on the organization itself if it ignored the obligation to undergo an audit, and in order to know from which auditor they can request information on the organization in accordance with Art. 93 Tax Code of the Russian Federation.

In the balance sheet, line codes from 2014 must correspond to the codes specified in Appendix 4 to Order No. 66n. At the same time, outdated codes from the expired order No. 67n with the same name, dated July 22, 2003, are no longer applied.

It is not difficult to distinguish previously used codes from modern ones - by the number of digits: modern codes are 4-digit (for example, lines 1230, 1170 of the balance sheet), while outdated ones contained only 3 digits (for example, 700, 140).

For information on what the form of the current balance sheet with line codes looks like, read the article “Filling out Form 1 of the balance sheet (sample)” .

How to avoid getting into bondage

Whether there is a need for additional investments obtained through a loan is decided at the management level.

Such income can solve the problem of purchasing expensive equipment or the necessary expansion of production. But with a new loan, the company also receives certain obligations. In this situation, the main thing to consider is whether the company will be able to pay for them. As the saying goes, “you take someone else’s, but give back your own,” and that is why you should conduct a detailed analysis of the balance sheet lines on which credit obligations are displayed. Assess the current need for new investments. Taking out a loan is not difficult, the main thing is not to use this channel if there is any slight lack of funding. Otherwise, you can fall into banking bondage.

One of the methods for analyzing the creditworthiness of an enterprise is to calculate the financial dependence ratio. To do this, divide your total equity by your total debt obligations. The result of the calculation will indicate the following:

- If the result is a number that is a multiple or greater than “1,” then the company is steadily afloat, and it is possible to attract additional investments by concluding a loan agreement.

- If the calculated value is significantly less than “1”, then there is a high probability that the enterprise will fall into debt. In this case, the company will work only to repay loan obligations and interest on them, without generating income to its founders.

How to decipher balance sheet asset lines

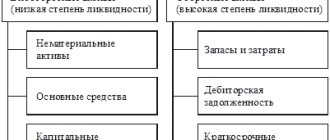

Before deciphering an asset item, let’s consider its code - it carries certain information. So, the first digit shows that this line refers to the balance sheet (and not to another accounting report); 2nd - indicates the section of the asset (for example, 1 - non-current assets, etc.); The 3rd digit reflects assets in increasing order of their liquidity. The last digit of the code (initially it is 0) is intended to help in line-by-line detailing of indicators considered significant - this allows you to fulfill the requirement of PBU 4/99 (clause 11).

NOTE! The requirement for detail may not be fulfilled by small businesses (clause 6 of Order No. 66n).

Read about what distinguishes accounting carried out by small businesses in the material “Features of accounting in small enterprises” .

The asset lines of the balance sheet with codes and explanations are shown in the table:

| Line name | Code | Decoding the string | |

| By order No. 66n | By order No. 67n | ||

| Fixed assets | 1100 | 190 | The total amount of non-current assets is reflected |

| Intangible assets | 1110 | 110 | The information reflected in lines 1110–1170 is explained in the notes to the statements (information on the availability of assets at the reporting dates and changes for the period is disclosed) |

| Fixed assets | 1150 | 120 | |

| Profitable investments in material assets | 1160 | 135 | |

| Financial investments | 1170 | 140 | |

| Deferred tax assets | 1180 | 145 | The debit balance of account 09 is indicated |

| Other noncurrent assets | 1190 | 150 | Filled in if there is information about non-current assets that are not reflected in the previous lines |

| Current assets | 1200 | 290 | The final result of current assets is determined |

| Reserves | 1210 | 210 | The total balance of inventories is given (debit balance of accounts 10, 11, 15, 16, 20, 21, 23, 28, 29, 41, 43, 44, 45, 97 without taking into account the credit balance of accounts 14, 42) |

| Value added tax on purchased assets | 1220 | 220 | Indicate account balance 19 |

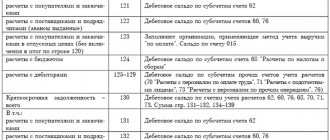

| Accounts receivable | 1230 | 240 | The result of adding the debit balances of accounts 60, 62, 68, 69, 70, 71, 73, 75, 76 minus account 63 is reflected |

| Financial investments (excluding cash equivalents) | 1240 | 250 | The debit balance of accounts 55, 58, 73 (minus account 59) is given - information on financial investments with a circulation period of no more than a year |

| Cash and cash equivalents | 1250 | 260 | The line contains the balance of accounts 50, 51, 52, 55, 57, 58 and 76 (in terms of cash equivalents) |

| Other current assets | 1260 | 270 | Filled in if data is available (for the amount of current assets not indicated in other lines of the section) |

| Total assets | 1600 | 300 | Total of all assets |

You can see line-by-line comments on filling out the balance sheet, including asset lines, in the ConsultantPlus system. Get trial access to the system for free and proceed to the explanations.

Cost of borrowed capital: formula for balance sheet as a percentage

So, borrowed capital is a set of obligations to external creditors. Such capital is a very impressive resource, often necessary for the development of a company. But since this source is still not the property of the company and must be returned, its volume must be strictly controlled.

Therefore, the borrowing company should calculate the cost of borrowed capital, which is a fee for using borrowed funds, i.e. the percentage that the company will pay for raising such funds. The formula for the cost of borrowed capital is the ratio of the amount of interest paid for the year (line 2330 on the “Report on Financial Results”) to the total amount of borrowed capital (the sum of lines 1400 and 1500 on the balance sheet).

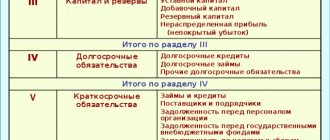

Interpretation of individual balance sheet liability indicators

Liability codes are also 4-digit: the 1st digit is the line’s belonging to the balance sheet, the 2nd is the number of the liability section (for example, 3 is capital and reserves). The next digit of the code reflects obligations in order of increasing urgency of their repayment. The last digit of the code is for detail purposes. Total liabilities in the balance sheet are line 1700 of the balance sheet. In other words, total liabilities in the balance sheet are the sum of lines 1300, 1400, 1500.

Liability items of the balance sheet with codes and explanations are shown in the table:

| Line name | Code | Decoding the string | |

| By order No. 66n | By order No. 67n | ||

| TOTAL capital | 1300 | 490 | The line contains information about the company's capital as of the reporting date |

| Authorized capital (share capital, authorized capital, contributions of partners) | 1310 | 410 | Information on lines 1300–1370 is detailed in the statement of changes in equity and the statement of financial results (in terms of net profit for the reporting period). The company has the right to determine the additional amount of explanations about capital. |

| Revaluation of non-current assets | 1340 | 420 | |

| Additional capital (without revaluation) | 1350 | ||

| Reserve capital | 1360 | 430 | |

| Retained earnings (uncovered loss) | 1370 | 470 | |

| Long-term borrowed funds | 1410 | 510 | The information is deciphered in tabular (Form 5) or text form in the explanations to the balance sheet |

| Deferred tax liabilities | 1420 | — | Indicate the credit balance of account 77 |

| Estimated liabilities | 1430 | — | The credit balance of account 96 is reflected - estimated liabilities, the expected fulfillment period of which exceeds 12 months |

| Other long-term liabilities | 1450 | 520 | Provides information about long-term liabilities not indicated in the previous lines of the section |

| TOTAL long-term liabilities | 1400 | 590 | The final result of long-term liabilities is reflected |

| Short-term debt obligations | 1510 | 610 | Account credit balance 66 |

| Short-term accounts payable | 1520 | 620 | The total credit balance of accounts 60, 62, 68, 69, 70, 71, 73, 75, 76 is reflected. The information is deciphered in the notes to the balance sheet (for example, in Form 5) |

| Other current liabilities | 1550 | 660 | Filled in if not all short-term liabilities are reflected in other lines of the section |

| Total current liabilities | 1500 | 690 | The total total of short-term liabilities is indicated |

| Liabilities of everything | 1700 | 700 | Summary of all liabilities |

ConsultantPlus experts have prepared a line-by-line commentary on filling out the balance sheet, including liability lines. If you don't have access to K+, get it for free.

Read about what characterizes simplified accounting in the article “Simplified reporting for small businesses.”

Credit balance of account 66 + Account balance 67

Redistribution of debt obligations

Each enterprise has the opportunity to transfer obligations that have a long maturity period to a short-term basis. This is acceptable when there are no more than 12 monthly payments remaining on the loan.

Important! Debt with a payment term exceeding 12 months cannot be included in accounts intended to reflect short-term loans and credits.

Overdue debt

When the borrower fails to repay the next payment on time, the accountant needs to transfer the remaining loan obligations to the status of overdue debt. In this case, the company may incur additional expenses:

- Paid consultations with credit experts.

- Verification of the loan agreement by third party specialists.

- Fines and penalties provided by the lender for late payments.

- Other expenses not covered by banking services.

Results

Decoding the balance sheet allows users to extract as much useful information as possible from its meager figures. For automated processing of data from accounting reports carried out by statistical authorities, accounting lines are encoded.

Sources:

- Federal Law of December 6, 2011 N 402-FZ “On Accounting”

- Order of the Ministry of Finance of Russia dated July 2, 2010 N 66n

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

What is considered borrowed funds?

Depending on the type of organization that lent financial resources, they can be divided into two types:

- Loans.

- Loans.

The difference between types lies in the source of funding. Loans can only be provided by specialized organizations, that is, banks and other financial organizations. Loans can be issued by almost any legal entity and even an individual.

A loan is issued for the purpose of generating income for the lender, that is, at monetary interest. Loans can be interest-free. There is no benefit for a lender to risk their money without even receiving additional income. Therefore, an interest-free loan is found among affiliated and interdependent persons when several companies are united:

- to a corporation;

- holding;

- group.

Thus, you can divide the loans:

- external;

- internal.