Forms of personalized accounting

Since 2020, changes have come into force in the accounting procedure for insurance premiums, which employers calculate from payments to their employees. Control over their accrual and payment was transferred to the Federal Tax Service. In this regard, the reporting submitted to the Pension Fund was also reformed. The reporting provided to the Pension Fund of the Russian Federation is necessary for organizing the registration of citizens in the pension system, monitoring the insurance period, and tracking the right to assign an early pension. Resolution of the Board of the Pension Fund of the Russian Federation No. 507p dated December 6, 2018 approved the personalized report forms that are still used today:

- SZV-STAGE;

- SZV-ISH;

- SZV-KORR;

- EDV-1.

Let us dwell in more detail on what the rules for filling out EFA-1 for 2020 are.

SZV-STAZH: to whom information is submitted

The SZV-STAZH form is filled out for insured persons with whom the following agreements were concluded in the reporting year (clause 1.5 of the Procedure, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 N 3p (hereinafter referred to as the Procedure)):

- employment contracts;

- GPA for the performance of work/provision of services;

- copyright contracts in favor of the authors of works under agreements on the alienation of the exclusive right to works of science, literature, art, publishing license agreements, license agreements on granting the right to use works of science, literature, art.

Who takes EFA-1 in 2020 and when?

Personalized accounting forms are provided to the Pension Fund. All organizations and individual entrepreneurs that hire employees are required to do this:

- under employment contracts;

- under civil law contracts.

Employers-insurers are required to calculate and pay insurance premiums from the remuneration paid to employees in accordance with the rules of Chapter 34 of the Tax Code of the Russian Federation. Insurance premiums, among other things, are paid for compulsory pension insurance.

The reporting form in question is not an independent document. It is an additional inventory form to the main report. Thus, the due date coincides with the due date for the main forms listed above - until 03/01/2020 (in 2020, March 1 fell on a Sunday, which means the due date is postponed to March 2). In addition, it will have to be prepared if the employee has applied for a pension.

Current EFA-1 form and deadlines

In 2020, with SZV-STAZH for 2020, EDV-1 must be submitted in the form that was approved by Resolution of the Pension Fund of the Russian Federation of December 6, 2018 No. 507p. Let us remind you that the new form of SZV-STAZH was approved by the same resolution.

The following is a free EFA-1, current in 2020 for the 2020 report:

Since EDV-1 is submitted only together with SZV forms, the deadlines and procedure for submitting them are the same. For example, ODV-1 with SZV-STAZH for 2019 must be submitted no later than 03/01/2020 and only through TKS channels, if the number of insured persons in SZV-STAZH exceeded 24 people. If the number of people included in the SZV-STAZH for 2020 was 24 or less, then the SZV-STAZH and the accompanying EFA-1 report can be generated and submitted on paper.

Determining the type of information

Filling out the EDV-1 form for 2020 is necessary when providing other forms of personal accounting: SZV-STAZH, SZV-ISKH and SZV-KORR. The rules for filling it out depend on which of these reports the inventory is compiled for. Let's look at the EFA-1 report, how to fill it out, step by step.

In any case, filling out a report begins with determining its type. Reporting can be:

- Initial - submitted upon initial submission complete with the main document.

- Corrective - provided if corrections need to be made to section 5 of the original form.

- Cancellation - provided if you need to cancel the data specified in the original form in section 5.

The type of form provided must be indicated by placing an “X” in the appropriate box.

Step-by-step instructions for filling out

We present step-by-step instructions on how to fill out the EFA-1 report for 2018 using a specific example. GBOU DOD SDYUSSHOR "ALLUR" provided a report SZV-STAZH for 24 people:

- We enter information in the first section of the report. We fill in the registration number assigned to the reporting organization in the Pension Fund, Taxpayer Identification Number (INN) and KPP, and write down the short name.

- We fill out the reporting period in accordance with the above-mentioned classifier. We also note the type of information in the accompanying inventory.

- In the third section of the accompanying document, we fill in the number of insured persons for whom reporting information has been prepared in the Pension Fund of Russia, broken down by reporting forms.

Please note that when submitting the SZV-STAZH form, only the first three sections are filled out. How to fill out the report, read the article “Sample for filling out SZV-STAZH”, and EDV-1 - an example for downloading below.

Let's briefly talk about some aspects of filling out EDV-1:

- When submitting the initial form SZV-STAZH in the EDV-1 form, a mark is placed on the type of information “Initial”.

- Section 1 “Details of the policyholder submitting the documents” EDV-1 is filled out in the same way as section 1 “Information about the policyholder” of the SZV-STAZH form.

- In section 2 “Reporting period (code)” you must enter “0” (for reporting periods starting from 2020) and the year for which EFA-1 is being submitted.

- The number of insured persons in section 3 is indicated in accordance with this number in SZV-STAZH.

- When submitting EDV-1 along with the SZV-STAZH form, section 4 of EDV-1 is not filled out.

- Section 5 must be completed if the SZV-STAZH form (with information type - ISH) contains information about insured persons employed in the types of work specified in paragraphs. 1 - 18 hours 1 tbsp. 30 of the Federal Law of December 28, 2013 N 400-FZ.

Sections that are always filled

Sections 1, 2 and 3 are completed regardless of which main report the inventory is attached to.

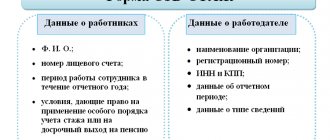

Section 1 reflects information about the reporting organization or individual entrepreneur:

- registration number in the Pension Fund of Russia: has 12 characters and is assigned when registering a company with the Pension Fund of Russia;

- TIN and checkpoint;

- name of the insured.

Section 2 is intended to indicate the period for which reports are submitted. It must indicate the year. And a coded designation of the time period for which the report is provided:

- quarter;

- half year;

- year;

- another time interval for which reporting was to be submitted.

Currently, the SZV-STAZH report is submitted once a year, so the reporting period code in EFA-1 for this report is always 0. A complete list of reporting period codes for previous years can be found by referring to the appendix to the procedure for filling out personalized accounting forms.

Section 3 is intended to indicate the number of persons for whom information is filed in the main report. Opposite the name of the corresponding form indicated in column 1, we reflect the number of insured persons in column 2. Only one line is filled in in this tabular part.

Who must report on the SZV-STAZH form

The employer’s obligation to annually report on the insured persons within the framework of personalized accounting is provided for in paragraph 2 of Art. 11 of the Law of 04/01/1996 No. 27-FZ (as amended on 12/28/2016), for this purpose a new reporting form SZV-STAZH was developed (adopted by Resolution of the Pension Fund Board of 01/11/2017 No. 3p, Appendix No. 1). The report contains information for each employee: about his period of work, accrual and payment of insurance “pension” contributions in the reporting year.

Filling out the SZV-STAZH for 2020 is mandatory for all organizations, individual entrepreneurs, private lawyers and notaries who have employees under employment and civil law contracts, for whose remuneration “pension” insurance contributions are accrued. It is necessary to submit the SZV-STAZH form even if in the reporting year no remuneration was paid to employees under existing contracts, or all employees were dismissed.

Representatives of the Pension Fund of the Russian Federation in Resolution No. 3p dated January 11, 2017 determined the circle of people who take EFA-1 in 2020.

These include all insurers who provide personalized accounting information for their employees. That is, all organizations and individual entrepreneurs, as well as persons engaged in private practice (lawyers, notaries, detectives), who report to the Pension Fund of the Russian Federation in the following forms:

- SZV-STAGE;

- SZV-KORR;

- SZV-ISH.

These reporting forms are annual, however, when an employee retires, the SZV-STAZH report will have to be submitted early. In such a situation, there is no need to generate an accompanying statement EDV-1.

Please note that private owners and individual entrepreneurs who do not have employees and pay insurance premiums exclusively for themselves do not have to submit this reporting form.

When section 4 EDV-1 is filled out

This part of the inventory is filled out only if it is submitted together with SZV-ISH or SZV-KORR reports with the “special” type. It contains information about the calculation and payment of insurance premiums for the reporting period. These reporting forms are submitted for periods up to 2020. During these periods, policyholders transferred information about paid contributions to compulsory pension insurance directly to the Pension Fund. Starting from 2020, calculations for insurance premiums are transferred to the Federal Tax Service.

If there is a need to adjust information about accrued contributions for one employee, this entails changes in information about accruals and debts for the entire policyholder as a whole. In order for the Pension Fund to be able to correctly correct information previously submitted by the company, Section 4 is intended.

Let's show with an example how to fill out section 4 of EFA-1. The company submitted the DAM to the Pension Fund for 2020 with the following data:

| 2016 | Debt at the beginning of the reporting period, rub., kopecks. | Insurance premiums accrued, rub., kopecks. | Insurance premiums paid, rubles, kopecks. | Debt at the end of the reporting period, rub., kopecks. | ||

| Total | For 2020 | For 2020 | ||||

| For the insurance part of the pension | 100 000,00 | 2 000 000,00 | 1 950 000,00 | 100 000,00 | 1 850 000,00 | 150 000,00 |

In 2020, it was discovered that information had not been filed for one employee. According to it, for 2020, contributions were calculated for the insurance part of the pension in the amount of 10,000 rubles. The organization submits information for this employee using the SZV-ISH form and fills out section 4 of the inventory as follows:

Penalties for late submission or errors in EFA-1

Liability can be applied for various types of violations:

- The Pension Fund will not accept reports on forms SZV-STAZH, SZV-KORR, SZV-ISKH, which the policyholder sent by mail without EDV-1. In this case, as well as if inaccuracies or errors are found in EDV-1, the Pension Fund of the Russian Federation will send the policyholder a notice to eliminate the shortcomings - they must be corrected within 5 working days (Part 5 of Article 17 of the Law of 01.04.1996 No. 27-FZ “On individual (personalized) accounting...").

- If the reports SZV-STAZH, SZV-KORR, SZV-ISKH are submitted late, the policyholder will be fined. The fine will be 500 rubles. for each employee for whom a report was filed or should have been filed (paragraph 3 of Article 17 of Law No. 27-FZ dated April 1, 1996).

- If the report is submitted on paper, and the number of employees is 25 or more, then the policyholder will be fined 1,000 rubles.

- If personalized accounting information is not submitted to the Pension Fund on time or is submitted incompletely, officials will be fined 300–500 rubles. (Article 15.33.2 of the Administrative Code).

How to fill out section 5 of the EFA-1 form

This section is filled out by policyholders when submitting the initial SZV-STAZH or SZV-ISKH only if the information contains data on employees who have the right to early assignment of a pension. Such persons include:

- those employed in hazardous and difficult working conditions;

- public transport drivers;

- civil aviation employees;

- professional rescuers, fire service workers;

- those employed in work with convicts;

- other persons named in paragraphs 1-18 of part 1 of article 30 of the Federal Law of December 28, 2013 No. 400-FZ.

Section 5 contains data on the number of such workers, their positions, codes of special working conditions and codes corresponding to positions from lists No. 1 and No. 2 of professions that give the right to preferential pensions (Resolution of the Cabinet of Ministers of the USSR dated January 26, 1991 No. 10).

SZV-STAZH: form

From January 1, 2020, a new EFA form is in effect. Therefore, you need to report for 2020 using an updated form.

You can fill out the EDV-1 form for free in the Bukhsoft program. The program will collect reports automatically.

Fill out EDV-1 online

The form is submitted when submitting personalized accounting reports to the Pension Fund. This document is not an independent report, but refers to accompanying forms containing information on the policyholder as a whole. Can contain the information type "Original", "Correcting" or "Cancelling". That is, it must be prepared only when submitting forms SZV-STAZH, SZV-KORR and SZV-ISKH. EFA-1 summarizes the data provided in the listed reports.

Since the form in question is not an independent report, the deadlines for its submission coincide with the deadlines for submitting the above documents. For example, the SZV-STAZH and EDV-1 set for 2019 must be submitted before 03/01/2020. Also, these documents are submitted, if necessary, during the year if the employee has applied for a pension. In this case, the report is provided within three days from the date of submission of the application.

| Set of documents | Situation |

| ODV-1 SZV-STAZH |

|

| ODV-1 SZV-ISKH |

|

| ODV-1 SZV-KORR |

|

It is not always necessary to fill out all sections of the form.

Fill in the details. The first section contains information about the policyholder:

- registration number in the Pension Fund of Russia;

- TIN;

- checkpoint;

- short title.

The second section includes information about the reporting period and report type. The reporting period code in EFA-1 for 2020 is “0”.

We provide information about the insured persons. The third section contains information on the number of insured persons for whom reporting is submitted.

Section 4 of EDV-1 must be completed when providing SZV-ISH or SZV-KORR with the “special” type. When wondering how to fill out section 4 of EDV-1, it is worth remembering that when submitting SZV-STAZH you do not need to fill it out. It reflects information about paid and accrued insurance premiums.

Section 5 of the EDV-1 form is filled out when submitting information about employees who are retiring early, in accordance with Article 30 of Federal Law No. 400 of December 28, 2013. Provided in combination with SZV-STAZH and SZV-ISKH.

The budgetary institution "City Passenger Transportation" received a notification from the Pension Fund of Russia to provide information for 2002. At that time, the organization employed 40 people, among them were 10 workers who worked in the position of “bus driver”. Note that the position of “bus driver” working on regular city passenger routes is named in paragraphs 1-18 of part 1 of Article 30 of Federal Law No. 400 of December 28, 2013.

Section 4 is completed only if the inventory is attached to SZV-ISH (or KORR) forms with the “Special” type and displays information on the employer for the period for which these reports are prepared.

The types of hazardous work for which you need to fill out section 5 are listed in clauses 1–18, part 1, art. 30 of the Law of December 28, 2013 “On Insurance Pensions” No. 400-FZ.

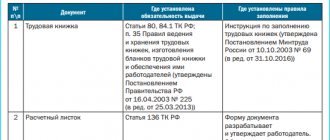

| Field | How to fill out and where to get information |

| Serial number | The serial number of the record is recorded in ascending order without gaps or repetitions. A number is assigned for each structural unit. If data on the names of professions is displayed in several lines, a serial number is assigned only to the first record |

| Name of the structural unit according to the staffing table | All names of structural divisions for the reporting year according to the staffing table |

| Name of profession, position according to staffing table | In separate lines for each division, all names of professions for the reporting year according to the staffing table |

| Number of jobs according to staffing table | The number of jobs in a structural unit for a specific profession for the reporting year according to the staffing table. In case of changes in the staffing table, the largest number of jobs according to the staffing table is indicated |

| Number of actual employees | The number of insured people actually working under special working conditions must coincide with the number of those for whom insurance premiums have been paid under additional tariffs for compulsory pension insurance. That is, this indicator will be equal to the number of employees for whom columns 9, 10, 12 of table 3 SZV-STAZH are filled in |

| The nature of the work actually performed and additional working conditions | The work and working conditions are described in accordance with the Unified Tariff and Qualification Directory of Work and Professions of Workers. For example, “Work as a crane operator for transporting hot sinter and pellets” |

| Name of primary documents confirming employment under special working conditions | An internal document of the organization, for example, certification of workplaces for working conditions or a special assessment of working conditions, technological regulations |

| Code of special working conditions/length of service according to the Classifier, approved. Government Decree No. 507p dated December 6, 2018 | The code is taken from the Classifier. Indicated only if during the period of work in conditions with the right to early retirement, insurance premiums were paid at an additional rate. An exception is periods with codes “DECREE”, “VRNETRUD”, “WATCH”, “DLOTPUSK” |

| Position code of lists No. 1 and 2, “small” list | The code can be found in lists No. 1 or No. 2, approved by Resolution of the Cabinet of Ministers of the USSR dated January 26, 1991 No. 10 |

Below the table is the total number of jobs in special working conditions in the state during the reporting period. It should be equal to the sum of jobs that are indicated in column 4 of the table for each structural unit and profession. The total number of employees who worked under special working conditions in the reporting year is also displayed. It should be equal to the sum of employees indicated in column 5 of the table for each structural unit and profession.

The first 2 sections of the EDV-1 inventory accompanying the SZV-KORR form are filled out in the same way as described in the previous sections. Let's consider how sections of EFA-1 are drawn up in each specific case.

| Chapter | Type SZV-KORR | ||

| Canceling | Corrective | Special | |

| 1-3 | Yes | Yes | Yes |

| 4 | No | No | Yes |

| 5 | No | No | No |

In section 3, in the line “Form “Data on adjustment of information recorded on the individual personal account of the insured person (SZV-KORR)”, it is necessary to record the number of employees, information about whom is submitted in the SZV-KORR report. This quantity must be equal to the number of SZV-KORR forms that are included in the package.

Section 4 of the inventory attached to the SZV-KORR “OSOB” form indicates information about insurance premiums that were:

- accrued in 2020;

- paid in 2020 with a breakdown (for which years).

For these amounts, you need to indicate the insurance premium rate code, which can be found in Appendix 1 to the Procedure, approved by Resolution of the Pension Fund Board of January 16, 2014 No. 2p.

It also shows the arrears of contributions to the budget at the beginning and end of the year for the policyholder as a whole and a breakdown of what amount was paid for what year.

In the EDV-1 inventory accompanying the SZV-ISH form, the first 4 sections are filled out. Section 5 is drawn up in the presence of hazardous types of work.

Sections 1, 2 and 5 are drawn up in the same way as in the inventory accompanying SZV-STAZH.

In section 3, in the line “Form “Information on earnings (remuneration), income, amount of payments and other remunerations, accrued and paid insurance premiums, periods of labor and other activities counted in the insurance period of the insured person (SZV-ISH)”" indicates the number of insured employees for whom you submitted information using the SZV-ISH form. This number must be equal to the number of SZV-ISH forms included in the package.

Section 4 is drawn up similarly to the inventory for SZV-KORR with the “SPECIAL” type.

Sample filling

To determine which sections of the report to fill out, use our cheat sheet.

How to fill out the EFA-1 report for 2020:

| Main report | Main report view | Chapter | ||||

| 1 | 2 | 3 | 4 | 5 | ||

| SZV-STAZH | Initial, contains information about persons entitled to early pension assignment | + | + | + | — | + |

| In all other cases | + | + | + | — | — | |

| SZV-ISH | Contains information about persons entitled to early pension assignment | + | + | + | + | + |

| In all other cases | + | + | + | + | — | |

| SZV-KORR | Corrective | + | + | + | — | — |

| Canceling | + | + | + | — | — | |

| Special | + | + | + | + | — | |

Since the SZV-KORR and SZV-ISH reports are used less and less, we will provide a sample of filling out the inventory for the SZV-STAZH form.

EDV-1 2018 - example of filling out indicators

ODF-1 comes in three types:

- original – standard;

- corrective – containing certain adjustments to section 5 of the original report;

- canceling – submitted for the purpose of canceling false or erroneous information presented in the original version, section five.

Deadlines for submitting EDV-1 After the end of the reporting year (for example, 2018), the EDV-1 report is submitted to the Pension Fund before March 1 of the following (that is, until 01.03.2019 inclusive) together with SZV-STAZH (Article 11 of the Federal Law No. 27 of 01.04. 1996 in updated edition). At any time, as necessary, that is, without reference to a specified date, the policyholder submits EDV-1 complete with the SZV-KORR and SZV-ISH reports. This is due to the fact that clearly defined deadlines for their submission are not provided for by law.

For all employers, from the beginning of 2020, a new reporting form was introduced - EDV-1, which presents information on the policyholder, transferred to the Pension Fund for maintaining individual records. Along with other forms, this report has its own deadlines for submission and procedure for filling out. In this article we will understand why this report is needed, who is obliged to submit it and in what time frame it is provided.

Important

EDV-1: new form A new form has been introduced for submission to the Pension Fund branch at the place of registration of the company acting as an employer. The document is not an independent report, but acts as an accompanying form. In other words, EDV-1 is provided by a representative of an enterprise or individual entrepreneur when submitting reports on personalized accounting: SZV-STAZH, SZV-KORR and SZV-ISKH.

General requirements for compilation

Instructions and key rules on how to fill out the EFA-1 form for 2019:

- The reporting document is prepared both electronically and on paper. The key condition for determining the reporting form is the number of employees. If the number is less than or equal to 24, then it is allowed to report on paper. If the institution employs 25 or more people, then only in electronic form.

- The report is certified by the signature of the responsible person who entered the information and the signature of the head of the organization and sealed. The policyholder, who does not have the status of a legal entity, signs the document personally.

- You can fill out paper reports by hand or using a computer. When handwritten, enter the information in block letters. It is acceptable to use ink of any color except green and red.

- Each report on insured persons is compiled into a separate package, which is accompanied by the EDV-1 form. If the organization submits the SZV-KORR (except for the report marked “special”), then sections 1, 2 and 3 of the accompanying inventory are filled out. When is section 4 of EFA-1 completed? It is filled in when sending SZV-KORR “special” or SZV-ISKH. The fifth section is filled out if SZV-STAZH or SZV-ISKH contains data on citizens working in positions specified in paragraphs 1-18 of part 1 of Article 30 of Federal Law No. 400 of December 28, 2013.

- There are three types of reporting for the accompanying inventory: initial, corrective and canceling. The initial type is set when the information is initially sent, the canceling type is to cancel incorrect or erroneous information contained in the inventory, and the correcting type is to make appropriate adjustments.

- Indicate the reporting period code in accordance with the data regulated in the special classifier. You will find the classifier in the appendix to the Pension Fund Resolution No. 507p. Use the table:

| № | Reporting period | Calendar period | |

| code | year | ||

| For reporting periods 1996 | 3 | 1996 | from 01.01.1996 to 30.09.1996 |

| 2. | 4 | 1996 | from 01.10.1996 to 31.12.1996 |

| 3. | 0 | 1996 | from 01/01/1996 to 31/12/1996 |

| For reporting periods 1997-2000. | 2 | yyyy | from 01.01.yyyy to 30.06.yyyy |

| 5. | 4 | yyyy | from 01.07.yyyy to 31.12.yyyy |

| 6. | 0 | yyyy | from 01.01.yyyy to 31.12.yyyy |

| For reporting periods 2001 | 2 | 2001 | from 01.01.yyyy to 30.06.2001 |

| 8. | 4 | 2001 | from 01.07.yyyy to 31.12.2001 |

| 9. | 0 | 2001 | from 01.01.yyyy to 31.12.2001 |

| 10. | 5 | 2001 | from 01.01.yyyy to 31.03.2001 |

| 11. | 6 | 2001 | from 01.04.yyyy to 30.06.2001 |

| 12. | 7 | 2001 | from 01.07.yyyy to 30.09.2001 |

| 13. | 8 | 2001 | from 01.10.yyyy to 31.12.2001 |

| 14. | 1 | 2001 | from 01.01.yyyy to 30.09.2001 |

| 15. | 3 | 2001 | from 01.04.yyyy to 30.09.2001 |

| 16. | 9 | 2001 | from 01.04.yyyy to 31.12.2001 |

| For reporting periods 2002-2009. | 0 | yyyy | from 01.01.yyyy to 31.12.yyyy |

| For reporting periods 2010 | 1 | 2010 | 1st half of 2010 |

| 19. | 2 | 2010 | 2nd half of 2010 |

| 20. | 0 | 2010 | All year 2010 |

| For reporting periods 2011-2013. | 1 | yyyy | From 01.01.yyyy to 31.03.yyyy |

| 22. | 2 | yyyy | From 01.04.yyyy to 30.06.yyyy |

| 23. | 3 | yyyy | From 01.07.yyyy to 30.09.yyyy |

| 24. | 4 | yyyy | From 01.10.yyyy to 31.12.yyyy |

| 25. | 0 | yyyy | From 01.01.yyyy to 31.12.yyyy |

| For reporting periods from 2014 | 3 | yyyy | From 01.01.yyyy to 31.03.yyyy |

| 27. | 6 | yyyy | From 01.04.yyyy to 30.06.yyyy |

| 28. | 9 | yyyy | From 01.07.yyyy to 30.09.yyyy |

| 29. | 0 | yyyy | From 01.10.yyyy to 31.12.yyyy |

| 30. | 4 | yyyy | From 01.01.yyyy to 31.12.yyyy |

| For reporting periods from 2020 | 0 | yyyy | From 01.01.yyyy to 31.12.yyyy |

What does the corrective report form contain?

The reporting administrator in the personalized data accounting segment is the Pension Fund of the Russian Federation.

It is to the Pension Fund that it is necessary to submit forms that display information on personalized records of officially employed individuals. Employers must prepare and submit such reports. EDV-1 information - who submits this form:

- legal entities that use hired labor, which is confirmed by valid labor contracts with individuals (including civil servants’ agreements, from the remuneration of which “pension” insurance contributions are calculated);

- private entrepreneurs who engage third-party specialists to work on the basis of employment contracts and civil process agreements (if an individual entrepreneur works for himself without outside help, he is not considered an employer, the entrepreneur cannot designate himself as a staff member).

https://www.youtube.com/watch?v=ytpolicyandsafetyru

When submitting the SZV-STAZH report, the deadlines for submitting EDV-1 coincide with the deadline for submitting the specified form - March 1 in the year following the reporting annual interval. Documents are submitted once a year.

If the employer submits the SZV-ISH form or corrective reporting based on personalized data (SZV-KORR), the completed EDV-1 inventory form must also be attached. In this case, there are no deadlines for submitting documents; the forms are filled out when the need arises.

Another case when submitting information about an insured person is mandatory is when one or more employees retire. The employer forms the SZV-STAZH and attaches the EDV-1 inventory form to the report.

The form for submitting information on the policyholder EDV-1 can be of three types:

- original (“original”);

- “corrective”, if it is necessary to make changes to the indicators reflected in section 5 of the inventory;

- “cancelling” when it became necessary to cancel the entire set of data previously reflected in section 5 of the EFA-1 form.

Form EDV-1 (as it is called in full), to be sent to the Pension Fund, is an appendix to other “pension” reports:

- SZV-STAZH (used to inform the Pension Fund about the length of service of employees);

- SZV-KORR (submitted for the purpose of adjusting various data about the insured person in the pension accounting system - for example, about his earnings and length of service, which affect the calculation of the pension);

- SZV-ISH (surrendered upon discovery of unprovided “pension” reporting for periods up to 2020 inclusive).

The EFA-1 form is not used separately from these reports. Essentially, this document has the function of listing information provided to the Pension Fund using these reports. At the same time, the EDV-1 form contains very detailed information about the employer - the insurer of employees under pension programs.

Thus, it is completely logical that the deadlines for submitting the EFA-1 form correspond to those established for the reports to which it is attached. The SZV-STAZH form (and therefore the supplementary EDV-1 form) must be submitted to the Pension Fund before March 1 of the year following the reporting year. For 2020, the EFA must be submitted before 03/01/2019, and for 2020 - before 03/02/2020, taking into account the rule for postponing due dates due to the fact that 03/01/2020 is a holiday).

And the forms SZV-KORR and SZV-ISH are submitted to the Fund as the need arises - when it is necessary to correct information for pension accounting or supplement it with unaccounted data for periods up to 2020 inclusive.

| The purpose of submitting the EFA-1 form | Deadline |

| Submission of the SZV-STAZH form (to which the EDV-1 form must be attached) | March 1 of the year following the reporting year |

| Submission of SZV-KORR forms (supplemented by EDV-1) | As quickly as possible - if the employer independently discovers errors in previously submitted reports to the Pension Fund, 5 days upon receipt of a request from the Pension Fund to correct information |

| Submission of the SZV-ISH form | As quickly as possible - if a failure to provide data to the Pension Fund for periods up to 2020 is detected |

Form EDV-1 is required to be submitted by all legal entities and entrepreneurs who pay remuneration to individuals for:

- employment contracts;

- civil contracts;

- copyright agreements, etc.

EDV-1 is submitted to the Pension Fund office and accompanies the forms SZV-STAZH, SZV-KORR, SZV-ISKH.

The EFA-1 presentation algorithm does not differ from the order in which the main reports are presented:

- submit it on paper or electronically (optional), if the average number of personnel is equal to or less than 24 people;

- if there are 25 employees or more, the report is submitted only electronically via telecommunication channels (TCS).

Those insurers whose employees are retiring are also required to issue SZV-STAZH and EDV-1. In this case, the forms are submitted no later than 3 days from the moment the future pensioner contacts the employer.

For reporting for 2020, Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507p approved a new form and the procedure for filling it out.

Accompanying the SZV-STAZH report for 2020, the EDV-1 inventory is submitted in the form approved. Resolution of the Board of the Pension Fund of December 6, 2018 No. 507p.

Since the SZV-STAZH is compiled for one person (the only founder-director), it, like the EDV-1 inventory, can be submitted both on paper and in electronic form. The restriction under which these two documents are submitted electronically only applies if the number of employees is 25 or more people. and higher.

The inventory attached to the “almost zero” SZV-STAZH consists of 5 sections. You only need to fill out the first three. You can familiarize yourself with the procedure and sample for filling out the EDV-1 inventory in this article.

EDV-1, accompanying the SZV-STAZH report, is submitted to the Pension Fund no later than March 1 of the year following the reporting year. For 2020, these documents must be sent to the Pension Fund no later than 03/02/2020. Due to the fact that it falls on a weekend, the deadline for submitting the inventory and report is postponed to the first working day - Monday 03/02/2020 (Letter of the Pension Fund of the Russian Federation dated 12/28/2016 No. 08-19/19045).

Form EFA-1 is an accompanying document. It is presented only with other forms of individual (personalized) accounting: SZV-STAZH, SZV-ISKH and SZV-KORR. There is no need to submit Form OVD-1 as self-reporting. Consequently, the deadlines for submitting the EFA-1 directly depend on the deadlines for submitting the reports in which the EFA-1 is submitted. See “Form EFA-1: Who Should Take It.”

The form in question must be submitted by all employers in relation to employees who are registered under an employment contract, civil process agreement, or author's order agreement.

More on the topic Questions and answers about the 100 days without interest classic card in 2020

List of those who need to take EFA-1:

- organizations;

- separate divisions;

- IP;

- lawyers, notaries, private detectives.

Only individual entrepreneurs without employees are exempt from preparing this document.

It is not always necessary to fill out all sections of the form.

Fill in the details. The first section contains information about the policyholder:

- registration number in the Pension Fund of Russia;

- TIN;

- checkpoint;

- short title.

The second section includes information about the reporting period and report type. The reporting period code in EFA-1 for 2020 is “0”.

We provide information about the insured persons. The third section contains information on the number of insured persons for whom reporting is submitted.

Section 4 of EDV-1 must be completed when providing SZV-ISH or SZV-KORR with the “special” type. When wondering how to fill out section 4 of EDV-1, it is worth remembering that when submitting SZV-STAZH you do not need to fill it out. It reflects information about paid and accrued insurance premiums.

Section 5 of the EDV-1 form is filled out when submitting information about employees who are retiring early, in accordance with Article 30 of Federal Law No. 400 of December 28, 2013. Provided in combination with SZV-STAZH and SZV-ISKH.

Each employer (company or entrepreneur) must regularly submit information to the territorial offices of the Pension Fund of Russia (hereinafter referred to as the Fund) about all insured employees, the insurance premiums paid for them and their length of service (Clause 1, Article 8 of Law No. 27 dated April 1, 1996 -FZ, hereinafter referred to as Law No. 27-FZ).

Form EDV-1 is a kind of description with general information about the policyholder. It is served together with one of the varieties of SZV-STAZH forms (-KORR or -ISKH).

Individual personalized accounting information, which is indicated in the reports submitted together with the EFA-1 form, is required to maintain personalized accounting for each employee and reflect it on personal accounts. They contain information about earnings and contributions accrued from employees, about length of service, including that which gives the right to early retirement.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

The employer is responsible for the content of personalized records of information about insured persons. So, in accordance with paragraph. 3 tbsp. 17 of Law No. 27-FZ, for untimely submission of information or its distortion in reports, a fine of 500 rubles is imposed on the perpetrator. for each employee receiving income or hired performer for whom all data has not been submitted.

As stated in paragraph 2 of Art. 11 of Law No. 27-FZ, employers must submit personalized information about each employee (form SZV-STAZH) to the Fund annually before March 1. And since the EFA-1 inventory is a mandatory component of this type of reporting, it is also submitted.

https://www.youtube.com/watch?v=ytcreatorsru

So, all employer-insurers (legal entities and individual entrepreneurs) submit employee identification information if they:

- have employees with whom they have signed an employment contract;

- entered into a civil contract, for the amount of payment for which insurance premiums are calculated.

When is the corrective EDV-1 submitted? This inventory, together with the SZV-KORR form, is prepared if there is a need to adjust the data in the report. You should also submit Form EDV-1 to SZV-STAZH upon the employee’s retirement. The reporting must be submitted within three days after receiving the corresponding application from the employee, but the inventory document in this case is not submitted.

The SZV-KORR form can be submitted at any time if there is a need to correct information previously submitted in the report. If EDV-1 is submitted along with the SZV-KORR form, then fill out only sections one through three. At the top of the form, do not forget to mark the type of report - “Corrective” by placing an “X” in the right place.

This is due to the fact that, according to clause 3.6 of the Procedure, approved. Resolution No. 507p, the fourth section is filled out only if the SZV-ISH form is submitted (-KORR, type “Special”), and information in the fifth section, in accordance with clause 3.7 of the Procedure, is entered if the inventory is submitted with the SZV-STAZH form (type “ Initial) or SZV-ISH (reporting for periods up to 2020 in accordance with clause 5.1 of the Procedure).

EDV-1: procedure for filling out the SZV-experience

The insurance experience report is submitted once a year - no later than March 1 after the reporting year. For the first time, such a report must be submitted for 2020 - no later than March 1, 2020 (subclause 10, clause 2, article 11 of the Federal Law of 04/01/1996 No. 27-FZ). Consequently, as part of the annual reporting on work experience, the EFA-1 report must be submitted to the Pension Fund for the first time no later than March 1, 2020.

If a person (employee) retires, then the SZV-STAZH is required to be passed early. Accordingly, the report must also be accompanied by Form OVD-1. In such a situation, EFA-1 may need to be sent as early as 2020.

As stated in clause 3.1 of the Procedure, approved. By resolution of the Foundation Board dated December 6, 2018 No. 507p, the EDV-1 form comes in three types:

- initial (submitted together with SZV-ISH);

- corrective (accordingly, submitted with SZV-KORR, if it is necessary to correct the entry from Section 5 of the previously submitted reports);

- canceling (submitted if it is necessary to cancel the entries made in section 5 of the original report form).

More on the topic Is it required to pay tax on the sale of a car in Korablino in 2020 tax deduction amount where to apply instructions when you can avoid paying the Federal Tax Service

Place an “X” on the form next to the entry corresponding to the time of reporting.

The inventory consists of five sections. In the first, indicate the details of the policyholder (registration number in the Pension Fund of Russia, INN, KPP and name (abbreviated)). In the second, you should enter the reporting period code - it is selected from the classifier, which is an appendix to Resolution No. 507p. For example, if information is filled in for the entire year 2019, then according to clause 30 of the classifier, the code is “0” and 2020.

In the third section, indicate the number of insured individuals opposite the entry on the form on which the inventory is submitted. In the fourth section, information about the policyholder is recorded only if the description is submitted along with one of the varieties of the SZV-ISH (-KORR s o) form.

The fifth section is completed if there is information about employees who worked under conditions that gave them the right to receive an early pension. The description document is submitted along with the SZV-STAZH (-ISH) form.

EDV-1 consists of 5 sections. But the need to fill out each of them depends on which form accompanies the EFA.

We will look at which sections of EDV-1 to SZV-STAZH need to be filled out in the table.

| Section EFA-1 | Type SZV-STAZH | ||

| Original | Complementary | Assignment of pension | |

| 1-3 | Yes | Yes | Yes |

| 4 | No | No | No |

| 5 | Yes* | No | |

https://www.youtube.com/watch?v=ytcopyrightru

* Section 5 is completed only if the information in gr. 9, 10, 12 tables. 3.

If the policyholder prepares several SZV reports (ISKH, KORR, EXPERIENCE), form EDV-1 is filled out for each report.

In sections 1 and 2 you should indicate:

- Registration number in the Pension Fund of Russia - you can find it on the Federal Tax Service website by downloading an extract from the Unified State Register of Legal Entities or the Unified State Register of Individual Entrepreneurs.

- TIN - when preparing a paper report, put a dash in the last 2 cells. There is no need to put dashes in the electronic version of the report.

- Checkpoint - filled out only by organizations. Entrepreneurs put dashes if they submit a report on paper.

- Short name - filled in in accordance with the constituent documents.

- Reporting period - for reports after 2020, the code “0” is always indicated. For reporting periods up to 2020, codes are taken from the classifier, which is an appendix to the procedure for filling out EFA-1.

- Type of information - about.

In section 3, in the line “Form “Information on the insurance experience of insured persons (SZV-STAZH)””, the number of insured persons is recorded, information on which is included in table 3 SZV-STAZH.

For most companies, filling out EDV-1, which accompanies SZV-STAZH, ends here.

Argon LLC employs 15 employees: 3 of them perform administrative functions. The remaining 12 employees work as gas welders in workshops No. 1 and No. 2. There is a vacancy for a gas welder in workshop No. 1.