Home > Registration of a pension > For old age > Early appointment > Northern pensions

1 560

In Russia there are groups of the population that can count on various pension benefits in the form of early retirement, accrual of an increased pension, etc. One of these groups is northerners , that is, citizens working in the regions of the Far North (KS) or areas equivalent to it (MKS), or residents of such areas (the list of such areas is fixed by Resolution of the USSR Council of Ministers No. 12 of 01/03/1983) . The provision of pension benefits for these citizens is due to the difficult working and living conditions in the northern regions.

The pension reform in Russia from 2020 will also affect northerners, for whom the retirement age will now change. President V. Putin has already signed the law on pension changes (No. 350-FZ of October 3, 2018), the provisions of which began to be gradually implemented from January 1, 2020 during a five-year transition period.

- After the pension reform, northerners will retire 5 years later: according to the old legislation, with the established length of service and points, workers in the KS and ISS regions retired at 50 and 55 years old, and after all the planned changes are implemented, they will retire at 55 and 60 years respectively.

- The new retirement age standard will not be established immediately, but will be gradually increased according to the prescribed schedule (over 5 years, starting from 01/01/2019)

Benefits for northerners upon retirement

Pension legislation provides for workers and residents of the North certain benefits related to pension provision:

- Reducing the retirement age . The retirement period for them is reduced depending on the accumulated northern experience. People who have worked for a specified number of years in the KS or ISS areas, regardless of their current place of residence, can count on early retirement.

- Social benefits (various types of compensation).

- Increased fixed payment (FV) towards retirement:

- If there is the required work experience in the KS or ISS areas, then the fixed payment increases by a certain percentage established by law: by 50% - for those who have worked 15 or more years in the KS areas and have an insurance experience of at least 25/20 years, respectively, men/women (h 4 Article 17 of Law No. 400-FZ);

- by 30% - those who have worked for 20 or more years in the ISS and have an insurance record of at least 25/20 years, respectively, men/women (Part 5, Article 17 of Law No. 400-FZ).

- If a person is registered or lives in a northern area, then the pension fund is increased by the corresponding amount of the regional coefficient (Part 9, Article 17 of Law No. 400-FZ of December 28, 2013).

Pensioners who receive an increased northern pension through the bank at the expense of the regional coefficient must annually confirm the fact of their residence in the KS or ISS areas by submitting an application to the Pension Fund or MFC. A personal application is required to confirm this fact, therefore it is impossible to submit such an application through your Personal Account on the Pension Fund website.

The size of the northern pension (namely, a fixed payment to it) is recalculated when moving to another Russian region, and depending on the value of the regional coefficient at the new place of residence, the pension can be either increased or decreased. We also note that when moving, the increase is adjusted only due to the regional coefficient, and the additional payment for northern experience is accrued even if you change place of residence.

The amounts of insurance pensions for northerners are indexed annually, just like for residents of all other regions of the Russian Federation. In connection with the ongoing reform in the period 2019-2024. The insurance pension will be indexed annually from January 1. For example, northern pensions in 2020 were indexed from January 1, 2020 by 6.6%.

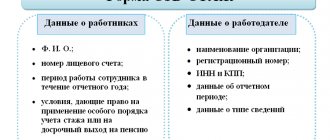

Confirmation of rights to the northern pension

Many people wonder whether it is necessary to confirm the right to receive the northern pension benefit.

Yes, of course it is necessary. Confirmation of rights also affects the increasing coefficients that can be applied when calculating the pension.

- If a citizen moves to the northern region, where a higher coefficient for the fixed pension payment has been established, then he will be able to obtain the right to the additional payment that arises only if he applies to the Pension Fund.

- If a citizen moves to a region that does not belong to the territories of the Far North or equivalent areas, then his pension must be recalculated taking into account the fact that the legal grounds for applying the increasing coefficient disappear (clause 9 of article 23 of Federal Law No. 400) .

It turns out that the northern pension can be either increased or decreased in size.

The law establishes the following criteria for recognizing the relevant move as valid:

- If a citizen is registered in a locality outside the North (subparagraph “c”, paragraph 10, article 23 of the Federal Law No. 400).

- If a citizen has applied to the Pension Fund of the Russian Federation in the relevant locality with an application for the issuance of a pension file.

- If an application for relocation has been submitted to the Pension Fund office.

- When the fund recorded non-compliance with the procedures for confirming registration in the North in the manner established by clause 19 of Art. 21 Federal Law No. 400.

- When the fund recorded non-compliance with the procedures for confirming registration in the North in the manner established by clause 5 of the rules established by Resolution No. 249.

Let us note that, according to the provisions of Article 23 of Law No. 400-FZ, a move can also be confirmed by the fact that a citizen has been deregistered in a northern settlement - due to the expiration of the registration period or at the request of the pension recipient himself. This is stated in paragraph 10 of Article 23 of Federal Law No. 400.

However, the Supreme Court of the Russian Federation, by decision of October 7, 2015 No. AKPI 15-859, recognized the relevant subparagraphs of clause 10 of Art. 23, as well as the corresponding provisions of paragraph 11 of Art. 23 inactive.

Most likely, the decision to increase or decrease the size of the northern pension will be made by Pension Fund employees.

Early retirement in the Far North

Conditions for early retirement for northerners are enshrined in Art. 32 of Law No. 400-FZ of December 28, 2013 “On insurance pensions”. The old-age insurance pension for them is assigned ahead of schedule - 5 years earlier than the generally established deadlines (according to clause 6, part 1, article 32 of Law No. 400-FZ), i.e. at 55 and 60 years old for women and men. To become an early retiree, the following conditions must be met:

| Retirement age (years) | Required experience in years | ||

| northern | general insurance | ||

| women | 55 | 15 years in KS areas or 20 years in ISS | 20 |

| men | 60 | 25 | |

Note: In addition to the length of service requirements, the minimum required number of IPC (pension points) must be met. If the northern work experience has not been fully developed, then the retirement age will be reduced in proportion to the period of work in the KS or ISS areas.

For northerners, it is also possible to have a so-called double reduction in the retirement age, for example, by an additional 5 years if the person worked in a hazardous industry during the established period. In this case, the requirements for length of service must be met for three indicators at once: insurance, northern and by type of work.

In addition to the above:

- For mothers of two or more , who have at least 20 years of insurance experience, as well as work experience in the CS areas of at least 12 years (or in the ISS 17 years), an insurance pension is assigned at 50 years of age (Clause 2, Part 1, Article 32 of Law No. 400-FZ).

- Hunters, reindeer herders, fishermen who have worked in their profession for at least 20 and 25 years (women and men), who live permanently in the areas of the KS or ISS, can become a pensioner upon reaching 50 and 45 years of age (clause 7, part 1 Article 32 of Law No. 400-FZ).

Retirement in areas equated to the Far North in 2020

If they have sufficient northern experience, citizens who have worked in areas equated to the Far North (FN) also have the legal opportunity to retire 5 years earlier. Until the end of 2018, the retirement age standards for citizens working in the ISS areas were set at 50 and 55 years, but due to the reform, starting in 2020, these values for them are also increasing to 55 and 60 years.

- In addition to reaching the established age, you must have work experience in the northern regions in the prescribed amount. The legislation establishes that in order to retire early, northerners must have 20 years of work experience in the ISS.

- When developing incomplete work experience for a northerner, the retirement age will be reduced, and the calculation is made by equating the length of service in the ISS to the time of work in the CS areas in the following proportion: one full year of work in the ISS areas is counted as 9 months of work in the CS. The counting order can be summarized in a table:

| Period of work in the ISS, in years | The corresponding period of work in the Far North | |

| years | months | |

| 1 | 0 | 9 |

| 2 | 1 | 6 |

| 3 | 2 | 3 |

| 4 | 3 | 0 |

| 5 | 3 | 9 |

| 6 | 4 | 6 |

| 7 | 5 | 3 |

| 8 | 6 | 0 |

| 9 | 9 | |

| 10 | 7 | 6 |

| 11 | 8 | 3 |

| 12 | 9 | 0 |

| 13 | 9 | |

| 14 | 10 | 6 |

| 15 | 11 | 3 |

| 16 | 12 | 0 |

| 17 | 9 | |

| 18 | 13 | 6 |

| 19 | 14 | 3 |

| 20 | 15 | 0 |

Photo pixabay.com

Conditions for granting a preferential pension to women with two children

To obtain the right to an early pension, several conditions must be met:

- Age. The retirement age in the north for women with two children in 2020 is set at 50 years.

- Availability of insurance experience - the time during which the employer made insurance contributions to a personal account in the Pension Fund (PFR) - at least 20 years.

- Duration of labor activity in the Far North regions (RKS) is 12 years and in equal territories (EKS) 17 years.

Northern experience for women and men

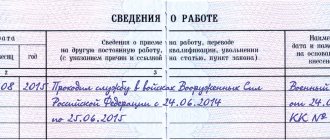

For early retirement, northerners need not only to reach a certain age, but also to have the northern experience stipulated by laws - a period of official work for a full working day in the regions of the KS and localities equivalent to them (ISS), during which the employer made deductions of insurance contributions to the Pension Fund (PFR). The northern length of service also includes periods of sick leave, annual main and additional leave.

In order to become a pensioner 5 years earlier than the generally established deadlines, you need to have 15 years of work in KS areas or 20 years in areas equivalent to KS.

If the northern length of service, which gives a citizen a benefit for retiring 5 years earlier, has not been fully developed, then the citizen can qualify for a proportional reduction in the retirement age. To do this, at least half of the standard for northern experience must be developed - at least 7.5 years in the KS or at least 10 years in the ISS.

- For one calendar year of work in the KS districts, the retirement period is reduced by 4 months.

- 1 full year of work in the ISS will be counted as 9 months of northern experience in the KS areas.

The scheme for reducing the retirement age in the presence of incomplete northern work experience is presented in the form of a table:

| Work experience in the Far North (FN), in years | How much does the retirement age decrease? | Retirement age for northerners under new legislation | ||||

| for women | for men | |||||

| years | months | years | months | years | months | |

| 15 and more | 5 | 0 | 55 | 0 | 60 | 0 |

| 14 | 4 | 8 | 4 | 4 | ||

| 13 | 4 | 8 | 8 | |||

| 12 | 0 | 56 | 0 | 61 | 0 | |

| 11 | 3 | 8 | 4 | 4 | ||

| 10 | 4 | 8 | 8 | |||

| 9 | 0 | 57 | 0 | 62 | 0 | |

| 8 | 2 | 8 | 4 | 4 | ||

| 7,5 | 6 | 6 | 6 | |||

It is worth noting that the values in the table are based on the final provisions of the law on increasing the retirement age (i.e. 65 years for men and 60 for women). During the period of transitional provisions (from 2019 to 2023), the retirement age will be lower than the values indicated in the table (will be calculated in relation to the schedule for increasing the retirement age).

Legislation and northern pensions

The issue of registration of northern pension payments is regulated by Russian legislation, in particular by the following regulations and articles:

- Articles 30, 32 Federal Law No. 400.

- Federal Law No. 4520-1.

- Federal Law No. 173.

- Order of the Ministry of Labor No. 2.

- Constitution of the Russian Federation.

Thanks to these laws, citizens working in the north or areas equivalent to it have the right to receive pensions. If certain requirements are met, Russians will be able to apply for a pension early .

This list of bills is not final, since laws undergo changes and editing. However, these main articles and laws spell out all the key nuances regarding the assignment and payment of pensions for northerners.

Pension reform for northerners (latest news)

On October 3, 2020, the President signed a law amending pension legislation, including raising the retirement age in Russia, which will apply in particular to northerners. If by the end of 2020 they could become pensioners upon reaching 50 and 55 years of age (if they have the necessary northern experience), then after the reform these standards will be increased by 5 years - to 55 and 60 years.

Changes will occur gradually, with a gradual increase in standards during the established period - from 2020 to 2023. Therefore, citizens of different years of birth will retire at different ages according to the schedule provided by law.

It is worth noting that the pension reform will not affect mothers with two children who have the required northern experience; reindeer herders, fishermen, commercial hunters living in the areas of the KS or ISS; northerners who work in hazardous or heavy production. For them, all stipulated standards and conditions remain the same.

Raising the retirement age for residents of the Far North

The main change in the pension reform from 2020 is the gradual increase in the retirement age, including for northerners. The retirement age for northerners who have accumulated the required amount of northern experience will be increased according to the following principle:

- From 2020 to 2023, the standard will be increased annually by 1 year until the final values of 55/60 years are established for women and men.

- In the first two years (2019-2020), an additional benefit is provided - payments can be issued six months earlier than the deadlines established by the new law: in 2020, women aged 50.5 years and men aged 55.5 years will be able to become pensioners;

- in 2020 - at 51.5 and 56.5 years, respectively.

If you have incomplete northern work experience, a proportional reduction in the retirement age from 2020 will be carried out relative to the new standards, taking into account the envisaged schedule for increasing the age. From 2023, the reduction will be carried out relative to the final standards - 60 years for women and 65 years for men.

Retirement schedule by year for northerners

During the transitional provisions of the new law on retirement age, the year of registration of the northern pension will depend on the year of birth of the future pensioner, since the values of the standards will be adjusted annually. The planned reform will affect only those citizens who must become pensioners from 01/01/2019 - these are women born in 1969 and men born in 1964.

The retirement schedule by year for northerners is presented below in table form:

| Women | Men | When will they be able to apply for a northern pension? | ||

| DR | PV | DR | PV | |

| 1st half of 1969 | 50,5 | 1st half of 1964 | 55,5 | 2nd half of 2019 |

| 2nd half of 1969 | 2nd half of 1964 | 1st half of 2020 | ||

| 1st half of 1970 | 51,5 | 1st half of 1965 | 56,5 | 2nd half of 2021 |

| 2nd half of 1970 | 2nd half 1965 | 1st half of 2022 | ||

| 1971 | 53 | 1966 | 58 | 2024 |

| 1972 | 54 | 1967 | 59 | 2026 |

| 1973 | 55 | 1968 | 60 | 2028 |

Note: DO - date of birth; PV is the value of retirement age.

Thus, women born 1969-1972 and men born in 1964-1967 who have the required amount of northern experience will be subject to the transitional provisions of the new law. This means that not final age standards will be established for them, but gradually increasing from 0.5 to 4 years.

For the female population born in 1973 and male since 1968 The final provisions of the law will apply - they will be able to become pensioners upon reaching 55 and 60 years of age (if they have the required work experience in the KS and ISS areas).

Photo pixabay.com

What is included in the northern experience

It will not count those episodes when the employee was registered with the labor exchange (upon dismissal due to staff reduction), and also worked at a part-time rate.

However, if a person worked part-time at several enterprises (two or more) and is claiming benefits, he will need to collect documented evidence of his work - then his work activity can be considered as full-time work. Labor activities at the compressor station include single-shift, rotational, and combined work. If a citizen works part-time at two enterprises at the same time, then such experience will be added to the northern one. A similar rule applies to young professionals who work full time. The northern pension experience includes:

- periods of official performance of work duties;

- time spent on advanced training, obtaining secondary vocational or higher education;

- period of child care up to 1.5 years;

- paid holiday;

- time spent on sick leave.

When working on a rotational basis, the following are taken into account:

- periods of work duties;

- breaks between shifts;

- rest time between shifts;

- time spent traveling from home (dormitory) to the site.

Excluded from the northern one, but counted towards the total insurance period:

- period of military service;

- child care time from 1.5 to 3.5 years;

- leave to care for a disabled child;

- the period a man was in unemployed status, regardless of whether the citizen was registered with the Employment Center or not.

Not taken into account when calculating the duration of work:

- the time it took to dismiss a specialist due to staff reduction;

- periods of registered unpaid leave;

- the time a man spent donating blood.

Basically, labor activity is counted, which a citizen can confirm with the help of entries in the work book, archival certificates and contracts. Northern pension experience also includes the following periods:

- prenatal and postnatal maternity leave;

- periods of work simultaneously at several enterprises in the Arctic.

The Pension Fund (PFR) will not take into account other types of activities. For example:

- parental leave from 1.5 to 3 years;

- part-time work;

- the period when the citizen was on the labor exchange and received state benefits;

- military service;

- studying at a university, college.

Social payments to northern pensioners

For “northern” pensioners, there are a number of social payments that are provided only to non-working citizens, for example, compensation for expenses for moving from the Far North or ISS regions and compensation for travel expenses to a vacation spot and back.

Reimbursement for moving expenses is made in case of relocation to a new place of residence only within Russia. The procedure for compensation is regulated by Decree of the Government of the Russian Federation No. 1351 of December 11, 2014.

- This payment is provided only to those with registration in the North, and not just to those actually living in these areas.

- Compensation is paid to pensioners receiving insurance pensions or state support, as well as family members of pensioners who are dependent on them.

- The size of the payment is determined as the amount of actual expenses incurred to pay for the move of the pensioner and his family members to a new place of residence by rail, sea, air, road or inland waterway transport.

- You can receive such compensation at any time by submitting an application to the Pension Fund.

The procedure for compensation for travel to and from a vacation spot is regulated by Government Decree No. 176 of April 1, 2005.

- It is made to pensioners who receive old-age and disability insurance pensions and live in the KS and ISS areas.

- Compensation is provided no more than once every two years and only for trips within the territory of the Russian Federation.

- The amount of payment is determined as the cost of actual expenses incurred to pay for a citizen’s travel to the place of vacation and back by sea, rail, air, road or inland waterway transport.

Documentation

To receive a northern pension you will need the following amount of documents:

- Passport;

- Statement of the established form: On the purpose of the content;

- About work in the north;

- Employment history;

Additional documents requested by Pension Fund employees on an individual basis include:

- Children's birth certificate;

- Documents confirming the presence of dependents.

Question answer

Will the northern pension remain the same when moving to another region?

It is important to understand on what basis the increased northern pension was assigned. There can be two reasons:

- Developing work experience in the districts of the KS or localities equivalent to them . In this case, the size of the fixed payment to the insurance pension increases depending on the type of length of service (in the KS or MKS). When moving to any other region of Russia, such an increase in pension will not be canceled for a pensioner.

- Actual residence in the northern regions . In this case, the size of the PV increases due to the application of the regional coefficient. After moving to a region with a lower regional coefficient or no coefficient at all, the pension will be reduced, and vice versa, in regions with a higher coefficient, the payment amount will be increased.

It is worth keeping in mind that regional coefficients and increases for length of service do not apply to the amount of the pension, but only to the size of the fixed payment to the pension.

1 560

The procedure for calculating the northern length of service for a pension

The rules taken into account when determining the northern length of service for a pension are contained in Order No. 2 of the Ministry of Labor of the RSFSR dated November 22, 1990. For the purposes of calculating pensions, they have the following features:

- Only the length of service is taken into account and only for the main job (clause 5), and for those working on a rotational basis - only for the time actually spent in the relevant area, including travel time (clause 5.1).

- The length of service is calculated by summing the calendar duration of periods of work (clause 5.1) with a coefficient of 1.5 applied to it (clause 44).

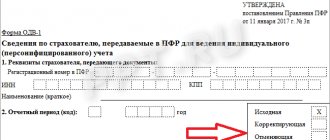

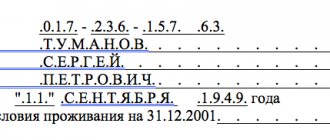

For information about how information about work in the Far North is reflected in personalized reporting submitted to the Pension Fund, read the article “Neopl” and “Administrator” in personalized accounting.”

Comments (25)

Showing 25 of 25

- Vera 12/21/2018 at 11:20

My husband has 13 years of experience in the Far North, born on October 18, 1962. When does he retire?answer

- Gulnara 01/01/2019 at 12:05

If I move to another region, not yet reaching retirement age, but having 15 years of northern work experience, at what age can I retire? At 55 or like everyone else - at 60? I was born in 1973.

answer

- Svetlana 06/21/2019 at 20:44

How many children do you have? If there are two people, and the insurance experience is 20 years, you will retire for 50 years.

answer

- Irina 07/13/2019 at 10:35

If there are 2 children, then at 50.

answer

Hello! Tell me please. I have a double reduction in the retirement age - full northern experience and complete completion of harmful experience under harmful grid number 2. I will turn 50 in March. So the question is: will I retire in March or six months later due to the gradual increase in the retirement age? Please tell me more precisely: either in March or in September six months after the birthday?

answer

Irina 01/22/2019 at 09:58

At 50.5 years old. Retirement will be delayed by six months.

answer

Federal law provides for early retirement upon reaching 42 years of insurance coverage, but not earlier than 60 years for men.

Does this provision absolutely not take into account the early retirement of people with northern experience? For example, by the age of 60 I will have 45 years of insurance experience, because... I have been working in the Far North since I was 15 years old. I did not work in hazardous industries.

answer

Hello! My husband turned 55 this year. He has 30 years of total experience, of which 9 years in the Far North region, i.e. in the Murmansk region. He was scheduled to retire in 2020 at the age of 56 years and 8 months. There have been changes since 2020, but there is a grace period of two years. My question is: when will my husband be able to retire under the new pension reform? Thank you.

answer

Good afternoon I worked in the north in the Murmansk region. from 1983 (December) to 2004 (August), 3.5 years at Rudnik in the mine. When I retired, I was given only 17 years of experience. But the mine had no effect at all, although when leaving the north, they told me in the personnel department that 3.5 years should be subtracted from 50 years, i.e. I should retire at 46.5, not 50. And for some reason I didn’t get into my seniority in a year and a half. The total length of service does not matter when calculating a pension, they said. Explain to me, is this so or did they deceive me by charging me only 12 thousand 900 rubles?

answer

Woman, born in 1977, with two children. I work from September 1, 2002 in the ISS area to December 31, 2012. In the KS area from January 1, 2013 to April 1, 2020. At what age can you receive a pension and what kind?

answer

I am 50 years old (turned in March), I have been a military pensioner since December 2000. Since that time, I have been living and working in the ISS in hazardous production since August 2007 (according to list 2). In February 2020, I am developing harmful work experience. From when do I have the right to receive a second pension?

answer

In 2020, I am applying for a preferential pension (teacher), total experience 29 years, preferential 25 years. I have 4 children, since 1990 I have been working in an area equivalent to the northern one. Will 0.5 years be added to receive a pension?

answer

Hello. Total work experience 30 years, ISS. All 30 years in hazardous production in the oil industry. If I understand everything correctly, then can I retire at 50? Thank you in advance.

answer

Total work experience is 46 years, of which 38 years in the north. When moving from Khanty-Mansi Autonomous Okrug to Tyumen, the pension decreased. Is this legal? Thank you.

answer

- Irina 04/30/2019 at 13:06

When moving to a region where a regional coefficient is not established, the pension is reduced. That's right.

answer

Citizens with a total experience of at least 25 men. and 20 years for women, in the north - 15 years, or in equal territories to the north - 20 years, regardless of place of residence, the basic pension increases by one and a half times.

answer

Am I entitled to a supplement to my pension?

answer

Hello! I want to know information about pension and access to it. My year of birth is December 19, 1966, two children. I worked in Yekaterinburg for 3 years 10 months. In the Far North (KhMAO) 11 years 6 months. Work experience until 2000, no longer worked. I have lived in Khanty-Mansi Autonomous Okrug for 30 years to this day. I want to know in what year I need to apply for a pension? Best regards, Galina.

answer

Please tell me, I have 11.9 years of experience in the North and 21.8 years of insurance experience. Three children. Turned 50 in August. I was denied early parole when I turned 50 years old. Now they said you can only apply at 53 years old. The phased schedule says the first half of 2020. So when should I really retire?

answer

Please tell me what to do in a situation where there are two children in the family, but only one child together. Out of noble intentions, I wanted my eldest son to know that he had a mother who died almost immediately after giving birth, and now it turns out that I lost the right to retire 5 years earlier. I live and work in a CS. What to do in this situation? Fill out documents (stating the fact of upbringing) for adoption as an adult man? At the same time, my son is studying in residency, and my husband and I are paying for his education.

answer

Hello! Please tell me about the storage part in the far north. They said that there is some kind of law that you can get the funded part in your hands at once. You need to write a statement. I can't find the law)

answer

- admin 02.12.2020 at 17:41

Hello. The procedure for a lump sum payment is regulated by Article 4 of Law No. 360-FZ of November 30, 2011. You can receive all your savings at a time if the calculated funded pension is less than 5% of the old-age insurance pension. In this case, the funded pension is unprofitable, and all savings are paid out at once in one amount.

answer

Please tell me. In three years I will turn 50 years old. By this time, I will have accumulated 30 years of general experience, 15 years of northern, 12.5 years of harmful experience on sheet 2. At what age will a man be able to apply for early retirement taking into account the new pension reform?

answer

Experience in the north: 26 years 10 months, 2 children, age 45 in May. Is it possible to assign a pension now, but receive it at 50 years old?

answer

Hello. How is a pension calculated? I worked in the far north and children born in 95-97 were not included in my pension.

answer

Share your opinionCancel reply

How does the northern pension change when moving?

There is a category of citizens who, on the contrary, wished to change their usual way of life or due to other circumstances, and move to the conditions of the Far North. There are various reasons why retirees decide to move for permanent residence to the northern regions. If a pensioner moved to the northern region, he can count on an increased pension according to the coefficient of that region.

There are 2 options for recalculating the northern pension for those moving:

- increase in PV taking into account regional coefficients;

- accrual of an increased FV insurance pension.

It is not permissible to select 2 types of increased payments at the same time.

If a pensioner moves to regions with normal climatic conditions, then the PV goes to her without taking into account regional coefficients. In case of significant experience, at least 15 for KS or 20 for PKS, an increased fixed fee will be charged regardless of the region of movement.

There is another category of pensioners who previously lived in one northern region, but decided to move to another region of the Far North. This category of citizens also has the right to receive an increased pension. However, payments will be made according to the established coefficient of the region to which the pensioner moved for permanent residence. Payments can be assigned upward or downward.