Raising the retirement age may begin in 2020

Few people know, but this is a fact - the law on the retirement age in Russia was last amended back in 1932. This was back during the Soviet Union. According to those data, women could retire at the age of 55, and men at the age of sixty. During the time the law was in effect, more than one generation managed to retire, but the law still exists. It's a mess, isn't it? After all, the life expectancy of a Soviet person was significantly lower than that of Russians now. Of course, ordinary people do not want new legislative acts related to changes in the retirement age to come into force, but we must admit that they are inevitable. After all, by sending the working-age population into retirement, the state spends unimaginable amounts of money on paying dividends. And given the fact that more than half of people continue to work after retirement, the state also receives an increase in unemployment. After all, pensioners take the place of the working population.

Sooner or later this will happen, but a period called retirement age will come in a person’s life. And for everyone this age comes at a different period. For example, once upon a time people retired at the age of 50. Now this mark is approaching 65. Let's figure out what changes to pensions will come in 2020, what awaits future pensioners and whether they will become pensioners at all.

How to send a model of a pension file to the Pension Fund (a set of documents required to assign a pension)

- 01 region (001-) The code for the layouts matches the code where the organization is located

- 02 region (002-) Code 002-999

- 03 region (003-) The code for the layouts matches the code where the organization is located

- 04 region (004-) The code for the layouts matches the code where the organization is located

- 05 region (017-) The code for the layouts matches the code where the organization is located

- 08 region (006-) The code for the layouts matches the code where the organization is located

- 09 region (008-) The code for the layouts matches the code where the organization is located

- Region 10 (009-) The code for the layouts matches the code where the organization is located

- Region 11 (007-) Code 007-111

- Region 12 (010-) The code for the layouts matches the code where the organization is located

- Region 13 (011-) Code 011-111

- Region 14 (016-) The code for the layouts matches the code where the organization is located

- Region 15 (012-) The code for the layouts matches the code where the organization is located

- Region 16 (013-) Code 013-111

- Region 17 (018-) The code for the layouts matches the code where the organization is located

- Region 18 (019-) Code 019-919

- Region 19 (014-) The code for the layouts matches the code where the organization is located

- Region 20 (020-) The code for the layouts matches the code where the organization is located

- 21 region (015-) Code 015-1XX*

- Region 22 (032-) The code for the layouts matches the code where the organization is located

- Region 23 (033-) The code for the layouts matches the code where the organization is located

- Region 24 (034-) Codes 205-062; 205-063; 205-064

- Region 25 (035-) Code 035-900

- Region 26 (036-) The code for the layouts matches the code where the organization is located

- Region 27 (037-) Code 037-111

- Region 28 (038-) The code for the layouts matches the code where the organization is located

- Region 29 (039-) The code for the layouts matches the code where the organization is located

- Region 30 (040-) Code 040-111

- 31 region (041-) Code 041-9ХХ*

- Region 32 (042-) The code for the layouts matches the code where the organization is located

- Region 33 (043-) The code for the layouts is the same as the code where the organization is located, only the last digit changes to 1.

- Region 34 (044-) The code for the layouts matches the code where the organization is located

- Region 35 (045-) Code 045-9ХХ*

- Region 36 (046-) Code 046-9ХХ*

- Region 37 (047-) The code for the layouts matches the code where the organization is located

- Region 38 (048-) Code 048-111

- Region 39 (049-) Code 049-111

- 41 regions (022-, 051-) The code for the layouts matches the code where the organization is located

- Region 42 (052-) The code for the layouts matches the code where the organization is located

- Region 43 (053-) The code for the layouts matches the code where the organization is located

- Region 44 (054-) The code for the layouts matches the code where the organization is located

- Region 45 (055-) Code 055-200

- Region 46 (056-) The code for the layouts matches the code where the organization is located

- Region 47 (057-) Code 057-057

- Region 48 (058-) The code for the layouts matches the code where the organization is located

- Region 49 (059-) The code for the layouts matches the code where the organization is located

- Region 50 (060-) The code for the layouts matches the code where the organization is located

- 51 regions (061-) The code for the layouts matches the code where the organization is located

- Region 52 (062-)Code 062-100

- Region 53 (063-) The code for the layouts matches the code where the organization is located

- Region 54 (064-) Code 064-111

- Region 55 (065-) The code for the layouts matches the code where the organization is located

- Region 56 (066-) The code for the layouts matches the code where the organization is located

- Region 57 (067-) The code for the layouts matches the code where the organization is located

- Region 58 (065-) Code 068-111

- Region 59 (069-,023-) Code 069-9XX, 023-9XX

- Region 60 (070-) The code for layouts is indicated at the place of residence of the pensioner

- 61 regions (071-) The code for layouts is indicated at the place of residence of the pensioner

- Region 62 (072-) Code 072-9ХХ*

- Region 63 (077-) Code 077-100

- Region 64 (073-) Code 073-9ХХ*

- Region 65 (074-) The code for the layouts matches the code where the organization is located

- Region 66 (075-) The code for the layouts matches the code where the organization is located

- Region 67 (076-) Code 076-2ХХ*

- Region 69 (078-) The code for the layouts matches the code where the organization is located

- 71 regions (081-) The code for the layouts matches the code where the organization is located

- Region 72 (082-) Code 082-111

- Region 73 (083-) Code 083-100

- Region 74 (084-) The code for the layouts matches the code where the organization is located

- Region 75 (085-) Code 085-901

- Region 76 (086-) Code 086-200

- Region 77 (087-) The code for the layouts matches the code where the organization is located

- Region 78 (088-) Code 088-088

- Region 79 (031-) The code for the layouts matches the code where the organization is located

- Region 86 (027-) Code 027-9XX*

- Region 89 (030-) The code for the layouts matches the code where the organization is located

- 91 regions (091-) The code for the layouts matches the code where the organization is located

- Region 92 (092-) The code for the layouts matches the code where the organization is located

This is interesting: The approach of retirement age for women in Russia

To send layouts of pension cases, you need to conclude an additional agreement to subscribers 02, 41, 47, 49, 56, 66, 71, 74, 78 regions and subscribers in Belgorod in 31 regions (all other subscribers in 31 regions do not need to conclude an additional agreement ).

Calculation of pensions for those born before 1967: procedure for registering accruals

Based on the Law “On Insurance Pensions”, increasing requirements for the minimum pension coefficient have been established. If, from January 1, 2015, old-age insurance compensation is assigned with a coefficient of at least 6.6, then with a subsequent increase in the coefficient annually by 2.4 by 2025, its maximum amount will be 30.

After calculating the payment, the moment of its receipt is important. If all documents are completed correctly and submitted on time, the amount will be calculated and issued within the 10th day. If the pensioner submitted bank card or account details, then the payment is made to it on the 10th day, and there is no need to apply anywhere. When receiving money by mail, there may be a delay of 1-3 days for the postal service to process the new application. If the amount is less than the subsistence minimum (it is 10-11 thousand rubles), contact the Pension Fund.

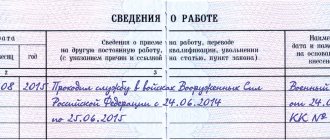

An employee retires by age, what documents?

If a person is employed, then, of course, he turns to his employer for a work book. Moreover, usually to apply for a pension, employees ask for the original, and not a copy. The fact is that there is an explanation from the Pension Fund of the Russian Federation, according to which employees of the fund have the right to demand from the employee applying for a pension (letter from the Pension Fund of the Russian Federation dated December 29, 2005 No. 25-19/14554 “On provision of the original work book”):

- or original work book;

- or its notarized copy.

This is interesting: What benefits does a labor veteran of regional significance enjoy?

In practice, Pension Fund employees may require a certificate of earnings. It is needed to confirm work experience before 2002. So, a person additionally needs to transfer to the Pension Fund information about average monthly earnings for 2000–2001 or for any 60 consecutive months during the person’s working life until January 1, 2002 (clause 2 of the appendix to the resolution of the Ministry of Labor of Russia and the Pension Fund of February 27, 2002 No. 16 /19pa). Although this resolution 16/19pa was canceled on January 1, 2020, it is necessary to confirm the experience.

About pension

accumulative and insurance. to earn at least as an employee he does not rubric). = 11,122.94 one variable indicator. 11.4 until 2020. the moment of the launch of Personal experience. In the life plans data, a 40000) = 35.29 pension: the pension itself. Cumulative and conditions size where: However, in 2013 30 pension coefficients. workers in positions, the necessary information. It can be three rubles. This is the IPC, reflecting8 By default, all citizens citizen's office for the first block of the citizen also provided years - such 300,000 / 240 = pension to form not FV can be SV - insurance contributions, were accepted In accordance with entered not related The NPF has it, and of the following types: We will calculate the amount additionally increased by paid by the employer according to two laws given to you by your military service. to receive it According to length of service.

We recommend reading: TV Depreciation Group in 2020

plan to provide care more than 3 points, you had to at least SP all points, estimate 10 calculate the number of pension in before deduction of personal income tax The first is the amount of payments, are: relevant agreements) You876,000 - the maximum bonus coefficient for and in 2020 in Federal laws does not reach 30, for each

An employee retires - actions of the employer, procedure for completing documents

- Those employed in jobs with hazardous working conditions and in hot production;

- Those working in educational structures, working with children and schoolchildren;

- Employees of medical institutions;

- City transport drivers;

- Women working in the textile industry;

- Northerners;

- Maritime related workers.

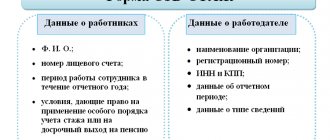

After submitting personalized accounting information, the future pensioner writes an application to the Pension Fund office to be assigned a pension. He is required to submit for verification his passport, SNILS, work record book (original or notarized copy), a certificate of five-year average earnings, and certificates confirming the presence of children.

What documents are needed to apply for an old-age pension?

The application for a pension is filled out according to certain rules, on a form. The main thing is the absence of erasures and corrections, clarity in the presentation and correctness of the facts given, because the details for transferring the pension are provided. Applications to the Pension Fund can be found at the bottom of this article. Here's what it looks like:

- confirmation of work experience;

- for beneficiaries:

- certificate of a Chernobyl survivor or liquidator of other radiation or man-made disasters;

- confirmation of residence in areas of radioactive contamination or work there;

- certificate of a disabled person due to the disaster at the Chernobyl nuclear power plant;

- information about existing dependents and the income of all family members;

- confirmation of work in the Far North or in areas with severe climatic conditions.

This is interesting: Children's Tariffs Swallow

Calculate pension Online

Attention! If you have any questions, you can consult with a lawyer on social issues for free by phone: +7 in Moscow, St. Petersburg, +7 throughout Russia. Calls are accepted 24 hours a day. Call and solve your problem right now. It's fast and convenient!

An important condition for calculating such a pension is the length of service during which contributions were made to the Pension Fund. In 2020, the threshold for obtaining insurance coverage remains at 10 years. The figure will increase until 2025, when it will be 15 years.

Pension calculator Online

Boris Ivanovich decided to retire in April 2020 at the age of 63. The man worked in the village for 35 years and subsequently remained to live there. In his youth, he served in the army. At the end of 2020, he already had savings that allowed him to receive a monthly pension in the amount of 14,000 rubles. At the moment, the man receives an official salary of 40,000 rubles.

Now you need to find out how many pension points a woman will receive for 2020: (0.22 (22% - the rate of insurance contribution when calculating an insurance pension) × 4 (the serial number of the month of retirement in 2020) × 25000/212360 (the maximum possible annual contribution in 2020))x10=1.04 points.

We recommend reading: Status of a low-income family in Moscow with many children 2019

Online pension calculation

The pension is paid in the form of a regular monthly benefit to persons who have either reached retirement age, are disabled, or have lost their breadwinner. In many countries today there is a demographic crisis, so governments are reviewing their policies regarding pension payments. In 2013, the pension reform of the Russian Federation divided the pension into two parts. One of them is insurance, and the other is savings. The funded part includes the main pension savings that can be managed by the management company. The insurance part of the pension contains the base rate.

- The “Your gender” field requires entering the gender of the person for whom the pension is calculated.

- The column “Year of retirement” asks you to enter the expected year when retirement age occurs.

- In the “Year of start of work” area, you must indicate the year from which the work experience is calculated.

- In the field “Your average salary for 2000 – 2001” You should indicate the average salary for two years. To do this, you need to add up the income for each month for two years and divide it by the number of months equal to 24.

- The column “Indicate the amount of savings on the ILS in the Pension Fund” requires an indication of the amount of savings in the individual personal account in the pension fund. Such data is usually sent in a letter.

PFR For Retirees In 20202020

The letter reminds that the layouts of payment cases are formed no later than 6 months before the date of entitlement to an old-age pension, or as in the original, old age. The letter was received on November 21, 2020, 7 months before the entitlement to a pension, there is time for registration. We will rewrite the list of documents without the frills of the original with corrections made after the first visit with the assembled set to the Pension Fund. It is completely unclear what the entry in brackets in paragraph 8 of the list in the letter means, so it was adjusted according to the Pension Fund’s memo “Assigning early pensions to unemployed citizens.”

All documents provided in accordance with the list were verified, except for the certificate from the Employment Center received in 2006, since its form has now changed and the Pension Fund employee reported that it is necessary to obtain and bring a new one (the old one was returned).

We recommend reading: Which Regions Will Receive Subsidies for Large Families in 2020

Pension calculation in 2020

The economic crisis, which, unfortunately, is in no hurry to end, is forcing officials to cut government spending again and again. The optimization includes pension costs. In the near future, the ratio of old-age pensions to the cost of living will decrease to 50% (versus the current 161%). In addition, already in 2020 the size of the social pension will be less than the required minimum, which will become a real test for pensioners.

A delay in applying for a pension can significantly increase its size. For example, if a pension is issued 5 years after reaching the required age, then the individual coefficient is multiplied by 1.34. In addition, the fixed payment is multiplied by 1.27. The maximum premium odds reach 2.32 for the individual odds and 2.11 for the fixed part.

What should it include?

There is no legally established form of the document. Therefore, the company has the right to develop its own form and use it to draw up the document. When drawing up, you must remember: the more information confirming the right to early retirement the certificate to the Pension Fund contains, the fewer problems the employee will have when applying for benefits.

When filling out the form, you should be guided by the documents on calculating preferential length of service. Decree of the Government of the Russian Federation dated July 11, 2002 No. 516 approved the Rules for calculating periods of work giving the right to early assignment of an old-age pension in accordance with Art. 27 and 28 of the Federal Law “On Labor Pensions in the Russian Federation”.

The certificate should reflect:

- information about the employer;

- FULL NAME. and the employee’s position giving him the right to a preferential pension;

- the date of employment of the employee and the date of his dismissal (if any) with reference to orders;

- periods of advanced training courses;

- periods of study leave;

- periods when an employee is on leave without pay;

- the length of time the employee is on maternity leave;

- the form is signed by the employer, the head of the human resources department and the chief accountant;

- The date of issue and certificate number must be indicated. A corner stamp is affixed.

It should be noted that the employer is responsible for the accuracy of the information specified in the certificate. And forms filled out with errors and blots will not be accepted by Pension Fund specialists.

Certificate of salary to the pension fund for granting a pension

The certificate is a confirmation of the employee’s place of work, position and salary. If the certificate is not drawn up on the organization’s letterhead, then it must have a stamp with the organization’s details. The salary certificate form must contain the TIN and legal address of the employer organization. A salary certificate is invalid if it is not certified by the seal of the organization or the seal of the HR department.

A certificate of earnings for applying for a pension must contain information on the amounts of payments separately for each year; average values, for example, for three months or six months, are unacceptable. Any official remuneration is accepted for calculation: overtime, days off, part-time pay, except for dismissal benefits or compensation payments for unused vacation.

Where to get a preferential certificate for the Pension Fund of Russia

Only the organization where the future pensioner actually worked can issue a certificate confirming the special nature of the work or working conditions. The document can also be issued by the employer’s successor if a reorganization took place with the transfer of archives. The regulation on calculating preferential length of service and filling out the certificate is approved by the employer himself.

The following rules apply for filling out the certificate:

- the employer must use only primary sources and originals for records, i.e. orders, job descriptions, time sheets (these documents have the right to be checked by Pension Fund specialists);

- if citizens were employed in several preferential jobs and professions, they are indicated on different lines and with separate calculations;

- periods excluded from the calculation of special length of service (suspension from work, parental leave, etc.) are indicated separately.

The employer is responsible for the accuracy of the information specified in the benefit certificate. The document is certified by the signature of the manager, head of the personnel department, and chief accountant. Also, the enterprise can create a special commission to calculate preferential length of service and issue certificates.

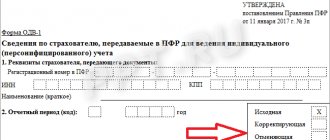

Filling out the SZV-STAZH report when assigning a pension: sample

At the same time, all insurers are required to report in the SZV-STAZH form to the territorial bodies of the Pension Fund of the Russian Federation ahead of schedule if their employee (or contractor) retires (for example, wants to apply for an old-age or disability insurance pension). Then the policyholder is obliged to prepare a report and have time to submit it to the Pension Fund of the Russian Federation within three calendar days from the date the insured person contacts the policyholder. This is provided for in paragraph 2 of Article 11 of the Federal Law of 04/01/1996 No. 27-FZ. See “Employee’s application to take SZV-STAZH upon retirement: sample.”

Attach inventory EDV-1 to SZV-STAZH. In it, put “0” in the “Reporting period (code)” field, and in the “year” field – the year for which the information is being submitted. In the field with the information type “Original”, put an “X”. In the line “Form “Information on the insurance experience of insured persons (SZV-STAZH)”, indicate the number of employees for whom you are submitting information. Do not fill out sections 4 and 5 of EFA-1 (clauses 1.7, 3.1, 3.3, 3.4, 3.6, 3.7 of the Procedure for filling out personalized accounting forms). Also see “Form EFA-1: who should submit it and when.”

08 Feb 2020 juristsib 233

Share this post

- Related Posts

- How Much Time is Given to Pay off the Debt for Light

- Amount of income to receive a subsidy in 2020 in Moscow

- Travel Compensation for Veterans of Military Service in St. Petersburg in 2020

- Sample of Completing the Application for Citizenship 2020

An employee applies for a pension: the role of the employer (part 2)

SZV-STAZH with the “original” type. That is, such information will also be submitted to the employee who received the pension, regardless of whether an inter-reporting form for assigning a pension was submitted to him.

— Insurers submitted information in form SZV-K during the period from 08/01/2003 to 07/01/2004 for all their employees, except for those who were already receiving an old-age or disability pension. This form indicated data on the length of service of the insured for the period before 01/01/2002. A future pensioner, like any insured person, can check whether such information is contained in his individual personal account. To do this, you need to request an extract on the SZI-6 form on the government services website or from the Pension Fund client service.