What are penalties and how are they calculated?

Since 2020, insurance premiums have been divided in relation to the legislative norms establishing the rules for working with them:

- the bulk of contributions (for compulsory health insurance, compulsory medical insurance, compulsory health insurance for disability and maternity) began to be subject to the Tax Code of the Russian Federation and the requirements that apply to tax payments;

- contributions for injuries remained under the provisions of the Law “On Compulsory Social Insurance...” dated July 24, 1998 No. 125-FZ.

However, the requirements for their payment have remained unchanged: insurance premiums must be paid by the payer on time and in full. If due to any circumstances they are not paid or not paid in full, not only the arrears are collected from the payer, but also a sanction for late payment, which is called a penalty.

The basis for payment of penalties (if they are not paid voluntarily) are the requirements presented to the payer by the body supervising the relevant contributions (IFTS or Social Insurance Fund). Thus, penalties are the estimated amount that must be paid by a payer who has violated the deadline for paying contributions. They are calculated as a percentage for each day of delay, starting from the day following the payment deadline, which is established by law.

You can calculate penalties using our calculator .

Read about the specifics of calculating penalties in the material “How to correctly calculate tax penalties (nuances).”

You will always find the KBC for contributions and taxes in ConsultantPlus. Get a free trial and jump into the content.

Accounting

When organizing the accounting of insurance premiums, you must follow the procedure approved by Order of the Ministry of Health and Social Development of Russia dated November 18, 2009 No. 908n (hereinafter referred to as the Procedure). According to this document, employers are required to keep records of:

- accrued insurance premiums, penalties and fines;

- paid (transferred) insurance premiums, penalties and fines;

- expenses incurred for payment of insurance coverage;

- settlements for compulsory social insurance in case of temporary disability and in connection with maternity with Social Insurance.

Moreover, in the latter case, we are talking not only about reflecting the amounts that were spent on paying contributions, but also the amounts received from the Social Insurance Fund.

The need to organize the accounting of these amounts was introduced for a reason. Settlements with funds are made in a special order.

Indeed, in fact, employers do not transfer all amounts of accrued contributions: previously calculated Social Security contributions can be reduced by the amount of benefits that are financed from this fund. For example, for the amount of payment of temporary disability benefits.

True, only within the limits of those amounts that are financed by the Social Insurance Fund in accordance with the law.

Those amounts by which the amount of funds transferred to the Social Insurance Fund can be reduced are clearly stated in the Procedure. We are talking about the following types of payments:

- temporary disability benefits;

- maternity benefits;

- a one-time benefit for women registered in medical institutions in the early stages of pregnancy;

- lump sum benefit for the birth of a child;

- monthly child care allowance;

- social benefit for burial or reimbursement of the cost of a guaranteed list of funeral services to a specialized funeral service;

- benefits for disability, pregnancy and childbirth in amounts related to the inclusion of periods of service and Chernobyl victims in the insurance period;

- payment for four additional days off per month to care for disabled children.

Methods for collecting penalties and the negative consequences of their late payment

If the payer has neglected the opportunity to voluntarily fulfill the requirement to pay penalties, they are collected using the following methods:

- sending a collection order to the payer’s bank;

To learn about which accounts penalties can be collected, read the article “From which accounts can tax authorities collect penalties?” .

- recovery from property.

In addition, if the terms and completeness of payment of insurance premiums are violated, we are talking not only about sanctions, but also about a violation of the pension rights of the insured persons.

The negative consequences of non-payment of contributions are:

- reducing the possibility of obtaining investment income from investing pension savings;

- reduction in the amount of pension savings when indexing them.

Read about the consequences of non-payment of insurance premiums due to their failure to be reflected in the calculation in the article “What is the liability for non-payment of insurance premiums?”

Reflection of penalties on insurance premiums in accounting

Clause 7 of PBU 1/2008 states that the enterprise itself has the opportunity to choose the method of reflecting expenses in accounting, if it is not expressly established by law. PBU 10/99 does not specifically specify the reflection of penalties for taxes and fees; it only indicates penalties for violation of the terms of contracts.

Moreover, we draw your attention to the fact that the amounts of taxes and contributions additionally accrued during the audit can be attributed to past periods, and fines and penalties - to the periods when the decision was made on the audit report (court decision). As for the accounts in which they should be taken into account, the Ministry of Finance of Russia in its latest clarifications (letter dated December 28, 2016 No. 07-04-09/78875) recommends that penalties accrued on payments other than income taxes and the simplified tax system be attributed to accounts cost accounting:

Dt 26 (44) Kt 69.

Read more about the latest point of view of the Ministry of Finance in the material “Tax penalties and fines - what is the account in accounting?” .

In earlier recommendations, the Ministry of Finance proposed using account 99 to reflect penalties (letter dated February 15, 2006 No. 07-05-06/31).

In the instructions for using the chart of accounts, approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n, account 99 is used to reflect tax sanctions. Penalties do not apply to tax sanctions, but the instructions say that account 99 can also be used to reflect penalties for violation of deadlines for paying contributions in correspondence with account 69.

In practice, they also use the option of assigning penalties to other expenses:

Dt 91 Kt 69.

The amount of the listed penalties is reflected by the posting: Dt 69 Kt 51.

We also emphasize that the amount of penalties on contributions is not involved in calculating the income tax base (clause 2 of Article 270 of the Tax Code of the Russian Federation), therefore, in relation to them, permanent differences arise between accounting and tax accounting (clause 4 of PBU 18/02). These differences correspond to permanent tax liabilities accrued by posting: Dt 99 Kt 68.

Extra-budgetary funds: functions

For late submission of reports or submission of accounting information, for example, when opening a current account, or payment of taxes later than the due date, penalties are imposed, the amount of which is regulated by the relevant articles of the Tax Code.

A penalty is something other than penalties. It is a kind of security that encourages the timely fulfillment of their obligations regarding the payment of relevant taxes and fees.

The amount of the accrued penalty is regulated by Article 75 of the Tax Code of Russia, which states that it is accrued from the day following the payment deadline and ends on the day the arrears are repaid.

According to this article of the Tax Code, the amount of the penalty depends on three parameters:

- Overdue amount;

- Number of days overdue;

- From the refinancing interest rate of the Central Bank of Russia.

To display penalties in accounting, you can use two accounts - 91 or 99.

To display the accrued penalty, it is recommended to use account 99, which allows you to avoid a permanent tax liability, since when generating an income tax return, the accrued penalty on insurance premiums is not included in the calculation of the tax base. It is recommended to consolidate the use of account 99 in the accounting policy of the enterprise.

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 20 (25, 26, 29, 44) | 69-2 | 10 000,00 | Insurance premiums paid to the Pension Fund | Payroll |

| 20 (25, 26, 29, 44) | 69-1 | 2 000,00 | Contributions to the Social Insurance Fund have been accrued | Payroll |

| 20 (25, 26, 29, 44) | 69-3 | 3 000,00 | Contributions to the Compulsory Medical Insurance Fund have been accrued | Payroll |

| 69-2 | 51 | 10 000,00 | Payment of insurance premiums to the Pension Fund | Bank statement |

| 91 (99) | 69-1,69-3 | 3,67 | Postings for calculating penalties for late insurance premiums. Overdue period – 2 days; Overdue amount – RUB 5,000.00; Refinancing rate – 11%. P = 5,000.00 * 2 days. * 11% * 1/300 = 3.67 rub. | Accounting information |

| 69-1, 69-3 | 51 | 5 000,00 | Payment of debt on insurance contributions to the Social Insurance Fund and the Compulsory Medical Insurance Fund | Payment order |

| 69-1, 69-3 | 51 | 3,67 | The accrued penalty was paid to the budget | Accounting certificate, payment order |

| 99-2 | 68-4 (68-2, 68-1) | 475,17 | A penalty was accrued for non-payment of tax in the amount of RUB 78,540.00. The delay was 22 days. Refinancing rate – 8.25%.P = 78540 * 22 days. * 8.25% * 1/300 = 475.17 | Accounting information |

| 68-4 (68-2, 68-1) | 51 | 78 540,00 | The amount of tax debt has been paid | Payment order |

| 68-4 (68-2, 68-1) | 51 | 475,17 | The accrued penalty was paid to the budget | Payment order |

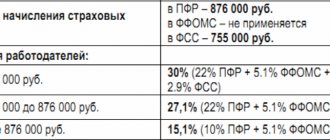

After calculating wages, insurance premiums must be calculated. Their number and volume depend on the type of activity of the economic entity, the applied taxation system, and the amount of payments. Insurance premiums include the following payments:

- Transfers to pension insurance - 22% (the rate is valid until the end of 2020).

- Payments for compulsory health insurance - 5.1%.

- Social security contributions - 2.9%.

- Contributions to the Social Insurance Fund for insurance against accidents at work - from 0.2% to 8.5%.

Above are the basic payroll insurance rates. However, rates may vary depending on the type of activity of the employer.

Organizations and individual entrepreneurs who are on the simplified tax system and are employed in a certain production sector, as well as in the field of healthcare, construction, sports development and others can apply for preferential payments in a reduced amount.

In addition, it is allowed to charge contributions in a reduced amount for payers whose activities meet the criteria of Art. 427 Tax Code of the Russian Federation. We are talking about entities working in technological, scientific fields and others.

In case of untimely repayment of outstanding contributions, the organization will have to pay the amount of penalties received. And here some nuances already appear. Indeed, in the case when insurance premiums are accrued, the posting takes the form - Dt cost account - Kt 69.

When penalties appear, account 99 is used. Postings for calculating penalties on insurance premiums are reflected in the accounting records as follows: Dt 99 - Kt 69 (the required subaccount is used). Repayment of debt on penalties will create an accounting entry: Dt 69 (corresponding subaccount) - Kt 51.

https://www.youtube.com/watch?v=Rh1T7EeJIns

If it is discovered that insurance premiums have not been transferred in full, in addition to penalties, the amount of arrears is also collected from the payer. If the amounts were initially calculated incorrectly, the arrears of insurance premiums should be calculated; the entries are identical in this case to the usual calculation of payments: Dt expense account - Kt 69.

In order for the state to coordinate cash flows in certain social areas, several insurance funds were created. The most famous of them are the Pension Fund, the Social Insurance Fund and the Federal Compulsory Medical Insurance Fund.

The peculiarity of these 3 state formations is that money is deposited into their accounts without fail by all organizations and individual entrepreneurs paying income to citizens of the Russian Federation. In the future, these funds are distributed according to social programs: for the issuance of pensions, maternity capital, payment of sick leave, etc.

The activities of the funds are regulated by the legislation of the Russian Federation, in particular:

- Budget Code of the Russian Federation dated July 31, 1998 No. 145-FZ;

- Federal Law “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund” dated July 24, 2009 No. 212-FZ.

Lyubov Kotova answers,

Refusal to transfer funds is fraught with punishment - penalties and fines established by regulatory authorities. Amounts are calculated based on the length of the period of non-payment. A penalty is charged for each day of delay, starting from the end date of the permitted period.

The day the debt is transferred is not taken into account in the non-payment period used to calculate the amount of the fine. According to Law No. 212-FZ, the obligation is considered fulfilled:

- from the moment a transaction related to the transfer of money to the relevant authorities is reflected in the enterprise’s account;

- from the date of presentation to the bank of a properly executed payment order;

- from the date of the supervisory authority’s decision to set off previously overpaid amounts;

- from the moment of depositing cash into the bank's cash desk, the administration to repay the debt to the relevant fund.

That is, if an organization transfers money for March 2020 on April 18, the accounting service should send to extra-budgetary funds an amount equal to mandatory contributions increased by the amount of the penalty. In this case, the amount of sanctions will be calculated taking into account 2 days of delay - April 16 and 17.

Fines are paid separately from insurance premiums. The transfer of debt does not exempt the company from penalties for missing the period established by law.

The amount of sanctions is calculated as a percentage of the amount of contributions payable. This indicator is equal to 1/300 of the refinancing rate of the Central Bank of Russia in effect on the date of delay. From January 1, 2020, it is 11%.

C - the amount of contributions to be paid;

https://youtu.be/DTX1n7qQUgA

D - number of calendar days of delay;

SR - refinancing rate.

Amounts that the company was unable to transfer for good reason are excluded from the calculations. Such situations include:

- suspension by court decision of all banking operations of the company;

- seizure of property belonging to the enterprise.

The amount of the fine determined by the formula is transferred in full on the same day as the overdue money. In order to quickly calculate penalties for insurance premiums, download a convenient → calculator for calculating penalties for taxes and contributions.

Organizations can pay penalties voluntarily. To do this, you should send a payment order to the fund indicating the amount of the sanction. The document must contain the correct details, including the relevant BCC.

MORE DETAILS: Termination of CASCO insurance contract, sample application.

Penalty or, more commonly, interest is money that is collected as a fine from the payer for late payment within the deadlines established by law. They may be charged taxes and insurance premiums.

They are calculated for each day that elapses from the date when the payment was due until the day the debt is repaid. Calculated based on the refinancing rate.

In this article we will look at the nuances of their accounting and the main entries for the calculation and payment of penalties for taxes.

The penalty is a percentage ratio of 1/300 to the refinancing rate of the Central Bank of the Russian Federation. The payer transfers the amount of penalties voluntarily or compulsorily (without the payer’s consent, the money is written off from his current account), simultaneously or after paying off debts on taxes or insurance fees.

As mentioned above, penalties should not reduce income taxes. Therefore, it is better to use posting D99 “Tax sanctions” K 68.4 “Income tax”. If the organization decides to account for them on account 91, the posting will look like: D91 “Other expenses” K 68.4.

Alpha did not pay income tax in the amount of 78,540 rubles on time. The payment deadline was April 28. The company paid off its debt on May 20. A fine was listed along with the tax. Refinancing rate is 8.25%.

78540 x (1/300 x 8.25%) x 22 = 475.17 rub.

For VAT, personal income tax and other taxes, the postings will be identical. Only the subaccount for account 68 will change. For VAT it is 68.2, for personal income tax it is 68.1. The method for calculating penalties for all taxes is identical.

Alpha transferred insurance contributions to the Pension Fund for pension provision for April in the amount of 39,847 rubles. June 10th.

Add additional explanation regarding the “tax due” date. As I understand it, the accrual of penalties begins on the day following the “tax payment deadline” day. Those. if the tax payment deadline = 04/25/2017 and the debt repayment date = 05/02/2017, then the number of days for which penalties are accrued is actually = 6 (and not 7 as in this calculation). Or the first date should be called “Start date of accrual of penalties.”

Penalties and fines from tax authorities are quite common here, and there are no elements of overtax delays with this. Well, in order to prevent this, it is necessary to strictly adhere to the deadlines for paying taxes and fees, as well as submitting the necessary reports...

Extra-budgetary funds were created to ensure the collection and expenditure of funds in certain areas. The formation and expenditure of funds by funds is regulated by fundamental documents:

- Federal Law of July 31, 1998 No. 145-FZ;

- Federal Law of July 24, 2009 No. 212-FZ.

Social extra-budgetary funds (PFR, FSS, FFOMS) are formed mainly from insurance contributions received from organizations. They are created to perform certain social tasks (payment of pensions, sickness benefits and others).

For accounting of settlements with extra-budgetary funds, account 69 “Settlements for social insurance and security” is provided. Sub-accounts are opened for each type of payment.

Let's look at accounting for insurance premiums in accounting using an example.

Dt 44 Kt 70 - 120,000 rub. - wages accrued.

Dt 70 Kt 68.01 “NDFL” - 15,600 rubles. — personal income tax is withheld from wages.

Dt 44 Kt 69.01 - 3,480 rub. (120,000 × 2.9%) - an insurance contribution to the Social Insurance Fund has been charged.

Dt 44 Kt 69.02 - 26,400 rub. (120,000 × 22%) - an insurance premium has been charged to the Pension Fund.

Dt 44 Kt 69.03 - 6,120 rub. (120,000 × 5.1%) - reflects the insurance contribution to the FFOMS.

Dt 44 Kt 69.11 — 240 rub. (120,000 × 0.2%) - a contribution for “injuries” has been added.

Dt 44 Kt 70 - 2,300 rub. — accrual for sick leave is reflected.

Dt 69 Kt 70 — 3,300 rub. — the calculation for sick leave was accrued in the part reimbursed by the Social Insurance Fund.

Dt 69.01 Kt 51 — 180 rub. (3480 – 3300) — contributions to the Social Insurance Fund have been paid.

Dt 69.02 Kt 51 - 26,400 rub. — contributions to the Pension Fund have been paid.

Dt 69.03 Kt 51 - 6,120 rub. — contributions to the FFOMS have been paid.

Dt 69.11 Kt 51 — 240 rub. — the “injury” contribution has been paid.

The posting reflecting the accrual of penalties in the Pension Fund looks like this: Debit account 99 “Profits and losses” - Credit account 69 “Calculations for social insurance and security”.

The transfer of penalties to the budget is reflected in the accounting records as the debit of account 69 “Calculations for social insurance and security” and the credit of account 51 “Current accounts”.

The date on which the transaction for accrual of penalties is reflected in the accounting records depends on whether you accrued them yourself or whether this was done based on the results of an audit:

- if penalties are accrued independently, then the posting is made on the date of their calculation (this date is reflected in the calculation certificate);

- if penalties are accrued by the Pension Fund, then the posting is made on the date of entry into force of the decision based on the results of the audit.

Results

Penalties for late payment of insurance premiums that are not repaid within the period specified in the request of the tax authority are collected forcibly from the policyholder’s funds or from his property if there are insufficient funds in the accounts. The policyholder is recommended to independently choose the method of reflecting penalties in accounting and reflect it in the accounting policy.

Sources:

- Tax Code of the Russian Federation

- PBU 10/99, approved. by order of the Ministry of Finance of Russia dated May 6, 1999 N 33n

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Calculation of penalties in the Pension Fund: postings

Penalties can be calculated and paid by the company voluntarily or based on notices issued to the payer by the supervising inspectorate of the Federal Tax Service after an inspection. To account for penalties on insurance contributions, subaccounts are usually opened to account 69 for each type of accrued sanctions.

In the company’s accounting, transactions on penalties in the Pension Fund of the Russian Federation are reflected in the following entries:

There are peculiarities in the timing of recording the operation to accrue penalties. This depends on two factors:

- if the fines are calculated by the company’s accounting department independently, then the posting of the fines to the Pension Fund is dated in the same way as the prepared calculation certificate;

- if the accrual of penalties was the result of an audit, the accounting is made on the date of entry into force of the decision based on the results of this audit.