What is the simplified tax system

There are six taxation systems in Russia, which differ in the amount of taxes and the amount of reporting.

The simplified system or simplified tax system is the most common among small businesses. It suits almost everyone and makes the life of an entrepreneur easier: one tax replaces several, you need to report once a year and there are ways to pay less. We talked about other systems and the benefits of each of them in the article “How to choose a taxation system.”

Submit reports in three clicks

Elba - online accounting for individual entrepreneurs and LLCs. The service will prepare reports, calculate taxes and free up time for useful things.

Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months

Who does not suit the simplified tax system?

If you are on this list, you will not be able to switch to the simplified tax system:

- annual income above 150 million rubles,

- LLC with branches,

- banks and microfinance organizations,

- organizations in which more than 25% of the authorized capital belongs to another organization,

- pawnshops,

- insurers,

- companies with more than 100 employees,

- organizations with fixed assets worth more than 150 million rubles,

- non-state pension and investment funds,

- professional participants in the securities market: brokers, dealers, securities managers and others from Chapter 2 of Law No. 39-FZ,

- organizations and individual entrepreneurs that produce excisable goods, extract and sell minerals, except for common ones,

- gambling organizers,

- notaries and lawyers,

- participants in production sharing agreements,

- payers of the single agricultural tax,

- state and budgetary institutions,

- foreign organizations,

- outstaffing companies.

Changes to the simplified tax system in 2020

Previously, a taxpayer lost the right to the simplified tax system when income exceeded 150 million rubles. After this amount, it was necessary to switch to a general taxation system.

In 2020 the situation will change. Changes to the tax code have not yet entered into force, but we have no doubt that the bill will be adopted. If your income exceeds 150 million rubles, you will not lose your right to the simplified tax system, but you will have to pay tax at an increased rate. This is 8% for the simplified tax system “Income” and 20% for the simplified tax system “Income minus expenses”. The increased rate will be applied from the quarter in which income reached RUB 150 million.

If you earn more than 200 million rubles, you will lose the right to the simplified tax system.

Thus, the limit on the use of the simplified tax system in 2020 will increase from 150 to 200 million rubles. and from 100 to 130 employees based on the average number.

Personal income tax and insurance premiums.

Personal income tax.

Formally, in the situation under consideration, employees receive income from the employer company in the form of insurance premiums paid for them under a VHI agreement.

However, due to the direct indication in paragraph 3 of Art. 213 of the Tax Code of the Russian Federation, when determining the taxable base for personal income tax, the amounts of insurance contributions are taken into account if they are paid for individuals from the funds of employers or from the funds of organizations or entrepreneurs who are not employers in relation to individuals for whom they make insurance contributions, except for cases when insurance of individuals is carried out under compulsory insurance contracts, voluntary personal insurance or voluntary pension insurance.

It follows from this that income received by employees in the form of paid insurance premiums under a VHI agreement does not need to be taken into account when determining the taxable base for personal income tax.

Note:

[email protected] dated 08/01/2016 explained that the calculation according to Form 6-NDFL does not reflect income that is not subject to personal income tax, listed in Art. 217 Tax Code of the Russian Federation. At the same time, about the income listed in other articles of Chapter. 23 of the Tax Code of the Russian Federation, in particular in paragraph 3 of Art. 213, they didn't mention it. The tax agent must decide independently whether to include data on VHI expenses in the calculation on Form 6-NDFL. At the same time, the reflection or, on the contrary, non-reflection of this information in the specified calculation will not in any way affect the tax base and the amount of tax.

If a VHI agreement is concluded between an insurance company and an employer company in favor of employees, but insurance premiums are deducted from their salaries, the taxpayer (employees) has the right to exercise their right to receive a social tax deduction provided for in paragraphs. 3 p. 1 art. 219 of the Tax Code of the Russian Federation. In this case, a deduction for the amount of payment for the cost of medical services and (or) payment of insurance premiums is provided to the taxpayer if (Letter of the Ministry of Finance of Russia dated December 11, 2018 No. 03-04-05/89998):

- medical services are provided in medical organizations (individual entrepreneurs) that have appropriate licenses to carry out medical activities, issued in accordance with the legislation of the Russian Federation;

- as well as when the taxpayer submits documents confirming his actual expenses for medical services provided, the purchase of medicines for medical use or the payment of insurance premiums.

Such documents, in particular, include payment documents (payment orders) confirming the employer’s payment of contributions to the insurance company, a copy of the voluntary health insurance agreement, a certificate issued by the employer indicating the amount of contributions transferred to the insurance company, which were withheld from the taxpayer’s salary during tax period.

Insurance premiums.

The insurance premium under voluntary health insurance contracts for employees concluded for a period of at least a year is not subject to insurance contributions to the Pension Fund of the Russian Federation, to the Social Insurance Fund (including contributions for injuries) and to the Compulsory Medical Insurance Fund (clause 5, clause 1, article 422 of the Tax Code of the Russian Federation, clause 5 Clause 1, Article 20.2 of the Federal Law of July 24, 1998 No. 125-FZ).

Thus, the insurance premium for the period when employees were in an employment relationship with the organization is not included in the base for calculating insurance premiums.

Two types of simplified tax system

Types of simplified taxation system differ in the amount on which tax is paid.

- STS "Income". Tax is paid on all money received. Costs for the purchase of goods, equipment, and employee salaries are not taken into account. In most regions the tax is 6% of income. But some have a reduced rate - from 1% to 6%. For example, in Crimea 4%.

- USN “Income minus expenses”. Tax is paid on the difference between income and expenses. Here the tax rate is higher - from 5% to 15%. It is established by regional laws: The simplified tax system rate in Moscow is 15% for everyone, 10% for those who do business in the field of social services, sports, livestock farming and others from the law of the city of Moscow. The simplified taxation system rate in St. Petersburg is 7% for everyone. The simplified taxation system rate in Yekaterinburg and the Sverdlovsk region is 7% for everyone, 5% for those doing business in the field of education, healthcare, sports and others from Article 2 of the law of the Sverdlovsk region No. 31-OZ. Important: the simplified tax system “Income minus expenses” cannot be lower than 1% of income. Even if the year was unprofitable, you will have to pay this minimum tax.

Elba will calculate the tax on the simplified tax system “Income” and “Income minus expenses”. Get 30 free days when you sign up and try it yourself. If you are using the simplified tax system “Income” and all payments are sent to your current account, use our free service.

Recognition of VHI in tax accounting

In accordance with paragraphs. 16th century 255 of the Tax Code of the Russian Federation, these amounts are included in labor costs, but subject to the following conditions:

- The medical organization must have a license.

- The contract must be valid for at least a year.

- You can reduce the income tax on the insurance premium, but if it is no more than 6% of the payroll volume (without VHI). The amount exceeding this limit is not accepted for reduction.

It should be taken into account that in accordance with paragraph 3 of Art. 318 of the Tax Code of the Russian Federation, if the insurance period covers two calendar years, then the payroll to determine the maximum amount by which income tax can be reduced is calculated incrementally:

- from the date of commencement of the contract until the end of the first year of its validity;

- from the beginning of next year until the end of the contract.

This procedure is confirmed by the Ministry of Finance in letter dated September 16, 2016 No. 03-03-06/1/54205.

Also clause 6 of Art. 272 of the Tax Code of the Russian Federation establishes the following methods for recognizing contributions as expenses:

- with a one-time payment evenly throughout the entire term of the contract;

- if the payment was made in parts, such payment is recognized for each paid part evenly from the date of payment of each part until the end of the agreement with the medical institution.

In the profit declaration, such expenses are reflected in Appendix No. 1: code 812 is entered in column 3, and in column 4 - the amount of insurance costs, which is taken into account in the tax reduction (Section XVII of the Procedure for filling out the declaration).

There are no reflection features or restrictions in accounting. Insurance premiums are taken into account monthly evenly throughout the insurance period.

VHI, accounting by postings:

| D 76 (97) - K 51 | Contributions transferred |

| D 20 (23, 25, 26, 44) - K 76 (97) | Part of the cost of employee insurance for the month is taken into account. The accounts on which the accrual of wages of insured workers are reflected are debited. |

| D 90, 91.2 - K 20 (23, 25, 26, 44) | Referred to the financial result of the insurance amount |

It is also possible to reflect a permanent difference in accounting by posting Dt 99 Kt 68:

- if the company’s contributions for voluntary insurance exceeded 6% of the payroll;

- if the conditions for recognizing them as expenses are not met.

Which simplified tax system to choose

This depends on two factors:

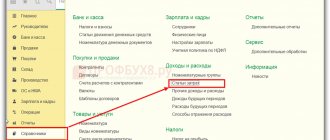

- What tax rate applies in your region. Look on the tax website in the “Features of regional legislation” section. It may turn out that for your business the rate of the simplified tax system “Income minus expenses” is even less than the simplified tax system “Income”.

- The amount of business expenses. Typically, the simplified tax system “Income” is suitable for the service sector, where costs are small, and the simplified tax system “Income minus expenses” is suitable for trade. If the simplified tax system rate is the maximum, then the share of business expenses should be 70-80% in order for applying the simplified tax system of 15% to be profitable.

How to reduce the simplified tax system “Income”

Insurance premiums for individual entrepreneurs and employees can be deducted from the tax. To do this, follow two main rules:

- An individual entrepreneur without employees can reduce the tax completely, but an individual entrepreneur with employees and all LLCs can only reduce it by half.

- The tax is reduced only by those contributions that you paid in the same period for which you are calculating the tax. For example, on March 18 you paid 10 thousand rubles in insurance premiums. By this amount you will reduce the simplified tax system for the first quarter.

Read about the nuances of tax reduction in the article “How to reduce the amount of tax on the simplified tax system.”

Costs of voluntary health insurance when applying the simplified tax system

Any enterprise pays mandatory contributions to the Mandatory Health Insurance fund. In addition, the employer can conclude a voluntary health insurance agreement for employees. According to clause. Tax accounting of expenses for voluntary health insurance is carried out in accordance with the provisions of art. From this document it follows that expenses are taken into account in the tax period in which the insurance premiums were paid. If the insurance conditions provide for a one-time payment, then the costs should be distributed evenly over the entire period of validity of the VHI contract.

The Ministry of Finance clarified whether expenses under voluntary health insurance contracts are included in the tax base under the simplified tax system.

How to reduce the simplified tax system “Income minus expenses”

Due to business expenses, it is not the tax that is reduced, but the tax base - the amount on which you calculate the tax. Here you need to be careful: you can only take into account expenses that are useful for the business and allowed. Their list is contained in Art. 346.16 of the Internal Revenue Code.

| Cannot be taken into account | Can be taken into account |

|

|

Important: each expense must be confirmed with a document confirming payment and receipt of the product or service. Payment is confirmed by a cash receipt or account statement, and receipt of goods or services is confirmed by an invoice or act. Keep these documents in case of a tax audit.

Read more about this in the article “Rules for writing off expenses on the simplified tax system”

How is insurance accepted as an expense under the simplified tax system?

In accounting, insurance costs are recognized in the period of actual provision of services, regardless of the moment of payment (clause 18 of PBU 10/99). The method of writing off costs is established by the simplifier independently - by attributing amounts to costs at a time or in equal parts, broken down by the term of the contract.

In tax accounting, insurance expenses are recognized after actual payment of the cost of services in accordance with clause 2 of Art. 346.17 Tax Code. There is no need to distribute the amounts evenly, because this requirement applies only to those enterprises that are payers of income tax.

How to pay and report according to the simplified tax system

The simplified tax system is paid every quarter:

- until April 25 - for the first quarter;

- before July 25 - for half a year;

- before October 25 - 9 months;

- until March 31 for an LLC, until April 30 for an individual entrepreneur - the final calculation of the simplified tax system for the year.

The Declaration of the simplified tax system is submitted once a year - before March 31 for an LLC, until April 30 for an individual entrepreneur. If the deadline falls on a weekend or holiday, it is moved to the next business day.

In addition, you need to keep a book of income and expenses. You don’t hand it over to the tax office until she asks.

We recommend reading the articles:

“Reporting of individual entrepreneurs on the simplified tax system”

“LLC reporting on the simplified tax system”

“How to keep a book of income and expenses”

Good to remember

- The simplified tax system is not suitable for: banks, lawyers, LLCs with branches.

- The limit for switching to the simplified tax system in 2020 is 150 million rubles and up to 100 employees. The limit on the use of the simplified tax system in 2020 will be increased to 200 million rubles and to 130 employees.

- There are two types of simplified tax system: “Income” 6% and “Income minus expenses” 15%. Before making a choice, look at regional legislation and estimate business costs.

- The simplified tax system “Income” is reduced by insurance premiums for individual entrepreneurs and for employees.

- On the simplified tax system “Income minus expenses” you can only take into account expenses from Art. 346.16 Tax Code, useful for business and supported by documents.

- The simplified tax system is paid every quarter, and the declaration is submitted once a year.

- You can switch to the simplified tax system only from the beginning of the calendar year or within 30 days after registering a business.

Accounting for VHI expenses

Reflection of VHI expenses in accounting is carried out on the basis of an order (instruction) on voluntary insurance of employees with a list of insured persons. The terms of payment for voluntary insurance may also be specified in the order or the attached insurance rules. In particular, the employer must establish the cost of voluntary insurance, repaid at the expense of employees, the procedure for calculating it, as well as the rules for employees to contribute the specified amounts (in a lump sum or in equal installments over a certain period).

All insured persons must be familiarized with the terms of payment for voluntary insurance upon signature.

According to the Instructions on the procedure for applying the budget classification of the Russian Federation for 2013 and for the planning period of 2014 and 2015, approved by Order of the Ministry of Finance of Russia dated December 21, 2012 N 171n, expenses for payment for insurance services (including life insurance) should be attributed to subarticle 226 “ Other works, services" KOSGU.

Let's look at the procedure for reflecting transactions for voluntary medical insurance of employees in accounting using an example.

- 50% (RUB 75,000) of the cost of insurance at the expense of the institution’s funds received from income-generating activities. The amount is transferred in a one-time payment as an advance payment under the VHI agreement;

- 50% (75,000 rubles) - at the expense of employees by deducting from their wages in equal shares within three months from the date of conclusion of the contract.

In accordance with Instruction No. 183n, these transactions will be reflected in accounting as follows:

Instructions for the use of the Chart of Accounts for accounting of autonomous institutions, approved. By Order of the Ministry of Finance of Russia dated December 23, 2010 N 183n.