https://youtu.be/rIxwXXrhjNc

Regulatory framework and definition of leasing

An example of calculating a leasing agreement

Accounting entries for the lessee, property on the lessee’s balance sheet

Redemption by the lessee of property on its balance sheet

Postings of the lessee, if the property is on the balance sheet of the lessor

Accounting for a leasing agreement with the lessor

Features of car accounting in leasing

Commission fee under a leasing agreement

Accounting for leasing when reflecting property on the lessor’s balance sheet

Leasing transactions correspond to the payment schedule located at the link.

If the leasing agreement provides for the reflection of the leased asset on the lessor’s balance sheet, the lessee reflects the leased property on off-balance sheet account 001 “Leased fixed assets”.

The accrual of leasing payments is reflected in the credit of account 76 “Settlements with various debtors and creditors” in correspondence with cost accounts: 20, 23, 25, 26, 29 – when accounting for leasing payments on property that is used in production activities, 44 – on property used in the activities of a trade organization, 91.2 - for property that is used for non-production purposes. Further, for simplicity, in the leasing accounting examples, only entries for the 20th account will be given.

What laws govern leasing?

Leasing is regulated by Art. 665 and 666 of the Civil Code of the Russian Federation, Federal Law of October 29, 1998 No. 164-FZ “On financial rent (leasing)” and by-laws.

In the leasing agreement, take into account the following essential conditions:

- condition on the subject of leasing;

- condition on the amount of leasing payments;

- condition on the lease term;

- condition about the seller of the property: who chooses it - the lessee or the lessor.

If the contract does not contain these conditions, it is considered not concluded. The contracts can also stipulate who services the equipment, trains the personnel, on whose balance sheet the property is accounted for, what happens to it at the end of the contract and what the redemption price will be then. Important issues: the procedure for property insurance and the distribution of risks between the parties to the contract.

https://youtu.be/qcVmNu-9lN4

Postings for current lease payments

Dt 60 – Kt 51 – 236,000 (advance payment (down payment) under the leasing agreement has been paid)

It is necessary to take into account that the advance payment under the leasing agreement can be charged as expenses (offset of the advance payment) not immediately, but throughout the entire agreement. In the above payment schedule, the advance payment under the contract is offset evenly (RUB 6,555.56 each) over 36 months.

Dt 20 – Kt 76 – 29,276.27 (accrued leasing payment No. 1 – 34,546 minus VAT – 5,269.73)

Dt 19 – Kt 76 – 5,269.73 (VAT charged on lease payment No. 1)

Dt 20 – Kt 60 – 5,555.56 (part of the advance payment under the leasing agreement is credited – 6,555.56 minus VAT 1,000)

Dt 19 – Kt 60 – 1,000 (VAT charged against advance payment)

Dt 68 – Kt 19 – 6,269.73 (VAT submitted to the budget)

Dt 76 – Kt 51 – 34,546 (leasing payment No. 1 listed)

The commission that is paid at the beginning of the leasing transaction (commission for concluding the transaction) is charged in accounting to the same expense accounts as current leasing payments.

Accounting and tax accounting of leasing from the lessee

Accounting for transactions under a leasing agreement is regulated by Order of the Ministry of Finance of the Russian Federation No. 15 dated February 17, 1997.

Leasing entries depend on whose balance sheet the leased property is reflected on: the lessor or the lessee. The party on whose balance sheet the leased property is accounted for must be indicated in the leasing agreement.

Accounting for leasing when reflecting property on the lessor’s balance sheet

Leasing transactions correspond to the payment schedule located at the link.

If the leasing agreement provides for the reflection of the leased asset on the lessor’s balance sheet, the lessee reflects the leased property on off-balance sheet account 001 “Leased fixed assets”.

The accrual of leasing payments is reflected in the credit of account 76 “Settlements with various debtors and creditors” in correspondence with cost accounts: 20, 23, 25, 26, 29 - when accounting for leasing payments on property that is used in production activities, 44 - on property used in the activities of a trade organization, 91.2 - for property that is used for non-production purposes. Further, for simplicity, in the leasing accounting examples, only entries for the 20th account will be given.

Postings upon receipt of the leased asset

Dt 001 - 1,000,000

(the leased asset is accepted for accounting at cost excluding VAT)

Postings for current lease payments

Dt 60 - Kt 51 - 236,000

(advance payment (down payment) under the leasing agreement has been paid)

It is necessary to take into account that the advance payment under the leasing agreement can be charged as expenses (offset of the advance payment) not immediately, but throughout the entire agreement. In the above payment schedule, the advance payment under the contract is offset evenly (RUB 6,555.56 each) over 36 months.

Dt 20 - Kt 76 - 29,276.27

(accrued leasing payment No. 1 - 34,546 minus VAT - 5,269.73)

Dt 19 - Kt 76 - 5,269.73

(VAT charged on lease payment No. 1)

Dt 20 - Kt 60 - 5,555.56

(part of the advance payment under the leasing agreement is credited - 6,555.56 minus VAT 1,000)

Dt 19 - Kt 60 - 1,000

(VAT is calculated based on the advance payment)

Dt 68 - Kt 19 - 6,269.73

(VAT submitted to the budget)

Dt 76 - Kt 51 - 34 546

(listed leasing payment No. 1)

The commission that is paid at the beginning of the leasing transaction (commission for concluding the transaction) is charged in accounting to the same expense accounts as current leasing payments.

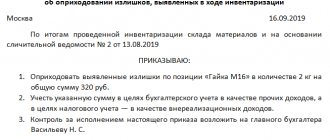

Postings for the redemption of the leased asset

If there is a buyout price in the leasing agreement (this amount is not included in the leasing payment schedule, for example, let’s take it equal to 1,180 rubles including VAT), the following entries are made in accounting:

Dt 08 - Kt 76 - 1,000

(reflects the costs of repurchasing the leased asset upon transfer of ownership to the lessee)

Dt 19 - Kt 76 - 180

(VAT is charged when purchasing the leased asset)

Dt 68 - Kt 19 - 180

(VAT submitted to the budget)

Dt 76 - Kt 51 - 1 180

(the amount of redemption of the leased asset has been paid)

Dt 01 - Kt 08 - 1 000

(the leased asset was accepted for accounting as part of its own fixed assets)

Accounting for leasing when reflecting property on the lessee’s balance sheet

The legislation regulating leasing accounting does not contain unambiguous instructions on the reflection of transactions under a leasing agreement if the lessee is the balance holder of the property.

Currently, the practice of communication between lessees and leasing companies with auditors and inspection bodies has developed, and a certain scheme of leasing transactions has been formed.

Accounting for leasing when reflecting property on the lessee’s balance sheet

If, under the terms of the leasing agreement, the property is taken into account on the lessee’s balance sheet, upon receipt of the leased asset in the lessee’s accounting, the value of the property minus VAT is reflected in the debit of account 08 “Investments in non-current assets” in correspondence with the credit of account 76 “Settlements with various debtors and creditors”.

When a leased asset is accepted for accounting as part of fixed assets, its value is written off from credit 08 of account to debit 01 of account “Fixed Assets”.

The accrual of leasing payments is reflected in the debit of account 76, subaccount, for example, “Settlements with the lessor” in correspondence with account 76, subaccount, for example, “Settlements for leasing payments”.

Depreciation on the leased asset is calculated by the lessee. The amount of depreciation of the leased asset is recognized as an expense for ordinary activities and is reflected in the debit of account 20 “Main production” in correspondence with the credit of account 02 “Depreciation of fixed assets, subaccount for depreciation of leased property.

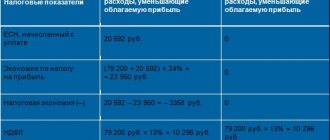

Tax accounting of leasing when reflecting property on the lessee’s balance sheet

In the tax accounting of the lessee, leased property is recognized as depreciable property.

The initial cost of the leased asset is determined as the amount of the lessor's expenses for its acquisition.

For profit tax purposes, the monthly depreciation amount is determined based on the product of the original cost of the leased asset and the depreciation rate, which is determined based on the useful life of the leased property (taking into account the classification of fixed assets included in depreciation groups). In this case, the lessee has the right to apply a coefficient of up to 3 to the depreciation rate. The specific size of the increasing coefficient is determined by the lessee in the range from 1 to 3. This coefficient does not apply to leased property belonging to the first to third depreciation groups.

Leasing payments minus the amount of depreciation on leased property are expenses associated with production and sales.

An example of accounting for leasing when reflecting property on the lessee’s balance sheet

Leasing transactions correspond to the payment schedule for property leasing located at the link

The lessee received a passenger car under a leasing agreement, payment schedule parameters:

- leasing agreement term - 3 years (36 months)

- the total amount of payments under the leasing agreement is 1,479,655.10 rubles, incl. VAT — 225,710.10 rubles

- advance payment (down payment) - 20%, 236,000 rubles, incl. VAT — 36,000 rubles

- The cost of the car is 1,180,000 rubles, incl. VAT - 180,000 rubles

The expected period of use of the leased property is four years (48 months). The car belongs to the third depreciation group (property with a useful life of 3 to 5 years). Depreciation is calculated using the straight-line method.

Let's determine the amount of monthly depreciation in accounting. Because the cost of the property (including the leasing company's remuneration) is equal to 1,253,945 rubles (1,479,655.10 - 225,710.10), monthly depreciation will be 1,253,945: 48 = 26,123.85 rubles.

A passenger car belongs to the third depreciation group, therefore, a period of 48 months can be established in tax accounting. The monthly depreciation rate is 2.0833% (1: 48 months x 100%), the monthly depreciation amount is 1,000,000? 2.0833% = 20,833.33 rubles.

In accordance with paragraph 10, paragraph 1 of Article 264 of the Tax Code of the Russian Federation, the amount of the lease payment recognized monthly as an expense for profit tax purposes is 8,442.94 rubles (34,546 (lease payment) - 5,269.73 (VAT as part of the lease payment) — 20,833.33 (monthly depreciation in tax accounting)).

Expenses under the leasing agreement are formed monthly in accounting due to depreciation (26,123.85 rubles), in tax accounting - due to depreciation (20,833.33 rubles) and leasing payment (8,442.94 rubles), a total of 29,276 ,27 rubles.

Because in accounting, the amount of expenses over 36 months (the term of the leasing agreement) is less than in tax accounting, this leads to the emergence of taxable temporary differences and deferred tax liabilities.

During the term of the leasing agreement, the lessee has a monthly taxable temporary difference in the amount of 3,152.42 rubles (29,276.27 - 26,123.85) and a corresponding deferred tax liability arises in the amount of 630.48 rubles (3,152.42?20% ).

Separately, it is necessary to say about accounting for the advance payment (down payment under the contract)

. The following situations are possible:

1. When transferring property for leasing, the lessor provides an invoice for the full amount of the advance

(in the given schedule of leasing payments - by 236,000 rubles). In this case, the entire amount of the advance payment minus VAT in tax accounting is recognized as an expense for profit tax purposes.

I would like to note that under the leasing agreement, services are provided throughout the entire contract and the fiscal authorities have no reason to assess compliance with the criteria of paragraph 4, paragraph 2 of Article 40 of the Tax Code of the Russian Federation on the comparability of leasing payments, because individual payments cannot be considered as separate transactions, and the price under a leasing agreement must be analyzed in aggregate for all payments in the agreement.

2. The advance payment under the leasing agreement is offset in equal payments throughout the entire leasing term.

In this case, the offset portion of the advance payment is recognized as an expense in tax accounting for profit tax purposes.

In the given example of a leasing payment schedule, it is assumed that an advance invoice is issued to the lessee when the property is leased, i.e. In tax accounting, when transferring property into leasing, expenses in the amount of 200,000 rubles are reflected (the advance payment, which is a leasing payment, is not deducted, since in the first month when transferring property into leasing, it is not yet accrued). At the same time, a taxable temporary difference in the amount of 200,000 rubles and a corresponding deferred tax liability in the amount of 40,000 rubles (200,000 rubles x 20%) arise.

At the end of the leasing agreement, the lessee will continue to accrue monthly depreciation in accounting in the amount of 26,123.85 rubles. There will be no expenses in tax accounting. This will lead to a monthly decrease in deferred tax liabilities in the amount of 5,224.77 rubles (26,123.85 rubles x 20%).

Thus, based on the results of the agreement, the total amount of deferred tax liabilities will be equal to zero:

40,000 (deferred tax liability for the advance payment) + 22,697 (630.48? 36 - deferred tax liability for current lease payments) - 62,697 (5,224.77? 12 - reduction of deferred tax liabilities for 12 months of depreciation in the accounting accounting after the end of the leasing agreement).

Postings upon receipt of the leased asset

Dt 60 - Kt 51 - 236,000

(advance paid under the leasing agreement)

Dt 08 - Kt 76 (Settlements with the lessor) - 1,253,945

(debt under the leasing agreement is reflected without VAT)

Dt 19 - Kt 76 (Settlements with the lessor) - 225,710.10

(VAT reflected under the leasing agreement)

Dt 01 - Kt 08 - 1 253 945

(a car received under a leasing agreement is accepted for registration)

Dt 76 - Kt 60 - 236,000

(advance payment paid upon concluding the leasing agreement is included)

Dt 68 (Income tax) - Kt 77 - 40,000

(deferred tax liability reflected)

Dt 68 (VAT) - Kt 19 - 36,000

(VAT submitted on advance payment)

Postings for current lease payments

Dt 20 - Kt 02 - 26,123.85

(depreciation has been calculated on the car)

Dt 76 (Settlements with the lessor) - Kt 76 (Settlements for leasing payments) - 34,546

(leasing debt has been reduced by the amount of the lease payment)

Dt 76 “Calculations for leasing payments” - Kt 51 - 34,546

(leasing payment transferred)

Dt 68 (VAT) - Kt 19 - 5,269.73

(VAT is presented on the current lease payment)

Dt 68 (Income tax) - Kt 77 - 630.48

(deferred tax liability reflected)

Postings at the end of the leasing agreement

Dt 01 (Own fixed assets) - Kt 01 (Fixed assets received under leasing) - 1,253,945

(reflects the receipt of the car into ownership)

Dt 02 (Depreciation of leased property) - Kt 02 (Depreciation of own fixed assets) - 940,458.60

(accrued depreciation on the car is reflected)

Postings within 12 months after the end of the leasing agreement

Dt 20 - Kt 02 (Depreciation of own fixed assets) - 26,123.85

(depreciation has been calculated on the car)

Dt 77 - Kt 68 (Income tax) - 5,224.77

(reflects a decrease in deferred tax liability)

There is also a method in which the initial cost of the leased asset in accounting is equal to the cost of purchasing a car from the lessor, i.e. coincides with the value in tax accounting. In this case, on account 76, when the property is accepted for accounting, only the debt for the value of the property is reflected.

Leasing payments are accrued monthly on credit 20 of account in correspondence with account 76 in the amount of the difference between accrued depreciation and the amount of the monthly lease payment.

Selecting the most reasonable option for reflecting leased property on the balance sheet of the lessor or lessee, as well as agreeing with the leasing company on the optimal scheme for reflecting leasing payments, is a very complex task that requires good knowledge of the specifics of accounting for leasing operations and the peculiarities of the wording in the leasing agreement and primary documents.

Postings for the redemption of the leased asset

If there is a buyout price in the leasing agreement (this amount is not included in the leasing payment schedule, for example, let’s take it equal to 1,180 rubles including VAT), the following entries are made in accounting:

Dt 08 – Kt 76 – 1,000 (reflects the costs of purchasing the leased asset when transferring ownership to the lessee)

Dt 19 – Kt 76 – 180 (VAT is charged when purchasing the leased asset)

Dt 68 – Kt 19 – 180 (VAT submitted to the budget)

Dt 76 – Kt 51 – 1,180 (the amount of redemption of the leased asset has been paid)

Dt 01 – Kt 08 – 1,000 (the leased asset is accepted for accounting as part of own fixed assets)

Accounting for leasing when reflecting property on the lessee’s balance sheet

If, under the terms of the leasing agreement, the property is taken into account on the lessee’s balance sheet, upon receipt of the leased asset in the lessee’s accounting, the value of the property minus VAT is reflected in the debit of account 08 “Investments in non-current assets” in correspondence with the credit of account 76 “Settlements with various debtors and creditors”.

When a leased asset is accepted for accounting as part of fixed assets, its value is written off from credit 08 of account to debit 01 of account “Fixed Assets”.

The accrual of leasing payments is reflected in the debit of account 76, subaccount, for example, “Settlements with the lessor” in correspondence with account 76, subaccount, for example, “Settlements for leasing payments”.

Depreciation on the leased asset is calculated by the lessee. The amount of depreciation of the leased asset is recognized as an expense for ordinary activities and is reflected in the debit of account 20 “Main production” in correspondence with the credit of account 02 “Depreciation of fixed assets, subaccount for depreciation of leased property.

Results

In relations arising under a financial lease agreement, it is allowed to delegate to the recipient of the property the right to take into account the subject of this agreement in the balance sheet. This leads to the appearance of accounting entries that differ significantly from those performed in a situation where the object is accounted for by the lessor.

The recipient's object is accepted into the OS through the usual transactions (using accounts 08 and 01) at the total cost given in the agreement, excluding VAT, the amount of which is debited to account 19. In the same usual manner, the object is accrued depreciation, the amounts of which are included in costs.

Lease payments are not included in accounting expenses. They are calculated by reducing the total amount of payment stipulated by the contract. VAT is deducted in parts as invoices are received for each lease payment. The last of the payments and the last deduction are made in relation to the cost of redemption, if the agreement does not provide for the return of the property. The return of the leased object will be reflected in the transactions as the sale of fixed assets.

For the purchased object, no changes in accounting in the amount of its accounting value and the procedure for calculating depreciation occur.

You only need to make entries that clarify the analytics of ownership of the property. You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Tax accounting of leasing when reflecting property on the lessee’s balance sheet

In the tax accounting of the lessee, leased property is recognized as depreciable property.

The initial cost of the leased asset is determined as the amount of the lessor's expenses for its acquisition.

For profit tax purposes, the monthly depreciation amount is determined based on the product of the original cost of the leased asset and the depreciation rate, which is determined based on the useful life of the leased property (taking into account the classification of fixed assets included in depreciation groups). In this case, the lessee has the right to apply a coefficient of up to 3 to the depreciation rate. The specific size of the increasing coefficient is determined by the lessee in the range from 1 to 3. This coefficient does not apply to leased property belonging to the first to third depreciation groups.

Leasing payments minus the amount of depreciation on leased property are expenses associated with production and sales.

An example of accounting for leasing when reflecting property on the lessee’s balance sheet

Leasing transactions correspond to the payment schedule for property leasing located at the link

The lessee received a passenger car under a leasing agreement, payment schedule parameters:

- leasing agreement term – 3 years (36 months)

- the total amount of payments under the leasing agreement is 1,479,655.10 rubles, incl. VAT – 225,710.10 rubles

- advance payment (down payment) – 20%, 236,000 rubles, incl. VAT – 36,000 rubles

- car cost – 1,180,000 rubles, incl. VAT – 180,000 rubles

The expected period of use of the leased property is four years (48 months). The car belongs to the third depreciation group (property with a useful life of 3 to 5 years). Depreciation is calculated using the straight-line method.

Let's determine the amount of monthly depreciation in accounting. Because the cost of the property (including the leasing company's remuneration) is equal to 1,253,945 rubles (1,479,655.10 - 225,710.10), monthly depreciation will be 1,253,945: 48 = 26,123.85 rubles.

A passenger car belongs to the third depreciation group, therefore, a period of 48 months can be established in tax accounting. The monthly depreciation rate is 2.0833% (1: 48 months x 100%), the monthly depreciation amount is 1,000,000 x 2.0833% = 20,833.33 rubles.

In accordance with paragraph 10 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation, the amount of the lease payment recognized monthly as an expense for profit tax purposes is 8,442.94 rubles (34,546 (lease payment) - 5,269.73 (VAT as part of the lease payment) – 20,833.33 (monthly depreciation in tax accounting)).

Expenses under the leasing agreement are formed monthly in accounting due to depreciation (26,123.85 rubles), in tax accounting - due to depreciation (20,833.33 rubles) and leasing payment (8,442.94 rubles), a total of 29,276 ,27 rubles.

Because in accounting, the amount of expenses over 36 months (the term of the leasing agreement) is less than in tax accounting, this leads to the emergence of taxable temporary differences and deferred tax liabilities.

During the term of the leasing agreement, the lessee has a monthly taxable temporary difference in the amount of 3,152.42 rubles (29,276.27 - 26,123.85) and a corresponding deferred tax liability arises in the amount of 630.48 rubles (3,152.42 x 20% ).

Separately, it is necessary to say about accounting for the advance payment (down payment under the contract) . The following situations are possible:

1. When transferring property for leasing, the lessor provides an invoice for the full amount of the advance (in the given schedule of leasing payments - for 236,000 rubles). In this case, the entire amount of the advance payment minus VAT in tax accounting is recognized as an expense for profit tax purposes.

I would like to note that under the leasing agreement, services are provided throughout the entire contract and the fiscal authorities have no reason to assess compliance with the criteria of paragraph 4, paragraph 2 of Article 40 of the Tax Code of the Russian Federation on the comparability of leasing payments, because individual payments cannot be considered as separate transactions, and the price under a leasing agreement must be analyzed in aggregate for all payments in the agreement.

2. The advance payment under the leasing agreement is offset in equal payments throughout the entire leasing term. In this case, the offset portion of the advance payment is recognized as an expense in tax accounting for profit tax purposes.

In the given example of a leasing payment schedule, it is assumed that an advance invoice is issued to the lessee when the property is leased, i.e. In tax accounting, when transferring property into leasing, expenses in the amount of 200,000 rubles are reflected (the advance payment, which is a leasing payment, is not deducted, since in the first month when transferring property into leasing, it is not yet accrued). At the same time, a taxable temporary difference in the amount of 200,000 rubles and a corresponding deferred tax liability in the amount of 40,000 rubles (200,000 rubles x 20%) arise.

At the end of the leasing agreement, the lessee will continue to accrue monthly depreciation in accounting in the amount of 26,123.85 rubles. There will be no expenses in tax accounting. This will lead to a monthly decrease in deferred tax liabilities in the amount of 5,224.77 rubles (26,123.85 rubles x 20%).

Thus, based on the results of the agreement, the total amount of deferred tax liabilities will be equal to zero:

40,000 (deferred tax liability for the advance payment) + 22,697 (630.48 x 36 – deferred tax liability for current lease payments) – 62,697 (5,224.77 x 12 – reduction of deferred tax liabilities for 12 months of depreciation in the accounting accounting after the end of the leasing agreement).

Depreciation in leasing

Although equipment purchased on lease is not the property of the organization, it still must be registered and depreciated accordingly. Depreciation is calculated using the document “Depreciation and depreciation of fixed assets” in the fixed assets and intangible assets menu. You can also calculate it automatically if you use the “Month Closing” assistant.

Fig. 15 Closing the month

In conclusion, it is important to pay attention to the fact that for leasing transactions there is a difference between accounting and tax accounting, since in the latter leasing expenses are taken into account minus tax depreciation. The 1C 8.3 program will automatically calculate depreciation and leasing expenses, and also reflect the difference between accounting and tax accounting. To do this, in 1C 8.3 it is necessary to correctly draw up the accounting policy of the enterprise.

If, in addition to leasing accounting, you regularly have questions about working with 1C programs, contact our specialists. We will be happy to advise you and also select the optimal tariffs for 1C subscription services, focusing on your individual tasks.

Postings upon receipt of the leased asset

Dt 60 – Kt 51 – 236,000 (advance paid under the leasing agreement)

Dt 08 – Kt 76 (Settlements with the lessor) – 1,253,945 (debt under the leasing agreement is reflected without VAT)

Dt 19 – Kt 76 (Settlements with the lessor) - 225,710.10 (VAT reflected under the leasing agreement)

Dt 01 – Kt 08 – 1 253 945 (a car received under a leasing agreement is accepted for registration)

Dt 76 – Kt 60 – 236,000 (advance paid at the conclusion of the leasing agreement is credited)

Dt 68 (Income tax) – Kt 77 – 40,000 (deferred tax liability reflected)

Dt 68 (VAT) – Kt 19 – 36,000 (VAT submitted on advance payment)

Postings for current lease payments

Dt 20 – Kt 02 – 26,123.85 (depreciation on the car has been calculated)

Dt 76 (Settlements with the lessor) - Kt 76 (Settlements for lease payments) - 34,546 (leasing debt reduced by the amount of the lease payment)

Dt 76 “Calculations for leasing payments” – Kt 51 – 34,546 (leasing payment transferred)

Dt 68 (VAT) – Kt 19 – 5,269.73 (VAT is presented on the current lease payment)

Dt 68 (Income tax) – Kt 77 – 630.48 (deferred tax liability reflected)

Postings within 12 months after the end of the leasing agreement

Dt 20 – Kt 02 (Depreciation of own fixed assets) – 26,123.85 (depreciation accrued on the car)

Dt 77 – Kt 68 (Income tax) – 5,224.77 (reflected decrease in deferred tax liability)

There is also a method in which the initial cost of the leased asset in accounting is equal to the cost of purchasing a car from the lessor, i.e. coincides with the value in tax accounting. In this case, on account 76, when the property is accepted for accounting, only the debt for the value of the property is reflected.

Leasing payments are accrued monthly on credit 20 of account in correspondence with account 76 in the amount of the difference between accrued depreciation and the amount of the monthly lease payment.

Selecting the most reasonable option for reflecting leased property on the balance sheet of the lessor or lessee, as well as agreeing with the leasing company on the optimal scheme for reflecting leasing payments, is a very complex task that requires good knowledge of the specifics of accounting for leasing operations and the peculiarities of the wording in the leasing agreement and primary documents.

Features of financial leasing and its advantages

Advantages of using the leasing form of rent:

- Inclusion of relevant costs in income tax;

- Payment and subsequent VAT refund;

- Off-balance sheet display of leasing costs, which does not worsen balance sheet indicators.

Accounting for leasing operations at the legislative level is regulated by Order of the Ministry of Finance of the Russian Federation No. 15 dated February 17, 1997. and PBU 6/01 for fixed assets accounting. The order in which they are displayed in accounting is determined by two factors:

- The leased object, which is recorded on the lessee’s balance sheet;

- A leased asset that is recorded on the lessor’s balance sheet.

Basic principles of leasing relations: