Control ratios for a unified calculation of insurance premiums are tips from the Federal Tax Service that contribution payers can use to check the correctness of filling out the DAM. Control ratios are regularly updated by the Federal Tax Service: in the report for the 1st quarter of 2020, updated data must be used.

The Federal Tax Service of Russia, by letter dated 02/07/2020 No. BS-4-11/ [email protected] , sent new control ratios for insurance premiums to the territorial authorities. They are used to check the correctness of reporting when:

- acceptance by the tax authority of calculations in the DAM form from payers of insurance premiums and desk verification of the report;

- uploading to the Pension Fund of Russia and receiving information from the Federal Tax Service of Russia for the purpose of posting information from calculations to individual personal accounts of insured persons.

Payers of insurance premiums use control ratios to calculate insurance premiums for self-checking when preparing and submitting reports.

New control ratios were required in connection with the transition to electronic work books, so they are of a special nature. The previously approved control ratios for the calculation of insurance premiums have not been abolished; they continue to operate in full.

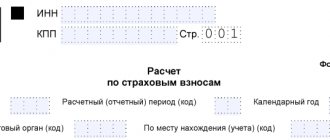

Rules for submitting RSV

Employers submit this report to the Federal Tax Service at the end of the year and quarterly. The new reporting form was approved by order of the Federal Tax Service of Russia dated September 18, 2019 No. ММВ-7-11/470. Its policyholders will rent for the first time in the first quarter of 2020. It has reduced the total number of indicators by about 30%, which means it has become easier to fill out.

Report on insurance premiums no later than the 30th day of the month following the reporting (calculation) period. In 2020, the deadlines for submitting this form look like this:

- for the first quarter - until 04/30/2020;

- 6 months before 07/30/2020;

- 9 months - until October 30, 2020;

- for 2020 - until 02/01/2021 (postponement from January 30, Saturday).

https://youtu.be/eXRxo1AAz88

Not all services are equally “free”

When using the new online service for reconciling insurance premium reports, be vigilant. Some sites offer a free test - a one-time reporting reconciliation. Further control of the forms will be paid.

For example, if the site requires you to enter a phone number or card, then most likely money will be debited from your accounts. But reporting control services may not be provided. Fraudsters have come up with a number of tricks. For example, during an online check, the site produces a new error that the accountant has not encountered before. But the service does not provide explanations for the shortcomings, but requires payment. Be carefull!

Why are control ratios needed?

Control ratios for any reporting form are a method of mathematical data verification that reflects the correctness of the information entered into the report by comparing certain indicators. Data is compared both within the form itself and with other reports.

Tax officials create and supplement a table comparing the indicators of the insurance premium calculation form and send it to the territorial offices so that the territorial Federal Tax Service Inspectors check the correctness of the data specified in the payers’ documents. The information is not kept secret: the policyholders themselves have the right to use the developed indicators for self-checking before submitting the calculation. Previously, the Federal Tax Service of Russia has already published a memo for payers of insurance premiums, which contains sufficient information on the procedure for their calculation and payment.

New test relations

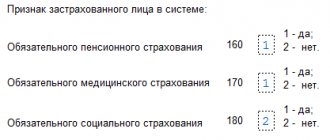

Amendments have been made to the procedure for submitting calculations for insurance premiums. In particular, the list of grounds on which calculations of insurance premiums may be recognized as not submitted has been expanded (clause 7 of Article 431 of the Tax Code of the Russian Federation as amended by Federal Law No. 335-FZ of November 27, 2017).

In addition to the criteria for refusal of acceptance still applied, when a payment is received by the tax authority, a notification of refusal will also be generated if errors are detected in section 3 for each individual:

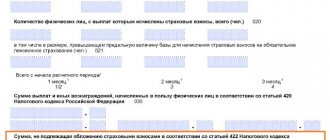

- in the amounts of payments and other remuneration (column 210);

- in the database for calculating insurance premiums within the established limit (column 220);

- in the amount of calculated insurance premiums (column 240);

- in the database for calculating insurance premiums at the additional rate (column 280);

- in the amount of insurance premiums calculated at the additional rate (column 290).

These changes came into force on January 1, 2018 (Clause 3, Article 9 of Federal Law No. 335-FZ of November 27, 2017). Accordingly, the new control ratios, which were published in the letter of the Federal Tax Service dated December 13, 2017 No. GD-4-11/, will be applied when accepting both calculations for insurance premiums for 2020 and updated calculations for the reporting periods of 2020: I quarter, half of the year , 9 months. The control ratios stipulate that the following will be checked:

- the amount of calculated insurance contributions for compulsory pension insurance at the rate (column 240) for each of the last three months of the billing (reporting) period, taking into account data for previous reporting periods (calculated on an accrual basis from the beginning of the year in accordance with paragraph 1 of Article 431 of the Tax Code of the Russian Federation );

- total amounts “in total for the last 3 months of the billing (reporting) period” (lines 250, 300);

- amounts on an accrual basis from the beginning of the year in order to exceed the maximum base value for calculating insurance contributions for compulsory pension insurance.

In the list of control ratios, you should pay attention to the reconciliation of the values in the lines of subsection 1.1 of Appendix 1 to Section 1 (lines 030, 050 – 051, 061) with the amounts for all sections 3 (in columns 210, 220, 240). Such a reconciliation is carried out when the value of field 001 of Appendix 1 of Section 1 corresponds to the value of line 200 of Subsection 3.2.1 of Section 3.

The ratio will be violated if the payer applies a general tariff for insurance premiums and combines different taxation systems (for example, simplified tax system and UTII), and two appendices 1 to section 1 with different tariff codes (02 and 03, which correspond to one category “NR”) will be filled out in the calculation ). It follows from this that such payers do not need to fill out two Appendix 1, distributing payments in proportion to revenue according to the simplified tax system and UTII. The Federal Tax Service gives such clarifications in letter dated December 28, 2017 No. GD-4-11/

Admission will be refused if negative values are detected in the fields containing data on payments and contributions:

- columns 210, 220, 230, 240 of subsection 3.2.1;

- columns 280, 290 of subsection 3.2.2;

- (lines 050 – 051), line 061 of subsection 1.1;

- lines 040, 050 of subsection 1.3.1;

- lines 040, 050 of subsection 1.3.2.

In addition to errors in the amounts, the reason for refusal to accept the payment may be the presence of two sections 3 with identical SNILS numbers if the full name matches. The procedure for submitting updated calculations in this case depends on the type of error:

- If an error in the initial calculation was made in the full name and changes are made to the first name, patronymic and last name, the updated calculation may have two sections 3 with the same SNILS.

- If the insured are full namesake by full name and when submitting the initial calculation an error was made in the SNILS number, when submitting an updated calculation, two sections 3 are allowed only with different insurance numbers.

If an updated calculation is submitted in order to correct the details in subsection 3.1, except in cases with identical SNILS plus full name, for example, errors in date of birth, field, passport data, then you need to fill out section 3 with an adjustment number greater than 0, maintaining the serial number in line 040 of primary calculation and indicate the correct values in lines 060, 120—180.

Elena Kulakova, expert of the electronic reporting system Kontur.Extern

The Federal Tax Service has updated the control ratios for checking the calculation of insurance premiums. The corresponding letter dated December 29, 2017 No. GD-4-11/ is posted on the website of the tax department.

New control ratios are applied from January 1, 2020 to check the indicators included in the unified calculation of insurance premiums.

As the Federal Tax Service clarifies, new control ratios (version 3) are intended to replace the previous ones specified in letter No. BS-4-11 dated June 30, 2017/

Let us recall that earlier the Federal Tax Service supplemented the control ratios for checking calculations of insurance premiums. The additions to the Constitutional Court are due to the fact that from January 1, 2020, the list of grounds for recognizing a calculation as not submitted has been expanded.

In 1C:Enterprise 8, the ability to check calculations for compliance with updated control ratios will be supported with the release of future versions. You can find out about the deadlines in “Monitoring changes in legislation.”

In 2020, tax inspectors are checking the indicators of the unified calculation of insurance premiums using control ratios.

A free program from the Federal Tax Service “Taxpayer Legal Entity” is designed to automate the process of preparation by legal entities and individuals of tax and accounting documents, calculation of insurance premiums, certificates of income of individuals (form No. 2-NDFL), special declarations (declaration of assets and accounts), documents for registration of cash registers and others.

Control ratios in the report: calculation of insurance premiums

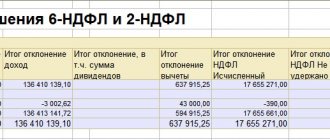

The data for verification is presented in the form of a voluminous table. It contains more than 300 internal control relations within the calculation and two inter-document relations. In particular, the control ratios of 6-NDFL and the calculation of insurance premiums 2020. For example, the first of them sounds like this: “the obligation to provide a calculation of insurance premiums in the case of providing 6-NDFL.” This means that all employers who are required to report under 6-NDFL are also required to report on insurance premiums. Even if the calculation turns out to be zero.

We will dwell in more detail on a small part of it, inter-document relationships, in order to understand how to use it. So, these indicators look like this:

| Document | № | KS | Violation | Actions of the Federal Tax Service | |

| RSV. 6-NDFL (in relation to the parent organization) | 2.1 | It is necessary to provide RSV in case of submitting 6-NDFL | Request for reporting | ||

| RSV. 6-NDFL (for taxpayers without separate sections, not for individual entrepreneurs on a patent and UTII) | 2.2 | Art. 020 rub. 1 6-NDFL - art. 025 rub. 1 6-NDFL >= art. 050 gr. 1 other 1.1 rub. 1 RSV | The amount of accrued income of the taxpayer is less than the base for calculating insurance premiums | Request for explanation or correction | |

| RSV, information from the FSS of Russia | 2.3-2.5 | Gr. 3-5 tbsp. 80 applications 2 r. 1 RSV = the amount of funds allocated by the Social Insurance Fund for reimbursement of expenses for insurance payments in 1-3 months of the reporting period | The amount of reimbursed expenses is more than the allocated amount | Same | |

It is not difficult to understand what the first line in this table means; this has already been discussed above. But the second line already contains a real comparative indicator, and we will dwell on it in more detail. So, tax authorities argue that the difference between line 20 of section 1 and line 25 of section 1 in the 6-NDFL declaration must be greater than or equal to the data reflected in line 50 of group 1 of subsection 1.1 of the calculation of insurance premiums. What's in these form fields:

- page 20 rub. 1 is the amount of accrued income;

- page 25 rub. 1 - these are accrued dividends, which are included in the amount of income.

Obviously, since insurance premiums are not charged on the amount of dividends, it is deducted in order to obtain the taxable base for them, which is indicated on page 050 gr. 1 other 1.1 RSV. If the data does not match, it means the payer made a mistake and will be sent a request for clarification. But this is not the only option. If discrepancies are identified in the document, tax authorities have the right to immediately draw up an act of violation in accordance with the provisions of Article 100 of the Tax Code of the Russian Federation and hold the payer accountable. If the payer himself discovers the error after the payment has been submitted, he has the right to submit an updated form.

How to check insurance premium calculations

The solution should be divided into two stages:

- intraform control is a check of indicators within the calculation itself. That is, whether the accountant performed the arithmetic calculations correctly;

- inter-documentary controls are a form of control that involves comparing the indicators of different reporting forms.

Each control category has its own characteristics. We offer instructions on how to check the calculation according to SV:

- Control inside the report:

- if you fill out reports using specialized accounting programs, then this type of control is carried out automatically;

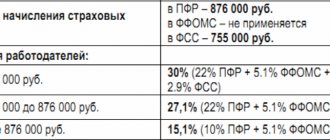

- when filling out the form manually, check that the taxable base is calculated correctly - this is the sum of all charges minus non-taxable amounts;

- check the correctness of calculation of contributions according to the approved insurance tariffs (base multiplied by the tariff);

- when filling out the third section, control the arithmetic operations (the amount of accrued earnings for the reporting three months);

- deposit amounts in rubles and kopecks;

- the total amount of the third section for all employees of the organization must correspond to the amount of accruals in the second section.

- We compare the indicators with other forms. Control ratios of 6-NDFL and insurance premiums: the difference between line 020 of section 1 and line 025 must be less than or equal to:

- the basis for calculating insurance premiums for compulsory insurance is line 050 of subsection 1.1 of Appendix No. 1 of the calculation for SV;

- the total amount of payments is line 030 of subsection 1.1 of Appendix No. 1 of the RSV.

About false personal data

Often policyholders are concerned about issues related to unreliable personal data identifying insured individuals, which are indicated in section. 3 calculations for insurance premiums. The fact is that personal data is not always incorrect: it may be correct, but irrelevant on the date of submission of the calculation (for example, the last name has been changed or the employee’s passport has been replaced). Will the settlement be accepted in this case?

In Letter No. GD-4-11/574 dated January 16, 2018, Federal Tax Service officials noted the following. When accepting the calculation of insurance premiums, the personalized data of the insured persons reflected in the reporting form is verified with the data available in the information resources of the tax authorities. If the submitted calculation for insurance premiums reflects out-of-date personal data of insured individuals, the tax authorities have the opportunity to identify them using information that has lost its relevance on the date of submission of the reporting form.

If the tax authority, during a desk audit, reveals discrepancies between the information on the accrued amounts of insurance contributions for compulsory pension insurance in the calculation submitted by the payer and the information on the specified amounts from calculations for previous reporting periods sent by the tax authority to the Pension Fund of the Russian Federation for reflection on the individual personal accounts of insured persons , the tax authority informs the payer about this with a request to submit updated calculations (Letter of the Ministry of Finance of the Russian Federation dated December 18, 2017 No. 03-15-06/84451).

About errors found in calculations

Will the calculation of insurance premiums be accepted if there is an error in the calculation of insurance premiums, for example, for compulsory medical insurance (CHI)? As a general rule, if an institution discovers inaccurate information in the calculation of insurance premiums submitted to the tax authority, the taxpayer has the right to:

- make the necessary changes to the calculation;

- submit an updated calculation to the tax authority.

At the same time, an updated calculation submitted after the expiration of the established deadline for its submission is not considered submitted in violation of the deadline (clause 1, 7, article 81 of the Tax Code of the Russian Federation, clause 1.2 of Procedure No. ММВ-7-11 / [email protected] ).

As stated in the Letter of the Federal Tax Service of the Russian Federation dated February 19, 2018 No. GD-4-11/ [email protected] , by virtue of clause 7 of Art. 431 of the Tax Code of the Russian Federation, the presence of errors in the calculation submitted by the payer when calculating insurance premiums for compulsory medical insurance is not a basis for refusing to accept the calculation.

As noted above, when conducting a desk tax audit and identifying errors in calculations, the tax authority on the basis of Art. 88 of the Tax Code of the Russian Federation informs the payer about this with the requirement to provide the necessary explanations within five days or submit an updated calculation to the tax authority.

Let us note that the organization is obliged to eliminate errors and submit a corrective report (clause 6 of article 6.1, clause 7 of article 431 of the Tax Code of the Russian Federation):

- within five working days from the date of sending the notification in electronic form;

- within 10 working days from the date of sending the notice on paper.